Guacamole Market Size, Share & Industry Analysis, By Nature (Organic and Conventional), By End-Use (Household/Retail [Supermarkets/Hypermarkets, Convenience Stores, Online Retail Channel, and Others], Food Service, and Food Processing Industry), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

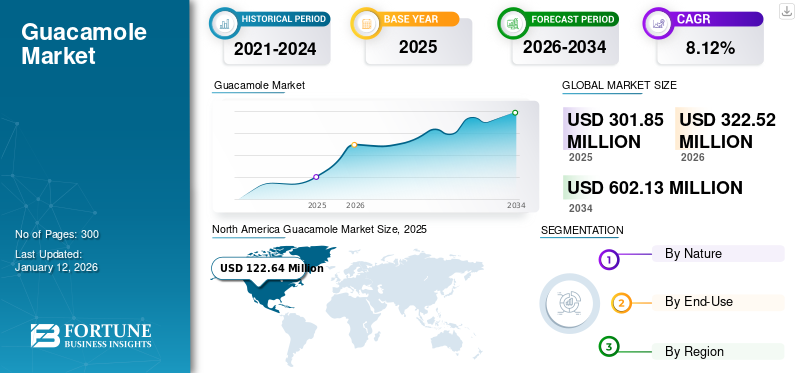

The global guacamole market size was valued at USD 301.85 million in 2025. The market is projected to grow from USD 322.52 million in 2026 to USD 602.13 million by 2034, exhibiting a CAGR of 8.12% during the forecast period. North America dominated the guacamole market with a market share of 40.63% in 2025.

Guacamole is a thick or semi-liquid paste, dip, spread, or salad made primarily from mashed avocados and other ingredients such as tomatoes, onions, chili peppers, and spices. It originated in Mexico during the Aztec civilization and has become a popular part of international and American cuisine. Guacamole is known for being a good source of potassium, antioxidants, and healthy fats, offering numerous health benefits.

The increasing disposable income of consumers and the growing penetration of social media advertisements have surged the inclination of consumers toward guacamole products. Furthermore, the rise in the adoption of company strategies such as product launches, business expansion, acquisition, and others by manufacturers propels the product demand. Conagra Brands, Inc., Hormel Foods Corporation, Calavo Growers, Inc., Sabra Dipping Company, LLC, and B&G Foods, Inc., are few of the prominent players operating in the market.

Guacamole Market Snapshot & Highlights

Market Size & Forecast

- 2025 Market Size: USD 301.85 million

- 2026 Market Size: USD 322.52 million

- 2034 Forecast Market Size: USD 602.13 million

- CAGR: 8.12% from 2026–2034

Market Share

- North America led the global guacamole market with a 40.63% share in 2025, supported by high avocado consumption, health-conscious consumers, and cultural food events like the Super Bowl and Cinco de Mayo.

- By Nature, the conventional segment dominated in 2024, driven by longer shelf life, cost-effectiveness, and wide availability across global retail channels.

- By End-Use, the food service segment held the largest revenue share, owing to the increasing integration of guacamole in fast food, Mexican, and vegan menus. The household/retail segment is expected to grow at the fastest rate due to rising health trends and e-commerce expansion.

Key Country Highlights

- United States: Growing trend of healthy eating and increasing demand for flavorful dips in food service chains (e.g., McDonald’s, Subway) support market leadership.

- Mexico: Largest avocado producer globally, playing a crucial role in the raw material supply chain for guacamole production and exports.

- Germany & U.K.: Rise in popularity of Mexican cuisine and increasing presence of meal kits and international food options in retail are fueling market growth.

- China & India: Increased exposure to international cuisines via social media, rising disposable income, and growing urban population are driving market expansion.

- Brazil & Argentina: Rapid growth in online food delivery and health-focused food choices are expanding guacamole’s reach.

- South Africa: Growing retail infrastructure and rising employment rate are supporting adoption of new food products like guacamole.

Market Dynamics

Market Drivers

Strong Demand from Food Service Restaurants Support Guacamole Market Growth

Guacamole, an avocado-based dip, is used significantly in modern Mexican cuisine and is in strong demand in international markets as a dip, salad ingredient, and condiment. Moreover, the demand for a flavorful and nutritious dip has increased due to a shift in consumer trends toward healthy ingredients and snacking. In the food service industry, guacamole has become a staple and used as an appetizer, topper, and versatile ingredient in burgers, sandwiches, and Mexican dishes. For instance, Subway has been using guacamole in its sandwiches since 2015. Similarly, some of the McDonald's (MCD) restaurants add guacamole to their burgers, Egg McMuffins, and French Fries. Therefore, the rise in the number of fast food chains such as McDonalds and Subway will boost the usage of guacamole.

Growing Demand for Healthy Products and Popularity of Ethnic Cuisine to Fuel Market Growth

Spreads and dips are made with a variety of ingredients such as black beans, tomatoes, white beans, jalapeños, mushrooms, and others, which are essential for enhancing both the dining and snacking experience, as they are regarded as condiments or side dishes. The global guacamole market share is also fueled by the rising consumer preference for healthy and natural food options. As more individuals become aware of the health advantages linked with avocados, an increasing number of people are adding guacamole to their meals. Avocados are packed with beneficial vitamins and minerals, making guacamole a desirable choice for health-conscious consumers. The shift toward healthier eating patterns and the growing appeal of plant-based diets have greatly increased the demand for guacamole. In April 2022, the brand Cornitos, under Greendot Health Foods Pvt Ltd., broadened its product line by introducing a new series of dips called Avocado Pulp and Dip. This dip is available in two variants: Cornitos Avocado Pulp and Cornitos Classic Guacamole, both of which are sourced from Mexico.

Market Restraints

High Cost of Raw Material to Restrain Market Growth

The major ingredient in guacamole is avocado. Avocado is majorly produced in Mexico, and its by-products or value-added products, including guacamole, are manufactured in the U.S., Germany, and the U.K. Most of the countries are dependent on importing the product. The import charges and trade duties additionally increase the product price, which further restricts the product demand. Consumers in developing economies, including China, Brazil, Thailand, Vietnam, and India, are price-conscious compared to those in developed countries, which further restricts the expansion of the guacamole market growth.

The taste-enhancing and exotic ingredients of guacamole are available at higher costs. The rising input costs of raw materials and increasing packaging prices lead to increasing end-product prices and resulting declining demand for various products.

Market Opportunities

Rising Trend of International Cuisines Offer Newer Market Growth Opportunities

The surge in popularity of international cuisines such as Italian cuisine, Chinese cuisine, Mexican cuisine, Thai cuisine, Turkish cuisine, and Korean cuisine in both developed and developing countries such as Brazil, India, China, Vietnam, and Thailand drives global market growth.

The increase in the use of social media platforms such as TikTok, YouTube, Instagram, and Facebook has significantly enhanced the popularity of international cuisine globally. The social media platform allows users to discover new flavors, dishes, and cooking techniques through visually appealing content. The increasing number of food bloggers and influencers globally share their traditional recipes and dining experiences, which directly results in promoting specific cuisines and food trends. Furthermore, online food delivery platforms provide competitive pricing, multiple discounts, and a great promotion facility, which further encourages consumers to try various types of cuisines, thereby boosting the global guacamole market growth.

Market Challenges

Avocado Costs and Perishability to Pose Challenge for Market Growth

Avocados can be prohibitively expensive for middle-class consumers, which seriously challenges the market. Many customers also consider avocados too perishable to purchase, and methods to extend their freshness can be problematic. Furthermore, the market faces challenges in maintaining consistent supplies of avocados, as well as dealing with the limited shelf life of this perishable item, which can lead to food waste.

Guacamole Market Trends

Increasing Demand for Organic and Clean-Label Products is Prominent Trend Emerging in Industry

Consumers are increasingly seeking minimally processed foods with recognizable ingredients, which has led to a rise in the popularity of organic and natural guacamole options. This trend is driven by a growing awareness of the health benefits associated with minimally processed foods, as well as a demand for plant-based and natural ingredients. Guacamole serves as a versatile and flavorful option that aligns with vegetarian and vegan lifestyles. The convenience factor associated with ready-to-eat guacamole products has also contributed to the growth of the guacamole market as consumers seek quick, easy, and nutritious food options.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic significantly hampered the growth of global market. The lockdown was imposed across countries, which resulted in disruption of the supply chain and closure of manufacturing facilities. Furthermore, the limited availability of raw materials and labor shortage issues in 2020 posed challenges in guacamole production. The shutting down of several supermarkets and grocery stores also hampered the products' consumption rate. Moreover, consumers focused more on essential food items such as fruits, vegetables, and grains, which affected guacamole sales. Guacamole is highly used in the food service industry, including cafeterias, fast food restaurants, and others, but due to the coronavirus outbreak, consumers worldwide stopped visiting these facilities. The implementation of the lockdown also resulted in the temporary closure of these food service establishments, which significantly declined product sales in 2020 and 2021. For instance, according to the Japan Foodservice Association, a Japan-based organization promoting food establishments, in March 2021, restaurant sales declined by nearly 5.2% compared to 2020 and around 19.6% compared to 2019 (pre-pandemic).

Segmentation Analysis

By Nature

Conventional Segment Dominate Market Owing to Longer Shelf Life and Widespread Use

On the basis of nature, the market is segmented into organic and conventional.

The conventional segment captured the largest share of the global guacamole market in 2024. Conventional guacamole refers to traditional recipes that are made with non-organic or commercially grown ingredients. Furthermore, conventional guacamole products are cost-effective and are produced in large quantities compared to organic products. Conventional guacamoles have a long shelf life, and they are easily available in hypermarkets, grocery stores, and online sales channels owing to the large-scale production methods used. Conventional foods are easy to handle, eat, and prepare. Their popularity in both developing and developed countries is growing significantly owing to the increasing millennial population, and the surge in millennial per capita spending is driving the segment’s growth. According to the World Economic Forum, in the U.S., the per capita spending of millennials is set to increase by over 10% by 2025.

Organic guacamole held 17% of the market share in 2024. This product refers to the guacamole prepared using organically grown avocados and other ingredients. According to the United States Department of Agriculture (USDA), the number of certified organic producers of avocado in Mexico was 770 in 2020, and increased to 905 by 2021. The surge in the number of certified organic producers of plant products such as avocado, coffee, grapefruit, mango, and bell pepper fuels the segment’s growth. Furthermore, the rise in popularity of organic foods in processed foods and packed meals is forcing food processing companies to source organic standard food ingredients.

To know how our report can help streamline your business, Speak to Analyst

By End-Use

Food Service Segment is Expected to Hold Largest Revenue Due to Growing Inclusion of Versatile and Flavorful Ingredients

In terms of end-use, the market is segmented into household/retail, food service, and food processing industry.

Based on the end-use, the food service segment dominates the global market, anticipating a considerable CAGR of 6.94% during the forecast period. The dominance of the food service can be attributed to the growing inclusion of versatile and flavorful ingredients in burgers and other fast food items. Also, the use of guacamole in popular Mexican and vegan restaurants influences its market growth.

On the other hand, the household segment is estimated to be the fastest-growing segment in the global market with a 16% revenue share in 2025. The household/retail segment includes supermarkets/hypermarkets, convenience stores, online retail channels, and others. Supermarkets/hypermarkets provide a great shopping experience to consumers, and they also offer promotions and discounts during weekends, holidays, and special occasions to attract consumers.

The online segment is projected to grow at a higher CAGR owing to its convenience and wide range of offerings of guacamole on the online platforms.

Guacamole Market Regional Outlook

North America

North America Guacamole Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

In 2026, North America attained a major share of 40.88% in the overall guacamole market with value of USD 130.23 million. The North American market is studied across the U.S., Canada, and Mexico. In terms of macroeconomic factors, the U.S. is the world's largest economy in terms of GDP and offers greater flexibility compared to doing business in Western Europe. The U.S. market is anticipating to reach USD 108.7 million in 2026. The rise in the number of health-conscious consumers in the region drives market growth. The main ingredient in guacamole is avocado, which is rich in fiber, potassium antioxidants, healthy fats, and other nutrients that help boost brain health, improve digestion & eye health, and lower the risk of heart disease. The surge in consumption of guacamole in events and sports culture, such as the Super Bowl and Cinco de Mayo, triggers the product demand in the region.

Europe

Europe is the second-largest region which is expected to hit USD 93.84 million in 2026, registering a CAGR of 8.08% during the forecast period. The increase in the popularity of Mexican food in the region, owing to the surge in the number of Mexican restaurants, fast food chains, and meal kits, which are available in supermarkets and convenience stores, drives the demand for the product in the region. The surge in consumer footfall in the food service industry, which includes cafes, fast-food chains, and restaurants, has significantly contributed to the spread of guacamole popularity by adding it to various food items such as sandwiches, tacos, nachos, burritos, and salads. Europe’s food service sector has grown steadily over the past few years owing to the increasing number of tourists, coupled with a shift in consumer trends of consuming food outside. According to UN Tourism, tourism in the European region has significantly increased, as the region witnessed 747 million international arrivals in 2024, which is a 5% rise compared to 2023. The prime factor driving the boosting of European tourism is strong travel within the continent itself. The U.K. market is projected to hit USD 18.22 million, along with the market in France is to reach USD 19.64 million in 2025 and Germany to hit USD 18.02 million in 2026.

Asia Pacific

The Asia Pacific is the third-largest region which includes China, Japan, India, Australia, and others. This region is predicted to hit USD 62.27 million in 2025. The guacamole market in the Asia Pacific is growing exponentially owing to a rise in disposable income, an increase in urban population & employment opportunities, and a rise in awareness toward a healthy lifestyle. According to the National Bureau of Statistics of China, in 2023, the disposable personal income in China rose to USD 7,309.25 from USD 7,115.57 in 2022. The increase in consumer exposure to international cuisines such as Mexican cuisine, Italian cuisine, Japanese cuisine, African cuisine, Thai cuisine, and European cuisine supports the guacamole market growth in the region. The China market is likely to hit USD 26.96 million, along with the market in Japan is to reach USD 11.47 million and India to hit USD 6.03 million in 2026.

South America

South America is the fourth-largest region and likely to hit USD 18.45 million in 2025. The growing demand for guacamole in Brazil, Argentina, Chile, and other countries highlight a combination of several factors, including rising consumer awareness toward healthy lifestyles, rise in consumer footfall in fast food restaurants, growing online food delivery apps, expansion of online sales channels, and many others. Furthermore, increasing penetration of e-commerce platforms allows consumers from even the most remote areas to access a variety of guacamole products that were previously unavailable in local retail stores. Besides, through online channels, consumers can browse, compare, and purchase products anytime and anywhere without the need to visit physical stores. This ease of purchase encourages impulse buying and repeated purchases, boosting product demand in the region.

Middle East & Africa

The Middle East & Africa have witnessed modernization and urbanization, and key players are offering products that help millennial families enhance the aroma and taste of their food. The rising working population of both men and women, along with growing disposable income in the region, are fueling the growth of the market. According to the World Bank Group, in South Africa, the employment ratio increased to 39.4% at the end of 2022 and 40.1% in the second quarter of 2023. The UAE market is anticipated to reach USD 1.18 million in 2025.

The growth of the retail sector in South Africa is increasing significantly owing to factors such as an increase in urbanization, a rise in middle-class income, better infrastructure policies, growing private sector investment, and increasing government support. For instance, in January 2023, Walmart announced the launch of 50 new stores in South Africa. Furthermore, Walmart is planning to open its stores in Angola, Senegal, and the Democratic Republic of the Congo. Walmart currently operates 154 stores across South Africa.

Competitive Landscape

Key Market Players

Leading companies in the global market are focusing on strategies such as new product launches, marketing, base expansion, collaborations, sustainability, and acquisitions to increase growth.

Conagra Brands, Inc., Hormel Foods Corporation, Calavo Growers, Inc., Sabra Dipping Company, LLC., and B&G Foods, Inc. are some of the major players in the market. Conagra Brands, Inc. leads the global market. The company has a strong sales network and a broad portfolio that includes several brands. The company offers guacamole through its brand, Frontera, and operates several well-established manufacturing facilities that help it produce quality products. Hormel Foods Corporation is a key player with a robust presence in the global market, including countries such as Brazil, Canada, the U.S., and Australia. The company has a wide distribution network, including key online players such as Amazon, Walmart, and Target.

List of Key Guacamole Companies Profiled

- Insignia International (Flagship Food Group) (U.S.)

- Sabra Dipping Company, LLC (U.S.)

- Westfalia Fruit (South Africa)

- Calavo Growers, Inc. (S.)

- Conagra Brands, Inc.(U.S.)

- B&G Foods, Inc. (U.S.)

- Hormel Foods Corporation (U.S.)

- CG Produce (Continental Green Produce) (U.S.)

- Good Foods Group (U.S.)

- Simplot Global Food (U.S.)

Key Industry Developments

- January 2025 – Westfalia Fruit, a plant-based products company, acquired Syros, a Belgian avocado products processor and distributor. The acquisition will help Westfalia Fruit expand in the European market and increase its market share. Syros has been collaborating with the company for years to source avocados for its products, such as guacamole, meal kits, and avocado oil.

- August 2024 – 505 Southwestern, a brand under Insignia International, launched a new collection of salsas, including guacamole salsa, throughout King Soopers stores (U.S.-based supermarket chain) across Colorado, U.S.

- June 2024 – MegaMex Foods and Hormel Foods brand Wholly Guacamole launched a new refrigerated guacamole variety, Extra Chunky Restaurant Style guacamole. The new product contains chunks of 100% Hass avocados and includes tomatoes, red onions, cilantro, lime juice, and jalapeño peppers. It is designed to bring restaurant-quality flavor to at-home meals and snacking.

- December 2022 – Calavo Growers, Inc. partnered with Old El Paso, a U.S.-based brand providing Mexican-inspired food items. The brand is owned by General Mills, a U.S.-based food processing company. Under the partnership, the company will produce products, including guacamole, for Old El Paso in the U.S. market.

- November 2022 – Good Foods Group launched Grab & Go snack packs for its popular products, plant-based queso dip and chunky guacamole. The packs include these dips with corn tortilla chips. Additionally, the packs are offered in single-serve 2.5 oz and are developed using high-pressure processing technology. Both packs are also vegan and gluten-free.

Report Coverage

The global guacamole market research report analyzes the market in-depth. It highlights crucial aspects such as prominent companies, market trends, research, market analysis, segmentation, competitive landscape, product types, distribution channels, and application usage areas. Besides this, it provides insights into the global market demand and highlights significant industry developments. In addition to the aspects mentioned earlier, it encompasses several factors contributing to the market growth over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.10% from 2026 to 2034 |

|

Unit |

Value (USD Million) & Volume (Tons) |

|

Segmentation |

By Nature

By End-Use

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 322.52 million in 2026 and is anticipated to record a valuation of USD 602.13 million by 2034.

Fortune Business Insights says that the global market value is estimated to be at USD 322.52 million in 2026.

The global market is projected to grow at a significant CAGR of 8.10% during the forecast period of 2026-2035.

By nature, the conventional segment is predicted to dominate the market during the forecast period of 2025-2032.

The strong demand from food service restaurants is likely to drive the demand in the market.

Conagra Brands, Inc., Hormel Foods Corporation, Calavo Growers, Inc., Sabra Dipping Company, LLC, B&G Foods, Inc., and others are some of the leading players globally.

North America dominated the global market in 2026.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us