Hafnium Market Size, Share & Industry Analysis, By Type (Hafnium Metal, Hafnium Oxide, Hafnium Carbide, and Others), By Application (Super Alloy, Optical Coating, Nuclear, Plasma Cutting, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

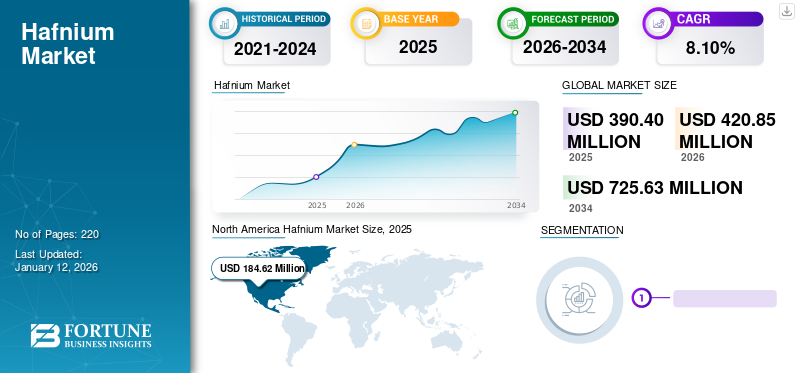

The global hafnium market size was valued at USD 390.4 million in 2025. The market is projected to grow from USD 420.85 million in 2026 to USD 725.63 million by 2034, exhibiting a CAGR of 8.10% during the forecast period. North America dominated the hafnium market with a market share of 47% in 2025.

Hafnium (Hf) is a lustrous, silvery transition metal recognized for its excellent neutron-absorbing capability, high melting point (~2,233 °C), remarkable corrosion resistance, and strong reactivity with oxygen and nitrogen. It is typically found in association with zirconium within mineral ores such as zircon and is obtained through advanced refining techniques.

Key producers of zirconium refining include the U.S., France, China, and Russia. Due to its unique properties, it is considered a critical material for applications requiring exceptional durability and stability under extreme conditions. Its metal-based compounds, valued for their superior physical characteristics, play an important role across industries such as aerospace, automotive, electronics, and energy. Growing interest from companies in reclaiming hafnium from machining scraps, spent nuclear parts, and manufacturing residues, coupled with rising demand in pressurized water reactors (PWRs) owing to its neutron absorption properties, will drive market growth during the forecast timeline. The major players operating in the market are Alkane Resources Ltd, Framatome Inc., and Neo.

MARKET TRENDS

Rising Demand from the Electrical & Electronic Industry to Create New Market Opportunities

The electrical and electronics industry is presenting significant growth prospects for hafnium due to its distinctive properties. A key opportunity lies in the semiconductor industry, where hafnium plays a vital role in producing high-dielectric materials required for advanced semiconductor devices. For example, hafnium oxide, known for its high dielectric constant, supports transistor miniaturization, enabling the creation of faster, more efficient electronic products. Consequently, it has emerged as a replacement for silicon dioxide in next-generation semiconductor nodes (10 nm and below) as a high-k dielectric material.

Globally, the shift toward electrification is accelerating, driven by the rapid adoption of electric vehicles and renewable energy systems such as solar and wind, which depend heavily on advanced electronics. The growing need for compact, efficient, and high-performance electronic components under this trend is expected to fuel the product demand and unlock new market opportunities over the forecast period.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for the Product in Aerospace Industry to Drive Market Growth

Hafnium plays a vital role in superalloys used for jet engine components such as turbine blades, nozzles, and propulsion systems, owing to its exceptional ability to retain structural integrity at high temperatures. This property enhances engine efficiency and performance, making it an indispensable material for modern aerospace applications. With the steady growth of global travel and defense activities, the aerospace industry is set to expand, driving higher demand for hafnium-based alloys in advanced jet engines and spacecraft.

The sector’s upward trajectory is further fueled by developments in commercial space exploration, supersonic travel, and military aircraft. Additionally, rising product utilization in defense and space applications, including re-entry vehicle heat shields, rocket engine parts, and ultra-high-temperature ceramics, is expected to further accelerate market growth during the forecast period.

MARKET OPPORTUNITIES

Ongoing Research and Development Activities in the Medical Industry to Propel Market Growth

The market is projected to witness substantial growth in the coming years, largely fueled by increasing research and development in the medical industry. Rising demand for medical imaging equipment is a key driver, as hafnium is an essential material in X-ray tubes used to generate high-quality diagnostic images. With the steady expansion of X-ray technology in healthcare and continued innovation from R&D activities, the product demand is set to grow further, creating new opportunities for manufacturers and suppliers in the market.

MARKET RESTRAINTS

Fluctuating Prices of the Metal to Hamper Market Growth

Hafnium is produced as a byproduct of zirconium, making its supply directly dependent on zirconium mining trends. When zirconium demand rises, particularly for nuclear applications, its production increases, often leading to oversupply and price declines. Conversely, reduced zirconium demand lowers product output, creating shortages and driving up prices. In recent years, the market has faced significant price volatility, influenced by factors such as the pandemic, geopolitical tensions, and trade conflicts, resulting in supply-demand imbalances. These fluctuations create uncertainty for both producers and consumers, posing risks that may hinder overall market growth.

MARKET CHALLENGE

Regulatory Barriers, High Costs, and Substitution Risks to Limit Market Expansion

Hafnium faces multiple challenges that restrict its broader adoption. Strict nuclear-related regulations, including export controls and security classifications, limit the trade of nuclear-grade hafnium due to its importance in reactor technologies. Furthermore, the complex and expensive purification processes needed to achieve nuclear- and semiconductor-grade quality significantly raise production costs. In addition, the product is exposed to substitution risks, as materials such as titanium, tantalum, and advanced ceramics can replace it in some applications during supply shortages or periods of high prices, making its market position more vulnerable.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Hafnium Metal Segment Accounted for the Largest Share Owing to Its High Demand across Various Industries

Based on type, the market is segmented into hafnium metal, hafnium oxide, hafnium carbide, and others, with a share of 89.22% in 2026. The hafnium metal segment accounted for the largest global hafnium market share in 2024. With its exceptionally high melting point, it is well-suited for high-temperature applications such as plasma torches. Its strong corrosion resistance also makes it valuable in demanding environments such as the aerospace and nuclear power industries.

In contrast, hafnium oxide is a highly versatile material used in semiconductors, optical coatings, ceramics, and medical devices. As a high-k dielectric in transistors, it supports transistor miniaturization, enabling the development of more powerful and energy-efficient electronic devices. The growing demand for compact and efficient electronics is expected to fuel the expansion of this segment over the forecast period.

By Application

To know how our report can help streamline your business, Speak to Analyst

Super Alloys Segment Led the Market due to Their Superior Properties

Based on application, the market is segmented into super alloy, optical coating, nuclear, plasma cutting, and others.

The super alloy segment held a dominant market share 51.45% globally in 2026. Superalloys are high-performance materials widely used across aerospace and non-aerospace industries, including nuclear energy, gas turbines, and biomedical applications. Hafnium-based alloys play a vital role in aircraft components such as engine parts and armor materials, where their exceptional heat resistance supports advanced military aircraft in withstanding the extreme temperatures generated during combustion. These alloys enhance the performance, efficiency, and safety of aircraft engines, enabling reliable operation at high speeds and altitudes. The growing reliance on superalloys for their superior properties is expected to remain a major driver of segment growth.

Additionally, the product is extensively used in plasma cutting due to its excellent heat conductivity, inert nature, and high melting point. When incorporated into plasma torches, it enables the ionization of gases at high temperatures to create plasma, making it highly effective for cutting steel, stainless steel, and aluminum.

HAFNIUM MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Hafnium Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market and accounted for 47.4% in 2024. Rising product demand in space exploration (NASA, SpaceX), defense, and semiconductor manufacturing is significantly boosting market growth in the U.S. At the same time, the surge in domestic and international air travel is driving the need for new and more efficient aircraft. To meet passenger demand and comply with stricter environmental standards, airlines are upgrading their fleets. Furthermore, U.S.-based manufacturers such as Boeing, Lockheed Martin, and Cessna produce a wide range of aircraft, from commercial airliners to business jets, and are strategically positioned to supply advanced, safe, and efficient models. This growing aircraft production, in turn, fuels demand for hafnium-based materials used in sophisticated engine components. The U.S. market is valued at USD 187.66 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Europe

The market in Europe is projected to experience strong growth, supported by advancements in both the aviation and nuclear power industries. The region’s aviation sector is at the forefront of developing sustainable technologies, where hafnium-based materials can enhance aircraft designs by improving fuel efficiency, durability, and safety. In parallel, the nuclear industry is expected to expand as European countries seek to reduce dependence on fossil fuels, with hafnium playing a key role in control rods for nuclear reactors. While opinions on nuclear power as a green alternative vary across the region, several countries are likely to increase their reliance on nuclear energy. Additionally, rising demand from France’s nuclear sector, the growing aerospace industries in the U.K. and Germany, and Russia’s integration of hafnium into its domestic nuclear and aerospace programs are expected to further drive hafnium market growth. The UK market is valued at USD 34.86 billion by 2026. The Germany market is valued at USD 33.38 billion by 2026.

Asia Pacific

The Asia Pacific region represents the fastest-growing consumer base for the market, driven by China’s expanding semiconductor fabrication plant, growing nuclear power capacity, and advancing aerospace programs. Rapid industrialization and a strong manufacturing ecosystem are expected to further accelerate market growth in the near future. Hafnium’s exceptional properties, such as its high melting point and strong corrosion resistance, make it highly valuable for producing components that demand durability and stability under extreme conditions. The Japan market is valued at USD 11.86 billion by 2026. The China market is valued at USD 35.28 billion by 2026. The India market is valued at USD 5.98 billion by 2026.

Key industries, including aerospace, automotive, electronics, and energy, are increasingly utilizing hafnium products. As a global hub for electronics manufacturing, the region plays a crucial role in semiconductor production, where hafnium-based compounds are essential for fabricating advanced microprocessors and integrated circuits. For example, hafnium oxide, used as a high-k dielectric material, supports transistor miniaturization, enabling the development of faster, more efficient, and powerful electronic devices. By leveraging such advanced materials, the region is well-positioned to remain at the forefront of technological innovation and shape the future of the global electronics industry.

Rest of the World

The use of hafnium in Latin America and the Middle East & and Africa is still at an early stage, with sluggish market growth. A few applications in these regions include aerospace, energy, and electronics. However, there are a number of challenges that need to be addressed in order to increase the use in regions. These challenges include the limited availability and high cost, the lack of infrastructure to produce and process raw ore, and the lack of awareness. As a relatively less explored material, its potential in these regions is still developing. However, emerging interest via advanced material imports for aerospace and energy diversification in the Middle East is anticipated to drive significant growth in the upcoming years.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

High Technical Expertise and Capital-Intensive Nature of Industry to Create an Entry Barrier for New Entrants

The market is highly consolidated, with a small number of established players dominating market share through well-developed production facilities. The entry of new competitors remains limited, as hafnium manufacturing requires advanced technological expertise and involves complex processes. Additionally, high capital investment requirements and restricted access to essential resources create significant entry barriers, further reducing the threat of new entrants.

LIST OF KEY HAFNIUM COMPANIES PROFILED

- Framatome Inc. (France)

- Alkane Resources Ltd. (Australia)

- American Elements (U.S.)

- Nanjing Youtian Metal Technology Co.,Ltd. (China)

- ACI Alloys Inc. (U.S.)

- Westinghouse Electric Company LLC (U.S.)

- Baoji City Hengxin Rare Metal Co., Ltd. (China)

- Nantong JP New Material Tech Co. LTD (China)

- Advanced Engineering Materials Limited (China)

- Neo (Canada)

KEY INDUSTRY DEVELOPMENTS

- June 2022: Australian Strategic Materials (Holdings) Ltd. granted Hyundai Engineering Co. Ltd. a contract for the extraction process and equipment for the Dubbo mining project. This project encompasses hafnium mining operations in New South Wales.

- July 2022: South Korean investors entered into an agreement worth USD 250 million with Australian Strategic Materials (ASM to acquire a 20% stake in the Dubbo rare earths project in Australia.

- November 2023- Framatome invested in expanding separative capacity at its Jarrie site in France to strengthen the production of high-quality hafnium. This strategic investment aims to meet the growing needs of advanced industries such as nuclear, aerospace, defense, space, medical, and electronics.

- April 2023: NEO Company completed the acquisition of SG Technologies Group Limited. The acquired company is a specialty manufacturer of rare-earth-based products. This move would help the company expand its product portfolio of rare earths.

REPORT COVERAGE

The research report provides both qualitative & quantitative insights on the product across the globe. Quantitative insights include market sizing in terms of value (USD Million) and volume (Tons) across each segment, sub-segment, and region profiled in the scope of study. Furthermore, it provides market analysis and growth rates of the segment and key countries across each region. Qualitative insight covers the elaborative analysis of key market drivers, restraints, growth opportunities, and industry trends related to the market. The competitive landscape section covers detailed company profiling of the key players operating in the industry.

[rptyTOwKyO]

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

CAGR (2023-2030) |

CAGR of 8.10% from 2026-2034 |

|

Unit |

Volume (Ton), Value (USD Million) |

|

Segmentation |

By Type · Hafnium Metal · Hafnium Oxide · Hafnium Carbide · Others |

|

By Application · Super Alloy · Optical Coating · Nuclear · Plasma Cutting · Others |

|

|

By Geography

· North America (By Type, By Application, and By Country) o U.S. (By Application) o Canada (By Application) · Europe (By Type, By Application, and By Country) o Germany (By Application) o France (By Application) o U.K. (By Application) o Rest of Europe (By Application) · Asia Pacific (By Type, By Application, and By Country) o China (By Application) o India (By Application) o Japan (By Application) o Rest of Asia Pacific (By Application) · Rest of the World (By Type, By Application, and By Sub-region) o Latin America (By Application) · Middle East & Africa (By Application) |

Frequently Asked Questions

According to Fortune Business Insights, the global market size was USD 420.85 million in 2025 and is projected to reach USD 725.63 million by 2034.

Growing at a CAGR of 8.10%, the market will exhibit steady growth during the forecast period.

By application, the super alloy segment led the market.

The expanding aerospace industry is a key factor driving market growth.

North America dominated the market share in 2024.

Alkane Resources Ltd, Framatome Inc., and Neo are a few of the leading players in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us