Health Insurance Market Size, Share & Industry Analysis, By Type (Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Others), By Payor (Private and Public), By User (Individual and Group), By Mode (Offline and Online), By Distribution Channel (Direct Sales, Agents, Brokers, Banks, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

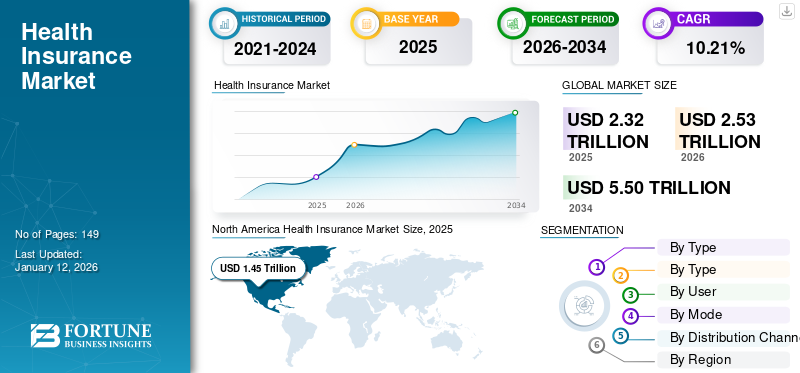

The global health insurance market size was valued at USD 2.32 trillion in 2025. The market is projected to grow from USD 2.53 trillion in 2026 to USD 5.5 trillion by 2034, exhibiting a CAGR of 10.21% during the forecast period. North America dominated the health insurance market with a market share of 62.41% in 2025.

Health insurance is an insurance product that covers the medical and surgical expenses of an insured individual. There are several types of policies that reimburse the expenses of an individual incurred due to illness or injury or pay the insured's provider directly. The health insurance marketplace helps people explore different insurance options, compare costs, and find a plan that fits their budget and healthcare needs. The growing prevalence of various disorders, the rising number of accidents and surgeries among the population, and the rising costs of healthcare services are some of the major factors contributing to the growing demand and adoption of these policies in the market.

- According to the 2023 statistics published by the American Medical Association (AMA), health spending in the U.S. increased to USD 4.5 trillion in 2022, growing by 4.1% as compared to 2019.

Moreover, the rising number of populations suffering from various disorders and accidents and the increasing focus of the players on expanding the coverage criteria are expected to spur the global health insurance market growth during the forecast period.

Global Health Insurance Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 2.32 Trillion

- 2026 Market Size: USD 2.53 Trillion

- 2034 Market Size: USD 5.5 Trillion

- CAGR: 10.21% from 2026–2034

Market Share:

- Region: North America dominated the market with a 62.41% share in 2025. This is driven by the rising number of private players with a wide product portfolio and a strong focus from the government on increasing universal health coverage for the population.

- By Payor: The Private segment held the largest market share. The segment's growth is supported by a high rate of coverage, with private insurance plans covering nearly two-thirds of the American population in 2023.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan is seeing market growth due to a large uninsured population, rising awareness of insurance products, increasing digital penetration, and rising healthcare expenditure.

- United States: The market is fueled by high and increasing health spending, which reached USD 4.5 trillion in 2022. The country also has a high insurance coverage rate, with approximately 92.1% of the population insured in 2022.

- China: Growth is supported by a large and growing uninsured population and a strong focus from major domestic players, such as Ping An Insurance Group, on expanding their health ecosystem and market presence.

- Europe: The market is advanced by a high rate of insurance coverage, particularly in countries like Germany, where about 89% of the population is enrolled in public health insurance. The market is also seeing significant growth in voluntary health insurance spending, which increased by nearly 7.3% in the U.K. in 2022.

Market Dynamics

Market Drivers

Rising Healthcare Costs and Growing Prevalence of Chronic Disorders to Boost Demand for Insurance Products

The growing prevalence of chronic conditions such as cancer, diabetes, and others among the population is leading to a growing number of consultations and procedures, including surgeries. The growing cost of healthcare in developed and emerging countries is another major factor fueling the demand for healthcare insurance products in the market.

- According to the 2023 article published by the NCBI, the estimated number of new cases of cancer in India was around 1.5 million in 2022. Also, one in nine people are likely to develop cancer in the country in their lifetime.

Also, the growing geriatric population with a higher risk of various disorders is another crucial factor supporting the adoption of these products in the market, thus fostering the global health insurance market size.

Market Restraints

Increasing Insurance Premiums to Hamper Product Adoption in Market

The growing demand for health insurance products among the population is resulting in rising premium costs for the products, which is expected to hinder the adoption of these policies among the population, especially in developing countries such as India, Brazil, Mexico, and others.

Currently, there is no cap on health insurance premiums in many countries, including the U.K., Germany, and others, which leads to a rising burden on individuals. The growing premium cost annually can hamper the adoption of these products in the market.

- According to the 2022 article published by the KLforExpats (KL Versicherungsservice GmbH), health insurance costs in Germany increase by an average of 3-5% every year.

Also, the limited awareness regarding various insurance policies in the market among the rural population of emerging countries is another limiting factor for the growth of the global health insurance market.

Market Opportunities

Rising Focus of Market Players to Increase Penetration Among Emerging Countries

Currently, the penetration of health insurance in emerging countries, including India and Brazil, among others, is significantly lower than in other developed countries such as the U.S., Germany, Japan, and others. The limited access to the products and awareness regarding the benefits of these policies among the population in these countries is one of the major factors for the low penetration of insurance in these countries.

The growing focus of the companies to introduce various policies with tailored features, benefits, and others to promote the adoption of these policies among individuals depending on their requirements presents a lucrative opportunity for the penetration of the market, especially in emerging countries including India, Southeast Asian countries, and others.

- According to a 2022 article published by BMJ Global Health, the average health insurance coverage was nearly 7.9% in low-income countries and 27.3% in lower-middle-income countries.

Along with this, the rising digitalization in emerging countries and the higher penetration of smartphones and the internet are other vital factors that open up a huge market opportunity for insurance companies to promote and penetrate policies among the population.

Market Challenges

Regulatory Hurdles

The limited standardization in the insurance industry laws and regulations across various countries owing to the constant changing of the regulatory framework in the sector is a major challenge in the market. The pricing, settlement process, and coverage criteria are some of the major factors that are affected owing to the lack of standardization in the sector.

Limited Awareness Among Population

There is limited awareness regarding the availability of various health insurance schemes and products in the market among the population, especially in emerging countries in Africa, Asia, and others. This is a major barrier to the penetration of these products in countries such as Nigeria, Gambia, and others.

- According to a 2022 article published by the MDPI, the 2019 Nigeria Demographic Health Survey (NDHS) reported that the prevalence of health insurance coverage in Nigeria was only 2.8%, owing to limited awareness among the public.

Market Trends

Growing Focus of Players to Expand Policy Coverage for Various Critical Illnesses

The growing demand for health insurance policies covering various chronic conditions, critical illnesses, and others is leading to a rising focus of the players to include mental health, telemedicine, and various critical illnesses in their policies.

The growing importance of mental health among the population, especially after the COVID-19 pandemic, is a major factor shifting the focus of government bodies and insurance providers to introduce tailored policies for individuals, which is an upcoming trend witnessed in the market.

- In September 2024, the U.S. government released a rule for the coverage inclusion of mental health care and addictive services with an aim to improve access to mental health among the population in the country.

Technological Integration

There are rising technological advancements in the insurance industry with the integration of various tools, including artificial intelligence, machine learning, and other technologies, for the overall improvement of services such as underwriting, claim processing, settlement, and others. The growing focus of companies on merging and collaborating to introduce various platforms with technological advancements, boosts the trend in the market.

Digital Platform

The rising focus of companies to launch various online platforms and applications for the accessibility to the insurance products to customers online is another major trend in the insurance sector. The rising number of smartphone users and improving internet connectivity among the population are major contributors to the trend.

- In January 2024, Allianz launched the Allyz mobile app, a digital platform that makes insurance products and benefits accessible digitally. The application has been launched in France, Germany, and the Netherlands.

Personalized Plans

The growing demand for personalized insurance products and plans among the population owing to their benefits, convenience, and other factors is an important factor supporting the rising trend for the introduction of tailored plans by insurance companies in the market.

- In December 2024, Star Health introduced SUPER STAR. This long-term retail insurance policy combines advanced features and highly customizable covers to cater to the growing demand for personalized plans among the population.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The COVID-19 pandemic positively impacted the global health insurance market. The increase in COVID-19 cases, hospitalizations, and testing led to an increased demand for insurance in the market. Along with this, the growing focus of the companies to cover major expenses for a COVID-19 patient during the pandemic also contributed to the growth of the market during the pandemic.

The pandemic created a rising importance of health and coverage for various conditions among the population, which fueled the demand for these products. Several key players in the market witnessed growth in their health insurance segment in 2020 due to increased demand for these policies.

- In 2020, AXA generated a revenue of USD 15.9 trillion from its health insurance business, witnessing nearly 6.0% growth as compared to 2019.

Segmentation Analysis

By Type

Rising Adoption of Health Maintenance Organization (HMO) Policies Among Population Led to Dominance of Segment

By type, the market is segmented into Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and others.

The health maintenance organization (HMO) segment is projected to dominate the market with a share of 47.71% in 2026. The rising adoption of these plans owing to their comparatively lower cost and more coverage are some of the major factors contributing to the growth of the segment. Additionally, the growing focus of companies on introducing more HMO plans is another major factor driving the adoption of the segment in the market.

- In November 2022, Alignment Healthcare USA, LLC launched the CalPlus + Veterans HMO plan in California. The plan will offer comprehensive medical and prescription drug coverage.

The Exclusive Provider Organization (EPO) segment is expected to register higher growth during the forecast period. The growing number of hospitalizations and clinic visits and rising healthcare costs among these settings are leading to rising demand for EPO plans among the population. These factors are leading to the rising focus of companies on introducing EPO plans in the market.

- In November 2023, Blue Cross Blue Shield of Massachusetts introduced new plans, including EPO plans for the students.

The Preferred Provider Organization (PPO) and other segments are expected to register a steady growth rate during the forecast period. The growing awareness among the population regarding the benefits of insurance plans, along with shifting preference toward specialty clinics for various therapies and treatments, are some of the major factors supporting the growth of the segment.

To know how our report can help streamline your business, Speak to Analyst

By Payor

Rising Focus of Private Players to Introduce Specialized Plans Led to Dominance of Private Segment

In terms of payor, the market is bifurcated into private and public.

The private segment is expected to lead the market, contributing 57.94% globally in 2026. The growing awareness regarding the importance of insurance policies for medical and surgical expenses among the population, along with increasing initiatives of the market players to promote the adoption, are driving the growth of the segment in the market.

- According to the 2023 data published by the Association of British Insurers (ABI), nearly 4.7 million people were covered by private medical insurance through their employer in 2023.

- According to the 2023 statistics published by the Peterson Foundation, the private insurance programs in the U.S. covered nearly 2/3rd of the Americans in 2023.

On the other hand, the public segment is expected to grow during the forecast period. The growing focus of government bodies on expanding the penetration of insurance products among the population through various schemes and policies is one of the major factors supporting the growth of the segment. The mandatory public coverage of the residents in developed countries, such as the U.S., Germany, and France, is another major factor fostering the growth of the segment.

By User

Growing Adoption of Group Coverage Policies Among Population

By user, the market is divided into individual and group.

The group segment will account for 69.17% market share in 2026. The growing focus of organizations on covering their employees is one of the significant reasons leading to the increasing adoption of group insurance policies in the market.

- According to 2022 statistics published by the U.S. Government Accountability Office (GAO), more than 11 million people were enrolled in insurance plans in the country through small-employer group health insurance, and around 40 million people were enrolled through large-employer group health insurance.

On the other hand, the individual segment is expected to register higher growth during the forecast period. The growing importance of health among individuals and the well-being and safety of families are some of the vital factors contributing to the increasing penetration of individual health insurance plans in the market.

By Mode

Offline Segment Held Largest Market Share Owing to Rising Number of Agents and Brokers

Based on mode, the market is divided into offline and online.

The offline segment is poised to account for 68.60% of the market share in 2026. The growing number of agents and brokers for non-life insurance policies, including health insurance plans in developed and emerging countries, is a major factor supporting the direct purchases of the plans in the market. Also, the rising focus of the companies to invest in strengthening the offline channels is another major factor attributable to the growth of the segment.

- In 2021, Ping An Insurance Group invested around USD 6.80 trillion in the New Founder Group to strengthen its offline health ecosystem.

The online segment is expected to register nominal growth during the forecast period. The rising digital penetration in emerging countries such as India, Southeast Asian countries, and others is a crucial factor leading to the growth of the segment in the market.

By Distribution Channel

Growing Number of Agents in the Market Led to the Dominance of the Agents Segment

Based on distribution channel, the market is segmented ino direct sales, agents, brokers, banks, and others.

The agents segment dominated the market in 2024. The growing number of agents for the distribution of non-life insurance policies, including health insurance, especially in emerging countries such as India, China, and others, is one of the major factors leading to the growth of the segment in the market.

- According to the 2023 report published by the Insurance Regulatory and Development Authority of India (IRDAI), the number of agents associated with health insurance in India in 2023 witnessed a growth of around 20.2% as compared to 2022.

The brokers segment held the second-largest market share in 2024. The increased diversity of insurance products among the brokers, along with growing awareness regarding various policies and plans among the general population, are some of the main factors driving the growth of the segment in the market.

The direct sales segment is expected to register the highest growth in the market during the forecast period. The growing focus of companies on promoting the purchase of insurance products through the company portals and websites is leading to segmental growth in the market.

The banks and others segments are projected to grow at a considerable growth rate during the forecast period. The rising integration of the banking sector with the insurance companies owing to the growing digital penetration in the countries, growing mergers and acquisitions among the insurance companies and banks to expand the distribution of insurance policies are some of the favorable factors fueling the growth of the segment.

- In March 2022, AIA Group Limited agreed to acquire 80% of the shares in Blue Care JV Holdings Limited from the Bank of East Asia Limited (BEA). The acquisition will enable the provision of AIA’s health insurance solutions to BEA’s banking customers in Hong Kong.

HEALTH INSURANCE MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Health Insurance Market Size, 2025 (USD Trillion)

To get more information on the regional analysis of this market, Download Free sample

The market in North America was valued at USD 1.45 Billion in 2025. The rising number of private players with a wide product portfolio, along with the growing focus of the government to increase the universal health coverage for the population in the U.S. and Canada, are some of the major factors supporting market growth in the region. Along with this, increasing awareness regarding the various policies among the population in these countries is boosting the market growth in the region. The North America market is projected to reach USD 1.58 trillion by 2026. The U.S. market is projected to reach USD 1.51 trillion by 2026.

- According to 2022 data published by the U.S. Census Bureau, around 92.1% of the U.S. population had health insurance in 2022, as compared to 91.7% in 2021.

The U.S. health insurance market is expected to register significant growth during the forecast period. The growing focus of the companies is on strategic mergers and acquisitions to increase their product portfolio and accessibility of insurance products to the population in the country.

- In January 2024, Health Care Service Corporation (HCSC) signed a definitive agreement to acquire Medicare businesses, including Medicare Advantage, Medicare Supplemental Benefits, Medicare Part D, and CareAllies businesses. The acquisition is aimed at strengthening its product portfolio and accessibility for customers in the U.S.

Asia Pacific

The region is projected to register the fastest growth during the forecast period. The large uninsured population in emerging countries such as China, India, and South Korea, along with rising awareness regarding insurance products, digital penetration, and rising healthcare expenditure, are some of the vital factors anticipated to fuel the market growth in the region. The Japan market is projected to reach USD 0.07 billion by 2026, the China market is projected to reach USD 0.18 billion by 2026, and the India market is projected to reach USD 0.02 trillion by 2026.

Europe

The region is anticipated to grow at a steady rate during the forecast period. The rising focus of the government authorities, along with private players, to increase the universal health coverage of the population in countries including the U.K., Ireland, and Netherlands, among others, is one of the factors favoring the growth of the market in the region. Also, the increasing healthcare expenditure among these countries is another significant factor supporting the growth of the market in the region. The United Kingdom market is projected to reach USD 0.06 trillion by 2026, while the Germany market is projected to reach USD 0.15 trillion by 2026.

- According to 2023 data published by the U.K. Office for National Statistics, voluntary health insurance spending in the U.K. increased by nearly 7.3% in 2022 as compared to the previous year.

Latin America

The market in the region is expected to register a steady growth rate during the forecast period. The growing adoption of these tools among the life science industry, including pharmaceutical companies, biotechnology companies, and others, and growing healthcare expenditure in countries such as Brazil, Mexico, and others, are some of the major reasons for the growth of the market in the country. The Latin America market is projected to reach USD 0.05 billion by 2026.

- According to 2023 statistics published by the International Trade Administration (ITA), Brazil spent nearly 9.5% of its GDP on healthcare in 2022.

Middle East & Africa

The market in the region is projected to grow at a slower pace during the forecast period. The slower market growth is mainly due to the limited awareness and accessibility of insurance products among the population. The Middle East & Africa market is projected to reach USD 0.03 billion by 2026.

- According to a 2023 article published by FSD Africa, insurance penetration is only around 0.5% in Nigeria.

COMPETITIVE LANDSCAPE

List of Key Companies in the Health Insurance Market

Increasing Focus on Technological Development by Major Companies to Strengthen Market Outlook

The global market is fragmented, with a large number of players accounting for a major proportion of the market and a wide range of health insurance products for the population.

UnitedHealth Group and Elevance Health are some of the major players in the market, with a strong product portfolio catering to the rising demand among the population. The growing focus of these companies on investing and introducing new products, including mental health plans for the community, is one of the major factors leading to the growth of these companies in the market.

- In September 2024, UnitedHealth Group announced a USD 250,000 investment in school-based healthcare provider Goodside Health to expand acces to physical and behavioral health plans to 50 new schools in Mexico.

Cigna Group and Allianz, among others, are a few other prominent players in the market, with increasing strategic mergers and acquisitions of other companies to expand their customer base and penetrate in the market.

- In July 2024, Allianz agreed to acquire Singapore-based insurer Income Insurance with the aim of expanding its business in the country.

AXA Group, Ping An Insurance Group, and AIA Group Limited are a few other players with a growing product portfolio that is leading to rising market shares in the global market. The increasing focus of these companies to merge strategically and acquire other companies to broaden their product offerings and geographical presence are some of the vital factors supporting their growth.

- In November 2023, AXA acquired Laya Healthcare Limited, one of the leading insurance companies in Ireland, with the aim of expanding its business and customer base for health insurance products.

LIST OF KEY COMPANIES PROFILED:

- UnitedHealth Group (U.S.)

- AXA (France)

- The Cigna Group (U.S.)

- CVS Health (U.S.)

- Ping An Insurance Group (China)

- AIA Group Limited (Hong Kong)

- Bupa Global (U.K.)

- Elevance Health (U.S.)

- China Pacific Insurance (Group) Co. Ltd. (China)

- Allianz (Germany)

KEY INDUSTRY DEVELOPMENTS

- November 2024 – Ping An Insurance partnered with Medtronic at the China International Import Expo (CIIE) with the aim of collaborating extensively on cardiac health chronic disease therapies to improve healthcare services.

- September 2024 – AU Small Finance Bank partnered with Niva Bupa, a health insurance company with the aim of offering health insurance products to their customers.

- September 2024 – Elevance Health acquired Indiana University Health Plans, Inc., which will operate as part of Anthem Blue Cross and Blue Shield in Indiana. The IU Health Plans provides Medicare Advantage plans to around 19,000 people across 36 countries globally.

- January 2024 – AXA entered into a strategic reinsurance agreement with NextGen International Insurance, one of the leading private medical insurance companies in Latin America and the Caribbean, with the aim of broadening the product offerings and geographical footprint.

- October 2023 – The Cigna Group expanded its Medicare Advantage (MA) presence to four new countries, including dental plans, hearing and vision benefits, and others.

REPORT COVERAGE

The global health insurance market report covers a detailed analysis and overview of the market. It focuses on key aspects such as gross written premium, competitive landscape, type, payor, user, mode, distribution channel, and region. Besides this, it offers insights into the market drivers, market trends, market dynamics, COVID-19 impact on the market, and other key insights. In addition to the factors mentioned above, it encompasses several factors that have contributed to the growth of the market over recent years.

The health insurance sector is set for significant expansion, fueled by technological progress, rising healthcare expenses, and a stronger focus on health safety. However, challenges such as elevated premiums and regulatory framework are some of the barriers to the growth of the market. Major players are emphasizing innovation, digital transformation, and strategic partnerships to leverage new opportunities and adapt to the changing dynamics of the health insurance sector.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 10.21% from 2026-2034 |

|

Unit |

Value (USD Trillion) |

|

Segmentation |

By Type

|

|

By Payor

|

|

|

By User

|

|

|

By Mode

|

|

|

By Distribution Channel

|

|

|

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global health insurance market was valued at USD 2.32 Trillion in 2025 and is projected to reach USD 5.5 trillion by 2034.

North America dominated the health insurance market with a market share of 62.41% in 2025.

The health insurance market is expected to exhibit a CAGR of 10.21% during the forecast period of 2026 to 2034.

Based on type, the Health Maintenance Organization (HMO) segment dominated the market in 2025.

The market growth is driven by increasing awareness of insurance plans, rising healthcare costs, and a growing number of product launches by major players.

Major players in the global health insurance market include UnitedHealth Group, CVS Health, and The Cigna Group.

Key trends include the integration of telemedicine services, the adoption of value based care models, the use of artificial intelligence for personalized plans, and the expansion of global mobility solutions to cater to expatriates and international travelers.

Fintech startups are introducing premium financing solutions, allowing individuals and corporates to pay health insurance premiums through manageable equated monthly installments (EMIs), making health coverage more accessible amid rising costs.

Health insurance companies are grappling with rising healthcare costs, increased utilization of services, and the need to manage expenses related to specialty drugs and chronic conditions.

An aging population, particularly in countries like China, is driving demand for health and retirement insurance products, influencing insurers to develop tailored plans and leverage technologies like AI for personalized coverage.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us