Hedge Fund Market Size, Share & Industry Analysis, By Fund Type (Equity Hedge Funds, Event-Driven Hedge Funds, Macro Hedge Funds, Relative Value Arbitrage Fund, and Others), By Investor Type (HNIs, Institutional Investors, Family Offices, Fund of Funds, Retail Investors, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

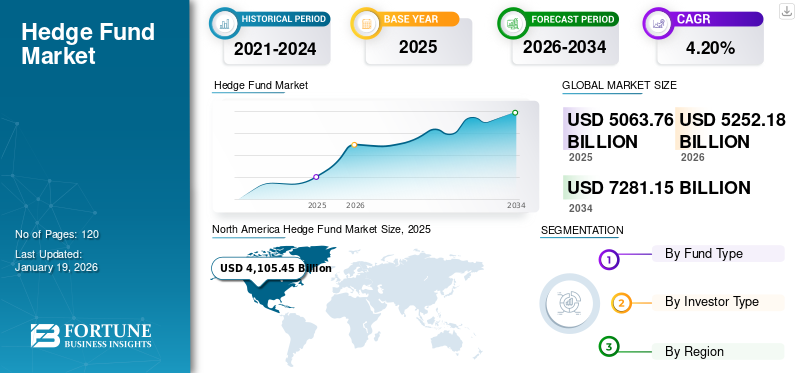

The global hedge fund market size was valued at USD 5,063.76 billion in 2025 and is projected to grow from USD 5,252.18 billion in 2026 to USD 7,281.15 billion by 2034, exhibiting a CAGR of 4.20% during the forecast period. North America dominated the global market with a share of 81.10% in 2025.

The global hedge fund market is continuously evolving as a key segment within the broader asset management industry. It is majorly driven by the growing demand for diversified and alternative investment strategies. Institutional investors, such as pension funds and endowments, along with high-net-worth individuals, are becoming more reliant on these funds for the diversification of their portfolios while mitigating the risks and generating alpha. The sector has seen a transformation toward a more systematic and quant-driven strategy, while ESG-aligned alternative funds are at the same time gaining traction among rising sustainability awareness. Moreover, Stricter regulations and greater expectations for transparency are encouraging fund managers to adopt more robust compliance and operational frameworks.

In the future, this industry is projected to remain resilient, with rising interest in multi-strategy and global macro funds to navigate market volatility and geopolitical uncertainties. The integration of artificial intelligence, machine learning, and big data analytics is further transforming the way these funds recognize opportunities and manage risk. Leading global players such as Bridgewater Associates, Renaissance Technologies, and Man Group dominate the global market share with their scale, innovation, and proven performance and setting benchmarks for the rest of the market. Overall, the future outlook remains optimistic, which is carried by investor appetite for flexible strategies that can deliver consistent returns across diverse market cycles.

IMPACT OF GENERATIVE AI

Generative AI to Reshape Market Through Streamlined Operations and Decision Making

Generative AI is poised to continue its disruption of the global industry by driving data-oriented decision-making, enhancing trading strategies, and advancing operations. For example, generative AI generates synthetic data, enabling fund managers to build enhancement models and backtest their strategies while uncovering previously unknown patterns and scenarios of what could happen to a market or trade. Generative AI even enables fund managers to customize their communications with investors, automate research requirements, and refine their operational obligations. Funds that understand how to leverage generative AI optimally will compete in an innovation-fueled industry that thrives on speed, insights, and accuracy.

Hedge Fund Market Trends

Rising Institutional Demand Driving Strategy Diversification in Industry

Hedge strategies are gaining traction through institutional allocations in search of uncorrelated returns and downside protection, particularly when faced with difficult market cycles. The rapid development of demand among institutions is driving fund managers to explore a wider variety of investment approaches beyond long-short equities, with multi-strategy, event-driven, and global macro models being pursued. Institutions appear open to bespoke solutions, contingent upon their desired level of risk-return profile. Hedge-fund managers are responding to institutional demand with innovative products and improved risk management processes. This push toward bespoke products is bringing expanded writing scope to the marketplace and raising both levels of sophistication and competition among fund managers.

MARKET DYNAMICS

Market Drivers

Rise in Market Volatility and Geopolitical Uncertainty Fueling Market Growth

The growing uncertainty around the world, such as geopolitical tensions, changes in interest rates, and inflation, has increased volatility in global markets, which helps to boost investor interest in these funds. These funds are designed in a way to generate returns in different market environments, as opposed to traditional asset classes, making them an appealing investment option in uncertain times. The current environment favors opportunistic, nimble strategies that can exploit market dislocations and inefficiencies, almost such as a tailwind and a meaningful catalyst for growth, given the size of the global market. This is expected to boost the hedge fund market growth in the coming years.

Market Restraints

High Management Fees and Underperformance Restrain Market Expansion

Even though these funds are high-return investments, they are facing scrutiny relative to management fees and performance fees, typically under a "2 and 20" model. More and more, investors are questioning these traditional fee structures, particularly in an environment where funds underperform relative to benchmarks or comparable passive investment vehicles. A common theme with these funds is that they charge high fees while delivering varying performance levels. Due to the high fees being charged while keeping at least some performing worse than passive alternatives, some investors are now questioning the allocation of assets to hedge funds, which detracts from any real macro/market-wide growth. In the face of this, some fund managers are experimenting with lower-fee models or even adopting hurdle rates in an effort to maintain investors' confidence.

Market Opportunities

Advanced Analytics and AI Integration to Create Lucrative Opportunities for Hedge Fund Innovation

The quick integration of advanced analytics and artificial intelligence is creating new horizons for hedge fund innovation and performance enhancement. By applying machine learning, generative AI, and predictive modeling, these alternative funds will be able to identify new trading signals, automate decision-making processes with multiple and expanding variables, and improve risk forecasting. These technological enhancements present a huge opportunity for funds that can integrate these tools and functionality into their approach, dramatically differentiating themselves from traditional funds by gaining competitive advantages, increasing their chances of outperforming traditional strategies, and attracting investor capital from technology-oriented investors in rapidly changing market environments.

SEGMENTATION ANALYSIS

By Fund Type

Equity Hedge Funds Dominate Market Due to Strong Investor Preference for Long/Short Strategies

By fund type, the market is segmented into equity hedge funds, event-driven hedge funds, macro hedge funds, relative value arbitrage fund, and others.

Equity hedge funds hold the largest market with a share of 48.24% in 2026, driven by their broad appeal and adaptability across market cycles. These funds can make a profit from rising and falling stock prices through long/short strategies, which makes them a preferred choice for investors who are looking for a balanced exposure that provides downside protection.

Relative value arbitrage funds are anticipated to see the highest CAGR during the forecast period, thanks to market inefficiencies and demand for low-risk, high-frequency strategies. Their strategies aim to take advantage of price discrepancies between related securities and are attractive to institutional investors seeking stable returns with no directionality to the markets.

Event-driven hedge funds are leveraging corporate actions, such as mergers, bankruptcies, and restructurings, with an objective to capture capital. While macro hedge funds profit from global economic trends and currency fluctuations.

The “others” category includes niche strategies that mainly serve specialized investor demands, thus offering unique diversification opportunities.

By Investor Type

To know how our report can help streamline your business, Speak to Analyst

Institutional Investors Lead Market Owing to Large-Scale Allocations and Long-Term Investment Horizon

By investor type, the market is segmented into HNIs, institutional investors, family offices, fund of funds, retail investors, and others.

Institutional investors hold the largest hedge fund market with a share of 51.66% in 2026, due to their large capital bases, desire for diversification, and ability to invest well beyond the standard hedge fund 2 & 20 period. Institutional investors, including pensions, endowments, insurers, and others, have been allocating capital to hedge funds for several years to mitigate risk across their larger portfolios and enhance portfolio returns.

Family offices are likely to show the highest CAGR, attributable to the sophistication and needs of family offices for direct, flexible, and alternative assets. Family offices are more agile than most institutional investors as they are in control of their asset allocation. Family offices are non-client-driven and focus on wealth preservation and generational wealth. Their ability to customize hedge-fund investments to their desired risk budgets is going to lend to increasing allocations. Family offices are finding themselves more aligned with these investments as they diversify their companies and/or families' wealth revenue streams away from a reliance on public equity returns alone.

High-net-worth individuals (HNIs) are an effective segment of investors leveraging hedge funds as they personalize their trade into any wealth strategy.

Similarly, fund-of-funds products are an avenue for a small subset of investors to have indirect access to hedge-fund investments, as they are innovative options for smaller allocations. However, this allocation pool will likely become less distinct due to fund-of-funds providing layered fee structures.

Some other smaller retail investors and "others" count for a smaller piece. Still, they are beginning to get exposure to some hedge-funds through lower-cost channelized vehicles now available and democratizing access.

HEDGE FUND MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America

North America Hedge Fund Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the global market, accounting for the largest share due to its mature financial ecosystem, deep capital markets, and presence of leading hedge-fund managers. North America dominated the global market in 2025, with a market size of USD 4,259.81 billion. The region benefits from strong institutional participation and from favorable regulatory frameworks and high investor confidence in alternative investment strategies.

Download Free sample to learn more about this report.

The largest market is primarily located in the U.S., dominated by the underlying integrity of the financial system, a strong rule of law, and a very strong institutional appetite. The U.S. market is projected to reach USD 3,784.02 billion by 2026. Continued innovation in terms of strategy diversification and technology also constantly assures the U.S. continues to play a leading role in global hedge-fund activity.

South America

Overall, South America experienced fairly limited hedge-fund activity, which is now increasing slowly. Brazil is the main source of hedge-fund activity, which, due to its investor base and macroeconomic trend, has the most positive catalyst to foster a growing market. Historically common obstacles to developing the asset class in the overall South America region are still political instability and low availability of institutional potential.

Europe

Europe has a reasonably sized market, growing with increasing appetite from pension plans and sovereign wealth funds. While experiencing serious regulatory scrutiny, such as AIFMD, Europe is seeing growth in assets under management and for future allocation, with significant contributions from firms in London, which are considered the main providers of hedge-fund strategies. The UK market is projected to reach USD 325.94 billion by 2026, and the Germany market is projected to reach USD 142.11 billion by 2026.

Middle East & Africa

The industry in the Middle East & Africa is growing, albeit slowly, as growing numbers of ultra-high-net-worth individuals and sovereign wealth funds diversify their portfolios with alternative investments. Due to regulatory overhaul, as financial regulators in many of these jurisdictions modernize their rules and attract international financial institutions, the area's market possibilities are developing.

Asia Pacific

The Asia Pacific region is projected to grow at the highest CAGR during the forecast period, as high-net-worth individuals show increased interest in alternative investments, family offices are growing in number, and would-be hedge-fund investors and potential investors in this area encounter an increasingly liberalized financial market in jurisdictions such as China and India. Increasing awareness of alternatives and appetite for alternatives is opening the door to inflows into hedge funds across the Asia Pacific region. The Japan market is projected to reach USD 39.26 billion by 2026, the China market is projected to reach USD 56.39 billion by 2026, and the India market is projected to reach USD 30.28 billion by 2026.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Leading Players Dominate, Owing to Strategies, Innovation, and Performance Excellence

The top key players in the global market are defined by their large amount of available capital, their experience using advanced investment strategies, and their use of proprietary technology and data analytics. These players generally operate on a global basis, managing diverse portfolios spanning all possible investments (from categories such as equity, fixed income, commodities, and derivatives). Top players place a strong emphasis on risk management capabilities and valuable trading infrastructure (reliability, efficiency, and affordability), all of which are subject to and drive creative innovation (e.g., trading with algorithms/strategies, quant trading). They have a reputation for attracting the most talented individuals in the market. They commit to institutional client transparency. Top players also regularly report returns to their institutions that meet or exceed the benchmarks set for the financial product, making up the investment portfolio performance, when comparing investment products.

Long List of Key Hedge Fund Companies Studied (including but not limited to)

- Bridgewater Associates (U.S.)

- Man Group (U.K)

- Elliott Investment Management (U.S.)

- Millennium Management, LLC (U.S.)

- Citadel LLC (U.S.)

- Renaissance Technologies (U.S.)

- E. Shaw & Co. (U.S.)

- Two Sigma (U.S.)

- Goldman Sachs Asset Management (U.S.)

- Farallon Capital (U.S.)

- Renaissance Technologies (U.S.)

- AQR Capital (U.S.)

- Davidson Kempner Capital Management (U.S.)

- Point72 Asset Management (U.S.)

- Marshall Wace (U.K)

- Brevan Howard (U.K)

- Wellington Management Company (U.S.)

- PIMCO (U.S.)

- Ruffer (U.K)

- Tiger Global Management (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2025: Millennium Management continued to build its credit-trading business by adding two prominent portfolio managers, Jonathan Grau and Christopher Reich, thus demonstrably investing in the firm's continued credit growth.

- February 2025: Elliott Investment Management disclosed that it owns a 5% stake in BP, valued at £3.969 million, and made the news by suggesting that BP should produce more oil and gas, which led BP to announce the cut in its investments for renewable energy.

- October 2024: Two Sigma Investments, LLC, indicated that it registered its real estate unit as an investment adviser, which now allows for external real estate capital, focusing on housing and industrial sectors.

- June 2024: Citadel Securities announced that it had started to trade Euro and Sterling interest-rate swaps to expand its business beyond the U.S. domestic market. The firm executed its first trade in interest-rate swaps and will declare Paris as its European trading hub.

- May 2024: Elliott Investment Management acquired a USD 1.9 billion position in Southwest Airlines and published a plan to change its leadership based on the company's lack of strategic investment.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types of funds, and investors. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 4.20% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Fund Type

By Investor Type

By Region

|

|

Companies Profiled in the Report |

Citadel LLC (U.S.), Bridgewater Associates (U.S.), Man Group (U.K.), Renaissance Technologies (U.S.), Millennium Management, LLC (U.S.), D.E. Shaw & Co. (U.S.), Elliott Investment Management (U.S.), AQR Capital (U.S.), and Tiger Global Management (U.S.), and Goldman Sachs Asset Management (U.S.) |

Frequently Asked Questions

The market is projected to reach USD 7,281.15 billion by 2034.

In 2025, the market was valued at USD 5,063.76 billion.

The market is projected to grow at a CAGR of 4.20% during the forecast period.

The equity hedge funds segment leads the market.

Rise in market volatility and geopolitical uncertainty are the key factors driving market growth.

Citadel LLC, Bridgewater Associates, Man Group, Renaissance Technologies, and Millennium Management, LLC are the top players in the market.

North America leads the global market.

By investor type, the family offices segment is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us