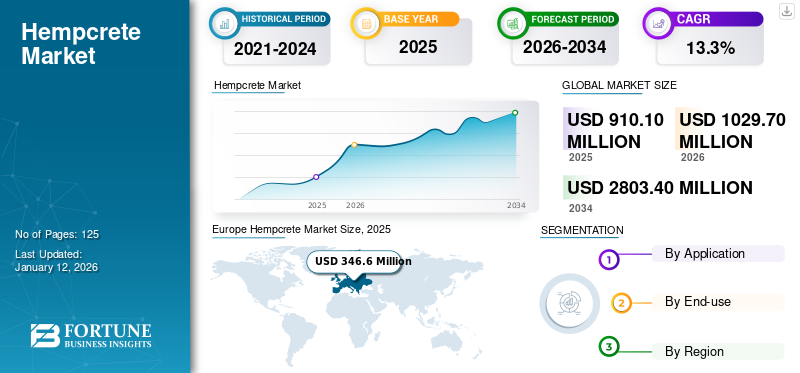

Hempcrete Market Size, Share & Industry Analysis, By Application (Walls, Floors, and Roofs), By End-use (Residential and Non-residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global hempcrete market size was valued at USD 910.1 million in 2025 and is projected to grow from USD 1029.7 million in 2026 to USD 2803.4 million by 2034 at a CAGR of 13.3% during the forecast period of 2026-2034. Europe dominated the hempcrete market with a market share of 38.00% in 2025.

Hempcrete is a sustainable, bio-composite building material made from the hemp plant's woody core (hurd) mixed with a lime-based binder and water. It is lightweight, non-toxic, and provides excellent insulation, breathability, and thermal regulation. The product is carbon-negative, as hemp absorbs CO2 during growth, and the lime binder sequesters additional carbon over time. It is used for walls, insulation, and finishing in eco-friendly construction, offering fire resistance, mold resistance, and acoustic benefits. However, it is not load-bearing and requires a structural frame. The growing demand for sustainable materials in the construction industry propels the market growth during the forecast period.

Australian Hemp Masonry Company, Sativa Building Products, IsoHemp, Hempitecture, and Hemp Homes Australia are the key players operating in the market.

HEMPCRETE MARKET TRENDS

Advancements in Hemp Cultivation and Processing Increase Demand for Products

Advancements in hemp cultivation and processing have significantly boosted the demand for products. Research and development have led to high-yielding hemp varieties tailored for product manufacturing. Selective breeding and precision farming enhance crop yields and the quality of hemp hurds, which are critical for the product's consistency and performance.

Innovations such as improved decortication technology separate hemp fibers from hurds more efficiently, reducing costs and improving the quality of product inputs. Supercritical CO2 extraction and other advanced techniques also enhance the production of high-quality hemp-derived materials.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for Sustainable Building Materials is a Key Growth Driver

Growing awareness of climate change drives demand for materials such as hempcrete in construction. Policies in Europe, North America, and Asia incentivize sustainable construction, boosting the adoption of hempcrete blocks.

The product offers excellent thermal insulation, moisture regulation, fire resistance, and pest/mold resistance. Builders and homeowners demand such properties. In addition, the products are seeking durable, eco-friendly alternatives to concrete or fiberglass. The product’s biodegradability and low embodied energy align with global sustainability goals, making it a preferred choice for eco-conscious construction.

MARKET RESTRAINTS

Performance Limitations May Hurdle Market Growth

The market, while promising due to its eco-friendly properties, faces several performance limitations that restrain its growth. The product is not a load-bearing material, requiring additional structural support such as timber or steel frames. This increases construction costs and complexity, making it less competitive than conventional materials such as concrete or brick, which offer insulation and structural integrity.

Compared to traditional materials such as concrete or steel, the products exhibit inferior compressive and tensile strength. This restricts its use to non-structural applications, such as insulation or infill, reducing its appeal for large-scale or high-load projects.

Market Opportunities

Government Regulations and Incentives are Creating Opportunities for Market

The European Union, particularly countries such as France, Germany, and Netherlands, has implemented robust regulatory frameworks supporting sustainable building practices. Favorable agricultural policies and green building codes, such as LEED and BREEAM, encourage product use due to their carbon-negative properties and thermal efficiency.

Countries such as India, China, and Japan are relaxing hemp cultivation laws, promoting green infrastructure, and fostering product adoption. For instance, India’s Uttarakhand state and Germany’s draft legislation have legalized industrial hemp cultivation, boosting raw material availability.

Market Challenges

Limited Awareness of Products Challenges Market Growth

Many architects, builders, and developers are unfamiliar with the product’s properties, benefits, and applications. This knowledge gap leads to hesitation in adopting it over conventional materials such as concrete or brick, which have well-established track records.

Awareness of the product varies significantly by region. In countries such as France and Canada, where products have gained some traction, awareness is higher due to supportive policies and pilot projects. However, knowledge remains minimal in emerging markets or regions with limited hemp cultivation, restricting hempcrete market growth.

Regulatory Compliance May Hurdle Market

In countries such as China and Japan, where product markets are emerging, inconsistent quality control and standardization of protocols further complicate compliance, hindering sustainable market growth.

Compliance with diverse regional regulations increases operational costs for product manufacturers. For example, ensuring product certifications and meeting environmental or safety standards can be resource-intensive, making the product less cost-competitive than traditional materials such as concrete or steel.

Impact of COVID-19

Stalled Supply Chain Due to Pandemic Hampered Market Growth

Lockdowns and restrictions on international trade disrupted hemp supply chains, affecting the availability of raw materials such as hemp hurds. Transportation halts and reduces international trade, particularly from major producers such as China, which leads to delays and increased costs for product manufacturers.

Despite initial setbacks, the COVID-19 pandemic increased consumer and industry focus on sustainability, aligning with product’s eco-friendly attributes, such as its carbon-negative properties and energy efficiency.

Trade Protectionism and Geopolitical Impact

Protectionist measures, including tariffs and import quotas, have increased the cost of hemp-based raw materials, particularly in markets reliant on imports such as the U.S. and European Union.

Tariffs on hemp imports, as observed in the U.S. and China trade war, have driven up prices for raw materials, making products less competitive than traditional materials such as concrete. This aligns with broader trends where protectionist policies increase consumer prices, as witnessed with the U.S. tariffs on Chinese goods.

Research and Development (R&D) Trends

Companies are focusing on improving product properties by experimenting with different formulations. The hemp hurds-to-lime ratio in hempcrete can be adjusted to enhance insulation, strength, and durability.

The researchers are also focusing on hybrid material solutions, such as combining market products with other materials, such as recycled plastics or natural fibers, to create composites that enhance performance while maintaining sustainability.

SEGMENTATION ANALYSIS

By Application

Walls Segment Dominated Due to Its Structural Properties and Effective Insulation

Based on application, the market is classified into walls, floors, and roofs. Among these, walls dominated the market share of 44.75% in 2026 due to the product’s excellent insulation and structural properties, making them ideal for energy-efficient building envelopes.

Floors is a growing segment, leveraging the product’s lightweight and thermal mass benefits for sustainable flooring solutions. Similarly, roofs have notable product demand for insulation and eco-friendly construction, particularly in green building projects. Market trends indicate increasing adoption across all segments, driven by demand for sustainable materials, with walls leading due to broader application scope.

By End-use

To know how our report can help streamline your business, Speak to Analyst

Increased Hempcrete Demand in Residential Applications Fuels Segment Expansion

In terms of end-use, the market is segmented into residential and non-residential.

The residential segment dominates the market with share of 60.39% in 2026. The demand for products in residential applications is increasing rapidly. It is gaining popularity due to its eco-friendly properties and benefits, primarily used for insulation, providing a natural and sustainable alternative to traditional materials.

The product is also registering positive growth in non-residential applications. It includes commercial buildings, industrial facilities, and public infrastructure. It has increasing demand as green building standards gain traction, though they hold a smaller share due to their lesser strength than traditional materials and regulatory hurdles.

HEMPCRETE MARKET REGIONAL OUTLOOK

Based on region, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Europe

Europe Hempcrete Market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market with a valuation of USD 346.6 million in 2025 and USD 391.7 million in 2026. Europe registered a dominant hempcrete market share in 2025, driven by stringent environmental regulations and a strong emphasis on sustainable architecture. Countries such as France, the U.K., and Germany are pioneers, with France being a global leader due to its established hemp industry and favorable policies. The product is widely used in new eco-friendly buildings, heritage restoration projects, and insulation retrofits, particularly in France and the U.K. The UK market is projected to reach USD 44.2 million by 2026, while the Germany market is projected to reach USD 109.6 million by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

In North America, particularly the U.S. and Canada, are significant countries in the market due to the legalization of industrial hemp in recent years. This region has shown interest in sustainable building materials, with products gaining traction for their eco-friendly properties, such as carbon sequestration and energy efficiency. The U.S. market is projected to reach USD 290 million by 2026.

Asia Pacific

The Asia Pacific region is an emerging market. Rising urbanization, increasing awareness of sustainable construction, and government initiatives promoting green building materials positively impact the market. Additionally, China’s dominance in hemp production provides raw material availability. The Japan market is projected to reach USD 44.7 million by 2026, the China market is projected to reach USD 106.2 million by 2026, and the India market is projected to reach USD 32.5 million by 2026.

Latin America and Middle East & Africa

Latin America and the Middle East & Africa are in the nascent market growth stage. Growing interest in sustainable development, especially in African nations, aims to address housing shortages with low-cost materials. The product’s thermal properties are advantageous in the region’s extreme climates.

Competitive Landscape

Key Market Players

Key Players Focus on Blending Organic and Inorganic Growth Strategies to Cope with Market Competition

Europe and North America have more supportive regulations for hemp products, while Asia Pacific and Latin America face inconsistent policies. The Middle East & Africa lag due to restrictive hemp laws. Hence, many players in the market have branches in European countries and are investing a considerable number of resources in research and development of customized market products as per the needs of end users.

Furthermore, these companies have adapted new product development, expansion, and acquisition strategies to increase their product offerings and geographic presence and efficiently serve customer demands. These strategies are projected to positively impact the global market during the forecast period, as many companies would increase their market share.

LIST OF KEY HEMPCRETE COMPANIES PROFILED

- Australian Hemp Masonry Company (Australia)

- Sativa Building Products (U.S.)

- IsoHemp (Belgium)

- Hempitecture (U.S.)

- Hemp Homes Australia (Australia)

- Carmeuse Group (Belgium)

- Rare Earth Global (U.K.)

- UK Hempcrete (U.K.)

- Hempbuild Sustainable Products Ltd. (Ireland)

- The Hempcrete Co. (Australia)

- The Hemp Block Company (U.K.)

KEY INDUSTRY DEVELOPMENTS

- March 2024: The Australian Hemp Masonry Company reported a significant increase in their hempcrete production, tripling their annual supply to 120 homes from 40 homes per year over the past decade. This growth highlights the increasing demand for sustainable and eco-friendly building materials such as hempcrete.

- January 2024: The International Code Council (ICC) added an appendix on hemp-lime construction to its 2024 International Residential Code (IRC). Such developments are helpful for builders to obtain permits and approvals to use hempcrete.

REPORT COVERAGE

The market report provides a detailed analysis of the market and focuses on key aspects such as leading companies, application, and end-use of the product. Besides this, the report offers insights into the market and current trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Million) |

|

Growth Rate |

CAGR of 13.3% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By End-use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was USD 1029.7 million in 2026 and is projected to reach USD 2803.4 million by 2034.

Growing at a CAGR of 13.3%, the market will exhibit steady growth over the forecast period (2026-2034).

In 2025, walls led the application segment in the market.

Rising demand for sustainable building materials is driving the market.

Europe held the highest market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us