Agricultural Micronutrients Market Size, Share & Industry Analysis, By Type (Zinc, Boron, Iron, Molybdenum, Manganese, and Others), By Application Mode (Soil, Foliar, and Fertigation), By Form (Chelated and Non-chelated), By Crop Type (Cereals, Pulses & Oilseeds, Fruits & Vegetables, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

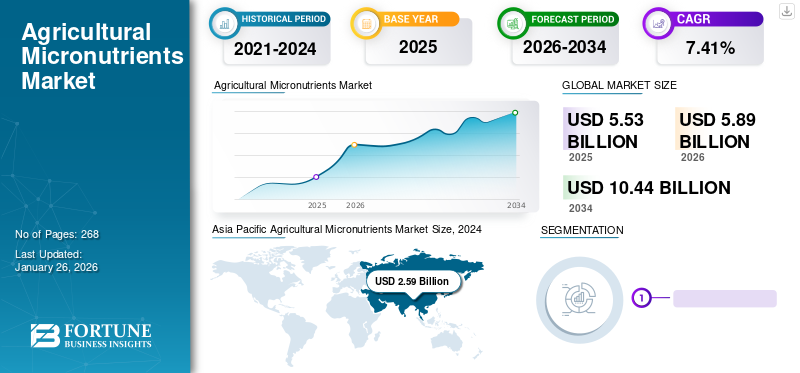

The global agricultural micronutrients market size was valued at USD 5.53 billion in 2025 and is projected to grow from USD 5.89 billion in 2026 to USD 10.44 billion by 2034, exhibiting a CAGR of 7.41% during the forecast period. Asia Pacific dominated the agricultural micronutrients market with a market share of 46.82% in 2025. Moreover, the agricultural micronutrients market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.88 billion by 2032, driven by high application on large-acre crops. Asia Pacific dominated the agricultural micronutrients market with a market share of 46.62% in 2024.

Zinc, boron, iron, molybdenum, chloride, nickel, copper, and manganese are agricultural micronutrients applied to crops to reduce soil micronutrient deficiency. These micronutrients are either chelated or non-chelated and can be applied to crops such as cereals, pulses and oilseeds, fruits and vegetables, and others through soil, foliar, or fertigation.

China, India, the U.S., Brazil, Russia, France, Mexico, Japan, Germany, and Turkey are said to be the top agricultural-producing countries globally, as per the Food and Agriculture Organization (FAO). Furthermore, the extensive growth in the demand for high-quality agricultural products globally has been a significant factor in the rising demand for efficient fertilizer in the agriculture industry. Thus, in recent years this market has grown significantly.

For instance, as per the Directorate General of Foreign Trade, Ministry of Agriculture and Farmers Welfare, the imports of agricultural products in India accounted for USD 31.4 billion, which was USD 22.1 billion in 2020. Furthermore, the Indian Agriculture Produce market exported goods worth USD 43.2 billion in 2021, a growth of around 29.34% compared to 2020.

In the first half of 2021, the pandemic caused massive economic and healthcare disruption, resulting in a global lockdown and closing of borders by countries across the globe, which resulted in supply chain disruption. However, the announcement of relief funds and policies, including government fertilizer subsidies, increased the trade of essential commodities, including fertilizers. For instance, as per the WTO, the global trade of food and agricultural products was projected to exhibit a growth of 3.5% in 2020. This rising demand for agricultural produce and inputs exceeded supply, resulting in rising global inflation.

Global Agricultural Micronutrients Market Overview

Market Size & Forecast:

- 2025 Market Size: USD 5.53 billion

- 2026 Market Size: USD 5.89 billion

- 2034 Forecast Market Size: USD 10.44 billion

- CAGR: 7.41% from 2026–2034

Market Share:

- Asia Pacific dominated the agricultural micronutrients market with a 46.82% share in 2025, driven by high cereal crop production and exports from China and India.

- Zinc held the highest market share in 2024 due to widespread soil deficiencies and crop-specific requirements.

Key Country Highlights:

- U.S.: Projected to reach USD 1.88 billion by 2032, supported by large-acre crop applications and growing awareness of micronutrient deficiency.

- India: Government initiatives like the Mission for Integrated Development of Horticulture (MIDH) and strong exports of agricultural produce fuel market expansion.

- China: Produces around one-fourth of the world’s grain with only 10% of global arable land, supporting heavy use of micronutrient fertilizers.

- Brazil: Rising demand for boron-based micronutrients due to poor soil quality; launch of K Forte multi-nutrient fertilizer supports growth.

- Europe: 60% of soil samples found deficient in iron and 28% in zinc; growing awareness and new product launches drive market growth.

Agricultural Micronutrients Market Trends

Rising Focus on Soil Health and Increasing Demand for Home Gardening to Aid Market Growth

Farmers and agricultural producers are increasing their focus on soil health as soil health influences the crop production rate. For instance, according to the Food and Agriculture Organization (FAO), ecological soil management has the potential to produce 58% more food. As productive soils result in higher yields, agricultural inputs such as soil amendment and micronutrients have seen an increasing demand.

In addition to soil health, home gardening is becoming more popular worldwide. Home gardeners mainly focus on cultivating horticultural crops due to their nutritious nature. The COVID-19 pandemic has further fueled the number of home gardeners wanting to grow their own food. Therefore, the growing trend of home gardening and the rising focus on soil health will drive the global agricultural micronutrient market growth. Asia Pacific witnessed a growth from USD 2.26 Billion in 2023 to USD 2.24 Billion in 2024.

Download Free sample to learn more about this report.

Agricultural Micronutrients Market Growth Factors

Increase in Production and Cultivation Areas of High-Value Crops to Support Market Growth

High-value crops, such as fruits, vegetables, turf, and ornamentals, are significant consumers of micronutrient fertilizers owing to the growing consumer demand for high-quality produce. The agricultural output and net return of high-value crops are significantly high. Thus, to improve the agriculture industry and high-value crop production, various government bodies have been launching new separate departments, such as the Indian government-sponsored Mission for Integrated Development of Horticulture (MIDH). These departments provide financial aid to farmers. For instance, in the 2020-2021 fiscal year, the Indian government allotted USD 292.18 million under the MIDH. Furthermore, the production of these high-value crops has recently seen substantial growth due to the rapid growth in the consumption of fruits in regions such as Asia Pacific, South America, Europe, and others, as fruits and vegetables are the major sources of vitamins, minerals, and other essential nutrients. Further, to meet this increasing demand, the production of fruits & vegetables is increasing, reaching 2.10 billion tonnes in 2020, as per data provided by FAO.

Micronutrients play a crucial role in the high-quality yield of fruits & vegetables. Thus, the adoption rate of such products among farmers is expected to increase, thus boosting the market growth globally. Culturing turf grasses to improve the aesthetic appeal of sports, landscapes, commercial homes, and other residential facilities has increased significantly in recent years. The area devoted to lawns has increased, and as per data provided by the U.S. Department of Agriculture, lawns are one of the highest non-irrigated crops in the country, accounting for 1.9% of the total land in the country.

Increasing Need for Soil Nutrient Management and Demand for Customized Micronutrient Solutions to Favor Market Growth

The rate of soil degradation has increased significantly in recent years. Several factors lead to soil degradation, although the use of pesticides is said to be one of the leading factors. Around 95% of the food provided globally is produced on soil, although as per the United Nations, around 30% of the soil globally is already degraded.

Over the past few decades, the constant use of synthetic fertilizers for crop production has impacted soil fertility. It has caused depletion in soil organic matter, reduced soil fertility, physical degradation of soil, and soil toxification, resulting in low-quality yield and agricultural produce. Nutrient management through the external application of nutrients on soil can help to improve soil health and crop yield. Therefore, several crop nutrient advisors suggest the 4R strategy to farmers to improve micronutrients in the soil. This strategy helps to educate farmers about the need to adopt a balanced application of crop nutrition products, including micronutrients. Therefore, rising concern about managing soil nutrients will promote the adoption of agricultural micronutrients.

There are significant regional differences in the availability of micronutrients. Identification and mapping of micronutrient availability in the region are helpful in the development of tailored micronutrient solutions and support precision agriculture in such regions. For instance, the European Soil Data Centre (ESDAC) has surveyed to assess top soils in Europe and determined the micronutrient content.

RESTRAINING FACTORS

Lack of Access to Government Services and High Taxes on Micronutrients to Impact Market Value

In developing countries, a lack of access to government schemes and services offered to farmers regarding soil health and nutrient deficiency can impact the adoption of micronutrients in the market. For instance, 700 of the 1,454 testing facilities in India provide micronutrient deficiency detection services. Thus, around 140 million farmers in the country lack access to laboratories and other services.

Several climatic factors, such as temperature and carbon dioxide, rising sea levels, climate disasters, and others, impact crop yield. Changes in climate factors also impact the crop’s micronutrient uptake, which in turn impacts its nutritional qualities and yield.

As per research conducted by the Harvard Chan School, the micronutrient content in several crops declines when exposed to higher levels of CO2. When exposed to high carbon dioxide levels, wheat, corn, rice, and soy lose 10% of zinc, 5% of iron, and 8% of their protein content.

Agricultural Micronutrients Market Segmentation Analysis

By Type Analysis

Rising Awareness Regarding Zinc and Iron Deficiency to Fuel the Demand for Micronutrient Fertilizers

Based on type, the market is classified into zinc, boron, iron, molybdenum, manganese, and others. The zinc segment holds the highest share of the market, owing to the higher rate of zinc deficiencies in soil across the globe. The choice of micronutrients is highly dependent on the crop and soil. Furthermore, with micronutrients readily available in the soil, the quantity required is less than that of traditional fertilizers.

- The zinc segment accounting for 41.43% of the global market share in 2026.

Iron is in significant demand among growers worldwide. Boron is also popular among consumers in the South American region due to its soil conditions. Brazil, Paraguay, Uruguay, and Bolivia have leached soils that are often poor in nutrients, acidic, and low in organic matter, which are favorable conditions for boron deficiency.

To know how our report can help streamline your business, Speak to Analyst

By Application Mode Analysis

Rising Investments in Technological Advancements and the Development of Fertilizer Equipment to Boost Micronutrient Consumption

Based on application mode, the market is segmented into soil, foliar, and fertigation. The soil segment accounting for 42.28% of the global market share in 2026. The soil application mode enjoys significant popularity in the global market owing to its ease of application and economics. Fertilizers are applied on the surface across an entire field using high-capacity spreaders in the soil application method. Furthermore, rising investments and initiatives in building new and advanced higher-capacity fertilizer spreaders will further boost the market growth. For instance, in January 2019, Kuhn & Rauch shared plans to launch a new facility to test their fertilizer spreaders.

The foliar application mode has the fastest growing CAGR in the forecast period owing to its rising popularity among farmers. Foliar application ensures uniform application of nutrients to the crops and provides supplementary feeding to complete soil fertilization and increase productivity. In addition, foliar application can be applied at specific stages of crop development to boost yield and improve quality.

By Form Analysis

Higher Availability of Non-Chelated Agricultural Micronutrients to Fuel Market Growth

By form, the market is segmented into chelated and non-chelated. The non-chelated segment is expected to lead by form, contributing 55.52% globally in 2026. The higher share of the non-chelated segment is owing to the product's higher availability in the market and a lower price than chelated products. The higher price of chelated agricultural micronutrients is due to its product design, which contains the micronutrient ion of zinc, copper, iron, boron, and others surrounded by a larger molecule called a ligand or chelator. This ligand or chelator can be natural or synthetic chemicals. These compounds, combined with a micronutrient, form a chelated micronutrient.

Owing to the rising demand and increasing awareness among consumers regarding the positive effects of chelated fertilizers on plant growth, the demand for chelated agricultural micronutrients is growing. Thus, companies are expanding their distribution channels to cater to this growing demand. For instance, in April 2019, BASF SE Canada announced signing its contract with Quadra Chemicals as the new distributor of its chelated micronutrient products in Canada.

By Crop Type Analysis

Higher Cultivation Rate of Cereal Crops to Impel Industry Growth

By crop type, the market is segmented into cereals, pulses & oilseeds, fruits & vegetables, and others. Among these, the cereals segment holding 49.07% of the global market share in 2026, and the fruits & vegetables segment is expected to exhibit substantial growth during the forecast period. The higher market share of cereal crops is due to the higher yield and a larger agricultural land covered under the cultivation of cereals, including wheat, maize, rice, and other cereal crops. Cereal grains are grown in greater quantities and provide more food energy worldwide than any other crop. Therefore, cereal crops are also called staple crops. For instance, as per FAO, cereal production in 2020-2021 was 2776.8 million metric tons.

REGIONAL INSIGHTS

The market is analyzed across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Agricultural Micronutrients Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific accounted for USD 2.59 billion in 2025, given that the region is a major producer of cereals/staple crops owing to countries, such as China and India. For instance, as per the FAO, China's agricultural sector produces around one-fourth of global grain production, feeding about one-fifth of the worldwide population. In addition, the arable land of China is just 10% of the world's arable land. Furthermore, these countries are major exporters of high-quality agricultural produce. The size and quantity of food developed to impact the value of export for which micronutrients significantly influence the quality of plant growth, as the deficiency of such elements can impact trade activities. For instance, boron is an important micronutrient that causes the quality of mango to decline. As per data provided by the National Institute of Health, deficiency of micronutrients leads to defects in plant growth and decreased productivity. The Japan market reaching USD 0.30 billion by 2026, the China market reaching USD 0.96 billion by 2026, and the India market reaching USD 0.87 billion by 2026.

North America

Followed by Asia Pacific, the North America market holds a significant share. Owing to the rising awareness of the major micronutrient deficiency in soil, assessment of nutrient deficiency in the U.S. soil started in the early 1980s, and some of the major nutrients which were found deficient in the crops included boron (B), copper (Cu), zinc (Zn), and others, which is similar to the situation in Canada. The agricultural landscape in the U.S. is vast, and thus, the adoption of micronutrients by farmers significantly varies from one region to another. The U.S. market reaching USD 1.24 billion by 2026.

Europe, South America, and the Middle East & Africa

The Europe, South America, and the Middle East & Africa regions will show significant growth in the market during the forecast period owing to the rapid growth in crop production, technological advancement, and rising micronutrient deficiency awareness in the region. For instance, a survey published in the National Library of Medicine in Portugal, Spain, Italy, and three other European countries showed that 60% and 28% of soil samples contain lower levels of Fe and Zn, respectively. In addition, new product launches based on technological advancements in these regions fuel market growth. For instance, Verde AgriTech Plc, an agri-tech company, completed a pre-feasibility study of the South America market to understand the demand for micronutrients and launched the multi-nutrient fertilizer K Forte, which contains micronutrients that are highly required in this region. The UK market reaching USD 0.22 billion by 2026 and the Germany market reaching USD 0.07 billion by 2026.

KEY INDUSTRY PLAYERS

Key Players Focus on Product Launches to Stay Competitive

The global market is a semi-consolidated market with large players competing with other small-scale manufacturers to expand their market presence. The agricultural micronutrients companies have been launching new products to cater to the growing demand. For instance, in September 2021, Coromandel launched its new NPK product coated with zinc. In addition, companies are focused toward merger and acquisition to further expand their geographical presence. For instance, ICL acquired Fertiláqua, Brazil's leading provider of specialty plant nutrition, for USD 122 million. This acquisition will help the company to expand its market presence and distribution capabilities in the Brazil market, which is one of the fastest-growing agricultural markets globally.

List of Top Agricultural Micronutrients Companies:

- Nutrien Ltd. (Canada)

- Israel Chemicals Ltd. (Israel)

- Coromandel International (India)

- Yara International ASA (Norway)

- Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India)

- Haifa Group (Israel)

- Koch Agronomic Services, LLC (U.S.)

- Grupa Azoty Zaklady Chemiczne Police Group (Poland)

- Marubeni Corporation (Helena Agri-Enterprises, LLC) (U.S.)

- Nouryon Chemicals Holdings B.V. (North Holland)

KEY INDUSTRY DEVELOPMENTS:

- October 2021: Grupa Azoty announced its strategy for 2021-2030, making Green Azoty a flagship project. The new project was intended for decarbonization and reducing carbon emissions, implementing R&D projects consistent with the European Green Deal, and deploying new solutions in environmentally friendly areas. In the new R&D plans, the company would focus on climate neutrality targets and new formulas enriched with micronutrients from utilized waste streams.

- April 2021: Compass Minerals, one of the well-known nutrient providers globally, announced that the company had entered a definitive agreement with Koch Agronomic Service (LLP) Koch, a subsidiary of Koch Industries, to sell North American micronutrient assets for approximately USD 60.25 million.

- March 2021: The Mosaic Company and Sound Agriculture announced their strategic partnership to bring new and revolutionary nutrient-efficient fertilizer products to the market. As per both companies, these new products would boost yields across major crops and improve soil health. The companies will use a proprietary mix of bio-inspired chemistry and key micronutrients.

- March 2021: Coromandel International Limited, a company under the Murugappa Group, launched a new fertilizer called GroShakti Plus. According to the Executive Vice-Chairman of Coromandel International, this new fertilizer is suitable for various cereals, pulses, oilseeds, and fruits and vegetables. It is designed to provide better root development with phosphorus and increase resistance with zinc.

- January 2021: CommoditAg, a well-known and trusted high-quality agricultural products online marketplace, announced its plant nutrition expansion by adding products from its new supplier, DeltaAg. The new products added are a wide range of stage-specific formulas and micronutrients.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types of micronutrient fertilizer products, application modes of the product, different product forms, and the micronutrient requirements of different crop types. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.41% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application Mode

|

|

|

By Form

|

|

|

By Crop Type

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size size is projected to grow from USD 5.89 billion in 2026 to USD 10.44 billion by 2034

The market is likely to register a CAGR of 7.41% over the forecast period of 2026-2034.

The zinc segment is expected to lead the market due to the rising awareness about zinc deficiency.

Increased production and cultivation area of high-value crops is expected to drive the global market growth.

Some top market players are Nutrien Ltd., Yara International ASA, Israel Chemicals Ltd., Nouryon Chemicals Holding B.V., and Indian Farmers Fertiliser Cooperative Limited (IFFCO).

Asia Pacific dominated the market in terms of product sales in 2025.

The market growth could be hampered by the lack of access to government services and high taxes on micronutrients.

Get 20% Free Customization

Expand Regional and Country Coverage, Segments Analysis, Company Profiles, Competitive Benchmarking, and End-user Insights.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us