The others component segment will remain a key category, accounting for 44.95% of the global market share in 2026.

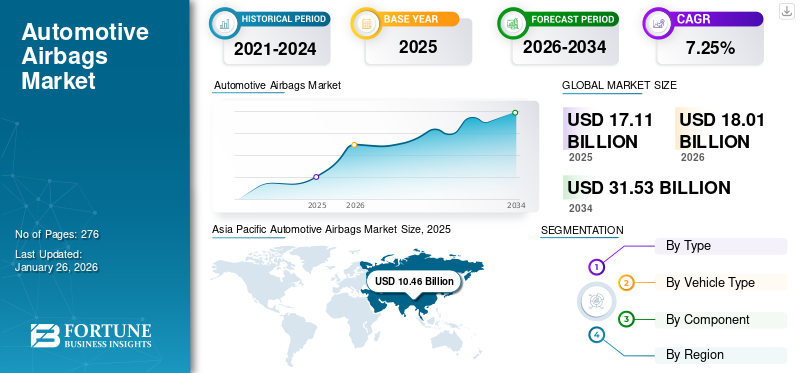

Automotive Airbags Market Size, Share & Industry Analysis, By Type (Frontal Airbag, Side Airbag, and Others), By Vehicle Type (Hatchback/Sedan, SUV, LCV, and HCV), By Component (Airbag Inflator, Impact Sensors, Indicator Lamp, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global automotive airbags market size was valued at USD 17.11 billion in 2025 and is projected to grow from USD 18.01 billion in 2026 to USD 31.53 billion by 2034, exhibiting a CAGR of 7.25% during the forecast period. Asia Pacific dominated the automotive airbags market with a market share of 61.15% in 2025. The Automotive Airbags Market in the U.S. is projected to grow significantly, reaching an estimated value of USD 4.69 billion by 2032.

An automotive airbag refers to a safety device that is designed to rapidly inflate and cushion the occupants in a vehicle during a collision. The purpose of these airbags is to reduce the risk of serious injury, providing safety to passengers against hitting the hard surface in a vehicle. Modern automotive airbags are typically lightweight, built with high-strength materials, and designed to inflate in milliseconds. With the growing awareness of automotive safety, the demand for automotive airbags is increasing. The governments of several nations are mandating the use of airbags in vehicles, which is driving the automotive airbags market growth in the near future. However, limited adoption of airbags in low-end vehicles due to high cost constraints hampers the market growth. The growing demand for passenger cars and technological advancement in the market fuels the adoption of airbags.

The 2020s COVID-19 pandemic lockdown caused a sharp decline in vehicle production as factories closed or operated at reduced capacity. Uneven lifting of restrictions disrupted supply chains, leading to input shortages and revenue losses for automotive industries. Rapid production to fulfill pending orders created material shortages and higher costs. Post-pandemic recovery gained momentum as market players reinstated supply chains. However, rapid production to fulfill pending orders led to shortages of raw materials and components, increasing procurement and production costs.

AUTOMOTIVE AIRBAGS MARKET TRENDS

Advancements in Technology to Boost the Market Development

Leading companies are concentrating on advancing innovative airbag technology to enhance the safety of vehicle passengers. In June 2023, Autoliv, Inc., a global leader in automotive safety systems, introduced a groundbreaking new passenger airbag module based on Bernoulli's Principle. This patented technology enables the inflation of larger airbags more efficiently while reducing development time and costs. The Bernoulli Airbag was set to be launched in the third quarter and would be showcased at the Autoliv Investor Day in Auburn Hills, Michigan, U.S.

Additionally, in March 2023, Hyundai Mobis developed the Brain Injury Prevention Airbag, which secured a perfect score in the Brain Injury Criteria (BrIC) during the U.S. National Highway Traffic Safety Administration’s (NHTSA) recent crash test. The airbag demonstrated exceptional performance in the Oblique Crash test, aligning with real accident scenarios anticipated by the NHTSA. This technology was also honored with the Silver Tower Order of Industrial Service Merit (STOISM) at the New Technology Commercialization Competition hosted by Korea's Ministry of Trade, Industry, and Energy (MOTIE).

Download Free sample to learn more about this report.

AUTOMOTIVE AIRBAGS MARKET GROWTH FACTORS

Rising Concerns on Vehicle Safety Fuels the Demand for Automotive Airbags

With rising concerns about vehicle safety among consumers, manufacturers constantly focus on providing advanced safety solutions, including airbags, in their vehicles. Consumers tend to adopt advanced safety features, including airbags in vehicles for increased safety. Furthermore, several countries and regions witnessed decreased road accident fatalities due to the increasing integration of vehicle safety technologies in modern vehicles. For instance, in September 2023, the National Highway Traffic Safety Administration (NHTSA) issued its preliminary findings regarding traffic fatalities during the initial half of 2023. According to these estimates, a continuous decline in traffic fatalities was witnessed for the fifth consecutive quarter. Approximately 19,515 individuals lost their lives in motor vehicle traffic accidents, reflecting a reduction of around 3.3% compared to the 20,190 fatalities recorded during the first half of 2022. The decline in fatalities emphasizes the significance of airbags in vehicles, thereby driving market demand.

RESTRAINING FACTORS

Cost Associated with Integrating Advanced Airbag Systems into Vehicles May Hamper the Market Development

The major restraint in the growth of the automotive airbags market is the cost of integrating advanced airbag systems into vehicles. Manufacturing and integrating advanced airbag systems with sophisticated technology can significantly increase the production costs for automakers. This includes research and development costs, manufacturing processes, and specialized materials required to produce high-quality airbag systems.

Incorporating advanced airbag systems contributes to the overall cost of the vehicle. As a result, consumers may be hesitant to purchase vehicles equipped with expensive safety features, especially in markets with high price sensitivity. Overall, while airbags are recognized as essential safety features in vehicles, the associated costs can significantly restrain the growth of the automotive airbags market, particularly in price-sensitive market segments. Balancing safety considerations with cost constraints remains a challenge for automakers and consumers.

AUTOMOTIVE AIRBAGS MARKET SEGMENTATION ANALYSIS

By Type Analysis

Frontal Airbag Segment to Dominate owing to Standard Add-ons of Frontal Airbags in All Types of Vehicles

Based on type, the market is divided into frontal airbag, side airbag, and others.

The frontal airbag segment held a significant share in 2024 and is anticipated to lead during the projection period. Driver airbags are fitted in every vehicle model as per the standard, which boosts the growth of the segment. Moreover, increasing safety concerns in the automotive industry have led to the installation of frontal passenger airbags, which will propel the market over the forecast period. In March 2021, the Indian government enforced the installation of frontal airbags in vehicles, elevating the segmental demand in the global market.

The side airbag segment held a significant market share in 2024. With increasing focus on safety and tightening of safety regulations across the globe, many automakers are incorporating side airbags into their vehicles to meet these requirements, driving the segmental growth.

The others segment includes airbag types such as knee airbags, pedestrian airbags, and others. The growth of these types of airbags is associated with increasing safety concerns and technological developments in the automotive industry.

By Vehicle Type Analysis

SUV Segment Dominated the Market Owing to Increased Sales of Vehicle

Based on vehicle type, the market is characterized as hatchback/sedan, SUV, LCV, and HCV.

The SUV segment is expected to lead the market, contributing 49.68% globally in 2026 due to the growing demand for SUVs in recent years, as consumers have increasingly gravitated toward vehicles that offer more space, utility, and versatility. This led to an increased number of SUVs on the road, which augments the airbag demand. For instance, in 2022, according to the IEA (International Energy Agency), SUVs comprised approximately 46% of worldwide car sales, experiencing significant growth in the U.S., India, and Europe.

The hatchback/sedan segment holds a substantial share of the market. The segment growth is associated with the popularity of these types of vehicles in urban areas. As the number of sales of these vehicles increases, the demand for airbags in automobiles also rises, which fuels the segment growth.

Light Commercial Vehicles (LCVs) segment holds a decent share in the market in 2023. Increasing government regulations and safety standards, such as mandatory airbags in commercial vehicles, propels the adoption of airbags in the LCV segment. Fleet operators and individual buyers are becoming more aware of the importance of safety features, including airbags, in reducing fatalities and injuries during accidents, which drives the market growth of the segment over the forecasted period.

Heavy Commercial Vehicles (HCVs) segmental market accounted for an influential share in the market. Governments worldwide are imposing stricter safety standards, which require HCVs to be equipped with advanced safety features, including airbags. Regulations such as the European Union's ECER 129 (Enhanced Safety of Large Vehicles) and other regional mandates are compelling manufacturers to include airbags in commercial vehicles. This fuels the segmental growth of market.

To know how our report can help streamline your business, Speak to Analyst

By Component Analysis

Technological Development in the Market Advances the Others Segment

Based on component, the market is characterized by airbag inflator, impact sensors, indicator lamp, and others.

The others segment is expected to hold a dominating market share throughout the forecast period. The others segment includes the remaining components of airbags, including clock springs, wiring harnesses, and others. The segment growth is associated with the advancement in technology, such as using lightweight and durable materials, and increasing demand for automotive safety features.

The airbag inflator segment accounts for a market share of 8.34% in 2024. The growth of the segment is attributed to technological advancements in recent years. For instance, there has been a shift toward the use of pyrotechnic inflators, which use a small explosion to rapidly inflate the airbags. This drives the growth of the segment. In June 2023, Autoliv China and NIO Inc., a prominent electric vehicle company based in China, entered a strategic cooperation framework agreement. The collaboration aimed to develop safety products tailored for electric vehicles and sustainable technologies, including passenger airbags designed to deploy from the headliner utilizing an environmentally friendly inflator.

The impact sensors segment held a substantial market share in 2024. Impact sensors are critical components of airbag systems. They detect the severity and location of an impact and then trigger the deployment of the airbag. Due to this, impact sensors play a vital role in the automotive airbags system, which fuels its demand in the market.

The indicator lamp segment held a decent share in the market in 2024. The growth of the segment is attributed to the regulations in several countries that require vehicles to have warning lamps to indicate the status of the airbag system. The indicator lamp ensures the drivers with any issue with the airbags system, which creates a demand for the component.

REGIONAL INSIGHTS

Asia Pacific Automotive Airbags Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Based on region, the market has been studied across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific Dominated the Market Share in 2024 with Increased Vehicle Production

Asia Pacific

Asia Pacific accounted for USD 10.46 billion in 2025. The region is home to some of the world’s largest automotive manufacturers such as Toyota, Honda, and Hyundai. These companies produce millions of vehicles each year, which drives the regional product demand. The Japan market reaching USD 1.15 billion by 2026, the China market reaching USD 3.04 billion by 2026, and the India market reaching USD 0.46 billion by 2026.

Europe

Europe held a substantial market share in 2024. Europe is home to many luxury and high-end car brands such as BMW, Mercedes-Benz, and Audi. These brands often incorporate advanced safety features, including airbags, in their vehicles, driving the product demand. The UK market reaching USD 0.10 billion by 2026 and the Germany market reaching USD 0.62 billion by 2026.

North America

North America held a notable market share in 2024. The growth is attributed to the strict safety regulations for automobiles, including mandatory airbag installations in new cars. In North America, due to the strict enactment of regulations, frontal airbags have been mandatory standard equipment for all passenger and commercial vehicles-LCVs (light commercial vehicles) since 1998. The U.S. market reaching USD 3.19 billion by 2026.

South America

The South America market held a considerable market share in 2024. The growing middle class and rising disposable incomes in many South American countries, including Brazil, Argentina, and Chile, are driving up vehicle sales. As more consumers purchase vehicles, the demand for safety features such as airbags also increases, which will further drive the market growth in the region.

Middle East & Africa

The Middle East & Africa market accounted for an influential market share in 2024. Governments in the MEA region are increasingly introducing and enforcing safety regulations that require automotive manufacturers to equip vehicles with airbags. For instance, countries such as Saudi Arabia, the UAE, and South Africa are adopting more stringent vehicle safety standards in line with global trends. This includes regulations mandating airbags in both passenger cars and commercial vehicles, pushing manufacturers to include them in their offerings. This drives the market demand in the region over the forecasted period.

KEY INDUSTRY PLAYERS

Autoliv Dominated the Market Due to Technological Advancement in Airbag Systems

The key players are focused on the development of advanced technology automotive airbags. For instance, Autoliv is a key player, which develops life cell airbags that help provide protection regardless of the way the driver and passenger are seated. Other airbag manufacturers are focused on developing advanced airbag systems such as knee airbags, side airbags, and roof airbags.

LIST OF TOP AUTOMOTIVE AIRBAGS COMPANIES:

- Joyson Safety System (China)

- Autoliv Inc (Sweden)

- Toyoda Gosei Co. Ltd (Japan)

- Robert Bosch GmbH (Germany)

- Hyundai Mobis Co. Ltd (South Korea)

- Denso Corporation (Japan)

- Nihon Plast Co., Ltd. (Japan)

- Ashimori Industry Co., Ltd. (Japan)

- ZF Friedrichshafen AG (Germany)

- Continental AG (Germany)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 - Hyundai Mobis introduced airbags for purpose-built vehicles, including a door-installed curtain airbag and a self-supporting passenger airbag. The door-installed airbag deploys from the bottom to the top and the self-supporting airbag absorbs impact solely through the support from the inflatable cushion’s lower part.

- November 2023 - Toyoda Gosei Co., Ltd., began operations at its newest airbag plant in South China. The company started its new manufacturing unit in Guangdong Province, China. The company aims to ramp up its airbag production through this new production facility in China.

- June 2023− Autoliv China and NIO Inc. signed a partnership to jointly work on an innovative airbag concept that ensures comprehensive protection across various seating positions. This advancement enhances safety and allows for greater flexibility in vehicle interior design. Moreover, the initiative involves the utilization of biology-based materials for both airbag cushions and seatbelt webbing.

- October 2022− Indorama Ventures Public Company Limited (IVL), a global sustainable chemical firm, built a plant for manufacturing high-performance nylon yarn for automobile airbags. The new facility in Rayong, Thailand, was built by Indorama Ventures and Toyobo Co., Ltd’s joint venture, Toyobo Indorama Advanced Fibers Co., Ltd. (TIAF).

- May 2022− ARC Automotive Inc., a leading manufacturer of inflation systems, signed a partnership with Yanfeng, a leading global automotive supplier. Under the partnership, both companies formed a joint venture to develop, produce, and commercialize automotive airbag inflators.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on crucial aspects such as leading companies, product types, and leading product applications. Besides this, the report offers insights into the market trends and highlights vital industry developments. In addition, the report encompasses several factors contributing to the market growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.25% from 2026 to 2034 |

|

Unit |

Value (USD Billion), Volume (Thousand Units) |

|

Segmentation |

By Type

|

|

By Vehicle Type

|

|

|

By Component

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size is projected to grow from USD 18.01 billion in 2026 to USD 31.53 billion by 2034.

In 2025, Asia Pacific stood at USD 10.46 billion.

The market is projected to grow at a CAGR of 7.25% and exhibit steady growth during the forecast period.

By vehicle type, the SUV segment is the leading segment and accounted for a dominating share in 2024.

Increased vehicle production, focus on advanced technologies, and demand for safety-equipped vehicles will drive market growth.

Autoliv Inc, Toyoda Gosei Co. Ltd, and Joyson Safety System are the major players in the market.

Asia Pacific dominated the market share in 2024.

Seeking Comprehensive Intelligence on Different Markets?Get in Touch with Our Experts

Speak to an Expert

Download Free Sample

Automotive & Transportation

Clients

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us