Bifacial Solar Market Size, Share & Industry Analysis, By Panel (Glass-Glass Panel and Glass Transparent Backsheet Panel), By Cell Technology (Bifacial PERC, Bifacial TOPCon, and Others), By Application (Utility, Commercial & Industrial, and Residential), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

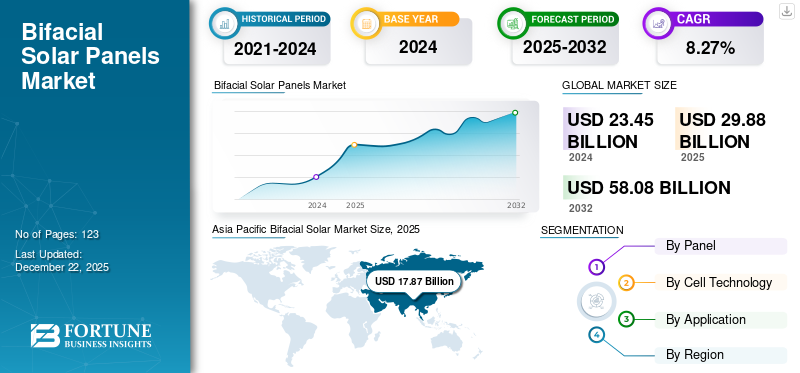

The global bifacial solar market size was valued at USD 29.88 billion in 2025. It is projected to grow from USD 34.78 billion in 2026 and reach USD 65.69 billion by 2034, exhibiting a CAGR of 8.27% during the forecast period. Asia Pacific dominated the bifacial solar panels market with a share of 59.82% in 2025.

Bifacial solar refers to technology that enables solar cells to produce power from a solar panel's front and rear surfaces. Compared to conventional monofacial solar panels, this design increases the total energy yield by allowing the capture of direct sunlight on the front and reflected or diffused light on the backside.

The market is expanding due to the rising demand for renewable energy and the potential of bifacial technology to increase energy generation and lower the levelized cost of energy (LCOE).

Jinko Solar is the leading player in the market. It serves the need for maximized energy generation and lower costs in large-scale solar projects by utilizing its extremely efficient N-type TOPCon bifacial technology.

MARKET DYNAMICS

MARKET DRIVERS

Enhanced Efficiency and Energy Yield Drive Market Growth

The bifacial modules produce electricity from both the front and back surfaces compared to conventional monofacial panels, resulting in significantly better energy outputs. Solar energy is now more competitive with other energy sources due to its higher production, resulting in a reduced Levelized Cost of Energy (LCOE). Due to its ability to maximize the amount of energy harvested from a specific piece of land, bifacial technology is attracting more attention from investors and project developers, improving the project's overall economics.

For instance, in October 2023, Trina Solar announced the launch of the Vertex N 720W line of bifacial modules, which deliver a power output of up to 720W and an efficiency of 23.2%. The ongoing advancements in module efficiency and power output are propelling the introduction of bifacial technology.

Reduced Costs of Balance of System (BOS) Drive Market Development

The higher energy production results in lower overall BOS costs, even if the bifacial modules may initially cost more. Racking, wiring, and other components are not required, as many modules are essential to produce the same amount of energy as a monofacial system. The economic feasibility of bifacial projects is further enhanced by this decrease in BOS costs, which increases their appeal to investors and developers.

For instance, on December 12, 2022, Longi's Hi-MO 5 bifacial module series was successfully deployed in large-scale utility projects internationally, proving the ability to lower BOS costs. The growing deployment of large-scale bifacial projects further aids the maturation of bifacial applications and the decreased cost of BOS.

MARKET RESTRAINTS

Insufficient Standardization and Uncertainty in Performance Hinder Market Expansion

For investors and project developers, the absence of standardized testing and performance evaluation for bifacial modules raises uncertainty. It is challenging to anticipate energy yield since site-specific elements such as tilt angle, mounting height, and albedo (surface reflectivity) significantly impact the backside performance. This unpredictability may make funding more difficult and delay the uptake of bifacial technologies.

In July 2023, the IEC (International Electrotechnical Commission) announced it is working on new bifacial module testing and performance characterization standards. This collaborative initiative addresses the standardization gap and facilitates wider adoption of bifacial technology.

MARKET OPPORTUNITIES

Agrivoltaics Growth is Positively Influencing Market Opportunities

For bifacial modules, agrivoltaics, which combines solar energy and agriculture, offers a substantial option. Bifacial modules work well with the raised mounting arrangements frequently employed in agrivoltaics systems to let sunlight reach crops. The reflective surfaces of the soil and crops can increase the backside gain, boosting energy output while offering shade and other agricultural advantages.

For instance, in September 2023, France approved over 600 agrivoltaics projects, reflecting the increased interest in co-locating solar energy and agriculture and further fueling the global bifacial market growth.

MARKET CHALLENGES

Lack of Availability of Land and Environmental Issues Hamper Market

Environmental issues and land availability are obstacles to implementing large-scale solar projects, especially utilizing bifacial technology. Conflicts may arise between solar farms enormous land footprint and other land uses, such as conservation or agriculture. Environmental effects must be evaluated and lessened, including soil erosion and habitat disruption.

BIFACIAL SOLAR MARKET TRENDS

Increasing Application of Vertical Bifacial is Latest Trend in Market

Installing bifacial panels vertically, facing east and west, is a revolutionary technique known as vertical bifacial solar. Vertical bifacial makes better use of diffused light and ground reflection, and this arrangement is especially beneficial in high-latitude areas with snowy weather. Additionally, it has enhanced snow-shedding capabilities, which minimize energy losses in the winter and maximize energy collecting all year.

In November 2023, a research team from Aalto University in Finland revealed promising results from a vertical bifacial solar system in snowy conditions. It also showed and demonstrated the potential of innovative use of bifacial panels in high-latitude areas.

Download Free sample to learn more about this report.

IMPACT OF TARIFFS

The global bifacial solar market growth is significantly impacted by President Trump's recent announcements on tariffs. Tariffs significantly affect the cost dynamics of investments in solar panels, affecting everything from market competitiveness to production costs. By adding a tax per unit, tariffs immediately raise the price of imported solar panels. For example, solar cells have seen a price increase of about 0.10 to 0.30 per watt for installations due to tariffs of up to 50% imposed by the U.S. These tariffs have the indirect potential to raise prices by upsetting supply networks, creating market instability, and discouraging investment. These policy changes and tariff introduction are expected to create uncertainty in the global market.

SEGMENTATION ANALYSIS

By Panel

Glass-Glass Panels Dominate Market Due to Their Superior Durability and Longevity

Based on the panel type, the market is segmented into glass-glass panel & glass transparent backsheet panel.

Glass-glass panels hold the majority of the bifacial solar market share 64.33% in 2026 due to their high durability, as these panels are more resilient to external elements such as moisture, UV rays, and temperature changes. Effective long-term energy yield and a lower Levelized Cost of Energy (LCOE) for projects result in longer lifespans and decreased degradation. As both sides are transparent, more sunlight may reach the cells, improving power output and maximizing the bifacial gain.

Glass transparent backsheet panels are also expanding as they are easier to handle and install, as they strike a compromise between bifaciality and weight. When a clear polymer backsheet is used instead of glass, the total weight is decreased, which might make installation easier and minimize transportation expenses. For projects where weight and affordability are important considerations, making it appealing.

By Cell Technology

Bifacial PERC Dominates Market Due to Its Low Cost

Based on Cell Technology, the market is segmented into bifacial PERC, bifacial TOPCon, & others.

Bifacial PERC (passivated emitter and rear cell) holds a major market share contributing 54.74% globally in 2026 due to its cost-effectiveness and maturity. These panels are less expensive to manufacture than other cutting-edge technologies, including TOPCon, and bifacial PERC is the most extensively used bifacial cell technology. PERC technology is a cost-effective choice for manufacturers as it is well-established and enjoys economies of scale.

Bifacial TOPCon (Tunnel Oxide Passivated Contact) cells are the second leading segment and have the potential to be more efficient than PERC cells, which could result in higher power output per panel. Its increased efficiency reduces land utilization, particularly aiding utility-scale projects, and increases energy generation per area. This makes the technology more appealing for projects looking to optimize energy production per unit area.

Other cell technologies include new technologies such as IBC (interdigitated back contact) and HJT (heterojunction technology). Despite having a smaller market share, these technologies are being studied and developed as they may provide greater efficiency and special advantages for particular uses.

By Application

To know how our report can help streamline your business, Speak to Analyst

Utility Segment Dominates Market Due to High Energy Yield Requirements

Based on application, the market is categorized into utility, commercial & industrial, and residential.

The utility segment dominates the market. accounting for 59.93% market share in 2026 Utility-scale farms fuel the market for bifacial panels as they can significantly lower costs through higher energy yield. Bifacial modules are highly appealing for large projects due to their decreased LCOE. Ground albedo can be maximized in open spaces, which optimizes Bifacial's capacity to generate power from both sides in the utility sector.

Commercial & Industrial is the second leading application due to the enhanced system performance & increased return on investment of bifacial panels in this industry. Bifacial panels enhance the energy output of commercial & industrial installations, particularly in open spaces with reflective surfaces, such as rooftops made of light-colored roofing materials. Businesses may get a quicker return on investment due to the increased energy yields. Additionally, where rooftop space is restricted, higher power generation per area is beneficial.

Despite a minor market sector, bifacial panels are becoming more popular in the residential market due to their increasing appeal and potential for improved energy production. Glass-glass panels' streamlined forms and functionality appeal to homeowners. Additionally, it can increase energy production, particularly when placed on reflective surfaces, reducing utility costs.

BIFACIAL SOLAR MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Bifacial Solar Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Fast-Growing Solar Capacity and Declining Prices Drive Market

Asia Pacific dominates the market due to its large-scale solar installations, especially in China and India, and its strong manufacturing capacity for advanced PV technologies. Market growth is driven by rising electricity demand and falling module prices. Investment in solar infrastructure is influenced by government incentives and support for renewable energy projects. The availability of enormous land areas for solar farms fuels bifacial adoption. The market is growing as more people become aware of the advantages of bifacial technology, namely increased energy output. For instance, in September 2023, Adani Green Energy commissioned a 500 MW bifacial solar plant in Rajasthan, India, demonstrating the growing use of bifacial technology across the region. The Japan market is projected to reach USD 3.26 billion by 2026, and the India market is projected to reach USD 2.07 billion by 2026.

China

High Manufacturing Power and Domestic Demand Drive Market in China

China's production capability and high domestic demand have made it a major participant in the solar bifacial business. The use of solar power is fueled by government initiatives that support renewable energy sources and lower air pollution. The development of bifacial projects is aided by the availability of inexpensive finance and incentives. Lower module prices result from manufacturing economies of scale and technological developments. However, the location and implementation of a project may be impacted by land availability and grid infrastructure constraints. China's leadership in solar technology innovation was reaffirmed in January 2024 when LONGi reported a new record efficiency of 26.81% for its silicon heterojunction (HJT) bifacial solar cell. China market is projected to reach USD 13.37 billion by 2026,

North America

Utility-Scale Projects and Government Support Fuel Bifacial Adoption in North America

Bifacial adoption is growing in North America as it can boost energy production in large-scale solar farms, particularly in regions with high albedo (reflectivity). Bifacial projects are further encouraged by supportive government regulations such as the Investment Tax Credit (ITC). It is economically viable in sun-belt countries due to favorable irradiance conditions. Projects are significant to handle the expanding solar capacity, interconnection regulations, and grid upgrading. However, trade regulations and supply chain limitations may affect project budgets and schedules. For instance, in June 2023, the U.S. Department of Energy announced plans to provide USD 26 million in funding for research and development programs centered on advanced solar technology, such as bifacial modules.

U.S.

Big Solar Farms Help Bifacial Market Dominance in the U.S.

The U.S. is a significant market for bifacial solar, as a lot of land is available for utility-scale projects. Tax incentives and a favorable regulatory environment drive investment in solar infrastructure. Bifacial technology is accelerated by the emphasis on lowering carbon emissions and reaching targets for renewable energy. Project development is aided by the established infrastructure of the solar industry and the availability of skilled staff across the country. Technological developments and bifacial module cost reductions help the U.S. market. In May 2024, Nextracker announced it to provide its bifacial-optimized tracker system for a 1,000 MW solar project in Nevada, underscoring the growing need for bifacial technology in large-scale settings. The U.S. market is projected to reach USD 3.01 billion by 2026.

Europe

Renewable Energy Goals and Policy Support Boost Market Expansion

The market in this region is fueled by Europe's aggressive carbon reduction targets and dedication to renewable energy. Economic incentives from the government, such as tax cuts and feed-in tariffs, make bifacial projects appealing. Investment in solar capacity is driven by the desire to reduce dependency on fossil fuels and provide energy security. Bifacial module cost reductions and technological developments improve the project's viability. However, project development may be hampered by restrictions on grid infrastructure and difficulties in obtaining permits. In March 2024, Lightsource BP announced the completion of a 200MW bifacial solar farm in Spain, indicating the increasing uptake of bifacial technology in European markets. The UK market is projected to reach USD 0.46 billion by 2026, while the Germany market is projected to reach USD 2.17 billion by 2026.

Latin America

High Solar Irradiance and Unrealized Potential Drive Bifacial Adoption in Latin America

Latin America's high levels of solar irradiation and rising energy demand make it a promising region for bifacial solar. The development of solar projects is influenced by government initiatives that promote renewable energy, such as tax breaks and auctions. Bifacial technology is commercially appealing due to the region's abundant land supply and ideal temperature. The use of solar energy is accelerated by expanding access to funding and global collaborations. However, investment may be hampered by political unpredictability and regulatory uncertainty. In November 2023, Enel Green Power highlighted the expanding use of this technology in Latin America by announcing the completion of a 300 MW bifacial solar plant in Brazil.

Middle East & Africa

High Solar Irradiance and High Solar Potential Drive Market

The region's expanding energy needs and abundance of solar energy present enormous possibilities for bifacial solar. Solar adoption is fueled by government initiatives to diversify energy sources and lessen dependency on fossil fuels. The region attracts investment due to its high renewable energy ambitions and large-scale solar projects. The economic viability of bifacial technology is due to the availability of large geographical areas and a favorable environment. However, limited grid infrastructure and water scarcity can challenge the market. For instance, in February 2024, ACWA Power signed a deal to build a 1.5 GW bifacial solar project in Saudi Arabia, which is driving investment in this market.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Market is Dominated by Innovation-led Manufacturers, Competing on Cost and Efficiency

With new and established module manufacturers such as LONGi, Jinko Solar, and Trina Solar fighting for supremacy, the bifacial solar market is highly competitive. Module efficiency, cost reduction, and creative designs that optimize energy yield are the main areas of competition. Although Western businesses invest in bifacial technologies to compete, Chinese manufacturers now control a sizable portion of the industry. Changing industry standards and the growing need for better-performing solar systems further influence the landscape. The companies that provide the finest LCOE will ultimately be the survivors.

List of Key Bifacial Solar Companies Profiled

- Canadian Solar (Canada)

- Huasun Energy (China)

- JA Solar (China)

- Jinko Solar (China)

- LONGi (China)

- Maxeon Solar Technologies (Singapore)

- Risen Energy (China)

- Seraphim Energy Group (China)

- TW Solar (China)

- Trina Solar (China)

- TW Solar (China)

- ZNShine PV (China)

KEY INDUSTRY DEVELOPMENTS

- November 2024- Jinko Solar successfully connected the world's largest gigawatt-scale offshore solar project, where it supplied 1.32GW of its N-type TOPCon Tiger Neo bifacial modules for the offshore solar project in HG14 waters off Shandong, which was created by CHN Energy Investment Corporation's Guohua Investment. This accomplishment establishes a new benchmark for creative offshore solar applications worldwide and emphasizes Jinko Solar's dominant position in offshore solar technology.

- July 2024- LONGi re-introduced its Hi-MO 7 bifacial module by presenting a new, higher-power variant that will only be offered in Canada. With an enhanced 620W power output and a 23.0% module efficiency, the revised Hi-MO 7 module continues to take advantage of high-efficiency cell technology. With dimensions of 2382 x 1134 x 30 mm, the module is intended for utility power plants.

- June 2023- Jinko Solar Holding Co., Ltd. declared that it has supplied over 220,000 Tiger NEO bifacial 72 modules to Bulgaria's 123 MW Verila Solar Power Plant. The Verila facility is anticipated to boost Bulgaria's solar power output capacity by 7% and is the country's largest PV project.

- December 2022- Canadian Solar Inc. announced that its subsidiary, CSI Solar Co., Ltd., will mass-produce high-efficiency N-type TOPCon (Tunnel Oxide Passivated Contact) solar modules in the first quarter of 2023. Canadian Solar will offer diverse TOPCon products to satisfy commercial, residential, and utility-scale market demands. The 210mm cell-based bifacial TOPBiHiKu7 (615W-690W) and 182mm cell-based bifacial TOPBiHiKu6 (555W-570W) and monofacial TOPHiKu6 (420W-575W) modules are part of the TOPCon line.

- December 2020- LONGi announced that for a solar project in Ningxia, it has exclusively provided 200MW of its Hi-MO 5 bifacial modules to the Northwest Electric Power Test Research Institute of the China Energy Engineering Group. The Ningxia Zhongke Ka New Energy Research Institute created the project, currently in the building and installation phase.

Investment Analysis and Opportunities

- Investments drive significant growth in this market by funding capacity expansion, new technologies, and infrastructure. Capital inflow allows manufacturers to expand facilities.

- For instance, in May 2025, British International Investment (BII), a development finance organization and impact investor in the U.K., invested USD 100 million in ReNew Energy Global (ReNew). The investment is BII's first-ever foray into solar manufacturing in India and will assist ReNew in expanding its solar manufacturing operations in the country. These developments reflect broader momentum, with the global bifacial market projected to grow over the forecast period.

- Additionally, more funding goes toward research and development, which raises the efficiency of bifacial panels and lowers installation costs, making them more competitive with conventional solar panels.

REPORT COVERAGE

The global bifacial solar market report delivers a detailed insight into the market and focuses on key aspects such as the leading companies in the market. Besides, the report offers insights into the market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.27% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Panel

|

|

By Cell Technology

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 29.88 billion in 2025.

The market is likely to grow at a CAGR of 8.27% over the forecast period (2026-2034).

By application, the utility segment leads the market.

The market size of Asia Pacific stood at USD 17.87 billion in 2025.

Enhanced efficiency, energy yield, and reduced costs of the Balance of System (BOS) are the key factors driving market growth.

Some of the top players in the market are Canadian Solar, Huasun Energy, JA Solar, Jinko Solar, and LONGi.

The global market size is expected to reach USD 65.69 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us