Biodiesel Market Size, Share & Industry Analysis, By Feedstock (Vegetable Oils {Soybean Oil, Corn Oil, Palm Oil, Canola Oil, Waste Oils, and Others}, Animal Fats, and Others), By Blend Type (B5 and Lower Blends, B6 to B20 Blends, and Above B20 Blends), By Application (On-road {Fleet Vehicles, Heavy-duty Trucks, and Others}, Off-road {Agricultural Equipment, Construction Equipment, Marine Vessels, Locomotives, and Others}, Stationary {Electric Generators and Furnaces}, and Others), and Regional Forecast, 2026-2034

Biodiesel Market Analysis

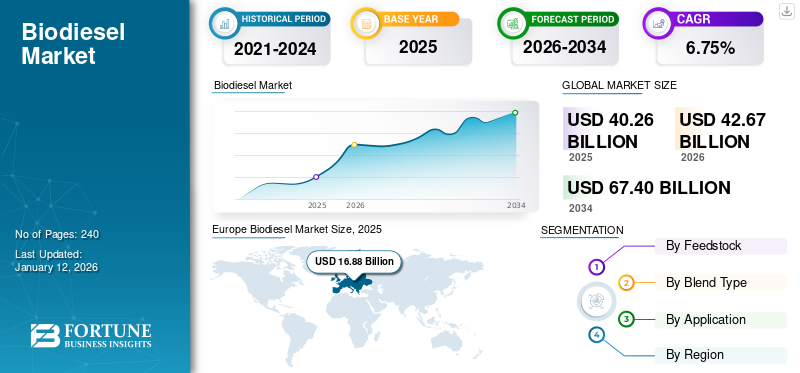

The global biodiesel market size was valued at USD 40.26 billion in 2025 and increased to USD 42.67 billion in 2026, with the market projected to reach USD 67.4 billion by 2034, growing at a CAGR of 6.75% during 2026–2034. Europe dominated the biodiesel market with a share of 41.92% in 2025.

Biodiesel is a renewable and biodegradable fuel primarily produced through transesterification to yield fatty acids and methyl esters. It is manufactured from various feedstocks: vegetable oils, including soybean oil, palm oil, canola oil, waste oils, animal fats, and recycled restaurant grease. Biodiesel is low carbon-intensity fuel used in diesel engines, boilers, and home heating systems, and is commercially available. Biodiesel is available in different blends, namely B5 and lower blends, B6 to B20 blends, and above B20 blends. B20 blends or lower are used in on and off-road vehicles & locomotives.

Globally, the market is growing as the product is used as a supplement to petro-diesel to boost its lubricating properties, which are affected by sulfur removal. Biodiesel has virtually no sulfur, owing to which reduces the emission of hydrocarbons, NOx, carbon monoxide, and ozone formation. Also, it minimizes the particulate discharge from engines at any concentration. The rise in petro-diesel prices globally is also driving the market growth.

Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., Ecodiesel Colombia S.A., FutureFuel Corp., and others are some of the leading companies operating in the market. Aemetis Inc., a prominent producer of renewable natural gas and biofuels, has stated that its Indian subsidiary, Universal Biofuels, has secured USD 31 million worth of biodiesel orders from three Oil Marketing Companies (OMCs) owned by the Indian government. The shipments, amounting to more than 33,000 kiloliters, are planned for delivery between May and July 2025.

Download Free sample to learn more about this report.

MARKET DYNAMICS

BIODIESEL MARKET DRIVERS

Growing Inclination Toward Decarbonization Drives Market Growth

The global push toward decarbonization, owing to the implementation of stringent policies to reduce carbon emissions, drives the biodiesel market growth. The transition toward clean energy sources and low-emission alternatives to fossil fuels is gaining significant popularity across different countries. For instance, in 2022, global production of biodiesel neared 59 billion liters, with Europe accounting for the highest market share, followed by the U.S. and Indonesia. Also, in 2022, Europe produced around 12 billion liters of biodiesel, with Germany, Spain, and France accounting for more than half of the EU fatty acid methyl esters (FAME) biodiesel production.

Various countries are implementing blending mandates and policy incentives to drive the adoption of biodiesel. For instance, the Global Biofuels Alliance (GBA), launched in September 2023, aims to boost the development and deployment of biofuels globally through collaboration with governments, international organizations, and various industries. This is majorly due to biodiesel’s capability of reducing greenhouse gas emissions by offsetting the emissions released during combustion.

Growing Adoption of Biodiesel in Transportation Sector Drives Growing Market Size

Biodiesel has gained huge popularity in the transportation sector across various on-road and off-road sectors, such as heavy-duty trucks, school buses, fleet vehicles, marine vessels, construction & mining equipment, urban transit vehicles, and others. It is used in transportation as a renewable and clean-burning substitute for petroleum diesel. It has lower exhaust emissions than petroleum diesel, contributing to reduced greenhouse gas emissions and cleaner air.

Sustainable transport fuels, including biodiesel, offer low carbon intensity mobility to the legacy fleet, which is becoming popular in the shipping & aviation sectors. The biodiesel with blends of B20 or lower is used in on-road and off-road vehicles and locomotives. Hence, biodiesel is a renewable alternative, especially for diesel vehicles, with improved fuel quality, reduced emissions, and energy security.

MARKET RESTRAINTS

High Production Cost & Limited Shelf-Life Hampers Market Growth

The production cost of biodiesel is around one and a half times more than petroleum diesel, mainly owing to the high cost of raw materials (feedstocks) such as vegetable oils, animal fats, and others. Additionally, biodiesel production consumes a lot of energy required for fertilizing, sowing, and harvesting.

Further, biodiesel has a lower shelf-life as it is susceptible to oxidation & breakdown, which requires careful storage & handling to maintain its quality. Few engines face compatibility issues with biodiesel, so the engine components can get corroded or damaged. As the energy density of biodiesel is low compared to petroleum fuel, a higher amount is required to produce the same amount of energy. In addition, large land are required for biofuel cultivation, which leads to deforestation & habitat destruction. These factors are anticipated to hamper the market growth in the coming years.

BIODIESEL MARKET OPPORTUNITIES

Investments in Biofuels to Generate Excellent Opportunities for Market Growth

A significant increase in biofuels production globally has led to lucrative investments in the biodiesel sector. Biofuels are crucial in decarbonizing the transport sector by providing low-carbon solutions for existing technologies. In 2022, the biofuel demand reached a record high of 4.3 EJ (Exajoule), surpassing the levels before the COVID-19 pandemic.

According to the International Energy Agency (IEA), Brazil plans to increase its blending to 15% by 2026, up from a 10% growth rate in 2022. For instance, as stated on May 17, 2024, the biofuel companies are investing over USD 1 billion in the construction of China's initial facilities aimed at converting waste cooking oil into aviation fuel for both export and fulfilling domestic requirements, especially after Beijing mandates its usage in aircraft to reduce emissions. As the second-largest aviation market globally, accounting for roughly 11% of global jet fuel consumption, China is anticipated to release its sustainable aviation fuel (SAF) policy for 2030 this year (2025), which could lead to billions in investments.

MARKET CHALLENGES

Scaling Biodiesel Production Presents Challenges for Emerging Industry Players

Although biodiesel helps in addressing climate neutrality and sustainability goals, the difficulties involved in its mass production & scalability pose significant challenges for the market players. According to the International Energy Agency (IEA), the demand for biodiesel feedstocks, namely vegetable oils, waste residue oil & fats, is anticipated to surge by 56%, accounting for 79 million tons between 2022-2027. Thus, securing a diverse & reliable feedstock requires effective supply chain management, which includes establishing partnerships with farmers, implementing efficient feedstock collection & processing systems, and promoting sustainable feedstock cultivation. Thus, diversification of feedstock is crucial to stabilize production costs and mitigate price volatility risks.

BIODIESEL MARKET TRENDS

Technological Advancements in Biodiesel Processing Methods are Recent Market Trends

There have been significant advancements in processing methods recently. This growth is majorly attributed to the growing focus on sustainability, cost-effectiveness, and efficiency, which has led to technological advancements and the exploration of sustainable feedstock for biodiesel production. For instance, the rising focus on food security has led to the exploration and use of non-edible feedstocks such as algae, waste oils, and animal fats, which do not compete with edible food crops.

In addition, the research related to the use of genetically modified (GM) algae has gained huge popularity for the production of high-quality biodiesel. The enzyme-catalyzed transesterification process, a greener alternative to chemical-based catalysts, is becoming highly popular. Also, ultrasonic heating and microwave technologies are being explored for energy-efficient biodiesel production.

IMPACT OF TARIFF

The impact of tariffs on the biodiesel industry will be multifaceted, owing to their effect on production and an increase in the price of feedstocks, which will affect domestic & global production. An increase in the cost of imports will lead to a growth in production costs for the companies operating in the biodiesel industry.

In addition, the demand for biodiesel in developing and underdeveloped countries is anticipated to decline owing to higher import tariff prices. For instance, the U.S. government implemented new tariffs on March 4, 2025, on various goods from Canada, Mexico, and China, including a 10% tariff on biofuels entering the U.S. from Canada. Hence, such tariffs are anticipated to impact U.S. biofuel exports as well. Canada ranks among the U.S.'s leading trading partners in ethanol and biodiesel, while Mexico was the primary recipient of U.S. distillers' grains exports in the previous year.

As reported by the USDA, the U.S. exported over 1.91 billion gallons of ethanol last year, generating USD 4.31 billion in revenue. Canada made up 35% of that export volume, with around 4% of the shipments going to Mexico. Thus, the impact of tariffs on the biodiesel industry is anticipated to be significant globally.

SEGMENTATION ANALYSIS

By Feedstock

Vegetable Oils Dominate Market Share as They are Renewable and Widely Available

Based on feedstock, the market is classified into vegetable oils, animal fats, and others. The vegetable oils segment is further classified into soybean, corn, palm, canola, waste, and others.

Among these, the vegetable oils segment dominated the market with a 74.57% share in 2026. Vegetable oils have gained significant popularity, including soybean oil, rapeseed oil, sunflower oil, and palm oil, which account for the largest share of production in the U.S. and Europe. Palm Oil segment accounted for a market size of USD 11.66 billion, representing 27.33% share by 2026. For instance, in 2022, the used coconut oil (UCO) accounted for around 44% of biodiesel production, followed by rapeseed oil with 29%, and others.

In the U.S., around 20% of biodiesel is produced from soybean oil, and in Indonesia, 19% is produced from palm oil. Though the primary feedstocks used for biodiesel production vary by region, palm oil accounted for 36% of global production. The European Union (EU) is a leading producer and consumer of FAME biodiesel, producing around 12 billion liters in 2022. The majority of this biodiesel was produced from rapeseed oil and used cooking oil.

To know how our report can help streamline your business, Speak to Analyst

By Blend Type

B6 to B20 Blends Dominate Market as They are Widely Used in Transportation Sector

Based on blend type, the market is classified into B5 and lower blends, B6 to B20 blends, and above B20 blends.

The B6 to B20 blends segment emerged as the largest sub-segment with a market size of USD 24.55 billion in 2026, accounting for 57.54% of the market. These blends are widely used in on- and off-road vehicles and locomotives as they are primarily used as fuel in on-road cars and trucks. Also, B6 to B20 blends are used in the construction & agriculture sectors. These blends are mainly used in rail applications as they are compatible with seals and gaskets. These biodiesel blends are even used as a marine fuel.

B6 to B20 blends reduce carbon emissions and offer improved fuel economy and compatibility with existing diesel engines. This can be used with standard diesel engines without requiring significant modifications, which makes them a relatively easy transition for fleets. Most biodiesel users purchase B20 or lower blends from normal fuel distributors or marketers. The engines operating on B20 blends offer excellent horsepower, fuel consumption, and torque, the same as petroleum diesels.

By Application

On-road Segment Dominated Market as Biodiesel Offers Improved Fuel Lubricity

Based on application, the market is segregated into on-road, off-road, stationary, and others. The on-road segment is further divided into fleet vehicles, heavy-duty trucks, and others. The off-road segment is further classified into agricultural equipment, construction equipment, marine vessels, locomotives, and others. The stationary segment is further classified into electric generators and furnaces. The 0n-road segment led the market with a market size of USD 23.99 billion in 2026, representing 56.23% market share.

Among these, the on-road segment accounted for the major market revenue. Biodiesel is widely used for on-road applications for various vehicles, such as light-duty and heavy-duty trucks, cars, tractors, boats, and even generators. The most common biodiesel blend in B20 ranges from 6% to 20% blended with petroleum diesel. The B5 biodiesel blend is highly used in fleet vehicles, whereas B20 and lower-level blends are used in diesel vehicles without engine modification.

The off-road segment is anticipated to grow at a significant rate owing to its wide range of applications in agriculture, in tractors & other farm machinery. Also, biodiesel is used in construction machinery, namely excavators, bulldozers, and other heavy equipment. It is used in marine and rail applications, which enhances the energy security and reduces the dependence on oil imports.

BIODIESEL MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa.

Europe

Europe Biodiesel Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Rise in Adoption of Renewable & Environmentally Friendly Fossil Fuels Market Growth

Europe is the leading biodiesel producer, accounting for around 32.2% of biodiesel production in 2022-2023. As stated by REN21, the Renewable Energy Policy, Germany, France, and Spain accounted for more than half of the FAME biodiesel production in Europe. Biodiesel is prominently produced from rapeseed oil and cooking oil in Europe. In addition, Europe's leading biodiesel consumers are France, Germany, Italy, Sweden, Spain, the U.K., and others. For instance, in 2022, France accounted for 50.922 thousand barrels per day of biodiesel consumption, Germany with 46.44 thousand barrels per day, Italy with 27.49 thousand barrels per day, and so on. The European Union (EU) Biofuel Directive supports biofuel use, including biodiesel, to reduce carbon emissions, promote sustainable development, and minimize dependence on imported energy. The Europe biodiesel market is valued at USD 17.9 billion and United Kingdom market is valued at USD 1.84 billion by 2026

Germany

Government Policies & Regulations Promoting Use of Sustainable Fuels Drive Demand for Biodiesel

Germany market is valued at USD 4.91 billion by 2026. Germany has implemented policies such as the biofuel quota, which encourages the use of biodiesel and other biofuels in the transportation sector to reduce greenhouse gas emissions. Germany was one of the first European countries to adopt biodiesel at around 10 PJ in 2000. In addition, the Biomass Sustainability Ordinance (BioNachV) policy sets standards for the sustainability of biomass used to produce biofuels.

Germany's regulations are influenced by the EU's RED II directive, which sets targets for using renewable energy, including biofuels. Germany emphasizes implementing regulations that focus on the use of biofuels, particularly biodiesel, highlighting its importance in sustainability and greenhouse gas emission reduction goals.

Asia Pacific

Ease of Availability of Biodiesel Feedstock Drives Market Growth

Asia Pacific is another prominent region for biodiesel production, with Indonesia, China, South Korea, Malaysia, Thailand, and others accounting for significant biodiesel production. Globally, Indonesia accounted for around 17.6% of biodiesel production, followed by China, 3.6%, and Thailand, 3.0%. These Asia Pacific countries are leading producers of vegetable oils, namely palm oil, coconut oil, and others. These countries have an abundant supply of other agricultural products, such as sugarcane, maize, soybean, cassava, and others, which are used to produce biodiesel. The Asia Pacific biodiesel market is valued at USD 11.38 billion by 2026. The China market is valued at USD 2.02 billion by 2026, and the India market is valued at USD 0.11 billion by 2026.

Indonesia

Rising Focus on Energy Security & Support for Palm Oil Industry Boost Market Expansion

Indonesia is one of the leading oil importers, and increased demand for fuel has led to an increase in the need for diversification of energy sources to reduce dependence on fossil fuels. Also, Indonesia is a leading palm oil producer, which is used as a feedstock for biodiesel production. Hence, biodiesel is mainly used to boost the local palm oil industry and create economic opportunities for farmers & producers. In addition, the Indonesian government offers subsidies to biodiesel producers that encourage the blending mandate to reduce the dependence on traditional fuels.

Indonesia has significantly increased its blending mandate from the B20 blending mandate program in 2018, followed by an upgrade to the B30 program in January 2020, and the country tried to increase its blending mandate to 35% in August 2023.

North America

Rising Awareness Regarding Carbon Footprint Reduction Drives Market Share

In North America, biofuel production, including biodiesel, is increasing significantly, driven by a growing emphasis on renewable energy sources and reducing the carbon footprint. The International Energy Agency (IEA) has stated that the U.S. has seen a considerable rise in biodiesel production capacity, reaching 2.1 billion gallons in 2023. Also, in 2023, the biodiesel consumption in the U.S. reached 1.94 billion gallons. From 2022 to 2023, the U.S. biodiesel imports doubled and reached 33,000 barrels per day (b/d). This growth is majorly due to the growing focus on carbon footprint reduction.

Latin America

Abundant Agricultural Resources & Favorable Government Policies to Boost Product Demand

The Latin America biodiesel market is valued at USD 4.47 billion by 2026. Latin America is one of the major producers of vegetable oils such as soybean & palm oil that are used as a feedstock for biodiesel production. In addition, growing awareness regarding sustainable energy solutions and environmental issues is driving market growth. The countries, namely Brazil and Argentina, are the prominent biodiesel manufacturers in this region. According to the data published by the Organization for Economic Co-operation and Development (OECD), by 2031, biodiesel production in Brazil is anticipated to reach 7,695 million liters, and Argentina will account for 2,003 million liters of biodiesel production.

Middle East & Africa

Growing Popularity of Sustainable Feedstocks to Boost Biodiesel Demand

The Middle East & Africa market is comparatively small in this region. However, in the coming years, the biodiesel demand in this region is anticipated to increase due to the growing popularity of sustainable feedstocks. Also, several pilot projects are being implemented in this region, with UAE leading the way. Countries, namely South Africa, Saudi Arabia, UAE, and others, have significant potential for biodiesel owing to the increased availability of biofuel crops.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Investments and Business Expansion Present Significant Growth Opportunities for Market Players

The global biodiesel market is characterized by intense competition driven by rapid investments and business expansion in biodiesel, which is driving its adoption across various countries. Major players, including Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., and Eco Diesel Colombia S.A., compete through collaboration, business expansion, and investments. For instance, in October 2024, Terviva, a company located in California that produces food, feed, and fuel from Pongamia trees, secured an undisclosed amount of investment from Chevron Renewable Energy Group, a leading biodiesel producer in the U.S.

List of Key Biodiesel Companies Profiled

- Ag Processing, Inc. (U.S.)

- Archer Daniels Midland Company (ADM) (U.S.)

- Bunge Ltd. (U.S.)

- Cargill, Inc. (U.S.)

- Ecodiesel Colombia S.A. (Colombia)

- FutureFuel Corp. (U.S.)

- Manuelita S.A. (Colombia)

- Renewable Biofuels, Inc. (U.S.)

- TerraVia Holdings, Inc. (U.S.)

- Wilmar International Ltd. (Singapore)

KEY INDUSTRY DEVELOPMENTS

- April 2025- Aemetis, Inc., a worldwide company specializing in renewable natural gas and biofuels, has revealed that its subsidiary in India, Universal Biofuels, has secured several orders for biodiesel worth USD 31 million. The shipments, planned from May to July, will provide more than 33,000 kiloliters of biodiesel to India's three state-owned oil marketing companies (OMCs).

- April 2025- Vast Infraestrutura and Be8, a prominent company in biodiesel production, have entered into a Memorandum of Understanding (MoU) to advance the biofuels market for the maritime industry at the Port of Açu in Rio de Janeiro. Currently, the port holds the second position in vessel traffic across Brazil. In 2024, over 7,300 ships are expected to dock at Açu.

- March 2025- D&L Industries Inc., a company that produces food ingredients and industrial chemicals, is considering the establishment of a second biodiesel facility to support the government's initiative to raise the biodiesel blend from the current 3% (B3) to 4% (B4) by October of this year.

- March 2025- Indonesia anticipates its B40 biodiesel initiative will be fully operational soon, following some setbacks at the beginning of the year. Eniya Listiani Dewi, an official from the energy ministry, mentioned that the delivery of palm oil-derived biodiesel has reached approximately 1.2 million kiloliters this year, according to Reuters.

- November 2024- UC Santa Cruz chemists have established a new method for the production of biodiesel from waste oil that both simplifies the process and requires relatively mild heat. This discovery has the potential to make the alternative fuel source much more appealing to the industrial sectors that play a crucial role in the nation’s economy.

Investment Analysis and Opportunities

Investments in the biodiesel industry are growing significantly owing to the growth in the renewable energy sector, reducing the dependence on fossil fuels and decreasing carbon emissions.

- In February 2025, a new hub for biofuels concentrating on Bio-Liquefied Natural Gas (Bio-LNG) is set to be built in the Johor-Singapore Special Economic Zone (JS-SEZ), featuring an annual processing capacity of 350,000 tons of Bio-LNG. The developers highlight that this joint effort across borders has already obtained some funding, with anticipated green investments totaling 1.5 billion ringgit (approximately 337 million USD).

- In January 2025, the Missouri Agricultural and Small Business Development Authority allocated almost USD 3.4 million toward initiatives aimed at enhancing the distribution and utilization of higher concentrations of ethanol and biodiesel within Missouri, according to an announcement made by the organization this week.

REPORT COVERAGE

The global biodiesel market report provides a detailed biodiesel market analysis. It focuses on key market aspects such as key players, feedstock used for biodiesel production, various blends, and their application. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.75% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Feedstock

By Blend Type

By Application

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 42.67 billion in 2026.

The market will likely grow at a CAGR of 6.75% over the forecast period (2026-2034).

The vegetable oils segment by feedstock led the market.

The market size stood at USD 16.88 billion in 2025.

The growing push toward decarbonization is driving the market growth.

Some key players operating in the market are Ag Processing, Inc., Archer Daniels Midland Company (ADM), Bunge Ltd., Cargill, Inc., and others.

The global market size is expected to reach USD 67.4 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us