Carbon Fiber Market Size, Share & Industry Analysis, By Precursor (PAN and Pitch), By Tow (Large Tow and Small Tow), By Application (Aviation, Aerospace & Defense, Automotive, Wind Turbines, Sports & Leisure, Construction, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

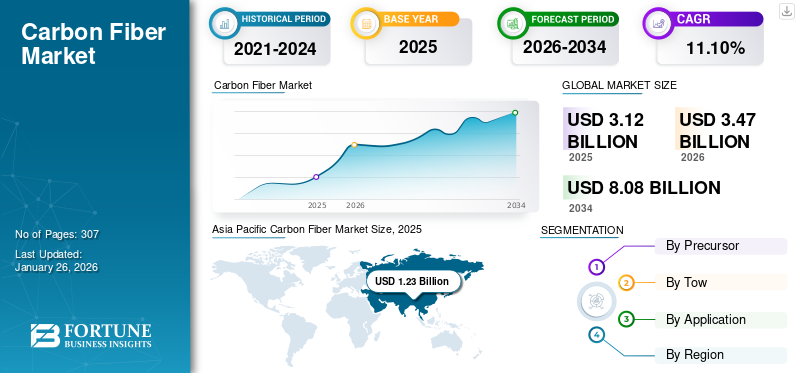

The global carbon fiber market size was valued at USD 3.12 billion in 2025 and is projected to grow from USD 3.47 billion in 2026 to USD 8.08 billion by 2034, exhibiting a CAGR of 11.10% during the forecast period. Asia Pacific dominated the carbon fiber market with a market share of 39.30% in 2025. Moreover, the carbon fiber market size in the U.S. is projected to grow significantly, reaching an estimated value of USD 1.98 billion by 2032. Toray Industries, Zoltek Corporation, SGL Carbon, Mitsubishi Chemical Carbon Fiber and Composites Inc., and Teijin Limited are key players operating in the market.

Carbon fiber, also known as graphite fiber, is made of carbon atoms with diameters ranging from five to ten micrometers. It has high stiffness, a high strength-to-weight ratio, low thermal expansion, high tensile strength, high temperature tolerance, and higher chemical resistance.

Global Carbon Fiber Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 3.12 billion

- 2026 Market Size: USD 3.47 billion

- 2034 Forecast Market Size: USD 8.08 billion

- CAGR: 11.10% from 2026–2034

Market Share:

- Asia Pacific dominated the carbon fiber market with a 39.30% share in 2025, driven by rapid industrial growth, increasing automotive production, and infrastructure investments in China, India, and Southeast Asia.

- By precursor, PAN-based carbon fiber is expected to retain the largest market share in 2025, supported by high tensile strength, cost-effectiveness, and widespread use across aerospace, automotive, and sporting goods industries.

Key Country Highlights:

- United States: The market is projected to reach USD 1.98 billion by 2032, fueled by increasing demand in the automotive and aerospace sectors and large-scale investments in carbon fiber research and production.

- China: As the largest carbon fiber market globally, demand is driven by the EV boom, industrialization, and heavy investments by major domestic producers like Jiangsu Hengshan and Toray Advanced Materials.

- Germany: A strong aerospace manufacturing base, including Airbus and Eurofighter, along with R&D in carbon-based aircraft components, supports rapid market growth.

- Brazil: Increasing automotive production and rising foreign investment in industrial sectors are contributing to strong growth in carbon fiber applications.

- GCC Countries: Growing aerospace and automotive demand, along with favorable trade ties with the U.S., are boosting regional growth, particularly in defense and wind energy sectors.

Carbon Fiber Market Trends

Research Focusing on Product Manufacturing from Non-Conventional Raw Materials to Create Lucrative Growth Opportunities

Industry partners and researchers are implementing projects to convert coal tar, a by-product, from coke production for the steel industry into carbon fiber and composites. This new product could increase the coal tar pitch value by five to 55 times its current value and find applications in low-weight and high-stiffness composites. Asia Pacific witnessed a growth from USD 1.10 billion in 2022 to USD 0.97 billion in 2023.

In December 2020, the U.S. Department of Energy (DOE), Oak Ridge National Laboratory (ORNL), and the University of Kentucky Center for Applied Energy Research (CAER) entered into a strategic partnership for around USD 10 million projects, which mainly convert coal into CFs and composite. The research will mainly report major challenges related to various coal feedstock, coal processing, and CF manufacturing. CAERs will focus on converting various coal feedstock into CF and composites. ORNL’s role will be to correlate the coal’s molecular structure. Such developments will accelerate the production of low-cost fiber, propelling the growth of the market.

Download Free sample to learn more about this report.

Market Dynamics

Market Drivers

Increasing Product Usage in the Automotive Industry to Drive Market Growth

Carbon fiber is a very lightweight and strong material with a low weight-to-strength ratio. It is five times stronger than steel and twice as stiff as steel. It has superior chemical resistance to steel. These properties of the product have led to an increase in its use in the automotive industry to manufacture lightweight and highly durable vehicles.

Graphite fiber increases the automobile's durability and ensures the long life cycle of the body parts. The collective demand for manufacturing automobile body parts, such as hoods, roofs, doors, deck lids, and bumper beams, favors product consumption. The rising consumption of graphite fiber composites in motorsport cars and luxury vehicles is driving the market growth.

Carbon fiber is an advanced material and is considered an ideal solution that meets the requirements of automotive manufacturers. Companies are investing in R&D and adopting strategies to innovate new methods that would reduce the vehicle's overall weight by using these fibers. The material has a density as low as 1.6g/cc, making it the ideal material for making extremely lightweight body parts for automobiles. A lightweight vehicle provides better fuel efficiency and 10% weight reduction, saving 6% to 8% in fuel. This has resulted in the wide use of Carbon Fiber Reinforced Polymer (CFRP) in various vehicles ranging from mopeds to high-end supercars.

The rising global automotive industry and the surge in the need for lightweight vehicles are fueling market growth. The rise in disposable income and growing young population are creating demand for individual vehicles, especially electric vehicles, which has led to several manufacturers increasing automobile production. For instance, according to the IEA (International Energy Agency), sales of electric cars doubled to 6.6 million in 2021, and they are anticipated to increase further soon.

Car companies, such as Audi, BMW, Honda, Polestar, and General Motors, are focusing on collaboration with major carbon composite material manufacturers for large-scale production and investment in processes to support low-cost composite materials. For instance, in May 2019, General Motors collaborated with Teijin, a Japanese information technology, chemical, and pharmaceutical company, to use CFRTP in high-production vehicles, where the material is used for mass production. Further, increasing industrialization and disposable income in developing economies, such as China, India, and Brazil, is anticipated to drive the growth of the automotive industry significantly.

Increasing Product Demand from Aviation and Aerospace & Defense Industries to Propel Market Growth

The increasing demand for carbon fiber in aviation and aerospace & defense industries is propelled by its unique properties that offer high strength-to-weight ratio, corrosion resistance, and durability. In the aviation industry, the lightweight nature of the product offers enhanced fuel efficiency, leading to lower operational costs and reduced emissions. In aerospace, it is utilized in structural components to improve performance and safety. The defense sector relies on carbon-based fibers for lightweight armor, ballistic protection, and advanced weaponry, thereby enhancing mobility and survivability. Additionally, ongoing technological advancements are expanding the applications of carbon-based fiber in these industries, further driving the market growth. As these sectors prioritize efficiency, performance, and sustainability, the versatility offered by the product is going to make it a crucial material for future innovations in the aviation and aerospace & defense industries. This, in turn, is expected to drive the global carbon fiber market growth.

Market Restraints

High Cost of Product to Hinder Market Growth

Carbon composites are widely used in the aerospace, automotive, construction, oil & gas, and wind energy industries owing to their high performance and lightweight properties. The manufacturing process of carbon fiber is expensive, increasing the overall price of the product. The cost of the product is a major restraining factor, prohibiting the widespread usage of carbon composites in various industries. The cost of CF is directly related to the yield and cost of the precursor from which it is obtained. Currently, the average cost of PAN-based fibers and their non-aerospace grade is around USD 21.5 per kg, with a conversion efficiency of only 50%. These high prices make it difficult for domestic and small-scale manufacturers to enter the market, thus limiting market growth. Moreover, the release of harmful and hazardous gases into the environment during the manufacturing of graphite fiber has resulted in the implementation of stringent regulations over its manufacturing in several developed and developing countries such as China, India, the U.S., Japan, and Brazil. Governments worldwide are further tightening these regulations, affecting the demand for the product and restraining market growth.

Market Opportunities

Rising Adoption of Renewable Energy Sources to Create New Growth Opportunities

The rising adoption of renewable energy, particularly wind and solar power, is anticipated to create new market growth opportunities. Carbon fibers' high strength-to-weight ratio, durability, and resistance to fatigue make them ideal for critical components in renewable energy systems.

Modern wind turbines are being designed with longer blades to capture more wind and increase power generation. Carbon fiber’s high strength-to-weight ratio is ideal for producing these larger blades. It allows for the creation of blades without adding excessive weight, which is crucial for maintaining structural integrity and performance. Carbon fiber’s superior fatigue resistance and durability contribute to the longevity and reliability of wind turbine blades. This reduces the frequency of maintenance and replacement, making wind energy systems more cost-effective over their operational lifespan.

Over the past decade, offshore wind farms have gained prominence due to their ability to harness stronger and more consistent wind resources. The environment near these farms poses significant challenges, including exposure to salt water and severe weather conditions. Carbon fiber’s resistance to corrosion and environmental degradation makes it an optimal material for offshore wind turbine components, ensuring long-term performance and reliability.

Market Challenges

Recycling and Sustainability Factors to Act as Challenge for Market Growth

One of the most significant challenges facing the carbon fiber industry is its lack of effective recycling methods, which directly impacts its long-term sustainability. While carbon fiber’s superior strength-to-weight ratio makes it highly desirable in industries such as aerospace, automotive, and renewable energy, its environmental footprint is a growing concern. Unlike materials such as steel or aluminum, which can be easily recycled and reused, carbon fiber composites are much more difficult to break down and repurpose.

The primary issue with recycling carbon fiber stems from its composition and the way it's manufactured. Carbon fiber is typically embedded in a polymer matrix (such as epoxy resin), which gives the material its lightweight and durable properties. However, this strong bond between the carbon fibers and the resin makes it extremely difficult to separate the fibers from the matrix once the product reaches the end of its life.

Traditional recycling methods, such as mechanical grinding or shredding, can break down the material, but they often result in a loss of the high-performance properties of the carbon fibers. In most cases, these fibers are not reused in high-value applications but instead used in lower-grade products, which limits the sustainability potential.

Impact of COVID-19

The outbreak of the COVID-19 pandemic halted most composite businesses due to the nationwide lockdown and a partial shutdown of factories, negatively affecting product growth. During the pandemic, automobile manufacturers globally faced severe impacts. For example, GM, Ford, and FCA suspended their manufacturing parts business in the U.S. and repurposed for producing COVID–19 medical devices. However, the gradual opening of economies in 2021 increased demand for the product for different applications.

Carbon Fiber Market Segmentation Analysis

By Precursor

PAN Segment to Hold Largest Market Share Due to High Demand from End-use Industries

Depending on the precursor, the market is segmented into PAN (polyacrylonitrile) and pitch.

The PAN segment is likely to hold a dominant share of the market, accounting for 97.98% of the market share in 2026 and is anticipated to dominate the market in the near future, owing to increasing demand from end-use industries. The higher demand for PAN-based graphite fiber is attributed to its properties, including cost-effectiveness, high modulus, high tensile strength, and better quality of fiber produced. Increasing demand for products in aerospace & defense, automotive, and sporting goods applications is anticipated to further increase the segment’s share.

The pitch-based segment may show a significant CAGR of 11.14% during the forecast period. Properties such as low electrical resistivity, low negative coefficient, high thermal conductivity, and high modulus make it suitable for the aerospace industries and sports industries.

By Tow

Small Tow Segment to Dominate Market Owing to Increasing Adoption in Aerospace & Defense Industry

Based on tow, the market is segmented into small tow and large tow.

The small tow segment accounted for the major share, accounting for 76.37% of the market share in 2026. Small tow fibers refer to rovings that contain 24,000 or fewer filaments. They are broadly used in the aerospace and defense industry due to their high modulus and tensile strength.

Fibers containing 48,000 to 320,000 or more carbon filaments are called large tow fibers. The segment led the market share by 24% in 2024. Large tow fibers also held a considerable share of the market, which is anticipated to rise in the near future, since companies are forming strategies to produce large tow intermediates. For instance, in November 2017, Solvay acquired European Carbon Fiber GmbH (ECF), a German-based large-tow PAN fiber producer. This acquisition will enable Solvay to develop a portfolio of large-tow fibers to complement the company’s existing PAN and pitch aerospace-grade fibers range.

To know how our report can help streamline your business, Speak to Analyst

By Application

Aviation, Aerospace & Defense Segment to Hold Major Share Due to Increased Aircraft Manufacturing

Based on application, the market is segmented into aviation, aerospace & defense, automotive, wind turbines, sports & leisure, construction, and others.

Among these applications, the aviation, aerospace & defense segment accounted for the highest market share in 2023 and may continue its dominance during the foreseeable period. The segment is also expected to showcase a CAGR of 10.15% during the forecast period, accounting for 34.29% of the market share in 2026. Composite materials are used in the aerospace industry in interiors, engine blades, propellers/rotors, brackets, single-aisle wings, and wide-body wings. Additionally, aerospace engineers are working to make flight more sustainable and safer, which has led to the use of fiber composite materials in helicopters, planes, and space shuttles. Therefore, rising aircraft production is likely to drive market growth.

Composite materials make up around 40% of modern aircraft. For instance, the Boeing 787 Dreamliner passenger plane comprises about 50% of composite material by weight, mostly carbon fiber sandwich or laminate. Fiber materials comprise the main body, parts of the aircraft's tail, wings, and fuselage. Boeing states that using carbon and other composite materials allows for less maintenance as they do not rust.

The product is gaining prominence in the sporting industry. The increasing use of high-performance and lightweight materials in sports equipment will drive market growth in sports & leisure applications. In tennis, the materials manufacture lighter and uniquely shaped rackets that allow major players to hit the ball faster. In high-performance cycling, carbon composite reduces the bicycle's weight, improving lap times.

- Automotive segment is expected to hold 10% of the market share in 2025.

Carbon Fiber Market Regional Outlook

Asia Pacific

Asia Pacific Carbon Fiber Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific accounted for the leading market share, valued at USD 1.23 billion in 2025 and USD 1.39 billion in 2026. China is the largest market for carbon fiber in the Asia Pacific and globally. The country's rapid industrial growth and investments in infrastructure are significant drivers of carbon fiber demand. Major Chinese companies such as Jiangsu Hengshanand Toray Advanced Materials have ramped up production capabilities, focusing on both large and small tow fibers. The market in China is projected to reach USD 1.09 billion in 2026. On the other hand, the market in India is expected to hit USD 0.03 billion, while Japan is projected to reach USD 0.18 billion in 2026.

The automotive industry in China is increasingly adopting carbon fiber components to improve vehicle efficiency and reduce weight, especially with the rise of Electric Vehicles (EVs). According to the ATA CFT Guangzhou Co. Ltd. (Guangzhou, China), China is the second largest carbon fiber composites market in the world.

To know how our report can help streamline your business, Speak to Analyst

Europe

The European market is expected to register rapid growth during the forecast period. The region is likely to be the third-largest region with a value of USD 0.78 billion in 2025. The presence of a well-developed aviation sector in Germany is expected to provide a favorable market growth opportunity. Eurofighter and Airbus A320 family have their manufacturing units in Germany. The country offers leading manufacturing bases for the aircraft industry and is home to several material and component suppliers, equipment manufacturers, whole system integrators, and engine producers. The market in U.K. is expected to hit USD 0.1 billion in 2026, whereas Germany is likely to hit USD 0.2 billion and France is projected to reach USD 0.11 billion in 2025. For instance, in February 2019, the German Aerospace Center developed a de-icing solution for critical points on aircraft utilizing CF and electricity.

North America

North America is a heavily industrialized region with a well-developed automotive and aerospace and defense industries. The region is expected to be the second-largest market with a value of USD 1.01 billion in 2025, exhibiting the second-fastest CAGR of 13.56% during the forecast period. The region has a high standard of living and a mature demand for high-end vehicles, leading to the continued growth of the automotive industry, further driving the North America carbon fiber market. The U.S. market size is estimated to hit USD 1.07 billion in 2026. For instance, according to the American Automotive Policy Council, the automotive industry contributed 3% of America’s GDP.

Latin America

Latin America is expected to be the fourth-largest market with a value of USD 0.06 billion in 2025. In the recent past, Latin America witnessed significant investment in the construction and automotive industries. For example, Mexico, owing to its logistical proximity as an exporter to the U.S. and Canada, has witnessed significant investments in the automobile sector. Rapid urbanization and the growing automotive industry in Brazil shall favor the industry outlook in the Latin America region.

Brazil’s automotive carbon composites market contains several large and small supplier companies such as Cromitec, Fiacbras, Elekeiroz, and Embrapol. Further increasing industrialization propelled by foreign investment is anticipated to significantly impact the market.

Middle East & Africa

The market in the Middle East & Africa is growing at a considerable CAGR owing to rising industrialization in the region. The rise in the GDP of the oil-producing countries has led to the growth of the aerospace and defense industry in the region, which is anticipated to continue soon. The GCC region dominates the Middle East & Africa market due to the high demand for automobiles in the region. A well-developed aerospace, defense, and wind energy industries in Israel and good trade relations with the U.S. for defense and military projects will likely create huge opportunities in the Middle East.

Competitive Landscape

Key Industry Players

To know how our report can help streamline your business, Speak to Analyst

Companies are Focusing on Strategic Partnership and Acquisition to Strengthen their Market Reach

Most of the key producers are focusing on acquisition, new product launches, and strategic partnerships to enhance their product portfolios, broaden their market reach, and gain a competitive edge over other key participants.

The largest players in the market are Toray Industries, Zoltek Corporation, SGL Carbon, Mitsubishi Chemical Carbon Fiber and Composites Inc., and Teijin Limited. The global carbon fiber market is consolidated, with the top five players accounting for around 75% of the market share.

LIST OF TOP CARBON FIBER COMPANIES:

- Toray Industries, Inc. (Japan)

- Syensqo (Belgium)

- Nippon Graphite Fiber Co., Ltd. (Japan)

- TEIJIN LIMITED (Japan)

- Hexcel Corporation (U.S.)

- ZOLTEK Corporation (U.S.)

- HYOSUNG ADVANCED MATERIALS (South Korea)

- Advanced Composites Inc. (U.S.)

- Mitsubishi Chemical Carbon Fiber and Composites, Inc. (U.S.)

- Formosa M Co., Ltd. (South Korea)

- SGL Carbon (Germany)

KEY INDUSTRY DEVELOPMENTS:

- December 2023- Teijin Limited introduced the Tenax Carbon Fiber produced from sustainable acrylonitrile(AN) by utilizing residue and waste from recycled raw materials or biomass-derived products.

- October 2023 - Toray Industries Inc. expanded its high modulus and regular tow* medium carbon fibers production facilities at French subsidiary Toray Carbon Fibers Europe S.A. This move is due to the increasing demand for carbon fiber in Europe, bolstered by the move toward a net-zero society.

- July 2021 –Hexcel Corporation announced that it entered into an agreement with Dassault to supply carbon fiber prepreg for the Falcon 10X program. The move is anticipated to strengthen the existing partnership between the two aerospace leaders.

- July 2021- Toray Industries Inc. completed the acquisition of Tencate Advanced Composites Holding BV, a Dutch producer and distributor of carbon fiber composite materials. TenCate's parent firm, Koninklijke Ten Cate BV, agreed to sell the business to Toray for €930 million (USD 1 billion), including net debt. With this acquisition, the company would be able to provide a wider product lineup, such as polymer technologies and carbon fiber.

- February 2021 – Teijin Limited launched Tenax BM (beam series) and Tenax PW (power series) brands of carbon fiber intermediate materials for sports applications. This launch will help the company to maximize power and speed due to its exceptional durability and toughness.

REPORT COVERAGE

The market research report provides detailed market analysis and focuses on crucial aspects such as leading companies, materials, products, and applications. In addition, it offers insights into carbon fiber market trends and highlights vital industry developments. It includes historical data & forecasts revenue growth at global, regional, and country levels, and analyzes the industry's latest market dynamics and opportunities. In addition to the factors mentioned above, it encompasses various factors contributing to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 11.10% from 2026 to 2034 |

|

Unit |

Value (USD Billion) and Volume (Tons) |

|

Segmentation |

By Precursor

|

|

By Tow

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 3.12 billion in 2025 and is projected to record a valuation of USD 8.08 billion by 2034.

Growing at a CAGR of 11.10%, the market will exhibit considerable growth during the forecast period of 2026-2034.

The aviation, aerospace & defense segment is the leading application in the market.

Increasing product usage in the automotive industry to drive market growth.

Asia Pacific is expected to hold the highest market share.

Research & development focusing on converting coal into carbon fiber is the key trend in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us