Chocolate Confectionery Market Size, Share & Industry Analysis, By Product Type (Milk Chocolate, Dark Chocolate, White Chocolate, and Other Specialty Types), By Product Form (Bars & Tablet, Countlines/Single-Serve Bar, Boxed Assortments/Praline, Seasonal/Gifting Chocolate, and Spreads & Coated Snack), By Ingredient Type (Conventional/Regular, Organic/Natural, Vegan/Plant-Based, Sugar-Free/Low-Sugar, and Functional/Fortified), By Price Tier (Mass Market, Premium, and Luxury/Artisanal), By Distribution Channel, and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

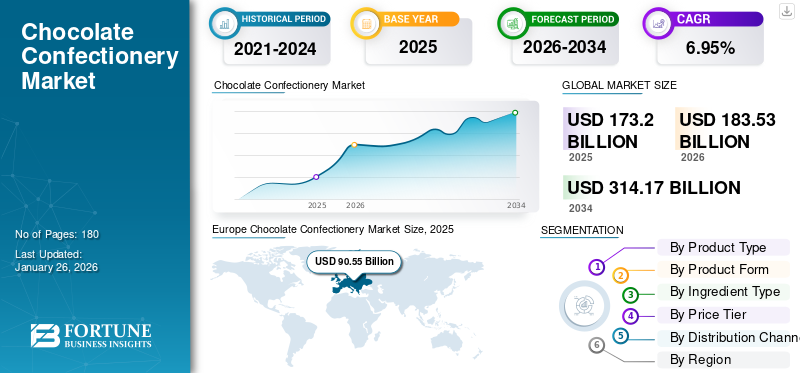

The global chocolate confectionery market size was valued at USD 173.20 billion in 2025 and is projected to grow from USD 183.53 billion in 2026 to USD 314.17 billion by 2034, exhibiting a CAGR of 6.95% during the forecast period. Europe dominated the chocolate confectionery market with a market share of 52.28% in 2025.

Chocolate confectionery are food products that can have cocoa or cocoa derivatives as its primary ingredients along with sugar, milk, fats, flavorings and others. These ingredients are combined to form bars, pralines, truffles, coated items, or filled candies for daily as well as seasonal consumption. This market is primarily driven by evolving preferences for novel and innovative confectionery products.

Companies such as Barry Callebaut, Nestle S.A., and Ferrero SpA are some of the key players operating in this market. Companies are launching new product lines with innovative flavors in the market.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Association of Chocolate with Festivals & Special Occasions to Drive Growth

In many countries across the world, chocolates are mainly consumed and associated with seasonal festive occasions, fueling their demand in the global market. Chocolates have become a popular dessert of religious events, special occasions such as Christmas, Easter, and others. Consumers are seeking more innovative varieties of chocolates every year. The mature markets across the world such as Australia, Canada, Russia, and others have shown notable growth in seasonal launches in the past few years. The leading manufacturers are intensively focusing on investing in research and development centers, distribution networks, and attractive packaging to capitalize on the growing demand. The growing demand for premium chocolates among millennials is further fueling the chocolate confectioneries market growth.

MARKET RESTRAINTS

Rising Awareness Regarding Health Risks Associated with Chocolate Confectioneries to Impede Market Growth

The increasing prevalence of lifestyle-related health conditions such as obesity and diabetes associated with excessive sugar consumption is having a significant impact on the chocolate industry. According to the International Diabetes Federation (IDF), about 589 million adults aged 20-79 are suffering from diabetes globally. Diabetic patients resist the consumption of chocolates to avoid and reduce sugar intake in their daily diet. Thus, the increasing number of people suffering from health conditions such as diabetes and cardiovascular diseases is expected to dampen the overall market growth during the forecast period.

MARKET OPPORTUNITY

Growing Demand for Artisanal Products Creates Opportunity To Expand Product Sales

Emerging markets in Asia Pacific, South America, and the Middle East & Africa, are witnessing significant growth due to the increasing urbanization, adoption of Western-style indulgence consumption patterns in these countries. Premiumization is another key opportunity area where consumers are shifting from mass-market products to premium and artisanal chocolates which consumers interested to know about the origin-specific cocoa used in the products, clean label products, and ethical sourcing of cocoa. Hence companies such as Lindt, Godiva, and Tony’s Chocolonely have positioned themselves around indulgence, craftsmanship, and sustainability.

CHOCOLATE CONFECTIONERY MARKET TRENDS

Digitization of Chocolate Retail is the key Trend Influencing Market

Key developments in the chocolate confectionery market growth include the expansion of digital retail channels, and the introduction of ethically sourced product lines. The digitalization of chocolate retail is also reshaping consumer engagement around the world. With growing digitization manufacturers are using direct-to-consumer (D2C) channels, subscription boxes, and personalized gifting options to sell their products creating new products to sell to their consumers. For instance, Hotel Chocolate in the U.K. and Godiva in Japan have successfully built e-commerce ecosystems offering customizable boxes, limited editions, and virtual gifting solutions, particularly popular during festive seasons and Valentine’s campaigns.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product Type

Milk Segment Accounts For Major Market Share Owing To Its Balanced Flavor And Sweetness Popular Among Consumers

The market is divided by product type into milk chocolate, dark chocolate, white chocolate,

and other specialty types.

The milk chocolate segment accounted for the largest market share of 51.19% in 2026. Its sweet, creamy flavor, makes it appealing to a broad range of consumers across all age groups and regions. Its smooth texture and mild cocoa taste are more favored by the consumers compared to the intense bitterness of dark chocolate.

The dark chocolate segment is expected to grow at a CAGR of 6.56% over the forecast period. Dark chocolates offer a premium appeal to the consumers along with the healthy, sensorial, and textural benefits. Dark chocolate is a rich source of antioxidants, balances the blood pressure level, and offers many other advantages that entice consumers to buy it in the market.

By Product Form

Bars and Tablets account for major market share due to Efficient Packaging

The market is segmented by product form into bars & tablet, countlines/single-serve bar, boxed assortments/praline, seasonal/gifting chocolate, and spreads & coated snack.

Bars and tablets segment account for the largest market share of 44.38% in 2026. Manufacturing chocolate in efficient production, packaging, and distribution economics helps manufacturers to easily sell its products in the market. It can be easily standardized in different sizes and mass produced easily helping brands cater to consumers at different price points and promoting consumption across various occasions.

Countlines/single-serve bar form is another major segment which is expected to grow by 6.74% during the forecast period. These products are positioned as individual treats as they cater to a wide audience offering a balance of taste, satiety, and convenience to the consumers.

By Ingredient Type

Conventional/regular Account For Major Market Share Due to Affordability and High product Availability

The market is segmented by ingredient type into conventional/regular, organic/natural, vegan/plant-based, sugar-free/low-sugar, and functional/fortified.

Conventional/regular segment account for the largest market share of 73.90% in 2026. Conventional chocolates are manufactured at mass production level and have a strong global retail reach. This makes it affordable and easily available for consumers across both developed and emerging markets.

Organic/natural segment is another major segment which is expected to grow by 7.24% during the forecast period. These products feature higher cocoa content, lower sugar levels, and clean labels, appealing to consumers who are seeking guilt-free indulgence with high product quality.

By Price Range

Strong Visibility and Impulse Buying Contributes To Higher Share of Mass Market Chocolates

The market is segmented by price range into mass market, premium, and luxury/artisanal.

Mass market products account for the highest market share of 66.84% in 2026. Mass-market chocolates are available easily across the world ensuring strong visibility and impulse buying. These products are affordable, accessible, and familiar making them the most preferred segment in the market. Such products can be enjoyed by the consumers every day.

Luxury/artisanal is the fastest growing segment with a CAGR of 6.84% during the forecast period. Consumers interested to know where ingredients come from the method used in the production of such chocolates. Small-batch chocolatiers often highlight farm-to-bar or bean-to-bar sourcing, the use of organic or fair-trade cocoa, and prompts the manufacturers to maintain direct relationships with farmers.

By Distribution Channel

To know how our report can help streamline your business, Speak to Analyst

Convenience, Visibility, and Variety Contributes To High Share of Supermarkets/Hypermarkets

The market is segmented by distribution channel into supermarkets & hypermarkets, convenience stores, specialty stores/chocolatiers, online/e-commerce, and others.

Supermarkets/hypermarkets account for the highest market share in 2024. Chocolate is bought impulsively in these stores as they are strategically placed near checkout counters and promotional aisles in supermarkets. Moreover, retailers frequently run discounts, combo offers, and festive promotions, which encourage bulk buying, gifting, and family consumption of such products.

Online/e-commerce is the fastest growing segment with a CAGR of 6.96% during the forecast period. Online channels help consumers order chocolates anytime, anywhere, and purchase products which they may not even find in their nearby physical stores. E-commerce platforms such as Amazon, Walmart.com, BigBasket, and brand-owned D2C websites such as Lindt, Hotel Chocolat, and Hershey’s, offer extensive assortments of chocolates with competitive pricing, and home delivery option.

Chocolate Confectionery Market Regional Outlook

By region, the market is categorized into Europe, North America, Asia Pacific, South America, and the Middle East & Africa.

Europe

Europe Chocolate Confectionery Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The market in Europe is estimated to reach USD 90.55 billion in 2025 and secure the position of the largest region in the market. Within Europe, countries such as Switzerland, Belgium, Germany, Austria, and the U.K. are the largest producers and consumers of chocolate products. The per capita consumption of chocolate in these countries is higher than the countries of other regions. According to the CBI Ministry of Foreign Affairs (EU), the global per capita consumption of chocolate was 0.9 kg per year while the same is higher in European nations (Switzerland at 10.5 kg and Germany at 9.2 kg per capita per year). During the forecast period, the European region is projected to record a growth rate of 6.74%. Backed by these factors, countries including Germany are expected to record the valuation of USD 24.15 billion, and the U.K. to record USD 17.3 billion in 2026. France to record USD 15.61 billion in 2025

Asia Pacific

The Asia Pacific market is valued at USD 35.63 billion, and also took the second largest chocolate confectionery market share in 2024. The market in the Asia Pacific is estimated to reach USD 37.90 billion in 2025. The demand for chocolate confectioneries in emerging economies such as China and India has witnessed an upward trend in recent years, attributed to the increasing consumer expenditure on indulgent confectionery products, especially chocolate items. In this region, China, India and Japan are estimated to reach USD 8.32 billion, USD 5.61 billion and USD 9.58 billion, each, in 2026.

North America

After Asia Pacific, the market in North America is estimated to reach USD 27.5 billion in 2025. The market in the region is primarily propelled by the growing trend of organic and clean-label chocolate confectioneries. Consumers are seeking healthy products that also provide indulgence. There is growing popularity of dark chocolate in the region which is attributed to the increasing knowledge regarding the health benefits of cocoa. In 2026, the U.S. market is estimated to reach USD 28.25 billion. The U.S. is one of the largest and most mature chocolate markets due to its diverse product availability, evolving lifestyle habits that supports chocolate consumption across all age groups.

South America

Over the forecast period, South America would witness a high growth in this market. The South America market in 2025 is set to record USD 9.42 billion. As purchasing power improves, consumers are transitioning from traditional sweets to branded chocolate products leading to the market’s growth.

Middle East & Africa

In the Middle East & Africa, Turkey's chocolate confectionery market forecast is set to grow at a CAGR of 5.92% during the forecast period. Westernization of eating habits, strong domestic manufacturing, and expanding retail infrastructure are some of the key factors supporting the market’s growth in the region.

COMPETITIVE LANDSCAPE

Key Industry Players

Companies are working to Invest in Product Innovation & Expansion to Strengthen Market Presence

The market exhibits a highly consolidated structure. It is dominated by five major players holding majority market share in the entire market owing to their huge client base, strong brand loyalty, & robust distribution network. The key players such as Nestle S.A. and Berry Callebaut AG are focusing on strategic mergers, acquisitions, and partnerships to further consolidate the market. The industry players are securing their position with the aggressive strengthening of the supply chain from procurement of raw materials to the production of chocolates. This will enable the market players to achieve sustainable growth in the industry. Leading brands such as Mondelez (Cadbury Plant Bar) and Lindt (Vegan Smooth) are expanding their plant-based product lines that are targeted toward health-conscious and flexitarian consumers.

LIST OF KEY CHOCOLATE CONFECTIONERY COMPANIES PROFILED

- Barry Callebaut (Switzerland)

- Nestle S.A. (Switzerland)

- Chocoladefabriken Lindt & Sprungli AG (Switzerland)

- Ferrero SpA (Italy)

- HARIBO GmbH & Co. KG (Germany)

- Mondelez International (U.S.)

- Meiji Holdings Co., Ltd. (Japan)

- The Hershey Company (U.S.)

- Ezaki Glico Co., Ltd. (Japan)

- Mars Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2025: ITC Sunfeast launched a molten chocolate product named Choco Meltz in the India market. The product is a spread which can be directly drizzled by consumers on their food products.

- September 2025: Lir Chocolates launched whirl shaped milk chocolate which is filled with a soft marshmallow centre and a layer of smooth caramel in the market. It is available across specific stores in the U.K. market.

- May 2024: Hershey India launched melt in mouth chocolate for the Indian market. The product is available across all retail stores in the country.

- October 2019: ITC Company (India) launched the most expensive chocolate priced at approximately INR 0.43 million for a kilogram under the brand name of Fabelle. The limited-edition product called ‘Trinity - Truffles Extraordinaire’ entered into Guinness World Records to become the world’s most expensive chocolate.

- June 2019: Mondelēz International, Inc. launched Cadbury Dairy Milk chocolate with 30% reduced sugar in India. The product is made of natural sweeteners and free from artificial preservatives.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.95% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel, and Region |

|

By Product Type |

· Milk Chocolate · Dark Chocolate · White Chocolate · Other Specialty Types |

|

By Product Form |

· Bars & Tablet · Countlines/Single-Serve Bar · Boxed Assortments/Praline · Seasonal/Gifting Chocolate · Spreads & Coated Snack |

|

By Ingredient Type |

· Conventional/Regular · Organic/Natural · Vegan/Plant-Based · Sugar-Free/Low-Sugar · Functional/Fortified |

|

By Price Tier |

· Mass Market · Premium · Luxury/Artisanal |

|

By Distribution Channel |

· Supermarkets & Hypermarkets · Convenience Store · Specialty Stores / Chocolatiers · Online / E-commerce · Others |

|

By Region |

North America (By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel , and Country)

Europe (By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel, and Country)

Asia Pacific (By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel, and Country)

South America (By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel, and Country)

Middle East and Africa (By Product Type, Product Form, Ingredient Type, Price Tier, Distribution Channel, and Country)

· Rest of the Middle East & Africa (By Ingredient Type) |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 183.53 billion in 2026 and is projected to reach USD 314.17 billion by 2034.

In 2025, the market value stood at USD 90.55 billion.

The market is expected to exhibit a CAGR of 6.95% during the forecast period.

By product type, the milk chocolate type segment led the global market in 2025.

Increasing association of chocolate with festivals & special occasions to drive growth.

Barry Callebaut, Nestle S.A., and Ferrero SpA are a few of the players in the market.

Europe held the largest market share in 2025.

Digitization of chocolate retail is the key trend influencing the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us