Coagulation Analyzers Market Size, Share & Industry Analysis, By Type (Systems {Automatic, Semi-automatic, and Manual}, and Consumables), By Technology (Optical Detection, Electromechanical Detection, Mechanical, and Others), By Test Type (Prothrombin, APTT, D-Dimer, Fibrinogen, and Others), By End-user (Hospitals, Diagnostic Laboratories, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

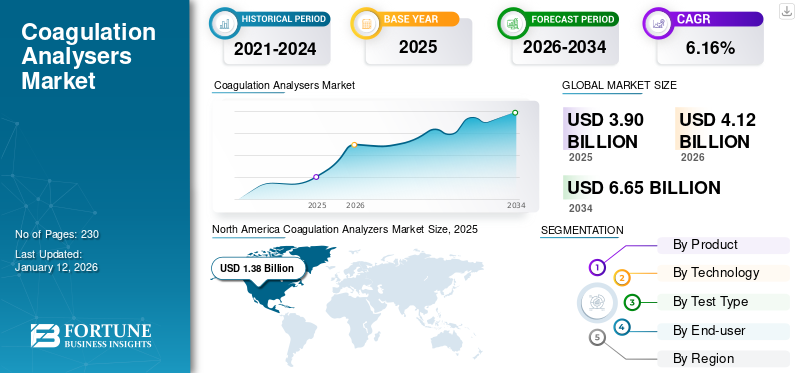

The global coagulation analyzers market size was valued at USD 3.90 billion in 2025. The market is projected to grow from USD 4.12 billion in 2026 to USD 6.65 billion by 2034, exhibiting a CAGR of 6.16% during the forecast period. North America dominated the coagulation analyzers market with a market share of 35.47% in 2025.

A coagulation analyzer is a medical laboratory device used to test how well and quickly a person’s blood clots. It is also commonly used to monitor patients taking anticoagulant medications, such as warfarin, which affect clotting time. The market growth is attributed to the increasing number of hospital-based and standalone laboratories purchasing coagulation analyzers due to high demand for blood clotting tests, driven by surgeries and various medical conditions.

Furthermore, the market is dominated by major players, including Siemens Healthineers AG, Sysmex, F. Hoffmann-La Roche Ltd., and Werfen. These companies are involved in new product launches, collaborations, and partnerships to enhance their market presence.

MARKET DYNAMICS

MARKET DRIVERS

Rising Prevalence of Hematological Disorders to Drive the Market Growth

Over the past few years, the increasing prevalence of coagulation-related disorders, such as hemophilia, has driven the demand for coagulation testing in healthcare facilities. The increasing aging population and unhealthy lifestyles are significantly driving this burden worldwide. In response, hospitals and diagnostic centers are adopting coagulation analyzers to ensure accurate and rapid diagnosis, which is critical for effective patient management.

Moreover, the growing demand for point-of-care (POC) testing has enhanced accessibility to coagulation monitoring, especially for patients undergoing anticoagulant therapy. These devices have minimized manual errors and reduced turnaround time, improving patient outcomes. Such a scenario is anticipated to fuel the global coagulation analyzers market growth in the forthcoming years.

- For instance, according to the Perth Blood Institute, as of July 2025, the prevalence of hemophilia in the male population worldwide was 1 in 6,000-10,000 in 2024, with hemophilia A affecting approximately 1 in 5,000 males and hemophilia B affecting approximately 1 in 30,000 males.

MARKET RESTRAINTS

High Cost of Advanced Coagulation Systems and Reagents to Restrict Market Expansion

Despite the increasing global demand for coagulation analyzers, the high capital and maintenance costs of automated coagulation analyzers are hindering their adoption, particularly among small and mid-sized laboratories. Advanced models with integrated multi-parameter testing, automation, and connectivity features are priced at a premium. Additionally, recurring reagent and calibration expenses are further increasing overall operational costs. As a result, in resource-limited healthcare settings, these financial barriers are leading to a shift toward manual or semi-automated systems, which compromise efficiency and test accuracy.

Moreover, budget constraints in public hospitals and inadequate reimbursement policies for coagulation testing in low-income countries are also hindering its large-scale adoption. This is expected to limit overall market penetration, hampering the market growth.

MARKET OPPORTUNITIES

Expansion of Coagulation Testing in Personalized Medicine to Offer Lucrative Opportunities

Tailored anticoagulant therapies, such as individualized dosing of warfarin and direct oral anticoagulants, necessitate continuous and personalized coagulation monitoring, which drives the demand for coagulation analyzers in precision medicine. Additionally, integrating genetic profiling with coagulation testing has allowed clinicians to optimize treatment efficacy and minimize adverse events such as bleeding or thrombosis.

Moreover, next-generation analyzers with data connectivity and AI integration have enabled real-time monitoring and predictive analytics. As a result, the rising demand for personalized healthcare is ultimately increasing utilization for advanced coagulation systems that support individualized therapy decisions in tertiary hospitals and research settings.

COAGULATION ANALYZERS MARKET TRENDS

Shift Toward Fully Automated and Point-of-Care Coagulation Systems to Emerge as a Key Market Trend

Currently, there is a growing preference for automation and point-of-care (POC) testing in healthcare facilities. Laboratories and hospitals are adopting high-throughput, fully automated analyzers that integrate multiple testing parameters, minimize human error, and deliver results in real-time. Simultaneously, POC coagulation analyzers are gaining traction for their portability, rapid testing capabilities, and suitability for emergency care. These systems utilize digital connectivity and cloud integration to facilitate seamless data sharing between clinicians and patients.

- For instance, in October 2021, Trivitron Healthcare, in collaboration with Diagon-Vanguard Diagnostics, launched a new range of Coagulation Analyzer products in India, enhancing clinical decision-making and patient management capabilities. These advanced, high-throughput analyzers are designed for various testing applications, including point-of-care and high-volume laboratories, with features such as automation, ease of operation, and built-in quality control.

Such advancements are reshaping the coagulation testing landscape, enhancing accessibility and operational efficiency.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Limited Skilled Laboratory Personnel to Challenge Market Growth

In emerging countries, the shortage of trained laboratory professionals remains a significant challenge for market expansions. Automated coagulation systems require skilled handling for calibration, quality control, and interpretation of results to avoid diagnostic errors. In such a scenario, developing countries face a major challenge in operating complex systems due to limited technical education and a shortage of skilled personnel compared to developed regions.

Such staffing gaps are leading to workflow inefficiencies and underutilization of available diagnostic instruments. Moreover, limited training across laboratories compromises data standardization and accuracy are affecting clinical decisions and research outcomes.

- For instance, according to data from the World Health Organization (WHO) as of October 2025, the healthcare workforce, including laboratory technicians, is projected to experience a shortfall of 11.0 million by 2030, primarily in low- and lower-middle-income countries.

Segmentation Analysis

By Product

Higher Utilization of Consumables Due to High Adoption of Fully Automated Systems Contributed to Segmental Growth

On the basis of product, the market is classified into systems and consumables. Furthermore, the systems segment is sub-classified into automatic, semi-automatic, and manual.

To know how our report can help streamline your business, Speak to Analyst

The consumables segment accounted for the dominant global coagulation analyzer market share 31.71% in 2026. The segment's growth is attributed to the shift toward automated and high-throughput analyzers, which surged the consumption rate of system-specific consumables optimized for precision and compatibility. Additionally, the trend of long-term anticoagulant therapy monitoring and quality assurance programs in laboratories is expected to boost recurring purchases of consumables further.

In addition, the systems segment is projected to grow at a CAGR of 5.8% during the forecast period.

By Technology

High Accuracy and Reproducibility of Optical Detection Technology to Drive the Segment’s Growth

Based on technology, the market is segmented into optical detection, electromechanical detection, mechanical, and others.

The optical detection segment accounted for the largest share in 2025. The segment’s growth is attributed to its high accuracy, reproducibility, and versatility across a wide range of coagulation assays. This method measures changes in light transmission or absorbance during clot formation, providing precise, real-time analysis of plasma samples. As a result, this method has become ideal for modern clinical laboratories. Furthermore, the segment is set to hold 60.64% share in 2026.

- For instance, in November 2024, an article by Shanghai Sun Biotech Co., Ltd. mentioned that the UR6000 and UP5500 coagulation analyzers utilize internationally recognized optical detection technology and feature 20 fully functional testing channels. They are equipped with HIL intelligent monitoring, a multi-wavelength optical design, and an automatic APTT correction function, all of which ensure high testing efficiency, precision, and reliability.

In addition, the electromechanical detection segment is projected to grow at a CAGR of 6.3% during the forecast period.

By Test Type

Widespread Clinical Use of Prothrombin (PT) Testing Propelled Segment Growth

Based on test type, the market is segmented into prothrombin, APTT, D-dimer, fibrinogen, and others.

By test type, the prothrombin segment accounted for the largest share in 2025. The segment's growth is attributed to its widespread clinical use and critical role in coagulation assessment. Prothrombin (PT) testing is the primary diagnostic tool for evaluating the extrinsic and common pathways of the coagulation cascade. This is essential for detecting bleeding disorders, monitoring warfarin therapy, and assessing liver function. Moreover, the global rise in cardiovascular diseases, thrombosis, and anticoagulant therapy usage is further surging the demand for frequent and accurate PT testing. Furthermore, the segment is set to hold 30.87% share in 2026.

- For instance, according to the data published by ScienceDirect in December 2024, in the U.S., the share of patients on oral anticoagulant therapy using DOACs rose sharply from 7.4% in 2011 to 66.8% by 2019.

In addition, the D-dimer segment is projected to grow at a CAGR of 6.3% during the forecast period.

By End-user

Increasing Number of Academic & Research Institutes Globally Drives the Segment Growth

Based on end-user, the market is segmented into hospitals, diagnostic laboratories, and other healthcare facilities.

In 2025, the global market was dominated by hospitals in terms of end-user. The growth is attributed to the increasing number of hospitals and the higher installation rate of coagulation analyzers in these settings. This is expected to influence key players to increase their product supply, thereby contributing to high product penetration globally. Furthermore, the segment is set to hold 38.13% share in 2026.

- For instance, in September 2024, Henry Ford Health launched a USD 2.2 billion expansion project in Detroit, featuring a state-of-the-art hospital with a 20-story patient tower, an expanded emergency department, and advanced rehabilitation floors in partnership with Shirley Ryan AbilityLab.

In addition, the diagnostic laboratories segment is projected to grow at a CAGR of 6.5% during the forecast period.

Coagulation Analyzers Market Regional Outlook

By region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Coagulation Analyzers Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

North America held the dominant share in 2025, valuing at USD 1.38 billion, and also maintained the leading share in 2026, with USD 1.46 billion. The growth is attributed to well-established healthcare infrastructure and a significant number of hospitals, which support the adoption rate of advanced coagulation analyzers in the region. In 2026, the U.S. market is projected to reach USD 1.32 billion.

- For instance, according to the data from the American Hospital Association, there are around 6,093 hospitals in the U.S. as of September 2025.

Other regions, such as Europe and the Asia Pacific, are projected to expand at a notable rate in the forthcoming years.

Europe

During the forecast period, the European region is projected to record a CAGR of 5.8%, which is the second-highest among all regions, and to reach a valuation of USD 1.16 billion by 2025. This growth is primarily driven by the large number of diagnostic laboratories in the region, which contribute to the higher adoption of coagulation analyzers. Due to such factors, countries including U.K. are anticipated to record the valuation of USD 0.23 billion, Germany to record USD 0.28 billion, and France to reach USD 0.19 billion in 2026.

Asia Pacific

After Europe, the market in Asia Pacific is likely to reach USD 1.10 billion in 2025 and secure the position of the third-largest region in the market. In the region, India and China are estimated to reach USD 0.14 billion and 0.47 billion, respectively in 2026.

Latin America, and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions are expected to showcase moderate growth in the market. The Latin American market is expected to reach a valuation of USD 0.16 billion by 2025. The growth is attributed to increasing awareness of bleeding disorders and the growing number of surgeries, which is driving the demand for coagulation testing in the region. In the Middle East & Africa, the GCC is set to reach a value of USD 0.08 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Focus on Strong Product Supply and Increasing Market Reach to Strengthen the Position of the Key Players

In 2024, Sysmex, F. Hoffmann-La Roche Ltd., and Werfen accounted for the largest global coagulation analyzers market share. These companies have a strong brand reputation and a well-established customer base for their coagulation analyzers worldwide. Moreover, they are launching new products to expand their product portfolio and enhance their market position.

Other prominent companies, including Helena Laboratories Corporation and Siemens Healthineers AG, are focusing on expanding their global presence through new collaborations and partnerships, which are expected to help them capture a significant portion of the market.

LIST OF KEY COAGULATION ANALYZERS COMPANIES PROFILED IN THE REPORT

- Siemens Healthineers AG (Germany)

- Sysmex (Japan)

- Hoffmann-La Roche Ltd (Switzerland)

- Werfen (Spain)

- Helena Laboratories Corporation (U.S.)

- Beckman Coulter, Inc. (U.S.)

- Meril Life Sciences Pvt. Ltd. (Germany)

- HORIBA, Ltd. (Japan)

- BIOLABO S.A.S (France)

- Diagon (U.S.)

KEY INDUSTRY DEVELOPMENTS

- June 2025: Sysmex received FDA clearance for its CN-6000 automated blood coagulation analyzer, along with key reagent products for five common hemostasis tests, including PT/INR, APTT, fibrinogen, antithrombin, and D-dimer.

- December 2024: Werfen expanded its Hemostasis and Acute Care Diagnostics Technology Center in Bedford, with a new 105,000-square-foot building, representing a USD 50.0 million investment to enhance innovation capabilities.

- April 2024: Sysmex and Siemens Healthineers began independently distributing their combined portfolio of hemostasis testing solutions under their respective brands in the U.S. and Europe.

- February 2024: Hoffmann-La Roche Ltd. launched three new coagulation tests for oral Factor Xa inhibitors apixaban, edoxaban, and rivaroxaban to support clinical decision-making for patients on direct oral anticoagulants, especially for stroke prevention and thromboembolism management. The tests feature Roche’s innovative reagent cassette technology that ensures high-quality results, automates reagent preparation, and optimizes workflow efficiency on cobas analyzers.

- February 2021: Siemens Healthineers and Sysmex renewed and extended their global partnership, under which Siemens Healthineers distributed Sysmex's CN-Series automated blood coagulation analyzers (CN-3000 and CN-6000).

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.16% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product, Technology, Test Type, End-user, and Region |

|

By Product |

· Systems o Automatic o Semi-automatic o Manual · Consumables |

|

By Technology |

· Optical Detection · Electromechanical Detection · Mechanical · Others |

|

By Test Type |

· Prothrombin · APTT · D-Dimer · Fibrinogen · Others |

|

By End-user |

· Hospitals · Diagnostic Laboratories · Others |

|

By Region |

· North America (By Product, Technology, Test Type, End-user, and Country) o U.S. (Product) o Canada (Product) · Europe (By Product, Technology, Test Type, End-user, and Country/Sub-region) o Germany (Product) o U.K. (Product) o France (Product) o Spain (Product) o Italy (Product) o Scandinavia (Product) o Rest of Europe (Product) · Asia Pacific (By Product, Technology, Test Type, End-user, and Country/Sub-region) o China (Product) o Japan (Product) o India (Product) o Australia (Product) o Southeast Asia (Product) o Rest of Asia Pacific (Product) · Latin America (By Product, Technology, Test Type, End-user, and Country/Sub-region) o Brazil (Product) o Mexico (Product) o Rest of Latin America (Product) · Middle East & Africa (By Product, Technology, Test Type, End-user, and Country/Sub-region) o GCC (Product) o South Africa (Product) o Rest of the Middle East & Africa (Product) |

Frequently Asked Questions

The global coagulation analysers market is expected to reach USD 6.65 billion by 2034, expanding at a 6.16% CAGR during the forecast period 2026-2034

In 2025, the market value stood at USD 1.38 billion.

The market is expected to exhibit a CAGR of 6.16% during the forecast period of 2026-2034.

The consumables segment led the market by product.

The key factors driving the market are the growing prevalence of bleeding disorders and the increasing number of surgeries worldwide.

Sysmex, F. Hoffmann-La Roche Ltd, and Werfen are some of the prominent players in the market.

North America dominated the market in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us