Cybersecurity Market Size, Share & Industry Analysis, By Component (Solutions and Services), By Deployment (On-premises and Cloud), By Security Type (Network Security, Cloud Application Security, End-point Security, Secure Web Gateway, Application Security, and Others), By Enterprise Size (Small & Medium Enterprises (SMEs) and Large Enterprises), By Industry (BFSI, IT and Telecommunications, Retail, Healthcare, Government, Manufacturing, Travel and Transportation, Energy and Utilities, and Others), and Regional Forecast, 2026-2034

CYBERSECURITY MARKET SIZE AND FUTURE OUTLOOK

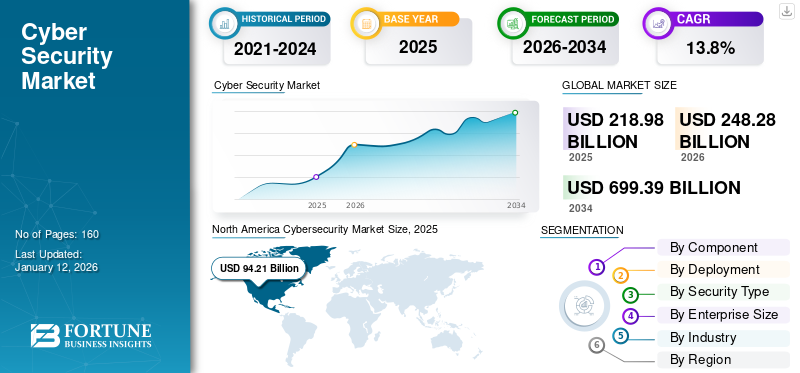

The global cybersecurity market size was valued at USD 218.98 billion in 2025 and is projected to grow from USD 248.28 billion in 2026 to USD 699.39 billion by 2034, exhibiting a CAGR of 13.8% during the forecast period. North America dominated the cybersecurity market with a market share of 43.0% in 2025.

Cybersecurity is a method of protecting systems, networks, and programs from digital attacks. Cyberattacks usually modify, access, or destroy sensitive information, extort users' money, or disrupt normal business processes. The increasing adoption of enterprise security solutions in manufacturing, Banking, Financial Services, and Insurance (BFSI), and healthcare is expected to drive market growth during the forecast period.

In the scope of the research report, we have included component solutions and services offered by companies, including IBM Corporation, Microsoft Corporation, Palo Alto Networks, Inc., Broadcom, Inc., and others.

Due to various customer services, companies offer a comprehensive solution for managing their communications effectively. Key players offer cyber services to manage customer communications across various touchpoints effectively. They provide various services covering various aspects, including threat detection, prevention, incident response, compliance, and risk management. Furthermore, the enhancement and expansion of the current product portfolio enhances the position of vendors in the market.

IMPACT OF GENERATIVE-AI

Rising Awareness of Gen-AI for Data Security and Protection to Boost Market

Generative AI plays a prominent role in cybersecurity; in a few cases, it is already enhancing cybersecurity management tools in a planned method. Generative AI utilizes neural networks and cutting-edge algorithms trained on huge datasets to produce information very similar to the original data in structure and form. Generative AI models, such as Generative Adversarial Networks and Variational Autoencoders, are employed to generate text, images, and videos. This process includes a constant feedback loop, where the model's output is regularly assessed and refined, ultimately enhancing its sanity and accuracy.

Additionally, generative AI provides an extra layer of security by creating complex, unique encryption keys or passwords that are particularly tough to crack.

MARKET DYNAMICS

Market Drivers

Growing Occurrence of Advanced Cyber Threats to Boost Market Growth

With the current global technology transmission, connected devices, digital solutions, and IT systems are growing drastically. This developing digital infrastructure is based on the communication between critical business applications and data across numerous devices, users, and platforms. Hence, to access crucial business information, cybercriminals are implementing guaranteed hacking methods to breach an organization’s IT infrastructure. For instance,

- The FBI’s Internet Crime Complaint Center reported around 880,418 complaints in 2023, an increase of 10% from 2022, from the public in the U.S.

Many cyberattacks exist, including malware injections and phishing, DDoS attacks, brute-force attacks, and social engineering. These are capable of causing substantial data and financial losses. For instance,

- As per the FBI’s Internet Crime Report, data phishing was the most reported incident in 2022 and resulted in the loss of USD 52 million.

Thus, with the growing number of security breaches, organizations across different businesses are installing cybersecurity solutions to protect their crucial networks, data, users, and end-points against such attacks.

Market Restraints

Lack of Experts and Budget Constraints for SMEs to Hinder Market Growth

With the rising number of online security threats, the requirement for advanced solutions is growing exponentially. The obsolete network security solutions are not proficient in securing enterprises from advanced network, cloud, and end-point security threats. Factors such as a lack of professionals and experts in developing and advancing security solutions are considered key restraining factors. The high cost of implementing and updating internet security solutions and services impedes the adoption of the market solutions among Small & Medium Enterprises (SMEs).

Market Opportunities

Rising Need for Cloud-Based Cybersecurity Solutions will Make a Great Opportunity for Market Growth

Organizations are gaining more cloud expertise and shifting their core business functions to cloud platforms. The growing adoption of cloud technology requires organizations to extend security to cloud-based workloads and data. The cloud computing model possesses a robust and flexible infrastructure option. Several organizations are shifting toward cloud solutions to simplify data storage, allowing access to enormous computing power and remote server access.

Moving to the cloud has the potential to improve overall security since cloud vendors own robust security solutions in the IT space. Implementing a cloud-based model empowers organizations to manage all their applications securely. Also, implementing the cloud enables organizations to add complementary infrastructure technology such as SDP (Software-Defined Perimeters), creating a highly robust and secure platform.

Cybersecurity Market Trends

Integration of Advanced Technologies in Business Security Units to Drive Market Growth

Key players implement core technologies, such as machine learning, the Internet of Things (IoT), cloud technologies, and big data in their business security units. They are further adopting IoT and machine learning signature-less security systems. This adoption would help the players understand uncertain activities and trials and identify and detect uncertain threats.

With the rising growth in the IoT market, IoT solutions are gaining popularity across various information security applications. Consequently, adopting advanced technologies in internet security is considered a rapidly emerging market trend. Moreover, big data and cloud technology support enterprises in learning and exploring potential risks.

Download Free sample to learn more about this report.

Another trend that aids the cybersecurity market growth is the increased adoption of cloud computing. Players in the market, including Cisco Systems, IBM Corporation, and others, focus on developing advanced solutions based on cloud computing. These services are designed on the Analytics as a Service (AaaS) platform, assisting users in identifying and mitigating threats rapidly.

SEGMENTATION ANALYSIS

By Component

Solutions Segment Leads with Increasing Prioritization of IAM to Safeguard Sensitive Data

Based on component, the market is divided into solutions and services.

The solutions segment accounts for the largest share of the market. The solutions in the market include firewall/antimalware/antivirus, Intrusion Detection and Prevention Systems (IDPS), Identity and Access Management (IAM), Data Loss Prevention (DLP) & disaster recovery, Security Information and Event Management (SIEM), and others. IAM solutions' popularity has grown among enterprises as they play a vital role in protecting digital assets by managing and controlling user access to sensitive information and resources within a firm. The segment dominated the market with a share of 61.73% in 2026.

The services segment is expected to grow with the highest CAGR in the coming years, owing to the complexity of the IT environment. With the digital transformation journey accelerating, businesses are adopting a complex IT infrastructure involving multi-cloud, on-premises, and hybrid environments. This complexity makes it difficult for internal teams to manage security effectively. For instance,

- Large enterprises such as Siemens, General Electric, and BMW are integrating IoT and industrial control systems, making them prime targets for cyberattacks. As a result, they rely heavily on specialized cybersecurity services to monitor and protect their infrastructures.

By Deployment

Growing Need for Scalable and Cost-Effective Cybersecurity Solutions to Drive Cloud Segment Growth

Based on deployment, the market is segmented into on-premises and cloud.

The cloud deployment segment holds the highest market share and is expected to continue its dominance during the forecast period. Cloud-based solutions can quickly scale up or down per business needs, making them suitable for businesses of all sizes. Cloud solutions offer lower upfront costs and predictable subscription-based pricing models, which are cost-effective for businesses. The segment is expected to capture 54.59% of the market share in 2026, recording a CAGR of 15.26% during the forecast period (2026-2034).

The growth of on-premise cybersecurity deployments is driven by the need for data privacy and regulatory compliance in industries including healthcare, finance, and government, where sensitive data cannot be hosted externally. Additionally, control over security infrastructure and low-latency requirements for critical applications push organizations to opt for on-premise solutions.

By Security Type

Network Security Segment’s Dominance Led by Increasing Virtual Enterprise Network Environments

Based on security type, the market is divided into network security, end-point security, cloud application security, secure web gateway, application security, and others.

The network security segment contributed the highest market share in 2024 due to increasing virtual enterprise network environments. It protects critical infrastructure and sensitive data and ensures the integrity of information in networks, making it indispensable for businesses of all sizes. The segment is estimated to gain 23.89% of the market share in 2026.

Cloud application security is projected to grow at the highest CAGR of 18.01% over the forecast period (2026-2034), owing to the rapid adoption of cloud services and the shift to remote work. Integrating AI and machine learning in cloud security solutions enhances threat detection and response capabilities. For instance, Microsoft Defender for Cloud and AWS Shield are witnessing increasing adoption to secure cloud-native applications against evolving threats.

By Enterprise Size

Increasing Adoption of End-Point Security Solutions by SMEs to Lead to Market Dominance

Based on enterprise size, the market is divided into Small & Medium Enterprises (SMEs) and large enterprises.

Small & Medium Enterprises (SMEs) are projected to grow at the highest CAGR of 15.47% over the forecast period. This growth is owing to the increasing demand for end-point security solutions across various e-commerce startups, including retail and financial sectors.

Large enterprises held a major market share in 2024, owing to the rising complexity of IT environments, with hybrid and multi-cloud infrastructures creating greater attack surfaces. Additionally, escalating cyber threats such as data breaches and ransomware are pushing enterprises to invest in comprehensive, advanced cybersecurity frameworks. This segment is expected to attain 65.62% of the market share in 2026.

By Industry

To know how our report can help streamline your business, Speak to Analyst

BFSI Takes Center Stage with Rising Demand for Robust Security and Digital Privacy Systems

Based on industry, the market is segmented into BFSI, IT and telecommunications, retail, government, manufacturing, travel and transportation, healthcare, energy and utilities, and others.

The BFSI segment holds the highest share of the market due to the increasing demand for robust security and digital privacy systems across financial, insurance, and banking institutions. Cloud application security solutions help banks, insurance, and financial organizations secure highly confidential data incorporated with real-time intelligence against insistent cyberattacks. This segment is set to hold 21.54% of the market share in 2025.

The healthcare sector is estimated to showcase the highest CAGR of 18.98% during the forecast period (2025-2032). The segment growth can be attributed to the rising adoption of connected devices, smartphones, and cloud-based solutions for diverse information systems, such as Electronic Health Records (EHRs), e-prescribing systems, radiology information systems, clinical decision support systems, and practice management support systems.

CYBERSECURITY MARKET REGIONAL OUTLOOK

North America

North America Cybersecurity Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 94.21 billion in 2025 and USD 105.81 billion in 2026. North America is likely to dominate with the highest cybersecurity market share during the forecast period. The rising number of high-section security breaches drives the demand for cloud application security solutions across the region. The increasing number of online e-commerce platforms boosts market growth in the U.S. and Canada. The government implements advanced network security protocols to offer enhanced security measures to enterprises.

The U.S. holds the largest share of the North American market. The growing investment by end-users and the high demand for enterprise security solutions boost the adoption of security solutions in the U.S. The presence of major players in the U.S., such as Palo Alto Networks, Inc., Microsoft Corporation, IBM Corporation, and others, is introducing advanced network security solutions to enhance their product portfolio. The U.S. market is estimated to reach a market value of USD 81.61 billion in 2026. For instance,

- In March 2025, Broadcom Inc. introduced new enhancements to VMware vDefend, aimed at helping organizations strengthen their security planning and assessments. This will also help to streamline lifecycle management and operational workflows and efficiently scale security across diverse application environments.

Europe

Europe is the second largest market anticipated to grow with a value of USD 63.11 billion in 2026, exhibiting a CAGR of 13.68% during the forecast period (2026-2034). The market in Europe is expected to rise with a notable CAGR during the forecast period. The U.K. market is poised to gain USD 11.55 billion in 2026. The growth is significantly driven by the increasing number of internet security projects and related investments by major companies in the market in the U.K., Germany, Spain, France, Italy, and others. Key providers install advanced IT security solutions to secure the highly sensitive information related to manufacturing operations and increase productivity. Germany is anticipated to reach a valuation of USD 11.36 billion in 2026, while France is expected to be valued at USD 7.97 billion in the same year.

Asia Pacific

Asia Pacific is the third largest market set to hold USD 52.04 billion in 2026. Asia Pacific is expected to grow at the highest CAGR during the forecast period, driven by the rapid digital transformation across industries, including banking, healthcare, and manufacturing, which increases the need for robust security measures. China is set to gain USD 13.03 billion in 2026. Additionally, government regulations and heightened awareness of cyber threats, especially in China, India, and Japan, push organizations to prioritize cybersecurity. The surge in cyberattacks and data privacy concerns further accelerates the region's need for comprehensive cybersecurity frameworks. India is anticipated to hit USD 8.92 billion in 2026, while Japan is foreseen to reach USD 11.13 billion in the same year.

Middle East & Africa

The Middle East & Africa is the fourth largest market expected to be worth USD 19.39 billion in 2026. The Middle East & Africa market is expected to grow considerably during the forecast period. This growth is due to the rising investment by the government and private enterprises in GCC, South Africa, and other countries. Furthermore, the increasing adoption of strategies such as mergers and partnerships among key players in the market will boost security solutions. The GCC market is predicted to stand at USD 6.92 billion in 2025.

South America

South America will grow at a considerable CAGR in the coming years. The rise in cyberattacks, such as ransomware and data breaches, motivates private and public sectors to invest in stronger security frameworks. Government regulations such as Brazil's LGPD (General Data Protection Law) also push companies to prioritize data protection and compliance. The growing awareness of cybersecurity risks across industries also fuels the market's expansion in South America.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Companies Focusing on Expanding Product Offerings through Adoption of Emerging Technologies

The major players in the market such as Cisco Systems, Inc., IBM, Microsoft, and Broadcom are focused on advancing its network capabilities by adopting emerging technologies, such as machine learning and advanced analytics. These companies also offer comprehensive internet security solutions based on network-related areas. The offerings include threat protection, web, unified threat management, network and data center security, access and policy, email security, advisory, integration, and managed services.

September 2023 – Cisco Systems, Inc., signed an agreement to purchase the cybersecurity firm Splunk for USD 28 billion. The deal upsurges Cisco’s software business and capitalizes on the increasing use of artificial intelligence.

Long List of Key Cybersecurity Companies Studied:

- Cisco Systems, Inc. (U.S.)

- IBM Corporation (U.S.)

- Fortinet, Inc. (U.S.)

- Proofpoint, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Palo Alto Networks, Inc. (U.S.)

- Zscaler, Inc. (U.S.)

- Broadcom, Inc. (U.S.)

- F5 Networks, Inc. (U.S.)

- Check Point Software Technologies (Israel)

- NTT Data Group Corporation (Japan)

- Juniper Networks, Inc. (U.S.)

- Sophos Ltd. (U.K.)

- EclecticIQ (Netherlands)

- CounterCraft (Spain)

- Tata Consultancy Services (India)

- Sangfor Technologies (China)

- HCL Technologies (India)

- Huawei Technologies (China)

- And Other Companies

KEY INDUSTRY DEVELOPMENTS:

- May 2025: Check Point Software Technologies Ltd introduced its next-generation Quantum Smart-1 Management Appliances, featuring advanced AI-powered security capabilities tailored for the evolving needs of hybrid enterprises. These appliances deliver faster and smarter threat detection and response, supported by a distinctive hybrid mesh architecture and seamless integration with over 250 third-party solutions.

- May 2025: Cisco developed its security solutions, particularly in AI Defense, Extended Detection and Response (XDR), with Splunk’s Enterprise Security (ES) and Security Orchestration. The partnership aims to deliver a comprehensive, AI-driven security solution capable of addressing the evolving threat landscape by combining Cisco's extensive network infrastructure with Splunk's advanced data analytics.

- April 2025: F5 introduced significant cybersecurity upgrades to its Application Delivery and Security Platform (ADSP), enhancing the ability to identify and address vulnerabilities in AI and modern applications. These improvements help enterprises bolster security for critical applications. The updates are designed to strengthen protection in an increasingly risky threat environment.

- March 2024: Darktrace partnered with Xage Security to aid firms in preventing insider threats and cyberattacks on critical infrastructures. The partnership combined AI-powered threat detection of Darktrace with zero trust protection of Xage Security, making identifying and responding to breaches easy.

- March 2024: Liquid C2 partnered with Google Cloud and Anthropic (an artificial intelligence company) to offer African firms advanced Cybersecurity solutions, cloud, and generative AI features. The partnership enabled Liquid C2 clients to improve security measures, securing their digital assets.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The cybersecurity market presents strong investment opportunities driven by the increasing frequency and sophistication of cyber threats, particularly in finance, healthcare, and government sectors. Key growth drivers include the rising adoption of cloud computing, the shift to remote work, and the push for compliance with stricter data protection regulations such as GDPR. Investment opportunities include AI-driven security solutions, managed security services (MSSPs), and zero-trust architectures. Additionally, emerging markets in Asia Pacific and South America offer untapped potential due to growing digitalization and regulatory changes. Investors should focus on companies offering innovative cybersecurity solutions and those expanding in cloud and IoT security.

REPORT COVERAGE

The research report highlights leading regions worldwide to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry growth trends and analyzes technologies being deployed at a rapid pace at the global level. It further offers some drivers and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 13.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component

By Deployment

By Security Type

By Enterprise Size

By Industry

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market is projected to reach USD 699.39 billion by 2034.

In 2025, the market value stood at USD 218.98 billion.

The market is projected to grow at a CAGR of 13.8% during the forecast period.

Rising instances of sophisticated cyber threats are driving the market growth.

Cisco Systems, Inc., IBM Corporation, Fortinet, Inc., Proofpoint, Inc., Microsoft Corporation, and Palo Alto Networks, Inc. are the top players in the market.

North America dominated the cybersecurity market with a market share of 43.0% in 2025.

Below is the list of companies that are studied in order to estimate the market size and/or understanding the market ecosystem

This list does not necessarily mean that all the below companies are profiled in the report. The report includes profiles of only the top 10 players based on revenue/market share.

- Accenture

- Amazon

- BAE Systems

- Broadcom, Inc. (Profiled in the report)

- Centrify

- Check Point Software Technologies (Profiled in the report)

- Cipher CIS

- Cisco Systems, Inc. (Profiled in the report)

- Crowdstrike

- CyberArk

- Cyfirma

- Darktrace

- F5 Networks, Inc. (Profiled in the report)

- FireEye

- Fortinet, Inc. (Profiled in the report)

- Herjavec Group

- IBM Corporation (Profiled in the report)

- Intel

- KnowBe4

- KPMG

- McAfee

- Microsoft Corporation (Profiled in the report)

- Mimecast

- MobileIron

- Northrop Grumman

- Okta

- OneTrust

- Optiv

- Palo Alto Networks, Inc. (Profiled in the report)

- Ping Identity

- Proofpoint, Inc. (Profiled in the report)

- Pulse Secure

- PwC

- Radware

- Raytheon

- RiskIQ

- RSA

- SailPoint

- ScienceSoft

- SecurityHQ

- Sophos Ltd. (Profiled in the report)

- Splunk

- Symantec

- Telos Corporation

- Trend Micro

- Tripwire

- Varonis

- Vmware

- Webroot

- ZeroFox

- Zscaler, Inc. (Profiled in the report)

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us