Parkinson’s Disease Drugs Market Size, Share, Trends and Industry Analysis By Drug Class (Decarboxylase Inhibitors, Dopamine Agonists, Monoamine Oxidase Type B (MAO-B) Inhibitor, Catechol-O-Methyltransferase (COMT) Inhibitors), Route of Administration (Oral, Injection, Transdermal), Distribution Channels (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) & Regional Forecast, 2026-2034

Parkinson’s Disease Drugs Market Size & Trends

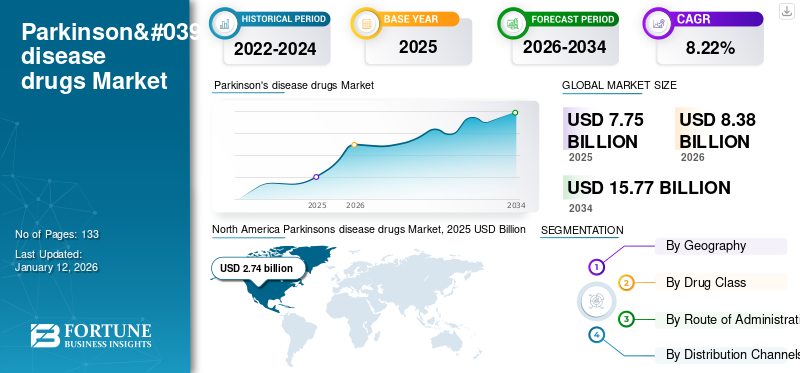

The global parkinson’s disease drugs market size was valued at USD 7.75 billion in 2025. The market is projected to grow from USD 8.38 billion in 2026 to USD 15.77 billion by the end of 2034, exhibiting a CAGR of 8.22% during the forecast period (2026-2034). North America dominated the parkinson's disease drugs market with a market share of 35.31% in 2025.

Parkinson’s disease is a neurodegenerative disease that mainly affects the parts of the human brain responsible for controlling movements making it difficult to perform daily activities. Caused due to the decreased production of dopamine, Parkinson’s disease often results in tremors, stiffness, difficulty in walking, and others.

According to the Parkinson’s UK, in 2015, there were approximately 137,000 people in the UK with Parkinson’s Disease. Levodopa is the most widely used treatment for Parkinson’s disease. Lack of resources for early diagnosis is one of the major factor increasing the severity of the disease, which makes its cure difficult.

Many pharmaceutical companies are conducting studies to develop novel therapy for Parkinson’s disease paving to strategic research collaborations. This factor will, in, turn benefit the market revenue. For instance, in October 2018, Pfizer Inc., one of the prominent pharmaceutical companies partnered with Bain Capital to launch a biopharmaceuticals company for developing drugs for Parkinson’s and other conditions of the central nervous system named Cerevel Therapeutics, further boosting the Parkinson’s disease drugs market growth.

Download Free sample to learn more about this report.

Global Parkinson’s Disease Drugs Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 7.75 billion

- 2026 Market Size: USD 8.38 billion

- 2034 Forecast Market Size: USD 15.77 billion

- CAGR: 8.22% from 2026–2034

Market Share:

- Region: North America dominated the market with a 35.31% share in 2025. This leadership is driven by the increasing prevalence of Parkinson's disease in the region and active government support provided through government-aided pharmacies.

- By Drug Class: Decarboxylase Inhibitors, which include carbidopa and levodopa, held the largest market share. The segment's dominance is attributed to the high preference for levodopa as a primary treatment and the successful launch of products such as RYTARY.

Key Country Highlights:

- Japan: The market is driven by the introduction of new treatments. For example, Eisai Co., Ltd. launched the Parkinson’s disease treatment Equfina in the country, marking its first launch in the Asian region outside of Japan.

- United States: Market growth is fueled by the launch of innovative products, such as Acorda Therapeutics' INBRIJA inhalation powder. Strategic partnerships are also a key factor, illustrated by Pfizer Inc.'s collaboration with Bain Capital to form Cerevel Therapeutics, a company focused on developing drugs for CNS conditions including Parkinson's.

- China: As a key country in the fastest-growing Asia Pacific region, the market in China is characterized by high demand, increasing healthcare spending, and improving pharmaceutical distribution networks, which are creating significant growth opportunities.

- Europe: The market is impacted by a high and growing patient population, with over 1.2 million people in Europe living with Parkinson's Disease, a number that is expected to double by 2030. In the U.K. alone, there were approximately 137,000 people with the condition.

SEGMENTATION ANALYSIS

By Drug Class

Decarboxylase inhibitors remain the cornerstone of Parkinson’s disease pharmacotherapy

Decarboxylase inhibitors, comprising carbidopa and levodopa, dominated the Parkinson’s disease drugs market with a share of 38.42% in 2026. The segment’s leadership is supported by the established clinical efficacy of levodopa-based regimens and their continued preference as first-line therapy in standard treatment protocols.

Sustained dominance is further reinforced by ongoing clinical evaluations and the commercialization of extended-release formulations such as RYTARY, developed by Impax Laboratories, Inc.. These developments support improved dosing control and treatment adherence, thereby strengthening the adoption of decarboxylase inhibitors over alternative drug classes during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By Route of Administration

Oral formulations dominate due to standardized prescribing practices

Based on route of administration, the market is segmented into oral, injection, and transdermal therapies. The oral segment accounted for the maximum market share in 2018, driven by established prescribing norms and strong alignment with government-recommended treatment guidelines for Parkinson’s disease management. This dominance is expected to continue, with the oral segment accounting for 56.68% of the market share in 2026.

Oral therapies continue to be favored within clinical practice due to ease of administration and compatibility with long-term disease management frameworks. This preference supports sustained utilization of oral Parkinson’s disease drugs across both developed and emerging healthcare systems.

By Distribution Channel

Hospital and retail pharmacies anchor drug accessibility

By distribution channel, the market is categorized into hospital pharmacy, retail pharmacy, and online pharmacy. Hospital and retail pharmacies represent the primary access points for Parkinson’s disease drugs, supported by their integration within structured neurological care pathways and prescription-based dispensing models. Together, these channels are expected to contribute 49.60% of the global market share in 2026.

The presence of specialized hospital pharmacies and established retail networks enables consistent availability of levodopa-based therapies and adjunct drugs. These channels continue to play a central role in ensuring regulated distribution and continuity of treatment across regions.

Parkinson’s Disease Drugs Market Regional Analysis

North America

North America Parkinsons disease drugs Market, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

North America leads the global Parkinson’s disease drugs market with maximum revenue of USD 21.17 billion in 2026, driven by the rising prevalence of Parkinson’s disease and active government support through government-aided pharmacies. The region is further supported by strong R&D investments and a robust clinical pipeline, with the expected approval and launch of potential pipeline drug candidates projected to help North America retain the market share in 2025 is 35.31%. Additionally, the launch of INBRIJA (inhalation powder) by Acorda Therapeutics in the United States in February 2019 has accelerated treatment adoption, reinforcing growth across the U.S. and Canada. The U.S. market is projected to reach USD 2.45 billion by 2026.

Asia Pacific

Asia Pacific is likely to report the highest CAGR during the forecast period, attributable to increasing healthcare spending, improved pharmaceutical distribution networks in emerging economies, and strong demand from China and Japan. Expanding patient pools, improving diagnosis rates, and growing access to advanced therapies in India, South Korea, and Australia are further supporting rapid market expansion across the region. The Japan market is projected to reach USD 0.25 billion by 2026, while the China market is projected to reach USD 0.39 billion by 2026, and the India market is projected to reach USD 0.74 billion by 2026.

Europe

Europe represents a significant share of the Parkinson’s disease drugs market due to well-established healthcare systems, high disease awareness, and steady uptake of advanced pharmacological therapies. Countries such as Germany, France, the United Kingdom, Italy, and Spain benefit from strong reimbursement structures and active participation in clinical research, supporting consistent treatment adoption. The UK market is projected to reach USD 0.3 billion by 2026, while the Germany market is projected to reach USD 0.66 billion by 2026.

Middle East & Africa

The Middle East & Africa market growth is anticipated due to increasing awareness of neurological disorders and ongoing investments in healthcare infrastructure, particularly in Saudi Arabia, the UAE, and South Africa. Gradual improvements in specialty care availability and access to pharmacological treatments are expected to support market growth over the forecast period.

Key Market Drivers

"Acadia Pharmaceuticals Inc., F. Hoffmann-La Roche Ltd, and UCB S.A to Account for More Than Half of the Market Share in Terms of Revenue"

Hoffmann-La Roche Ltd and UCB S.A have emerged as a leading player in the market owing to the higher sales of Madopar and Neupro in 2024. Also, the strategic collaboration of UCB S.A for the distribution of Parkinson’s disease drugs enabled the company to hold a major portion of the market. Acadia Pharmaceuticals Inc. is ranked third in the Parkinson’s Disease drugs market due to the higher demand for Nuplazid.

The share of Acadia Pharmaceuticals Inc., in market, is expected to increase owing to the commercial launch of INBRIJA, an inhalation powder to treat patients with Parkinson’s disease in 2019. Other players operating in the global market are Pfizer, Inc., Merck & Co., Inc., Teva Pharmaceutical Industries Ltd., Orion Pharma, Vertical Pharmaceuticals, LLC, ACADIA Pharmaceuticals Inc., Impax Laboratories, Inc., H. Lundbeck A/S and other players.

List of Top Parkinson’s Disease Drugs Companies:

- Pfizer, Inc.

- Hoffmann-La Roche Ltd

- Merck & Co., Inc.

- Novartis AG

- Orion Pharma

- UCB S.A

- Teva Pharmaceutical Industries Ltd.

- Vertical Pharmaceuticals, LLC

- ACADIA Pharmaceuticals Inc.

- Impax Laboratories, Inc.

- Lundbeck A/S

- Other players

Key Industry Developments:

- May 2021 - PharmaTher‘s investigational new drug (IND) has been approved by the U.S. Food and Drug Administration (FDA) for ketamine as a treatment for levodopa-induced dyskinesia in people with Parkinson’s disease. This approval will also clear the paths for PharmaTher to proceed with the phase II clinical trial to study low dose Ketamine.

- April 2021 - Optimus Pharma made an announcement that the company has received the approval for its drug Safinamide from DCGI. Safinamide is indicated as adjunctive treatment to levodopa/carbidopa in patients with Parkinson's disease (PD) experiencing "off" episodes. Company will contribute in delivering robust treatment for Parkinson's diseases in India which is easily accessible and affordable.

- February 2021 - Eisai Korea Inc., made an announcement of the launch of the Parkinson’s disease treatment Equfina. This is the first launch of Equfina in the Asian region excluding Japan. Equfina is launched for the first time in Asian region excluding Japan. In Asia, Eisai has rights for development and marketing for safinamide and company is preparing for submission of applications for other regions too.

Report Overview

Parkinson’s disease is a type of neurodegenerative disease that mainly affects the parts of the human brain responsible for controlling movements. Parkinson’s disease is caused due to the deterioration of neurons resulting in decreased production of dopamine. Parkinson’s disease often results in tremors, stiffness, loss of balance, difficulty in walking, and others. According to the European Parkinson’s Disease Association, more than 1.2 million people in Europe are living with Parkinson’s Disease, which is expected to double by 2030.

The rising prevalence of the disease has increased the overall healthcare cost in many countries. Parkinson’s disease drugs are witnessing increased demands across the globe. Presence of potential pipeline products, increased research and active government support is expected to boost the Parkinson’s disease drugs market shares during the forecast period.

The report provides qualitative and quantitative insights on the Parkinson’s disease drugs industry and detailed analysis of market size and growth rate for all possible segments in the market. Market is segmented by drug class, route of administration, and distribution channel. Based on drug class, the market is segmented into Decarboxylase Inhibitors, dopamine agonists, Monoamine Oxidase Type B (MAO-B) Inhibitors, Catechol-o-Methyltransferase (COMT) inhibitors and others.

In terms of route of administration, the market is categorized into oral, injection, and transdermal. The distribution channels which are covered under the report are hospital pharmacy, retail pharmacy, and online pharmacy. Geographically, the market is segmented into five major regions, which are North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The regions are further categorized into countries.

Along with this, the report provides an elaborative analysis of the market dynamics and competitive landscape. Various key insights provided in the report are the prevalence of Parkinson’s disease, recent industry developments such as mergers & acquisitions, the regulatory scenario in key countries, new product launch, pipeline analysis, patent analysis, and Parkinson’s disease drugs market key industry trends.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Growth Rate |

CAGR of 8.22% from 2026 to 2034 |

|

Segmentation |

By Drug Class

|

|

By Route of Administration

|

|

|

By Distribution Channels

|

|

|

By Geography

|

Frequently Asked Questions

According to Fortune Business Insights, the global Parkinsons Disease Drugs Market was valued at USD 7.75 billion in 2025 and is projected to grow to USD 15.77 billion by 2034

Leading companies in the Parkinsons Disease Drugs Market include Roche, Pfizer Inc., Novartis, Teva Pharmaceuticals, and Merck & Co. These companies are actively involved in developing and marketing treatments for Parkinsons disease.

The Parkinsons Disease Drugs Market will grow at the rate of 8.22% CAGR.

Recent trends include the development of disease-modifying therapies, personalized medicine approaches, and the integration of digital health technologies for patient monitoring and treatment optimization.

Key factors include the increasing prevalence of Parkinsons disease, advancements in drug development, and growing awareness about the disease leading to early diagnosis and treatment.

Common drug classes include Decarboxylase Inhibitors, Dopamine Agonists, Monoamine Oxidase Type B (MAO-B) Inhibitors, and Catechol-O-Methyltransferase (COMT) Inhibitors.

North America dominated the market with a share of 35.31% in 2025, followed by Europe and Asia Pacific, due to advanced healthcare infrastructure and higher awareness levels.

Technology is playing a significant role through the development of digital therapeutics, wearable devices for monitoring symptoms, and AI-driven research for new drug discoveries.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us