Neurostimulation Devices Market Size, Share & Industry Analysis, By Device Type (Spinal Cord Stimulators, Deep Brain Stimulators, Vagus Nerve Stimulators, Transcranial Magnetic Stimulation, Sacral Nerve Stimulation, and Others), By Type (Invasive, and Non-invasive), By Application (Pain Management, Movement Disorders, Psychiatric Disorders, and Others), By End User (Hospitals & Specilaty Clinics, Research & Academic Institutes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

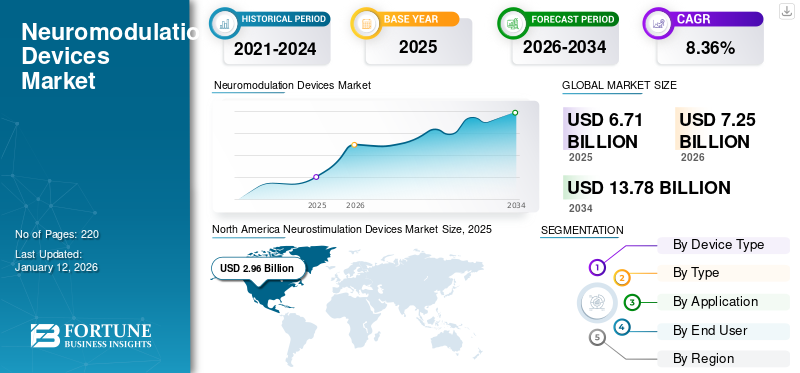

The global neurostimulation devices market size was valued at USD 6.71 billion in 2025. The market is projected to grow from USD 7.25 billion in 2026 to USD 13.78 billion by 2034, exhibiting a CAGR of 8.36% during the forecast period. North america dominated the neurostimulation devices market with a market share of 44.12% in 2025.

Neurostimulation devices are medical devices that deliver mild electrical stimuli to specific parts of the nervous system in order to alter neural signals or function. They are commonly used for the treatment of chronic pain, movement disorders such as Parkinson’s disease, epilepsy, depression, and spinal cord injuries.

Moreover, the devices offer advantages such as lower drug dependency, fewer adverse effects than the use of drugs for extended periods, and improved in quality of life. The growth of the neurostimulation devices market is attributed to rising prevalence of neurological disorders, aging population, and technological advancements.

Furthermore, the market includes several major players, with Boston Scientific Corporation, Abbott, Liva Nova Plc, and Medtronic at the forefront. Strong distribution network coupled with technologically advanced products has supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Growing Prevalence of Neurological Conditions to Boost Market Growth

The growing prevalence of neurological disorders is one of the prominent factors influencing market growth. The incidence of conditions such as Parkinson’s, epilepsy, Alzheimer’s, chronic pain, and migraine diseases is increasing as the population ages and lifestyle trends persist. These diseases affect daily living and regular activities.

- For instance, according to data published by the Centers for Disease Control and Prevention (CDC), in May 2024, an estimated 3 million adults in the U.S. currently have epilepsy.

Neurostimulation devices give a less risky option by delivering mild electric stimuli for the symptoms treatment. In addition, increasing awareness, availability, and benefits for neurological conditions is further projected to boost the adoption of neurostimulation devices during the forecast period.

MARKET RESTRAINTS

High Cost of Treatment To Deter Market Growth

The considerable cost of neurostimulation devices and associated treatment is expected to deter the market growth by 2032. The devices and the surgery for their placement are very expensive, thereby becoming unaffordable for the majority of patients. In addition, the health cover for majority of countries does not provide reimbursement, leaving a further burden. Due to these factors, patients with strong financial support gain access to such therapy. The patients from developing countries prefer medicines as an alternative therapy option.

- For instance, the implantation cost of a spinal cord stimulator in India lies between approximately USD 20,000 to USD 24,000 per person.

MARKET OPPORTUNITIES

Technological Advancements in Electrical Stimulations to Offer Favorable Opportunity for Market Expansion

Players operating in the neurostimulation devices market are continually focusing on technological developments in order to develop novel technologies. The new devices are smaller, more effective, and easier to deploy surgically. Also, they offer additional benefits such as minimal risk and higher biocompatibility. Moreover, these systems also recharge, and those without a wire minimize repeat surgeries. Advanced programming allows doctors to tailor the therapy to the specific patient's needs, yeilding a better result. Such advancements not only attract more patients but also convince doctors to prescribe such devices.

- For instance, in June 2025, Boston Scientific Corporation announced FDA approval and launch of its new spinal cord stimulation lead splitters, which are compatible with its Precision Plus spinal cord stimulator system. The new leads are designed to deliver electrical impulses to the spinal cord that mask pain signals to the brain.

NEUROSTIMULATION DEVICES MARKET TRENDS

Rising Preference for Non-Drug Therapeutics is One of the Neurostimulation Devices Market Trends

One of the prominent trends of the neurostimulation devices market involves the rising preference for non-drug therapies. The vast majority of patients suffering from movement disorders, epilepsy, or chronic pain seek drug alternatives since drugs tend to cause side effects or also lose their efficacy over time. Neurostimulation offers a long-term as well as safe therapy by taking direct action on the nerves or brain without heavy drug dependence. Such trends also gains support from healthcare authorities as they prescribe device-based therapies for better patient outcomes.

- According to a survey published by researchers at the University of Nottingham in February 2025, patients who have mental conditions prefer non-invasive interventions over medications for disease treatment.

Download Free sample to learn more about this report.

MARKET CHALLENGES

Invasive Procedure and Patient Hesitation to Offer a Significant Challenge to Market Growth

Fear of invasive surgical procedures and hesitation, especially among the geriatric population to presents a significant challenge for market growth. Although these operations are safe, patients feel uneasy thinking of getting a device implanted within them. In addition, fear of adverse effects, as well as discomfort, might persuade individuals into retaining usage of drugs with side effects. Additionally, expenditure for recuperating as well as regular follow-ups would discourage patients from adopting these therapies.

- For instance, according to a survey published on NCBI in November 2019, an estimated 45% of Parkinson's disease patients from the sample size were reluctant to choose neurostimulation devices.

Segmentation Analysis

By Device Type

Superior Outcome of Spinal Cord Stimulator for Chronic Pain to Boost Segment Growth

On the basis of the segmentation of device type, the market is classified into spinal cord stimulators, deep brain stimulators, vagus nerve stimulators, transcranial magnetic stimulation, sacral nerve stimulation, and others.

To know how our report can help streamline your business, Speak to Analyst

The spinal cord stimulator segment accounted for the maximum neurostimulation devices market share in 2024. The spil cord stimulators segment is projected to dominate the market with a share of 38.04% in 2026. The high share of spinal cord stimulator segment is mainly attributed to its extensive adoption for chronic pain. The device offers an effective alternative by conveying mild electrical stimuli into the spinal cord, which prevents the pain impulses from reaching the pain-processing centers of the brain. In addition, healthcare settings are well equipped to perform implantation of these devices, which is further expected to propel segment growth during the forecast period.

- In April 2024, Medtronic received FDA approval for its Inceptiv spinal cord stimulator, which is rechargeable and offers superior treatment outcomes for chronic pain. The newly launched device has functionality to adjust electrical impulses as needed.

By Type

Proven Clinical Effectiveness Coupled with Wide Availability of the Implantable Devices Drive Invasive Segment Growth

In terms of type, the market is categorized into invasive, and non-invasive.

The invasive segment captured the largest share of the market in 2024. In 2025, the segment is anticipated to dominate with a 95.5% share. The segment growth is prominently attributed to its proven clinical effectiveness, coupled with considerable product availability. In addition, most regulatory approvals and insurance reimbursements are currently focused on invasive devices, which further boosts their adoption. The Invasive segment is expected to lead the market, contributing 94.40% globally in 2026.

- According to a survey published in a Frontiers Pain Research article, in July 2025, an estimated 80% of the survey population observed a reduction in pain and improved quality of life.

Non-invasive segment is expected to grow at a CAGR of 4.5% over the forecast period.

By Application

Extensive Prevalence of Chronic Pain to Boost Segment Growth

In terms of application, the market is categorized into pain management, movement disorders, psychiatric disorders, and others.

The pain management segment captured a largest share of the market in 2024. In 2026, the segment is anticipated to dominate with a 55.91% share. Chronic pain represents the most widespread health condition globally. Millions of patients suffer from the conditions of failed back surgery syndrome, complex regional pain syndrome, arthritis, neuropathic pain, and diabetic neuropathy. In addition, a substantial increase in the number of back surgeries is also estimated to offer a lucrative environment for segment growth.

- For instance, according to a study published by NCBI in 2020, an estimated 619 million people across the world suffer from low back pain.

Also, the psychiatric disorders segment is expected to grow at a CAGR of 8.3% over the forecast period.

By End User

Availability of Cutting-Edge Resources in Hospital Settings to Accelerate Segment Growth

Based on end-user, the market is segmented into hospitals & specialty clinics, research & academic institutes, and others.

In 2024, the global market was dominated by hospitals & specialty clinics segment in terms of end-user. The major share of this segment is attributed to the increasing number of patients opting for hospitals & specialty clinics to perform implant procedures. Invasive operations such as spinal cord and deep brain stimulators are conducted with experienced surgeons and advanced equipment and monitoring facilities, and they are part of hospitals and special clinics. These are sought-after health facilities as they combine full caregiving with diagnosis and surgery, and postoperative and continuing therapy under one roof. Furthermore, the segment is set to hold 78.58% share in 2026.

In addition, research & academic institutes end users are projected to grow at a CAGR of 7.41% during the study period.

Neurostimulation Devices Market Regional Outlook

By geography, the market is categorized into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America

North America Neurostimulation Devices Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The North America held a dominant share in 2025 valuing at USD 2.96 billion and also took the leading share in 2026, with USD 3.19 billion. Factors fostering the dominance of the region include considerable prevalence of neurological diseases, technological advancements, and product approvals. In 2026, the U.S. market is estimate to reach USD 2.96 billion.

- For instance, in September 2024, Nevro Corp. announced the launch of HFX AdaptivAI, the world’s only AI-based technology for spinal cord stimulation. The system can analyze data of 100,000 patients and provide personalized pain relief in real time.

Asia Pacific and Europe

Asia Pacific is expected to exhibit fastest CAGR during the forecast period. Europe is also projected to witness a notable growth in the years to come. During the forecast period, European region is projected to record the growth rate of 7.62%, and touch a valuation of USD 1.97 billion in 2026. This is primarily due to the extensive adoption of neurostimulation devices for pain management. Backed by these factors, countries including U.K. anticipates to record the valuation of USD 0.33 billion, Germany to record USD 0.37 billion in 2026, and France to record USD 0.26 billion in 2025. After Europe, the market in Asia Pacific is estimated to reach USD 1.45 billion in 2026. In the region, India and China are both estimated to reach USD 0.21 billion and USD 0.4 billion, respectively in 2026.

Rest of the World

Over the forecast period, Latin America and Middle East & Africa regions would witness a moderate growth in this marketspace. Latin America market in 2026 is set to record USD 0.4 billion as its valuation. The rising incidence of chronic diseases and expanding healthcare infrastructure further drive the product usage in these regions. In the Middle East & Africa, GCC is set to attain the value of USD 0.11 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Incorporation of New Technologies and Focus on New Product Development to Help Companies in Maintaining Their Market Position

The global neurostimulation devices market shows a semi-concentrated structure with numerous small- to mid-size companies actively operating across the globe. These players are actively involved in product innovation, strategic partnerships, and geographic expansion.

Boston Scientific Corporation, Abbott, Liva Nova Plc, and Medtronic are some of the dominating players in the market. A comprehensive range of neurostimulation devices, continual innovation, and extensive focus on research & development are few characteristics of these players that support their dominance.

Apart from this, other prominent players in the market include NeuroPace, ElectroCore, BrainsWay, Synapse Biomedical, and others. These companies are undertaking various strategic initiatives, such as partnerships with healthcare providers to enhance their market presence.

LIST OF KEY NEUROSTIMULATION DEVICES COMPANIES PROFILED

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- Abbott (U.S.)

- Nevro Corp. (U.S.)

- LivaNova (U.K.)

- NeuroPace (U.S.)

- ElectroCore (U.S.)

- Magstim (U.K.)

- BrainsWay (Israel)

- Neuronetics (U.S.)

KEY INDUSTRY DEVELOPMENTS

- July 2025: Neuros Medical announced first implant of its Altius, an electrical nerve stimulation system, designed for the treatment of chronic post-amputation pain.

- April 2025: Abbott announced introduction of its new delivery system in order to streamline the implantation procedure for electrodes.

- March 2025: Newronika received CE approval for its AlphaDBS, an advanced deep brain stimulation

- February 2025: Medtronic received FDA approval for its world’s first deep brain stimulation technology, which is highly adaptive and personalized. The device is designed for treatment of Parkinson’s disease.

- January 2025: Saluda Medical, Inc. received FDA approval for its automated and biomarker-based patient programming platform in spinal cord stimulation.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.36% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Device Type, Type, Application, End User, and Region |

|

By Device Type |

· Spinal Cord Stimulators · Deep Brain Stimulators · Vagus Nerve Stimulators · Transcranial Magnetic Stimulation · Sacral Nerve Stimulation · Others |

|

By Type |

· Invasive · Non-invasive |

|

By Application |

· Pain Management · Movement Disorders · Psychiatric Disorders · Others |

|

By End User |

· Hospitals & Specialty Clinics · Research & Academic Institutes · Others |

|

By Geography |

· North America (By Device Type, Type, Application, End User, and Country) o U.S. o Canada · Europe (By Device Type, Type, Application, End User, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Device Type, Type, Application, End User, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Device Type, Type, Application, End User, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Device Type, Type, Application, End User, and Country/Sub-region) o GCC o South Africa o Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 6.71 billion in 2025 and is projected to reach USD 13.78 billion by 2034.

In 2025, the market value stood at USD 2.96 billion.

The market is expected to exhibit a CAGR of 8.36% during the forecast period of 2026-2034.

The spinal cord stimulation segment led the market by type.

The key factors driving the market are rising prevalence of neurological disorders and technological developments.

Boston Scientific Corporation, Abbott, Liva Nova Plc, and Medtronic are some of the prominent players in the market.

North America dominated the market with a share of 44.12% in 2025.

The benefits of stimulation devices for chronic pain, coupled with introduction of advanced products in the market to favor adoption of neurostimulation devices.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us