ePharmacy Market Size, Share and Industry Analysis By Product (Over-the-Counter Products, Prescription Medicine) and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

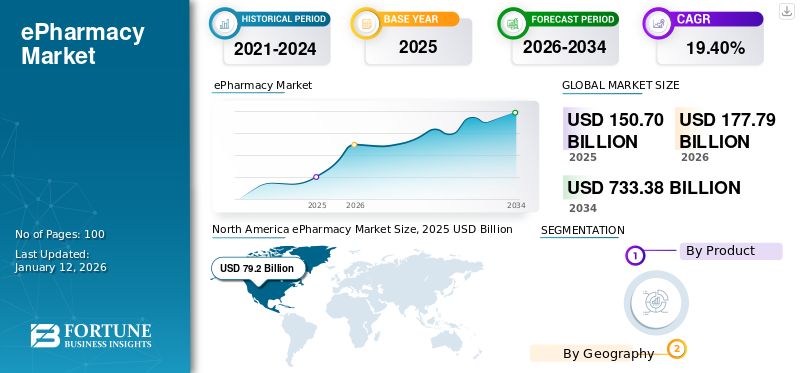

The global ePharmacy market size was valued at USD 150.7 billion in 2025. The market is projected to grow from USD 177.79 billion in 2026 to USD 733.38 billion by 2034, exhibiting a CAGR of 19.40% during the forecast period (2026-2034). North America dominated the epharmacy market with a market share of 53.43% in 2025.

There is an ever-increasing demand for mail-order medicines with the increasing penetration of e-commerce and the use of the Internet. Many online pharmacies, otherwise known as ePharmacies, around the globe offer doorstep delivery and dispensing of prescription medicines and over-the-counter products. However, ordering and dispensing of a prescription drug through an online channel requires a prescription from a medical practitioner. With the onset of ePharmacy, patients do not have to travel to the pharmacist.

Additionally, major ePharmacy companies provide medicines in discounted rates compared with other traditional brick and mortar pharmacy stores. The ePharmacy market trend is estimated to experience an exponentially growing CAGR of 18.9% in the upcoming 6 -7 years, owing to the increasing investment of e-commerce giants in the field of healthcare. For Instance, in June 2018, Amazon.com, Inc. announced the company’s plans to acquire ePharmacy company PillPack, Inc. for approximately US$753 Mn.

Global ePharmacy Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 150.7 billion

- 2026 Market Size: USD 177.79 billion

- 2034 Forecast Market Size: USD 733.38 billion

- CAGR: 19.40% from 2026–2034

Market Share:

- Region: North America dominated the market with a 53.43% share in 2025. This is driven by the high reliance of the general population on online delivery for consumable goods, including OTC healthcare products, coupled with a rising number of patients adopting home care treatment and services.

- By Product: Over-the-Counter (OTC) products held the largest market share. The segment's dominance is attributed to the high reliance of consumers, especially millennials, on online platforms for purchasing healthcare supplies, vitamins, and cosmetic products.

Key Country Highlights:

- Japan: The market is driven by the rising penetration of the internet and a higher adoption rate of e-commerce platforms for purchasing healthcare and wellness products, reflecting a broader trend across the Asia Pacific region.

- United States: Growth is fueled by a strong consumer shift to online procurement of healthcare goods, an increasing number of patients receiving home care, and proactive regulatory guidance from the FDA on the safe use of online pharmacies. The market is also influenced by major e-commerce players, such as Amazon, entering the space.

- China: As part of the fastest-growing Asia Pacific market, growth in China is propelled by the increasing penetration of the internet and a high adoption rate of e-commerce websites for a wide range of consumer goods, including healthcare products.

- Europe: The market is advanced by high internet reliance, with about 84% of the population in countries like Germany being active internet users. Growth is also supported by the implementation of digital health frameworks, such as Germany's approval of fully digital e-prescription redemption channels through major ePharmacy apps.

Download Free sample to learn more about this report.

Key Market Drivers

"The efficiency of ePharmacies in delivering low-cost medical products, and combined with the increasing penetration of e-commerce, is driving the global ePharmacy market growth."

A large patient pool globally prefers doorstep delivery of healthcare products owing to the unavailability of certain medicines in retail pharmacy stores. Additionally, ePharmacies lower the dependency of chronically ill patients and elderly citizens on third person for the procurement of medicines and healthcare supplies. Additionally, the increasing penetration and literacy regarding internet resources are projected to boost the market sales.

The growing reach of e-commerce has facilitated the ePharmacy to capture a wide customer base in the developed and developing countries of the world. Millennials of this generation are highly reliant on the online procurement of goods like cosmetics and over-the-counter medicines. There are also various startups springing up around the globe due to the advent of new information technologies and algorithms that offer a better consumer experience and satisfaction. New technologies based on artificial intelligence is estimated to ensure better customer satisfaction in market. All these factors cumulatively are expected to drive the global ePharmacy market growth.

Conversely, there are stringent regulations for selling prescription drugs through online channels. Prescription drug sales through ePharmacy in North America and Europe are highly regulated, and the companies have to comply with various rules, which could impact the market growth in these regions. Additionally, not all countries in the world have legalized sale of prescription drugs through online sites. Factors such as the unregulated sale of prescription medicines that could lead to the prohibition of online pharmacies are estimated to restrain the global market revenue.

Market Segmentation

To know how our report can help streamline your business, Speak to Analyst

Based on the product, the global market segments include prescription medicine and over-the-counter products. The over-the-counter segment dominated the market 65.49% in 2026.The over-the-counter segment dominated the ePharmacy industry in 2018. The prescription medicine segment accounted for a lower share of the market in 2018 but is estimated to grow at a faster CAGR during the forecast period. Based on geography, the market segments include North America, Europe, Asia Pacific, and Rest of the World.

Regional Analysis

"A rising number of internet users and higher dependency on e-commerce goods are anticipated to boost the ePharmacy industry growth in the North America"

North America

North America dominated the global market by generating revenue of USD 79.2 billion in 2025. In North America, the over-reliance of the general population on the online delivery of consumable goods including over-the-counter healthcare products like vitamin tablets, nutrition supplements, and cosmetic among others are projected to positively influence the ePharmacy market trend. A rise in the number of patients adopting home care treatment and services owing to high healthcare expenditure in hospitals are estimated to increase the online procurement of medicines in North America.

The market in North America is well established and have captured wide population base owing to high penetration of the Internet. Additionally, the Food and Drug Administration (FDA) in the U.S focuses on actively informing the citizens regarding the rules and regulations of ePharmacy and making them aware about the safety of buying drug online. The U.S. market is projected to reach USD 87.75 billion by 2026.

North America ePharmacy Market Size, 2025 USD Billion

To get more information on the regional analysis of this market, Download Free sample

Europe

The Europe market is highly regulated by the European Commission with stringent guidelines; however, the global market is estimated to witness growth owing to the lucrative price offering by major companies operating in the market. The UK market is projected to reach USD 5.98 billion by 2026, while the Germany market is projected to reach USD 15.23 billion by 2026.

Asia Pacific

The market in Asia Pacific are projected to demonstrate a comparatively higher CAGR during the forecast period, owing to rising penetration of the Internet and higher adoption of e-commerce websites. The Japan market is projected to reach USD 10.87 billion by 2026, the China market is projected to reach USD 12.55 billion by 2026, and the India market is projected to reach USD 4.31 billion by 2026.

Latin America and Middle East & Africa

The market in the rest of the world that includes countries of Latin America and Middle East & Africa accounted for a comparatively small ePharmacy market share for the year 2024 owing to lower literacy regarding ePharmacy however, it is expected to experience a considerable CAGR owing to the unmet needs of online distribution of medicines.

Key Market Players

"CVS Health Corporation, Doc Morris, and Express Scripts Holding Company dominated the global ePharmacy market in 2024

The market is a semi-consolidated market with the top five players accounting for a significant share of the market in 2024. A deep-rooted product presence in the ePharmacy, along with a strong distribution channel, has been contributory to the dominance of these players in the market. Additionally, the established market presence and trust of the consumers have facilitated the dominance of the top market players in ePharmacy.

On the flip side, other market players are expanding their presence in ePharmacy, combined with a focus on the expansion through the geographic presence and strengthening their distribution channel with mergers and acquisition with local players. These players are expected to gain significant ePharmacy market share during the forecast period. The rising completion within the companies operating in the ePharmacy industry is estimated to affect the market share of the key players.

List of Companies Profiled

- DocMorris

- CVS Health Corporation

- Express Script Holding Company

- Walgreen Co.

- Optum Rx, Inc.

- Giant Eagle, Inc.

- Walmart Stores, Inc.

- Rowland Pharmacy

- The Kroger Co.

- Other players

Report Coverage

According to the World Bank, around 75% of the population in the U.S are internet subscribers, and around 84 % population in Germany are reliant on internet. This large population dependent on internet for the procurement of commodities combined with the lucrative price offerings by major players are leading to rising demand for ePharmacy globally. The introduction of new players in the ePharmacy market combined with rising competition globally is projected to further augment the growth for ePharmacy during the forecast period.

The report provides qualitative and quantitative insights on the ePharmacy industry trends and detailed analysis of market size and growth rate for all possible segments in the market. The market segments include product and geography. On the basis of the product, the market segments include prescription medicines and over-the-counter products. Geographically, the global market is segmented into four major regions, namely, North America, Europe, Asia Pacific, and rest of the world. The regions are further categorized into countries.

Along with this, the report analysis includes ePharmacy industry dynamics and competitive landscape of the market. Various key insights provided in the report are key start-ups and funding overview, recent industry developments such as mergers & acquisitions for 2018, an overview of regulatory scenario – key countries, key industry trends, and an overview of e-commerce penetration – key countries.

Request for Customization to gain extensive market insights.

Segmentation

| ATTRIBUTE | DETAILS |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Billion) |

| Growth Rate | CAGR of 19.40% from 2026 to 2034 |

| Segmentation |

By Product

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the value of the global ePharmacy Market was USD 150.7 billion in 2025.

The ePharmacy Market is projected to reach USD 733.38 billion by 2034.

The ePharmacy Market will grow at the rate of 19.40% CAGR.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us