eDiscovery Market Size, Share & Industry Analysis, By Component (Solutions and Services) By Deployment Model (Cloud and On-premises), By Enterprise Type (Large Enterprises and SMEs), By End-user (BFSI, Retail & Consumer Goods, Government & Public Sector, Healthcare & Life Sciences, IT & Telecommunications, Legal, and Others), and Regional Forecast, 2026-2034

eDiscovery Market Size

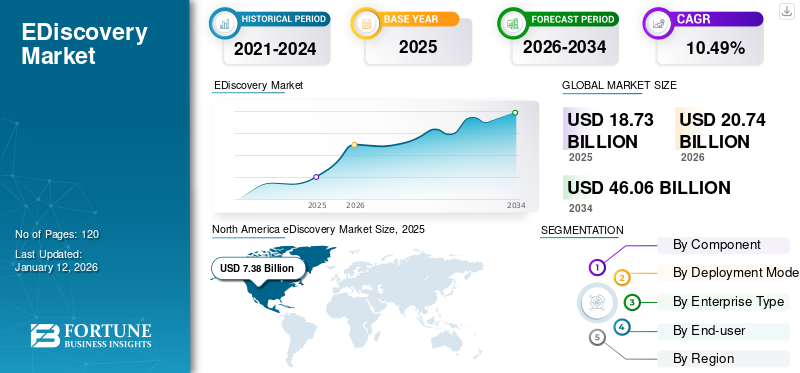

The global eDiscovery market was valued at USD 18.73 billion in 2025 and is projected to be worth USD 20.74 billion in 2026 and reach USD 46.06 billion by 2034, exhibiting a CAGR of 10.49% during the forecast period. North America dominated the global eDiscovery market with a share of 39.41% in 2025.

eDiscovery is the process mainly used for filing a lawsuit or investigation by collecting and exchanging evidence in the form of email, voicemail, audio, digital data, video, social media posts, and so on. In the scope, we have considered key players including Microsoft Corporation, Open Text Corporation, CloudNine, IBM Corporation, Deloitte, CS DISCO, Inc, KLDiscovery Ontrack, LLC, EPIQ, Nuix, and Conduent, Inc., among others that provide solutions and services for various industries.

Due to rise in data usage and technologies, such as Artificial Intelligence (AI) and automation, the companies have to ensure adequate data protection and data management. According to the American Records Management Association (ARMA), more than 90% of records created nowadays are in electronic form.

The organizations relying on cloud services resulted in the discovery of sensitive data, which is prone to data theft. To help solve this problem, many companies started using cloud SaaS platforms with enhanced security, which resulted in less discoverable data. Also, legal firms have efficiently started to review the data and information from these cloud services that are generating demand for eDiscovery.

The COVID-19 pandemic accelerated the adoption of cutting-edge technologies by legal teams as organizations moved toward electronic documentation instead of physical documents. Large-scale adoption of technology and preservation of metadata from electronic documents is also leading to strong relationships with clients. These factors are expected to boost the market in the post-pandemic years.

Investments in this market are expected to grow more as Artificial Intelligence (AI) and other legal technology have become a standard part of legal practice and eDiscovery projects. For instance, in November 2021, Everlaw announced series D funding of USD 202.0 million, making a valuation of over USD 2.0 billion. Everlaw provides cloud-native electronic discovery software for document analysis to law firms, government, and corporations.

Such advancements have helped data professionals to ease their tasks and are driving the eDiscovery market growth.

eDiscovery Market Trends

Integration of AI and Automation in eDiscovery to Aid Market Proliferation

The integration of new-age technologies in eDiscovery provides enhancements in efficiency, improvement in accuracy, and, more importantly, enables cost-effectiveness. This integration revolutionizes the traditional Electronic Discovery Reference Model (EDRM) lifecycle stages. The advanced solution helps identify and classify data, further streamlining the governance process. Moreover, these solutions also help in minimizing the risk of human error and thus enable a seamless governance process. Companies are leveraging generative AI and developing advanced solutions to provide their end users with improved services. For instance,

- January 2024 - Lexbe Inc. introduced Lexbe CoPilot, which is an integration between the company’s eDiscovery Platform and gen AI large language models, such as ClaudeSM and ChatGPTSM. This new launch revolutionizes the way lawyers and other legal experts navigate the complexities of the market.

Thus, the integration of new-age technologies, such as AI and Automation in eDiscovery, is accelerating the market growth.

Download Free sample to learn more about this report.

eDiscovery Market Growth Factors

Increasing Data Breaches and Adoption of Cloud-based Solutions to Propel Market Growth

Businesses are increasingly adopting electronic discovery solutions for preventing frauds and breaches. According to an IBM report published in 2023, the average cost of a data breach is USD 4.45 million. This data shows a 15% increase over three years, and the number is expected to increase in the coming years. The enhanced context for prioritizing and responding to data security threats is provided by AI-powered electronic discovery systems, allowing for quicker incident response and the identification of root causes to reduce vulnerabilities and prevent future concerns.

Cloud-based electronic discovery solutions and services increased acceptance and are readily available in this rapidly developing market. Organizations have been able to cut down on response times, meet stringent reporting deadlines, keep an audit trail, and save money by using platforms that are helping them to prevent the breaches.

The key market players are adopting cloud-based solutions and services to gain the benefits of that migration and pass them on to their clients, as corporations and law firms generate large amounts of Electronically Stored Information (ESI). These factors are helping the vendors to generate more revenue for this market.

RESTRAINING FACTORS

Change in Data Variety and Growth of Data in Organizations to Restrict Market Growth

There is a wide variety of potential sources of substantial information as businesses use more social media, chat tools, audio, video, and other data-generating means of communication, including email. As technologists and lawyers continue to learn how to process, search, and produce cloud-based data sources related to electronic discovery that are newer and more complicated but this creates complex obstacles for them. Organizations increasingly rely on messaging platforms and social media to conduct business. These platforms contain a wide range of file types, data, and confidential information, which has made it difficult for market professionals to perform their tasks.

Data volumes for minor litigation matters are exploding in addition to data diversity. Due to the ever-increasing amount of data, court discovery deadlines rarely change. There is a vast amount of data to sort through and look over before litigation, which can cause storage issues and security and compliance risks for organizations. These factors made the data more complicated and spent a lot of time, money, and effort, which restrains market growth.

eDiscovery Market Segmentation Analysis

By Component Analysis

Increasing Legal Proceedings and Maintenance of Infrastructure in eDiscovery Services to Boost Market

Based on component, the market is divided into services and solutions. According to our analysis, the services segment dominated the electronic discovery market in 68.80% 2026. The adoption of services by businesses is much higher than the solutions. The service providers maintain the infrastructure and make technology upgrades at the backend providing all the tools an organization needs under a user-friendly interface. Implementation of such services is helping organizations in reducing costs, preventing data frauds, and overturning the risks of handling data to service providers. However, this factor is propelling the demand for electronic discovery services.

By Deployment Model Analysis

Growing Adoption of Cloud-based Solutions and Services to Boost the Market

As per deployment, the market is split into cloud and on-premises. In 76.65% 2026, the cloud segment accounted for a larger market share and is projected to grow with a high CAGR during the forecast period. The cloud environment growth is attributed to an increase in remote work due to the pandemic and centralized structure, which is accelerating the demand for cloud.

Cloud electronic discovery solutions offer better convenience and collaboration as they can be accessed from anywhere, and allow organizations to share and process files in real-time. By adopting cloud solutions and services, businesses can reduce the cost of data storage and ease of use in AI and automation technologies, thus increasing demand for cloud-based solutions.

By Enterprise Type Analysis

Large Enterprises to Dominate the Market due to Increasing Investments in eDiscovery Tools

Electronic discovery solutions and services are used in large enterprises and SMEs. According to the analysis, the large enterprises segment will dominate the market during the forecast period due to rising investments in electronic discovery tools.

The Large enterprises segment is projected to dominate the market with a share of 69.93% in 2026. Large enterprises focus on hiring resources for their in-house legal department to support electronic discovery in an organization. Due to lack of resources in the legal department of Small & Medium-sized Enterprises (SMEs), they are facing data challenges to support a dedicated internal staff. Large enterprises are also increasing investment in tools to manage electronic data records before litigation comes up, which will surge the demand for solutions in large enterprises during the forecast period.

By End-user Analysis

Government & Public Sector to Grow with Highest CAGR in the Market amid Rise in Litigation and AI-based Technologies

The BFSI segment is expected to lead the market, contributing 24.68% globally in 2026. By end user, the market is segmented into BFSI, retail & consumer goods, IT & telecommunications, healthcare & life sciences, government & public sector, legal, and others (education, energy & utilities and manufacturing). During the forecast period, the government & public sector is anticipated to experience the fastest growth rate. This sector is adopting litigation and AI-based technologies to work on their outside and internal processes. Electronic records have proven useful in a variety of investigations for government agencies worldwide such as Civil Division of the U.S. Department of Justice. Furthermore, product updates in this sector are playing a crucial part for the rising adoption of electronic discovery tools. For instance,

- In March 2023, Casepoint, a forerunner in cloud-based lawful hold and electronic discovery innovation, announced an update to its industry-driving legal hold solution to meet the developing necessities of companies and government organizations.

Thus, electronic discovery solutions in the government & public sector have helped to deliver advanced technological experience, in turn, leading to a higher growth rate.

To know how our report can help streamline your business, Speak to Analyst

REGIONAL INSIGHTS

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific and each region is further studied across countries.

North America eDiscovery Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

North America

The United States market is projected to reach USD 5.68 billion by 2026. North America dominated the market with a valuation of USD 7.38 billion in 2025 and USD 8.2 billion in 2026. According to our findings, North America generated maximum revenue in 2023 and held the highest eDiscovery market share. The demand for electronic discovery solutions in the region is accelerated by an increase in data threats and governmental and regulatory spending among businesses for security reasons. In North America, the adoption of electronic discovery solutions and services is increasing in government and public sectors as government databases contain important strategic information and are frequently targeted by hackers for financial gain. For instance, Russian hackers breached U.S. defense outsourcers and stole crucial information from 2020 to 2022. Moreover, increasing investments in R&D activities, acquisitions, and partnerships by key players to develop advanced solutions also support the growth of the regional market.

- For instance, in March 2023, Gimmal and CloudNine announced a partnership to deliver a streamlined, holistic solution covering the complete EDRM model.

Asia Pacific

The Japan market is projected to reach USD 0.63 billion by 2026, the China market is projected to reach USD 0.97 billion by 2026, and the India market is projected to reach USD 0.89 billion by 2026. Asia Pacific is expected to grow at the largest CAGR during the forecast period. Many organizations in the region are migrating to cloud platforms from on-premises environments to enhance data governance, which increases the adoption of electronic discovery solutions. Additionally, the region’s government and public sectors are increasingly using electronic discovery solutions and services as data security threats continue to rise. As per IBM, the region accounted for 31% of all incidents in 2022, marginally ahead of North America and Europe.

Key Industry Players

Strategic Acquisition by Key Players to Strengthen the Market Expansion

The major players in the market are focusing on providing advanced solutions and increasing their investments in research and development to introduce products and update existing solutions to expand their customer base and presence. In addition, players are adopting partnerships and acquisition strategies to expand their businesses into new regions and enhance the offerings and customer experience.

- February 2022 – Congruity 360, LLC's legal workflow products, Hold360 and Request360, and also linked regulatory and alert solutions have been acquired by CS DISCO. An updated, digital solution for corporate legal hold requirements and legal demand compliance has been provided by these important legal workflow capabilities, which collaborated with CS DISCO's cloud-based electronic discovery platform.

- August 2021 – CloudNine recently announced that it acquired ESI Analyst. ESI Analyst is the new standard for file types such as chat, audio, social media, text, computer activity, and financial data. CloudNine's recent announcement to cut costs and risk by investing in the creation of additional, high-value product offerings for its customers and the market as a whole is confirmed by the acquisition. Through acquisition and the hiring of 50% more employees, CloudNine committed to invest in customer challenges throughout the EDRM lifecycle.

LIST OF KEY COMPANIES PROFILED:

- Microsoft Corporation (U.S.)

- Open Text Corporation (Canada)

- CloudNine (U.S.)

- IBM Corporation (U.S.)

- Deloitte (U.K.)

- CS DISCO, Inc. (U.S.)

- KLDiscovery Ontrack, LLC (U.S.)

- EPIQ (U.S.)

- Nuix (Australia)

- Conduent, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- October 2023 – Relativity completed its strategic partnership with The University of New England (UNE) School of Law in Australia. With this, the company aims to offer e-discovery education to its law scholars. This school becomes the first in the Asia Pacific region to benefit from the success of the company’s Academic Partner Program.

- August 2023 – Reveal, which specializes as a Legal technology firm, completed the acquisition of IPRO and Logikcull, which are two other electronic discovery firms. With this, the company now stands for more than USD 1 billion and was funded by its majority shareholder, K1 Investment Management.

- November 2022 – The enhanced Viewpoint eDiscovery 7.5 platform from Conduent, Inc. has been released. It includes titled entity recognition, constant active learning improvements that reduce time by ordering documents for review, and the capability to review data from Microsoft Teams.

- August 2022 – LexFusion collaborated with CS DISCO for e-discovery solutions and services. As the industry continues to grab modern technology to reduce risk, improve compliance, regulate costs, and deliver better outcomes, the partnership helped to accelerate digital transformation for corporations and law firms.

- March 2022 – OpenText, a backer of Legalweek New York 2022 started off the current year's program by exhibiting progressed capacities in its lawful innovation portfolio. OpenText Axcelerate is one of the developments that eases legal and regulatory investigations, and data privacy compliance review through a distributed enterprise, enabling modern tasks.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding of the user. Furthermore, the report provides insights into the latest industry and eDiscovery market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some of the growth-stimulating factors and restraints, helping the reader gain in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 10.49% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Component, Deployment Model, Enterprise Type, End-user, and Region |

|

Segmentation |

By Component

By Deployment Model

By Enterprise Type

By End-user

By Region

|

Frequently Asked Questions

The market is projected to reach USD 46.06 billion by 2034.

In 2025, the market stood at USD 18.73 billion.

The market is projected to grow at a CAGR of 10.49% over the forecast period (2026-2034).

Government & public sector is likely to lead the market.

Increasing data breaches and adoption of cloud-based solution is driving market growth.

Microsoft Corporation, Open Text Corporation, CloudNine, IBM Corporation, Deloitte, CS DISCO, Inc, EPIQ, KLDiscovery Ontrack, LLC, Nuix, and Conduent, Inc are the top players in the market.

North America held the highest market share in 2025.

Asia Pacific is expected to grow at the largest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us