Facility Management Market Size, Share & Industry Analysis, By Offering (In-House and Outsourced (Single & Bundled Services)), By Service Type (Hard Services (Mechanical, Electrical, Plumbing, & HVAC Maintenance, Energy Management, Asset Management, Offshore Facility Management & Soft Services (Janitorial and Sanitization, Office Support Services, Housekeeping, Pest Control, Security and Guarding, Ground Maintenance), By Industry Vertical (Healthcare, Business & Corporate, Manufacturing, Government, Education, Military & Defense, Hospitality & Regional Forecast, 2026-2034

Facility Management Market Size

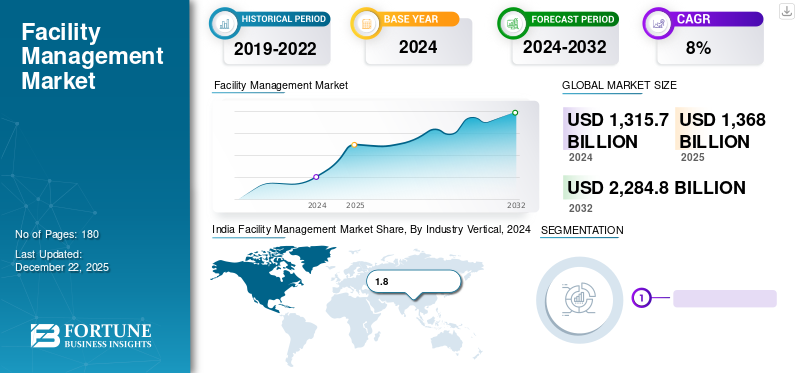

The global facility management market size was valued at USD 1,367.96 billion in 2025 and is projected to grow from USD 1,435.13 billion 2026 to USD 2,750.87 billion by 2034, exhibiting a CAGR of 8.50% during the forecast period. The Asia Pacific dominated the Facility Management Market with a share of 40.60% in 2025.

The International Facility Management Association describes facility management as the integration of a physical space with the organization's staff and work, which may include tasks such as the maintenance of equipment or planning for future portfolios. These services include emergency preparedness and business continuity, environmental sustainability, human aspects of communication, project management, quality, real estate & property management, leadership or strategy, and others.

The study focuses mainly on the technology side of management, which includes software and services that help improve the efficiency and effectiveness of the management of the facilities. This sector, which is defined as providing maintenance assistance, user management, and project management services, has grown significantly over the last two decades due to initial growth in urbanization and industrial development. In the coming years, the demand for these solutions and services is likely to record a considerable increase. Government spending on transport, energy, construction, and others is the factor for the increase in demand. In addition to building management contracts with its service providers for the provision of its services, contract management also comprises personnel, equipment, and other services.

During the COVID-19 pandemic, there was economic chaos, which was followed by further lockdowns. However, an increase in the usage of these services by governments boosted the market as facilities managers began to consider new options for remote work or socially distant workplaces. The growing awareness of hygiene, management, maintenance, and security helped drive industry expansion during the period.

Download Free sample to learn more about this report.

Facility Management Market Trends

Integration of Artificial Intelligence in Facility Management Services to Boost Market Growth

The ability to process massive amounts of data and extract valuable information is an important factor in the use of artificial intelligence for facility management. Facility managers are able to leverage real-time data from a variety of sources, including the maintenance logs, internet of things sensors, occupancy reports, and energy consumption records through AI powered data analytics tools. These data-driven insights allow facility managers to make well-versed choices regarding space utilization, preventive maintenance, and resource allocation strategies. An example is that artificial intelligence can analyze past patterns of energy consumption to determine waste areas and provide recommendations on energy conservation measures.

By optimizing the energy consumption of heating, ventilation, and air conditioning systems based on occupancy data and weather forecasts, artificial intelligence optimizes their efficiency which will ultimately reduce operating costs and improve sustainability. The traditional approach to facility management usually consists of a reactive approach, which addresses the maintenance challenges after they arise. By providing proactive management, artificial intelligence challenges this paradigm. By employing machine learning algorithms, AI can predict equipment failures and maintenance needs based on patterns in historical data, further propelling industry growth.

Facility Management Market Growth Factors

Rise in Urbanization and Infrastructure Development to Accelerate Market Growth

Due to their direct impact on the demand for efficient management of built environment, urban development and infrastructure development are major drivers of the market. As cities expand to accommodate growing populations, urban development leads to an increase in construction activity. This will lead to the construction of new commercial buildings, residential developments, industry facilities, and infrastructure such as transport networks, utilities, and healthcare.

The demand for these services is driven by the need to maintain, operate, and optimize these facilities on a continuous basis. A wide variety of establishments, such as office towers and shopping centers, residential highrises, and open spaces are developing rapidly due to increased urbanization. Specialized management and maintenance services are required for each type of facility, with a specific focus on its particular needs. Therefore, industry players are keen to tap into this demand and offer a comprehensive range of services to meet the needs of various urban infrastructure assets. These factors are poised to drive facility management market growth.

RESTRAINING FACTORS

Inadequate Optimization Practices and Technology May Hinder Market Expansion

Limited use of technology is rarely a problem for some major facilities management service providers that have made significant initial investments in the provision of services due to contracts drawn up over many years. Large companies, in order to provide hard and soft services that allow them to offer better and enhanced services, often use innovative technologies such as BIMs (Building Information Models).

On the other hand, small and medium sized enterprises in different countries are not adequately implementing the inputs at the initial stage, which is the design stage. This is due to the lack of operational and maintenance practices in a number of SMEs. This results in sustainability related problems for construction facilities, particularly during the transitional phase and after occupancy.

Facility Management Market Segmentation Analysis

By Offering Analysis

In-House Offerings Segment to Dominate Owing to Huge Adoption by Major Organization

By offering, the market is classified into in-house and outsourced offerings.

The in-house offerings segment held the dominating position in the market in terms of revenue share of 54.97% in 2026, and will exhibit the highest CAGR during the forecast period. Major organizations that require a large degree of facility management are increasingly opting for in house offerings to retain the direct control of operations and guarantee alignment with organizational objectives.

The outsourcing offerings segment is also witnessing considerable growth. A range of services, such as maintenance, security, cleaning, and others are being offered by these providers for explicit needs. Facilities management companies or service providers often chose these offerings for specific expertise, access to technology, scale, and cost effectiveness.

By Service Type Analysis

Hard Services Segment Leads the Market Due to the Development in Infrastructure Sector

By service type, the market is categorized into hard services and soft services.

The hard services segment is likely to lead the market by capturing a market with a share of 50.62% in 2026. The segment is projected to exhibit the highest CAGR over the forecast period. The growth is attributed to the expansion of the infrastructure industry globally as these services include mechanical-electrical-plumbing and HVAC maintenance, energy management, asset management, offshore facility management, and other related services. These services are connected to the building's structural components. In addition, as a result of the increasing urbanization across the globe, the rapidly growing building and construction sector is also driving the hard service segment.

The soft services segment is anticipated to exhibit a CAGR of 6.83% during the forecast period. Soft services are essential for creating a conducive environment for the core activities of a business or institution. They contribute to employee well-being, productivity, and overall operational efficiency. The rise is owing to the increased investments in waste management, energy management, wastewater management, and other green energy sectors.

By Industry Vertical Analysis

To know how our report can help streamline your business, Speak to Analyst

Healthcare Segment to Hold the Highest Market Share Due to its Adoption as a Precautionary Measure

By industry vertical, the market is divided into healthcare, business & corporate, manufacturing, government, education, military & defense, construction (real estate), hospitality, and others (IT & telecommunication, BFSI).

The healthcare segment is projected to hold a major market with a share of 25.71% in 2026. Facility management is an essential part of the healthcare sector as it ensures that hospitals, clinics, and other health facilities are hygienic, safe, and efficient. The management of heating, ventilation, and air conditioning systems, and compliance with health and safety legislation, the management of medical waste and optimizing space utilization are also part of this process.

The construction segment will exhibit substantial growth over the forecast period. Facility management services are being adopted to improve the value and functionality of a building and manage both new constructions and old buildings. These include property maintenance, tenant services, lease management, construction security, and facility improvement.

The education segment encompasses the maintenance and management of school campuses, colleges, and universities. The sector records a high demand for facility management services. These include maintaining classrooms, laboratories, libraries, sports facilities, and dormitories and ensuring a safe and conducive learning environment for students and staff.

The manufacturing segment is expected to hold 6% of the market share in 2025, while hospitality segment is likely to exhibit a CAGR of 6.2% during the forecast period.

REGIONAL INSIGHTS

By region, the market has been studied across North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific

Asia Pacific Facility Management Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Due to the existence of various organized and unorganized companies in India and China, Asia Pacific is expected to record the largest market share along with generating the maximum revenue. Asia Pacific dominated the global market in 2025, with a market size of USD 555.71 billion. The robust growth is fueled by rapid urbanization, industrialization, and infrastructure development. Key sectors driving the demand for facility management services in Asia Pacific include commercial real estate, manufacturing, healthcare, education, retail, and hospitality. Outsourced services are becoming increasingly popular, particularly in emerging economies such as China, India, and Southeast Asian countries, where companies seek cost-effective solutions and expertise. The Japan market is projected to reach USD 223.37 billion by 2026, the China market is projected to reach USD 79.87 billion by 2026, and the India market is projected to reach USD 154.81 billion by 2026.

Increasing Hospitality Industry and Smart City Initiatives in India to Boost Market Growth

In addition, significant growth is expected in the Indian market over the forecast period. The development of smart cities in Asia Pacific is driven by an increase in government methods. Furthermore, with the development of smart cities and their increased demand for these services, there is a growing number of large public facilities, such as airports, shopping malls, universities, hospitals, or ports. The rapidly expanding building sector in India, as well as China, is expected to help businesses in the country which is aiding the growth of facility management market share.

North America

To know how our report can help streamline your business, Speak to Analyst

North America is exhibiting substantial growth as the market is mature and highly diversified, with a significant presence of internal maintenance departments and outsourced service providers. North America is anticipated to account for the second-highest market size of USD 410.96 billion in 2025, exhibiting the second-fastest growing CAGR of 6.2% during the forecast period. Healthcare, corporate offices, manufacturing, government buildings, education, and hospitality are the main sectors that drive the demand for facilities management services in the region. The market is characterized by a focus on advanced technologies, sustainability initiatives, and stringent regulatory compliance. The U.S. market is projected to reach USD 303.86 billion by 2026.

Europe

Europe is having considerable growth as the region has a well-established facility management market, characterized by a mix of in-house departments and outsourced service providers. The region is to be anticipated as the third-largest market with USD 324.25 billion in 2025. Industry sectors, such as corporate offices, healthcare, manufacturing, government, education, and hospitality are driving the market expansion in the region. European countries prioritize sustainability, energy efficiency, and compliance with stringent regulations, driving the demand for innovative solutions. The UK market is projected to reach USD 101.49 billion by 2026, while the Germany market is projected to reach USD 73.81 billion by 2026, and France is likely to hold USD 61.31 billion in 2025.

South America and Middle East & Africa

The Middle East & Africa region is to be anticipated as the fourth-largest market with USD 64.1 billion in 2025. Moreover, driven by infrastructure development, urbanization and the growth of sectors such as hospitality, healthcare, retail or real estate, the Middle East & Africa is expanding at a rapid pace. The market for facilities management in the Middle East, characterized by high emphasis on luxury, sustainability and technology driven solutions, is particularly active in Dubai, Abu Dhabi, and Riyadh. The GCC market size is estimated to be USD 30.65 billion in 2025.

In Africa, South Africa, Nigeria, and Kenya are witnessing an increasing demand for facility management services, particularly in sectors such as commercial real estate, healthcare, and government facilities.

Rapid urbanization, infrastructure development, and increased demand for commercial and residential premises in South America have led to sustained growth. Real estate development, hospitality, healthcare, and public buildings are the main sectors that contribute to the demand for these services in South America. In particular, in Brazil, Argentina, and Chile, the outsourcing of these services is on the rise.

List of Key Companies in Facility Management Market

Upgradation of Services with Technological Advancements Aids Key Players to Expand their Presence

The increase in the usage of advanced technologies in facility management services along with the continuous investment to enhance service capabilities are major steps adopted by industry players to increase their market share. These major players are constantly developing their segments and expanding their businesses. These companies are teaming up with businesses majorly involved in technologies such as cloud platform, an easy-to-use system that unites all the technology and applications used to run buildings in one place.

LIST OF KEY COMPANIES PROFILED:

- Sodexo (France)

- CBRE Group, Inc. (U.S.)

- ISS A/S (Denmark)

- Compass Group (U.K.)

- Aramark (U.S.)

- Jones Lang LaSalle IP, Inc. (U.S.)

- Johnson Controls International plc. (Ireland)

- Cushman & Wakefield (U.S.)

- Dussmann Group (Germany)

- Tenon Group (India)

- OCS Group International Limited (U.K.)

- EFS Facilities Services Group (UAE)

- Veolia Environment (France)

- American Facility Services Group (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- February 2024 - CBRE Group, Inc. and Arlington Capital Partners acquired J&J Worldwide Services, a company involved in base support operations facilities maintenance for the U.S. federal government from Arlington along with engineering services.

- March 2023 - ISS entered into a five-year contract to provide integrated facilities services (IFS) to a U.S. based pharmaceutical company with global reach.

- July 2022 - ABM announced the launch of ABMVantage, with new data-enabled, driver-first Smart Parking platform which was introduced at the International Parking & Mobility Institute Conference & Expo.

- January 2022 - Aramark, a global company in uniforms and food and facilities management, announced a strategic partnership with PEA (Patient Engagement Advisors), an advance technology platform that associates transition specialists with patients.

- March 2020 – Cushman & Wakefield acquired Réponse, a design and build contractor in France. The acquisition would strengthen Cushman & Wakefield’s business in France, adding a build capability and in-house design services alongside its existing services, which include capital markets, development, agency, asset services, hospitality, valuation & advisory, and occupier services.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.50% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Offering, Service Type, Industry Verticals, and Region |

|

Segmentation |

By Offerings

By Service Type

By Industry Vertical

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market is projected to reach USD 2,750.87 billion by 2034.

In 2025, the market was valued at USD 1,367.96 billion.

The market is projected to grow at a CAGR of 8.50% during the forecast period.

By service type, the hard service type is leading the market in terms of share.

Rise in urbanization and infrastructure development is a key factor accelerating market growth.

Sodexo, CBRE Group, Inc., ISS A/S, and Johnson Controls International plc. are the top companies in the market.

Asia Pacific generated the maximum revenue in 2025 and the growth is attributed due to the presence of developing countries in the region, such as India and China.

By industry vertical, the construction segment is expected to grow at the highest CAGR during the forecast period

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us