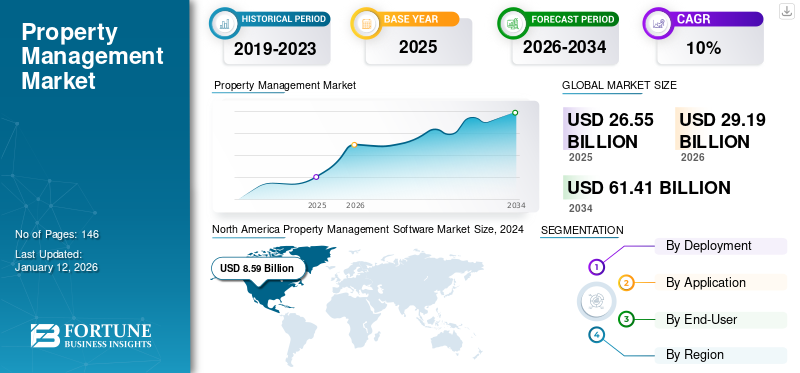

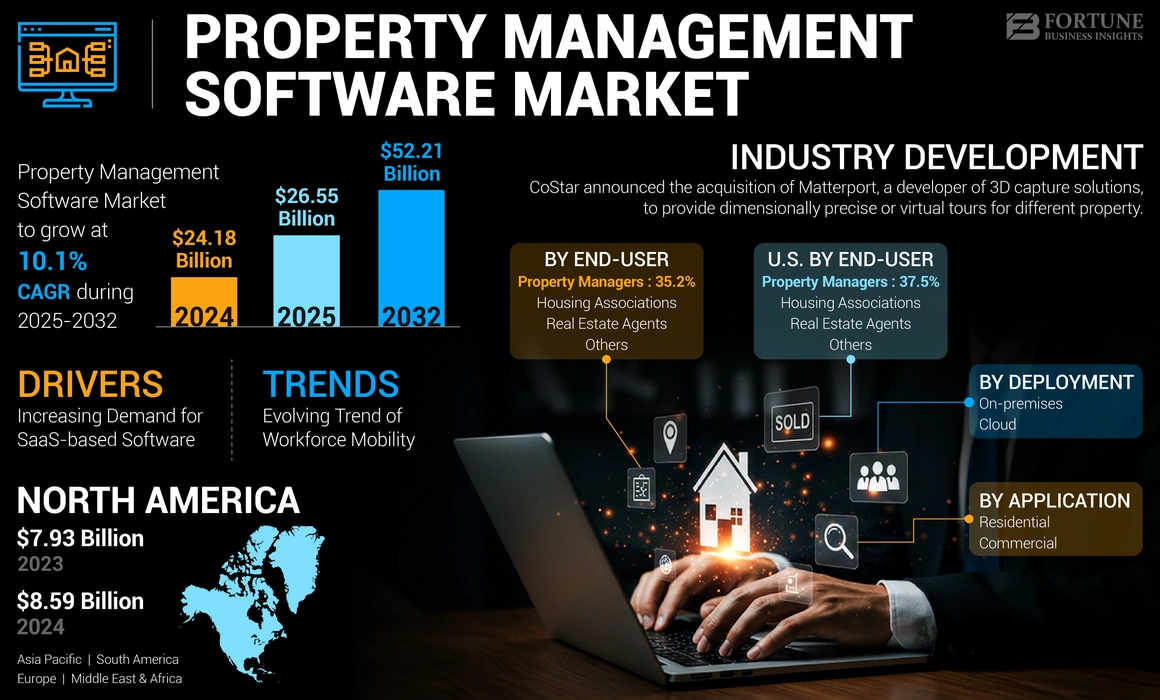

Property Management Software Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premises), By Application (Residential and Commercial), By End-User (Property Managers, Housing Associations, Real Estate Agents, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

The global property management software market size was valued at USD 24.18 billion in 2024. The market is projected to grow from USD 26.55 billion in 2025 to USD 52.21 billion by 2032, exhibiting a CAGR of 10.1% during the forecast period. North America dominated the global market with a share of 35.53% in 2024.

The increasing demand for property management software to address consumers’ real estate preferences and the growing need for improved consumer handling and support are driving the market expansion. For instance, in February 2021, Yardi Systems, Inc. launched Rent Relief by Yardi. This launch will help households and landlords manage payments quickly and easily. Similarly, in March 2021, Planon partnered with AddOnn to combine AddOnn’s SaaS solution with Planon’s software platform for building & service digitization to offer an end-to-end solution to customers across the globe.

The global property management software market growth is attributed to the rapid adoption of cloud computing solutions, increased adoption of digitalization, and reliance on software-as-a-service (SaaS) platforms. The market is also benefiting from smart real estate infrastructure growth and the trend toward using one platform for multiple needs.

However, the effects of the COVID-19 pandemic were felt globally, with real estate enterprises witnessing major disruptions. Short-term concerns for real estate management included keeping visitors & tenants safe, maintaining value, using advanced cleaning procedures, and adhering to governmental norms. Furthermore, many schools and offices were closed, and companies were forced to explore various "work from home" options. The COVID-19 pandemic gave residential property managers a chance to rethink their strategies. As a result, smart processes and Artificial Intelligence (AI)-based technologies saw a notable increase in their popularity.

GENERATIVE AI IMPACT

Integration of Generative AI Capabilities across Emerging Property Tools to Aid Market Growth

Generative AI can automate data processing tasks such as data entry, extraction, and analysis. This can help property management software platforms handle large volumes of property-related data more efficiently, leading to faster decision-making and improved operational efficiency for property managers. Moreover, Generative AI algorithms can assist in property design and visualization by generating and optimizing floor plans, layouts, and architectural designs based on specified criteria and constraints. This could be particularly useful for property developers and architects in new construction projects' planning and design phase. For instance,

- According to industry experts, generative AI technology could generate around USD 100 billion to USD 200 billion for the real estate industry.

Overall, the integration of generative AI technologies into property management software platforms has the potential to revolutionize the industry by offering advanced analytics, personalized recommendations, natural language interfaces, virtual assistants, design optimization, fraud detection, security enhancements, and energy efficiency optimization. Property management software vendors that leverage generative AI effectively will likely gain a competitive edge and drive innovation in the market.

Property Management Software Market Trends

Evolving Trend of Workforce Mobility to Strengthen Growth

Many employees are currently opting to work from home rather than from offices, corporate headquarters, or a global branch of an organization. This helps necessitate flexibility in access to office resources and data. Furthermore, businesses are utilizing virtual workplaces to decrease their physical infrastructure requirements to a bare minimum, allowing them to be more flexible and make better use of their office space.

Many companies are searching for mobility management, workplace management, and other integrated facility management solutions. This allows property managers to maintain the speed of work while dealing with a large workforce. These solutions may be used by associated real estate agents and property managers to keep track of all the properties they maintain and the routine maintenance that needs to be done on them. As a result, the business of asset management is benefiting from the growing trend of worker mobility.

Download Free sample to learn more about this report.

Property Management Software Market Growth Factors

Increasing Demand for SaaS-based Software to Aid Market Growth

Software-as-a-Service (SaaS) and cloud computing integrated services have grown in popularity as preferred methods of delivery services. Subscription-based SaaS solutions help in benefiting businesses of all sizes. Companies in the market are increasingly resorting to SaaS solutions to streamline operations by automating workflows and eliminating manual input. Also, by deploying SaaS solutions, organizations can decrease the complexity and cost of on-premises deployment. SaaS software helps large multifamily property management companies integrate numerous technologies throughout their portfolio. Furthermore, the SaaS approach is critical for multi-vendor device compliance with older systems.

The software offers a single platform to easily access and manage all properties, including tenant requirements and maintenance tasks. The SaaS market is growing rapidly, leading more companies to adopt SaaS technology for their long-term business needs.

RESTRAINING FACTORS

Budget Constraints to Reflect Broader Range of Risk Impeding Market Growth

As the real estate business globalizes, the scope of risks is expected to get more extensive. The top risks will be country or city risks, including political risks and the risks whose benefits would be seized. Also, rising real estate investments in developing nations may pose several dynamic risks. Furthermore, owing to a lack of funds, real estate brokers choose to engage with local developers, which introduces several operational hazards, such as delayed building sites or even fraudulent operations. This might impede the expansion of the property management software market growth.

Property Management Software Market Segmentation Analysis

By Deployment Analysis

Cloud Segment to Aid Market Growth Owing to High Convenience and Security

By deployment, the market is bifurcated into cloud and on-premises.

The cloud segment is anticipated to account for the largest market share and record the highest CAGR during the forecast period. Cloud-based solutions enable property managers and landlords to store all documents, such as legal contracts, lease agreements, and contractor SLAs (Service Level Agreements), on a single platform at a minimal price. Another advantage of cloud-based software is improved security. Security upgrades for traditional property applications are rare, exposing data to theft, power failures, and physical disasters.

The on-premises segment is anticipated to register a moderate CAGR during the forecast period. The installation of property management software on-premises eliminates security problems via the internet, reducing the risk of data breaches and cybersecurity attacks.

By Application Analysis

Residential Segment to Dominate Market Owing to Development of Residential Buildings

Based on application, the market is categorized into commercial and residential.

The residential segment is anticipated to account for the largest share of the market. The necessity of property management software to manage residential properties, such as residences, single & multi-story flats, and bungalows, is driving the expansion of this segment. With an ever-increasing population, the need for residential buildings is expected to increase. Owing to this, the demand for asset management systems will also grow to meet the rising construction of residential properties.

The commercial segment is anticipated to grow steadily. A commercial property manager is responsible for managing non-residential assets, such as retail spaces, offices, industrial buildings, and storage facilities. Commercial property owners keep complete administrative and financial records and keep all applicable fees, mortgages, repairs, and benefits up to date.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

Rising Product Adoption among Property Managers to Organize their Work Efficiently Aids Market Growth

Based on end-user, the market is divided into property managers, housing associations, real estate agents, and others (third-party agents, property investors).

The property managers segment held the majority market share in 2024. Property managers need to manage their everyday duties, which include several balancing activities around them. The manual execution of corporate duties, such as monitoring, rent payments, and receiving maintenance orders is time-consuming and often intimidating. Thus, there is a growing demand for automated software that allows property managers to manage many business operations simultaneously.

The market growth is driven by the increasing development of smart real estate infrastructure and the growing reliance on a single-platform approach. Real estate agents also prioritize gathering and managing property information using centralized property management software to improve data administration and accessibility. The use of this software by real estate agents is expected to experience a positive compound annual growth rate (CAGR) during the forecast period.

REGIONAL INSIGHTS

Geographically, the market is segmented into five major regions: North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Property Management Software Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America accounted for the largest part in the property management software market share in 2024. The expansion of e-commerce in this region is predicted to offer property managers and real estate developers several opportunities to invest in asset management software/services. External investment in the region's real estate market is likely to increase significantly in the coming years.

Moreover, a survey by the National Apartment Association in 2023 revealed that 68% of property managers in North America are now using some form of property management software, emphasizing the widespread adoption and integration of technology into the industry. Further, due to the wide range of investment options and a positive economic situation, real estate wealth managers may employ foreign real estate funds to diversify more efficiently. Also, metropolitan areas in the region are struggling in terms of population and economic development. As a result, urban areas are the most profitable asset management software marketplace. The region's profitability from real estate investments is significantly correlated with its GDP growth and population changes.

To know how our report can help streamline your business, Speak to Analyst

Europe is anticipated to grow at a significant rate as monetary development in the region is more promising in metropolitan areas. Furthermore, the region's digital strategy and infrastructure are being updated continually. This has boosted the use of business intelligence and predictive analytics to make buildings future-ready and better employ IoT to design and redesign structures. This improved transparency has spurred investments in real estate markets. This has helped boost the market growth in Europe.

The market in Asia Pacific is anticipated to record an exponential CAGR. Emerging countries are quickly growing. In particular, China, India, and Indonesia will grow notably in terms of global middle-class spending. As a result, households may exceed their spending threshold, which opens up opportunities for real estate investment. The retail, logistics, and hotel industries are all undergoing a substantial change as they respond to the escalating demands caused by the rapid rise of e-commerce. Similarly, co-working and shared workplaces have expanded across the Asia Pacific in recent years, bringing a technological edge to the traditional serviced-office industry while providing good returns for landlords.

The Middle East & Africa market could witness rapid growth owing to the impact of changing laws and the significance of more transparency in the real estate business. Revaluation or deletion of senior housing and financial support from owners provide investment possibilities in various nations' private rental and healthcare sectors. Furthermore, low housing interest rate suggestions by governments in the region have contributed to the market's expansion.

KEY INDUSTRY PLAYERS

Companies Offer Targeted Solutions to Owners and Managers to Expand Penetration

Key players operating in the market are AppFolio Inc., Archibus Inc., Yardi Systems Inc., CoreLogic, Entrata Inc., and others. Owners and property managers are said to benefit from these company's solutions for managing properties, such as residential, commercial, and hotels.

Various players have emerged as major providers of candidate screening, revenue management, and utility management services owing to their effective solutions. These firms are concentrating their efforts on the commercial sector of the industry to provide modern and effective solutions to property managers and agents.

List of Top Property Management Software Companies

- AppFolio, Inc. (U.S.)

- Archibus, Inc. (U.S.)

- Yardi Systems, Inc. (U.S.)

- CORELOGIC (U.S.)

- Entrata, Inc. (U.S.)

- ManageCasa (U.S.)

- MRI Software LLC (U.S.)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- MAISONETTE (UAE)

- Oracle Corporation (U.S.)

- RealPage Inc. (U.S.)

- CoStar Group (U.S.)

KEY INDUSTRY DEVELOPMENTS

- April 2024 – CoStar announced the acquisition of Matterport. Matterport is a developer of 3D capture solutions to provide dimensionally precise, photorealistic digital twins or virtual tours for any kind of property. The company will acquire all remaining shares of Matterport in a cash and stock transaction valued at USD 5.50 per share, signifying an equity value of roughly USD 2.1 billion and a company value of around USD 1.6 billion on the concluding value for CoStar Group common stock on April 19, 2024.

- September 2023 – AppFolio enhanced its cloud-based business management solutions for the real estate industry by incorporating generative AI capabilities and introducing new payment options. The latest addition to AppFolio's suite of AI capabilities is Realm-X, a conversational interface powered by generative AI specifically designed for property managers.

- July 2023 – Entrata, Inc. acquired Rent Dynamics, a company that specializes in resident rent reporting and financial resources. This strategic move enabled Entrata to enhance its range of services and solidify its position in the property management sector. As a result, residents can now benefit from even more valuable services related to rent reporting and financial management.

- April 2023 – Inhabit launched ResidentIQ, a property management software for residential property managers. This software offers secured operations, payment, insurance, resident engagement, and screening solutions in a single software, making it a user-friendly software.

- January 2023 – Union, a property management software provider, launched a centralized leasing software and support solution to allow organized remote management of multifamily communities.

REPORT COVERAGE

The research report provides an in-depth analysis of the market. It focuses on key aspects such as leading companies, applications, and the adoption of advanced technologies in several applications. Besides this, it offers insights into the latest market trends and highlights key industry developments. In addition to the aforementioned factors, the report encompasses several key factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE AND SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 10.1% from 2025 to 2032 |

|

Unit |

Value (USD billion) |

|

Segmentation |

By Deployment

By Application

By End-User

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size is expected to reach USD 52.21 billion by 2032.

Fortune Business Insights says that the market size stood at USD 24.18 billion in 2024.

The market is expected to grow at a CAGR of 10.1% during the forecast period of 2025-2032.

By application, the residential segment is expected to lead the market during the forecast period.

The increasing demand for SaaS-based property management software is one of the key drivers of market growth.

AppFolio, Inc., Archibus, Inc., RealPage, Inc., Trimble, Inc., and Yardi Systems, Inc. are the top companies in the market.

By end-user, the property managers segment captured a majority market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us