Metal Forming Tools Market Size, Share & Industry Analysis, By Type (Hydraulic Presses, Mechanical Presses, Servo Presses, Rolling Machine, Shearing Machines, Forging Machines, Bending Machines, and Others), By Process (Rolling, Forging, Bending, Punching, Shearing, Stamping, Deep Drawing, and Others), By Automation Level (Conventional/Manual, CNC, and Automated/Robotic), By Application (Automotive, Aerospace and Defense, General Manufacturing, Electrical & Electronics, Energy & Power, and Others) and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

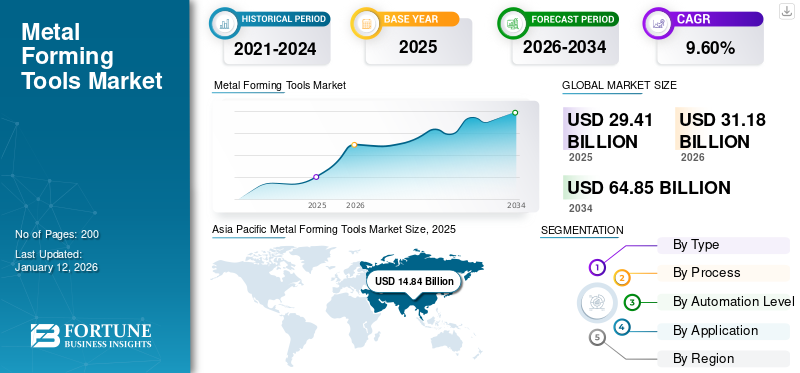

The global metal forming machine tools market size was valued at USD 29.41 billion in 2025 and is projected to grow from USD 31.18 billion in 2026 to USD 64.85 billion by 2034, exhibiting a CAGR of 9.60% during the forecast period. Asia Pacific dominated the metal forming machine tools market with a market share of 50.50% in 2025.

The global market is experiencing steady momentum owing to the continuously rising demand from sectors such as automotive, aerospace, and general manufacturing. Market growth is majorly driven by advancements in automation, precision engineering, as well as the integration of digital technologies. The Asia Pacific region is dominating the market share due to rapid industrialization and infrastructure development, while Europe and North America regions are also contributing through high-end technological advancements and increasing demand for customized solutions.

Leading players in the global market such as TRUMPF Group, DMG Mori Co., Ltd., AMADA Co., Ltd., and Schuler AG are strengthening their market positions through innovation, strategic collaborations, and global expansion.

Download Free sample to learn more about this report.

Looking ahead, the global market is anticipated to benefit from the ongoing shift toward smart manufacturing along with energy-efficient production systems. The increasing focus on sustainability along with the growing adoption of Industry 4.0 technologies is further accelerating the growth of the market.

IMPACT OF TARIFFS ON THE MARKET

Imposition of Tariff Leading to Supply Chain Disruptions to Hinder Market Growth

The tariff imposition on essential raw materials and finished machine tools has disrupted the global market. These tariffs have increased the input costs and further strained the margins of manufacturing companies, while trade barriers have created complications for cross-border transactions and sourcing strategies. As a result, many companies are re-evaluating their global supply chains, which has led to production delays and project execution. This has therefore slowed market expansion, especially in regions that are heavily reliant on imports, consequently dampening overall metal forming machine tool market growth.

MARKET DYNAMICS

Metal Forming Tools Market Trends

Growing Adoption of Automation in Metal Forming Processes Boost Market Demand

The rising integration of robotics along with the growing adoption of automation into metal forming processes is transforming the way machine tools are designed and operated. This trend is mainly driven by the growing demand for higher precision, consistency, along with efficiency in intricate manufacturing setups. Automated metal forming systems reduce human error and increase production speed, while allowing for real-time monitoring and control, thus significantly improving output quality. As a result, an increasing number of manufacturers are investing in CNC and smart machines, which has positively impacted the metal forming machine tool market. This shift is expanding the application scope across the automotive, aerospace, and electronics sectors.

Market Drivers

Inclination Toward Manufacturing Modernization is Fueling Global Demand

The global ongoing transition toward modernization of manufacturing facilities is one of the key driver boosting demand for metal-forming tools. As industries seek to enhance productivity, reduce waste, and meet tighter tolerances, the adoption of advanced metal forming solutions becomes vital. Developing countries undergoing industrial transformation, especially in the Asia Pacific region are rapidly embracing these tools to assist infrastructure and automotive growth. This push for modernization directly accelerates to metal forming tools market growth through increasing capital investment along with broadening the user base.

Market Restraints

Trade Barriers to Hinder the Expansion and Demand for Metal-Forming Tools

The introduction of tariffs and trade restrictions have emerged as a major restraint on the global market. These measures drive up the raw material prices and also create uncertainties across international supply chains, curbing the potential of manufacturers to offer competitive pricing. In regions heavily dependent on the imports or exports of machine tools and their components, these trade barriers have led to project delays, cost escalations, and deceased investment in new equipment, ultimately weakening the market’s potential for unified global outreach.

Market Opportunities

Green Manufacturing Creates New Avenues for Metal Forming Solutions

The global push toward sustainability and improved energy consumption is creating significant growth opportunities for the metal forming tools market. As industries shift toward low-emission manufacturing, there is an increased demand for energy-efficient, electrically driven, and hybrid metal forming machines. Manufacturers that support environmentally friendly technologies, such as regenerative drive machines or machines that consume less power, will be rewarded with government incentives, and increasing demand from more cost-concerned customers. The transition to environmentally friendly future will continue to create new avenues of revenue and product innovation, positioning green technologies as a primary driver of future growth for the overall metal forming machine tool market.

SEGMENTATION ANALYSIS

By Type

Hydraulic Presses Segment Dominate the Market Owing to Versatility in Various Applications

By type, the market is segmented into hydraulic presses, mechanical presses, servo presses, rolling machine, shearing machines, forging machines, bending machines, and others.

The hydraulic presses segment is expected to lead by type, accounting for 23.32% of the global market share in 2026. Hydraulic presses hold the largest market share within the larger global metal forming machine tool market share as they are versatile, affordable, and capable of delivering a consistent force across many different applications. They are predominately used in automotive, construction, and heavy machinery, performing tasks such as deep drawing, punching, and general metal forming, which require high tonnage with precision.

Servo presses are forecasted to register the highest CAGR during the forecast period. Since servo presses use energy more efficiently than traditional press systems and are able to control speeds, positions, and loads in high-speed, high-accuracy manufacturing applications, it is no wonder these are becoming more common in production. Their increasing popularity across the electronics and precision component industries, along with the growing importance of Industry 4.0 across every manufacturing industry, is driving demand for the servo presses.

Mechanical presses have the second-largest market share. Mechanical presses are used widely across mass production areas due to their high-speed operation and lower operational costs. For shaping steel and metal sheets, rolling machines have created a steady demand. In aerospace and automotive, forging machines are considered essential in the manufacture of parts. In fabrication industries, bending machines and shearing machines enable the flexibility required to cut and shape metal sheets into various parts.

The others category includes niche equipment types that cater to the forming needs of smaller and niche industries.

By Process

Stamping Leads the Market Owing to its Usage in High-Speed and High-Volume Production

By process, the market is categorized into rolling, forging, bending, punching, shearing, stamping, deep drawing, and others.

The stamping process accounts for the largest share of the global market, primarily due to its extensive use in high-speed and high-volume manufacturing, particularly in the automotive and consumer electronics industries. Its potential to produce complex parts with high precision at lower per-unit costs makes it suitable for mass-production environments.

Deep drawing is projected to register the highest CAGR over the forecast period, driven by its growing use to manufacture complex, lightweight, and durable components across the automotive, aerospace, and packaging sectors. Its capability to create complex shapes while maintaining material integrity supports the increasing demand for complex and lightweight components.

Other key processes also contribute significantly to market growth. For instance, forging is being extensively adopted in heavy-duty applications that require superior strength, while bending offers flexibility for forming components in construction and fabrication.

The rolling process assists in continuous forming in the steel and metal processing industries. Punching and shearing remain essential for precise cutting and hole-making operations, and the others segment includes niche forming processes tailored to the specialized industrial needs. The rolling segment will contribute 18.79% market share globally in 2026.

By Automation Level

Conventional Machines Dominate the Market Owing to its Cost-Effectiveness

By automation level, the market is segmented into conventional/manual, CNC, and automated/robotic.

Conventional/manual metal forming tools hold the majority of the market share due to their widespread availability, relatively lower upfront costs, and continued popularity among small to medium-scale manufacturing enterprises. In emerging economies and less automated sectors with budget constraints, manual machines remain dominant.

Automated/robotic systems are anticipated to witness the highest CAGR, owing to high demand for precision along with the need to reduce labor cost. These systems are being adopted in advanced manufacturing setups, particularly within the automotive and aerospace sectors, as part of the Industry 4.0 movement toward smart factories.

The CNC segment is projected to dominate the metal forming machine tools market with 53.98% in 2026. CNC machines, which bridge the gap between manual and fully robotic systems, continue to witness steady demand. Their programmable flexibility and suitability for high-precision, mid-to-high volume production, make them a practical choice across a wide range of industries. By offering balanced mix of automation and control, CNC machines cater to manufacturers seeking efficiency without fully transitioning to robotics.

To know how our report can help streamline your business, Speak to Analyst

By Application

Automotive Segment Drives Market Dominance Owing to High Volume Production

By application, the market is segmented into automotive, aerospace and defense, general manufacturing, electrical & electronics, energy & power, and others.

The automotive segment accounts for the largest market share in the global market, driven by its consistent demand for high-volume production of vehicle components, such as body panels, engine components, and structural frames. In this sector, parts are being manufactured to be lightweight, durable, and have specific shapes required by both internal combustion engines (ICE) and electric vehicles (EV). As a result, hundreds of millions have been invested in stamping, forging, and deep drawing equipment tailored to automotive production needs.

Aerospace and defense is a key application area and is expected to register the highest CAGR during the forecast period. The sector requires high-precision forming tools for manufacturing complex and safety-critical components. The growth in air travel and defense modernization programs is fueling the adoption of advanced forming technologies in this sector. General manufacturing also contributes substantially to market growth due to the diverse application base across industrial machinery and consumer goods.

Electrical & electronic applications are growing steadily, particularly driven by the trend toward miniaturization and the need for high-precision parts used in semiconductors and devices. These sectors are seeking new solutions for forming tooling designs to produce more complex designs. The energy & power sector, though niche, is another important consumer of forming tools, to manufacture structural components in renewable and traditional energy systems.

The others segment includes a range of industries, including construction and marine, which need customized metal forming solutions for diverse fabrication demands.

METAL FORMING TOOLS MARKET REGIONAL OUTLOOK

By region, the market is studied across Asia Pacific, North America, Europe, South America, and Middle East & Africa.

Asia Pacific

Asia Pacific Metal Forming Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific region holds the largest share for USD 14.84 billion in 2025 underpinned by key countries such as China, Japan, and India. The market in the region is driven by rapid industrialization, increasing automotive production, and a strong manufacturing base. The region is also experiencing increasing investment in automation and export-oriented manufacturing. These trends have solidified the region’s position for both the production and consumption of forming tools.

China is the largest country in the market, supported by an extensive industrial base with manufacturing taking up the majority of output, and its role as a global leader in automotive and electronics production. Additionally, the government’s "Made in China 2025," initiative has further accelerated investments in high-end equipment manufacturing, including CNC and robotic forming machines. Local players are more competitive than ever, on both local and worldwide levels, offering affordable and technologically advanced solutions. The Japan market reaching USD 1.20 billion by 2026, the China market reaching USD 7.66 billion by 2026, and the India market reaching USD 1.52 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America benefits from the region’s technological advancements and strong demand from industries such as automotive, aerospace, and defense. The U.S. leads the region with its emphasis on high-precision manufacturing, increasing use of CNC and robotic systems, and ongoing initiatives to restore industrial production. The U.S. is also benefiting from wide investments in electric vehicles and infrastructure modernization.

South America

The market in South America is relatively moderate, with growth potential largely influenced by countries such as Brazil and Argentina. Demand is driven by general manufacturing and automotive component production. However, economic volatility and historically low levels of automation characteristics have restricted the adoption of advanced forming technologies in South America.

Europe

The market is heavily influenced by advanced engineering capabilities, quality standards, and the established automotive and aerospace industries. Countries such as Germany, Italy, and France are home to many OEMs and are globally known for some of the world's most innovative and advanced forming technologies. Europe has an emphasis on energy-efficient and automated systems. This focus on lower energy and labor costs will continue to support the steady adoption of servo and robotic presses, despite high energy and labor operating costs. The UK market reaching USD 1.91 billion by 2026 and the Germany market reaching USD 4.30 billion by 2026.

Middle East and Africa

The Middle East & Africa market is in a developing stage, with demand stemming from infrastructure projects, oil & gas, and the developing manufacturing sector. Countries such as the UAE and Saudi Arabia are making notable investments in industrial diversification as part of their long-term economic visions. These initiatives will create opportunities for metal forming equipment, particularly in construction-related applications.

Competitive Landscape

KEY INDUSTRY PLAYERS

Major Players are Prioritizing Innovation to Meet the Evolving Demand

Key players in the global metal forming tools market are mainly characterized by their strong technological potential, extensive global distribution networks, and wide product portfolios that cater to diverse industries and forming processes. These players are majorly emphasizing innovation, which enables them to offer cutting-edge solutions such as servo-driven systems, robotic integration, and Industry 4.0-enabled equipment that cater to evolving production needs. Their competitive advantage lies in the strategic combination of R&D investment, strong after-sale service, and partnerships that enable quick adaptation to regional market demands. This flexibility helps them maintain leadership status in mature and developing economies.

Long List of Companies Studied (including but not limited to)

- AMADA Co. Ltd. (Japan)

- TRUMPF SE Co. KG (Germany)

- DMG MORI Co. Ltd. (Japan)

- Schuler AG (Germany)

- Komatsu Ltd. (Japan)

- Mitsubishi Corporation (Japan)

- Hyundai WIA Corp. (South Korea)

- Haas Automation Inc. (U.S.)

- JIER Machine Tool Group Co. Ltd. (China)

- ANDRITZ AG (Austria)

- FAGOR ARRASATE S.COOP. (Spain)

- Sumitomo Heavy Industries Ltd. (Japan)

- Nidec Corp. (Japan)

- Accurl CNC Machine Anhui Manufactory Co. Ltd. (China)

- Accurpress Product Sales (U.S.)

- CINCINNATI Inc. (U.S.)

- Lodesani and Carreri Srl (Italy)

- Santec Exim Pvt. Ltd. (India)

- Machine Tools (India) Limited (India)

- MONDRAGON Corp. (Spain)

KEY INDUSTRY DEVELOPMENTS

- January 2025: Phillips Machine Tools showcased its latest next-generation CNC machining technologies at IMTEX 2025, highlighting advancements in high-end metal forming solutions.

- January 2024: ModuleWorks, a leading CAD/CAM software provider, collaborated with DN Solutions, a prominent CNC machine tool manufacturer, to jointly develop machine tool software and integrated solutions for digital transformation in the manufacturing sector.

- April 2023: Okuma Corporation launched the Okuma Factory Automation Division to cater to the growing demand for automated machining systems, enhancing production capacity to tackle labor shortages.

- September 2022: Desktop Metal launched the Figur G15, a digital sheet forming machine designed to enable rapid and low-cost production of sheet metal parts. Targeting sectors such as automotive and aerospace sectors, the G15 significantly reduces production costs and lead times.

- May 2022: Phillips Machine Tools India Pvt. Ltd. partnered with JFY International to enhance metal-forming solutions portfolio in India and Bangladesh, by leveraging JFY’s CNC machine tool technologies.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The global metal forming tools market is increasingly attracting investment, driven by the growing focus on precision manufacturing, energy efficiency, and automation. Large to mid-sized manufacturers are increasingly allocating capital toward CNC and robotic systems with an objective to enhance production flexibility and improve quality output. Investors are also acknowledging the worth of companies that integrate smart manufacturing technologies, such as real-time monitoring, predictive maintenance, and AI-driven control systems, which are quickly becoming benchmarks. Mergers and acquisitions are on the rise as leading players are looking to expand their regional footprints as well as technological capabilities, particularly in fast-growing economies such as India, Southeast Asia, and South America.

Opportunities are especially strong in end-use sectors such as automotive, aerospace, electrical & electronics, and renewable energy, where demand is increasing for lightweight and complex metal components. Infrastructure and industrialization initiatives in emerging markets also lead to strong opportunities for capacity expansion and technology transfer. In addition, government initiatives to support domestic manufacturing, such as the China’s “Made in China 2025” and India’s “Make in India,” are appealing to both local and foreign investment. Manufacturers that are focusing on energy-efficient solutions along with customization for specific end-use industries are in a strong position to capitalize on the dynamic requirements of the global manufacturers.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, types, process, automation levels and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.60% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

By Process

By Automation Level

By Application

By Region

|

|

Companies Profiled in the Report |

AMADA Co. Ltd. (Japan), TRUMPF SE Co. KG (Germany), DMG MORI Co. Ltd. (Japan), Schuler AG (Germany), Komatsu Ltd. (Japan), Mitsubishi Corporation (Japan), Hyundai WIA Corp. (South Korea), Haas Automation Inc. (U.S.), JIER Machine Tool Group Co. Ltd. (China), and ANDRITZ AG (Austria) |

Frequently Asked Questions

The market is projected to reach USD 64.85 billion by 2034.

In 2025, the market was valued at USD 29.41 billion.

The market is projected to grow at a CAGR of 9.60% during the forecast period.

The hydraulic presses segment leads the market.

Modernization of manufacturing is the key factor driving market growth.

AMADA Co. Ltd., TRUMPF SE Co. KG, DMG MORI Co. Ltd., Schuler AG, and Komatsu Ltd. are the top players in the market.

Asia Pacific hold the highest market share.

By application, the aerospace and defense segment is expected to register the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us