Mining Automation Market Size, Share & Industry Analysis, By Type (Underground Mining Automation and Surface Mining Automation), By Offering (Equipment {Autonomous Hauling, Autonomous Drilling Rigs, Underground Load Haul Dump (LHD) Holders, and Others}, Software {Workforce Management System, Fleet Management System, Mine Design and Planning Software, Data Management Software, Air Quality Detection Software}, Communication {Navigation System, and Cybersecurity Solutions}), By Application (Mine Maintenance), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

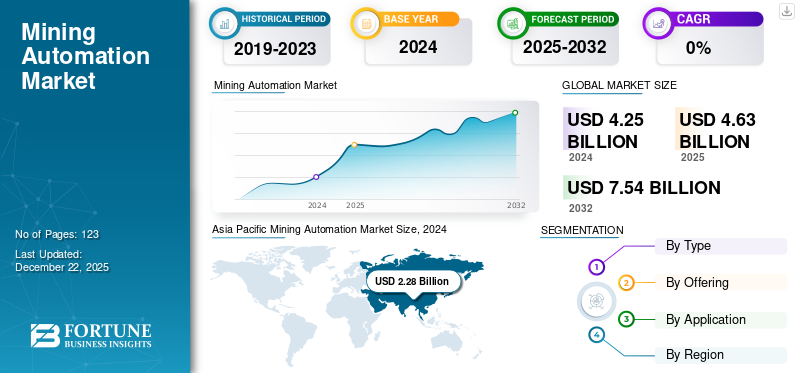

The global mining automation market size was valued at USD 4.63 billion in 2025. The market is projected to grow from USD 5.02 billion in 2026 to USD 8.41 billion by 2034, exhibiting a CAGR of 6.66% during the forecast period. Asia Pacific dominated the global market with a share of 54.35% in 2025.

The mining sector is experiencing a major transition toward digital transformation, utilizing technologies such as Artificial Intelligence (AI), machine learning, robotics, and the Internet of Things (IoT) to optimize operations. These technologies enhance safety, boost efficiency, and minimize environmental impact. Automation technologies, including self-driving vehicles and intelligent connected mines, allow mining activities to operate continuously with little downtime. This results in increased productivity and lower operational expenses. Increasing demand for mineral exploration and global shift toward digital transformation and smart mines are anticipated to drive market growth. Mining automation significantly enhances mineral exploration by improving efficiency, safety, and data analysis. Automation allows for remote operation of drilling rigs, enabling access to hazardous areas and reducing human risk, while also increasing productivity through 24/7 operation and optimized routes.

Caterpillar is one of the leading market players, has created sophisticated automation solutions such as Cat MineStar Command, allowing for autonomous operations, fleet management, and real-time decision-making. It provides the capability to automate specific processes or complete fleets. Sandvik is focused on automation systems for drilling, loading, and hauling. Its emphasis on productivity and sustainability positions it as a leader in mining automation solutions.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Mineral Exploration to Drive Market Growth

The rising need for mineral exploration is a significant factor contributing to the global mining automation market growth. This need arises from the global transition to clean energy technologies, which highly depend on essential minerals such as lithium, cobalt, and nickel. The need for "green" minerals has surged due to their importance in renewable energy infrastructure. Lithium, cobalt, and nickel have experienced substantial exploration growth as they are crucial for batteries and clean energy systems. Automation technologies boost operational efficiency by decreasing downtime and enhancing resource extraction processes. They also increase safety by eliminating workers from dangerous environments and allowing real-time surveillance of mining activities.

In September 2024, Caterpillar launched the Cat Dynamic Energy Transfer (DET) system, which is focused on enhancing efficiency and sustainability in mining. The system delivers energy to both diesel-electric and battery-electric mining trucks during operation, and is capable of charging machine batteries during motion, minimizing downtime and boosting performance.

Global Shift Toward Digital Transformation and Smart Mines to Drive Market Growth

The incorporation of technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), blockchain, and sophisticated sensors is improving mining procedures and significantly contributing to the expansion of the market during the forecast period. Linked mines and immediate data analysis are boosting operational effectiveness and lowering expenses. Self-driving vehicles, robotics, and AI-driven predictive models are changing the exploration and extraction processes.

In September 2021, Hexagon’s Mining Division and Liebherr revealed at MINExpo in Las Vegas a worldwide framework agreement that propels the upcoming generation of mine automation. Hexagon technology, featuring its autonomous mission management system, will be utilized in the mine automation solutions provided by Liebherr to clients.

MARKET RESTRAINTS

High Cost and Capital Investment to Restrain Market Growth

Implementing automation systems needs considerable initial expenses, which encompass acquiring specialized equipment, software, and infrastructure, along with training staff. This can be difficult for smaller mining operations or those with constrained financial resources. Beyond the initial expenses, there are ongoing costs for upkeep, updates, labor, and ensuring compatibility with current infrastructure. These expenses put pressure on budgets, particularly if the return on investment is not immediate or evident.

The operation and upkeep of automated systems necessitate a skilled labor force, which is expensive to train or recruit. The absence of skilled workers in certain areas makes implementing automation technologies more challenging.

MARKET OPPORTUNITIES

Increasing Significance of Smart Connected Mines Provides a Lucrative Opportunity for Market Growth

Intelligent mines employ self-driving transport systems, anticipatory maintenance, and continuous monitoring to enhance operations and decrease downtime. AI-powered analytics facilitate the anticipation of equipment malfunctions, boosting productivity and lowering expenses.

In November 2024, Hexagon revealed the purchase of Indurad, a worldwide frontrunner in radar and Real-Time Location Systems (RTLS) technologies, together with its autonomous haulage branch, xtonomy. This strategic decision highlights Hexagon’s dedication to enhancing mine productivity, safety, and autonomy using cutting-edge technology.

Intelligent mining technologies, including self-driving haulage systems, predictive upkeep, and instant monitoring, greatly enhance operational efficiency and productivity. These systems employ IoT, AI, and cloud-based solutions to maximize resource utilization, minimize downtime, and simplify processes.

MARKET CHALLENGES

Regulatory and Social Pressure to Hamper Market Growth

The mining sector functions under stringent and frequently changing regulations, which pose different challenges for companies in maintaining compliance while introducing new automation technologies. Regulatory structures must be modified to facilitate the incorporation of autonomous systems gradually.

Stricter environmental laws and regulations restrict the utilization of specific technologies and raise operational expenses for mining firms. This could deter investment in automation if the regulatory landscape is not favorable. As mining activities become more digitized, there is an increasing demand for strong cybersecurity measures to safeguard sensitive operational information. Regulatory frameworks must effectively tackle these issues.

MINING AUTOMATION MARKET TRENDS

Rising Focus on Worker Safety to Drive Mining Automation Market Growth

Mining automation minimizes human exposure to dangerous situations such as cave-ins, gas explosions, and machinery mishaps by utilizing remote-controlled equipment and autonomous machines. This enhances worker safety, making it an essential element in the implementation of automation technologies.

Governments and health organizations stress on providing a secure working environment in mines. Obtaining licenses for large-scale mining activities typically necessitates showing enhanced safety standards, which automation aids by reducing dangers linked to manual labor.

IMPACT OF COVID-19

The requirement for physical distancing during COVID-19 has brought attention to the advantages of remote mining operations. Firms such as Rio Tinto and Fortescue Metals have adopted automated processes that are monitored by remote operations centers, which are situated more than 1,000 km away from the actual mining locations.

Fully automated mines, such as Resolute Mining's Syama gold mine located in Mali, have successfully maintained production rates that meet expectations even amidst the pandemic, showcasing the durability of automated processes.

The mining automation market is currently emphasizing technological competence, analytical reasoning, innovation, and adaptability among its employees. This change is generating fresh employment prospects while gradually eliminating conventional positions. Mining firms are expected to focus on technologies that improve operational resilience in response to future disruptions, resulting in a broader acceptance of autonomous systems and remote operation functionalities.

SEGMENTATION ANALYSIS

By Type

Innovations In IoT, AI, Robotics, and Communication Technologies Led to Dominance of Underground Mining Automation Segment

By type, the market is segmented into underground mining automation and surface mining automation.

Among these, underground mining automation accounted for the highest market size, and is estimated to show the fastest growth during the forecast period. Underground mining is intrinsically dangerous, with hazards including inadequate ventilation, exposure to toxic gases, and collapses. Automation in this mining type reduces human interaction with hazards by using remote-controlled and autonomous machinery, thus improving worker safety. As surface ore deposits are exhaust, mining activities venture deeper, where circumstances are more difficult. Automation offers effective methods for functioning in these conditions, guaranteeing productivity while tackling safety issues. Innovations in IoT, AI, robotics, and communication technologies have made underground automation more practical. These developments facilitate accurate ore extraction, real-time surveillance, and predictive upkeep, which are essential for functioning in difficult underground conditions.

The surface mining segment led the market accounting for 69.34% market share in 2026. Surface mining automation is the second dominating segment in the market. Automation in surface mining improves operational efficiency by minimizing human error and streamlining processes such as drilling, digging, loading, and hauling. Autonomous machinery, including trucks and drill rigs, guarantees uniform productivity while decreasing downtime.

By Offering

Software Segment to Dominate Market Growth Owing to Its Increased Use For Safety Management And Environmental Monitoring

By offering, the market is classified into equipment, software, and communication. Equipment segment dominated the market with a value of USD 3.22 billion in 2026. Equipment is sub-segmented into autonomous hauling, autonomous drilling rigs, underground load haul dump (LHD) holders, and others. Software is sub-segmented into workforce management systems, fleet management systems, mine design and planning software, data management software, and air quality detection software. Communication is sub-segmented into wireless mining mesh network, navigation system, and cybersecurity solutions.

Among these, software is the fastest-growing segment in the market. The extensive adoption of Industry 4.0 concepts and the Industrial Internet of Things (IIoT) has increased the demand for automation software. These technologies depend on sophisticated software solutions for real-time data assessment, connectivity, and remote surveillance, facilitating more intelligent and efficient operations.

Equipment is the dominating segment in the market. Mining machinery, including autonomous haul trucks, drilling rigs, LHD loaders, and tunneling machines, is progressively integrating advanced technologies such as machine learning, robotics, IoT, and AI. These advancements improve operational effectiveness, optimize fuel usage, and minimize waste, making them highly attractive for mining firms.

By Application

To know how our report can help streamline your business, Speak to Analyst

Increased Mineral Exploration Activities Due to Industrialization and Population Growth Drive Need for Efficient Mining Operations

By application, the market is segmented into mining operations, mine maintenance, and mine development.

Mining operations segment is the dominating segment with a market size of USD 2.25 billion in 2026, capturing 44.86% of the global market share. The rising need for minerals across different sectors propels the implementation of automation technologies to boost efficiency, reduce downtime, and optimize resource utilization. Automation in mineral extraction enhances safety by lowering worker exposure to dangerous environments and improving operational efficiency by simplifying processes such as drilling and ore processing.

Mine maintenance is the second dominating segment in the mining automation market. The combination of AI and machine learning enables predictive maintenance, which is crucial for minimizing downtime and prolonging the lifespan of mining machinery. By evaluating real-time information from sensors, possible malfunctions are detected and resolved prior to their occurrence, lowering maintenance expenses and enhancing operational efficiency.

MINING AUTOMATION MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Increasing Demand for Rare Earth Metals for EVs to Drive North American Market Growth

North America is anticipated to observe growth during the forecast period. The increasing demand for rare earth metals, lithium, copper, and various materials vital for electric vehicles (EVs), renewable energy technologies, and electronics is fueling the mining operations in North America. This requirement has resulted in heightened investments in sophisticated machinery to enhance extraction efficiency and satisfy the service demands. Innovations such as self-driving trucks, drones for exploration, AI-powered systems, and IoT-connected sensors are revolutionizing mining activities by maximizing resource utilization, improving efficiency, and allowing for predictive upkeep across the region.

In November 2021, Newmont Corporation, the largest gold mining firm globally, revealed a strategic partnership with Caterpillar Inc. (CAT), manufacturer of the most extensive range of mining equipment and technologies available worldwide, to provide a fully integrated, automated, zero carbon-emitting, comprehensive mining system. In unison, they aimed to work together to develop a safer, more efficient mine and significantly assist Newmont in achieving their 2030 greenhouse gas (GHG) emissions reduction objectives of over 30%, with an ultimate aim of achieving net-zero carbon by 2050.

U.S.

Increasing Investments in Innovative Technologies Drives Growth in the U.S.

The U.S. is anticipated to dominate market share in North America. In the U.S., the market is primarily driven by the need for increased operational efficiency, cost reduction, and improved safety standards. The adoption of advanced technologies such as autonomous trucks, drones, and robotic systems streamlines operations, boosts productivity, and ensures compliance with environmental regulations. Government investments in technological innovation and the expansion of mining projects.

Companies are making significant investments in automation to stay competitive. Partnerships between mining companies and technology firms are facilitating the implementation of innovative solutions such as connected mines and fleet management systems.

In September 2024, Epiroc commemorated the official inauguration of its Surface Mining Automation Center (SMAC) in Providence, Utah. This new establishment is devoted to the prior ASI Mining team, after Epiroc’s acquisition. It signifies a substantial investment in creating OEM-agnostic autonomous haulage solutions for the mining sector. The official inauguration featured a ribbon-cutting ceremony, guided tours, and presentations of cutting-edge automation technologies, demonstrating how these advancements will improve safety, efficiency, and sustainability in surface mining operations.

Europe

Strong Focus on Enhancing Worker Safety is Expected to Continue Driving Market in Europe

The market for mining automation in Europe is anticipated to grow gradually over the coming years. Autonomous mining vehicles, electric-driven equipment, and live surveillance systems are some of the innovations transforming the industry landscape in Europe. These advancements not only enhance efficiency but also enable operators to adhere to progressively stringent regulations and lower their carbon footprint. The shift toward eco-friendly mining methods, along with the rise in digital technologies, has been a pivotal factor for the market growth across Europe. The UK market is projected to reach USD 0.02 billion by 2026, while the Germany market is projected to reach USD 0.04 billion by 2026.

Worker safety is an essential element influencing the uptake of mining automation in Europe. Specifically, underground mining presents considerable hazards owing to poor ventilation, exposure to dangerous gases, and various adverse health consequences. By adopting automated mining technologies, firms can remove or lessen these risks, aiding in the expansion of the market across the region.

In September 2024, Becker Mining Systems and alwaysAI joined forces to introduce Vision AI technology into the mining sector, improving safety, productivity, and efficiency. The partnership provides real-time monitoring solutions for equipment tracking, PPE compliance, and restricted area surveillance, reducing risks and operational downtime.

Asia Pacific

Asia Pacific Mining Automation Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Rapid Industrial Growth and Urban Expansion in Asia Pacific Countries to Drive Demand

Asia Pacific holds the dominating mining automation market share as the mining firms in the area are implementing advanced automation technologies such as Autonomous Haul Systems (AHS), Automated Drilling Systems (ADS), and real-time asset monitoring to improve productivity and safety while minimizing operational expenses.

Rapid industrial growth and urban expansion in China, India, Indonesia, and South Korea are fueling the need for minerals and metals required for construction, automotive, electronics, and renewable energy industries. The growth of the middle-class demographic with higher disposable income is generating chances for market participants to enlarge their customer base.

In August 2022, Hitachi Rail and Rio Tinto celebrated another important milestone for AutoHaul with the launch of the autonomous rail transport system for the new Gudai-Darri iron ore mine located in Western Australia’s Pilbara. The development of the greenfield mine has included the building of a 166-kilometre rail division that links the new mine to Rio Tinto’s established AutoHaul rail network in the area.

China

Rapid Industrialization and Infrastructure Development to Drive China’s Market Growth

China is anticipated to dominate the mining automation market in Asia Pacific. Automation aids in reducing the workforce underground, consequently lowering the risk of accidents. China's coal mines have long faced safety challenges, resulting in a considerable number of deaths annually. Technologies such as 5G networks and sensors facilitate real-time observation of mine conditions, including air quality and structural integrity, and additionally improve safety. The China market is projected to reach USD 1.37 billion by 2026, while the India market is projected to reach USD 0.34 billion by 2026.

Automated systems are capable of functioning nonstop without interruptions, resulting in greater coal production. For instance, the Xiaobaodang mine has realized notable improvements in coal extraction efficiency.

Latin America

Combination of Economic Necessity, Government Support, and Sustainability Efforts to Lead Market Growth

Mining plays a significant role in the economy of the region, producing income and job prospects. Brazil, Chile, Peru, and Mexico are at the forefront of mineral production, raising the need for effective technologies.

The push for mining automation in Latin America stems mainly from the area's abundant mineral resources and the necessity to enhance operational efficiency and safety. Aspects such as plentiful mineral reserves, advancements in technology, more stringent environmental regulations, and government initiatives are contributing to the development of the market in the region. Furthermore, the growing demand for sustainable mining practices and the ongoing digital transformation of operations are also significant factors driving this trend.

In May 2024, Sandvik obtained an order from Codelco, the largest copper producer globally, to provide an AutoMine load and haul automation system for the new Andesita project at the El Teniente mine located in Chile. This order is worth around USD million and was recorded in the first quarter of 2024.

As part of the new agreement, which comes after several orders for automation solutions from Codelco in 2023, Sandvik will install an advanced automation system and supply a new automated Toro LH621i loader during 2024.

Middle East & Africa

Presence of Abundant Mineral Deposits to Fuel Market Growth

The Middle East, especially Saudi Arabia and the UAE, is working to diversify its economies and lessen the reliance on oil & gas. This involves investing in areas such as mining to generate employment and promote economic expansion. Africa, possessing extensive mineral resources, is also concentrating on enhancing its mining industry to promote economic growth.

The market in the Middle East is primarily driven by the need to improve operational efficiency, and tackle labor shortages, especially in isolated or dangerous mining locations. Mining Automation is being utilized to enhance resource extraction, reduce environmental effects, and manage expenses effectively.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Unveiling Advanced Equipment for Enhanced Performance to Drive Market Growth for Caterpillar

The global market is mostly fragmented, with key players such as Caterpillar Inc., Komatsu, Rockwell Automation, and Sandvik AB, among others. Globally, Caterpillar Inc. is dominating the market due to the launch of various automation equipment and other autonomous solutions. In September 2024, Caterpillar Inc. introduced a novel solution to aid in charging battery electric trucks, the Cat Automated Energy Transfer System (Cat AETS). The firm effectively showcased this innovative technology for clients at its Tucson Proving Ground located in Green Valley, Arizona.

Rockwell Automation provides comprehensive automation and digital transformation solutions for the mining industry, focusing on improving operational efficiency, safety, and sustainability. Their offerings include solutions for various aspects of mining, from extraction and mineral processing to mine-to-market integration and digital transformation.

List of Key Mining Automation Companies Profiled

- Caterpillar Inc. (U.S.)

- Komatsu (Japan)

- Sandvik AB (Sweden)

- Epiroc (Sweden)

- Hitachi Construction Machinery Co., Ltd (Japan)

- Hexagon AB (Sweden)

- Trimble Geospatial (U.S.)

- Rockwell Automation (U.S.)

- AVEVA (U.K.)

- Rio Tinto (U.K.)

- Atlas Copco (Sweden)

- Liebherr (Switzerland)

- MST Global (Australia)

- RPMGlobal (Australia)

- FANUC (Japan)

- Worley (Australia)

KEY INDUSTRY DEVELOPMENTS

- In April 2025, The Weir Group PLC acquired Mining Software Holdings Pty – Micromine, a software provider to the mining sector offering extensive solutions throughout the upstream mining value chain. Some of these solutions include exploration, mine design and planning, operational scheduling, and mining activities in hard ore, soft ore, and underground applications.

- In December 2024, Trimble and GroundProbe, a division of Orica Digital Solutions that focuses on real-time solutions for assessing and observing geohazards, revealed a new partnership. Rather than relying on multiple suppliers for insights into technology solutions, this collaborative endeavor will allow geotechnical mine monitoring clients to acquire a complete slope stability monitoring suite from one central source.

- In September 2024, FLSmidth and AVEVA, a worldwide frontrunner in industrial software promoting digital transformation and sustainability, established a global alliance to provide state-of-the-art digitally enabled solutions and services to the mining sector. The union will speed up the digitalisation of mining activities and enable miners to enjoy enhanced performance and productivity on a global scale.

- In July 2023, Sweden-based multinational technology firm Hexagon AB reportedly took over HARD-LINE, a prominent player in mine automation, teleoperation, remote control technology, and mine product optimization. This acquisition is intended to improve Hexagon’s life-of-mine technology stack, thereby minimizing the necessity for human involvement in hazardous mining environments.

- In June 2022, Komatsu Ltd, via its fully owned subsidiary in Australia, consented to purchase Mine Site Technologies Pty Ltd, a supplier of operational optimization platforms for underground mining that utilize communication devices and position tracking systems. The agreement, intended to finalize the completion of all essential closing procedures, will enable both companies to assist customers in creating digital ecosystems with real-time insights and alerts, voice and communication technologies, software solutions, solid network infrastructure, as well as wireless and geospatial technologies.

INVESTMENT ANALYSIS AND OPPORTUNITIES

- In November 2024, KSB GIW, Inc. is a leading manufacturer of slurry pumps and related technologies for the mining industry, with a strong focus on automation and IIoT solutions. They offer a range of pumps designed for harsh mining conditions and are actively developing technologies like GIW® SLYsight and GIW® RAMSL to improve pump monitoring, maintenance, and overall operational efficiency. KSB GIW Inc. will conduct a groundbreaking ceremony for an advanced IoT and automation laboratory in Grovetown, Georgia, USA, aimed at fostering innovation in mining technology. KSB GIW’s funding for the new laboratory represents a commitment to its customers. The company is dedicated to assisting clients in reaching their goals, with a primary focus on the digital transformation of their complete mining process. This laboratory will serve as a hub for developing technologies that realize this vision.

REPORT COVERAGE

The global mining automation market research report delivers a detailed insight into the market. It focuses on key aspects such as leading companies and their operations offering asset integrity management solutions. Besides, the report offers insights into market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.66% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Offering

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 5.02 billion in 2026.

The market is likely to grow at a CAGR of 6.66% over the forecast period (2026-2035).

Mining operations segment is expected to lead the market in the forecast period.

The market size of Asia Pacific stood at USD 2.52 billion in 2025.

Increasing demand for mineral exploration to driving the market

Komatsu, Sandvik, Hexagon AB, and Liebherr are some of the market's top players.

The global market size is expected to reach USD 8.41billion by 2034.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us