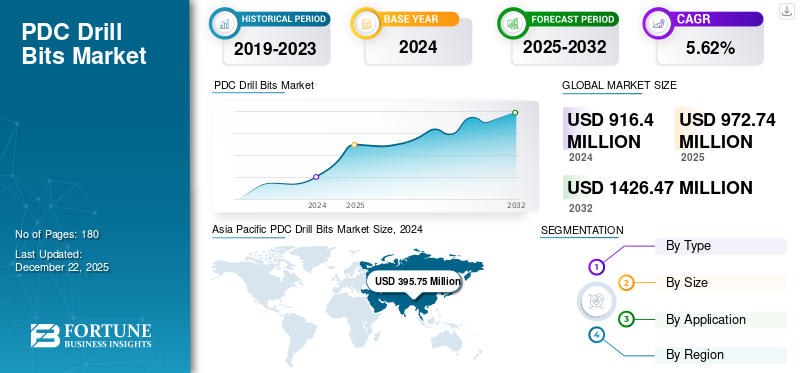

PDC Drill Bits Market Size, Share & Industry Analysis, By Type (Rotary Bit, DTH Hammer Bit, and Others), By Size (Below 8 inches, 8 inches to 11 inches, and Above 11 inches), By Application (Surface Mining and Underground Mining), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global PDC drill bits market size was valued at USD 972.74 million in 2025. The market is expected to grow from USD 1,032.21 million in 2026 to USD 1,554.25 million by 2034, exhibiting a CAGR of 5.25% during the forecast period. Asia Pacific dominated the global market with a share of 43.77% in 2025.

PDC drill bits, also known as polycrystalline diamond compact bits, are specialized drilling equipment that uses synthetic diamond cutters for effective and durable drilling and mining operations, particularly in hard and abrasive rock formations. They are categorized by their fixed-head design, depicting that the bit rotates as a single unit, and they feature Polycrystalline Diamond Compact (PDC) drill bit cutters instead of roller cones to drill and mine.

They are basically used in drilling and mining operations. It delivers multiple benefits, such as effective drilling speed, bottom hole safety, long service life, and heavy rock formations. The growing trend for exploration activities in onshore and offshore will drive the market growth during the forecast years.

The market is experiencing growth, driven by increasing oil and gas drilling activities and the need for faster, more efficient drilling techniques. Schlumberger is a major player in the market, alongside Baker Hughes and Sandvik AB.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Investments in Oil & Gas Exploration to Drive the Market Growth

The strong growth in oil & shale gas exploration in recent years created a demand for drilling operations. Many regions such as North America and Middle East are considered the hub owing to the rapid investment in oil & gas activities. North America is expected to have the highest production rate for crude oil from offshore resources, followed by Russia and Saudi Arabia. Furthermore, many countries across the globe are investing in finding new resources for the oil & gas sector. For instance, on April 14, 2021, GOM announced two new crude oil production projects, which accounted for 200,000 barrels per day, 12% of the total oil production in the Gulf of Mexico. This large project of crude oil production has projected the growth of crude oil production in the U.S. Federal Gulf of Mexico (GOM). Such operations are directly influencing the growth of drilling components including PDC drill bits globally.

MARKET RESTRAINTS

Fluctuations in the Oil & Gas Prices to Negatively Impact the Mining Projects

The oil & gas sector is unpredictable owing to the global variation in the prices of oil & gas. This impacts the mining projects that are taking place or about to initiate. The instability of demand and supply globally can pull the market down; hence, the drilling equipment, such as drill bits, can negatively impact the company’s revenue. Moreover, crude oil prices in the international market continuously fluctuate due to socio-political scenarios and economic slowdown. Additionally, the oil crisis due to the Russia-Ukraine war crumbled the investment in the oil and gas industry demand. This is restraining the PDC drill bits market growth globally.

MARKET OPPORTUNITIES

Advancement in the PDC Drill Design to Create New Opportunities for Businesses

In recent years, technological advancements have taken place in industrial equipment, including drilling components. Revolutions in drill bits, such as polycrystalline diamond compact (PDC) and hybrid bits, have enhanced the productivity of drilling processes, thus boosting the product demand. Moreover, other innovative drill bits, such as rotary steerable systems (RSS), aid in enabling precise control of the drilling path and are useful in offshore and deep wells, unlike others. Such innovation is influencing the global PDC drill bit market expansion.

PDC DRILL BITS MARKET TRENDS

Growth in Unconventional Drilling Activities to Support Market Growth

PDC (Polycrystalline Diamond Compact) drill bits are experiencing significant growth due to the expansion of unconventional drilling activities, particularly in oil and gas exploration. Their superior durability, higher rate of penetration (ROP), and cost-effectiveness compared to traditional roller-cone bits make them ideal for drilling through the challenging formations encountered in shale and tight oil reservoirs.

The increasing global demand for energy, coupled with advancements in drilling technologies like hydraulic fracturing, has fueled the growth of unconventional oil and gas resources. PDC bits are well-suited for drilling through the hard, abrasive, and often interbedded formations found in shale and tight oil plays.

SEGMENTATION ANALYSIS

By Type

Rotary Bits Segment Is Expected To Dominate Owing to Demand in Mining Sectors

The market by type is broadly categorized into rotary bit, DTH hammer bit, and others. The rotary bit segment is further classified into fixed cutter bits and roller cone bits.

Considering the global demand, rotary bits dominated the PDC drill bits market owing to their wide application in mining operations. Moreover, advancements in oil and gas extraction have also driven the rotary bits in recent years.

DTH hammer bits are the fastest-growing segment owing to the need for efficient drilling solutions in diverse industrial applications. They are also widely used in the hard rock formation efficiency, delivering a high penetration rate to the activity.

By Size

8 to 11 inches Segment Dominated the Market Owing to Their Extensive Use in Exploration Mining

The global market by size covers below 8 inches, 8 inches to 11 inches, and above 11 inches.

8 inches to 11 inches dominated the market owing to the growing production, drilling, and heavy use in oil and gas exploration and production activities. This size range is commonly used for a variety of applications, including oil and gas wells, geothermal projects, and mining.

Larger bits (above 11 inches) are the fastest-growing segment owing to their use in production drilling at greater depths. Deep drilling and mining operations have influenced the larger bits in recent years. PDC bits are crucial for drilling through hard rock formations encountered in many mining operations, including those for resource extraction and underground development.

The below 8 inches are not used daily in the operation as they are applicable to small mining and drilling activities. These smaller bits are favored for precision drilling in tight spaces and complex geological formations, commonly found in mineral exploration, smaller extraction projects, etc.

By Application

Heavy Investment in Mining Sector to Boost Surface Mining Segment Growth

The global market covers surface mining and underground mining.

Surface mining is anticipated to dominate the global PDC drill bits market share in the forecast years, owing to the heavy investment in the sector. For instance, as per the data by the ESFC Investment group, industrial information stated that investment projects in the surface mining industry accounted for more than 13 thousand in 2020. All these 13 thousand projects are valued at around USD 1.2 trillion.

Underground mining is the fastest-growing segment, driven by the growing operation of deep and ultra-deep mining projects in recent years.

PDC DRILL BITS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific PDC Drill Bits Market Size, 2024 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

North America is one of the fastest-growing regions owing to the major availability of companies with a wide portfolio of products and services. In addition, these businesses are pushing the drilling and mining operations with the influence of advancements.

U.S. is the dominating country in North America, owing to the massive adoption of technology in the country. Moreover, the government's focus on the expansion of oil & gas operations in the country will boost the mining and drilling markets in the forecast years. In January 2025, U.S. President Donald Trump’s order to executive new oil & gas production and baseload generation to reduce dependency on other countries boosts the economy in new ways.

Europe

Europe is consistently influencing the drilling and mining operations owing to the availability of oil & gas production sites in major countries. Europe is home to large resources for oil & gas production and hence ruling the market dynamics. Countries including Russia, Ukraine, and the U.K. are actively responsible for the majority of the mining operations in the region. In March 2025, Ukraine’s president Zelensky stated that their government is ready to sign a “Minerals Deal” between Ukraine and the U.S. despite all geopolitics challenges in Europe. This deal will benefit the U.S. to drill and mine Ukraine's specific areas for the extraction of minerals.

Asia Pacific

Asia Pacific dominated the market with a valuation of USD 425.73 billion in 2025 and USD 457.70 billion in 2026. The Asia Pacific is leading the market due to the presence of minerals and metals resources in the majority of the countries. Hence, it dominates the global market. Rise in power generation by fossil fuel and use of raw materials in industries to drive the demand for mining drill bits across the Asia Pacific. Moreover, businesses' collaboration to deliver self-assured progress to the economy through drilling activities is influencing the market growth. For instance, in March 2025, Rock Solutions and Sandvik Mining announced their plans to provide another fleet of productive underground drills and related equipment to a mine in Southeast Asia.

Latin America

Latin America holds an ample share of the global market. It can create new opportunities in the market owing to the availability of mineral sites in the region. New investments in drilling and mining projects are needed to boost the market in the region. For instance, in September 2024, Vale, a mining company, publicized that it had begun the commissioning of wet processing processes in the Vargem Grande 1 Project, with the capability to continue around 15 million tpy of iron ore making at the Vargem Grande complex in Minas Gerais.

Middle East & Africa

The Middle East & Africa demonstrated high growth owing to the exploration of the oil & gas operations in the region. Countries such as Saudi Arabia, UAE, Kuwait, and Oman are heavily investing in new projects that are associated with mining and drilling. This factor is highly influencing the market growth, as per the data of the IEA, the Middle East invested around USD 134 billion in fossil fuel supply for the year 2023 to secure the energy demand in the region. Moreover, clean energy investment in the GCC countries is growing, but the leftovers are being overshadowed by the region’s traditional role as a provider of oil and gas.

COMPETITIVE LANDSCAPE

Key Industry Players

Advancements in Operations and Partnership Strategies by Market Players to Boost Market Growth

The market is experiencing strong growth driven by advancements in drilling technologies and strategic partnerships among the key industry players. Companies are focusing on developing premium synthetic diamonds, nano-coated cutters, and hybrid matrix materials to improve bit longevity and cutting efficiency. Also, the popularity of premium synthetic diamonds, hybrid matrix materials, nano-coated cutters is growing rapidly. For instance, in February 2024, Fervo Energy stated early drilling results from its Cape Station geothermal project. The company has completed the project by saving around 70% in drilling time compared with the actual planned period.

List of Key PDC Drill Bits Companies Profiled

- Schlumberger (U.S.)

- Halliburton (U.S.)

- MICON Drilling GmbH (Germany)

- Robit Plc (Finland)

- Rockmore International (U.S.)

- Sandvik AB (Sweden)

- KING SML (China)

- Western Drilling Tools (Canada)

- Boart Longyear (U.S.)

- Glinik Drilling Tools (Poland)

- Atlas Caopco (Sweden)

- Mitsubishi Materials Corporation (Japan)

KEY INDUSTRY DEVELOPMENTS

- In November 2024, Boliden AB- a Swedish mining operator- is planning to acquire two key European mines from Lundin Mining Corp. The strategic acquisition of the two mines will create new opportunities for businesses as the mining will be focused on Zinc production.

- In March 2024, TAQA, a well solutions provider, is launching its marketable launch of Threlix, a patented technology intended to help oil and gas operators decrease drilling rig downtime by easing downhole drilling dysfunctions associated with torsional oscillations, vibration, and lack of consistent bit engagement.

- In August 2023, Patterson-UTI Energy, Inc., provider of drilling and completions services in the U.S., acquired Ulterra Drilling Technologies, L.P., a global provider of specialized drill bit solutions in a total consideration on a cash-free, debt-free basis, included $370 million of cash and 34.9 million shares of Patterson-UTI common stock.

- In July 2022, Halliburton introduced the advanced Hedron product portfolio of fixed-cutter polycrystalline diamond compact (PDC) drill bits. These drill bits cover advanced technology with an industry-leading custom-made process to deliver high-performance, application-specific designs for end-users.

- In October 2020, Halliburton introduced the Crush & Shear Hybrid Drill Bit, an advanced technology that combines the efficiency of polycrystalline diamond compact (PDC) cutters with the torque-reducing abilities of rolling elements to upsurge drilling effectiveness and enhance bit stability through changing formations.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service process, competitive landscape, and leading source of the drilling and mining components. Besides, the report offers insights into the drill bits market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.25% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type

|

|

By Size

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 972.74 million in 2025.

In 2025, the market value stood at USD 166.42 million.

The market is expected to exhibit a CAGR of 5.25% during the forecast period.

The surface mining application was leading the market.

Investments in oil & gas exploration to drive the market growth.

Some of the top major players in the market are Schlumberger, Halliburton, and MICON Drilling GmbH.

Asia Pacific is anticipated to dominate the market share in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us