Power Tools Market Size, Share & Industry Analysis, By Mode of Operation (Electric, Pneumatic, and Others (Hydraulic)), By Tool Type (Drilling & Fastening Tools, Material Removal Tools, Sawing and Cutting tools, Demolition Tools, and Others (Routing Tools)), By Application (Do-It-Yourself (DIY) and Industrial), and Regional Forecast, 2026 – 2034

POWER TOOLS MARKET SIZE AND FUTURE OUTLOOK

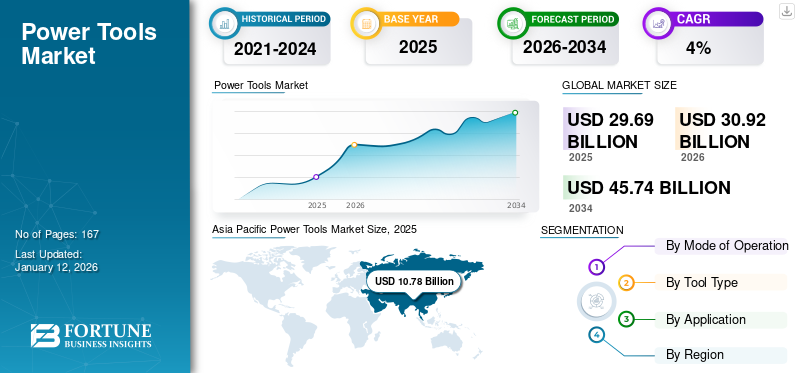

The global power tools market size was valued at USD 29.69 billion in 2025 and is projected to grow from USD 30.92 billion in 2026 to USD 45.74 billion by 2034, exhibiting a CAGR of 5.0% during the forecast period. The Asia Pacific dominated global market with a share of 7.04% in 2025.

Rising investment in residential and commercial infrastructure buildings and rising sales of new homes across the globe are raising the demand for power tools. The increasing penetration of cordless tools and battery-enabled tools, coupled with the integration of Internet of Things (IoT) technology, is further accelerating the growth of the market. The global market is expected to grow significantly, owing to the increasing adoption of cordless equipment, which will increase operating hours. However, factors such as high costs, maintenance of moving parts, and fluctuations in raw material prices may hamper the market's growth. To address these challenges, several companies are working continuously on developing products that require low maintenance and can provide multi-purpose operations at lower prices.

Global key players in market are actively competing in the global market with huge investments on research and development to make the product even more lighter and ergonomically compliant to work force to reduce physical strain. Players like Bosch and Makita are focusing on expanding their customer retention through new products development which are affordable and ergonomically designed creating a healthy competitive ecosystem for peer competitors.

Impact Of Reciprocal Tariffs

Volatile Market Dynamics and Disturbed Trades Due to Tariffs are Restructuring the Market

Due to the trade war, many manufacturers experience additional risks, such as decreased foreign demand, research and development investment, and thereby fueling the need for a resilient supply chain. The various industries that impact the power tool market, such as automotive, aerospace, shipbuilding, energy, and construction were drastically affected by the outbreak of COVID-19. Further, the impact of tariffs on power tools is a major reason for the market restructuring. Power tools manufacturers are focusing on identifying new markets and increasing their presence in existing markets, supporting the merger and acquisition strategies of major manufacturers globally. The reciprocal tariffs' impact is very high in the short term, as it would delay order proceedings, and in the long term, it would create a price pressure on the end user, creating difficulties for the market.

- For instance, in April 2025, Stanley Black & Decker, a prominent power tools manufacturer, said that they were raising their prices and shifting their supply chain in response to the Trump administration’s tariffs. The prices will be raised in the second quarter of 2025 and further in the third quarter.

MARKET DYNAMICS

Download Free sample to learn more about this report.

Power Tools Market Trends

Advancements in Tool Technology Present New Trends in the Industry

Technological advancements in power tools, including the Internet of Things, wireless connectivity, and battery swapping, are enhancing operation in the power tool industry. These innovations provide users with access to top-tier features at competitive price. They improve convenience by enabling more efficient use of modern power tool, offering higher uptime as tools require less time for charging and deliver operational productivity. Additionally, manufacturers integrate advanced modes and features into their power tools, offering enhanced performance in various operations and flexibility to use the product in different configurations. These latest advancements are driving new market trends, with power tools becoming more advanced, that will expand power tools market share during the forecast period.

- For instance, in November 2024, Makita, a prominent professional tool manufacturer, announced a four-speed impact driver, 18 LXT. The new impact driver sets new standards with multiple speed sections and a wide range of applications powered by 18V lithium batteries that offer more working time.

Market Drivers

Embracing of Cordless Power Tools in Residential and Commercial Spaces to Fuel Market Growth

The market is experiencing dynamic growth owing to its extended battery life, portability, storage, and user-friendly features. Additionally, technological improvements and additions of technologies such as the Internet of Things, better connectivity, and sensors, are reshaping the equipment and tools industry. The adoption of automation and smart solutions across various end-use verticals, such as construction, automotive, and aerospace is widening. These industries are implementing smart manufacturing, where workflows, including assembly and production, are connected. In such a scenario, connected power tool categories are gaining impetus, allowing trained professionals to work smarter and faster in real-time. Thus, embracing these cordless tools is driving the global power tools market growth steadily in the long term.

- For instance, in October 2024, Makita Inc., a high-quality professional tool manufacturer, released a new 40V max XGT 9-inch power cutter designed to deliver more power and less vibration than previous models. The tool caters to masons, general contractors, hardscape contractors, fire and rescue professionals, and other industry professionals.

Market Restraints

Volatility in Raw Material Prices and High Upfront Investments is Hindering Market Growth

The demand for power tools is growing with the emergence of innovative, efficient, and easy-to-use equipment. Fluctuation in raw material availability is a major factor limiting market growth. Additionally, changes in trade policies, imbalances in the supply & demand ecosystem, fluctuations in foreign exchange rates, and heightened geopolitical risks across different geographies, create a potential impact on the pricing of these materials. Considering the power tool market, the raw material prices are experiencing high volatility owing to imbalances in supply & demand, dampened market sentiments, etc. All these factors could affect the pricing of the products in the near future, compelling the manufacturers to reduce the profit margins to sustain in the competitive environment. The cost of power tool ownership increases with increasing material costs, further limiting the power tool sales. Additionally, a lack of technological awareness amongst local users/operators leads to severe accidents at job sites, posing another barrier to market expansion.

Market Opportunities

Commercialization of Power Tool Rental is Creating New Revenue Streams

The market for renting power tool businesses is anticipated to flourish during the forecast period owing to the rising number of contractors hired across residential and commercial applications. These durable products are ideally used only sporadically for a defined period in the household segment, further fueling market growth. Additionally, the tools manufacturer or distributor can enhance customer value by offering training sessions, workshops, and Do-It-Yourself (DIY) resources as part of service contracts, which also serve as effective marketing strategies. Thus, commercialization and expansion of the power tool rental business will contribute to the power tools market in the long term.

- For instance, Tri Rent-ALL provides power tools on a rental basis, providing benefits, such as cost efficiency, no maintenance costs, no need for insurance, time savings, and discovering new products.

SEGMENTATION ANALYSIS

By Mode of Operation

Electric Segment Dominates owing to its Rising Adoption

Based on mode of operation, the market is categorized into electric, pneumatic, and hydraulic tools.

Among these, electric power tools, which include both cordless and corded tools, remain dominant and are anticipated to witness 60.93% of the market share in 2025 owing to high adoption among customers demanding high-power electric tools. Moreover, it has been observed that electric power tool have revolutionized the work culture in industries such as automotive and construction, as they save time and effort required for conducting various operations. According to The European Power Tool Association, the rechargeable battery industry beholds a heavy investment in research & development activities.

Hydraulic and others power tool segments are growing at a decent pace, with significant demand in construction and mining activities.

To know how our report can help streamline your business, Speak to Analyst

By Tool Type

Tool Type Segment Led due to Advancements in Drilling Technology

By tool, the market is divided into drilling & fastening tools, material removal tools, sawing and cutting tools, demolition tools, and others (routing tools).

Drilling and fastening tools segment accounted for the largest market share in 2024 attributed to advancements in drilling technology by power tools manufacturers. These advancements have enhanced characteristics such as resistance to unbalanced temperatures, high resistance to shocks and vibrations, and increased durability. The drilling and fastening tool segment will account for 34.51% of the market share in 2026.

Material removal tools, sawing and cutting tools, and demolition tools are expected to experience signififcant growth with a CAGR of 5.40% during 2025-2032 due to rising demand from residential and industrial spaces.

By Application

Industrial Segment Dominates the market due to Its Heavy Usage

By application, the market is categorized into the do-it-yourself and industrial categories.

The industrial application is dominating the market showcasing a significant share of 55.91% of the in 2026, owing to the growth of the industrial development, commercial manufacturing, and heavy usage of modernization tool. In the industrial sector, major manufacturers such as Robert Bosch GmbH and Stanley and Decker are majorly emphasizing on manufacturing power tools that are user-friendly. Moreover, rising demand from the automotive and construction industry fuels industrial segment growth.

The Do-it-yourself (DIY) segment is showcasing a robust CAGR of 5.21% during the forecast period, as residential and DIY enthusiasts are investing heavily on the home improvement tools and equipment. The trend is driven by the increasing spending capability and the increasing number of households across developed and developing countries. Furthermore, a broad spectrum of creative DIY enthusiasts focus on getting equipped with the necessary power tools, which has led players to focus on manufacturing tools that can be used across the DIY application.

POWER TOOLS MARKET REGIONAL OUTLOOK

The global power tools sector is segmented by region into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific Power Tools Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific

Asia Pacific is the dominant and fastest-growing region in the power tool sector, driven by rapid industrialization, infrastructure development, and urbanization. The region is projected to grow with potential growth during the forecast period, owing to rising demand from the construction and automotive sectors. The market in India will be valued at USD 2.26 billion, China at USD 5.85 billion, and Japan at USD 2.31 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North America ranks third in the market size with a value of USD 7.32 billion in 2026, with growth driven by factors such as infrastructure development and rising demand from the automotive and industrial sectors. However, the market is relatively mature and has limited development opportunities. Growth in this region is mainly due to product innovation from established players investing in versatile and compact power tools for diverse applications.The U.S. market value in 2026 accounts for USD 5.81 billion and shaped by the increasing demand for erogonomically designed and IoT wireless products. The growing adoption of wireless tools among the end users and DIY customers is supporting the growth.

Europe

Europe’s market value is expected to hit USD 8.56 billion in 2026, along with a CAGR of 4.34% and projected to grow with potential growth during the forecast period, owing to rising demand from the construction and automotive sectors. It has a robust presence of global and established regional players, contributing to a substantial market share and development potential. Europe’s focus on reducing carbon emissions is accelerating advancements in power monitoring and switching technologies within power tools. The convenience and appeal of DIY tools have also increased demand in the market. The market in U.K. will reach USD 1.7 billion, Germany at USD 2.16 billion, and Italy at USD 1.37 billion in 2025.

Middle East & Africa

Middle East and Africa region witnessed a sizable contraction in year-over-year market growth in 2020 and 2021, primarily due to pandemic-induced economic slowdowns and halted cross-border trade. However, the market will slowly regain as industrial activity resumes and global economic conditions stabilize. The Middle East & Africa market size in 2026 will hit USD 2.39 billion, along with GCC market at USD 1.46 billion in 2025.

Latin America

Latin America consists of Mexico, Brazil, and other countries in the region, has the slowest growth rate in the market. Despite this, prominent market players are actively working to expand their presence across the region, aiming to tap into its potential.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on New Product Launches to Boost Their Market Growth

Prominent power tools players across the globe are focused on product differentiation and new product launches to strengthen their market position. Major players are focusing on expanding the cordless product portfolio with advanced technology that enhances productivity in the workplace. Moreover, major tool manufacturers are investing in research and development to align with evolving lifestyles and the growing DIY culture. Hilti has implemented a strong research and development strategy to expand its product portfolio.

- For instance, In August 2023, Hilti Corporation introduced a new FX-3A cordless stud fusion system to reduce welding time. This fully automatic, cordless system, is used for drilling and fastening applications in the metal and manufacturing sector.

To know how our report can help streamline your business, Speak to Analyst

Robert Bosch GmbH, Stanley Black & Decker, Inc., Makita Corporation, Techtronic Industries Co., Ltd, Ingersoll Rand, Atlas Copco AB, Hilti Corporation, Koki Holdings Co. Ltd. Festo, Emerson Electric Co., and Enerpac Tool Group are among the prominent players in the global market. These key players hold a significant market share (78.3%), making the industry highly consolidated worldwide.

List of Key Power Tools Companies Profiled:

- Atlas Copco AB (Sweden)

- Emerson Electric Co. (U.S.)

- Enerpac Tool Group (U.S.)

- Hilti Corporation (Liechtenstein)

- Ingersoll Rand (U.S.)

- Koki Holdings Co. Ltd. (Japan)

- Makita Corporation (Japan)

- Robert Bosch GmBH (Germany)

- Stanley Black & Decker Inc. (U.S.)

- Tectronic Industries Co. Ltd. (China)

- DeWalt (U.S.)

- Hitachi Power Tools (Japan)

- Metabo (Germany)

- Festool (Germany)

- Chervon (China)

- Ryobi (Japan)

- Würth (Germany)

- Fein (Germany)

- Festool (Germany)

KEY INDUSTRY DEVELOPMENTS:

- October 2024: Bosch power tools introduced a range of new products to its existing 18V cordless tool lineup. The new tools include a palm router, angle grinder, new generation interior leveling layers, brand first-hand tool, and 18V press tool kits that offer ergonomic design, powerful brushless motor, and durability.

- September 2024: Milwaukee Tool introduced next-generation deep cuts and band saws that deliver better user-cutting performance. The new band saws cut 4-inch black iron pipes 20% faster than old ones.

- August 2024: Milwaukee Tool introduced next-generation grinders in the M18 series that provide corded-level performance with improved run time and enhanced ergonomics, optimizing them for cutting and grinding applications.

- June 2024: Milwaukee Tool expanded its MX Fuel lineup with a new MX Fuel High Cycle concrete vibrator. The new solution delivers the most powerful and improved performance, leveraging a power-state brushless motor that sustains 11,500 vibrations per minute in the stiffest concrete.

- June 2024: Milwaukee Tool introduced a new solution, the M18 overhead rotary hammer integrated with dust extraction optimized for ceiling drilling. The solution delivers the lightest weight and minimal fatigue while enhancing productivity and comfort during repetitive overhead drilling applications.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Industry players are scaling their global presence by expanding their associate sales network and partnering with regional and local distributors to better serve customers requiring high-precision equipment.

- For instance, in October 2022, Robert Bosch GmbH invested around USD 320.2 million to enhance the company’s product portfolio and supply chain. Additionally, the company plans to boost its appeal among its existing target audience.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.0% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

| Segmentation | By Mode of Operation, Tool Type, Application, and Region |

|

Segmentation |

By Mode of Operation

By Tool Type

By Application

By Region

|

|

Companies Profiled in the Report |

Atlas Copco AB (Sweden), Emerson Electric Co. (U.S.), Enerpac Tool Group (U.S.), Hilti Corporation (Liechtenstein), Ingersoll Rand (U.S.), Koki Holdings Co. Ltd. (Japan), Makita Corporation (Japan), Robert Bosch GmBH (Germany), Stanley Black & Decker Inc. (U.S.), and Techtronic Industries Co. Ltd. (China) |

Frequently Asked Questions

The market is projected to reach USD 45.74 billion by 2034.

In 2025, the market was valued at USD 29.69 billion.

The market is projected to grow at a CAGR of 5.0% during the forecast period.

By mode of operation, the electric segment leads the market.

Embracing cordless power tool in residential and commercial space are the key factor driving market growth.

Atlas Copco AB (Sweden), Emerson Electric Co. (U.S.), Enerpac Tool Group (U.S.), Hilti Corporation (Liechtenstein), Ingersoll Rand (U.S.), Koki Holdings Co. Ltd. (Japan), Makita Corporation (Japan), Robert Bosch GmBH (Germany), Stanley Black & Decker Inc. (U.S.), and Tectronic Industries Co. Ltd. (China) are the top players in the market.

Asia Pacific holds the dominant market position.

By application, the do-it-yourself segment is expected to grow with the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us