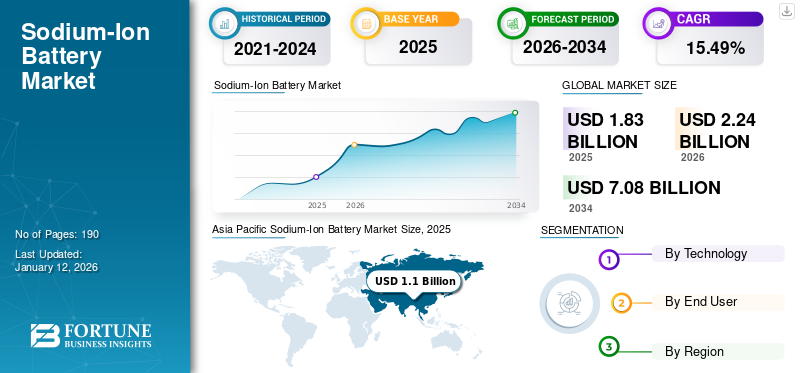

Sodium-Ion Battery Market Size, Share & Industry Analysis By Technology (Sodium Sulfur Battery, Sodium Salt Battery, and Sodium Air Battery), By End User (Consumer Electronics, Transportation, Utility, and Others), and Regional Forecast, 2026-2034

Sodium-Ion Battery Market Size and Future Outlook

The global sodium-ion battery market size was valued at USD 1.83 billion in 2025 and is projected to grow from USD 2.24 billion in 2026 to USD 7.08 billion by 2034, exhibiting a CAGR of 15.49% during the forecast period. The Asia Pacific dominated the sodium-ion battery market with a share of 60.22% in 2025.

Sodium-ion batteries are rechargeable batteries that operate similar to lithium-ion batteries but use sodium ions (Na⁺) instead of lithium ions (Li⁺) to carry the charge. Sodium, a soft, abundant alkaline metal found in sea salt and the Earth's crust, forms the basis of the electrode material in these batteries. Similar to lithium-ion batteries, sodium-ion batteries exchange ions between the positive and negative electrodes during charging and discharging. Sodium-ion battery offers a cost-effective and sustainable alternative to lithium-ion batteries. Its innovative approach utilizes abundant sodium resources, reducing dependence on scarce lithium and cobalt materials. Faradion's batteries provide high energy density, safety, and environmental advantages, making them ideal for various applications, including stationary energy storage and electric vehicles. By addressing supply chain concerns and delivering robust performance, Faradion is driving the commercialization of sodium-ion technology globally.

The main advantage of sodium-ion technology is the use of sodium salts, which are more abundant and cheaper than lithium salts. This has led to its growing adoption as an alternative to lithium-ion batteries.

MARKET DYNAMICS

MARKET DRIVERS

Rising Solar and Wind Energy Installations to Lead the Market Growth

The growing focus on expanding renewable energy sources such as solar and wind, owing to the rising carbon emissions and other greenhouse gasses, is one of the key market drivers for the demand for large scale energy storage applications. According to the International Renewable Energy Agency (IRENA), 2023 set a new record for renewable energy deployment, with global capacity reaching 3,870 GW. Renewables comprised 86% of new capacity, but growth is uneven worldwide, falling short of the goal to triple renewable power by 2030. Solar energy led the way, contributing 73% of the growth and reaching 1,419 GW, followed by wind power, which accounted for 24% of the expansion.

Solar and wind energy, though key drivers of renewable power generation, face the challenge of intermittency due to their dependence on weather conditions. Solar energy is only available during daylight hours and can fluctuate with cloud cover, while wind power is highly variable, depending on wind speeds. This intermittency makes it difficult to provide a consistent, reliable energy supply, which can disrupt grid stability. Sodium ion batteries offering energy storage solutions play a crucial role in addressing this issue by storing excess energy generated during peak production times and releasing it when generation is over, such as at night or during calm weather.

Abundant Availability of Sodium to Play a Key Role in Market Expansion

The wide availability of sodium worldwide is one of the key factors leading to the battery's development and a promising future. It is a widely available element found in sea salt and the sixth most abundant element in the earth's crust, existing in minerals such as feldspars, sodalite, and halite. This makes sodium cost-effective and more accessible than lithium, which faces growing supply constraints and price volatility due to increasing demand, especially from the electric vehicle and electronics sectors.

In addition to sodium, sodium-ion batteries often use more affordable cathode materials such as iron and manganese than the expensive cobalt or nickel used in lithium-ion batteries. These factors significantly lower the production costs of sodium-ion batteries, making them a more cost-effective solution, particularly for large-scale energy storage applications where affordability is critical.

MARKET RESTRAINTS

Challenges in Developing Compatible Electrolytes May Hinder the Market Growth

Unlike lithium-ion batteries, which have a well-established range of compatible electrolytes, sodium-ion batteries require specific electrolyte formulations due to differences in sodium chemistry. Sodium ions are larger and more reactive, which can make conventional lithium-ion electrolytes less effective. The electrolyte must allow for smooth ion transport without causing unwanted side reactions that could degrade the battery's performance or reduce its lifespan.

Moreover, the electrolyte must be stable at the voltage ranges used in sodium-ion batteries to avoid breakdown or safety risks. If the electrolyte decomposes at certain voltages, it can lead to the formation of harmful by-products, reduced efficiency, and potential safety hazards such as overheating or short-circuiting. Solid-state electrolytes, in particular, are being researched as they offer better safety and stability by reducing the risk of leaks or fires compared to liquid electrolytes. However, they still face challenges in achieving high ionic conductivity and long-term stability with sodium ions, further constraining the market expansion.

MARKET OPPORTUNITIES

Rising Government Support for Increasing Energy Storage Systems to Lead the Market Growth

Government policies and support are expected to play an important role in advancing sodium-ion battery commercialization owing to the compulsory installation of grid-scale energy storage systems. Sodium ion batteries offer one of the prominent solutions for energy storage solutions, gaining traction for various research & development. For instance, China is investing heavily in battery storage, targeting 100 GW by 2030, driven by the 14th Five-Year Plan, which supports various battery technologies such as sodium-ion, lithium-ion, lead-carbon, and redox flow. Since 2021, many Chinese provinces have set energy storage targets, with some aiming for nearly 100 GW of installed capacity by 2025. Furthermore, authorities in Shanxi and Xi’an provide a subsidy of USD 0.15/kWh per month for solar-plus-storage systems that started operating between 2021 and 2023, with a yearly cap of around USD 74,294 per system.

Grid operators and utility companies are increasingly seeking lower-cost grid scale energy storage options to meet regulatory requirements and climate targets, positioning sodium-ion batteries as an attractive choice for enhancing grid reliability and integrating renewable energy sources in the forecast period. Therefore, the demand for large-scale energy storage applications is expected to boost the growth of the global market over the forecast period.

MARKET CHALLENGES

Low Energy Density of the Battery to Limit the Market Growth

One of the primary challenges associated with the sodium-ion battery industry is the lower energy density of these batteries compared to lithium-ion batteries. For instance, sodium-ion batteries have an energy density of about 160 Wh/kg, compared to 200 Wh/kg for LFP batteries. This is mainly due to the larger size and heavier atomic mass of sodium ions compared to lithium ions, which limits how efficiently the ions can be packed into the battery’s electrodes. As a result, sodium-ion batteries may not be ideal for applications that require high energy density, such as electric vehicles, where battery weight and space are critical factors.

SODIUM-ION BATTERY MARKET TRENDS

Rising Research and Development in Sodium-Ion Batteries to Lead the Market Growth

Research and development in sodium-ion batteries (SIBs) is rapidly advancing as scientists and engineers work to enhance their performance and broad commercialization. Key focus areas include improving energy density, cycle life, and charge/discharge efficiency to make SIBs competitive with established lithium-ion technologies. Researchers are exploring various materials for anodes and cathodes, such as hard carbon for anodes and sodium transition metal oxides for cathodes, to optimize the electrochemical processes involved. For instance, in 2023, researchers at the Banaras Hindu University, India, have developed advanced cathode materials, “sodium nickel manganese cobalt oxide (Na-NMC) and sodium nickel manganese iron oxide (NFM)” for sodium-ion batteries, which utilize sodium ions instead of lithium. These materials enhance battery capacity and lifespan, making sodium-ion batteries longer-lasting and more powerful. Innovations in electrolytes are also being pursued to enhance safety and performance, with researchers experimenting with different sodium salts and solvent combinations.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

Market Recorded Mixed Impact Due to Supply Chain Disruptions and Increased Need for Resilient Energy Storage Solutions

The COVID-19 pandemic had a mixed impact on the development of sodium-ion batteries. In the short term, disruptions in global supply chains and manufacturing slowed down research and production efforts, delaying key projects and commercial scaling. Lockdowns and reduced workforce availability also hindered lab-based research and development. However, the pandemic highlighted the need for more resilient and cost-effective energy storage solutions, which renewed interest in alternatives such as sodium-ion batteries, especially as supply chain issues around lithium and other critical materials worsened. Post-pandemic, the growing demand for energy security and sustainable technologies has accelerated research and investment in sodium-ion technology.

SEGMENTATION

By Technology

Sodium Sulfur Leads the Market owing to its Adoption in Large Scale Energy Storage

Based on sodium ion battery technology, the market is segmented into sodium sulfur battery, sodium salt battery, and sodium air battery.

The sodium sulfur battery segment held the dominant share of 92% in 2024 owing to their primary utilization in large-scale energy storage applications, especially for grid stabilization and renewable energy integration. Due to their high energy capacity, long discharge times, and ability to operate at high temperatures, they are particularly suitable for stationary energy storage.

The sodium salt batteries segment is the second-leading segment in the market due to their lower cost and use of more abundant materials compared to lithium-ion batteries. This positions the segment as a promising alternative for large-scale energy storage and low-cost electric vehicles.

By End User

To know how our report can help streamline your business, Speak to Analyst

Transportation Holds the Dominating Share Owing to its Low Cost

By end-user, the market is segmented into consumer electronics, transportation, utility, and others.

The transportation segment is the leading segment owing to growing product adoption, especially in low-cost, entry-level electric vehicles (EVs) and public transportation systems such as e-bikes and buses. The sodium-ion batteries have a lower energy density than lithium-ion batteries, they offer a more cost-effective solution, particularly for vehicles that do not require long ranges. The segment is expected to dominate the market share of 26.8% in 2025.

The utility segment is projected to be the fastest-growing segment. The lower cost of sodium-ion batteries, combined with the abundant availability of sodium, makes them an ideal candidate for large-scale energy storage systems (ESS) to stabilize grids and store renewable energy. The batteries are well-suited for stationary energy storage applications, where weight and energy density are less important and cost-effectiveness is critical. This segment is anticipated to exhibit a CAGR of 21.21% during the forecast period.

Asia Pacific Sodium-Ion Battery Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

SODIUM-ION BATTERY MARKET REGIONAL OUTLOOK

The market has been studied geographically across North America, Europe, Asia Pacific, and the rest of the world.

Asia Pacific

Demand For Energy Storage Solutions To Drive The Market Growth in Asia Pacific

Asia Pacific holds the largest sodium-ion battery market share and is anticipated to grow at the fastest rate over the forecast period owing to China’s leading the way in production and innovation. The regional market value in 2026 was USD 1.37 billion, and in 2025, the market value led the region by USD 1.1 billion. Key players such as CATL and HiNa Battery Technology are investing heavily in sodium-ion technology as a cost-effective and abundant alternative to lithium-ion batteries.

The market expansion is further driven by the region's growing electric vehicle market and demand for energy storage solutions. For instance, in July 2024, BYD, a Chinese automaker, opened its first electric vehicle factory in Southeast Asia, located in Rayong, Thailand. The facility worth USD 0.486 billion produces around 150,000 vehicles annually. This marks BYD's latest effort to expand its presence in the rapidly growing Southeast Asian EV market. India is projecting to hit USD 0.07 billion and Japan is likely to hold USD 0.11 billion in 2025.

China

Exponential Research & Development for Commercializing Sodium-ion Batteries to Lead the Market Growth

China is one of the leading countries with a high focus on research and development in sodium-ion battery technology, positioning it as a promising alternative to lithium-ion batteries. The market value in China is expected to be USD 0.83 billion in 2025. This R&D push is supported by government initiatives to enhance energy storage capacity, foster innovation, and drive clean energy adoption. These efforts support China's broader goals of reducing reliance on imported lithium and meeting its carbon neutrality targets. In May 2024, China launched its first large-scale sodium-ion battery energy storage station in Nanning, Guangxi. It distributed 10,000 kWh of energy on its first day, supplying power to about 1,500 households.

North America

Rising Demand for Renewable Energy Sources is Fostering Market Growth

North America region is to be anticipated as the third-largest market with USD 0.37 billion in 2026. The North America market is growing with advancements in technology and the adoption of new policies to increase the penetration of the renewable energy market in the region. For instance, according to the Canadian Renewable Energy Association, the wind, solar, and energy storage sector grew by 11.2% in 2023 in Canada, bringing the total installed capacity to 21.9 GW. In 2023, the industry added 2.3 GW of new capacity, including over 1.7 GW of utility-scale wind, nearly 360 MW of utility-scale solar, 86 MW of on-site solar, and 140 MW/190 MWh of energy storage. The growth in these sectors is expected to positively influence the market.

U.S.

Expanding Solar & Wind Energy Installation to Bolster the Need for Energy Storage System

The U.S. has been experiencing a significant surge in wind farms and solar installations, leading to the demand for sodium-ion energy storage solutions. This growth is owing to the government's rising focus on limiting carbon emissions and achieving its carbon neutrality target. Clean energy investments grew from USD 200 billion in 2020 to USD 280 billion in 2023. Two major legislative efforts supporting this growth are the Bipartisan Infrastructure Investment and Jobs Act of 2021, which allocated USD 550 billion for clean energy and infrastructure and the Inflation Reduction Act of 2022, which provides USD 370 billion to promote energy security and combat climate change. The U.S. market size is estimated to hit USD 0.27 billion in 2025.

Europe

Demand for Alternative Solution to Lithium-ion Battery to Lead Regional Market Growth

Europe is anticipated to account for the second-highest market size of USD 0.41 billion in 2026, exhibiting the second-fastest growing CAGR of 17.48% during the 2024-2032. The Europe market size is driven by the increasing demand for alternative energy storage solutions and a push for reduced reliance on lithium-ion batteries. Companies such as France's Tiamat and the U.K.'s Faradion are at the forefront of this technology, supported by investments in sustainable energy and battery innovation. Europe's share is expected to grow as governments and industries increasingly prioritize local and sustainable energy storage options. The market value in U.K. is expected to be USD 0.06 billion in 2025.

On the other hand, Germany is projecting to hit USD 0.07 billion and France is likely to hold USD 0.06 billion in 2025.

Rest of the World

Increasing Deployment of Renewable Energy Projects to Push the Market Growth

The rest of the world is to be anticipated as the fourth-largest market with USD 0.07 billion in 2025. Countries such as Brazil, South Africa, GCC nations, and others are showing positive growth in renewable energy deployments. This is expected to beef up the demand for sodium-ion batteries over the forecast period. The visionary targets of the GCC nations, such as Saudi Vision 2030, Abu Dhabi Vision 2030, and others, are also expected to play a key role in the expansion of the market over the coming years.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Major Players Enhance Their Technologies Making Sodium-Ion Battery a Cost Effective Alternative

Faradion Limited, Aquion Energy, Hina Battery, Tiamat Energy, and others are some of the leading companies in the sodium ion battery market. Faradion Limited, a U.K.-based company, pioneered developing sodium-ion battery technology. The company is focused on creating sodium-ion batteries as a cost-effective, sustainable alternative to lithium-ion batteries. Faradion’s sodium-ion batteries offer several advantages, including abundant raw material availability, lower production costs, enhanced safety (due to better thermal stability), and comparable energy density to lithium-ion batteries.

Faradion has developed proprietary technology to improve the performance and lifespan of sodium-ion batteries, making them viable for a range of applications, from electric vehicles to stationary energy storage. The company's efforts have attracted significant interest, including being acquired by India’s Reliance Industries in 2021, which aims to scale the production of sodium-ion batteries and deploy them in various energy storage markets, including renewable energy integration and electric mobility.

List of the Key Companies Profiled:

- Faradion Limited (U.K.)

- Aquion Energy (U.S.)

- Hina Battery Technology Co., Ltd (China)

- Ben'an Energy Technology (Shanghai) Co., Ltd (China)

- AMTE Power plc (U.K.)

- Natron Energy, Inc. (U.S.)

- Tiamat Energy (France)

- Jiangsu Zhongna Energy Technology (China)

- Contemporary Amperex Technology (China)

- Li-FUN Technology (China)

- BLUETTI Power Inc. (U.S.)

- Indi Energy (India)

- Altris AB (Sweden)

- NEI Corporation (U.S.)

- Blackstone Technology GmbH (Germany)

KEY INDUSTRY DEVELOPMENTS:

- July 2024 - Sineng Electric launched a 50 MW/100 MWh sodium-ion battery energy storage system (BESS) in China's Hubei province, with plans to expand to 100 MW/200 MWh. The current system, already connected to the grid, can power about 12,000 households for a day. It is the world's largest sodium-ion BESS and China’s first 100 MWh-scale energy storage project using sodium-ion batteries. The project includes 42 BESS containers, 21 power conversion systems, and a 110 kV booster station.

- July 2024 - Peak Energy, a U.S. company focused on low-cost energy storage for grid stabilization, secured USD 55 million in Series A funding from Xora Innovation, Eclipse, TDK Ventures, and other investors. The funding would be used to scale the production of Peak Energy's sodium-ion battery technology.

- May 2024 – India-based Cygni Energy introduced a certification-ready sodium-ion battery pack for electric two-wheelers. The pack offers a range of 40 to 50 km per charge, 30-minute fast charging, over 3,000 charging cycles, and minimal capacity loss, even in extreme temperatures (-20°C to +55°C). Cygni claims that the battery pack will last five years with 2 to 3 daily uses. The company has invited e-2W manufacturers and battery-swapping solution providers to test the pack and aims to collaborate with powertrain component makers to develop a sodium-ion powertrain.

- May 2024 - BYD, a Chinese EV and battery manufacturer, formed a joint venture with Huaihai to produce sodium-ion batteries. The new company, Huaihai FinDreams Sodium Battery Technology, is based in Xuzhou, China, with BYD's battery division holding 51% and Huaihai 49%. With a seed capital of USD 70.67 million, the venture would produce, sell, recycle, and reuse batteries. Earlier this year, the two companies started building a sodium-ion battery factory in Xuzhou, with an annual capacity of 30 gigawatt-hours and a total investment of USD 1.41 billion.

- December 2023 - KPIT, an Indian automotive software and engineering company, launched its sodium-ion battery technology, offering energy densities from 100 Wh/kg to 170 Wh/kg, with the potential to reach 220 Wh/kg.

Investment Analysis and Opportunities

- Natron Energy has unveiled plans in August 2024, to invest USD1.4 billion in building a 1.2 million square-foot sodium-ion battery gigafactory in Edgecombe County, North Carolina. The factory is set to generate 1,062 jobs and manufacture 24GW of sodium-ion batteries per year once it becomes fully operational.

- TaiSan, a London-based developer of quasi-solid-state sodium-ion batteries for EVs, recently raised USD 1.67 million to advance its technology. The pre-seed round was led by EIT InnoEnergy and TSP Ventures, with participation from Heartfelt VC and Exergon. EIT InnoEnergy, co-funded by the EU, has ties to major automotive OEMs and gigafactories, while Heartfelt VC is also linked to a leading automotive OEM.

REPORT COVERAGE

The global market report delivers a detailed insight into the market and focuses on key aspects such as leading companies in sodium-ion battery. Besides, the report offers insights into the market trends and technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth and downfall of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 15.49% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology, By End User, and By Region |

|

Segmentation |

By Technology

|

|

By End User

|

|

|

By Region

|

Frequently Asked Questions

As per a study by Fortune Business Insights, the market size stood at USD 2.24 billion in 2026.

The market is likely to grow at a CAGR of 15.49% over the forecast period.

The transportation segment is expected to lead the market over the forecast period.

The Asia Pacific market size stood at USD 1.37 billion in 2026.

Rising installations of solar and wind energy are the key factors driving market growth.

Some of the top players in the market are Faradion Limited, Aquion Energy, HiNa Battery Technology, and others.

The global market size is expected to reach USD 7.08 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us