Speech and Voice Recognition Market Size, Share & Industry Analysis, By Technology (Voice Recognition and Speech Recognition), By Deployment (Cloud and On-Premise), By End-user (Healthcare, IT and Telecommunications, Automotive, BFSI, Government & Legal, Education, Retail & Ecommerce, Media & Entertainment, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

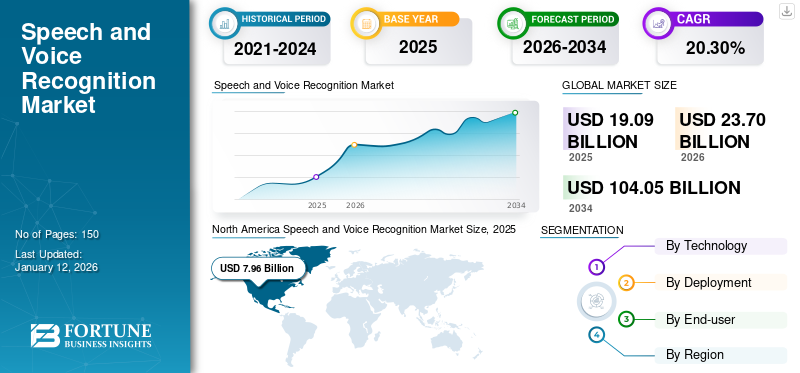

The global speech and voice recognition market size was valued at USD 19.09 billion in 2025. The market is projected to be worth USD 23.70 billion in 2026 and reach USD 104.05 billion by 2034, exhibiting a CAGR of 20.30% during the forecast period. Additionally, the U.S. speech and voice recognition market is projected to grow significantly, reaching an estimated value of USD 24.02 billion by 2032.

Pattern recognition is used to turn speech into a series of words in speech and voice recognition technologies. This enables users to receive prompt responses by verbally addressing the systems rather than typing or scrolling through the screen with the assistance of voice and speech software.

Global Speech and Voice Recognition Market Overview

Market Size:

- 2025 Value: USD 19.09 billion

- 2026 Value: USD 23.70 billion

- 2034 Forecast Value: USD 104.05 billion, with a CAGR of 20.30% from 2026 to 2034

Industry Trends:

- Integration of Natural Language Processing (NLP) and Machine Learning (ML) to enhance speech recognition capabilities.

- Development of Automated Speech Recognition (ASR) systems for real-time transcription and translation.

- Expansion of voice-enabled applications in various sectors, including healthcare, automotive, and customer service.

Driving Factors:

- Increased adoption of voice assistants and smart devices.

- Growing demand for contactless interfaces and hands-free operations.

- Advancements in AI and deep learning technologies.

- Expansion of cloud computing infrastructure supporting voice recognition services.

Moreover, ongoing advances in Natural Language Processing (NLP), Machine Learning (ML), and Automated Speech Recognition (ASR), along with the massive amount of data and availability of AI based platforms have led to an exponential increase in the capabilities to process voice at a larger scale. For instance,

- In August 2023, Meta introduced an AI model for speech and text translation into nearly a hundred languages. By reducing delays and errors in the translation process, this new model improves efficiency and quality.

- In August 2021, LumenVox launched Automatic Speech Recognition (ASR) engine with transcription. The next-generation speech and voice recognition technology was built on deep Machine Learning (ML) and Artificial Intelligence (AI), delivering accurate speech-enabled customer experiences.

The COVID-19 pandemic augmented the development of various technologies that stimulate safety and social distancing, from telemedicine to contactless payments. Speech and voice recognition software played a vital role during the COVID-19 pandemic.

Speech and Voice Recognition Market Trends

Machine Learning and Artificial Intelligence to be the Nexus Point of Innovation and a Key Trendsetter for Speech and Voice Recognition

The evolution of artificial intelligence is creating potential opportunities for the digitalization of numerous industries. The dominance of AI-powered devices indicates that search algorithms and systems have evolved to improve machine learning and its applications in daily life. Google's RankBrain is a crucial example designed to recognize phrases and words to learn, understand, and better predict outcomes. It uses machine learning and natural language processing technologies to transcript voice searches.

Moreover, web conferencing tools have gained popularity in the industry. Speech and voice recognition technology can further improve web conferencing by providing post-call transcripts through real-time captioning from calls.

As per the Speechmatics Voice report, in 2021, web conference transcription accounts for around 44% of the voice technology market share and is one of the top applications that will have the most significant commercial impact.

Download Free sample to learn more about this report.

Speech and Voice Recognition Market Growth Factors

Rising Use of Deep Neural Engines and Networks to Increase Speech and Voice System Demand

Superior adoption of emerging technologies, such as IoT, AI, and machine learning, fuels the speech and voice recognition market growth. Voice-based authentications in smartphone applications have increased the demand for voice and speech biometric systems. Moreover, the usage of deep learning and neural networks in applications, such as audio-visual speech recognition, isolated word recognition, speaker adaptation, and digital speaker recognition, is propelling the demand for voice technologies. Key players are focusing on such emerging technological advancements to grow their businesses in the long run. For instance,

- In April 2022, Google LLC released speech recognition technology to help boost the voice UI. Google's Speech-to-Text API utilizes a neural sequence-to-sequence model to further develop exactness in 23 dialects and 61 of the supported localities.

RESTRAINING FACTORS

Speaker Diarization & Accuracy in Multilinguistic Approach to Hinder Speech Recognition Technology Demand

As voice technology continues to excel, developers and engineers have been trying to surpass difficulties related to speech software. Factors frequently seen hindering the seamless performance of speech and voice recognition systems include fluency, punctuation, accent, technical words/jargon, background noise, and speaker identification. One of the biggest challenges in voice is the breakthrough in accuracy for languages other than American English. As per the Speechmatics Voice report, in 2021, around 30.4% and 21.2% account for concerns related to accent and dialect, respectively.

Voice-based technologies will sustain to deliver more customized experiences as they better differentiate and identify users' voices. However, the threat to voice data privacy remains, which hinders the market growth.

Speech and Voice Recognition Market Segmentation Analysis

By Technology Analysis

Rising Deployment of Smart Appliances and Behavioral Shift of Consumers to Propel Speech Recognition Demand

On the basis of technology, the market is divided into speech recognition and voice recognition.

Speech recognition segment holds the largest market share 66.40% in 2026. and is estimated to continue its dominance over the forecast period. The continuous advancements in Artificial Intelligence (AI) and the development of smart appliances with the availability of high-speed internet connectivity have increased the growth of the market. In addition, this technology enables doctors and radiologists to keep patient records due to benefits such as shorter turnaround times for reports. The market demand is projected to increase as a result of the integration of speech recognition with Virtual Reality (VR).

Further, the voice recognition segment is anticipated to witness the highest growth rate during the projection period. This is due to increased adoption across banking and finance institutions, contact centers, and healthcare institutions to reduce fraudulent activities. AI-based speech and voice recognition software identify the speech pattern of users and speaker voice, which is expected to boost the market growth.

By Deployment Analysis

Surging Adoption of Cloud-based Solutions by Small & Medium Enterprises to Augment Segment Share

On the basis of deployment, the market is categorized into on-premise and cloud. The cloud segment is expected to rise with the highest CAGR, owing to escalating demand for cloud solutions. The increased adoption of cloud technology among organizations is expected to drive cloud deployments during the forecast period.

However, the on-premise segment is expected to show a slow demand during the projection period owing to increasing adoption of cloud-based solutions among SMEs.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Product Demand in Healthcare to Impel Industry Growth

By end-user, the market is classified into healthcare, IT & telecommunications, BFSI, automotive, government & legal, education, retail & ecommerce, media & entertainment, and others.

The demand for speech and voice recognition software has increased drastically among healthcare and BFSI, owing to the COVID-19 outbreak. The process of capturing data in electronic health records systems is enhanced by speech recognition. By speaking a few words, physicians are empowered to interact with the system. The development and deployment of speech recognition in individual healthcare segments, such as radiology, pathology, emergency medicine, and others, is still ongoing.

- In September 2021, clinical voice solutions provider Scribetech introduced Augnito, a cloud-based, AI-powered, secure, and portable speech recognition platform. The solution offered an efficient and fast way to collect live clinical data on any device, including smartphone, Windows, or Mac, with higher accuracy. It was also equipped to automatically transcribe referrals, medical records, and patient letters into clinical documentation at the point of dictation.

REGIONAL INSIGHTS

The global market scope is classified across five regions, North America, South America, Europe, the Middle East & Africa, and Asia Pacific.

North America Speech and Voice Recognition Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market with a valuation of USD 7.96 billion in 2025 and USD 9.79 billion in 2026. In 2024, North America held the highest market share. The presence of prominent market players such as Amazon Web Services, Inc., IBM, Google LLC, and Microsoft Corporation, among others contributes to market growth. The growing adoption of smart home appliances with voice assistants is expected to spur market expansion. For instance, as per the Voicebot.AI 2021 report, 45.2 million U.S. adults leveraged voice search for shopping a product at least once. The U.S. market is projected to reach USD 6.01 billion by 2026.

Asia Pacific

Asia Pacific is projected to expand at the highest rate during the analysis period. The surge in adoption of AI technology across BFSI, healthcare, automotive, and government is anticipated to boost the implementation of voice technology across the region.

Similarly, Europe is expected to showcase remarkable growth in the coming years owing to increased innovations and advancements in voice assistants to support French, Spanish, Russian, and other European languages. The Japan market is projected to reach USD 1.01 billion by 2026, the China market is projected to reach USD 1.46 billion by 2026, and the India market is projected to reach USD 1.37 billion by 2026.

Further, recent developments in Latin American countries will foster the market growth in this region. For instance,

- In June 2022, Minds Digital, Brazil-based voice biometrics developer, raised USD 305,000 in seed funding round.

- In April 2022, AWS added Alexa voice services in Chile, Argentina, Costa Rica, and Peru.

Key Industry Players

Strategic Collaborations and Partnerships to Expand Product Reach of Key Players

Major global corporations are forming alliances and partnerships with other players to streamline and grow their business operations. The key players adopt this strategy to support their product portfolio and expand the scale of their operations. For instance,

- January 2024: RAZ Mobility integrated speech recognition technology into its Memory cell phone to enable it to recognize nonstandard spoken language. The integration of this technology into the RAZ Memory cell phone enables people with speech impairment to use telecommunications in a completely new way.

- November 2023: Assembly Software, a reseller of Nuance Communications, launched its Neos case management platform with the cloud-based Nuance Dragon Legal Anywhere speech recognition solution for legal experts. With the addition of Dragon Legal Anywhere to the Neos platform, legal practitioners can streamline their processes and easily dictate directly to the platform.

List of Top Speech and Voice Recognition Companies

- Alphabet Inc. (U.S.)

- Amazon Web Services, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- IBM Corporation (U.S.)

- Apple Inc. (U.S.)

- Baidu, Inc. (China)

- iFLYTEK Co., Ltd. (China)

- SESTEK (Turkey)

- LumenVox (U.S.)

- Sensory Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- May 2023 – Webex by Cisco, a video conferencing platform, and the speech recognition technology company, Voiceitt, announced a partnership aiming to make virtual meetings more accessible to people with speech impairments. Transcription for people with speech impairments and real-time AI-enabled captioning, will be made possible as a result of the partnership so that users can understand during Webex virtual meetings.

- January 2023 – iFLYTEK launched its pre-trained industrial AI models at the iFLYTEK Global 1024 Developers’ Day, 2022. The pre-trained AI model can be deployed for a range of services such as emotion recognition, speech recognition, and others. The pre-trained AI-based speech recognition model is intended to give complete speech recognition services.

- August 2022 – iFLYTEK launched multilingual AI subtitling solutions in addition to translation and transcription services for live and video streams. The solution enabled machine translation between Chinese and 168 languages and speech and voice recognition for 70 languages.

- June 2022 – STMicroelectronics, a worldwide semiconductor organization serving clients across the range of electronics applications, and Tangible Inc., a company providing embedded speech recognition technology and a ST Approved partner, announced a partnership that empowers the STM32 microcontroller (MCU) user community to create and model intuitive voice-based UIs for a large variety of smart embedded products.

- September 2021 – IBM Corporation launched additional automation and AI capabilities in IBM Watson Assistant to make it easy for firms to create great customer experiences. This launch includes a new partnership with IntelePeer to test a voice agent. IntelePeer is a Communications Platform-as-a-Service provider.

- August 2021 – Amazon Transcribe supports group transcription in six new dialects - Danish, Afrikaans, Mandarin Chinese (Taiwan), New Zealand English, Thai, and South African English. These dialects are accessible in all open AWS regions where Amazon Transcribe is accessible.

REPORT COVERAGE

The research report highlights leading regions across the world to offer a better understanding to the user. Furthermore, the report provides insights into the latest industry and market trends and analyzes technologies deployed at a rapid pace at the global level. It further highlights some growth-stimulating factors and restraints, helping the reader gain an in-depth knowledge about the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021–2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026–2034 |

|

Historical Period |

2021–2024 |

|

Growth Rate |

CAGR of 20.30% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Technology

By Deployment

By End-user

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the market was valued at USD 19.09 billion in 2025.

Fortune Business Insights says that the market is expected to reach USD 104.05 billion in 2034.

The market is anticipated to grow at a CAGR of 20.30% during the forecast period (2025-2034).

The IT and telecommunications segment is expected to hold the highest revenue share in 2025.

The rising popularity of speech recognition technology among voice-based IVRs for better customer experience is the key factor driving the market growth.

Alphabet Inc., Amazon Web Services (AWS) Inc., Microsoft Corporation, IBM Corporation, Apple Inc., Baidu, Inc., iFLYTEK Co., Ltd., SESTEK, LumenVox, and Sensory Inc. are the top players in the market.

The Asia Pacific market is expected to grow with a remarkable CAGR over the estimated period.

In 2025, North America held the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us