Talent Management Software Market Size, Share & Industry Analysis, By Type (Talent Acquisition, Performance Management, Compensation Management, Learning Management, and Others), By Enterprise Type (Small & Medium Enterprises (SMEs) and Large Enterprises), By Deployment (Cloud and On-premise), By End-User (IT and Telecommunication, BFSI, Government, Healthcare, Education, Manufacturing, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

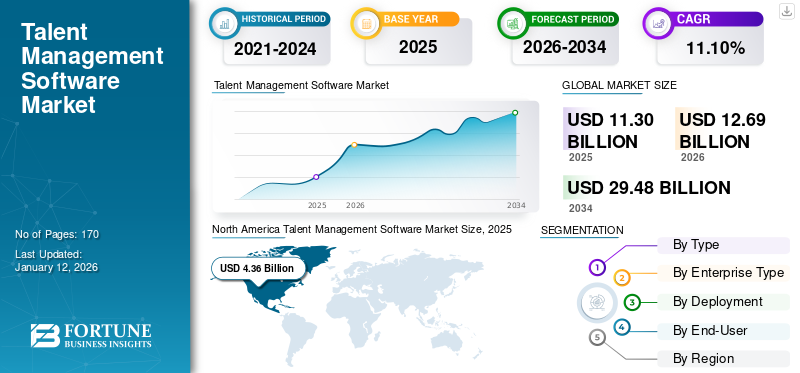

The global talent management software market size was valued at USD 11.30 billion in 2025. The market is projected to grow from USD 12.69 billion in 2026 to USD 29.48 billion by 2034, exhibiting a CAGR of 11.10% during the forecast period. Additionally, the U.S. talent management software market is projected to grow significantly, reaching an estimated value of USD 5,180.4 million by 2032. North America dominated the global talent management software market with a share of 38.10% in 2025

Talent management software is experiencing substantial technological modifications primarily driven by the introduction of mobile technology. The market is obtaining significant traction supported by dynamic human resource practices and the continuous implementation of innovative technologies. In addition, the increasing demand for hiring process automation and performance management among enterprises has driven the market growth. Key companies operating in the market are focusing on product launches and software enhancements to increase their market share. For instance,

- In November 2023, Oracle NetSuite launched NetSuite Enterprise Performance Management (EPM). Organizations can further unify and streamline their financial operations through this new software.

Furthermore, organizations are projected to focus on adopting advanced technologies to boost business operations and decrease costs following the COVID-19 outbreak, which would likely generate profitable prospects. Furthermore, owing to several advantages, AI-enabled platforms will be in high demand shortly, boosting the market during the forecast period.

Global Talent Management Software Market Overview

Market Size:

- 2025 Value: USD 11.30 billion

- 2026 Value: USD 12.69 billion

- 2034 Forecast Value: USD 29.48 billion, with a CAGR of 11.10% from 2026–2034

Market Share:

- Regional Leader: North America dominated the global market with a share of 38.10% in 2025, driven by the presence of key players such as Oracle, IBM, and Ceridian.

- Fastest-Growing Region: Asia Pacific, driven by rapid digital adoption and a growing number of tech-enabled enterprises.

- End-User Leader: IT & Telecom segment, driven by the need for scalable HR solutions and high-volume workforce management.

Industry Trends:

- Cloud-Based Solutions Adoption: Companies are shifting from on-premises to cloud-based TMS for better scalability, flexibility, and real-time analytics.

- AI Integration in HR Tech: Increasing use of AI and ML to improve hiring, workforce planning, and employee engagement tools.

- Post-Pandemic Digital Acceleration: COVID-19 has accelerated digital HR transformations and automation adoption.

Driving Factors:

- Increasing demand for automation in recruitment and performance management.

- Growing integration of mobile platforms in HR workflows.

- Expansion of AI-based platforms for smarter decision-making.

- Rising investment in HCM platforms to enhance employee experience.

- Strategic collaborations between TMS providers and SMEs/HR firms to boost implementation.

Talent Management Software Market Trends

Acceptance of Cloud-based Talent Management Solutions to Foster Market Potential

Due to digitization, organizations generate vast amounts of data, exerting pressure to exploit that data to obtain competitive advantages. Agencies are increasingly adopting cloud-based solutions to turn massive data into relevant insights. Talent management is proving to be a critical competitive advantage for key players. Furthermore, organizations are shifting to cloud-driven software, owing to flexible payment and plan options. For instance,

- In April 2023, Paycom Software Inc., a provider of comprehensive and cloud-based HR Management software called 'HCM', launched its latest product offering Global HCM. This new service would enable businesses and their staffs, both international and domestic, to take care of their human resources needs in the same system.

- In March 2021, IBM OpenPages launched cloud-powered data privacy management software, enabling companies to resolve emerging data privacy issues.

Therefore, cloud-based solutions provide organizations with a customized model to fit their needs, including analytical functions and talent management capabilities.

Download Free sample to learn more about this report.

Talent Management Software Market Growth Factors

Streamlining Hiring Process through Technological Innovations to Boost Market Potential

One of the essential factors driving the talent management software market growth is the increasing penetration of cloud-based platforms as well as the use of mobile-based personnel management systems. Organizations and HR professionals are increasingly using Software-as-a-Service (SaaS) platforms to automate scouting, identifying, and recruiting new talent from talent pools, and retain existing personnel. Talent management software can also help streamline the hiring process, reinforce workplace culture, provide flexible learning opportunities, and identify top performers. By integrating with social media tools, which increase the overall use of talent management software, these advancements are well adapted and integrated into other mobile applications. Various technical breakthroughs, such as Machine Learning (ML) and Artificial Intelligence (AI), also expand the economy. For instance,

- In October 2023, IBM and EY announced the launch of EY.ai Workforce, an innovative human resources solution, that enables organizations to integrate AI into their major HR processes.

- In June 2021, Trakstar, a Software-as-a-Service (SaaS) performance management and employee engagement organization, announced the merger of its modular offerings into a single Trakstar Platform. Trakstar Learn is offered for employee development, Trakstar Hire is available for better hiring and quicker onboarding, and Trakstar Perform is accessible for constant performance engagement and tracking.

Furthermore, prominent players are introducing various talent management solutions that aid in staff management and give proper development opportunities for employees. As a result of the increased need to optimize HR operations, talent management software has become more popular among companies.

RESTRAINING FACTORS

Limited Awareness of Talent Management Software Solutions among SMEs to Hinder Market Growth

Although data and analytics have long been used to make informed business decisions, most companies still have a long way to go with respect to adopting talent analytics. A lack of understanding of the benefits of talent management software is a significant factor hindering the market growth. Furthermore, the costs of talent management in terms of resources, time, and money can be significant. Talent management necessitates using tools to map out talent requirements at all levels of the organization, which can be expensive. Due to their limited resources, Small & Medium Enterprises (SMEs) find it challenging to invest in advanced technologies. As a result, limited adoption of talent management technologies across SMEs will stifle the market growth.

Talent Management Software Market Segmentation Analysis

By Type Analysis

Talent Acquisition Captured Maximum Market Share with Rising Demand to Boost Productivity

By type, the market is classified into talent acquisition, performance management, compensation management, learning management, and others. In 2024, the talent acquisition segment held the largest market share of 51.34% in 2026 and was predicted to continue to grow, owing to the need for smooth onboarding, recruiting, and sourcing processes.

Furthermore, recruiting and HR teams use a performance management dashboard to manage and track the recruitment process. Thus, the rising demand for performance management dashboards is estimated to fuel the segment growth throughout the forecast period.

By Enterprise Type Analysis

Growing Integration of Talent Management Solutions with Emerging Technologies in Large Enterprises to Aid Growth

Based on enterprise type, the market has been divided into SMEs and large enterprises.

The large enterprises segment dominated the market share of 61.55% in 2026. Large enterprises will likely integrate their talent management systems with emerging technologies to provide services such as staff headcount and working hours. These firms use analytical solutions to handle problems such as recognizing the threat of high-potential employees leaving for different countries and essential roles.

SMEs are predicted to be the early adopters of HR technologies. As a result, market participants are being forced to create economical options that produce quality and high-value outcomes. Similarly, mid-sized enterprises are projected to increase their HR technology spending in the coming years. Moreover, key players are partnering to enhance HR solutions for SMEs. For instance,

- In October 2023, Workday, Inc., a player in enterprise cloud applications for human resources and finance, partnered with Insperity, Inc., which provides HR and business performance management solutions. With this move, they aim to create, brand, market, and sell a full-service HR solution for SMEs.

By Deployment Analysis

Adoption of Cloud-based Software to Rise Due to Its Beneficial Properties

By deployment, the market is segmented into cloud and on-premise.

Cloud is expected to have the largest market share of 52.35% in 2026 and is also expected to grow at a highest CAGR. Cloud-based solutions are highly adopted as they offer benefits such as on-demand services, adaptability, and agility.

The other advantages of cloud-based services and solutions include regular software upgrades, improved user experience, and enhanced dashboards & analytics.

By End-User Analysis

To know how our report can help streamline your business, Speak to Analyst

IT & Telecommunications Sector to Capture Maximum Market Share Due to Digital Competition and Unpredictable Economy

By end-user, the market has been segmented into IT & telecommunication, BFSI, government, healthcare, education, manufacturing, and others.

The IT & telecommunication segment held a sizable market share in 2024. This industry is facing tremendous problems owing to digital competition, an unpredictable economy, and a new generation of customers with precise information and high demands. As a result, there is a robust need for a highly trained workforce and advanced recruiting tactics. Talent management platforms provide complete insights and efficient business strategies to respond to the demand for appropriate criteria.

The BFSI segment is expected to grow at a highest CAGR during the forecast period. The demand for talent management solutions across the BFSI segment is driven by the changing dynamics of employee relationships and the domain's rising reliance on digitalization for managing daily operations. The healthcare industry's demand for skilled employees is increasing, contributing to the development of human capital management technologies.

REGIONAL INSIGHTS

By region, the market has been analyzed across five major regions, North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America Talent Management Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America dominated the market and is projected to continue its dominance during the forecast period. According to a Cornerstone OnDemand, Inc. survey, North America is a potentially developed region for adopting talent management, core HR, and recruitment technologies. The presence of prominent HCM software suppliers, such as Ceridian HCM Holding Inc., Oracle Corporation, and IBM Corporation, among others, contributes to the regional market growth. The U.S. market is projected to reach USD 3.43 billion by 2026.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is expected to record the highest CAGR. The market's growth may largely be credited to organizations’ increasing acceptance of innovative technologies. A significant shift in organizational management technologies is driving the product demand across developed countries. Due to active ecosystems, SMEs are projected to promote the adoption of this software in Japan, India, and Australia. On the other hand, large companies in IT & telecom, BFSI, manufacturing, education, and other sectors are predicted to generate significant revenue. The Japan market is projected to reach USD 0.89 billion by 2026, the China market is projected to reach USD 0.99 billion by 2026, and the India market is projected to reach USD 0.39 billion by 2026.

Europe

Europe is expected to register a significant growth rate during the forecast period. Active government initiatives and policies related to talent management may generate demand for robust talent management software for employee selection, mobility, and assessment. The European government is implementing such policies to produce a competent, skilled, adaptable, and networked workforce in the region. The UK market is projected to reach USD 0.63 billion by 2026, while the Germany market is projected to reach USD 0.86 billion by 2026.

Middle East & Africa and South America

The Middle East & Africa and South America markets will likely grow steadily. IT & telecommunication, healthcare, manufacturing, and government sectors are some of the high-tech investors. As a result, it is anticipated that the number of potential consumers for this software will expand.

Key Industry Players

Key Players Focus on Acquisitions & Mergers to Expand Market Opportunities

IBM Corporation, Cisco Systems, Inc., Talentsoft, Oracle Corporation, and CornerStone OnDemand, Inc. are the market's major participants. These players provide solutions integrated with advanced technologies such as cloud and AI. Moreover, high market competition has forced major players to implement the acquisition strategy to strengthen their positions.

List of Top Talent Management Software Companies:

- Cornerstone OnDemand (Saba Software, Inc.) (U.S.)

- Workday, Inc. (U.S.)

- Applied Training Systems, Inc. (Trakstar) (U.S.)

- Talentsoft (Cegid) (France)

- BambooHR LLC (U.S.)

- Oracle Corporation (U.S.)

- SAP SE (Germany)

- IBM Corporation (U.S.)

- Sage Group plc (U.K.)

- 15Five (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2023: Mitratech announced the expansion of its human resources offering in the area of legal and compliance software by acquiring two technology companies. The company acquired Circa, a provider of software for diversity equity and inclusion, and Trakstar, a talent acquisition, development, and performance management solution provider.

- July 2022: 15Five, a provider of constant performance management solutions, received a funding of USD 52.0 million. This funding accelerates the vision and solution of 15Five, giving human resource leaders the tools to make better strategic decisions and improve performance.

- May 2022: TriHealth chose Oracle Human Capital Management (HCM) to streamline and integrate its present HR systems. This allowed TriHealth’s staff to reduce manual processes and enhance employee engagement.

- May 2022: IBM and EY announced a program that aids organizations and businesses in identifying workforce challenges, such as employee retention, recruitment, and upskilling, and showcases the need to integrate HR systems technology at pace.

- January 2022: Workday Inc. acquired VNDLY for USD 510.0 million. This acquisition allowed VNDLY to boost its value to customers by offering greater visibility, collaboration, and oversight of workforce opportunities and needs.

- October 2021: CEIPAL launched an AI-powered solution for addressing diversity, equity, and inclusion across companies for talent management sources. This solution enabled hiring companies to simplify their workforce and hiring processes.

- November 2020: IBM acquired Instana, a software company focused on developing application performance management software. The acquisition signified IBM’s continual investment in Big Data, hybrid cloud, and artificial intelligence (AI) capabilities.

REPORT COVERAGE

The report highlights the key regions across the globe for better user understanding. In addition, it provides an overview of the latest industry trends and analyzes the technologies being rapidly adopted worldwide. Furthermore, it highlights growth-stimulating factors and constraints, aiding the reader in obtaining in-depth knowledge of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 11.10% from 2026 to 2034 |

|

Segmentation |

By Type

By Enterprise Type

By Deployment

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the global market size is expected to reach USD 29.48 billion by 2034.

The market value stood at USD 12.69 billion in 2026.

The market is expected to grow at a CAGR of 11.10% during the forecast period of 2026-2034.

By type, the talent acquisition segment is expected to lead the market during the forecast period.

Streamlining the hiring process through technological innovations will boost the market growth.

IBM Corporation, Cornerstone OnDemand (Saba Software, Inc.), Workday Inc., Applied Training Systems, Inc. (Trakstar), Talentsoft, and Lattice BambooHR LLC, among others are the top companies in the market.

In 2024, the IT & telecommunication segment held a significant market share in terms of end-user.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us