Insulated Glass Market Size, Share & Industry Analysis, By Type (Tempering Insulating Glass, Custom Insulated Glass, Heated Insulating Glass, and Others), By Application (Building & Construction, Automotive & Transportation, Industrial Applications, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

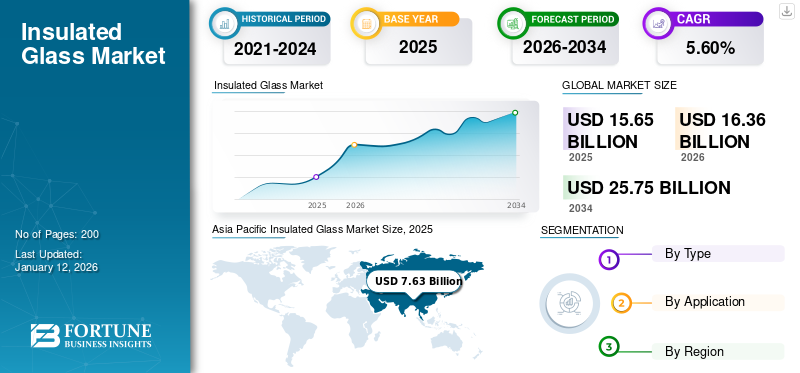

The global insulated glass market size was valued at USD 15.65 billion in 2025. The market is projected to grow from USD 16.36 billion in 2026 to USD 25.75 billion by 2034, exhibiting a CAGR of 5.60% during the forecast period. Asia Pacific dominated the insulated glass market with a market share of 49% in 2025.

Insulated glass, also known as insulated glazing or double glazing, is a high-performance glass product designed to enhance thermal efficiency, acoustic insulation, and overall comfort in buildings. It is composed of two or more panes of glass separated by a sealed spacer, which creates an insulating air space between the layers. This cavity is often filled with dry air or inert gases such as argon or krypton to reduce heat transfer and improve energy efficiency. The edges of the panes are sealed with specialized sealants to ensure durability, prevent moisture penetration, and maintain long-term performance. It is widely used in residential, commercial, and industrial buildings for windows, façades, curtain walls, and skylights due to its ability to regulate indoor temperature, reduce energy costs, and improve occupant comfort.

Stricter energy-efficiency and building codes worldwide, including net-zero standards and HVAC load reduction, coupled with rapid urbanization and increased commercial and residential construction, are boosting market growth. Additionally, growing consumer emphasis on acoustic comfort, security glazing, and smart or solar control glazing systems, such as electrochromic and dynamic tints, further drives the market’s growth. Moreover, the increasing adoption of green-building and sustainability initiatives elevates the demand for low-emissivity (low-E) coatings, warm-edge spacers, and inert gas fills, which enhance thermal performance.

Furthermore, the market encompasses several major players with Saint-Gobain Glass India, AGC Inc., Nippon Sheet Glass Co., Ltd, Guardian Industries Holdings, and CARDINAL GLASS INDUSTRIES, INC. at the forefront. Broad portfolio with innovative product launch, and strong geographic presence expansion have supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rapid Urbanization and Infrastructure Growth to Propel the Market Growth

As populations migrate toward cities and metropolitan areas, there is an increasing demand for modern residential complexes, commercial hubs, and industrial facilities, all of which require advanced building materials to ensure energy efficiency, safety, and durability. In China, large-scale housing projects and commercial skyscrapers dominate city skylines, and government-led initiatives to promote energy-efficient construction directly boost the demand for insulated glass units (IGUs). The prevalence of glass façades and curtain walls in modern Chinese architecture makes IGUs essential for balancing design aesthetics with sustainability. Similarly, India’s Smart Cities Mission emphasizes sustainable infrastructure and green building practices. High-rise apartments, airports, shopping malls, and IT parks progressively incorporate IGUs to decrease energy consumption while maintaining modern architectural standards.

MARKET RESTRAINTS

High Initial Cost to Restrict Market Expansion

Insulated glass units are more expensive than conventional single-pane or basic glass due to their multi-layer construction, low-emissivity coatings, and gas fills such as argon or krypton. This high upfront cost discourages adoption, especially in price-sensitive regions.

- For example, in parts of Southeast Asia and Latin America, builders often prefer standard glass for residential projects to reduce construction costs, limiting IG penetration despite its long-term energy-saving benefits.

MARKET OPPORTUNITIES

Technological Advancements in Glass Manufacturing to Create Lucrative Growth Opportunities

Innovations in technology have greatly expanded its performance capabilities and market potential. Traditional double-pane IGUs are now being replaced or enhanced with advanced solutions such as low-emissivity (Low-E) coatings, which reduce infrared and ultraviolet light penetration while maintaining natural daylight.

- Companies including Saint-Gobain have introduced specialized glazing products with enhanced solar control, while Guardian Glass has developed high-performance Low-E coatings for commercial buildings.

The development of low-emissivity (Low-E) coatings, which are ultra-thin metallic layers applied to glass surfaces, also offers beneficial opportunities for market growth. These coatings reduce infrared and ultraviolet radiation penetration while allowing visible light to pass through, improving energy efficiency without sacrificing natural daylight.

- For example, Guardian Glass and Pilkington have launched advanced Low-E glass that significantly lowers cooling costs in commercial and residential buildings.

INSULATED GLASS MARKET TRENDS

Energy Efficiency and Green Building Regulations Are Significant Market Trends

Buildings account for a significant share of total energy consumption, particularly for heating and cooling needs. Insulated glass units (IGUs) help minimize heat transfer, improving indoor thermal comfort while reducing reliance on air conditioning and heating systems. Governments and organizations are setting strict standards to enforce energy-efficient construction practices.

- For example, the European Union’s Energy Performance of Buildings Directive (EPBD) requires all new buildings to be nearly zero-energy, encouraging widespread use of IGUs in both residential and commercial projects.

- In the U.S., green building certifications such as LEED strongly promote insulated glazing to cut carbon emissions. Countries such as Japan have also incorporated high-performance glass into their Building Energy Efficiency Act, driving demand for IGUs in compliance with these regulations.

MARKET CHALLENGES

Complex Installation and Maintenance to Hamper Market Growth

IG requires skilled labor for proper installation to ensure airtight sealing and thermal efficiency. Improper installation can lead to condensation between panes or reduced insulation performance. For instance, in regions where certified IG installers are scarce, such as rural areas in Eastern Europe, faulty installations have led to customer dissatisfaction, restraining insulated glass market growth. Additionally, repairing or replacing damaged IG is more complicated and costly as compared to traditional glass.

Download Free sample to learn more about this report.

Segmentation Analysis

By Type

High Demand for Tempering Insulating Glass Contributes to Segmental Growth

On the basis of type, the market is classified into tempering insulating glass, custom insulated glass, heated insulating glass, and others.

The tempering insulating glass segment held the largest insulated glass market share 68.46% in 2026 and is expected to experience substantial growth, driven by the rising demand for such glasses due to its superior safety, strength, and energy efficiency features. It provides excellent thermal insulation when combined with gas-filled cavities or Low-E coatings, helping to reduce energy consumption in both residential and commercial buildings. The growing global focus on urbanization, coupled with stringent safety norms and green building certifications such as LEED and BREEAM, drives the market’s growth.

The custom insulated glass segment is expected to experience significant growth in the coming years. The rising demand for design flexibility and specialized architectural requirements drives the growth of the segment. This segment caters to projects that require non-standard dimensions, shapes, finishes, or performance enhancements such as acoustic insulation, solar control, or decorative aesthetics. The increasing adoption of tailor-made solutions in luxury residential projects, commercial complexes, museums, and retail spaces, where architects and designers prioritize uniqueness and functional customization, boosting the market growth.

The growth of the heated insulating glass segment is driven by its ability to prevent condensation and improve thermal comfort in extreme climates. This glass incorporates embedded electrical heating elements or coatings that ensure windows remain frost-free and clear, making it highly valuable for colder regions such as North America and Northern Europe.

By Application

To know how our report can help streamline your business, Speak to Analyst

Building & Construction Segment to grow with the Fastest CAGR during the Forecast Period

Based on end-user, the market is segmented into automotive & transportation, building & construction, industrial applications, and others.

The building & construction segment dominates the market contributing 81.42% globally in 2026 and is projected to growth with fastest CAGR over the forecast period. This is driven by growing awareness of energy efficiency, sustainability, and green building initiatives worldwide. The rising urbanization and smart city development projects across the Asia Pacific, the Middle East, and Latin America are driving demand for energy-efficient glazing solutions that help reduce heating and cooling costs. Furthermore, the segment is set to hold 81.1% share in 2025.

The automotive & transportation segment is also experiencing favorable growth over the projected period. The growth of this segment is due to rising demand for energy-efficient, lightweight, and high-performance glazing solutions. Modern vehicles increasingly rely on insulated glass for enhanced thermal insulation, noise reduction, and passenger comfort. Growing urbanization and longer commuting hours have amplified the need for acoustic comfort, which insulated glass provides by reducing external noise. In addition, automotive & transportation applications are projected to grow at a CAGR of 5.1% during the study period.

Insulated Glass Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Asia Pacific

Asia Pacific Insulated Glass Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The Asia Pacific held the dominant share in 2025, valued at USD 7.63 billion, and also took the leading share in 2026 with USD 8.03 billion. The factors fostering the dominance of this region include rapid urbanization, infrastructure expansion, and rising middle-class income levels. Countries such as China, India, and Japan are witnessing robust demand due to large-scale residential and commercial construction projects, often supported by government initiatives promoting energy efficiency. The China market is estimated to reach USD 4.99 billion in 2026.

- China, the world’s largest construction market, drives significant adoption of insulated glass in skyscrapers, airports, and urban housing projects. At the same time, India’s Smart Cities Mission further expands demand for sustainable building materials.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is anticipated to witness a notable growth in the coming years. During the forecast period, European region is projected to record a growth rate of 5.5%, which is the second highest amongst all the regions and touch the valuation of USD 3.61 billion in 2025. This is primarily driven by the region’s stringent environmental policies, building energy performance directives, and commitment to carbon neutrality. The European Union’s Energy Performance of Buildings Directive (EPBD) and initiatives aligned with the European Green Deal highlight reducing heating and cooling energy consumption, boosting the product demand. Backed by these factors, countries including the U.K. are anticipated to record a valuation of USD 0.37 billion, Germany to record USD 0.83 billion in 2026 and France to record USD 0.35 billion in 2025.

North America

After Europe, the market in North America is estimated to reach USD 2.98 billion in 2025 and secure the position of the third-largest region in the market. The stringent energy efficiency standards, advanced construction practices, and widespread adoption of green building certifications such as LEED drive the growth of the market in North America. In the U.S., regulations such as the International Energy Conservation Code (IECC) mandate improved building insulation performance, which strongly supports the use of insulated glass in residential and commercial buildings. In 2025, the U.S. market is estimated to reach USD 2.28 billion.

Latin America and Middle East & Africa

Over the forecast period, the Latin America and Middle East & Africa regions would witness a moderate growth in the market. The Latin America market in 2025 is set to record USD 0.61 billion in its valuation. This growth is driven by increasing urbanization, construction growth, and rising awareness of energy efficiency. In the Middle East & Africa, Saudi Arabia is set to attain the value of USD 0.22 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Product Innovation and Partnerships with End-Users Are Essential Aspects for Growth of Companies Operating in Market

Product innovation & partnerships with end-users are important aspects for companies to maintain their position in the market. Some of the key market players include Saint-Gobain Glass India, AGC Inc., Nippon Sheet Glass Co., Ltd, Guardian Industries Holdings, and CARDINAL GLASS INDUSTRIES, INC. These companies possess substantial production capabilities and manufacture products for industry-specific applications. They are also expanding their manufacturing capacity and sales and distribution network across the globe.

LIST OF KEY INSULATED GLASS COMPANIES PROFILED

- Saint-Gobain Glass India (India)

- AGC Inc. (Japan)

- Nippon Sheet Glass Co., Ltd (Japan)

- Guardian Industries Holdings (U.S.)

- CARDINAL GLASS INDUSTRIES, INC. (U.S.)

- Xinyi Glass Holdings Limited (Hong Kong)

- Fuyao Group (China)

- Viridian Glass Pty Ltd (Australia)

- Magnum Tuff India Private Limited (India)

- Şişecam (Istanbul)

- Glas Trösch (Switzerland)

- Viracon (U.S.)

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.60% from 2026-2034 |

|

Unit |

Value (USD Billion), Volume (Kiloton) |

|

Segmentation |

By Type · Tempering Insulating Glass · Custom Insulated Glass · Heated Insulating Glass · Others |

|

By Application · Building & Construction · Automotive & Transportation · Industrial Applications · Others |

|

|

By Geography · North America (By Type, Application, and Country) o U.S. o Canada o Mexico · Europe (By Type, Application, and Country/Sub-region) o Germany o Italy o France o UK o Rest of Europe · Asia Pacific (By Type, Application, and Country/Sub-region) o China o India o Japan o South Korea o Rest of Asia Pacific · Latin America (By Type, Application, and Country/Sub-region) o Brazil o Rest of Latin America · Middle East & Africa (By Type, Application, and Country/Sub-region) o Saudi Arabia o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 15.65 billion in 2025 and is projected to reach USD 25.75 billion by 2034.

In 2025, the market value stood at USD 7.63 billion.

The market is expected to exhibit a CAGR of 5.60% during the forecast period of 2026-2034.

The tempering insulating glass segment led the market by type.

The key factors driving the market are the rising demand for energy-efficient buildings, stricter environmental regulations, urbanization, and growth in modern architectural designs.

Saint-Gobain Glass India, AGC Inc., Nippon Sheet Glass Co., Ltd, Guardian Industries Holdings, and CARDINAL GLASS INDUSTRIES, INC. are some of the prominent players in the market.

Asia Pacific dominated the market in 2025.

Increasing green building initiatives, retrofitting of aging infrastructure, advancements in smart and self-cleaning glass technologies, and expanding applications in automotive and industrial sectors are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us