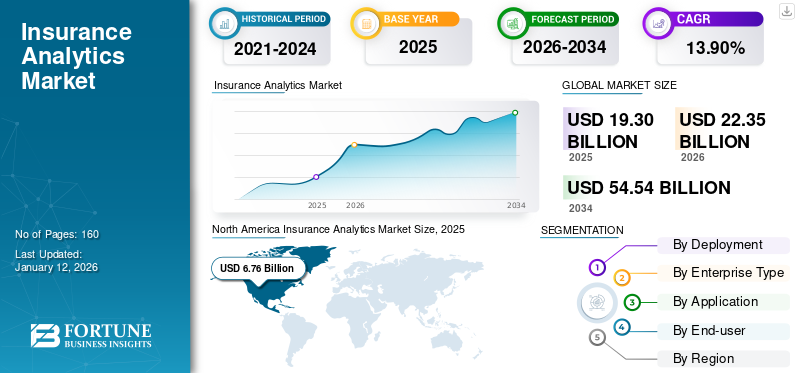

Insurance Analytics Market Size, Share & Industry Analysis, By Deployment (Cloud and On-premise), By Enterprise Type (Large Enterprises and Small and Medium Enterprises (SMEs)), By Application (Claims Process Optimization, Fraud Detection & Risk Assessment, Customer Engagement & Retention, and Others), By End-user (Insurance Firms, Government Agencies, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global insurance analytics market was valued at USD 19.3 billion in 2025. The market is projected to grow from USD 22.35 billion in 2026 and reach USD 54.54 billion by 2034, exhibiting a CAGR of 13.90% during the forecast period. North America dominated the global insurance analytics market with a share of 40.40% in 2025.

Insurance analytics uses advanced data analysis and modelling techniques within the insurance industry to extract valuable insights from vast amounts of data. It encompasses collecting, processing, and interpreting data related to policyholders, claims, risk management, and other insurance-related processes. The primary objectives in adopting insurance analytics are to enhance decision-making, improve operational efficiency, manage risks effectively, and develop a deeper understanding of customer behaviour.

As competition in the insurance sector increases, the need for analytical solutions tends to rise to gain a competitive edge in the global market. Businesses are adopting scalable and efficient solutions to manage growing risks, respond to disasters, and meet regulatory management requirements. Furthermore, competition arises among industry players as consumers tend to receive online quotes and customized insurance solutions from different companies 24/7. Increasing competition accelerates the adoption of insurance analytics among key market participants. These are some of the key factors driving the market growth.

The COVID-19 pandemic had a profound impact on the market. Insurers relied on data-driven insights, which surged the demand for analytics solutions within the insurance industry. The technology became influential in helping insurers assess the unique risks brought by the pandemic and develop predictive models for effective risk management. Overall, insurance analytics proved to be an essential tool for insurers in navigating the challenges posed by COVID-19, fostering innovation, and enhancing industry resilience.

Insurance Analytics Market Trends

Increasing Implementation of Artificial Intelligence (AI) and Machine Learning (ML) with Insurance Analytics Tools to Surge the Demand for Solutions

The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) in analytics is reshaping the insurance industry. Insurers are harnessing the power of these technologies to gain deeper insights from their data, streamline operations, and enhance customer experiences. AI and ML algorithms are used for more accurate risk assessment, enabling insurers to develop personalized insurance products and pricing models. For instance,

- In June 2022, SAS, a provider of AI and analytics, acquired Kamakura Corporation, which offers specialized software, data, and consulting services, enabling financial organizations, including banks, insurance companies, asset managers, and pension funds, to manage various financial risks effectively.

Claims processing is becoming faster and more efficient through automation, reducing administrative overhead. Moreover, these technologies are pivotal in fraud detection and swiftly identify irregularities in claims data. Customer service is revolutionizing with AI-driven chatbots providing immediate assistance and improving overall customer satisfaction. Underwriting processes are becoming more agile with predictive analytics, enabling insurers to proactively address customer needs.

Hence, the factors mentioned above are modifying the fundamental changes in the insurance industry, making it more data-centric, customer-focused, and efficient.

Download Free sample to learn more about this report.

Insurance Analytics Market Growth Factors

Surge in Demand for Data-driven Decision-making to Fuel Market Growth

The increasing need for data-driven decision-making in the insurance industry is a crucial market driver. Insurers are realizing the value of immense data in assessing risks, optimizing underwriting processes, detecting fraud, and enhancing customer experiences. The vast amount of data generated through policyholders, Internet of Things (IoT) devices, and external sources provide an opportunity to gain deeper insights into customer behavior and risk factors. Thus, insurance companies are investing in advanced analytics tools and platforms to harness this data effectively. For instance,

- According to industry experts, 90% of insurance professionals and enterprise analytics highlight the role of insurance analytics in driving their organizations’ digital transformation efforts.

Additionally, regulatory requirements and the need for accurate reporting encourage insurance firms to adopt analytics solutions for compliance.

Therefore, the rise in demand for data-driven and evidence-based decision-making is a major factor fueling the insurance analytics market growth.

RESTRAINING FACTORS

Lack of Resources and Limited Capabilities to Hamper Market Growth

The insurance industry generates massive amount of data, including customer information, claims data, market trends, and others. Managing, processing, and extracting valuable insights from this data can be complex, especially for insurance companies with limited data analytics capabilities. In addition, insurance companies deal with sensitive customer information and strict data protection laws, such as GDPR, which demand rigorous adherence. Ensuring analytics processes aligned with these regulations while delivering meaningful insights requires substantial effort and resources. Thus, a lack of resources and substantial effort is expected to restrain market growth.

Insurance Analytics Market Segmentation Analysis

By Deployment Analysis

Benefits Offered by Cloud-based Solution to Fuel the Segment Growth

Our research shows that the deployment is implemented on the cloud and on-premise. Cloud deployment dominated the market with a share of 68.14% in 2026 and is expected to grow at the highest CAGR throughout the projected period as it offers scalability, allowing insurers to expand their analytics capabilities as required without large upfront requirements in infrastructure. Additionally, cloud-based solutions provide real-time data processing and analysis, and are crucial for making timely decisions in the fast-paced insurance industry.

The on-premise deployment is expected to grow at an average rate as it provides control, security, and customization but may involve higher upfront costs and maintenance responsibilities. The choice between on-premise and cloud-based depends on an organization’s specific needs, resources, and regulatory requirements.

The on-premise deployment is expected to grow at an average rate as it provides control, security, and customization but may involve higher upfront costs and maintenance responsibilities. The choice between on-premise and cloud-based depends on an organization’s specific needs, resources, and regulatory requirements.

By Enterprise Type Analysis

Large Enterprise to Dominate Market Due to Ability of Analytics to Handle the Increasing Amount of Data Generated

According to our research, the solutions are used by large enterprises and small & medium enterprises. Large enterprises segment is expected to dominate the market accounting for 55.70% market share in 2026 and as they handle vast amounts of data, and analytics help them make sense of this information to improve risk assessment and underwriting accuracy. Also, analytics enable large enterprises to identify trends and patterns in claims data, helping them detect fraud more effectively fueling the segment’s growth.

On the other hand, small and medium enterprises segment is projected to grow at the highest rate in the adoption of analytics in the insurance sector as they increasingly recognize the value of data-driven insights to make informed decisions, manage risks, and optimize their insurance reporting. Furthermore, technological advancements have made insurance analytics solutions more accessible and affordable for smaller businesses.

By Application Analysis

Growing Insurance Analytics Use for Minimizing Fraudulent Activities to Surge Claims Process Optimization Segment Growth

As per our study, the market has specific applications, including claims process optimization, fraud detection & risk assessment, customer engagement & retention, and others. The claims process optimization segment holds the highest market share of 29.71% in 2026, as it is designed to streamline and enhance the entire claims process, leading to cost savings by automating routine tasks and reducing fraudulent claims. Moreover, it significantly improves customer satisfaction by expediting the claims settlement process, which leads to increased policy renewals.

Customer engagement & retention segment is projected to grow at the highest rate as insurance companies increasingly recognize the critical role of customer-centric strategies in the competitive landscape. By utilizing analytics better to understand customer behaviour, preferences, and needs, insurers can tailor their offerings, communications, and services to create a more personalized and engaging experience. Additionally, these tools enable insurance providers to identify potential issues that could lead to customer churn proactively. By detecting signals of dissatisfaction, insurers can intervene with timely and relevant offerings, improving customer satisfaction and retention rates.

By End-user Analysis

To know how our report can help streamline your business, Speak to Analyst

Increasing Analytics Use for Risk Management and Customer Satisfaction to Drive Insurance Firms Segment Growth

As per our study, the market has specific end-users, including insurance firms, government agencies, and others. The insurance firms segment holds the highest market share of 39.15% in 2026. The insurance firms segment is expected to grow rapidly as insurance companies heavily rely on data to make informed decisions regarding risk assessment, pricing, claims processing, and customer service. These tools empower insurers to extract valuable insights from their vast data repositories, enabling more accurate underwriting and enhanced risk management, improving profitability through optimized pricing, and reducing fraud.

Government agencies hold the second largest share as they are increasingly adopting insurance analytics for enhancing their operations, saving costs, and providing better services to the public.

REGIONAL INSIGHTS

As per our report, the market is studied across five regions, including North America, South America, Europe, the Middle East & Africa, and Asia Pacific. These regions are further categorized into leading countries.

North America Insurance Analytics Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

North America holds the highest market share as insurers harness analytical tools to assess potential risks and proactively enhance policyholder security. These advanced tools are required for extensive data research and meticulous processing to yield precise decision-making insights that drive expansion in the region. Moreover, substantial technological advancements and investments in cutting-edge analytics within the insurance sector contribute significantly to the insurance analytics market share. The U.S. market is projected to reach USD 5.19 billion by 2026. For instance,

- In May 2023, SAS, an analytics solutions provider, planned to invest USD 1 billion in three years to develop enhanced analytics solutions for industries' specific requirements. Further, SAS will build its focus on offering tailored solutions to industry challenges in banking, insurance, government, retail, healthcare, manufacturing, telecom/media, and others.

To know how our report can help streamline your business, Speak to Analyst

Asia Pacific

Asia Pacific is the fastest-growing region, with governments actively endorsing and boosting the insurance sector through advanced analytical tools, ultimately enhancing their business revenue. The region is set for accelerated growth due to its swift adoption of insurance technology. Additionally, robust economic expansion, rapid digitalization, and widespread adoption of cloud-based services provide significant growth opportunities for the market in the region. The Japan market is projected to reach USD 0.78 billion by 2026, the China market is projected to reach USD 1.27 billion by 2026, and the India market is projected to reach USD 0.69 billion by 2026.

Europe

Europe is gaining prominence due to continuous technological advancements within the insurance sector. Insurance firms, government agencies, party administrators, brokers, and consultancies are increasingly adopting insurance analytics technology for managing risks. This trend is further fueled by European insurance companies using analytical tools to mitigate regulatory risks and reduce claim processing costs, contributing to the region’s industrial growth. The UK market is projected to reach USD 1.23 billion by 2026, while the Germany market is projected to reach USD 1.15 billion by 2026.

South America and the Middle East & Africa

South America and the Middle East & Africa are expected to grow slowly as insurance analytics in these regions is still developing, with countries starting to recognize the importance of utilizing analytics in the insurance industry.

Key Industry Players

Key Players Launch New Products to Strengthen Their Market Position

The key players in this market are actively creating advanced solutions to cater to customer demands and also focus on enhancing their existing product portfolio to deliver flexible solutions. Furthermore, these organizations proactively pursue collaboration, acquisitions, and partnerships to bolster their product offerings.

Insurers can use data analytics to learn more about customer behavior and offer solutions tailored to their needs. These analytics providers enter contracts with various companies to support their IT software and services. As companies switch to digital technology, there is more room for expansion and insurance analytics solutions need to become more consistent. Players tend to invest in innovations in their product offerings to meet the changing needs of the insurance industry.

List of Top Insurance Analytics :

- IBM Corporation (U.S.)

- Tableau Software, LLC (U.S.)

- Wipro (India)

- LexisNexis Risk Solutions (U.S.)

- Vertafore, Inc. (U.S.)

- SAS Institute Inc. (U.S.)

- Verisk Analytics, Inc. (U.S.)

- ExlService Holdings, Inc. (U.S.)

- Altair Engineering Inc. (U.S.)

- Moody's Analytics, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- January 2024: Insurity announced an AI-powered analytics solution that it claims would revolutionize decision-making for property and casualty insurance companies. Insurity's analytics solutions give network operators a higher level of reliable insight into their portfolios, improve loss ratios, and enable deeper segmentation.

- August 2023: IBM and FGH Parent, L.P. (with subsidiary “Fortitude Re”) transformed Fortitude Re’s life insurance policy. It would help service operations through the implementation of other automation tools and AI technology developed to achieve the highest levels of performance.

- June 2023: iPipeline and Vertafore joined forces to simplify life insurance distribution for insurance carriers and independent agents. This partnership aims to streamline and improve the process of offering life insurance policies, making it more efficient and accessible for all parties involved.

- June 2023: Verisk unveiled an advanced insurance fraud analytics solution in collaboration with Kyndryl Technology in Israel. This innovation solution combines Kyndryl’s robust cloud computing capabilities with Veriks’s extensive domain knowledge to rapidly access fresh automobile insurance claims involving bodily injury, a mandatory insurance component in Israel. Its primary goal is to identify potential fraud indicators.

- April 2023: Guidewire introduced the Garmisch solution, offering self-service tools through the Guidewire Cloud Console for developers, enabling insurance companies to swiftly establish digital claims processes. Garmisch includes ready-to-use connectors for major global data platforms, speeding up organizations’ access to insights.

- April 2023: Verisk introduced an innovative Rating-as-a-Service (RaaS) solution that transforms insurance product innovation. This cloud-based rating engine eliminates the need for insurers to invest significant time collecting and updating ratings. Instead, insurers provide relevant rating inputs to Verik through API. This approach streamlines and modernizes the rating process, enhancing efficiency for insurers.

- March 2023: LexisNexis Risk Solutions upgraded its AI-driven home insurance solution to enhance and accelerate the underwriting process for home insurance. Their goal is to leverage data and advanced analytics to offer valuable insights that assist businesses and governmental organizations in mitigating risks and make better decisions, ultimately benefiting individuals.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 13.90% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Enterprise Type

By Application

By End-user

By Region

|

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 54.54 billion by 2034.

In 2026, the market was valued at USD 22.35 billion.

The market is projected to grow at a CAGR of 13.90% during the forecast period.

The large enterprises are expected to lead the market.

The surge in demand for data-driven decision-making fuels market growth.

IBM Corporation, Tableau Software, LLC, Wipro, LexisNexis Risk Solutions, Vertafore, Inc., SAS Institute Inc., Verisk Analytics, Inc., ExlService Holdings, Inc., Altair Engineering Inc., and Moodys Analytics, Inc. are the top players in the market.

North America dominated the global insurance analytics market with a share of 40.40% in 2025.

By end-user, the insurance firms is expected to grow with a remarkable CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us