Ka, K, Ku Band Satellite Equipment Market Size, Share & Industry Analysis, By Platform (Land V-SAT, Maritime V-SAT, and Airborne V-SAT), By Network Architecture (Star Topology, Mesh Topology, Point-To-Point Links, and Others), By End-user (Video Broadcasting, Data Transfer, Private Network, Voice Communication, and Others), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

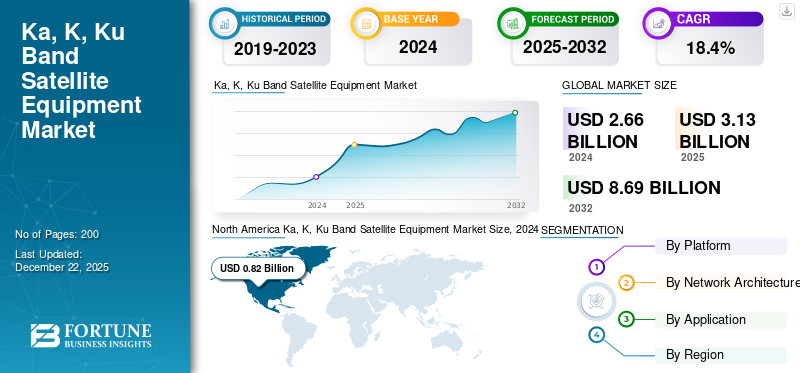

The global Ka, K, Ku band satellite equipment market size was valued at USD 2.66 billion in 2024. The market is projected to grow from USD 3.13 billion in 2025 to USD 8.69 billion by 2032, exhibiting a CAGR of 18.4% during the forecast period. North America dominated the ka, k, ku band satellite equipment market with a market share of 30.83% in 2024.

Ka-band satellite equipment utilizes the Ka-band frequency band (27–40 GHz), an extremely high data rate microwave band. Satellite communication systems, transceivers, modems, amplifiers, and antennas are the building blocks of Ka-band satellite equipment. Ka-band provides much larger bandwidth, twice that of Ku-band and five times that of C-band, to provide increased data rates and increased anti-interference capability. Low Ka-band frequency with its smaller wavelengths enables the use of compact ground terminal hardware and antennas. Hence, they are best suited for use in high-speed internet, broadcasting, remote sensing, and military communications. It is well suited for new satellite systems, such as High Throughput Satellites (HTS), that use directed spot beams and frequency reuse with an attempt to maximize the efficiency.

The major share of the ka, k, ku band market is with top players such as Viasat, Hughes Network Systems, Intelsat, Gilat Satellite Networks, Cobham SATCOM, and L3Harris Technologies. Ka-band satellite equipment is expanding rapidly, with the growing need for high-speed internet access and bandwidth-intensive applications. Its ability to deliver higher data throughput at affordable prices also enhances its appeal in bridging connectivity gaps in rural areas. Growth within satellite constellations such as Starlink and OneWeb has further stimulated demand as these platforms heavily rely on Ka-band technology for global coverage. Other than that, HTS technologies enable low-cost reuse of spectrum and focused beams, lessening the cost per bit while increasing capacity. Its integration with 5G networks has also made it more viable, making low-latency communication possible in remote locations. Additionally, Ka-band's compact size of equipment and high performance makes it essential in aviation, maritime, and military operations.

Global Ka, K, Ku Band Satellite Equipment Market Overview

Market Size & Forecast

- 2024 Market Size: USD 2.66 billion

- 2025 Market Size: USD 3.13 billion

- 2032 Forecast Market Size: USD 8.69 billion

- CAGR: 18.4% from 2025–2032

Market Share

- North America dominated the market in 2024, driven by advanced satellite infrastructure, strong presence of key players like Viasat and Hughes Network Systems, and increased demand for broadband connectivity across defense, aviation, and rural broadband sectors.

- By platform, the land VSAT segment accounted for the largest share due to rising adoption of IoT and M2M communications in remote areas, while the maritime VSAT segment is projected to register the highest growth, supported by increasing digitalization of shipping and global maritime trade.

Key Country Highlights

- United States: Leads globally with extensive deployment of LEO constellations (Starlink, OneWeb), defense modernization programs, and strong investments in multi-orbit Ka/Ku terminals. Post-Ukraine war, U.S. manufacturers accelerated domestic production of ruggedized and anti-jam Ka-band solutions.

- China: Expanding Ka-band infrastructure under Belt and Road Initiative and deploying COMAC satellite networks for military and rural broadband applications.

- Europe: Strong growth fueled by initiatives like ESA’s IRIS² and investments from SES and Eutelsat to expand broadband coverage and support maritime/aviation communications.

- Asia Pacific: Fastest-growing region driven by high internet penetration, 5G integration, and national satellite programs in Japan, South Korea, and India.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Speed Internet and Reliable Communication Services Lead to Substantial Market Growth

The growing need for fast internet and reliable communication services in rural and underpenetrated areas drives the Ka-band satellite equipment market growth. Its increased data transmission rate and efficient spectrum make it easier to integrate applications such as telemedicine, IoT, and distance learning. Low-Earth orbit satellite constellations such as Starlink and OneWeb have also increasingly relied on Ka-band technology to provide global coverage. In addition, integration with 5G has the capability of providing low-latency services without involving any ground infrastructure. Advancements in satellite technologies, such as High Throughput Satellites (HTS), are continuously improving performance while reducing cost.

MARKET RESTRAINTS

High Cost of Satellites, Ground Equipment Production to Limit Market Expansion

Despite its advantages, the Ka, k, ku band satellite equipment market growth faces significant challenges. The high costs associated with the production of satellites, ground equipment, and launch operations present a financial obstacle, especially for small businesses. The complexity of engineering and the need for thorough testing further increase these expenses. Regulatory restrictions on spectrum usage introduce another layer of complexity, as compliance with both international and domestic regulations is necessary to avoid interfering with other telecommunication services. Furthermore, adverse weather conditions such as heavy rains can disrupt signal quality, making Ka-band systems less practical for widespread use in certain regions.

MARKET OPPORTUNITIES

Ka-Band Satellite Hardware Growth to Positively Impact Market Growth

The Ka-band satellite equipment market presents significant opportunities due to advancements in technology and a growing demand for high-quality connectivity. The deployment of low-Earth orbit (LEO) constellations such as Starlink and OneWeb offers immense potential for satellite internet access worldwide. The integration of 5G networks also plays a crucial role by providing high-speed, low-latency services to remote areas. Furthermore, the increasing use of Ka-band technology in aviation, maritime, and defense sectors for integrated communications solutions is broadening its applications. Governments and private industries are making significant investments in Ka-band systems to bridge the digital divide and support data-intensive applications such as telemedicine and IoT.

KA, K, KU BAND SATELLITE EQUIPMENT MARKET TRENDS

Advancement in Antenna Technology, Semiconductor Technology, and Satellite Constellation Expansion to Positively Impact Market Growth

Modular and scalable antennas are among the key Ka-band satellite equipment market trends. These antennas are engineered to support higher frequencies, ensure easy deployment, and minimize installation complexity. Phased-array systems and multi-beam systems improve signal efficiency and provide flexibility for various applications, such as remote sensing, 5G integration, and IoT. For instance, CPI Vertex Antennentechnik's "plug-and-play" Ka-band antennas enhance connectivity for MEO satellite constellations such as SES's O3b mPOWER system.

- North America witnessed Ka, K, Ku band satellite equipment market growth from USD 0.69 Billion in 2023 to USD 0.82 Billion in 2024.

Semiconductor material such as Gallium Nitride (GaN) is revolutionizing Ka-band power amplification. GaN amplifiers offer linear power and enhanced efficiency, which helps meet the demands of multi-carrier systems and video bandwidth requirements. Transitioning from vacuum tube amplifiers to GaN technology is crucial for addressing the increasing demand for broadband internet and 5G service. The deployment of future LEO and MEO satellite constellations is transforming Ka-band communications. Operators such as OneWeb and Starlink use Ka-band frequencies to deliver global broadband coverage. These constellations utilize frequency reuse and dense spot beams to maximize data rates without incurring additional costs.

Download Free sample to learn more about this report.

Impact of Russia-Ukraine War

Supply Chain Fracturing & Technological Pivot: The war fractured critical supply chains, as Russian bans on neon gas/palladium, which are vital for RF amplifiers/laser optics, and Ukrainian wiring harness shortages spiked Ka/Ku-band component costs by 20–30% and delayed satellite production. This forced Western companies such as Viasat, SpaceX to accelerate localized production in India/Vietnam. The countries will adopt ruggedized COTS terminals, validated by Ukraine’s Starlink-dependent drone warfare. Concurrently, Russian electronic warfare attacks such as Tirada-2 jamming exposed Ku-band vulnerabilities, compelling a shift toward radiation-hardened GaN amplifiers and hybrid multi-band terminals.

Demand Surge & Operational Doctrine Shift: Battlefield reliance on low-latency satcom for drone swarms and artillery targeting ignited a 40% NATO funding surge for anti-jam Ka-band systems such as Inmarsat GX and dual-payload Ka/Ku terminals such as Collins Freedom 450. Ukrainian success with Starlink cemented demand for LEO constellations, doubling orders for K/Ka-band user terminals (OneWeb, Telesat) and rendering GEO satellites obsolete for tactical use. This rewrote procurement doctrine: 60% of new military contracts now mandate multi-orbit resilience and quantum encryption, abandoning proprietary standards.

Geopolitical Fragmentation & Market Bifurcation: Sanctions collapsed Russia’s space sector—crippling the Yamal Ka-band program and triggering 95% loss of global launch share, while ASAT tests raised Ku-band insurance costs by 50%. This created parallel markets:

- NATO-aligned blocs pivoted to sovereign Ka-band HTS such as, EU’s IRIS², South Korea’s 425 Project.

- Neutral states turned to Chinese launches (Great Wall Industry) and Middle Eastern capacity (Arabsat, Yahsat).

Segmentation Analysis

By Platform

High Demand for Fast & Reliable Remote Area Communications and IoT Integration to Drive the Land V-SAT Segment’s Growth

Based on platform, the market is classified into land V-SAT, maritime V-SAT, and airborne V-SAT.

The land V-SAT segment accounted for a dominating market share in 2024. Land VSAT systems are becoming increasingly robust due to the high demand for fast and reliable connectivity in remote areas. These systems provide broadband solutions for various high-utility applications such as telecommunication, live streaming, and private networks, making them essential for both business activities and government operations. As the use of IoT and M2M communications increases, the demand for land VSAT systems rises as they enable real-time data processing and automation. Moreover, advancements in rugged VSAT designs allow them to operate in extreme environmental conditions, enhancing their applicability for defense and disaster management. Customized solutions provided by manufacturers further expand their range of applications.

Additionally, the maritime V-SAT segment is expected to grow at the highest CAGR in the forthcoming years. This rapid expansion is fueled by the increasing demand for uninterrupted connectivity on board ships, such as commercial ships, military fleets, and unmanned marine vehicles. The growth of global maritime trade and the use of digital technologies in shipping are key drivers. Maritime VSAT provides consistent internet access for operations such as navigation, crew welfare, and remote monitoring. Advances in technology have reduced the costs and complexity of these systems, further fueling their adoption. Moreover, increased import-export activities and the opening of new sea trade routes are driving the demand for maritime VSAT solutions in civil as well as military applications.

By Network Architecture

Emergence of Advanced Mesh Topology for Commercial Applications Propels Mesh Topology Segment Growth

Based on network architecture, the market is divided into star topology, mesh topology, point-to-point links, and others.

The mesh topology segment accounted for the largest share of the market in 2024 and is expected to grow at the highest CAGR in the forthcoming years. Mesh topology is gaining popularity because it is highly fault-tolerant, scalable, and reliable. In mesh design, devices are physically interconnected, providing multiple pathways for data transmission. This redundancy ensures that the network remains operational even if some nodes fail, making it ideal for mission-critical applications such as health care, banking, and military operations. Mesh networks also allow for easy scalability as new nodes can be added without disrupting the existing network. Additionally, the architecture enhances security by eliminating single points of failure and supporting encryption through multiple paths. Its usage in IoT installations and high-speed applications such as gaming also aids in its increasing adoption.

Star topology segment will continue to account for a considerable share of the market. Star topology is on the rise due to its simplicity, centralized control, and cost-effectiveness. In star architecture, all devices connect to a central hub, which makes control and monitoring easier. Its simple design reduces complexity and makes it easy to troubleshoot. Star topology is particularly advantageous in corporate environments, retail networks, and banking systems where centralized data is essential. Its lower initial cost compared to mesh topology makes it attractive for small organizations or low-budget networks. Additionally, this architecture supports asymmetric data flow, maximizing bandwidth utilization for applications such as point-of-sale transactions and satellite communication services via VSAT systems.

By Application

Increased Reliance on Digital Systems across Various End User Industries to Propel the Data Transfer Segmental Market Growth

Based on application, the market is divided into video broadcasting, data transfer, private network, voice communication, and others.

The data transfer segment accounted for the largest share of the market in 2024 and is expected to grow at the highest CAGR in the forthcoming years. This growth is driven by an increased reliance on digital ecosystems across various industries. There is a growing demand for secure, high-speed methods for processing and transferring large volumes of data, particularly with the integration of IoT devices and cloud computing. High-speed data transmission facilitates real-time analysis, making it possible for essential applications such as financial transactions, remote work, and global communication to function effectively. Technologies such as AI-based encryption, multi-path transfer technology, and global load balancing optimize the speed and reliability of data transfer. Moreover, strict adherence to data privacy regulations such as GDPR and CCPA compels companies to adopt complex solutions for secure data transfers. The increased integration of these systems into business processes further enhances the need for high-quality data transfer systems.

The video broadcasting segment will continue to account for a considerable share of the market driven by the growing demand for high-definition streaming services and real-time content delivery. The growth of OTT platforms, virtual events, and online gaming requires advanced broadcasting capabilities that can handle large volumes of data. Enhanced network infrastructure, such as 5G technology, improves streaming quality by reducing latency. Companies use video broadcasting for various purposes, including marketing, training, and customer engagement, utilizing adaptive bitrate streaming to ensure smooth playback on different devices. In addition, global load balancing improves content delivery to audiences worldwide. All these elements in combination propel the adoption of video broadcasting apps in the entertainment, corporate events, and education sector.

Ka K Ku Band Satellite Equipment Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, and the Rest of the World.

North America

North America Ka, K, Ku Band Satellite Equipment Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America is the dominant region in the Ka-band satellite equipment market owing to its well-developed infrastructure of satellite technology and heavy investments in space research and communication system development. Leading industry players such as SpaceX, Viasat, and Hughes Network Systems drive innovation and adoption of Ka-band solutions across various sectors such as defense, aviation, and broadband services. There is an increasing need for broadband internet in rural areas and connectivity with 5G networks, which further boosts growth in the industry. Moreover, government-sponsored programs, such as NASA’s use of Ka-band for high-data-mission missions, and cooperative activities with private industries reinforce the region's leadership in this marketplace.

The U.S. solidifies its global leadership in Ka/Ku/K-band satellite equipment market, driven by defense modernization, LEO constellation deployment, and post-Ukraine War supply chain resilience. U.S. firms such as Viasat and Hughes dominate the global market, leveraging accelerated DoD procurement for tactical multi-band terminals such as Starlink’s Starshield, L3Harris’ Falcon IV, and anti-jam Ka-band systems that counter Russian EW threats.

Europe

Europe holds the second-largest Ka, K, Ku band satellite equipment market share. The region is experiencing strong growth in the Ka-band satellite gear market as it aims to improve digital connectivity and reduce the digital divide. Private companies such as SES and Eutelsat, as well as the European Space Agency (ESA), are investing heavily in Ka-band satellites for TV broadcasting and broadband internet. The developed aerospace industry of the region supports technological innovation in satellites, and state-funded programs focus on enhancing connectivity in off-grid areas. In addition, the increased use of Ka-band in sea as well as air communications also solidifies its position in Europe's market.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region and will depict the highest CAGR in the forecast period. This growth is largely attributed to the expanding Ka-band satellite infrastructure, driven by the evolution of digital networks and increasing internet penetration. Chinese, Japanese, South Korean, and Indian governments are investing significantly in satellite communications to promote rural broadband growth and address national defense needs. The Belt and Road Initiative of China utilizes Ka-band satellites to enhance connectivity across its extensive network. Additionally, Japan is leading advancements in space technology, while South Korea focuses on IoT applications that require high-throughput systems through Ka-band satellites. The country's developing maritime and aviation industry also fuels the region’s expansion.

Rest of the World

The market in the rest of the world is expected to witness considerable growth in the near future. Increased internet services via satellites are taking place in remote areas of the Middle East, Latin America, and Africa. Governments and non-governmental institutions are utilizing Ka-band technology to bridge connectivity gaps and foster economic development. The growing need for efficient communication solutions in the maritime, defense, and disaster management segments also drives demand. Additionally, the availability of affordable technology for satellite launch is making Ka-band systems accessible to developing nations, accelerating market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Position

The Ka, K, Ku band satellite equipment market is experiencing rapid growth, driven by the increasing demand for high-speed communication in industries such as defense, aerospace, and commercial business. With higher data transmission capacity and better spectrum efficiency compared to lower bands, Ka-band systems are ideal for applications such as broadband internet, telemedicine, and IoT connectivity.

North America currently leads the market in technological advancements, while China and South Korea are making progress through strategic investments in satellite facilities. However, the industry faces challenges such as high production costs and stringent regulatory standards. Top industry players such as Viasat, SpaceX, and Intelsat are investing in R&D to enhance performance and capitalize on future opportunities.

LIST OF KEY KA, K, KU BAND SATELLITE EQUIPMENT COMPANIES

- Hughes Network Systems, LLC (U.S.)

- Viasat Inc. (U.S.)

- Gilat Satellite Networks Ltd. (Israel)

- Cobham Limited (U.K.)

- Marlink (Norway)

- ST Engineering (Singapore)

- L3Harris Technologies, Inc. (U.S.)

- Intelsat (Luxembourg)

- Orbit Communications Systems Ltd. (Israel)

- Speedcast (Australia)

KEY INDUSTRY DEVELOPMENTS

- December 2024: Space Systems Command (SSC) granted SES Space & Defense a cover purchase agreement to provide multi-orbit, multi-band satellite capabilities to United States European Command (USEUCOM). The agreement features a ceiling value of USD 117 million.

- December 2024: Northrop Grumman announced the completion of mission operations and the actuation of Space Norway's Arctic Satellite Broadband Mission (ASBM) constellation, enhancing access to satellite communications in the High North for both the U.S. Space Force and Norway.

- August 2024: Orbit Communication System Inc. partnered with Viasat Inc. to supply advanced SATCOM Multi-purpose terminals (MPTs) for the latter’s airborne platforms. Orbit is expected to introduce the next-gen SATCOM equipment system to integrate with Viasat’s Ka-band networks.

- July 2024: Aselsan, one of Türkiye's defense industry companies, exchanged its accumulated information in space to Türkiye's first indigenous communications, Turksat 6A, subsequently nationalizing the satellite's communication payloads.

- May 2024: Airbus unveiled the delivery of the first active antenna of the SpainSat NG-I satellite. Acceptance testing of the active transmit antenna for Hisdesat's SpainSat NG-I satellite has been effectively completed after the ultimate radiation pattern tests. The antenna is also integrated onto the satellite in Toulouse, France.

REPORT COVERAGE

The global Ka, K, Ku band satellite equipment market analysis provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on key regions/countries, key industry developments, new product launches, details on partnerships, and mergers & acquisitions. It covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 18.4 % from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Platform

|

|

By Network Architecture

|

|

|

By End-User

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.66 billion in 2024 and is projected to record a valuation of USD 8.69 billion by 2032.

In 2024, the market value stood at USD 0.82 billion.

The market is projected to exhibit a CAGR of 18.4% during the forecast period of 2025-2032.

The airborne segment led the market by platform.

Rising demand for high-speed internet is expected to lead to substantial growth.

Major companies operating in the market are Vuasat, ST Engineering, and Northrop Grumman.

North America dominated the market in 2024 by holding the largest share of the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us