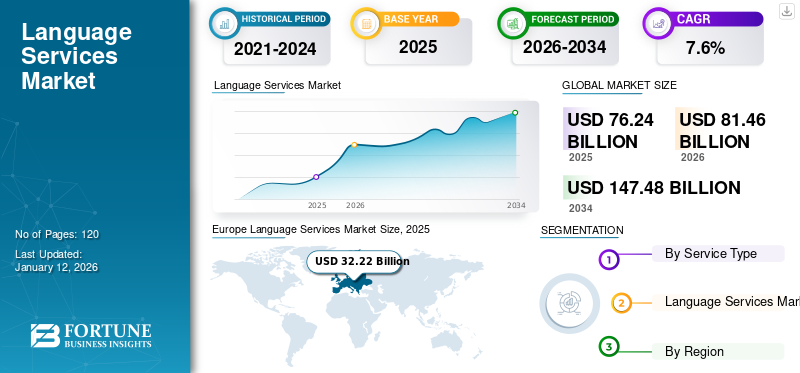

Language Services Market Size, Share & Industry Analysis, By Service Type (Subtitling, Translation Services, Interpreting Services, Localization Services, Transcription Services, and Others), By End-Use Vertical (Government, Healthcare/Medical, BFSI, Education, Travel & Tourism, Entertainment, IT & Telecom, and Others), and Regional Forecast, 2026–2034

LANGUAGE SERVICES MARKET SIZE AND FUTURE OUTLOOK

The global language services market size was valued at USD 76.23 billion in 2025. The market is projected to grow from USD 81.45 billion in 2026 to USD 147.48 billion by 2034, exhibiting a CAGR of 7.60% during the forecast period. Europe dominated the language services market with a market share of 42.27% in 2025.

In a globalized economy, the consideration of language and cultural implications is integral to effective communication on a global stage. With approximately 7,139 languages spoken in the world, the need for expert language services continually rises as global connectivity increases. As companies compete internationally, consumer demands evolve, and health issues emerge globally, the language services industry continues to grow.

Language translations enable companies to expand their reach into international markets by ensuring that marketing materials, product information, and customer support are accessible in multiple languages. As per Redokun, around 75% of consumers prefer to buy products from websites that offer content in their native language.

Players in the market including LanguageLine Solutions, Transperfect, Atlas Language Services Inc., Lionbridge, DeepL, and RWS Holdings among others are providing services such as translation, subtitling, localization, interpretation and these companies are leveraging artificial intelligence (AI) to assist human translation.

IMPACT OF GENERATIVE AI

Increasing Demand for Generative AI for Transforming Language Services to Boost Market Growth

Generative artificial intelligence has emerged as a transformative technology with potential to revolutionize global communication and accessibility. Generative AI is significantly transforming the language services market by enhancing efficiency, reducing costs, and automating complex workflows. By allowing faster content generation and translation, generative AI enables language service providers to shift their focus on more creative and nuanced tasks while improving overall productivity. Generative AI reduces translation costs by automating repetitive tasks and streamlining workflows, allowing companies to allocate resources more efficiently.

The ability to generate content at scale empowers providers to handle larger volumes of work in shorter timeframes, enhancing overall productivity. As generative AI technology advances, language service providers will likely develop new offerings that integrate AI capabilities, further enhancing the value they provide to clients. The market is expected to continue its upward trajectory, with generative AI playing a pivotal role in shaping its evolution, making services more accessible and efficient.

Language Services Market Trends

Demand for Multilingual Customer Support Acts as a Key Market Trend

In today's interconnected world, where businesses frequently cross geographical and cultural boundaries, providing multilingual customer support is essential for companies seeking to expand into new markets and strengthen their presence in existing ones. Serving a diverse global customer base requires more than just offering services in multiple languages, it is a fundamental necessity. By doing so, businesses showcase a deep respect for their customers' cultures and languages, acknowledging the diverse clientele.

Companies can create an inclusive environment by making their services accessible to everyone, regardless of the language they speak. This approach makes customers feel welcome and also enhances the company's reputation. As a result, businesses seek more customer-focused and globally competent.

Therefore, demand for multilingual customer support is driving the language services market growth.

MARKET DYNAMICS

Market Drivers

Rise of Global Workforce and Remote Work to Boost Market Growth

Surge in digitalization globally has brought significant changes to the working environment. The COVID-19 pandemic has accelerated the adoption of remote work, making it a permanent fixture in many sectors. This model removed geographic boundaries, enabling talent from around the world to collaborate effectively. Prior to the pandemic, remote work was relatively uncommon, with only 3% of the global workforce participating in it. However, the global pandemic of 2020 prompted many workplaces to quickly adopt this model. According to data published by industry experts in 2021, 48% of the global workforce transitioned to remote work, and this trend has remained permanent in various sectors.

The COVID-19 pandemic disrupted industries globally and the language services sector was no exception. From interpretation and translation to localization and language education, providers had to adapt quickly to meet new demands. The shift to remote work transformed the language services sector, as virtual meetings necessitated real time translation and interpretation. Additionally, companies increasingly relied on localization services to engage with global customers through digital channels.

Market Restraints

Challenges Associated With Recruiting and Retaining Skilled Linguists Hampers Market Growth

The language industry continues to face challenges in finding and retaining skilled linguists. With the increasing demand for language services, there is a rising need for qualified interpreters, translators, and localization professionals. However, attracting top talent and establishing long-term relationships with linguists can be quite difficult.

Despite these challenges, the language industry is essential for facilitating global communication and promoting cultural exchange. Language professionals are continually adapting and innovating to meet the needs of a multilingual world. However, increasing concerns around talent recruitment and retention are creating hurdles that may hinder market growth.

Market Opportunities

Increasing Demand for Medical Translation to Create Lucrative Opportunities for Market Players

The healthcare industry is complex, and language barriers pose significant challenges as the patient population becomes increasingly diverse. Consequently, the demand for accurate healthcare translation services is rising. Precise medical translations are crucial in preventing misunderstandings and potential medical errors, thereby ensuring patient safety and well-being. When medical information is translated correctly, patients are better equipped to make informed decisions about their healthcare.

Inaccurate translations can hinder patients’ understanding of their conditions, leading to confusion, frustration, and even non-compliance with medical instructions. This can erode trust in healthcare providers. Therefore, key players in the market focus on delivering high-quality translations to ensure that patients fully comprehend their medical care.

Therefore, increasing demand for medical translation is expected to increase the language services market share.

SEGMENTATION ANALYSIS

By Service Type

Localization Services Segment Led due to Enhanced Global Reach

Based on service type, the market is segmented into subtitling, translation services, interpreting services, localization services, transcription services, and others.

The localization services segment dominated the market in 2024 with a share of 29% and is estimated to grow with highest CAGR during the forecast period. Localization helps overcome language barriers and cultural differences, making products more accessible and appealing to global audiences. According to an OneSky survey, localization increases search traffic by 47%, boosts website visits by 70%, and increases conversion rates by 20%.

Subtitling is estimated to grow significantly in coming years, as it significantly enhances content comprehension and engagement. Subtitling boosts content engagement and contributes to higher customer satisfaction. As per survey by Milestone Localization, video subtitles increases video viewing time by 40%.

Download Free sample to learn more about this report.

By End-Use Vertical

IT & Telecom Segment Led the Market Owing to Rising Adoption of Language Services for Ensuring Compliance

By end-use, the market is further segmented into government, healthcare/medical, BFSI, education, travel & tourism, entertainment, IT & telecom, and others.

The IT & telecom segment dominated the market in 2024. Language services help companies in the sector by ensuring compliance with legal and regulatory requirements across different countries. By providing documentation in local languages, businesses can reduce the risk of penalties or legal disputes. Language services help companies to operate more effectively and efficiently on a global scale.

Healthcare/medical is expected to grow with the highest CAGR during the forecast period, as language services help to overcome language barriers between healthcare providers and patients who speak different languages. Healthcare facilities strive to ensure that language does not restrict access to appropriate care. By promoting inclusivity and equity in healthcare delivery, these services enable patients to fully understand their health conditions and make informed decisions about their treatment.

To know how our report can help streamline your business, Speak to Analyst

LANGUAGE SERVICES MARKET REGIONAL OUTLOOK

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Europe

Europe Language Services Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Europe dominated the market by capturing the maximum share valued at USD 32.22 billion in 2025 and USD 34.58 billion in 2026. The attitude toward multilingualism is considerably positive among Europeans, with around 86% agreeing that everyone should speak at least one language in addition to their mother tongue, and 69% believing that citizens should know more than one additional language. The U.K. market continues to grow, projected to reach a value of USD 5.09 billion in 2026.

Language diversity holds strong importance in the region, as per Eurobarometer Survey, around 47% of Europeans speak English as a foreign or second language. After English, most spoken foreign languages are French, German, and Spanish. The Germany market is expected to hit USD 5.68 billion in 2026, while France is anticipated to be valued at USD 6.67 billion in 2025.

Europe Language Services Market Size, 2019-2032 (USD Billion)

In France, the market is expected to experience a strong growth during the forecast period. French is the official language of 29 countries and ranks as the third most used language in international business after English and Chinese. France is home to some of the top’s universities and research institutions that offer higher education to international students. French is one of the fastest-growing languages in the world, especially in Africa, where it is projected that more than half of the world’s French speakers will reside by 2050. As African economies continue to develop and integrate into the global market, the ability to speak French will become an increasingly valuable asset.

Asia Pacific

Asia Pacific is the third largest market, estimated to be valued at USD 10.61 billion in 2026. The region is expected to grow with the highest CAGR during the forecast period. Rapid economic development across the region is attracting global businesses and investments. China is expected to reach a market value of USD 2.98 billion in 2026. As companies expand, there is an increasing need for language services to communicate effectively in diverse markets. This region is home to a multitude of languages and dialects, with the rise in cross-border trade and tourism, the demand for translation industry and localization services will also rise. India is projected to be valued at USD 1.43 billion in 2026, while Japan is estimated to capture a valuation of USD 2.64 billion in the same year.

North America

North America is the second leading region, projected to reach a market value of USD 26.66 billion, exhibiting a CAGR of 5.70% during the forecast period (2025-2034), owing to increasing diversity, globalization and the need for effective communication across diverse populations and industries. Immigration and globalization are key drivers of market growth and more than 350 different languages are spoken in the United States alone. According to Bureau of Labor Statistics, employment of translators and interpreters is estimated to grow 19% by 2028.

The demand for language services in the U.S. is increasing, according to the U.S. Central Bureau, around 68 million people speak a language other than English at home and this language includes Chinese, Spanish, and Arabic among others. This linguistic diversity creates demand for localization, translation and interpretation services. The U.S. market is estimated to reach the valuation of USD 18.03 billion in 2026.

Middle East & Africa

The Middle East & Africa is the fourth largest market, projected to hit USD 6.16 billion in 2026. The region is anticipated to grow at a healthy rate during the forecast period. The growth of language services is propelled by an increasing focus on economic diversification and digital transformation. The demand for translation services increases with the integration of human expertise, advanced machine translation technologies, and the growing use of cloud-based models. The GCC market is expected to hit USD 2.34 billion in 2025.

South America

South America is likely to register a steady growth during the forecast period, driven by increasing international trade, linguistic and cultural diversity, and the growing effects of globalization. Brazil, an emerging market where Portuguese is the official language, presents opportunities for businesses. To successfully enter this market, companies need translation services to ensure their products, services, and marketing materials are accessible to the local population.

COMPETITIVE LANDSCAPE

Key Market Players

Market Players Opt for Merger & Acquisition Strategies to Expand Their Presence

Key players in the market are adopting various business strategies to enhance their market presence and capitalize on emerging opportunities. Companies are integrating AI and machine learning into their platforms to enhance speed and quality of translation and to enhance content optimization. Players are expanding their operations into emerging markets to boost their customer bases. Companies are investing in research and development to innovate and improve their offerings and stay competitive in the market.

List of Key Language Service Companies Profiled:

- Atlas Language Services Inc. (U.S.)

- Lionbridge (U.S.)

- Transperfect (U.S.)

- LanguageLine Solutions (U.S.)

- DeepL (Germany)

- Globe Language Services Inc. (U.S.)

- RWS Holdings PLC (U.K.)

- Hogarth Worldwide Limited (U.K.)

- Keywords Studios PLC (U.K.)

- Semantix AB (Sweden)

- Summa Linguae Technologies (Poland)

- Teleperformance SE (France)

- Welocalize (U.S.)

- Multicultural NSW (Australia)

- PTSGI (Taiwan)

- Translate Plus (U.K.)

- Global Talk (Netherlands)

….and more

KEY INDUSTRY DEVELOPMENTS:

- March 2025 – Welocalize launched AILQA Beta program, a collaborative initiative aimed at refining AI-driven translation quality assessment. AILQA leverages AI for classifying and detecting translation errors.

- January 2025 – Onvida Health entered into partnership with AMN language services for enhancing patient care with seamless language access solutions including OPI and VRI.

- November 2024 – Teleperformance acquired ZP Better Together, a player in providing language solutions and technology platforms for the deaf community in the U.S. The acquisition aims to strengthen its Specialized Services division.

- June 2024 – Acolad partnered with DeepL to enhance AI-driven language solutions. This partnership focuses on technology integration, AI adoption, and expert-in-the-loop services, modernizing the machine translation and automated content creation.

- April 2024 – Transperfect acquired Content Lab for expanding its media services in Africa, strengthening its audiovisual localization capabilities.

INVESTMENT OPPORTUNITIES

Investment landscape for language services is evolving rapidly owing to technological advancement, rise in international trade, globalization and ongoing demand for multilingual solutions across various industries. The market is diverse with multiple subsectors offering different types of services and each of these services offer investments opportunities.

With surge in e-learning, there is substantial potential in companies providing language learning solutions. There is growing demand for language training in multinational companies, which provides opportunities for investments in platforms that offer both language learning and cultural training to businesses with international teams.

As ML and AI technologies improve, investing in companies that offer machine translation tools is beneficial for companies, for instance, DeepL has raised significant investment to scale its platform.

REPORT COVERAGE

The market research report provides a detailed market analysis. It focuses on key points, such as leading companies, offerings, and applications. Besides this, the report offers an understanding of the latest market trends and highlights key industry developments. In addition to the above-mentioned factors, the report contains several factors that have contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.6% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Service Type

By End-Use Vertical

By Region

|

|

Companies Profiled in the Report |

|

Frequently Asked Questions

The market is projected to reach USD 147.48 billion by 2034.

In 2026, the market was valued at USD 81.45 billion.

The market is projected to grow at a CAGR of 7.6% during the forecast period.

The localization services segment led the market in terms of market share.

Rise of global workforce and remote work is a key factor boosting market growth.

Atlas Language Services, Lionbridge, Transperfect, Language Line Solutions, DeepL, Globe Language Services Inc., are the top players in the market.

Europe dominated the market in terms of share.

By end-use vertical, the healthcare/medical segment is expected to grow with the highest CAGR during the forecast period.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us