Laser Interferometer Market Size, Share & Industry Analysis, By Type (Michelson Interferometer, Fabry-Perot Interferometer, Fizeau Interferometer, Mach-Zehnder Interferometer, Sagnac Interferometer, and Twyman-Green Interferometer), By Technique (Homodyne and Heterodyne), By Application (Surface Topology, Engineering, Applied Science, Biomedical Imaging, Semiconductor Detection, and Others), By End-Use (Automotive, Aerospace & Defense, Industrial, Healthcare and Life Sciences, Semiconductor and Electronics, and Others), and Regional Forecast, 2026–2034

KEY MARKET INSIGHTS

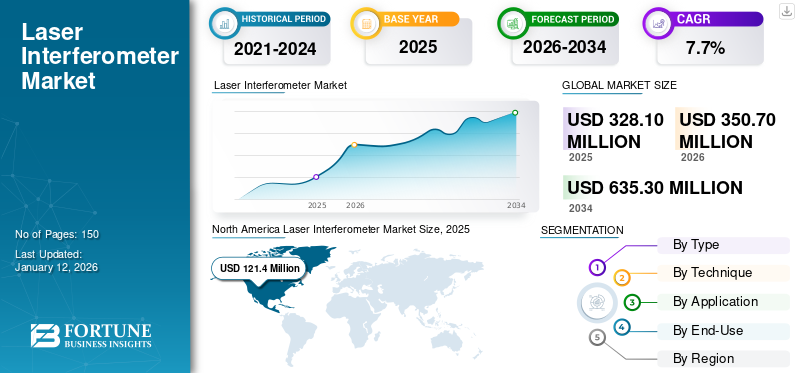

The global laser interferometer market size was valued at USD 328.1 million in 2025. The market is projected to grow from USD 350.7 million in 2026 to USD 635.3 million by 2034, exhibiting a CAGR of 7.7% during the forecast period. North America dominated the laser interferometer market with a share of 37.00% in 2025.

Laser interferometry is the method employed in laser interferometers to measure the distance between two objects accurately or to determine the shape of an object with great precision.

The growth of laser interferometers is attributed to rising demand for ultra-high precision metrology in semiconductor manufacturing and automation & industry 4.0 adoption across advanced manufacturing. The other driver is R&D spending and government/industry investment in precision engineering. In addition, the growing need for traceable calibration & standards compliance, which in turn fuels market growth.

The major market players included in this industry are Renishaw plc, Keysight Technologies, Carl Zeiss AG, Zygo (AMETEK Zygo), Bruker Corporation, Mahr GmbH, Thorlabs, Inc., Newport Corporation, Attocube Systems AG, and SmarAct GmbH.

IMPACT OF GENERATIVE AI

Generative AI transforms laser interferometry with signal elucidation, synthetic training data, real-time adaptive control evolution, and digital twin development, pushing measurement accuracy and speed well beyond what has ever been realized before with even the best traditional computational approaches. In addition to gravitational wave detectors, there is a growing interest in employing AI to create novel interferometric or sensing systems from the ground up, optimizing the optical arrangements, configurations, and more.

IMPACT OF RECIPROCAL TARRIFFS

Reciprocal tariffs raise the cost of precision optics, lasers, and semiconductors used within laser interferometers, thereby raising general production plus research & development costs. They break international supply chains, forcing firms to focus production domestically and leading to a regionally fragmented market. End-users encounter higher costs for equipment and a delayed adoption rate. Although this poses challenges for global collaboration, it could also motivate regions to enhance their domestic interferometer ecosystems.

MARKET DYNAMICS

Market Drivers

Rising Demand for Precision Measurement to Aid Market Growth

The increasing demand for very accurate measurements in production, research, and quality control is a major driving force. Laser interferometers provide precision at the level of nanometers and are useful in applications where exact measurements are required. Accuracy is essential at all stages of semiconductor production to guarantee the performance and quality of semiconductor components. Laser interferometers find applications in semiconductor manufacturing, including wafer inspection, lithography, and alignment of equipment.

Market Restraints

High Cost of Advanced Laser Interferometry Systems to Hinder Market Expansion

Sophisticated laser interferometer systems, which boast features such as multi-axis measurement, rapid scanning, and automated data analysis, tend to be expensive initially. This significant upfront investment could prevent small and medium-sized enterprises (SMEs) or organizations with restricted budgets from adopting laser interferometer technology. As noted by OSTI.GOV, the price of portable laser interferometer measuring devices ranges from USD 30,000 to USD 40,000.

Market Opportunities

Rising Development of Cost-Effective and User-Friendly Present Lucrative Opportunities

The development of new laser interferometer products that can be utilized across a wider range of industries and provide high precision at reduced costs is a key factor driving laser interferometer market growth. These advancements simplify usage for individuals, as user proficiency rises alongside enhancements in software. The reduced costs can thus draw in more small and medium-sized businesses that, before now, could not pay for such top-level technologies. These improvements can help broaden uses in different fields, such as making things and caring for health, causing the market to grow and pushing new uses to be thought of.

Laser Interferometer Market Trends

Strong Demand from Manufacturing & Quality Control to Emerge as a Key Market Trend

Manufacturers increasingly rely on laser interferometers to ensure ultra-high accuracy in inspection and alignment. This trend is further fueled by the growing implementation of automation and Industry 4.0, where real-time interferometer feedback is directly hooked into the production lines to nip errors in the bud and ensure better yield.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

Demand for Extensive Availability of Commercial Michelson Systems and Exceptional Features Boosted Expansion of Michelson Interferometer

Based on type, the market is segmented into Michelson interferometer, Fabry-Perot interferometer, Fizeau interferometer, Mach-Zehnder interferometer, Sagnac interferometer, and Twyman-Green interferometer.

The Michelson interferometer segment led the market in 2025. The segment is expected to lead with a 32.87% share in 2026 due to its well-established reputation for precise measurements and adaptability to various applications such as distance, displacement, and refractive index analysis. The extensive availability of commercial Michelson systems, along with their compatibility with digital data acquisition systems, further bolsters their dominant position in the market.

The Mach-Zehnder interferometer segment will achieve the highest compound annual growth rate (CAGR) of 10.68% during the forecast period.

By Technique

Increasing Demand for Improved Accuracy Fueled Expansion of Homodyne

Based on technique, the market is segmented into homodyne and heterodyne.

By share, the homodyne segment led the market in 2025. The segment is expected to lead with a 59.37% share in 2026. Homodyne interferometry refers to a kind of laser interferometry where the measurement and reference beams share the same frequency. The technique has gained particular note for being able to sensitively and accurately detect small displacements or changes in length. Applications for high accuracy and resolution will find particularly great use in such fields as nanotechnology, semiconductor fabrication, and optical testing.

The heterodyne segment will achieve the highest compound annual growth rate (CAGR) of 10.67% during the forecast period.

By Application

Increasing R&D Investments Boosted Expansion of Applied Science Application

Based on application, the market is segmented into surface topology, engineering, applied science, biomedical imaging, semiconductor detection, and others.

By share, the applied science segment led the market in 2025. The segment is expected to lead with a 38.47% share in 2026. The applied science segment benefits from increasing R&D investment, as more experiments demand sub-nanometer precision, long-baseline interferometry, or measurement in extreme conditions.

The semiconductor detection segment will achieve the highest compound annual growth rate (CAGR) of 9.97% during the forecast period.

By End-Use

To know how our report can help streamline your business, Speak to Analyst

Automotive Dominated Market Due to Rising Application of Optical Interferometry in Vehicles

Based on end-use, the market is categorized into automotive, aerospace & defense, industrial, healthcare and life sciences, semiconductor and electronics, and others.

The automotive segment was the major segment in 2025. In 2026, the segment is anticipated to dominate with a 27.63% share. The growth of the laser interferometer industry within the automotive sector is anticipated to be driven by rising vehicle sales, which are projected to benefit from higher disposable incomes and greater purchasing power among consumers in various countries around the globe. The automobile industry's development has been further enhanced by the rising application of optical interferometry for product validation, precise dimensional measurement, and geometric constraints.

The healthcare and life sciences sector is growing at a CAGR of 10.95% during the forecast period.

LASER INTERFEROMETER MARKET REGIONAL OUTLOOK

By region, the market is divided into North America, Europe, South America, Asia Pacific, and the Middle East & Africa.

North America

North America Laser Interferometer Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 121.4 million in 2025 and USD 128.7 million in 2026. North America hosts numerous recognized developers of laser interferometers and serves as a key location for a variety of customers across different industries. Many manufacturers of laser interferometers are broadening their product lines to attract a wider clientele and enhance the application of laser interferometers in research facilities and calibration labs. In 2026, the U.S. market is estimated to reach USD 96.5 million.

Asia Pacific

To know how our report can help streamline your business, Speak to Analyst

During the forecast period, the Asia Pacific region is projected to record a growth rate of 9.09%, which is the highest amongst all the regions, and reach a valuation of USD 108.9 million in 2025. The fast development of industry and innovation strategies by the government has sped up the use of semiconductor making, telecom setup, and self-driving car tech. China’s ability to produce fiber lasers and photonic integrated circuits has advanced considerably, resulting in more competitive pricing and a wider range of supply choices. The Japan market is projected to reach USD 26.3 million by 2026, the China market is projected to reach USD 43.1 million by 2026, and the India market is projected to reach USD 16.3 million by 2026.

Europe

After Asia Pacific, the market in Europe is estimated to reach USD 61.6 million in 2025 and secure the position of the third-largest laser interferometer market share. The UK market is projected to reach USD 13.9 million by 2026, while the German market is projected to reach USD 12.8 million by 2026.

South America and the Middle East & Africa

Over the forecast period, South America and the Middle East & Africa regions would witness a moderate growth in this market. The South American market in 2025 is set to record USD 12.4 million in its valuation. Rising demand in the automotive, aerospace, and precision machining sectors in Brazil and Argentina is driving the adoption of interferometer-based surface, flatness, and calibration systems. In the Middle East & Africa, GCC is set to attain the value of USD 10.0 million in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Notable Players to Implement Strategic Strategies to Expand Business Reach

Key players present in this market are offering laser interferometers to provide users with non-contact, high-precision measurements by enhancing product accuracy, yield, and performance. They concentrate on holding contracts with small and local businesses to grow their business. Moreover, such mergers & acquisitions, partnerships, and investments will create a surge in demand for this industry.

List of the Key Laser Interferometer Companies Profiled (including but not limited to)

- Renishaw plc (U.K.)

- Keysight Technologies (U.S.)

- Carl Zeiss AG (Germany)

- Zygo (AMETEK Zygo) (U.S.)

- Bruker Corporation (U.S.)

- Mahr GmbH (Germany)

- Thorlabs, Inc. (U.S.)

- Newport Corporation (U.S.)

- Attocube Systems AG (Germany)

- SmarAct GmbH (Germany)

- 4D Technology Corporation (U.S.)

- Polytec GmbH (Germany)

- Jenoptik AG (Germany)

- Holmarc Opto-Mechatronics P Ltd (India)

- QED Technologies, Inc. (U.S.)

- Luna Innovations Inc. (U.S.)

- Lasertex Co., Ltd. (Japan)

- Tokyo Seimitsu Co., Ltd. (Japan)

- OptoTech GmbH (Germany)

- Chotest Technology Inc. (China)

…and more

KEY INDUSTRY DEVELOPMENTS

- January 2025: MetriX successfully raised USD 25 million in a Series B funding round to further develop its AI-driven laser interferometer platforms. This important investment aims to speed up the creation of smart, high-accuracy measurement solutions, enabling MetriX to seize an increasing portion of the market for automated and data-centric interferometry systems.

- November 2024: Micro-Epsilon absolute interferometers set new standards for high-precision distance measuring. The IMP-DS10/90/VAC small sensor is made for vacuum use and can be easily added without needing much room owing to its 90-degree beam path.

- January 2024: ZEISS Group presented the Qualifier mobile laser interferometer with smart accessory detection, phase measurement included, and easy setup to increase accuracy at the site.

- November 2023: Renishaw showcased the ATOM DX encoder along with CENTRUM scales at the Smart Production Solutions (SPS) exhibition.

- January 2023: Bruker Corporation unveiled two new white-light interferometry (WLI) systems: the NPFLEX-1000 and ContourX-1000 optical profilometers. These floor-mounted systems facilitate quicker, automated measurements of surface texture, and roughness over a larger area.

INVESTMENT ANALYSIS AND OPPORTUNITIES

Investors witness laser interferometers as a strategic play in semiconductor, aerospace, defense, and precision optics markets, with long-term opportunities in quantum research, AI-driven metrology, and life sciences. In September 2025, a Series A round of USD 11 million, led by NOVA by Saint-Gobain, was raised to expand laser projection tech for construction layout with high precision (1/16-inch accuracy) globally.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects, such as leading companies, product/types, and the leading end-use of the product. Besides, it offers insights into the laser interferometer market trends and highlights key industry developments. In addition to the factors mentioned above, the report encompasses several factors that have contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.7% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Type · Michelson Interferometer · Fabry-Perot Interferometer · Fizeau Interferometer · Mach-Zehnder Interferometer · Sagnac Interferometer · Twyman-Green Interferometer By Technique · Homodyne · Heterodyne By Application · Surface Topology · Engineering · Applied Science · Biomedical Imaging · Semiconductor Detection · Others (Astronomy, etc.) By End-Use · Automotive · Aerospace & Defense · Industrial · Healthcare and Life Sciences · Semiconductor and Electronics · Others (Telecommunication, etc.) ByRegion · North America (By Type, Technique, Application, End-Use, and Country) o U.S. (By End-Use) o Canada (By End-Use) o Mexico (By End-Use) · South America (By Type, Technique, Application, End-Use, and Country) o Brazil (By End-Use) o Argentina (By End-Use) o Rest of South America · Europe (By Type, Technique, Application, End-Use, and Country) o U.K. (By End-Use) o Germany (By End-Use) o France (By End-Use) o Italy (By End-Use) o Spain (By End-Use) o Russia (By End-Use) o Benelux (By End-Use) o Nordics (By End-Use) o Rest of Europe · Middle East & Africa (By Type, Technique, Application, End-Use, and Country) o Turkey (By End-Use) o Israel (By End-Use) o GCC (By End-Use) o North Africa (By End-Use) o South Africa (By End-Use) o Rest of the Middle East & Africa · Asia Pacific (By Type, Technique, Application, End-Use, and Country) o China (By End-Use) o Japan (By End-Use) o India (By End-Use) o South Korea (By End-Use) o ASEAN (By End-Use) o Oceania (By End-Use) Rest of Asia Pacific |

Frequently Asked Questions

The market is projected to reach a valuation of USD 635.3 million by 2034.

In 2025, the market was valued at USD 328.1 million.

The market is projected to record a CAGR of 7.7% during the forecast period.

By application, the applied science segment led the market in 2025.

Rising demand for precision measurement to aid market growth

Renishaw plc, Keysight Technologies, Carl Zeiss AG, Zygo (AMETEK Zygo), Bruker Corporation, Mahr GmbH, Thorlabs, Inc., Newport Corporation, Attocube Systems AG, and SmarAct GmbH are the top players in the market.

North America held the highest market share in 2025.

By end-use, the healthcare and life sciences segment is expected to record the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us