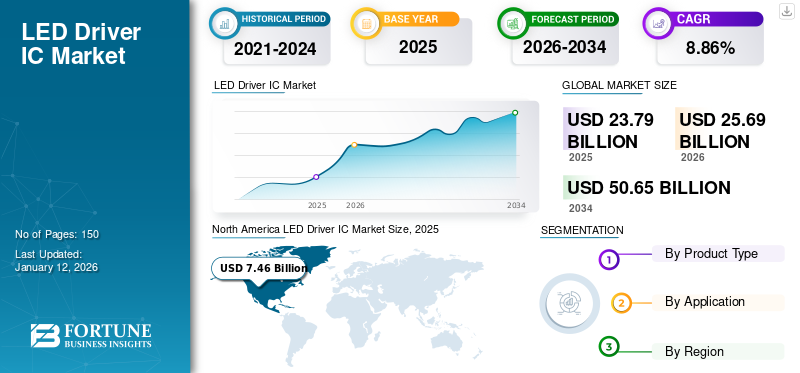

LED Driver IC Market Size, Share & Industry Analysis, By Product Type (Buck-boost, Current Sink, Inductorless, Step-down (Buck), Step-up (Boost), Multi-topology, and Others), By Application (Consumer Electronics, Aerospace & Defense, Healthcare & Medical Devices, Automotive, Telecommunications, Industrial, and Others), and Regional Forecast, 2026 – 2034

KEY MARKET INSIGHTS

The global LED driver IC market size was valued at USD 23.79 billion in 2025. The market is projected to grow from USD 25.69 billion in 2026 to USD 50.65 billion by 2034, exhibiting a CAGR of 8.86% during the forecast period. North America dominated the global market with a share of 31.35% in 2025.

An LED driver IC (Integrated Circuit) controls the voltage and current for LEDs, which can be arranged in either series or parallel configurations to achieve the desired lighting. They can be configured as switching regulator-based LED drivers or inductorless (charge pump), which allows for driving white LEDs in series, parallel, or a mixture of both. The different types of ICs include buck-boost, current sink, inductorless, step-down (buck), step-up (boost), multi-topology, and others. Regardless of design, these ICs provide the highest efficiency, minimal noise, and compact sizes.

Global LED Driver IC Market Overview

Market Size:

- 2025 Value: USD 23.79 billion

- 2034 Forecast Value: USD 50.65 billion, with a CAGR of 8.86% from 2026–2034

Market Share:

- Regional Leader: North America held the largest market share in 2023, driven by early technology adoption and strong infrastructure

- Fastest-Growing Region: Asia Pacific expected to grow rapidly, supported by expanding industrial and residential sectors

- End-User Leader: Consumer electronics led the market, driven by rising demand for efficient display and lighting systems

Industry Trends:

- Buck-Boost Dominance: Buck-boost converter ICs held the largest product share due to versatile voltage regulation

- Growing Medical Applications: Healthcare devices increasingly incorporate LED driver ICs for compact, power-efficient performance

- Automotive LED Integration: Advanced vehicle lighting systems boosting IC demand

Driving Factors:

- Energy Efficiency Regulations: Government mandates promote adoption of efficient LED lighting solutions

- Smart Device Expansion: Growth in portable and smart electronics enhances IC market demand

- Technological Advancement: Innovation in miniaturized and integrated circuits supports high-performance LED systems

The global market is poised to exhibit significant growth driven by the increasing demand for advanced power management solutions, the adoption of IoT, and scalability in several applications. Key players in the market include Texas Instruments Inc. (U.S.), Diodes Incorporated (U.S.), and NXP Semiconductors (Netherlands), with products such as TLC6984 and Flash & IR LED driver’s modules. The market's future is likely to unveil technological innovations concentrated on increasing energy-efficient solutions and technological advancements in extreme conditions.

LED DRIVER IC MARKET TRENDS

Diverse Applications and Numerous Capabilities of LED Driver ICs to Fuel the Market Growth

Typical lighting applications for linear driver LEDs are set up in commercial LED lighting, such as channel letters, signage, modules, LED strips, emergency lights, automotive interior lights, and multi-channel/color implementations for architectural lighting. Another application is the implementation of lighting for shops and retail systems such as freezers, vending machines, and fridges. For instance,

- In January 2023, Infineon Technologies and Nichia Corporation announced the launch of an entirely incorporated micro-LED (hereinafter µPLS light engine) light engine for HD (high-definition) adaptive enhancing beam applications. The µPLS light engine uses Nichia's LED chip and micro-LED mechanisms and an incorporated LED driver IC of Infineon that can enhance all 16,384 micro-LEDs independently with the help of PWM (pulse-width modulation) control.

Several general lighting implementations can benefit from linear LED strips and string designs, as linear ICs are appropriate for an extensive range of power ranges and uses. Such varied applications and capabilities of the product boost the market progress.

MARKET DYNAMICS

Market Drivers

Increasing Government Regulations for Energy-efficient LED Lighting Solutions Across the Globe to Drive Market Growth

LED driver ICs are used in LED lighting to control the power supply to LEDs and safeguard them from current and voltage fluctuations. Thus, the IC is vital in LED lighting solutions as it offers a controlled power source to the LED lights, ensuring they function efficiently and safely. It delivers various benefits, such as improved efficiency, consistent brightness, and enhanced lifetime, among other benefits. Moreover, the government offers various incentives, such as rebates and tax credits, to boost consumers and businesses to switch to LED lighting. For instance,

- In May 2023, South Africa published new efficacy requirements for all GSLs (General Service Lamps) to fulfill at least 90 lm/W.

These factors are anticipated to drive the growth of the market.

Market Restraints

Complexity of LED Driver ICs Can Hamper the Usage of LED Drivers ICs in Lighting Solutions

LED driver ICs can be multifaceted and require precise design, development, and implementation knowledge. It can also increase the time and cost required to progress LED lighting solutions. These LED drivers can also need additional circuits, increasing the system's complexity. The ICs can produce interference or noise, if not sufficiently shielded or designed. It can cause concerns with other electronic systems and devices.

Moreover, multiplying LED modules across general lighting systems places new necessities on system hardware, such as minimized EMI (electromagnetic interference) and reduced component size to fit supplementary electronics within the same setup. Incorporating an LED driver IC into an already-using lighting system may lead to compatibility issues and variations in design. It can also result in manufacturers seeking alternatives. These factors may hinder the global LED driver IC market growth.

Market Opportunities

Increasing Adoption of IoT and Smart Lighting Solutions to Create Numerous Market Opportunities

Incorporating IoT and connectivity characteristics in LED enables the advancement of modernized lighting solutions that are more energy-proficient, customizable, and convenient than before. By integrating enhanced communication protocols, dimming competencies, color temperature regulators, and other inventive features, IoT-driven LED driver design drives smart lighting solutions that transform how they interact with houses. With the growing demand for smart lighting solutions, LED driver manufacturers are integrating connectivity and IoT features into their products to offer improved control and functionality. Hence, these factors are poised to drive the market growth over the coming years.

SEGMENTATION ANALYSIS

By Product Type

High Adoption of Buck-boost ICs to Propel Its Segment Growth

On the basis of product type, the market is categorized into buck-boost, current sink, inductorless, step-down (buck), step-up (boost), multi-topology, and others.

The buck-boost segment held the largest market share of 22.18% in 2026.. Buck-boost ICs offer high efficiency by regulating the current supplied to the LED load. This leads to lesser power consumption and less heat dissipation, resulting in higher energy efficacy and a lengthier LED lifespan. Therefore, these factors, accelerates the growth of the market.

The multi-topology segment is expected to grow at the highest CAGR during the forecast period. These ICs provide flexibility by integrating step-up and step-down functionalities, accommodating various applications. Furthermore, these integrated circuits fulfill a broad spectrum of voltage needs and can simplify design processes, reduce bill-of-material (BOM) expenses, and enhance power efficiency. Hence, these factors drives the segmental growth.

By Application

To know how our report can help streamline your business, Speak to Analyst

Consumer Electronics Segment to Lead with Rising Consumer Demand for Energy-efficient Products

On the basis of application, the market is categorized into consumer electronics, aerospace & defense, healthcare & medical devices, automotive, telecommunications, industrial, and others.

The consumer electronics segment held the largest global LED driver IC market share of 23.72% in 2026. Due to the rising use of smartphones and televisions in developing nations globally, the consumer demand for energy-efficient products is increasing. This shift corresponds to consumers' heightened awareness of energy concerns and associated costs, which will remain a key factor in driving the development of new products and innovation. Therefore, this factor accelerates the segment growth.

The healthcare & medical devices segment is expected to expand at the highest CAGR during the forecast period. The technology of integrated circuits (ICs) is becoming essential in electronic medical devices. As the usage of these devices in monitoring, diagnosing, and performing both surgical and non-surgical treatments, such as neurotechnological drug delivery and nerve stimulation, grows, the incorporation of semiconductors in clinical medical equipment is on the rise, fueling market expansion.

LED DRIVER IC MARKET REGIONAL OUTLOOK

North America LED Driver IC Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America held the highest market share with a revenue of USD 23.72 billion in 2025. The region has been experiencing significant growth due to regulations promoting energy-efficient lighting set by various regional governments. Additionally, increasing awareness of the advantages of energy-efficient lighting, decreasing costs of LED products, and the expanding use of LED solutions in commercial, residential, and industrial sectors are also driving regional market growth. The U.S. market is projected to reach USD 5.02 billion by 2026.

Download Free sample to learn more about this report.

Furthermore, the growth of the U.S. LED Driver market is attributed to the increased demand for energy-efficient lighting solutions across commercial, residential, and industrial sectors. Additionally, developments in semiconductor technology and government incentives stimulating sustainable lighting contribute to the rapid growth of the U.S. LED driver market.

Asia Pacific

The Asia Pacific market is anticipated to witness the highest CAGR between 2024 and 2032. Countries such as India, Japan, and China have been witnessing a growing manufacturing sector, rapid urbanization, and government initiatives promoting energy efficiency and sustainability, which is estimated to fuel the Asia Pacific market growth over the forecast period. The Japan market is projected to reach USD 1.56 billion by 2026, the China market is projected to reach USD 1.68 billion by 2026, and the India market is projected to reach USD 0.7 billion by 2026.

Europe

Europe is projected to exhibit steady growth over the forecast period, driven by the region's commitment to sustainability via the advancement of energy-efficient LED lighting solutions compelled by EU directives, alongside national enterprises such as Spain's "Aid Program for Energy Efficiency Actions" and further increased by the execution of smart city initiatives that require progressive LED drivers for intelligent lighting systems. The enhanced capabilities, improving efficacy, and innovative product features attract more clients and businesses to accept these solutions, thereby driving the regional growth. The UK market is projected to reach USD 1.04 billion by 2026, while the Germany market is projected to reach USD 1.24 billion by 2026.

Middle East and Africa (MEA) and South America

The markets in the Middle East & Africa and South America are still emerging but experiencing major potential. Many countries in the region have been increasing significantly owing to aggressive infrastructure investments, mostly in smart city projects such as NEOM in countries including the UAE and Saudi Arabia, endorsing the adoption of energy-efficient LED lighting solutions. This is coupled with growing awareness about the profits of the LED technology and government policies that enforce standards and regulations for energy-efficient lighting solutions, driving the demand for LED drivers.

Similarly, the South America market is expected to grow moderately. Governments worldwide must invest significantly in research and development to support the development of the market. However, the region's economic challenges and incomplete technological infrastructure may limit the market growth.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Players to Adopt Merger & Acquisition Strategies to Expand Their Operations

Prominent industry players are actively expanding their global presence by introducing specialized solutions tailored to the requirements of various sectors. They are acquiring local businesses and forming strategic partnerships to establish a robust market foothold. These companies are concentrating on developing new solutions and creating effective marketing strategies to increase their market share. The growing demand for LED driver ICs is expected to create lucrative opportunities for market players.

Major Players in the LED Driver IC Market

To know how our report can help streamline your business, Speak to Analyst

STMicroelectronics, NXP Semiconductors, Texas Instruments Incorporated, Infineon Technologies AG, and ON Semiconductor are the largest players in the market. The global market is consolidated, with the top 5 players accounting for around 46% of the market share.

List of Companies Studied

- Texas Instruments Incorporated (U.S.)

- CREE LED (U.S.)

- NXP Semiconductors (Netherlands)

- STMicroelectronics (Switzerland)

- MACROBLOCK, INC. (Taiwan)

- Renesas Electronics Corporation (Japan)

- Semtech Corporation (U.S.)

- Monolithic Power Systems, Inc. (U.S.)

- SG MICRO CORP (China)

- Diodes Incorporated (U.S.)

- Eaglerise Electric & Electronic (China) Co., Ltd. (China)

- Fitipower Integrated Technology Inc. (Taiwan)

- Shanghai Awinic Technology Co., Ltd. (China)

- Broadcom, Inc. (U.S.)

- Lumissil Microsystems (U.S.)

KEY INDUSTRY DEVELOPMENTS

- August 2024: Renesas announced the acquisition of Altium to make electronics design available to a wider market and fast-track innovation. The acquisition sets the basis for Altium and Renesas to develop an inventive electronics system design and lifecycle management platform.

- March 2024: Powerchip Semiconductor Manufacturing Corporation (PSMC) revealed its partnership with Tata Electronics in India to build the nation’s inaugural 12-inch fabrication plant in Gujarat. Tata Electronics intends to manufacture display driver ICs, power management ICs, high-performance computing logic, and microcontrollers at the 12-inch facility to enter the automotive, computing and data storage, wireless communications, artificial intelligence, and other market segments.

- January 2024: Monolithic Power Systems (MPS) announced the acquisition of Axign in a cash deal in exchange for all outstanding shares of Axign. Axign is a Dutch firm that develops and designs class-D audio ICs, aiming at applications such as portable consumer speakers and automotive- and professional-grade multi-speaker systems. The initial total acquisition consideration was around USD 33.8 million.

- August 2023: NXP Semiconductors N.V., Robert Bosch GmbH, TSMC, and Infineon Technologies AG announced the establishment of a joint venture to bring the manufacturing of advanced semiconductors to Europe. These companies jointly invested in ESMC (European Semiconductor Manufacturing) Company GmbH in Dresden, Germany. ESMC makes a substantial step toward constructing a 300mm fab to aid the future capability requirements of the industrial and automotive sectors. The project is intentional under the structure of the European Chips Act.

- June 2022: Diodes Incorporated acquired Onsemi's wafer fabrication facility and operations in South Portland, Maine ("SPFAB"). The company purchased SPFAB to offer an additional 200mm wafer fabrication capability for analog products to fast-track the firm’s progress initiatives in the industrial and automotive end markets.

INVESTMENT ANALYSIS AND OPPORTUNITIES

The market is focused on research & development activities to develop more advanced, efficient, and cost-effective solutions. Companies are increasingly collaborating with small organizations, providing opportunities for merger and acquisition strategies. Expanding product offerings for new applications and industrial sectors gives enterprises a competitive advantage and helps them expand their offerings and reach across the global landscape. Emphasis on understanding customers' requirements and developing solutions that suit their needs and market trends also helps them acquire a new customer base. The company’s collected technology and production capacity to develop and deliver quality and cost-competitive products rapidly can contribute to market players' business growth.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on key aspects such as leading companies, product/service types, and leading product applications. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market growth in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 8.86% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product Type

By Application

By Region

|

|

Companies Profiled in the Report |

Texas Instruments Incorporated (U.S.), NXP Semiconductors, (Netherlands), STMicroelectronics (Switzerland), Renesas Electronics Corporation (Japan), Monolithic Power Systems, Inc. (U.S.), SG MICRO CORP (China), Diodes Incorporated (U.S.), Fitipower Integrated Technology Inc. (Taiwan), Shanghai Awinic Technology Co., Ltd. (China), and Lumissil Microsystems (U.S.) |

Frequently Asked Questions

According to Fortune Business Insights, the market is projected to reach USD 50.65 billion by 2034.

In 2025, the market was valued at USD 23.79 billion.

The market is projected to grow at a CAGR of 8.86% during the forecast period.

Based on product type, the buck-boost segment is the leading segment in the market.

Increasing government regulations for energy-efficient LED Lighting solutions across the globe is a key factor driving market growth.

Texas Instruments Incorporated, NXP Semiconductors, STMicroelectronics, Renesas Electronics Corporation, Monolithic Power Systems, Inc., SG MICRO CORP, Diodes Incorporated, Fitipower Integrated Technology Inc., Shanghai Awinic Technology Co., Ltd., and Lumissil Microsystems are the top players in the market.

North America held the highest market share in 2025.

By application, the healthcare & medical devices segment is expected to grow at the highest CAGR during the forecast period.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us