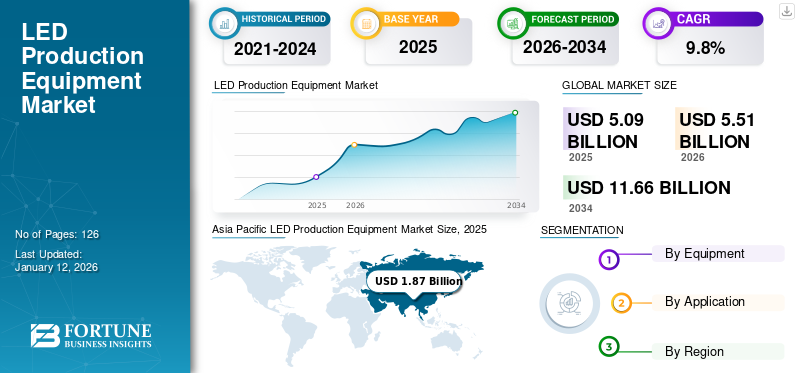

LED Production Equipment Market Size, Share & Industry Analysis, By Equipment (Vapour Deposition, Lithography, Etching & Fabrication, Patterning, Doping & Die forming, Assembly & Packaging, and Testing & Inspection), By Application (Displays, Lighting & Illumination, Security & Signage, Electronics & Electric Devices, and Others (Speciality Applications)), and Regional Forecast, 2026 – 2034

LED PRODUCTION EQUIPMENT MARKET SIZE AND FUTURE OUTLOOK

The global LED production equipment market size was valued at USD 5.09 billion in 2025 and is projected to grow from USD 5.51 billion in 2026 to USD 11.66 billion by 2032, exhibiting a CAGR of 9.8% during the forecast period. The Asia Pacific dominated global market with a share of 36.8% in 2025.

The global LED production machinery market exhibits steady growth driven by the demand for energy-efficient lighting solutions and smarter displays. The market is highly transformative, with the growing adoption of advanced manufacturing technologies such as automation, robotics, and artificial intelligence. The key characteristics of the market include cost competitiveness, prevalence of innovation, and stringent quality standards. Also, supporting government policies and regulations that focus on promoting energy efficiency, minimizing energy consumption, and reducing carbon footprints by banning incandescent bulbs is driving the demand for LEDs.

Download Free sample to learn more about this report.

The COVID-19 pandemic disrupted the global supply chains and impacted critical semiconductor markets, including China, Japan, the U.S., and others, leading to delays in the production and delivery of LED Machinery. However, the crisis accelerated the adoption of remote monitoring and automated solutions due to workforce constraints. The pandemic highlighted the need for resilience to handle critical economic operations, which helped manufacturers actively integrate automation into their manufacturing machines to improve production efficiency.

IMPACT of IoT and AUTOMATION

Automating Machines for Consistent Quality and Precision to Support Long-Term Growth

Automation has revolutionized every industry by improving operational efficiency. In LED production, it enhances precision and scalability for business owners. IoT enables machinery to ensure seamless connection across production lines, reducing human errors and standardizing quality. This connectivity also facilitates customization that allows manufacturers to address customer-specific requirements. Furthermore, the automated system adapts easily to new technologies such as micro LEDs, ensuring quality control and cost efficiency owing to its feature compatibility and easily integrated software.

- For instance, in December 2024, JUKI Corporation, a prominent surface mount technology provider for PCB, LED, and microLED manufacturing, launched the multitask platform JM-E01. The machine is designed to handle large, irregularly shaped components with an integrated automation system for post-surface mount processes. It also eliminates manual handling of boards, reducing human error.

LED PRODUCTION EQUIPMENT MARKET TRENDS

Adoption of Advanced Production Techniques is a Key Market Trend

The LED production equipment sector witnessed a shift toward advanced production techniques that leverage IoT and automation to achieve cost-effective production efficiency and reduced waste. These smart factories are equipped with industrial IoT that allows real-time monitoring of the equipment to reduce downtime and minimize waste. Moreover, the adoption of advanced manufacturing techniques, such as lead-free welding for LED PCB and the use of recyclable materials that comply with environmental regulations, is helping to minimize waste. These trends and emphasis on sustainable practices expand the market.

- For instance, in December 2024, Veeco Instruments, a prominent Vapour deposition technology supplier, announced that PlayNitride, an industry leader in MicroLED technology, had qualified Veeco’s Lumina MOCVD system for the production of the next generation of microLEDs.

MARKET DYNAMICS

Market Drivers

Rising Demand for Energy-Efficient Solutions in Smart Cities Drive Market Growth

The LED production industry is experiencing significant growth due to the increasing adoption of energy-efficient lighting solutions for residential and commercial lighting. Moreover, the rise of smart cities and IoT-enabled devices led to the adoption of smart lighting across end users. Additionally, government policies promoting energy conservation and sustainable lighting further enhance the market dynamics. For instance, the European Union’s Ecodesign directive and India’s UJALA Scheme emphasize sustainable lighting technologies, creating a favorable ecosystem for LED adoption. All these factors are potential drivers that boost the demand for LED products and drive LED production equipment market growth in the long term.

- For instance, EESL, a prominent government body, has replaced over 1.32 crore street lights with LED under the Street Lighting National Program (SLNP). Since its launch in January 2015, EESL, with this initiative, facilitated GHG emissions, reducing 6.15 million tonnes of CO2, resulting in 8.92 billion KWh energy savings. Moreover, the company announced plans to replace an additional 1.62 crore LED street lights.

Market Restraints

High Initial Costs and Technical Complexities to Hamper Market Development

The LED Production equipment industry is highly associated with the initial costs, which poses challenges and acts as a restraint for new entrants and small manufacturers. Additionally, these semiconductor machines are built with complex technical specifications and expensive materials that are hard to source, especially in stringent geopolitical situations. Thus, fluctuating raw material prices impact the initial setup cost, and the technical complexities involved in producing miniaturized products such as microLEDs create further restraints for the market.

Market Opportunities

Demand for Advanced Display Technology to Present Various Growth Prospects in Emerging Markets

The rise of OLEDs and MicroLEDs, which are increasingly used in premium display panels, smartphones, and other electronic devices, has created untapped revenue opportunities for LED manufacturers. Additionally, emerging markets, particularly Asia Pacific, present significant growth potential owing to their rapid industrialization, urbanization, and supporting government policies. Furthermore, the promotion of sustainable production practices and government-led electrification projects creates a strong demand for LEDs. Thus, technological advancements are extending opportunities in emerging markets, which are expected to significantly exceed LED production equipment market share during the forecast period.

- For instance, in March 2023, it announced that it would provide investment support to VuReal, a primary manufacturer of microLED technologies. The company would invest USD 40 million to boost the commercial capacity of VuReal’s cutting-edge microLED displays.

SEGMENTATION ANALYSIS

By Equipment

Rising Emphasis on Creating Precise Chipsets Encourages Etching & Fabrication Segment Growth

By equipment, the market is classified as vapour deposition, lithography, etching & fabrication, patterning, doping & die forming, assembly & packaging, and testing & inspection.

The etching & fabrication segment is leading, acquiring the highest market share owing to the sector’s growing emphasis on creating more precise and miniaturized chipsets that are capable of delivering efficient lighting. Additionally, the market is experiencing significant growth driven by technological innovations and standard production practices that provide steady long-term growth.

Vapour deposition machines are witnessing the highest CAGR during the forecast period due to heavy demand for MOCVD equipment in advanced LED SMT processes for ultra-thin MicroLEDs manufacturing. Furthermore, lithography, assembly & packaging, and testing & inspection machines are growing steadily, fueled by the need for precision, quality standards, and high efficiency in products. At the same time, pattering and doping & die-forming equipment are maintaining substantial growth due to the product's advanced applications, including specialty electronics.

Lithography segment is held accountable for the dominant share of 13% in 2024.

By Application

Lighting & Illumination Segment Showcases Highest Growth due to Growing Demand for Efficient Lighting

By application, the market is categorized into displays, lighting & illumination, security & signage, electronics & electric devices, and others (speciality applications).

The lighting and illumination segment is witnessing the highest growth, gaining 34.66% of the market share owing to the increasing use of advanced and efficient lighting. The growing use of decorative lighting to enhance ambiance and aesthetics for residential and commercial settings is further supporting segment growth.

The displays segment is supporting the market potential with advancements in OLEDs and curved LED technology. The segment is likely to acquire 25% of the market share in 2025.

Electronics & electric devices are witnessing stable growth due to the increasing use of technology in the production of daily consumer electronics that are equipped with intelligent displays, ovens, and other light-emitting appliances.

Other segments are observing significant growth owing to its growing use in various applications, including scientific applications, UV inspection systems, and other research appliances.

Security & signage segment is projected to exhibit a CAGR of 8.44% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

LED PRODUCTION EQUIPMENT MARKET REGIONAL OUTLOOK

Geographically, the global market analysis covers North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific LED Production Equipment Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the fastest-growing region, holding approximately 36.8% of the market share due to the large semiconductor manufacturing base presence in China, Japan, and South Asia. The regional value in 2025 was USD 1.87 billion, whereas in 2023, the market size stood at USD 1.57 billion. The region benefits from the lowest production costs, skilled labor, and high demand for consumer electronics. Additionally, the growing emphasis of governments in emerging countries such as India to set up semiconductor facilities is fueling market expansion in the region.

China is witnessing robust growth due to the extensive use of semiconductor technology across television and automotive industries for efficient lighting and projection. Additionally, increasing innovation capabilities and the emphasis on boosting domestic production by seamlessly integrating with Industry 4.0 are supporting market growth. The market in China is poised to hold USD 0.55 billion in 2026. The other markets including India is likely to hit USD 0.35 billion and Japan anticipated to reach USD 0.43 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

North American market is expected to be the second-largest region with a USD 1.44 billion in 2025, exhibiting a second-fastest growing CAGR of 9.21% during the forecast period. The LED production sector in North America experiences steady growth driven by the rising demand for efficient and advanced micro LEDs in modern projection devices and television systems. Additionally, the growing demand for solar-led energy-saving lights across smart city infrastructure is driving market growth in the long term. The U.S. production equipment industry is driven by the growing usage of high-power industrial LED lights and growing investment to expand production capabilities to nearshore countries such as Canada and Mexico. The U.S. market size is estimated to be USD 0.96 billion in 2026.

South America

In South America, there is a growing adoption of LED lights for the smart lighting infrastructure, driving the demand for LED production equipment. This growth is fueled by increasing investments in Industry 4.0, aimed at improving operational proficiency.

Europe

Europe is set to showcase moderate growth due to stringent energy regulations, energy efficiency standards, and government incentives. The region is expected to be the third-largest market size of USD 1.20 billion in 2026. These factors are helping unlock significant growth potential. Germany and the U.K. are dominant markets, with strong demand for efficient industrial flood lighting and automotive lighting. The market in U.K. is poised to hold USD 0.31 billion in 2026. The other markets including Germany is likely to hit USD 0.34 billion and France anticipated to reach USD 0.14 billion in 2025.

Middle East & Africa

The Middle East & Africa region is expected to be the fourth-largest region with USD 0.43 billion in 2026. Customers across the Middle East & Africa are increasingly adopting LEDs in commercial and outdoor settings. Furthermore, increasing investments in renewable projects and government-led energy conservation initiatives bolster market prospects. The GCC market size is estimated to be USD 0.16 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Increasing Investments for Sustainable Product Development Drive Market Potential

Top LED production equipment manufacturers are focusing on developing more sustainable and efficient solutions. The lighting and display segment market is highly competitive as there is a high demand for products among customers; thus, producers are focusing on developing machines that incorporate advanced technologies such as microLED, OLEDs and Curved LED displays. Additionally, they are developing products that comply with stringent quality standards, which is enhancing the long-term potential of the LED production equipment industry.

- For instance, in February 2024, TNSC, a prominent MoCVD technology provider, collaborated with the Innovation Center of Nagoya Institute of Technology. The collaboration aims to contribute to decarbonizing society by developing MOCVD equipment that stably supplies GaN/Si epi substrates with high electrical energy efficiency for electronics and electrical equipment.

List of Key LED Production Equipment Companies Profiled:

- Aixtron SE (Germany)

- Veeco Instruments Inc. (U.S.)

- ASM International N.V. (Netherlands)

- Tokyo Electron Limited (Japan)

- Nordson Corporation (U.S.)

- Hitachi High-Tech Corporation (Japan)

- Jusung Engineering (South Korea)

- Taiyo Nippon Sanso (Japan)

- NAURA Technology Group Co., Ltd. (China)

- Xin Yi Chang Automatic Equipment (China)

- Daitron Co., Ltd (Japan)

- Shenzhen ETON Automation Equipment Co., Ltd (China)

- Shanghai Micro Electronics Equipment (Group) (China)

- Dongguan ICT Technology Co.,Ltd. (China)

- FSE Corporation (Fulintec) (China)

KEY INDUSTRY DEVELOPMENTS:

- October 2023: SPEA, a global semiconductor and electronic testing equipment manufacturer, showcased its unique T100L Automatic LED Light Tester alongside the pioneering engineering for testing products. It is a fully automatic flying scanner that helps manufacturers ensure the highest quality of their lighting devices.

- September 2023: Panasonic Smart Factory Solutions India, a division of a diversified technology group, announced the launch of new cutting-edge NPM-G series surface mount technology (SMT) machines. The new NPM-GH modular mounter and the NPM-GP screen printing solution for autonomous security solution are designed to meet the advanced requirements of SMT production.

- September 2023: DPVR, a Shanghai-based manufacturer of VR technology, launched its VR headset, DPVR P2, aimed at innovators, edtech providers, and enterprises. The DPVR solves user concerns for battery longevity and power sustainability, extending operational hours to ensure more consistent VR headset functionality.

- August 2023: Veeco Industries, a prominent semiconductor manufacturing technology supplier, introduced an advanced MoCVD system for InP and GaAs applications. The technology deposits GaAs and Inp compounds with ultra precision and leading performance while maintaining the lowest cost of ownership.

- February 2023: ams OSRAM, a global leader in optical solutions, and Aixtron SE, a leading provider of deposition equipment to the semiconductor industry, announced the qualification of AIXTRON AIX G5+C and G10-AsP MoCVD system on 200mm wafers for microLED applications.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends, competitive landscape, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.8% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment

By Application

By Region

|

|

Key Market Players Profiled in the Report |

Aixtron SE (Germany), Veeco Instruments Inc. (U.S.), ASM International N.V. (Netherlands), Tokyo Electron Limited (Japan), Hitachi High-Tech Corporation (Japan), Taiyo Nippon Sanso (Japan), Daitron Co., Ltd (Japan), Shenzhen ETON Automation Equipment Co., Ltd (China), Dongguan ICT Technology Co., Ltd. (China), and Nordson Corporation (U.S.), etc. |

Frequently Asked Questions

The market is projected to reach USD 11.66 billion by 2034.

In 2025, the market was valued at USD 5.09 billion.

The market is projected to grow at a CAGR of 9.8% during the forecast period.

Etching & fabrication is leading the equipment segment in the market.

Demand for sustainable lighting in smart cities is a key factor driving market growth.

Aixtron SE, Veeco Instruments Inc., ASM International N.V., Tokyo Electron Limited, Hitachi High-Tech Corporation, Taiyo Nippon Sanso, Daitron Co., Ltd, Shenzhen ETON Automation Equipment Co., Ltd, Nordson Corporation, and Dongguan ICT Technology Co., Ltd. are the top players in the market.

The Asia Pacific dominated global market with a share of 36.8% in 2025.

By application, the lighting and illumination segment showcases the highest growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us