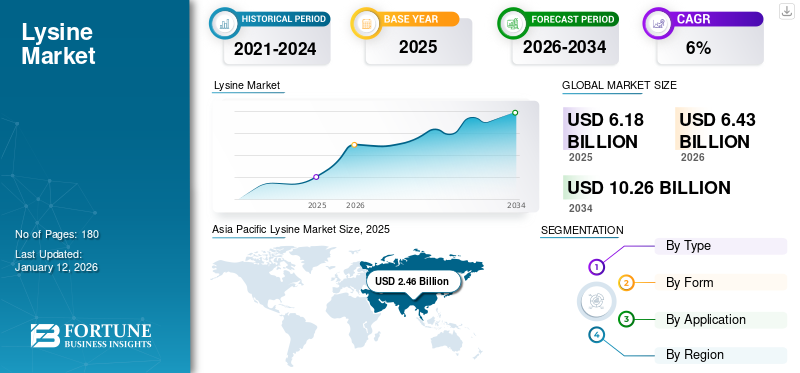

Lysine Market Size, Share & Industry Analysis, By Type (L-Lysine and D-Lysine), By Form (Dry and Liquid), By Application (Animal Feed, Food & dietary supplements, Pharmaceuticals and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global lysine market size was valued at USD 6.18 billion in 2025. The market is projected to grow from USD 6.43 billion in 2026 to USD 10.26 billion by 2034, exhibiting a CAGR of 6.0% during the forecast period. Asia Pacific dominated the lysine market with a market share of 39.82% in 2025

Lysine is an essential amino acid that acts as a building block for the body. The compound supports growth and is responsible for the conversion of fatty acids to energy. It also reduces cholesterol content in the body, supports calcium absorption, and supports bone strength and collagen formation. Lysine supplementation is thus growing in popularity among consumers. The product is also used in animal feed, where it is a major source of protein for animal growth and improves their productivity. Some of the prominent manufacturers of lysine products include Ajinomoto (Japan), ADM, Evonik, Shandong Golden Corn Co., Ltd., and others.

Lysine Market Snapshot & Highlights

Market Size & Forecast:

- 2025 Market Size: USD 6.18 billion

- 2026 Market Size: USD 6.43 billion

- 2034 Forecast Market Size: USD 10.26 billion

- CAGR: 6.0% from 2026–2034

Market Share:

- Asia Pacific dominated the lysine market with a market share of 39.82% in 2025, driven by large-scale production in countries like China, rising livestock farming, and increasing exports to other regions.

- By type, L-lysine accounted for the highest market share in 2024 due to its wide application across animal feed, pharmaceuticals, and dietary supplements, supported by consistent research and product innovation.

Key Country Highlights:

- China: Major global producer and exporter of lysine, with government-backed production expansions supporting domestic and international demand.

- United States: Lysine is widely used in animal feed and fortified foods; demand is supported by growth in meat, dairy, and pharmaceutical sectors.

- Brazil: Rapid expansion in livestock and meat exports is boosting demand for high-protein animal feed, attracting investment from major amino acid manufacturers.

- Germany: Focus on production and use of liquid lysine in animal nutrition; leading firms like ADM and Ajinomoto driving innovation in feed applications.

- India: Rising demand for animal protein and growing livestock farming is supporting strong uptake of lysine-based animal feed products.

MARKET DYNAMICS

Market Drivers

Growing Demand for High-Quality Animal Protein Products for Human Consumption to Support Market Growth

Increasing demand for animal protein products acts as one of the prominent factors positively influencing the market’s growth. The popularity of protein products, especially animal-derived proteins such as eggs and meat and plant-derived proteins such as soybean and corn, has increased in recent years. The rise in disposable income, change in food consumption behavior, and other socio-economic factors have contributed to the increased growth. Thus, the need to increase meat and egg yield and improve animal health through a balanced diet and nutrition has increased rapidly. As lysine is one of the essential amino acids that helps to support the growth and overall health of animals, the demand for such products as an ingredient in producing animal feed products has increased in recent years. This increase in demand in the animal feed industry has been one of the major factors that supported the overall market’s growth.

Advancement in Production Process to Escalate Market Growth

In recent years, advancements in the production of lysine have enabled manufacturers to adopt different approaches for manufacturing different types of lysine. Microbial fermentation is a promising method of fermentation, offering an efficient and environmentally friendly alternative to chemical manufacturing processes. Companies such as Evonik are also conducting life cycle assessments of their products to evaluate the environmental impact of the products throughout their lifecycle, i.e., from sourcing raw materials and production to consumption. Such studies also help to demonstrate the environmental sustainability of the products and thus promote the product's adoption in different industries.

Market Restraints

Volatility in Raw Material Availability to Limit Market Growth

The price of lysine is impacted by the fluctuation in the price of raw materials used in its production. In recent years, global warming-induced climate change has impacted the yield of corn and soybean, which are the primary raw materials used for lysine production. Moreover, corn and soybean are also used as a source of crude protein for the animals, and the increase in prices may force farmers to opt for cheaper alternatives that can be used in place of expensive products. Such changing market dynamics can make it difficult for manufacturers to develop cost-effective solutions that can be used as animal feed or in other industries.

Market Opportunities

Research and Development of New Lysine Products with Wider Industrial Applications to Offer Immense Opportunities for Innovation and Expansion

Companies can invest in identifying new potential applications of lysine apart from their usage in animal feed products. Research is being conducted on lysine to explore its application in treating diseases and medical conditions and the drug response to treating such diseases. As more conclusive findings are obtained on this compound, manufacturers can develop new product formulations where lysine is used as a key ingredient, and this, in turn, can fuel the product’s adoption in new sectors.

Market Challenges

Demand Fluctuations and Supply Chain Disruption to Hinder Market Growth

Disruption in the supply chain can prevent manufacturers from exporting their products to other countries. European countries are heavily dependent on countries such as China to source dry lysine. Hence, any disruption in key trade routes can create challenges for the suppliers and importers in souring the products, causing an imbalance between demand and supply and leading to price rises. Moreover, fluctuations in the demand for the products in the industries, specifically the feed industry, can create challenges for manufacturers in demand forecasting and impact the overall market growth.

Lysine Market Trends

Growing Inclination to Develop New Forms of Lysine to Support Wider Applications

There is a growing popularity of producing lysine from locally sourced raw materials in a region. Thus, to produce such lysine with low carbon content, manufacturers are setting up manufacturing plants in regions where the demand for such products is relatively high. Moreover, the demand for other forms of products, specifically the liquid form, is also increasing among users. Selling dry lysine across long distances has been less profitable for some of the manufacturers. Hence, new research is being conducted to identify other credible forms of lysine that can yield higher returns to the manufacturers.

Download Free sample to learn more about this report.

Impact of COVID-19

The COVID-19 pandemic had a negative impact on global lysine market growth owing to the disruption in the global supply chain prompted by the government-backed lockdowns worldwide. Brazil, Mexico, Europe, and others depend heavily on China and other countries to source their animal feed products, and the COVID-19 pandemic-induced supply chain disruptions affected the product availability in these markets. Moreover, domestic production of amino acids was also disrupted during the pandemic due to lockdown restrictions and instability in workforce availability, which in turn disrupted the factory operations. Hence, the imbalance between the supply and demand for lysine in the market, especially in the feed sector, negatively impacted the market’s growth.

SEGMENTATION ANALYSIS

By Type

L-lysine Accounted for Highest Market Share Owing to its Wider Application in Various Industries

Based on type, the market is segmented into L-lysine and D-lysine.

L-lysine or acid lysine accounted for the highest market share by 96.59% in 2026 owing to the wider production of this form of product. There are different types of l lysine, including L-lysine monohydrochloride, Lysine, L-lysine hydrochloride, and others. Significant research is being conducted in this segment, and several animal feed products and dietary supplement products manufactured using this form of lysine are being launched in the market.

D-lysine is comparatively less popular than lysine. However, the product is finding application in animal feed and pharmaceuticals. In aquaculture, the product is used to promote weight gain, growth rates, feed efficiency ratio, and protein efficiency. However, as per certain research, the effectiveness of this particular form of lysine was found to be lower than that of l-lysine products.

By Form

Dry Segment Accounts for the Largest Market Share Owing to Better Storage

Based on form, the market is segmented into dry and liquid.

Among these, dry form accounted for the highest market share in 2024 owing to the wider production of lysine in such a format. Factors that contribute to the growth of the dry segment include the low cost of the products, better storage, and higher safety of the products due to the low risk of pathogen presence in such products. Dry form segment is anticipated to attain 74.87% of the market share in 2026.

The liquid form is expected to register the fastest CAGR of 5.63% during the forecast period, as several manufacturers are investing in expanding their liquid form of lysine production capability. The use of liquid products is helpful in improving feed indigestion, and it is also used in creating a uniform mix of high-quality animal feed and functional food products for human consumption.

By Application

To know how our report can help streamline your business, Speak to Analyst

Animal Feed Accounts Held Highest Market Share Due to Wide Usage in Formulating Protein Rich Animal Nutrition Products

Based on application, the market is segmented into animal feed, food & dietary supplements, and pharmaceuticals.

Animal feed accounted for the highest market share in 2024, and the application of this segment is expected to increase in the future. This ingredient plays a crucial role in the growth and development of animals. It is an alternative source of protein and is used in animal feed formulations to meet the demand for amino acids in animals. Animal feed segment to capture 67.83% of the market share in 2026.

Food & dietary supplements and pharmaceutical segments account for another major segment, and the usage of such products is also expected to increase rapidly. Lysine-fortified products help to create collagen, produce carnitine, and lower cholesterol. It is also known to improve muscle strength, bone health, support anti-anxiety effects, and provide other supporting health effects to the body.

Pharmaceuticals segment is estimated to exhibit CAGR of 5.24% during the forecast period.

Lysine Market Regional Outlook

Geographically, the global market report covers analysis across North America, Europe, Asia Pacific, South America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Lysine Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the largest user of lysine and holds the largest lysine market share globally. The region’s market value stood at USD 2.58 billion in 2026. Japan, China, and India have large animal farms and livestock farms, and the product is used in heavy quantities in these countries to provide protein nutrition in these farms. Moreover, the region also exports a huge quantity of its lysine products to other regions, especially Europe.

China is one of the largest consumers of lysine products, estimated to hit USD 1.45 billion in 2026, while the government continues to encourage manufacturers to invest in expanding the production of lysine. The large-scale production of this product by China enables it to sell its products not only to satisfy domestic demand but also to export them to other regions. Expansion in the livestock and feed industries in the country has created a favorable market condition for the expansion of lysine production.

The market for India is projected to reach USD 0.39 billion and Japan to hit USD 0.18 billion in 2026.

North America

The North America region is the second-largest market and is expected to hit the value USD 1.50 billion in 2026, exhibiting a CAGR of 5.03% during 2024-2032. In the U.S., lysine has been used for making fortified food and dietary supplements for a long time. It has commonly been used in the country for manufacturing animal feed products in the region. It is also used to support the growth of bone, skin, collagen, and growth and development in children and strengthen immunity. The compound is also used for the production of advanced pharmaceuticals for diseases such as Alzheimer’s, hair loss, cancer, cardiovascular diseases, and other diseases. Apart from human nutrition, there is an expanding demand for livestock products, which includes meat, dairy, and eggs, in the region and globally, which is expected to further contribute to the demand for high-quality feed products among animal farm owners. Hence, the demand for ingredients such as lysine for feed production is expected to remain steady in the country. The U.S. market is anticipated to reach USD 1.22 billion in 2026.

Canada and Mexico are other major lysine product markets in the region. As per data provided by the Animal Nutrition Association of Canada, an estimated 292.2 million feed was consumed by animals in the country. These countries have their own manufacturing ecosystem to support the animal feed and lysine industry, and they have the opportunity to expand their presence in the region and boost their sales.

Europe

Europe market is the third-largest market and it is predicted to hit USD 0.93 billion in 2026, is another leading user of lysine products, and the product is used for the production of animal feed, dietary supplement products, and other industrial applications. The region sources a significant proportion of its lysine from Asian countries such as China. Several production plants in the region fulfill the demand for lysine across the European Union. In recent years, companies such as ADM and Ajinomoto Animal Nutrition Europe have focused on manufacturing higher quantities of liquid lysine products. Especially in animal feed farms, many farmers are opting to lean more toward liquid forms of products owing to their limited packaging waste and fast product unloading compared to dry forms of products. The market for U.K. is expected to hit USD 0.15 billion, as well as Germany to reach USD 0.13 billion in 2026 and France predicted to strike USD 0.11 billion in 2025.

South America

South America is the fourth-largest regional market, anticipating to hit USD 0.82 billion in 2025 for lysine manufacturers to expand their market presence. Brazil has some of the largest exports of meat and livestock products in the world, and animal farmers invest in high-quality feed to improve the health and productivity of the animals. Therefore, Evonik, Ajinomoto, and other prominent amino acid manufacturers are expanding their production capacity in the region. For instance, in May, CJ do Brasil, a subsidiary of CJ Bio, completed the expansion of its amino acid production unit in Brazil. The investment amounted to USD 220.26 million and also included the establishment of research and development centers to expand production efforts toward other South American countries, Europe, and the U.S.

Middle East & Africa

The demand for animal feed products in this region is growing steadily, and this is expected to support the market’s overall growth in the region. Growing demand for meat and egg products in the region is fueling the need for compound feed ingredients to ensure high-quality yield from animals. Amino acids such as lysine thus play a crucial role in providing the necessary animal nutrition. The market for Turkey is expecting to reach USD 0.16 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Investments in Capacity Expansion and Technological Innovation to Support Market Growth

Some of the prominent manufacturers of sports nutrition products are Ajinomoto, ADM, Evonik, Shandong Golden Corn Co., Ltd, and others. The market is semi-consolidated, with China being one of the largest manufacturers of lysine products. Companies are expanding their production capacity, investing in research and development of new production technologies to achieve competitive advantages, and manufacturing products that find application in a wide range of industries.

Major Players in the Lysine Market

To know how our report can help streamline your business, Speak to Analyst

Ajinomoto, ADM, Evonik, Shandong Golden Corn Co., Ltd, and Ajinomoto Co., Inc. are the key players in the lysine market. The global market is semi-consolidated, with the top 5 players accounting for around 45% of the global lysine market share.

List of Key Lysine Companies Profiled:

- ADM Animal Nutrition (U.S.)

- Evonik Industries (Germany)

- Shandong Golden Corn Co., Ltd. (China)

- CJ CheilJedang Corp. (South Korea)

- Juneng Golden Corn Co. Ltd. (China)

- Ajinomoto Co., Inc.(Japan)

- KYOWA HAKKO BIO CO.,LTD. (Japan)

- COFCO Technology & Industry Co., Ltd (China)

- Kemin Industries (U.S.)

- Shivam Pharma (India)

KEY INDUSTRY DEVELOPMENTS:

July 2024: French company, Avril Group, acquired Metex Nøøvistago, which will be managed by Bpifrance in 2030. The acquisition is expected to relaunch the production of amino acids and meet the growing demand for feed amino acids in France and the European Union.

October 2023: Russian chemical company, Ruskhim, acquired the lysine manufacturing plant Donbiotech for USD 7 million. The plant is expected to become operational in 2026, and the company plans to invest an additional USD 200 million for production.

May 2023: Evonik launched a new Biolys formulation that can be used for the production of animal feed. The product contains a higher percentage of lysine, 62.4 percent L-lysine, compared to the current version, which contains 60 percent L-lysine. The product is a part of the company’s strategy to develop high-quality animal protein for healthy human nourishment.

May 2022: Terremoto Biosciences, a biotechnology company known for using lysine to develop enhanced medicines, raised USD 75 million in series A funding. The funding is being used to develop best-in-class therapies and medicines.

July 2020: ADM launched a lysine-based supplement called NutriPass L in the market. The cows can easily absorb the product and supply a stable supply of lysine for cattle.

Investment Analysis and Opportunities

Manufacturers are adopting product innovation and capacity expansion initiatives to expand their market presence in the sector. New product launches and opening new production plants in untapped markets are the key areas of investment for the companies. As new production methodologies are being investigated to manufacture such amino acids in a sustainable manner, the identification of new bacterial strains acts as a promising area where mid-sized companies and startups can invest and launch new product lines that can be used in a wide range of industries.

REPORT COVERAGE

The market report analyzes the market in-depth and highlights crucial aspects such as global lysine market trends, prominent companies, market trends, and applications. Besides this, the market statistics report also provides insights into the market trends and highlights significant industry developments.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

Global Lysine Market Scope |

|

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.00% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Form

|

|

|

By Application

|

|

|

By Region North America (By Type, Form, Application, and Country) · U.S. (By Form) · Canada (By Form) · Mexico (By Form) Europe (By Type, Form, Application, and Country) · U.K. (By Form) · Germany (By Form) · France (By Form) · Spain (By Form) · Italy (By Form) · Rest of Europe (By Form) Asia Pacific (By Type, Form, Application, and Country) · China (By Form) · India (By Form) · Japan (By Form) · Australia (By Form) · Rest of Asia Pacific (By Form) South America (By Type, Form, Application, and Country) · Brazil (By Form) · Argentina (By Form) · Rest of South America (By Form) Middle East & Africa (By Type, Form, Application, and Country) · Turkey (By Form) · UAE (By Form) · Rest of the Middle East & Africa (By Form)

|

|

Frequently Asked Questions

Fortune Business Insights says that the global market was USD 6.18 billion in 2025 and is anticipated to record a valuation of USD 10.26 billion by 2034.

At a CAGR of 6.00%, the global market will exhibit steady growth over the forecast period of 2026-2034.

By type, the L-lysine segment leads the market.

Growing demand for high-quality animal protein products for human consumption to support market growth.

Ajinomoto, ADM, Evonik, Shandong Golden Corn Co., Ltd are the leading companies in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us