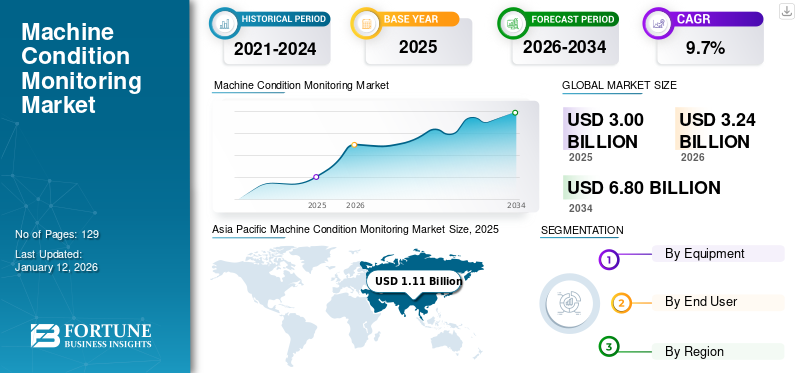

Machine Condition Monitoring Market Size, Share & Industry Analysis, By Equipment (Vibration Analysis, Oil Analysis, and Thermography), By End User (Oil & Gas, Power Generation, Manufacturing & Mining, Chemicals, Automotive, Aerospace and Defense, and Others (Marine & Propulsion)), and Regional Forecast, 2026 – 2034

MACHINE CONDITION MONITORING MARKET SIZE AND FUTURE OUTLOOK

The global machine condition monitoring market size was valued at USD 3.00 billion in 2025 and is projected to grow from USD 3.24 billion in 2026 to USD 6.80 billion by 2034, exhibiting a CAGR of 9.7% during the forecast period. Asia Pacific dominated the machine condition monitoring market with a share of 36.9% in 2025.

The global market is experiencing dynamic growth driven by the increasing adoption of predictive maintenance technologies and industry 4.0 practices across diverse sectors such as oil & gas, power generation, manufacturing & mining, chemicals, automotive, aerospace, and defense. Advancements highly influence this growth in industrial automation and sensor technologies. Furthermore, the market is characterized by fierce competition and innovation. The market demonstrates a strong inclination toward advanced real-time data monitoring solutions that offer predictive insights to prevent machine failure and operational efficiency.

Key players such as Rockwell Automation, Siemens AG, General Vernova, and others in the market are investing heavily in reducing the integration cost and optimizing production flow for manufacturers developing products for end users. The demand for the latest innovation and improving production efficiency through reliable monitoring systems is driving market growth.

The COVID-19 pandemic spurred the need for remote monitoring solutions that eliminate human interaction and provide quick insights to handle situations effectively. The machine condition monitoring solutions boosted the adoption of IoT-enabled sensors and accelerated the adoption of Industry 4.0. Supply chain disruptions initially hampered market growth; however, growing investments in automation and digital transformation post-pandemic have fueled the demand for machine condition monitoring equipment.

IMPACT of INDUSTRY 4.0

Leveraging IoT Functionality to Monitoring Systems Accelerates Automation Integration

Automation has amplified the adoption of machine condition monitoring across various industries by enhancing operational and cost efficiencies. The integration of automation into machine condition monitoring systems optimizes the workflows and reduces human errors. Automated systems offer more consistent data accuracy, enabling industries to achieve higher productivity levels. Furthermore, IoT significantly enhances the functionality of these systems by enabling seamless data collection and real-time analytics.

- For instance, in January 2024, MachineMetrics announced a new product feature in its condition monitoring workflow. This addition is designed to enhance robust condition monitoring capabilities, helping users take actionable steps on real-time machine conditioning data.

Machine Condition Monitoring Market Trends

Adoption of Wireless Monitoring Systems and Cloud Based Solutions to Drive Market Growth

The machine condition monitoring sector has witnessed a shift toward advanced production techniques that leverage Industrial automation and wireless monitoring for cost-effective production efficiency and reduce waste. Moreover, the adoption of IoT-based automation and the integration of cloud-based monitoring are notable trends shaping the base for smart factories. These smart factories are equipped with industrial IoT software and components that allow real-time monitoring of equipment, reducing downtime and minimizing waste. Additionally, key players focusing on developing sustainable and energy-efficient technologies are driving the adoption of eco-friendly monitoring solutions, thereby expanding the machine condition monitoring market share.

- For instance, in January 2025, Puresignal, a Swedish-based company, launched a wireless condition-based lubrication system monitored via an app. This AI-based system software represents a significant breakthrough in predictive maintenance technology. The app can be wirelessly operated with a distance upto 2 km. The system monitors whether a machine is in operation, automatically stops, or determines if any lubrication is needed.

Download Free sample to learn more about this report.

MARKET DYNAMICS

Market Drivers

Proliferation of Industrial IoT (IIoT) to Boost Market Growth

The industry is experiencing significant growth due to the increasing adoption of smart, efficient machine condition monitoring technologies. Moreover, the proliferation of industrial IoT (IIoT) accelerates the adoption of machine condition monitoring technologies by enabling real-time data collection and analysis. The government's investment in digital infrastructure and rising adoption of Industry 4.0 practices are further propelling the demand for products. Thus, the increasing demand for predictive maintenance, cost reduction, and automation of the processes to minimize unplanned downtime is driving machine condition monitoring market growth.

- For instance, in December 2024, NKE FERSA, an Austria-based bearing manufacturer, and Nanoprecise, a Canadian company, launched a new and innovative condition monitoring system for wind turbines. The collaboration allows NKE FERSA to offer wind farm solutions that detect potential issues and extend equipment life.

Market Restraints

High Upgradation Costs and Skill Gaps are Major Restraints to Market Progress

High initial costs of implementation and the complexity of integrating machine condition monitoring with legacy systems hinder market growth. Additionally, the lack of skilled professionals to operate and interpret advanced monitoring techniques poses a challenge for technicians. Furthermore, the limited adoption of these systems in small and medium-sized enterprises (SMEs) due to budget constraints also restricts market expansion in the short term.

Market Opportunities

Demand for Automated Systems and Rapid Industrialization Provides Lucrative Opportunities

The emergence of AI and the integration of machine learning into monitoring systems opens up new opportunities for predictive maintenance by analyzing large amounts of data, patterns, and correlations between data points. This can be beneficial for predicting future anomalies and failures. These advancements enable targeted maintenance planning and execution, helping to minimize machine downtime and increase overall equipment efficiency (OEE). Subsequently, AI advancements and innovation are creating new possibilities expanding product reach and customer base in emerging markets, which significantly expand the market size.

- For instance, in May 2024, GE Vernova released AI-powered autonomous inspection software designed for energy asset inspection. The system leverages AI/ML algorithms to automate the manual inspection process, enabling cost-effective, faster, and safer inspection and monitoring.

Segmentation Analysis

By Equipment

Emphasis on Predictive Maintenance Promotes Vibration Analysis Dominance

As per equipment, the market is classified into vibration analysis, oil analysis, and thermography.

Vibration analysis is the dominant segment due to the high demand for machines in continuous working equipment that need frequent maintenance. The technology enables real-time monitoring of mechanical vibrations in rotating and oscillating machinery. Additionally, continuous measurement and vibration analysis lead to the early detection of failures.

The oil analysis machine segment showcases steady progress as industries use these systems to detect oil levels and lubrication, helping prevent lubricant shortage, contamination, and wear particles at an early stage.

The thermography segment is growing steadily as the equipment allows for visual inspection of surfaces through infrared radiation and helps detect temperature anomalies. The segment held 36.11% of the market share in 2026.

To know how our report can help streamline your business, Speak to Analyst

By End User

Manufacturing and Mining Segment is Displaying Highest Growth Due to its Ability to Predict Failures

By end user, the market is categorized into oil & gas, power generation, manufacturing & mining, chemicals, automotive, aerospace and defense, and others (marine and propulsion).

The manufacturing & mining segment is witnessing the highest growth due to the widespread adoption of systems in rotational components and complex machinery. Additionally, the ability to predict failures through IoT integration revolutionizes operational efficiency across industries.

The automotive sector is showcasing progressive growth due to its early adoption of IoT and automation, which has enhanced predictive maintenance strategies to optimize production flow, driving the growth of the segment in the long term.

The power generation and chemicals sectors have grown steadily owing to the early detection of failures through various equipment analyses.

Oil & gas, aerospace & defense, and other segments will show significant growth during the study period as the technology's frequent usage and failure detection capabilities benefit this sector in the long term. Aerospace & defense segment is likely to acquire 11% of the market share in 2025.

Oil & gas segment is anticipated to hold a CAGR of 7.85% during the forecast period.

MACHINE CONDITION MONITORING MARKET REGIONAL OUTLOOK

Geographically, the global market analysis covers North America, South America, Europe, Asia Pacific, and the Middle East & Africa.

Asia Pacific

Asia Pacific Machine Condition Monitoring Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the fastest-growing region, holding approximately 36% of the global market share due to the large manufacturing base presence in China, India, Japan, and South Asia. The region benefits from the high demand for automation and integration of IIoT into legacy systems. Also, supportive government policies and growing demand for capabilities such as predictive maintenance, visual scanning, and failure prevention are fueling the setup of advanced automotive smart facilities in emerging countries such as India. The regional market value was USD 1.11 billion in 2025. In 2026, the market size stood at USD 1.21 billion.

China is experiencing the highest CAGR, with growth in technology adoption across manufacturing and automotive industries. The push for efficient equipment performance and utilization is driving product adoption in the long term. Additionally, increasing technological advancements and emphasis on enhancing domestic production by integrating Industry 4.0 are further supporting market growth. The market size in China is likely to stand at USD 0.32 billion in 2026. On the other hand, Japan is projected to hit USD 0.26 billion and India is anticipated to be USD 0.21 billion in 2026.

To know how our report can help streamline your business, Speak to Analyst

North America

The market in North America is experiencing progressive growth, driven by growing demand for industrial automation to maximize productivity. The automotive and aerospace sectors significantly contribute to market growth, which is supported by technological advancements and R&D investments. North America is anticipated to account for the second-highest market size of USD 0.92 billion in 2026, exhibiting the second-fastest growing CAGR of 9.06% during 2025-2032.

The U.S. condition monitoring is highly prone to government regulations and newly announced tariffs as major manufacturers, and most trade occurs in this region. The U.S. tariffs are an opportunity for national companies at the same time risk as it could shift the EU and emerging market demand to EU and Asia manufacturers. The U.S. market size is estimated to be USD 0.57 billion in 2026.

South America

Growth in the manufacturing and energy sector supports the significant growth of the South American region. Brazil and Argentina are prominent contributors due to their growing industrial base and adoption of automation.

Europe

Europe is set to showcase steady growth due to energy-efficient solutions, focusing on sustainability, standards, and stringent energy regulations to promote the adoption of advanced monitoring solutions, which are helping to increase growth potential. The regional market value is sizing for USD 0.69 billion in 2026 as the third-largest market globally. Additionally, the region's supportive policies to automate the process, providing opportunities for established and emerging players, are supporting market growth in the long term. The market size in U.K. is likely to stand at USD 0.16 billion in 2026. On the other hand, Germany is projected to hit USD 0.18 billion in 2026 and France is anticipated to be USD 0.07 billion in 2025.

Middle East & Africa

The Middle East & Africa region is experiencing substantial growth, driven by the rising oil & gas sector. The regional market value is anticipating to be USD 0.25 billion in 2026, as the fourth-largest market in the world. Increasing investments in smart infrastructure and energy projects further bolster the adoption of monitoring services. The GCC market size is estimated to be USD 0.92 billion in 2025.

Competitive Landscape

KEY INDUSTRY PLAYERS

Key Players Focus on Investments to Strengthen their Market Positions

The competitive landscape is marked by continuous innovation and strategic collaboration. Companies are increasingly focusing on AI predictive analytics, highlighting the shift toward intelligent solutions. Revenue trends indicate robust growth, with players investing heavily in R&D to stay ahead in the evolving market. Additionally, collaborations between major players to develop advanced systems are reshaping the competitive environment.

- For instance, in May 2024, GE Vernova, a prominent player in electrification, decarbonization, and energy solutions, announced the launch of Autonomous inspection, a computer-based vision software solution designed to automate manual inspection. The solution utilizes image capture devices and AI and machine learning-based algorithms.

List of Key Machine Condition Monitoring Companies Profiled

- General Vernova (U.S.)

- Honeywell International Inc. (U.S.)

- SKF (Sweden)

- Siemens AG (Germany)

- Rockwell Automation Inc. (U.S.)

- Fluke Corporation (U.S.)

- Bentley Nevada (Nevada)

- Emerson Electric (U.S.)

- Parker Hannifin Corporation (U.S.)

- Meggitt PLC (England)

- National Instruments Corporation (U.S.)

- Bruel & Kjaer Vibro GmBH (Germany)

- PRUFTECHNIK Dieter Busch AG (Germany)

- Bosch Rexroth AG (Germany)

- Analog Devices Inc. (U.S.)

- Teledyne Technologies Inc. (U.S.)

- Schaeffler (U.S.)

- Fortive Corporation (U.S.)

- Regal Rexnord (U.S.)

- Acoem (France)

KEY INDUSTRY DEVELOPMENTS

- May 2024: DMG MORI CO. Ltd., a prominent health monitoring service provider, released ‘WALC CARE,’ an advanced machine health monitoring service. The newly developed WALC CARE regularly performs predictive diagnostics for early failure detection and reduces downtime.

- April 2024: IMI Sensors, a prominent industrial vibration monitoring instrumentation, announced the release of a fully programmable accelerometer featuring a universal link IO protocol. The sensor is an ideal solution for measurements and averages at a user-specified interval and is ideal for full-spectrum industrial vibration monitoring.

- March 2024: Tan Delta, a prominent player in oil condition monitoring sensors and systems, announced the launch of its mining and mineral processing sector offering. Tan Delta's highway monitoring system helps users to cut oil consumption and cut maintenance costs by upto 30%. Tan Delta’s mining and mineral uses advanced real-time oil analysis to tell the actual status of oil and instantly optimize maintenance programs.

- February 2024: Tan Delta, a leading manufacturer of real-time oil monitoring sensors and systems, announced DAPONA as a best-in-class SENSE technology. DAPONA partnered with Tan Delta to monitor oil conditions alongside its various other plant efficiency monitoring technologies.

- April 2023: Timken, a global player in engineered bearings and industrial motion, released a new wireless and condition monitoring solution that helps users detect failure or change before it happens through temperature and vibration monitoring. The company sensor and monitoring solutions can indicate potential performance issues before they occur.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product types, and leading applications of the product. Besides, the report offers insights into the market trends, competitive landscape, and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 9.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Equipment, End User, and Region |

|

Segmentation |

By Equipment

By End User

By Region

|

|

Key Market Players Profiled in the Report |

General Vernova (U.S.), Honeywell International Inc. (U.S.), SKF (Netherlands), Siemens AG (Germany), Rockwell Automation Inc. (U.S.), Fluke Corporation (Japan), Bentley Nevada (Nevada), Acoem (France), Schaeffler (U.S.), Bosch Rexroth AG (Germany) |

Frequently Asked Questions

The market is projected to reach USD 6.80 billion by 2034.

In 2026, the market was valued at USD 3.24 billion.

The market is projected to grow at 9.7% CAGR over the forecast period.

Vibration analysis is leading the equipment segment in the market.

The proliferation of industrial IoT (IIoT) is a key factor driving market growth.

General Vernova, Honeywell International Inc., SKF, Siemens AG, Rockwell Automation Inc., Fluke Corporation, Bentley Nevada, Acoem, Schaeffler, and Bosch Rexroth AG are the top players in the market.

Asia Pacific dominated the machine condition monitoring market with a share of 36.9% in 2025.

By end user, the manufacturing and mining segment shows the highest growth in the market.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us