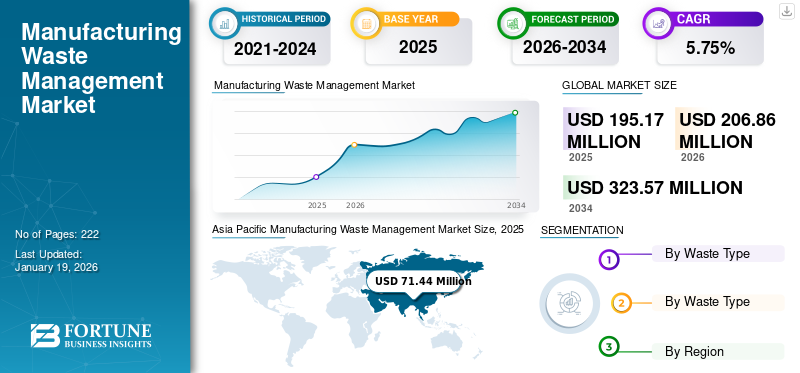

Manufacturing Waste Management Market Size, Share & Industry Analysis, By Waste Type (Hazardous Waste {Chemical Waste, Biomedical Waste, and Flammable and Toxic Substances}, and Non Hazardous Waste {Organic Waste, Packaging Waste, Metal Scraps, Glass and Ceramics, E-Waste, and Others}), By Service (Landfill, Recycling, and Incineration), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global manufacturing waste management market was valued at USD 195.17 million in 2025. It is projected to be worth USD 206.86 million in 2026 and reach USD 323.57 million by 2034, exhibiting a CAGR of 5.75% during the forecast period. Asia Pacific dominated the manufacturing waste management market with a market share of 36.60% in 2025.

The manufacturing waste management market is expanding steadily due to increasing industrial output, regulatory compliance demands, the shift toward circular systems, and technological advances. As manufacturing continues to grow globally, particularly in emerging economies the need for integrated waste management services will grow, making this one of the fastest growing segments in the industrial waste sector. Hazardous industrial waste refers to waste materials generated during manufacturing processes that pose substantial or potential threats to public health and the environment.

The market is growing due to several economic, regulatory, and environmental factors. Veolia, SUEZ SA, and Clean Harbors, Inc. are few major vendors in the manufacturing waste management market. Veolia and Suez have extensive global networks, operating in over 40+ countries and enabling them to serve large scale manufacturing clients efficiently.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Hazardous and E-Waste Generation to Drive the Market

Modern manufacturing processes, especially in electronics, automotive, chemical, and pharmaceutical industries, produce large quantities of hazardous and electronic waste. These waste types require specialized handling, treatment, and disposal, which creates strong demand for professional waste management services. Hazardous waste and e-waste batteries contain pollutants that pose serious health and environmental risks.

In June 2025, a major strengthening of its hazardous waste treatment capabilities was announced by Veolia, the global leader in comprehensive hazardous waste solutions. By 2030, Veolia is increasing its annual treatment capacity for hazardous waste by 530,000 tons through a combination of targeted acquisitions and organic growth. This will allow it to proactively address growing global demand, severe shortages in essential treatment capacity, and the critical need to safeguard the environment and public health.

MARKET RESTRAINTS

High Initial Investment and Operational Cost to Hinder Market Growth

Setting up effective waste management systems requires significant upfront capital, particularly for industries looking to implement advanced technologies such as waste segregation units, recycling machinery, hazardous waste treatment plants, and emissions control systems. These high costs can deter manufacturers, especially small and medium enterprises from adopting sustainable waste practices.

In addition to setup costs, ongoing operational expenses such as equipment maintenance, skilled labor, energy consumption, transportation of waste and regulatory compliance further strains budgets.

MARKET OPPORTUNITIES

Technological Advancements in Smart Waste Management Solutions to Create Opportunity for the Market

Technological innovations are transforming the waste management landscape, particularly through smart waste solutions. In the manufacturing sector, these advancements offer new opportunities by improving efficiency, compliance, and cost effectiveness. Smart technologies such as IoT enabled bins, AI driven sorting systems, real time waste tracking, automation, and predictive analytics allow manufacturers to monitor waste generation in real time. In November 2023, to transform water, energy, and waste management, Veolia announced the global roll out of a digital solution based on artificial intelligence.

Manufacturing Waste Management Market Trends

Circular Economy and Zero Waste Initiatives to Lead the Market Growth

Traditionally, manufacturing followed a linear model that made use of disposal which leads to higher waste generation. In contrast, the circular economy promotes a closed loop approach: reduce, reuse, recycle, and recover. This shift is driving demand for efficient waste segregation, material recovery, and recycling infrastructure.

Manufacturers are under pressure to reduce raw material dependency and operational costs. Circular practices such as recycling scrap materials or reusing by products help reduce input costs creating a strong incentive to invest in waste management solutions.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Waste Type

Increasing E-Waste and Chemical Use to Lead Hazardous Waste Growth

The manufacturing waste management market by waste type covers hazardous waste (chemical Waste, Biomedical Waste, flammable toxic substances), and non-Hazardous waste (organic waste, packaging waste, metal scraps, glass and ceramics, e-waste, and others).

Hazardous waste is the dominating segment in the market. Industries such as chemical, pharmaceutical, oil and gas, metal processing, and electronics generate large quantities of hazardous waste including toxic chemicals, heavy metals, solvents, acids and flammable materials. Due to its volume, risk, regulatory pressure, and complexity, hazardous waste remains the leading segment in the market.

Non Hazardous are the second largest segment in the market. Non-hazardous waste dominates in volume and sustainability relevance, making it the second largest and rapidly growing segment in the market.

By Services

Economic Benefits and Cost Savings to Drive Landfill Growth

By services, the market is segmented into landfill, recycling, and incineration.

Landfills dominate the market as they are often cheaper than recycling, incineration, or other advanced treatment methods especially in regions where land is readily available and regulations are less strict.

Recycling is the fastest growing segment in the market. Manufacturers are increasingly adopting circular economy principles, aiming to reuse and recycle materials instead of sending them to landfill, thus driving the segment growth.

MANUFACTURING WASTE MANAGEMENT MARKET REGIONAL OUTLOOK

The manufacturing waste management market has been analyzed geographically across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Asia Pacific

Asia Pacific Manufacturing Waste Management Market Size, 2025 (USD Million) To get more information on the regional analysis of this market, Download Free sample

Asia Pacific is the dominating region in the market owing to the growing manufacturing waste due to rapid industrialization and other factors. Asia Pacific dominated the manufacturing waste management market with a market size of USD 71.44 million in 2025.

Additionally, rising environmental awareness and government regulations also drive the regional market growth. Major contributors include China, India, Japan, South Korea, Indonesia, and Southeast Asia Countries. Accelerated development of smart cities and industrial zones is creating demand for modern, large-scale waste management infrastructure especially in China and India.

North America

North America is a mature and well regulated market for manufacturing waste management. The region’s strong environmental policies, industrialization, and focus on sustainability are key factors supporting market growth. Agencies such as the EPA enforce strict compliance for waste disposal, treatment and recycling. Manufacturers are increasingly adopting waste to resource and recycling solutions to reduce landfill dependency.

U.S.

The U.S. produces one of the highest volumes of waste per capita globally including municipal solid waste, industrial, medical, e-waste, and hazardous materials. Urbanization, population growth, and increasing consumerism are leading to higher overall waste volumes. The U.S. is moving away from landfilling toward recycling, composting, and waste to energy. Corporate sustainability goals and government initiatives promote reuse and material recovery, boosting demand for advanced recycling and processing services.

Europe

Europe has a large and diverse manufacturing base automotive, electronics, chemicals, textiles, and food processing which naturally generates significant waste. As industries output rises the volume of waste needing management grows. The European green deal promotes circular manufacturing, where waste is minimized, and by-products are reused or recycled. This drives demand for recycling, recovery, and sustainable services in the manufacturing sector.

Latin America

Countries such as Brazil, Mexico, Argentina, Chile and Colombia are expanding their automotive, electronics, food, chemical, and textile manufacturing bases. This rise in manufacturing activity leads to increased industrial waste generation, which could be both hazardous and non-hazardous. Governments are implementing and tightening regulations to manage solid, hazardous, and industrial waste.

Middle East & Africa

Many countries in the Middle East & Africa region, especially the Gulf Corporation Council countries including Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman, are spreading away from oil dependence by investing in manufacturing, construction, and heavy industries. Key sectors include petrochemicals, cement, metals, automotive, and electronics. This growth in manufacturing output naturally results in increased industrial waste generation, driving demand for waste management services.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovative Strategies Adoption by the Leading Companies to Lead their Market Presence

The manufacturing waste management market is undergoing significant transformation as companies adopt innovative strategies to meet growing environmental regulations and sustainability goals. Major players such as Veolia, Waste Management Inc., Republic Services, and Clean Harbors are investing in advanced technologies such as AI-powered waste sorting, real-time monitoring systems, and waste-to-energy solutions. These innovations not only improve operational efficiency but also help reduce the environmental impact of industrial waste. Companies are also expanding their services through acquisitions and global partnerships, with Veolia's merger with Suez being a key example of consolidation to strengthen market presence.

List of Key Manufacturing Waste Management Companies Profiled

- Veolia Environnement S.A. (France)

- SUEZ SA (France)

- Clean Harbors, Inc. (USA)

- Waste Management, Inc. (USA)

- Republic Services, Inc. (U.S.)

- Stericycle, Inc. (U.S.)

- Covanta Holding Corporation (U.S.)

- Remondis SE & Co. KG (Germany)

- Biffa plc (U.K.)

- DS Smith (UK)

- Bee'ah (UAE)

- Averda (UAE)

- Urbaser (Spain)

- Ambipar Group (Brazil)

- China Everbright Environment Group Ltd. (China)

- Hitachi Zosen (Japan)

KEY INDUSTRY DEVELOPMENTS

- In January 2025, Gruppo Ecosystem, an independent business focused on industrial waste processing and recovery, will be majority owned by SUEZ under a Share Purchase Agreement. In accordance with the Group's strategic growth areas, the transaction enhances SUEZ's presence in Italy and strengthens its position in these high-value-added services.

- In January 2023, The Emirates News Agency reported that the Abu Dhabi Waste Management Company, also known as Tadweer, has signed five contracts valued at over USD 545 million for operations in Abu Dhabi and Al-Ain. Waste container management, public cleaning services, transportation services, and solid waste collection are all covered by the six-year agreements.

- In May 2022, one of the largest privately held integrated waste management businesses in the Middle East & Africa, Averda International, and IFC signed a groundbreaking new agreement that is helping to introduce cutting-edge waste solutions to developing markets in the two regions. The UAE-based business will be able to continue its intended expansion in Oman, Morocco, and South Africa due to a USD 30 million IFC loan that will help it become more resilient in the aftermath of the pandemic.

- In September 2021, the purchase of Viridor Waste Management Ltd.'s collections division and some recycling assets, which are also located in the U.K., was completed by Biffa plc, a major integrated waste management company. The assets were sold to Biffa by Viridor for USD 154.3 million.

- In May 2021, the world's largest and most technologically sophisticated dry mixed-waste recycling facility was officially opened by BINGO Industries' Eastern Creek Recycling Ecology Park in Western Sydney, a Planet Ark partner. With cutting-edge resource recovery and manufacturing technology costing USD 100 million, BINGO can significantly reduce the amount of materials sent to landfills and manufacture new products on-site.

REPORT COVERAGE

The report provides a detailed analysis of the market. It focuses on key aspects such as leading companies, product/service processes, competitive landscape, and the leading manufacturing waste management market. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the market's growth in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 5.75% from 2026 to 2034 |

|

Unit |

Value (USD Million) |

|

Segmentation |

By Waste Type

|

|

By Service

|

|

|

By Geography

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 195.17 million in 2025.

In 2025, the Asia Pacific market value stood at USD 71.44 million.

The market is expected to exhibit a CAGR of 5.75% during the forecast period of 2026-2034.

The Landfill segment led the market by services.

Increasing Hazardous and E-Waste Generation to Drive the Market

Some of the top major players in the market are Veolia, Suez Environment, Clean Harbors, Inc., and Others.

Asia Pacific dominated the manufacturing waste management market with a market share of 36.60% in 2025.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us