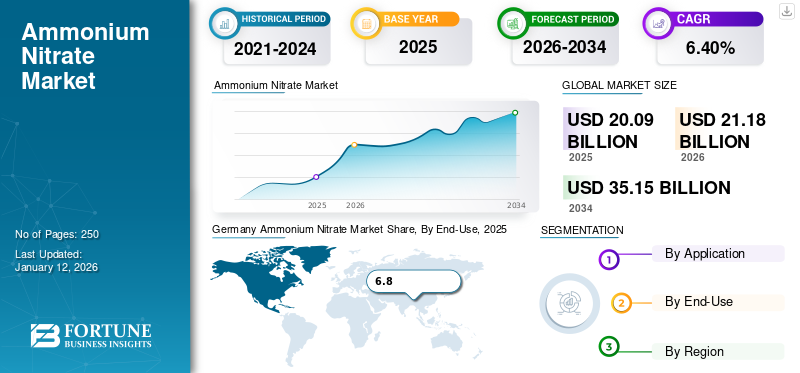

Ammonium Nitrate Market Size, Share & Industry Analysis, By Application (Fertilizers, Explosives, and Others), By End-Use (Agriculture, Mining, Defense, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global ammonium nitrate market size was valued at USD 20.09 billion in 2025. The market is projected to grow from USD 21.18 billion in 2026 to USD 35.15 billion by 2034 at a CAGR of 6.40% during the 2026-2034 forecast period. Europe dominated the ammonium nitrate market with a market share of 38% in 2025.

Ammonium Nitrate (NH₄NO₃) is a pure, highly soluble white crystalline salt formed by vaporous ammonia reacting with nitric acid. Its high nitrogen content surges its major demand in agriculture to promote plant growth. On the other hand, AN is also utilized as a main component in explosives as a key oxidizing agent in quarrying, mining, and construction. Also, its broad industrial and agricultural utility makes it a pivotal compound in global bulk chemicals. The rapid growth of the agriculture industry globally, coupled with growing mining activities, is expected to trigger product adoption in the coming years. Hence, increasing consumption in this application would help the overall market growth flourish during the forecast period. The major key players operating in the market are Yara International ASA, Orica Ltd, Sigdo Koppers Group, CF Industries Holdings, Inc., and Incitec Pivot Ltd.

GLOBAL AMMONIUM NITRATE MARKET TAKEAWAYS

Market Size & Forecast:

- 2025 Market Size: USD 20.09 billion

- 2026 Market Size: USD 21.18 billion

- 2034 Forecast Market Size: USD 35.15 billion

- CAGR: 6.40% from 2026–2034

Market Share:

- Europe led in 2025 with a 38% share, rising from USD 7.72 billion in 2025 to USD 8.14 billion in 2026.

- By application: Fertilizers segment dominated due to high nitrogen content enhancing crop yield.

- By end-use: Agriculture held the largest share, driven by rapid industry growth and technological innovation.

Key Country Highlights:

- Germany: Strong demand from defense and agriculture sectors.

- U.K. & France: Rising fertilizer adoption for sustainable farming.

- China & India: Leading producers and consumers with expanding agricultural and mining activities.

- U.S.: Demand fueled by agriculture, construction, and mining explosives.

- Brazil: Growing usage in mining and agricultural development.

MARKET OPPORTUNITIES

Rapid Growth of Defense Industry to Create Ample Opportunities for Market

The defense industry offers significant demand for ammonium nitrate, particularly in its role as a key component in the production of high-performance explosives and propellants. Its stability, high energy content, and ability to be stored safely make it an ideal choice for various military applications, such as munitions, missiles, and pyrotechnics. Furthermore, ongoing advancements in defense technology continually drive the demand for more potent and reliable explosives, thereby creating a sustained need for product formulations.

Moreover, its versatility allows for adaptation to a wide range of defense requirements, from precision-guided munitions to Improvised Explosive Device (IED) countermeasures, making it crucial in modern defense technologies. Hence, due to such aforementioned factors, the defense industry offers ample opportunities for market growth.

AMMONIUM NITRATE MARKET TRENDS

Decarbonization Pressure Driving Shift to Low-Carbon Ammonium Nitrate

The shift toward sustainable and low-carbon ammonium nitrate production is driven by the need to reduce the high carbon footprint associated with conventional ammonia-based processes, which rely heavily on natural gas. Manufacturers are increasingly adopting green hydrogen produced via renewable-powered electrolysis as a feedstock for ammonia, enabling the creation of “green ammonium nitrate” with drastically lower emissions. In parallel, technologies like carbon capture and process efficiency improvements are being integrated to further cut energy use and environmental impact. This transition is reinforced by stricter regulations, decarbonization targets, and growing demand from agriculture and mining sectors for eco-friendly inputs, positioning sustainable ammonium nitrate as a key growth opportunity despite higher initial costs.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Growing Demand for Fertilizers Globally to Boost Market Growth

Rising need for higher crop yields, coupled with increasing food demand, is expected to drive the demand for ammonium nitrate nitrogen-rich fertilizer. Ammonium nitrate is a widely used compound in fertilizers due to its dual role as a source of both nitrogen and oxygen, thereby making it an essential element for plant growth. Also, growing demand for high nitrogen fertilizer promotes healthy foliage and vigorous growth. Furthermore, the nutritional benefits, along with affordability and ease of production, contribute to the surge in demand in the agricultural industry.

Moreover, growing convenient storage and transportation of AN, as it is known for its stability, ensures its widespread availability to farmers worldwide. Thus, the driving factors behind the product usage in fertilizers stem from its effectiveness, affordability, ease of handling, and crucial role in supporting global food production. Furthermore, growing product advancements such as the introduction of coated granules, stabilizers, and cleaner production methods for reducing environmental impact, will further surge the product demand. As a result, the market is expected to grow positively in the near future.

Infrastructure Growth and Mining Expansion Continue to Accelerate Ammonium Nitrate Demand

AN continues to be a key component in the construction and mining sectors. As a primary component in ANFO (Ammonium Nitrate Fuel Oil) explosives, ammonium nitrate benefits directly from infrastructure and mining expansions. As global infrastructure development accelerates, including highways, bridges, rail tunnels, and energy projects, the demand for reliable and efficient blasting agents including AN is increasing steadily. Its controlled detonation characteristics, cost-effectiveness, and efficiency in breaking hard rock make it a preferred choice for excavation and quarrying activities. The material supports safer and faster operations, improving productivity and reducing overall project timelines in large-scale civil construction projects. With rising infrastructure spending and mining operations expanding globally, AN is expected to remain a core industrial material supporting large-scale development and resource extraction efforts.

MARKET RESTRAINTS

Implementation of Stringent Rules and Availability of Substitutes Restricts Market Growth

The presence of substitute options, coupled with stringent governmental regulations to limit product utilization, poses a challenge to the ammonium nitrate market growth. Governmental authorities have implemented stringent guidelines governing the production and utilization of AN to mitigate its potential misuse in terrorist activities. Also, many countries heavily regulate manufacturing, transport, and storage due to their potential misuse in industrial explosives, increasing compliance burdens. Consequently, this regulatory environment is anticipated to restrain the market growth, as the utilization of alternative options has expanded across fertilizer and explosives application segments.

MARKET CHALLENGES

Growing Safety Concern Due to Storage of Ammonium Nitrate Poses Challenge to Market

The growing safety concern among the production site and laborers poses a significant challenge for the market. For instance, in the 2020 Beirut explosion, around 2,750 tons of improperly stored ammonium nitrate caused one of the largest non-nuclear blasts in history, killing over 200 people and injuring thousands. This tragedy triggered a wave of regulatory tightening across multiple countries to tighten their chemical safety laws. These growing safety and environmental concerns make it increasingly difficult for producers to operate profitably. Also, historical explosions (e.g., West, Texas) have damaged ammonium nitrate’s reputation, prompting tighter safety standards. As a result, compliance costs are rising, and industries are gradually shifting toward safer or less-regulated alternatives. Also, regulatory burden and safety risks remain major challenges on the global market.

TRADE & REGULATIONS

The global trade of AN has been significantly impacted by its potential misuse as an explosive, leading to stricter regulations and challenges for international trade. Countries worldwide have implemented restrictions, including licenses and certifications, while regions including Europe and North America have introduced rigorous safety rules for transportation, storage, and labeling. These factors, combined with regulatory variations, pose difficulties for multinational companies involved in AN trade.

SEGMENTATION ANALYSIS

By Application

Fertilizer Segment to Hold Largest Share in this Market Due to its Characteristics

Based on application, the market is segmented into fertilizers, explosives, and others.

The fertilizers segment accounted for the highest ammonium nitrate market share in 2023. Its low-impurity grade optimized for nutrient release in farming holds the largest market share. The growth is attributed to its water-soluble properties that ensure rapid absorption by plants, promoting efficient nutrient uptake. Moreover, the rapid growth of the agriculture industry, coupled with rising technological innovations, will further propel the segment's growth. This segment is likely to record a considerable CAGR of 4.50% during the forecast period (2024-2032).

On the other hand, the demand for AN in the explosives segment is associated with its inherent properties and versatility. Particularly, industrial/technical-grade is majorly used as a key ingredient in explosives and mining applications. It serves as an oxidizing agent that releases oxygen during detonation, thereby fueling the combustion of other reactive materials in explosive formulations. The other segment includes cold packs, generators, rocket propulsion, pyrotechnics, and industrial processes. The segment is expected to capture 46.55% of the market share in 2026.

By End-Use

Agriculture Segment is Largest End-Use due to Rapid Industry Growth and Technological Innovation

Based on end-use, the market is segmented into agriculture, mining, defense, and others.

The agricultural segment accounted for the highest market with a share of 46.13% in 2026 , as it plays a critical role in nitrogen supplementation. Moreover, the rapid growth of the agriculture industry globally and technological innovations are creating lucrative opportunities for segment growth. Additionally, the cost-effectiveness and ease of production make the product an ideal choice in the agriculture industry.

Growing product adoption in mining activities such as mining, quarrying, and civil construction activities will further fuel the segment growth. The growth is associated with its increasing use in explosive formulation, blasting, and safety precautions. On the other hand, the product is sometimes used as an oxidizing agent in pyrotechnic compositions for defense applications, such as signaling devices, smoke grenades, and illuminating flares. The other segment includes pharmaceuticals and construction.

To know how our report can help streamline your business, Speak to Analyst

GLOBAL AMMONIUM NITRATE MARKET REGIONAL OUTLOOK

Based on region, the market is segmented into North America, Europe, Asia Pacific, and Rest of the World.

EUROPE

Europe Ammonium Nitrate Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market size in Europe stood at USD 7.72 billion in 2025 and USD 8.14 billion in 2026. The market is dominated by Europe, in which Germany, the U.K., France, and Italy are the key countries. A rise in food security concerns is driving the demand for products. Collective efforts by governments, farmers, and organizations to enhance the yield per unit of cultivated land, coupled with rising environmental compliance, are fueling the usage of fertilizers, thereby driving market growth. The UK market is projected to reach USD 0.39 billion by 2026, while the Germany market is projected to reach USD 1.12 billion by 2026, while France is poised to be valued at USD 0.27 billion in the same year.

Germany Ammonium Nitrate Market Share, By End-Use, 2025

To get more information on the regional analysis of this market, Download Free sample

ASIA PACIFIC

Asia Pacific is the second largest market anticipated to be worth USD 8.11 billion in 2026, exhibiting a CAGR of 7.60% during the forecast period (2026-2034)Asia Pacific ammonium nitrate market is expected to witness higher growth during the forecast period. The region is the leading producer and a significant consumer, driven by major agricultural economies including China and India. The Chinese market is foreseen to grow with a value of USD 5.62 billion in 2026. Moreover, the growing demand for ammonium nitrate fuel oil and defense explosives drives this massive product adoption. India is set to gain USD 2.25 billion in 2026, while Japan is likely to hit USD 0.03 billion in the same year.

NORTH AMERICA

North America is the third largest market expected to hold USD 3.39 billion in 2026. The market growth in North America is primarily driven by its increasing use in agriculture as a high-nitrogen fertilizer to boost crop yields, supported by rising food demand and intensive farming practices. Additionally, the expanding construction and mining industries in the U.S. will further fuel the demand for ammonium nitrate-based explosives due to infrastructure development and resource extraction activities. Technological advancements in production processes and distribution efficiency further support market expansion. The U.S. market is likely to gain USD 1.91 billion in 2026.

REST OF THE WORLD

The rest of the world is the fourth leading region set to gain USD 1.48 billion in 2025. On the other hand, the sub-region in the Rest of the World, such as Latin America and Middle East & Africa, is expected to witness growth potential, especially in Brazil and parts of Africa. Moreover, growing technological innovations, along with product advancement and increasing mining activities, are the major factors surging product demand in these regions. However, regulatory hurdles along with infrastructure may limit rapid adoption.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Business Expansion is a Strategic Initiative Implemented by Companies to Gain Competence

Most of the companies in the market invest in capacity expansion and research & development activities to enhance product adoption and manufacturing. They focus on new product offerings, strategic acquisitions, partnerships, and production capacity expansion to boost their product portfolio, fortify their manufacturing capacities, and gain a competitive edge in the value chain.

LIST OF KEY MARKET PLAYERS PROFILED IN THE REPORT:

- Yara International ASA (Norway)

- Orica Ltd (Australia)

- Sigdo Koppers Group (Chile)

- CF Industries Holdings, Inc. (U.S.)

- Dyno Nobel Limited (U.S.)

- Neochim Plc. (Bulgaria)

- EuroChem Group (Switzerland)

- OSTCHEM Holding Company (Ukraine)

- Fertiberia SA (Spain)

- Austin Powder Company (U.S.)

- San Corporation (China)

- Deepak Fertilisers and Petrochemicals Corporation Ltd. (India)

- CSBP Limited (Australia)

- Uralchem Group (Russia)

KEY INDUSTRY DEVELOPMENTS:

- In June 2024, Orica partnered with Fertiberia to successfully conduct the first blast using low-carbon Technical Ammonium Nitrate (TAN) at the Canteras de Santullán quarry in Spain. This initiative marked a significant advancement in sustainable mining practices by reducing the carbon emissions typically associated with conventional blasting operations.

- In January 2024, Dyno Nobel entered into a non-binding Memorandum of Understanding (MoU) with Saudi Chemical Company Limited and a Saudi Investment company to explore the development and operation of a Technical Ammonium Nitrate (TAN) plant in Saudi Arabia.

- In March 2023, Voskresensk Mineral Fertilisers JSC merged with Uralchem as its branch. Now its called the VMU branch of Uralchem. Such merger aimed to improve Uralchem's operating efficiency by reducing intragroup transactions, lowering administrative and management costs, and enhancing financial management. This development effectively streamlined operations within the Uralchem Group.

- In June 2023, Orica acquired two ammonium nitrate emulsion plants along with associated assets in Blackwater, Queensland, and Gunnedah, New South Wales. The acquisition involved a payment of USD 19.6 million at completion, with an additional amount of up to USD 2.5 million payable within 24 months.

- May 2023 – Incitec Pivot Limited entered into a long-term gas supply agreement for the Moranbah ammonium nitrate plant, supporting the operations of Queensland Pacific Metals Ltd. (QPM) with a corporate guarantee valid until February 2025 to ensure project performance.

REPORT COVERAGE

The global market research report delivers a detailed analysis of the market and focuses on crucial aspects such as leading companies, applications, and end-uses. Also, it provides quantitative data in terms of volume and value, market analysis, research methodology for market data, and insights into market trends. It highlights vital industry developments and the competitive landscape. In addition to the factors mentioned above, the report encompasses various factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion), Volume (Million Ton) |

|

Growth Rate |

CAGR of 6.40% from 2026 to 2034 |

|

Segmentation |

By Application

|

|

By End-Use

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 21.18 billion in 2026 and is projected to record a valuation of USD 35.15 billion by 2034.

Recording a CAGR of 6.40%, the market is slated to exhibit steady growth during the forecast period of 2026-2034.

The fertilizers segment is the leading application in the market.

Growing demand for fertilizers is anticipated to boost the market growth.

Yara International ASA, Orica Ltd, Sigdo Koppers Group, CF Industries Holdings, Inc., and Incitec Pivot Ltd are the major players in the global market.

Europe dominated the market in terms of share in 2025.

The rapid growth in the agriculture and defense industries is anticipated to boost the consumption of the product.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us