Drone Delivery Service Market Size, Share & Industry Analysis, By Drone Type (Fixed-Wing Drones, Multirotor Drones, and Hybrid Drones), By Payload Capacity (Less than 2 kg, 2 kg to 5 kg, and More than 5 kg), By Range (Short Range (Less than 25 km), Mid-Range (25 km to 100 km), and Long Range (More than 100 km), By Application (Urban Delivery, Rural Delivery, Emergency Delivery (Medical supplies, disaster relief), Industrial Delivery, and Residential Delivery), By End-User (Retail and E-commerce, Healthcare and Pharmaceuticals, Food Delivery, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

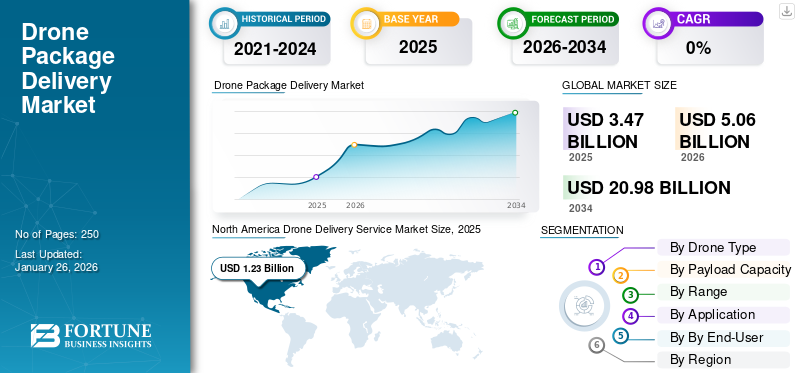

The global drone delivery service market size was valued at USD 3.47 billion in 2025. It is projected to grow from USD 5.06 billion in 2026 to USD 20.98 billion by 2034, exhibiting a CAGR of 19.45%. North America dominated the drone package delivery market with a market share of 35.47% in 2025.

Drone delivery services refer to using Unmanned Aerial Vehicles (UAVs), also known as drones, to transport goods and packages from a particular location to a customer's designated delivery address. This technology aims to improve logistics by offering cost effective, more efficient, and faster delivery solutions especially aiding last-mile deliveries. The market is experiencing significant growth due to numerous factors, including the increasing demand for faster delivery with the rise of e-commerce and the need for efficient last-mile solutions.

Additionally, advancements in drone technology, such as improved autonomous flight systems and longer battery life contribute to market expansion. Furthermore, the COVID-19 pandemic accelerated the adoption of drone delivery as a contactless and efficient way to transport goods. While initial investments in drone technology can be higher, drone delivery is effective, efficient, and cost-saving in the long run as compared to traditional delivery methods. Reduced fuel, labor, and operational costs contribute to overall cost-effectiveness. Apart from e-commerce and retail, these drones are used significantly for various applications, including industrial inspections, medical deliveries, and emergency response.

The versatility of drone technology is driving its adoption across multiple sectors. Governments across the world are increasingly recognizing drone delivery's potential and developing supportive regulations. This favorable regulatory environment is facilitating the growth of the market. Key industry players such as Zipline (U.S.), Matternet (U.S.), United Parcel Service of America, Inc. (U.S.), Wing Aviation LLC (U.S.), and others are leading to a strong growth of the market. These major market players are heavily investing in technological advancements and aiming for higher and more sustainable reach for drone delivery, thereby leading to market growth.

Global Drone Delivery Service Market Key Takeaways

Market Size & Forecast

- 2025 Market Size: USD 3.47 billion

- 2026 Market Size: USD 5.06 billion

- 2034 Forecast Market Size: USD 20.98 billion

- CAGR: 19.45% from 2026–2034

Market Share

- North America dominated the drone delivery service market in 2025, driven by the strong presence of key drone manufacturers, rapid adoption of last-mile delivery solutions, and favorable FAA regulatory support. Advancements in drone technology, such as longer flight times and enhanced payload capacities, further boost regional growth.

- By drone type, multi-rotor drones are expected to retain the largest market share in 2025, supported by their high maneuverability, vertical take-off and landing (VTOL) capability, and suitability for short-range, urban, and healthcare deliveries.

Key Country Highlights

- United States: Growth is driven by e-commerce expansion and supportive FAA regulations, including approvals for beyond-visual line-of-sight deliveries, enabling large-scale commercial operations.

- China: A booming e-commerce sector and government-backed initiatives such as the Belt and Road contribute to widespread drone adoption for urban and rural logistics.

- Japan: Rising use of drone deliveries for medical and emergency supplies in densely populated urban regions, coupled with advanced robotics and AI integration, supports market growth.

- Europe: The European market benefits from strict carbon reduction mandates and increasing demand for last-mile healthcare and retail deliveries, aligned with the EU’s sustainability goals.

Market Dynamics

Market Drivers

Growing Need for Product Delivery in the E-Commerce Sector is Driving the Market Growth

Drones are destined to revolutionize the future of logistics and e-commerce. They offer online retailers a prompt, economical, and straightforward delivery solution that benefits their customers. Numerous nations have already begun to experience the practicality of this approach.

Over 3000 packages have already been delivered by drones in Australia. Moreover, remote health centers in Ghana have received more than 200 deliveries of medical supplies via drone from an organization based in San Francisco. Over the next decade, drones are expected to increase e-commerce revenue by almost 25% and save online retailers approximately USD 50 million in delivery costs. With deliveries costing less than USD 1 and being delivered within 30 minutes, it is evident that drones will have a significant impact on e-commerce deliveries.

- For instance, in January 2024, Skye Air Mobility bagged seven contracts from various institutions, including AIIMS Jodhpur and AIIMS Rajkot, whereby the company will deploy advanced drone technology to deliver medical supplies. The company announced in a press release that the contracts have been awarded by AIIMS Jodhpur (Rajasthan), AIIMS Rajkot (Gujarat), AIIMS Bhubaneswar (Odisha), AIIHPH Kolkata (West Bengal), CLTR Chengalpattu (Tamil Nadu), RLTRI Bankura (West Bengal), and RLTRI Aska (Odisha).

Market Restraints

Growing Regulatory and Safety Concerns Affecting the Demand for in the Market

Regulatory and safety concerns highly impact the market demand for drone delivery services by limiting operational capabilities and creating hindrances for widespread adoption. These concerns regarding public safety, airspace management, and potential risks highly influence public perception and increase the importance of strict safety protocols, impacting the efficiency and feasibility of drone deliveries.

Regulatory authorities across the world are implementing stringent regulations on safely accommodating drones into existing airspace, especially in densely populated areas. This process involves establishing clear rules for separation, navigation, and altitude, which can be complex and slow down the deployment of drone delivery services.

Accidents involving drones, such as malfunctions or collisions, threatening people and property on the ground, raising concerns about public safety and leading to calls for stricter regulations. Additionally, drones equipped with cameras and sensors raise privacy issues, as they can potentially capture images and data from private properties, thereby diminishing public trust and necessitating clear guidelines on data collection and usage.

Market Opportunities

Implementation Of Drone Delivery Services In Food Delivery Applications Fuels The Growth Opportunities

Drone delivery presents a significant opportunity for the food delivery market, offering faster, more efficient, and potentially cost-effective solutions compared to traditional delivery methods. This is especially true as consumers' demand for quicker delivery times, fueled by the rise of quick commerce, continues to grow. Drones can bypass traffic congestion and deliver directly to the customer's doorstep, significantly reducing delivery times, especially in urban areas. Drone Food Delivery (DFD) services are expected to become widely available, potentially increasing unhealthy food accessibility and consumption.

While early drone delivery applications have focused on high-value and urgent items including medical supplies, the scope is broadening. Companies are exploring drone deliveries for retail products, food, and everyday items. Notable examples include Amazon Prime Air, Walmart, and Zipline, each pushing the boundaries of what drones can deliver and where they can operate.

- For instance, in June 2025, Doordash partnered with Flytrex to launch food delivery drone delivery services in the Dallas-Fort Worth metroplex. Customers in parts of Little Elm and Frisco can now order food from dozens of local and national restaurants, including Papa John's King Road location and The Brass Tap, with delivery via Flytrex’s autonomous drone fleet.

Drone Delivery Service Market Trends

Rising Innovation and Integration of Artificial Intelligence to Improve the Accuracy of Drones

Artificial Intelligence (AI) in drone technology has led to new industry opportunities and challenges. AI algorithms can process huge amounts of data and do complex calculations. This allows drones to do tasks more quickly and efficiently.

One of the main applications of AI in drones is autonomous flight. With the help of AI algorithms, drones can fly without any human intervention. This allows them to cover larger distances and perform tasks more effectively.

Using advanced algorithms, AI in logistics and transportation enables drones to assess factors, such as airspace conditions, traffic, and weather, in real time. This helps autonomous flight systems manage schedules, avoid potential disruptions, and optimize delivery routes, resulting in on-time and reliable customer service.

Integrating Artificial Intelligence (AI) is crucial for unlocking the maximum potential of drone delivery systems. AI empowers drones with advanced operational and maneuverability capabilities that help them navigate complex environments, make intelligent decisions, and operate autonomously in real-time. Numerous market players have started investing in AI technology to help with drone delivery services operations.

- North America witnessed drone delivery service market growth from USD 0.3 Billion in 2023 to USD 0.5 Billion in 2024.

- For instance, in June 2025, Arrive AI, a pioneering autonomous delivery company, partnered with Skye Air Mobility, India’s dominant and rapidly expanding hyperlocal drone delivery platform, to scale secure and automated delivery solutions across the Indian market.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Drone Type

Growth in Last-Mile Delivery Application to Lead to Multi-Rotor Segment Growth

By drone type, the market is divided into fixed-wing drones, multi-rotor drones, and hybrid drones.

The multi-rotor drones segment accounted for a dominating market share and is expected to grow at a significant CAGR in the forthcoming years. Higher maneuverability, ease in deployment, compatibility with last-mile and short-range deliveries, and high drone volumes are major factors behind the segment's dominance in the market. Multi-rotor drones are highly technologically equipped and have a maximum of eight rotors, enabling easy vertical take-off and landing (VTOL). This property allows them to take missions in congested urban environments, making them vital for healthcare, e-commerce, food delivery, and other similar applications. This leads to an overall segmental growth in the forecast period.

- The multi-rotor drones segment is expected to hold a 56.97% share in 2024.

The hybrid drones segment is expected to grow at the highest CAGR in the forecast period. Hybrid drones combine long-range capabilities with vertical take-off and landing (VTOL), gaining maximum traction in the market. Hybrid drones have enhanced speed, range, propulsion systems, and flexibility in operations. Therefore, operators prefer them since they’re ideal for covering longer ranges, accessing crammed spaces, and delivering to a precise location due to VTOL capability.

Additionally, hybrid drones are especially helpful in countering geographical barriers such as forests and rivers; therefore, they are preferred by medical service providers to help deliver important medication and medical assistance at remote locations.

- In June 2022, Aster DM Healthcare announced the commencement of drone delivery trials with the logistics firm Skye Air Mobility based on drone technology in Kerala. The two companies have recently collaborated to transport essential medicine and critical laboratory samples from Aster MIMS Hospital to Aster Mother Hospital Areekode using drones. As per the terms of the agreement, Aster DM Healthcare intends to utilize Skye Air's drone technology to deliver diagnostic samples and medicines, initially in Calicut and subsequently throughout Kerala.

To know how our report can help streamline your business, Speak to Analyst

By Payload Capacity

Rise In Demand Of Small Drones Fueling The Growth For Less Than 2kg Segment

Based on payload capacity, the market is segmented into less than 2 kg, 2 kg to 5 kg, and more than 5 kg.

The less than 2kg segment accounted for a dominating market share in 2024 and is expected to grow at the highest CAGR in the forthcoming years. Drones with a payload capacity of less than 2 kg are gaining traction due to their suitability and adaptability for low-weight, high-frequency deliveries in suburban and urban areas. The growth of drone delivery applications, such as pharma deliveries, food deliveries, fast retail, etc., is a major growth contributor in the segment. Small drones are more efficient in energy and cost, making them cheaper to manufacture and operate and a preferred option for commercial deployment.

Additionally, drones in the less than 2kg segment generally face fewer regulations and restrictions. For instance, in the U.S., the FAA allows drones under a certain weight threshold to operate under part 107 guidelines for drone operations.

The 2kg to 5kg segment is expected to grow significantly during the forecast period. Drones in this segment are gaining traction due to the growth in delivery services and transport of mid-weight goods in urban regions. This payload bridges the gap between ultra-light and heavy deliveries, offering an ideal solution for groceries, electronics, e-commerce, and bulk food orders. Drones in the 2Kg to 5Kg payload offer better operational capacity and range and can cover longer distances in different weather conditions, ensuring reliable delivery.

- The 5-25 kg segment accounted for a dominating market share of 37.00% in 2026

By Range

Surging Last-Mile Logistics Are Driving Expansion In Short Range Segment

Based on range, the market is divided into short range (less than 25 km), mid-range (25 km to 100 km), and long range (more than 100 km).

The short-range segment dominated the global drone delivery service market in 2024 and is expected to grow at the highest CAGR in the forthcoming years. Short-range drones are experiencing high growth in drone delivery services due to a surge in last-mile logistics and heavy local demands. The drones’ compact size, minimal regulatory requirements, and lower operational & maintenance cost makes them a preferred solution for short-range deliveries.

Short-range deliveries can be done in a short time; therefore, they are demanded by emergency medical services. For instance, in Sweden, the evert drone project unveiled deployment of short-range drones within a 10 km radius to deliver defibrillators as emergency medical assistance, reducing emergency response time.

The mid-range segment accounted for a significant market share in 2024. Mid-range drones offer better capacity, environmental durability, and redundancy features than other types. Mid-range drone deliveries are time-sensitive, as are longer-range deliveries such as emergency relief packages, natural disaster assistance, etc., especially for regions with poor connectivity or remote locations.

Retailers and logistics conglomerates invest heavily in designing and developing medium-range drones to enhance timely delivery, supply chain efficiency, and avoid road congestion.

By Application

Urban Delivery Segment to Dominate Due to Availability of Supportive Infrastructure for Drone Deliveries

Based on application, the market is divided into urban delivery, rural delivery, emergency delivery (medical supplies, disaster relief), industrial delivery (warehouse to warehouse), and residential delivery.

The urban delivery segment dominated the global drone delivery service market in 2024. Urban delivery applications are a major reason for the growth of drone delivery services, primarily due to increasing e-commerce penetration, growing demand for quick deliveries, and high population density. Drones offer an efficient, eco-friendly, fast alternative to traditional deliveries for short-distance, time-sensitive deliveries in congested urban regions.

Major companies operating in drone delivery services, such as Amazon Prime Air and Flytex, have initiated urban drone delivery to transport commodities such as consumer goods, medicine, and food products in a limited range. Additionally, urban areas have drone delivery support infrastructure, leading to high segmental growth.

The residential delivery segment is estimated to grow at the highest CAGR during the forecast period. Growing adoption of drones for several applications such as pipeline inspection, aerial photography, surveillance, and life monitoring is anticipated to drive the segment's growth. In addition, the rising adoption of advanced technology enables fully autonomous drones globally, supporting the market’s growth.

- In November 2023, Dronamics, the world's first cargo drone airline, and Hellenic Post announced an agreement to bring the first postal services by cargo drone to Greece.

By End-user

Retail and E-commerce Segment to Grow Backed by Increasing Modernization Projects Globally

On the basis of end-user, the market is classified into retail and e-commerce, healthcare and pharmaceuticals, food delivery, logistics and transportation, government and defense, and others.

The retail and e-commerce segment dominated the global drone delivery service market in 2024. This sector is a major factor behind the market's growth, driven by increased consumer demand for quick, cost-efficient, and contactless deliveries. A recent surge in online commerce, primarily for small cargo goods such as apparel, electronics, and other consumer goods, has made drone delivery services a preferred option for retail and e-commerce giants.

Major e-commerce conglomerates such as Amazon, Walmart, and others are heavily investing in pilot programs and researching commercial drones delivery networks. For instance, JD.com, a major Chinese e-commerce company, has been using drones to deliver parcels to remote villages in China as a part of this initiative.

The healthcare and pharmaceutical segment is estimated to grow at the fastest CAGR during the forecast period. The segment has emerged as one of the most impactful use cases for drone delivery services in emergency and other medical services, primarily due to critical, reach, speed, and reliability in transporting lifesaving medication and often organs. Often, drones are used to transport essential medications, diagnostic samples, and blood units, especially to disaster-hit or remote locations.

- In May 2023, Qualcomm Technologies, Inc. and Speedbird Veculos Aéreos No Tripulados S.A. (Speedbird Aero) announced a strategic agreement to revolutionize the logistics industry by utilizing autonomous delivery drones equipped with the Qualcomm FlightTM RB5 5G Platform.

Drone Delivery Service Market Regional Outlook

The market is studied by region into North America, Europe, Asia Pacific, and the rest of the world.

North America

North America Drone Delivery Service Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 1.23 billion in 2025 and USD 1.79 billion in 2026, accounting for the largest drone delivery service market share in 2024. The rise in adoption of drone services and the presence of key drone manufacturers in the U.S. are anticipated to fuel the market growth in North America. Due to growing demand for last-mile logistics and the introduction of the latest technologies, the region is expected to witness tremendous growth in the coming years. The growth in U.S. for these services is highly driven by the need for more efficient, faster, and cost-effective commodity delivery, which is especially gaining traction in the last mile delivery type. Advancements in drone technology, including longer flight times and higher payload capacities, are also contributing to this growth for U.S. in the forthcoming years. The U.S. market is projected to reach USD 1.56 billion by 2026.

- In January 2024, DroneUp, a leading autonomous drone delivery and logistics company, announced that the Federal Aviation Administration had approved conducting beyond-visual line-of-sight drone deliveries.

Europe

Europe accounts for a significant market share in 2024. The European market is growing significantly due to the dominance of the healthcare and pharmaceuticals segments, which caters to most of the businesses: strong regulatory frameworks, a high demand for last-mile delivery solutions, and technological advancements in drone capabilities. Government initiatives and approvals supporting drone use along with the rise of e-commerce and the need for faster deliveries, are also major drivers of regional growth. The increasing use of drones for various applications is expected to support market growth in Europe during the forecast period. The UK market is projected to reach USD 0.24 billion by 2026, while the Germany market is projected to reach USD 0.23 billion by 2026.

Asia Pacific

The Asia Pacific region is witnessing the highest CAGR in the market during the forecast period. The growth is attributed to rising investments by the government and OEMs in drone services. The countries in Asia Pacific, such as China and Japan, have the presence of large drone service providers. A booming e-commerce sector, a need for faster delivery solutions, and increasing urbanization, particularly in countries such as China and India. These factors, combined with advancements in drone technology and supportive government policies, are driving the adoption of drone delivery across various industries in the Asia Pacific region. The Japan market is projected to reach USD 0.17 billion by 2026, the China market is projected to reach USD 0.78 billion by 2026, and the India market is projected to reach USD 0.24 billion by 2026.

Rest of the World

The rest of the world is expected to grow at a high CAGR in the forthcoming years. The region's focus on technological advancement, need for faster deliveries, and overcome infrastructure challenges to fuel demand for these services. Government support, particularly in Dubai, has also been crucial in fostering adoption and innovation. Additionally, geographic challenges such as mountainous terrain and vast rural areas, coupled with the need for faster and more cost-effective delivery options, have created a favorable environment for drone adoption.

Competitive Landscape

Key Market Players

Leading Players Are Focusing on Integrating Advanced Technologies to Identify Objects in Low Light

The market's competition landscape depicts the domination of top players such as Zipline, Wing Aviation LLC, Matternet, Manna, and others, propelling the drone delivery service market growth. Key players focus on growing investment in research and development, a diversified product portfolio of drone services solutions, and strategic acquisitions. These companies focus on business expansion strategies such as agreements, mergers, acquisitions, product portfolio expansion, and long-term contracts with multinational companies.

For instance, in April 2024, Zipline, the world's largest autonomous delivery system, became the first company to complete one million commercial drone deliveries to customers. Zipline's zero-emission autonomous drones have successfully flown over 70 million commercial autonomous miles across four continents and delivered over 10 million products.

LIST OF KEY DRONE DELIVERY SERVICE COMPANIES PROFILED

- Zipline (U.S.)

- Matternet (U.S.)

- United Parcel Service of America, Inc. (U.S.)

- Wing Aviation LLC (U.S.)

- Flytrex Inc. (Israel)

- Wingcopter (Germany)

- Elroy Air (U.S.)

- Joby Aviation (U.S.)

- Swoop Aero (Australia)

- Manna Drone Delivery (Ireland)

KEY INDUSTRY DEVELOPMENTS

- February 2024 - AgEagle Aerial Systems has announced that it has secured a major contract for the U.S. Department of Energy's use of eBee X and eBee TAC drones. These drones will assist the Department of Energy with national security and emergency response efforts.

- February 2024 - Zipline has diversified its partnership with its initial client, the Government of Rwanda, by introducing a novel delivery service that promotes economic development and wildlife conservation. Zipline has initiated the delivery of products produced by local artisans directly to guests at resorts and lodges in collaboration with the Rwanda Development Board (RDB).

- February 2024 - The drone logistics company TechEagle has announced its partnership with 10 AIIMS to expedite medicine delivery. TechEagle's widespread impact is exemplified by its swift implementation of drone services in 10 AIIMS and INI hospitals, which established new range and speed records.

- January 2024 - Wing and Walmart are expanding their services to millions of customers using Wing's airspace approvals, facilitating service throughout the Dallas-Fort Worth community.

- May 2023 - Matternet, the developer of the world's leading urban drone delivery system, announced that its partner, Ameriflight, has received approval from the Federal Aviation Administration to operate the Matternet M2 for commercial delivery. Ameriflight has been designated the second operator in the U.S. to obtain authorization to operate the Matternet M2.

REPORT COVERAGE

The report provides a detailed market analysis and focuses on important aspects across various countries, such as key players, products, applications, and platforms. Moreover, it offers deep insights into the market trends, competitive landscape, market competition, pricing of drone delivery services, and market driver, and highlights key drone industry developments. In addition, it encompasses several direct and indirect factors that have contributed to the expansion of the global market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 19.45% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Drone Type

|

|

By Payload Capacity

|

|

|

By Range

|

|

|

By Application

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

According to the Fortune Business Insights study, the global market was valued at USD 3.47 billion in 2025 and is anticipated to be USD 20.98 billion by 2034.

The market is likely to grow at a CAGR of 19.45% during the forecast period.

The top players in the industry are Zipline (U.S.), Matternet (U.S.), United Parcel Service of America, Inc. (U.S.), Wing Aviation LLC (U.S.), among others.

North America dominated the global market.

The retail and e-commerce segment is driving the market growth, backed by increasing modernization projects globally.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us