Digital Lending Platform Market Size, Share & Industry Analysis, By Solution (Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, and Others {Debt Management}), By Service (Design & Implementation, Training & Education, Risk Assessment, Consulting, and Support & Maintenance), By Deployment (On-premise and Cloud), By End-User (Banks, Insurance Companies, Credit Unions, Savings & Loan Associations, Peer-To-Peer Lending, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

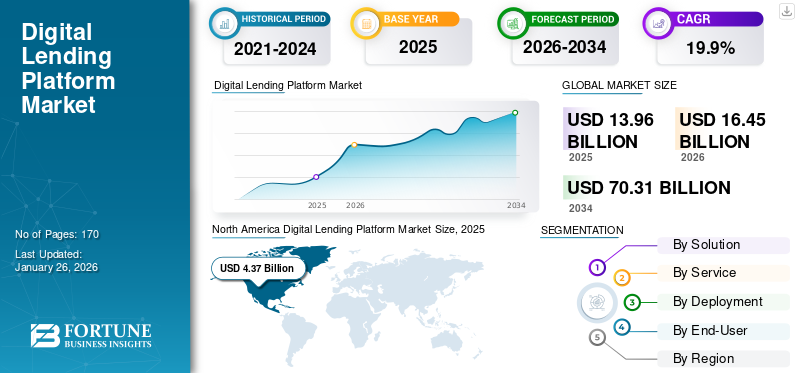

The global digital lending platform market size was valued at USD 13.96 billion in 2025 and is projected to grow from USD 16.45 billion in 2026 to USD 70.31 billion by 2034, exhibiting a CAGR of 19.9% during the forecast period. North America dominated the digital lending platform market with a market share of 4.93% in 2025.

Digital lending platform is a solution that automates the lending process. This platform allows financial institutions to streamline workflows. It simplifies the process of acquiring loans by connecting borrowers and lenders. This supports reduction in time required to take a loan significantly and helps borrowers to receive competitive rates with transparent terms and conditions. It is extensively used to facilitate loans for business and personal use.

The market is growing rapidly due to growing adoption of digital solutions by banks and financial institutions to enhance customers’ experiences. Rising requirement for fast and secure loan processing and growing necessity for innovative features including risk scoring and automated underwriting are fostering market growth.

Few major players operating in the market are Afterpay, Bread, Finastra, Affirm Holdings, Inc., Klarna, Lendingkart, Pine Labs, LendingClub, and others.

MARKET DYNAMICS

Market Drivers

Increasing Adoption of Digital Financial Services Foster the Market Development

Rising implementation of digital financial services globally is propelling the global digital lending platform market growth. Rapid globalization and escalating implementation of online banking are accelerating the adoption of digital lending platforms in the BFSI sector. This solution is enabling faster decision-making, improved customer experiences, and cost efficiency is attracting numerous end-users.

In addition, the sudden outburst of COVID-19 pandemic has further propelled financial institutions to embrace digital channels, impelling market growth. For instance, in June 2024, Bandhan Bank initiated an online tax collection service while providing constant offline support to customers through its 1,700 branches, emphasized on the incorporation of digital and traditional channels.

Market Challenges

Poor Infrastructure and Network Connectivity Hinders the Market Growth

The market is facing barriers with poor and old infrastructure and low network connectivity that may impede the demand for digital lending platforms. The outdated digital infrastructure restricts high-speed connectivity and low-latency performance. This leads to poor customer experience and reduced service quality. Thus, many firms are discouraged to adopt the solution as it requires high infrastructure, which may incur extra cost on upgrading the system and high operational costs.

Market Opportunities

Growing Regulatory Support Offers Lucrative Growth Opportunities

One of the major opportunities for market growth is raising imposition of favorable regulatory support. These supportive regulations encourage enhancement in transparency, security, and compliance. It encourages makers to design innovative solutions. Initiatives, for instance, Salesforce’s 2024 digital lending platform for India’s public sector and strict data privacy laws including GDPR are promoting adoption of platforms such as Temenos and Finastra. They are pushing firms to integrate robust compliance and data protection features and fostering market growth.

DIGITAL LENDING PLATFORM MARKET TRENDS

Rising Investments in Advance Technologies Has Emerged as a Key Market Trend

Increasing investments in advanced technologies into the systems is one of the major market trends. Various financial institutions are spending huge amounts on integration of advanced technologies including artificial intelligence, machine learning, and blockchain to enhance digital lending solutions. The AI-driven credit scoring and predictive analytics are rapidly adopted to lessen default risks and improve loan approval times. On the other hand, blockchain is being used for securing loan documentation and fraud prevention is drawing attention of numerous firms. For instance, In June 2024, Salesforce India launched "Digital Lending for India," an AI-powered platform built to streamline loan origination and approvals for banks and lenders. It also unveiled a dedicated Public Sector division to improve government services through employment of AI and automation.

SEGMENTATION ANALYSIS

By Solution

Rising Adoption of the Platform by Several Banking Firms Boosts Loan Origination Segment Growth

Based on the solution, the market is segmented into business process management, lending analytics, loan management, loan origination, risk & compliance management, and others. The others sub-segments include debt management and others.

In 2024, loan origination segment held the largest digital lending platform market share and with revenue share of USD 3.61 billion. In 2026, the loan origination segment is projected to lead the market with a 31.31% share. This dominance is attributed to the extensive implementation of these platforms by banks, fintechs, and alternative lenders to streamline credit approval as well as disbursement processes. Additionally, the segment is supported by rising demand for automation in underwriting and faster digital onboarding to enhance customer experience. The presence of regulatory encouragement for transparent and efficient lending operations boosts segment growth.

Lending analytics segment is expected to grow with a highest CAGR of 23.27% over the forecast period. This is due to intensifying demand for data-driven insights to analyze credit risk, personalize customer assistance, and optimizing landing decisions. Furthermore, embracing AI and ML technologies into the systems is offering predictive analytics and rising regulatory focus on risk management boosting compliance within digital lending operations is fuelling segment growth.

To know how our report can help streamline your business, Speak to Analyst

By Services

Growing Demand Modernization of Legacy Systems to Impel the Design & Implementation Segment Growth

The market is divided into design & implementation, training & education, risk assessment, consulting, and support & maintenance, based on services.

The design & implementation segment dominated the market with a revenue share of USD 4.81 billion in 2024. In 2026, the design & implementation segment is projected to lead the market with a 42.19% share. This expansion is attributed to the high insistence for modernizing legacy systems and deployment of end-to-end digital lending platforms from banks and fintechs. Furthermore, increasing expenses on incorporation of cloud-based systems are impelling segment growth.

Furthermore, this segment is also projected to grow with highest CAGR of 23.10% during the forecast period, attributed to rising requirement for scalable and compliant solutions to enhance efficiency and customer experience, bolstering market growth. In addition, rising adoption of regulatory-driven transformation by users is amplifying segment growth.

By Deployment

Rising Demand for High Control on Operations Augments the On-premise Segment Growth

Based on the deployment, the market is divided into on-premise and cloud.

On-premise segment held the highest market share in 2024 with a revenue share of USD 6.94 billion, driven by rising requirement for long-standing reliance of financial institutions on secure and customizable on-premise infrastructures. In 2026, the on-premise segment is projected to lead the market with a 55.26% share.They are supported to manage sensitive lending data and meet the terms of strict regulatory requirements. Additionally, increasing significant amounts of spending on in-house IT systems and the inclination for greater control over operations are supporting segment growth.

On the other hand, the cloud segment holds a substantial market share that offers CAGR of 22.48%. The growing inclination toward cloud adoption by finance firms due to its cost efficiency, scalability, and faster deployment capabilities is fostering segment growth. Furthermore, the segment is growing due to rising adoption of real-time analytics, incorporation with fintech ecosystems, along with regulatory acceptance of cloud solutions in financial services.

By End-User

Expansion of Transparent Lending and Digital Transformation Augment the Bank Segment Growth

Based on the end-user, the market is divided into banks, insurance companies, credit unions, savings & loan associations, peer-to-peer lending, and others.

In 2024, the banks segment held the highest market share with a revenue share of USD 5.36 billion. It is also anticipated to grow with the highest CAGR of 21.99% during the forecast period.In 2026, the banks segment is projected to lead the market with a 46.32% share. This leading and rapid growth are due to the vital role of banks in formal credit markets and their large-scale implementation of these platforms to enhance efficiency, decrease turnaround times, and improve customer engagement. This segment is further supported by regulatory imposed policies for transparent lending practices and increasing competition from fintechs. Growing sustained spending on digital transformation by banks to expand retail and SME lending portfolios are thrusting segment growth.

DIGITAL LENDING PLATFORM MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America, and Middle East & Africa.

North America

North America Digital Lending Platform Market Size, 2025 (USD Billion) To get more information on the regional analysis of this market, Download Free sample

The North America digital lending platform market dominates the global market with a revenue share of USD 4.37 billion in 2025. This dominance is driven by the existence of a large mobile workforce prompting financial institutions to digitize services and enhance customer experience. Banks and fintechs are launching innovative digital solutions to stay competitive. For instance, in November 2024, Numerated announced its partnerships with GoDocs to restructure commercial loan documentation for setting a benchmark for faster and more efficient lending. The U.S. leads the North American market with an expected revenue share of USD 3.23 billion in 2026. This lead is due to early acceptance of advanced technologies, strict regulatory support, and growing large number of tech-savvy customers.

Download Free sample to learn more about this report.

Europe

The European market is considerably growing and expected to contribute to a revenue share of USD 3.76 billion in 2026. This is attributed to the rising demand for digital lending services from commercial level and individual level. Additionally, the growing numbers of fintech startups in this region are heightening demand for the platforms. U.K., Germany, and France are some of the major contributors to the market growth with an estimated revenue share of USD 1.21 billion, USD 0.79 billion in 2026 and USD 0.49 billion respectively by 2025.

Asia Pacific

Asia Pacific is expected to register the fastest growth in the market with the highest CAGR of 28.14%, caused by the increasing population of unbanked and underbanked individuals looking for accessible credit. In addition, imposition of supportive regulatory frameworks is also thrusting digital financial innovation. For instance, SBI India introduced an end-to-end digital onboarding process for NRIs in January 2025. They intended to lessen paperwork and turnaround time to emphasize the focus on technology-driven customer service in this region. India and China are expected to contribute to a revenue share of USD 1.79 billion and USD 2.18 billion respectively in 2026. The Japan market is projected to reach USD 0.37 billion by 2026.

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 1.39 billion and USD 0.95 billion respectively in 2025 due to escalating demand for digital financial services and growing rate for mobile users. Rising demand from unbanked population and SMEs are bolstering market growth. GCC countries are predicted to have a market share of USD 0.56 billion by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Growing Focus of Key Players on Product Innovation Leads to their Dominating Market Positions

The global digital lending platform industry is highly fragmented with different market players operating in the market. These include Bread, Finastra, Klarna, LendingClub, Lendingkart, Pine Labs, Upstart Holdings Inc., and others. These players are applying several market strategies including new launches, mergers, acquisitions, and integration of new technologies to reinforce their market competition.

LIST OF KEY DIGITAL LENDING PLATFORM COMPANIES PROFILED

- Affirm Holdings, Inc. (U.S.)

- Afterpay (Australia)

- Bread (U.S.)

- Finastra (U.K.)

- Klarna (Sweden)

- LendingClub (USA)

- Lendingkart (India)

- Pine Labs (India)

- Upstart Holdings Inc. (U.S.)

- Flexiti (Canada)

- PayPal Credit (U.S.)

- MoneyTap (India)

KEY INDUSTRY DEVELOPMENTS

- April 2025- Fiserv, Inc. unveiled a definitive agreement to acquire Money Money Servicos Financeiros S.A, a Brazilian Fintech Company. The purpose of this acquisition is to boost their services in Brazil, and facilitate small and medium-sized businesses (SBMs) to access capital for growth and development.

- March 2025- Finastra unveiled an upgraded AI-powered lending module within its Fusion Digital Lending platform. The aim of this enhancement is to accelerate loan processing and improve credit risk evaluations by utilizing advanced machine learning. It offers faster approvals and reduced default rates to financial institutions. These strategies supported the company's leadership in the market worldwide.

- November 2024- Zest AI launched its new upgraded AI-driven underwriting platform, platform ZAML 3.0. This platform underlines fairness, transparency, and regulatory agreement and offers updates, improves predictive accuracy and decreases bias in credit decisions. This system supported more inclusive lending practices and reinforces the company’s position as leader in ethical and liable digital lending technology.

- September 2024- Akme Fintrade Limited announced its strategic co-lending partnerships with MAS Financial Services Limited to provide loans to small business owners. This alliance intended to enhance credit access to the underserved MSME sector through a seamless digital lending platform.

- October 2024- Jio Financial Services (DFSL) launched its innovative JioFinance app to propose a comprehensive range of digital financial services. The app facilitates an aggregated view of users’ bank and mutual fund holdings, improving financial management.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the digital lending platform market trends and highlights key industry developments and market share analysis for key companies. In addition to the aforementioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Growth Rate |

CAGR of 19.9% from 2026-2034 |

|

Historical Period |

2021-2024 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Solution

|

|

By Service

|

|

|

By Deployment

|

|

|

By End-User

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 13.96 billion in 2025 and is projected to reach USD 70.31 billion by 2034.

The market is expected to exhibit steady growth at a CAGR of 19.9% during the forecast period.

Increasing adoption of digital financial services drives the market growth.

Affirm Holdings, Inc., Afterpay, Klarna, and Upstart Holdings Inc. are some of the top players in the market.

The North America region held the largest market share.

North America was valued at USD 4.37 billion in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us