Core Banking Software Market Size, Share & Industry Analysis, By Deployment (SaaS/Hosted and Licensed), By Banking Type (Large Banks (Greater than USD 30 billion in Assets), Midsize Banks (USD 10 billion to USD 30 billion in Assets), Small Banks (USD 5 billion to USD10 billion in Assets), Community Banks (Less than USD 5 billion in Assets), and Credit Unions), By End User (Retail Banking, Treasury, Corporate Banking, and Wealth Management), and Regional Forecast, 2026 – 2034

Core Banking Software Market Size

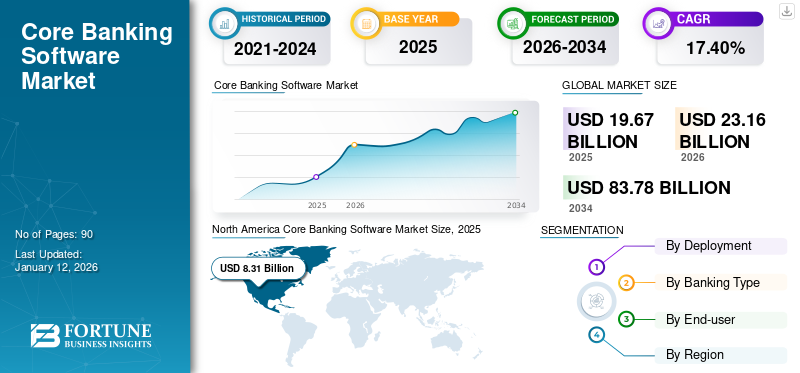

The global core banking software market size was valued at USD 19.67 billion in 2025. The market is projected to grow from USD 23.16 billion in 2026 to USD 83.78 billion by 2034, exhibiting a CAGR of 17.40% during the forecast period. North America dominated the global market with a share of 42.20% in 2025. Additionally, the U.S. core banking software market is predicted to grow significantly, reaching an estimated value of USD 15,870.0 million by 2032.

Core banking software is a centralized system that enables banks and financial institutions to manage their core operations, including account management, transactions, loans, deposits, and customer interactions. It allows banks to provide seamless banking services across multiple branches and digital channels. The software provides multiple benefits, such as 24/7 banking services, centralized data management, faster transactions, scalability, and regulatory compliance. This system plays a crucial role in modern banking by streamlining operations, improving customer experience, and supporting digital banking transformation.

The COVID-19 pandemic forced numerous banks, other financial institutes and their employees to adopt the WFH (work from home) policy. The COVID-19 crisis caused a significant shift in the global financial market, as the financial industry was grappling with abrupt changes in interest rates and deferred rent payments. Thus, it was challenging for many financial institutions and banks to restore the changes in the overall credit and loan management scenario owing to the pandemic. According to the IDC COVID-19 Impact Report, less than 20% of the financial institutions globally report being back to a “new normal”. Additionally, the study revealed that 89% of the banks in North America and 83% of banks in Europe and MEA continue to enhance operational resilience. In contrast, 77% of banks in Asia Pacific, where the pandemic had an earlier impact, had resumed their emphasis on innovation and implementation of core banking solutions for long-term transformative projects.

Impact of Generative-AI

Increasing Demand for Advanced AI Chatbots and Virtual Assistants Drives the Growth of Market

Generative AI enables hyper-personalization by analyzing customer data to offer tailored products, recommendations, and financial advice. Advanced AI chatbots and virtual assistants handle customer queries, provide real-time support, and improve customer satisfaction. Banks are leveraging AI-powered core banking systems to improve banking operation efficiency and enhance user experiences. For instance,

- In May 2024: Temenos unveiled a novel Generative AI solution for the banking platform. This solution can be integrated with Temenos Core and Financial Crime Mitigation (FCM) solution. Integration of Generative AI technology will transform the way banks relate with their data, and enhance profitability and productivity to realize substantial return on investment.

- In October 2023: Sopra Banking Software, a France-based company launched an AI-enabled core banking system. It is developed to enable banks to enhance their digital services. This AI-enables core banking system allows customers to quickly adopt the solution whilst reducing Total Cost of Ownership (TCO).

MARKET DYNAMICS

Market Drivers

Rising Demand for SaaS and Cloud-based Solutions Drives the Growth of the Market

One of the key drivers of core banking software market growth is the increasing adoption of SaaS-based and cloud-based banking platforms offered by leading software providers such as Finastra, FIS Global, and Temenos AG. These cloud-based platforms enable banking institutions to efficiently monitor payments, transactions, and other financial operations. The demand for enhanced productivity and operational efficiency is fueling the market expansion. To gain a competitive edge, key players are actively launching new products. For instance,

- In January 2023, Kenya-based fintech company Kwara acquired IRNET Coop to deploy a cloud-based core banking platform. This acquisition also provided access to IRNET’s existing consumer base, as it was a subsidiary of the Kenya Union of Savings and Credit Cooperatives (KUSCC). Such advancements aim to accelerate cloud adoption among enterprises, offering comprehensive banking functionalities to consumers.

Market Restraints

Increasing Privacy Concern and Data Breaches in the Core Banking Sector Impede the Market Growth

Data security remains a top priority for banking executives as financial institutions continue to face increasing cyber threats. Despite leveraging advanced digital platforms, banks and financial service providers remain vulnerable to cyberattacks and data breaches, posing significant risks to the core banking software market. For instance,

- According to IBM’s Cost of a Data Breach 2024 report, financial firms incur an average loss of USD 5.9 billion per data breach, which is 28% higher than the global average. Malicious actors account for 48% of financial sector attacks, while 33% result from human error.

The convergence of privacy concerns, software complexity, and security vulnerabilities is slowing the growth of the market. Addressing these challenges through enhanced cybersecurity measures, encryption, and compliance-driven solutions will be crucial for sustaining market expansion.

Market Opportunities

Integration of RegTech in Core Banking is Creating a Potential Opportunity for the Market Growth

The integration of Regulatory Technology (RegTech) into core banking systems is transforming the way banks manage risk, automate compliance checks, and streamline reporting processes. By leveraging AI and advanced data analytics, RegTech enhances regulatory compliance and operational efficiency while reducing manual intervention. Banks worldwide are increasingly adopting RegTech to ensure compliance with evolving local and global regulations. Integrating these solutions into core banking systems helps automate compliance workflows, mitigate risks, and enhance transparency. For instances:

- ACI Worldwide provides solutions that integrate real-time compliance monitoring, fraud detection, and anti-money laundering (AML) capabilities into core banking platforms.

As regulatory landscapes continue to evolve, RegTech integration presents a significant opportunity for banks to stay compliant, reduce costs, and enhance operational efficiency.

Core Banking Software Market Trends

Inclination Towards Digital Transformation Accelerated the Growth of the Market

In the financial technology landscape, the software has become a major part of the digital transformation of banks around the world. As financial institutions strive to improve operational efficiency, enhance customer experience, and comply with regulations, the adoption of core banking systems has become a strategic imperative.

One of the most important market factors influencing the adoption of core banking is the rapid acceleration of digital transformation in banking sectors. As banks are facing increasing pressure from digitally savvy customers and agile fintech competitors, traditional banks are investing heavily in modern core banking systems. These platforms not only form the backbone of day-to-day banking operations but also act as catalysts for innovation. For instance:

- In January 2024, Bank of America CEO Brian Moynihan revealed the company’s ambitious plan to invest USD 3.8 billion in technology initiatives, demonstrating its commitment to innovation and digital transformation in the banking sector.

The demand for flexible, efficient, and accessible banking solutions continues to rise in the market. As banks shift toward digital-first strategies, the market presents significant revenue opportunities, which drives growth and innovation for long-term industry

SEGMENTATION ANALYSIS

By Deployment Insights

Surge in Need for Subscription Models Fueled Demand for SaaS/Hosted Deployments in Major Sectors

Based on deployment, the market is divided into SaaS/Hosted and licensed.

Among these, SaaS/hosted is estimated to hold the largest core banking software market share 67.54% in 2026 with the highest CAGR in the estimated study period. The growth is attributable to enterprises' rising demand for cloud-based banking systems. Such solutions would assist end-users in improving banking activities, including calculating interests, servicing loans, and processing withdrawals and deposits. According to the Future of Cloud in Banking report, 60% of banks in North America are increasing their cloud investments in the upcoming years. Similarly, 82% in Europe, and Middle East Africa and 83% in Asia Pacific regions for cloud investments direct the market toward healthy growth in cloud adoption.

The licensed is expected to depict radical growth owing to the rising adoption of licensed-based banking solutions to reduce security concerns and operational costs. End-users are focusing on implementing numerous licensed banking engines to carry out financial activities without any need for payment processors. For instance, Finacle is a licensed core banking software product offered by Infosys that provides universal digital banking functionality to various banks.

By Banking Type Insights

Growing Need of a Centralized Banking System in Large Banks is Propelling the Market Growth

Based on banking type, the market is studied into large banks, midsize banks, small banks, community banks, and credit unions.

Large banks captured the largest market share 30.66% in 2026, owing to strict adherence to diverse regulatory requirements across the European Union. Large banks are capable of handling millions of transactions per day, thus, deployment of a centralized banking system plays an important role in fueling the market growth.

Community banks across the globe are majorly focusing on the adoption of digital banking solutions to provide to their customers with technologically advanced financial service experience. Owing to this, community banks are anticipated to grow at the highest CAGR of 18.8% during the forecast period.

To know how our report can help streamline your business, Speak to Analyst

By End User Insights

Corporate Banking to Gain Traction from Increasing Adoption of Advanced Banking System

Based on the end user, the market is studied into retail banking, treasury, corporate banking, and wealth management.

The corporate banking segment is likely to hold the dominant share 27.14% in 2026. during the predicted period. Due to the increasing adoption of online and mobile banking software among users, the corporate banking is able to track and monitor banking activities in real time.

The wealth management segment is projected to exhibit the highest growth rate and is expected to gain traction in the upcoming years. Major factors for the growth of this segment are rising digitalization & process automation and increasing demand for investment modules. Besides, the rising implementation of such banking solutions across retail banking and treasury is expected to propel the market growth.

CORE BANKING SOFTWARE MARKET REGIONAL OUTLOOK

Based on the regional analysis, the market is studied across North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America

North America Core Banking Software Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a valuation of USD 8.31 billion in 2025 and USD 9.6 billion in 2026. The market in North America is leading the banking software market, owing to investments done by government banks, and financial institutions. Key players in the market are focusing on developing advanced core banking software solutions to provide services across the globe. Also, government banks and financial institutions in countries such as the U.S and Canada are highly investing in adopting core banking services. Also, these countries have a significant number of service providers of core banking software and services. The U.S. market is projected to reach USD 6.83 billion by 2026. For instance,

- In January 2024: Temenos AG and Deloitte US engaged in a partnership to provide technology solutions to help the U.S. financial institutions speed up core banking and payments modernization in the cloud at lower cost.

Download Free sample to learn more about this report.

The U.S. captured the largest market share in 2024. Key players across the U.S are likely to invest in core banking software by actively engaging with innovation technology providers. The rising number of online banking applications, financial organizations, and advancements in cloud technology are likely to bolster the growth of the U.S. market.

To know how our report can help streamline your business, Speak to Analyst

Europe

Europe is expected to cover a significant share of the core banking software market. The growth is due to the increasing adoption of cloud services, surge in data generation in the banking and financial sector, and growing government and public spending on adopting advanced banking applications. The U.K. market is projected to reach USD 1.38 billion by 2026, while the Germany market is projected to reach USD 1.18 billion by 2026. For instance,

- According to European organizations, around 70% of the organizations in Europe are migrating their workloads to the cloud. This is primarily attributed to optimizing cost due to cloud usage, and around 50% of organizations have deployed a cloud-first strategy to increase business efficiency.

This will create various market opportunities for key players to expand their core banking software offerings across the U.K., Germany, France, Spain, Italy, and other countries.

Asia Pacific

Asia Pacific market is expected to grow with the highest CAGR during the forecast period. Governments and banks in the region are actively modernizing their banking infrastructure to enhance operational efficiency, regulatory compliance, and customer experience. For example, governments in India, Indonesia, and the Philippines promote banking for the people who are not using the banking system. This factor increases demand for cost-effective core banking software solutions.

Middle East & Africa

In the Middle East and Africa, the market is in an emerging phase, owing to the increasing number of end-use banking startups and domestic financial institutions. Also, governments’ vision for economic diversification strategies like Saudi Arabia’s Vision 2030, Kuwait’s Vision 2035, and UAE’s Smart Government Initiative are pushing banks towards digitalization. The Japan market is projected to reach USD 1.21 billion by 2026, the China market is projected to reach USD 2.45 billion by 2026, and the India market is projected to reach USD 0.56 billion by 2026.

South America

South American market is in an evolving phase, owing to rising investment done by the government and key players in sectors such as banking and finance. The banking sector in this region is undergoing a significant digital transformation, with banks modernizing their infrastructure to improve efficiency, regulatory compliance, and customer engagement. For instance,

- According to a new research report published by Information Services Group (ISG), banks in Brazil are opting for more responsive core banking and payment platforms to sustain increasing market competition.

COMPETITIVE LANDSCAPE

Key Industry Players

Collaborations & Partnerships among Key Players to Propel the Market Growth

Companies are forming partnerships with technology innovators and cloud service providers to enhance their software offerings and gain a larger share of the market. For instance,

- In January 2025, 10x Banking, a cloud banking platform, and DLT Apps partnered to transform data migration for financial institutions. The partnership aims to address the friction involved in migrating complex existing systems and modern core banking platforms by leveraging AI-based tools.

List of Key Core Banking Software Companies Profiled

- Edgeverve Systems Limited (Infosys) (India)

- Temenos Headquarters SA (Switzerland)

- Oracle Corporation (U.S.)

- Fidelity National Information Services (U.S.)

- Tata Consultancy Services Limited (India)

- Fiserv, Inc. (U.S.)

- Intellect Design Arena Ltd (India)

- Finastra International Limited (U.K.)

- Mambu GmbH (Germany)

- 10x Banking Technology Limited (U.K.)

- SDK.finance (Ukraine)

- Backbase (Netherlands)

- nCino (U.S.)

- SAP SE (Germany)

- CGI (Canada)

- Alkami Technology (U.S.)

- Jack Henry & Associates (U.S.)

- DeshDevs (U.K.)

- Securepaymentz (U.S.)

- Sopra Banking Software (France)

…and more

KEY INDUSTRY DEVELOPMENTS

- In January 2025, Infosys Finacle, a wholly-owned subsidiary of Infosys and part of EdgeVerve Systems launched the Finacle Asset Liability Management Solution which is a risk management solution that offers banks with an enterprise-wide view of balance sheet exposures.

- In January 2025, Intellect Design Arena Ltd entered into a strategic partnership with Coforge. The collaboration leverages Intellect’s platforms, eMACH.ai and iTurmeric, to enable financial institutions to modernize their systems with minimal disruption.

- In January 2025, Intellect Global Consumer Banking (iGCB), the consumer banking division of Intellect Design Arena Limited, announced an enhancement to its eMACH.ai card platform. The incorporation of Thales payShield HSM introduced an additional layer of security and authentication aimed at next-generation protection for banks and financial institutions.

- In December 2024, Fiserv, Inc. expanded its relationship with COCC, a customer-owned fintech company serving more than 200 credit unions. The partnership provides digital banking solutions powered by Fiserv’s Experience Digital (XD), paving the way for continued innovation to transform the standard of financial services.

- In October 2024, INDEXO launched a new comprehensive banking experience for Latvians, powered by Mambu's cloud banking platform. The platform offers enhanced services in everyday banking and financial lending.

INVESTMENT INSIGHTS AND OPPORTUNITIES

Key investment areas of the market are considered as below:

- AI and Automation: Implementation of AI and automation technology in core banking software enhances fraud detection, risk management, and personalized banking.

- Blockchain Technology: Vendors are focusing on the adoption of blockchain technology in CBS to improve transaction security and digital identity management.

- Additionally, the demand for flexible, API-driven core banking systems is rising as neobanks and fintech startups disrupt traditional banking with the use of digital technology in the banking system.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, banking type, deployment, and end-user of the service. Besides, the report offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

REPORT SCOPE & SEGMENTATION

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 17.40% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Deployment

By Banking Type

By End-user

By Region

|

|

Companies Profiled in the Report |

Edgeverve Systems Limited (Infosys) (India), Temenos Headquarters SA (Switzerland), Oracle Corporation (U.S.), Fidelity National Information Services (U.S.), Tata Consultancy Services Limited (India), Fiserv, Inc. (U.S.), Intellect Design Arena Ltd (India), Finastra International Limited (U.K.), Mambu GmbH (Germany), and 10x Banking Technology Limited (U.K.) |

Frequently Asked Questions

The market is projected to reach USD 83.78 billion by 2034.

In 2025, the market was valued at USD 19.67 billion.

The market is projected to grow at a CAGR of 17.40% during the forecast period.

By end-user, corporate banking is expected to lead the market.

Rising demand for SaaS and cloud-based solutions drives the growth of Market

Edgeverve Systems Limited (Infosys), Temenos Headquarters SA, and Oracle Corporation are the top players in the market.

North America is expected to hold the highest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us