Military Helicopter Market Size, Share and Industry Analysis, By Number of Engines (Single Engine and Twin Engine), By Maximum Take-off Weight (MTOW) (Less than 3,000 Kg, 3,000 Kg to 9,000 Kg, and Greater than 9,000 Kg), By Point of Sale (New and Pre-Owned), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

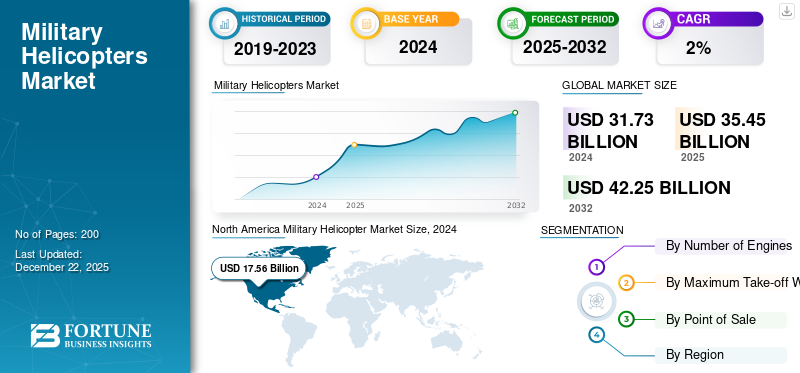

The global military helicopter market size was valued at USD 31.73 billion in 2024. The market is projected to grow from USD 35.45 billion in 2025 to USD 42.25 billion by 2032, exhibiting a CAGR of 2.5% during the forecast period. North America dominated the military helicopter market with a market share of 55.34% in 2024.

A helicopter is a type of Vertical Take-Off and Landing (VTOL) aircraft designed for numerous military missions such as armed reconnaissance, attack, utility, maritime, special operations, and naval. There are various types of military helicopters, including attack helicopters, rescue helicopters, observation helicopters, and others. The market is expected to grow significantly due to an increase in the defense budget allocated to procure and develop advanced military aircraft for strengthening national security. Moreover, different plans and programs are being conducted to renew the military helicopter fleet and meet military needs, which are expected to stimulate market growth.

Download Free sample to learn more about this report.

The market is driven by rising global military expenditure, increasing territorial and political conflicts, and rapid technological advancements such as lightweight materials, artificial Intelligence (AI) integration, and autonomous systems. Demand is especially strong for fleet modernization, attack, transport, and multi-role helicopters, as nations replace aging platforms and enhance operational capabilities. Key players of the market include Airbus Helicopters, Boeing, Sikorsky (Lockheed Martin), Leonardo, and Bell. These companies aim toward innovation, strategic partnerships, and a broad portfolio of advanced rotorcraft to strengthen their market positions.

GLOBAL MILITARY HELICOPTER MARKET OVERVIEW

Market Size & Forecast:

- 2024 Market Size: USD 31.73 billion

- 2025 Market Size: USD 35.45 billion

- 2032 Forecast Market Size: USD 42.25 billion

- CAGR: 2.5% from 2025–2032

Market Share:

- North America dominated the market in 2024 with a 55.3% share (USD 17.56 billion), driven by high defense spending, strong industrial base, and modernization programs such as the Future Vertical Lift (FVL).

- By Engine Type, the Twin Engine segment led the market due to increased demand for long-range rotor aircraft with better safety, performance, and mission flexibility.

- By MTOW (Maximum Take-off Weight), helicopters >9,000 kg held the largest share, fueled by heavy-lift transport and combat operations.

Key Country Highlights:

- United States: Largest global spender on military (USD 968 billion in 2024). Significant investments in CH-53K King Stallion and Black Hawk helicopters. FVL program is a key driver.

- France: Modernizing with Airbus H225M helicopters; replacing legacy platforms like Puma.

- India: Focus on indigenous production under Make in India; plans to induct ~250 helicopters.

- China: Developing next-gen Z-21 attack helicopter with stealth and AI features; increasing budget allocation for advanced capabilities.

- Middle East: Prioritizing fleet upgrades and combat-readiness via heavy investment (e.g., UAE A400M MRO centers).

- Philippines & Greece: Expanding and replacing aging fleets via Lockheed Martin UH-60 Black Hawk procurement.

MARKET DYNAMICS

MARKET DRIVERS

Rise in Defense Budgets Acts as a Driver for Market Growth

The global defense industry has witnessed significant shifts due to the current geopolitical tensions and advancements & innovations in technologies. This has led to an increase in defense spending across the globe. A significant part of the defense expenditure is allocated to the expansion and modernization of defense capabilities. Moreover, there has been a rise in the allocation of defense budgets to the procurement of advanced military aircraft and helicopters by various countries to improve their airpower. According to the International Institute for Strategic Studies, global defense spending increased to USD 2.46 trillion in the year 2024, making a notable increase compared to USD 2.24 trillion in 2023. This increase was driven by the current rising security challenges, with a noteworthy growth rate of 7.4% in real terms, surpassing the increases of 6.5% in 2023 and 3.5% in 2022. Similarly, defense spending as a percentage of GDP rose to an average of 1.9% in 2024, up from 1.6% in 2022 and 1.8% in 2023. This surge in defense budgets has become a critical driver for the military aircraft market, influencing both the demand for new aircraft and the development of cutting-edge technologies.

Conflicts and geopolitical tensions globally, such as the Russia-Ukraine conflict, have allowed countries to strengthen their military capabilities. This has led to huge investments made in advanced military aircraft to maintain or gain strategic advantages. Increased defense spending helps countries procure new helicopters/aircraft and modernize their current fleets. The allocated budget also allows the governments to invest in advanced technologies such as stealth capabilities and network-centric warfare systems, which are necessary for maintaining strategic advantages in modern conflict.

MARKET RESTRAINTS

High Cost Associated with the Development of Military Aircraft and Budget Constraints to Limit Market Expansion

The development of advanced military aircraft requires high expenses, particularly for research and development (R&D). For instance, programs such as the F-22 and F-35 have faced huge R&D costs due to the integration of cutting-edge technologies such as stealth capabilities and advanced avionics. This cost is increased by the complexity and innovation required in modern military aircraft, which increases both development and production expenses. Production costs are also a major factor, with the unit cost of advanced fighter jets being extremely high. For example, the F-22 costs around USD 361 million per aircraft, largely due to the use of advanced materials and complex manufacturing processes.

Although the overall defense budget has increased, the budget constraints toward the procurement of helicopters can severely limit the military helicopter market growth. Allocating a large portion of the defense budget to military aircraft allows for a smaller share of other military needs, such as personnel, infrastructure, or other equipment. Economic factors also play a crucial role, as economic downturns or budget cut can further constrain defense spending, impacting the military aircraft market. Overall, the combination of high costs and budget constraints poses significant challenges for countries seeking to modernize or expand their air forces, limiting procurement and influencing strategic decisions.

MARKET OPPORTUNITIES

Raising Security Concerns Due to Terrorism Threats and Regional Conflicts Expected to Positively Impact Market Growth

The rise in security concerns, owing to terrorism threats and regional conflicts, is expected to have a positive impact on market growth. There is increasing demand to modernize military helicopter fleets in response to evolving threats. The evolving threat landscape has encouraged countries to procure new aircraft with advanced capabilities such as network-centric warfare systems, stealth technology, and enhanced sensors to counter emerging threats effectively.

Thus, different countries are focusing on improving air force capabilities to protect national interests during regional conflicts and terrorist attacks. This promotes significant investments in advanced military helicopters, such as electronic warfare helicopters, transport helicopters, attack helicopters, and reconnaissance helicopters to bolster aerial strike capabilities. The ongoing geopolitical tensions and security threats have further emphasized the importance of airpower in military strategies. Thus, various countries across the globe are aiming to acquire helicopters that can support out-of-area operations and provide superior networking and intelligence capabilities to counter non-state actors and emerging threats.

MILITARY HELICOPTER MARKET TRENDS

AI-driven Autonomy and Modern Electronic Warfare Systems to Enhance Survivability and Operational Efficiency

Manned-unmanned teaming (MUM-T) is becoming more common, enabling helicopters to operate alongside drones for enhanced mission versatility. AI-driven autonomy and advanced electronic warfare systems are improving survivability and operational effectiveness. The use of composite rotor materials and digital avionics is boosting speed, agility, and reliability. Hybrid-electric propulsion is also emerging, promising greater fuel efficiency and reduced operational costs for future military helicopters. Therefore, rapid technological advancements such as lightweight materials, AI integration, and autonomous systems, are also fueling product demand.

Segmentation Analysis

By Number of Engines

Twin Engine Segment Dominated the Market Owing to Increased Demand for Long Range Rotor Aircraft

Based on the number of engines, the market is classified into single engine and twin engine.

The twin engine segment dominated the market and is expected to be the fastest-growing segment during the forecast period. A rise in demand for long-range rotor aircraft drives the segment growth. Different advantages of twin engine military helicopters, such as improved safety and performance capabilities during critical and challenging conditions, are expected to drive their demand. Moreover, this configuration is in high demand for search and rescue, medical evacuation, and special operations.

- For instance, in January 2025, the Republic of Ireland awarded a contract to Airbus Helicopters to acquire four H145M helicopters. It is expected to be utilized in the operational capabilities of the Irish Air Corps on a variety of defense and security tasks and in special operations forces. The H145M is the military version of the proven twin-engine H145 helicopter.

On the other hand, the single engine segment is expected to witness moderate growth during the forecast period due to a rise in demand for military trainer aircraft. Single engine aircraft are increasingly being adopted for roles such as training, reconnaissance, light attack, and close air support due to their affordability and operational efficiency.

By Maximum Take-off Weight

Greater than 9,000 Kg Segment Dominated the Market Due to Growing Adoption of Heavy-lift Helicopters for Transportation and Rescue Operations

Based on maximum take-off weight (MTOW), the market is divided into less than 3,000 kg, 3,000 kg to 9,000 kg, and greater than 9,000 kg.

The greater than 9,000 kg segment accounted for the larger market share in 2024. These helicopters are in high demand for the transportation of troops, materials, and supplies.

- For instance, in August 2023, the U.S. Navy awarded Sikorsky, a Lockheed Martin company, a USD 2.7 billion contract to produce and deliver 35 CH-53K King Stallion helicopters. This includes 27 helicopters for the U.S. Marine Corps (12 Lot 7 and 15 Lot 8) and eight for the Israeli Air Force under a Foreign Military Sales agreement.

Moreover, less than 3,000 kg is expected to grow with the highest CAGR during the forecast period due to the rise in demand for lightweight helicopters for their high performance and flexibility. These are used for a wide range of missions, such as light attacks, precision attacks, reconnaissance, and surveillance.

By Point-of-Sale

New Segment Dominates the Market Due to Extensive Replacement Programs Initiated by Various Countries

Based on point-of-sale, the market is segmented into new and pre-owned.

The new segment dominates the market due to increasing defense budgets and modernization programs worldwide. Nations such as the U.S., China, and India are prioritizing advanced rotorcraft to replace aging fleets and enhance operational capabilities.

- For instance, in February 2025, the Indian Army announced its plans to induct around 250 helicopters for surveillance and reconnaissance operations, focusing on indigenous production under the "Make in India" policy. Key contenders include HAL’s Light Utility Helicopter, Kamov-226T, and Airbus H125.

Moreover, the pre-owned segment is expected to grow at a moderate rate during the forecast period. Pre-owned helicopters are popular due to their use in secondary missions such as training and humanitarian aid. Moreover, developing countries with limited defense budgets find pre-owned helicopters to be a suitable choice.

Military Helicopter Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East.

North America

North America Military Helicopter Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the global market with a 55.3% share in 2024. The region generated revenues of USD 17.56 billion in 2024. The market is growing due to the rise in defense budgets and military programs in various countries. The U.S. has a well-established defense industrial base and a wide range of programs and organizations to strengthen the military industry. The country ranks among the top 10 largest spenders in total global military expenditure. According to Stockholm International Peace Research Institute, military spending by the U.S. rose to reach USD 968 billion in 2024. Moreover, the presence of key players such as Boeing and Lockheed Martin in North America contributes to the total gyroscope market share in the region. In addition, the U.S. military's ongoing modernization efforts, including the Future Vertical Lift (FVL) program, are driving innovation and investment in the market.

Europe

Europe holds the second-largest military helicopter market share. Countries are focusing on multi-mission helicopters to enhance operational flexibility. There is a strong emphasis on integrating advanced avionics, fly-by-wire controls, and ISR capabilities into rotorcraft. European major players such as Airbus Helicopters and Leonardo Helicopters are leading the technological advancements in the military helicopter sector.

For instance, in January 2025, Airbus Helicopters delivered two H225M helicopters to the French Air and Space Force, marking the first of eight ordered in 2021. These helicopters will replace aging Pumas in overseas territories and support operational, search and rescue, and utility missions. Such developments highlight the rise in demand for modernized, multi-role helicopters with advanced technology in the region, which is driving the market growth.

Asia Pacific

The Asia Pacific region is expected to showcase the highest growth rate, owing to the surge in defense spending by countries such as China and India. These countries are actively focused on the modernization of their military capabilities. This has led to a surge in demand for advanced helicopters.

For instance, in March 2024, China revealed that it is working on the development of a new attack helicopter, tentatively designated as the Z-21, which is comparable in size and capability to the US AH-64 Apache and the Russian Mi-28 Havoc. The Z-21 features advanced technologies such as upward-facing engine exhausts to reduce its infrared signature and laser warning systems. Such developments stimulate the production of advanced military helicopters and influence procurement trends, which are expected to fuel the market growth in the coming years.

Latin America and Middle East & Africa

In Latin America and the Middle East, geopolitical instability and territorial conflicts are driving helicopter acquisitions. Countries are focusing on modernizing their fleets to address diverse operational needs. The Middle East prioritizes attack helicopters for combat scenarios, while Latin America focuses on utility helicopters for multi-role applications such as search and rescue, medical evacuation, and border patrol.

COMPETITIVE LANDSCAPE

Key Industry Players

Continuous Development and Introduction of New Products by Key Companies Resulted in Their Dominating Positions in the Market

The global military helicopter market is concentrated with companies such as Boeing Company, Lockheed Martin Corporation, and Airbus Helicopters SAS, which account for a significant market share.

Companies such as Northrop Grumman and Raytheon Technologies have maintained dominance through huge investments in research and development. These companies also aim to deliver cutting-edge technologies such as stealth capabilities, autonomous systems, and advanced avionics. These players are using strategic partnerships and joint ventures to manufacture advanced helicopters and expand their global footprint. The market is growing due to government support through military modernization programs.

LIST OF KEY MILITARY HELICOPTER COMPANIES PROFILED

- Boeing Company (U.S.)

- Lockheed Martin Corporation (U.S.)

- Airbus Helicopters SAS (France)

- Leonardo Helicopters (Italy)

- Bell Helicopters (U.S.)

- Russian Helicopters (Rostec) (Russia)

- Hindustan Aeronautics Limited (HAL) (India)

- MD Helicopters (U.S.)

- Kawasaki Heavy Industries (Japan)

KEY INDUSTRY DEVELOPMENTS

- March 2025: Airbus announced its plans to establish maintenance, repair, and overhaul facilities, along with a training center, for the A400M military transport aircraft in the UAE while integrating local firms such as EPI and Strata into its global supply chain. This initiative aligns with Airbus’s localization strategy, focusing on job creation, skills development, and supporting the UAE’s industrial goals.

- January 2025: Lockheed Martin delivered 10 S-70i Black Hawk helicopters to the Philippines in 2024 as part of a USD 624 million contract for 32 units, which expanded the Philippine Air Force fleet to 47 by 2026. These versatile helicopters, manufactured by PZL Mielec in Poland, are designed for troop transport, disaster relief, and humanitarian missions.

- January 2025: Airbus Helicopters delivered the first two of eight H225M helicopters ordered in 2021 to the French Armament General Directorate (DGA) for the French Air and Space Force. These helicopters, replacing Pumas in overseas territories, will be used for operational, search and rescue, and utility missions.

- December 2024: Boeing secured a USD 135 million U.S. Army contract to deliver three additional CH-47F Block II Chinook helicopters, bringing the total under contract to nine. The Block II variant offers enhanced lift capacity (4,000 pounds more), extended range, and improved airframe and drivetrain, supporting the modernization and heavy-lift mission needs of the Army.

- October 2024: Sikorsky, a Lockheed Martin company, signed a USD 1.95 billion Foreign Military Sale contract with Greece for 35 UH-60M Black Hawk helicopters to replace aging Bell UH-1H and Agusta-Bell models. The deal includes training, equipment, and spare parts, enhancing Greece's defense modernization and interoperability with NATO allies.

REPORT COVERAGE

The global helicopter market research report provides an in-depth analysis of the market and its trends, focusing on key aspects such as leading market players, market segments, the impact of the Russia-Ukraine war, government bailout packages, and advancements in helicopter technologies. In addition, the report highlights aviation market trends, key industry developments, military helicopter market analysis, and technological innovations that are driving demand. It also identifies factors contributing to market growth during the helicopter market forecast period.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 2.5% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Number of Engines

|

|

By Maximum Take-off Weight (MTOW)

|

|

|

By Point of Sale

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 31.73 billion in 2024 and is projected to reach USD 42.25 billion by 2032.

In 2024, the market value in North America stood at USD 17.56 billion.

The market is expected to exhibit a CAGR of 2.5% during the forecast period of 2025-2032.

The greater than 9,000 Kg segment led the market by maximum take-off weight (MTOW) in 2024.

The key factor driving the market is the increase in defense budgets across the globe.

Boeing Company, Lockheed Martin Corporation, and Airbus Helicopters SAS are the top players in the market.

North America dominated the market in 2024.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us