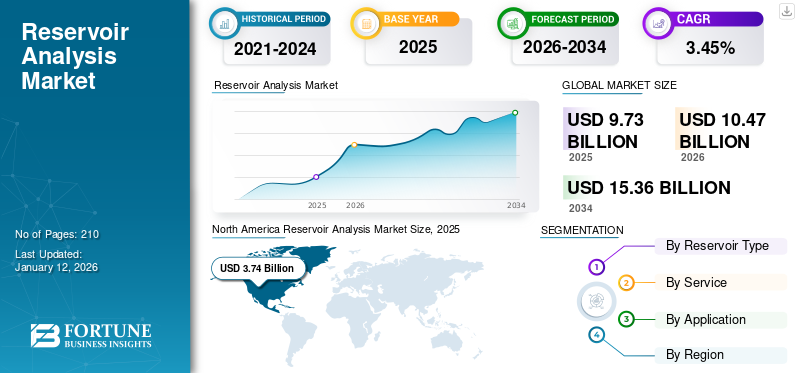

Reservoir Analysis Market Size, Share & Industry Analysis, By Reservoir Type (Conventional and Unconventional), By Service (Geomodeling & Reservoir Simulation, Data Acquisition & Monitoring, and Reservoir Sampling), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

The global reservoir analysis market size was valued at USD 9.73 billion in 2025 and is projected to grow from USD 10.47 billion in 2026 and is expected to reach USD 15.36 billion by 2034, exhibiting a CAGR of 3.45% during the forecast period. North America dominated the global market with a share of 38.47% in 2025.

Reservoir analysis is one of the prominent tool used to predict the performance of a reservoir over the production life of the oil & gas field. It calculates the dynamic rock & fluid properties and mitigates the effects of uncertainties by optimizing reservoir performance, controlling & monitoring reservoir and fluid properties. It is used to explore oil, gas, and coal, which are used as an energy source and fuel across various applications such as power generation, automotive, aviation, and others.

The market is expected to witness significant growth owing to factors such as the robust demand for energy, significant technological advancement in reservoir analysis, and the increasing need to achieve higher accuracy in exploration activities.

Schlumberger is one of the prominent players and is the world’s largest offshore drilling company, engaged in detailed analysis by utilizing various digital technologies.

MARKET DYNAMICS

MARKET DRIVERS

Significant Advancements in Technology for Reservoir Analysis Aids Market Growth

Transitions in technology for analyzing the reservoir are evolving at a faster rate, which improves the precise description of hydrocarbon composition and the efficiency of the field. Development in technology provides real-time monitoring solutions and actionable data, which enables the producer to make faster, easier, and more effective decisions. For instance, traditional approaches of data assimilation into numerical simulation models are outdated techniques; however, Pressure Transient Analysis (PTA) and Rate Transient Analysis (RTA) use the data efficiently and support decision-making for on-time production management. Hence, significant advancements in technology and growing adoption of these technologies to achieve higher accuracy will drive the demand for the market in the coming years.

Growing Demand for Energy and Hydrocarbon Recovery to Drive Market Growth

The increasing need for hydrocarbon recovery and power demand are the major factors attributed to the growth of this market. For instance, according to the International Energy Agency, global oil demand is expected to increase from 840 kb/d in 2024 to 1.1 mb/d next year, with consumption to 103.9 mb/d in 2025. Hence, increasing production and exploration activities of oil & gas upsurge the demand for energy and hydrogen recovery, which involves the extraction of fossil fuel in large amounts. Hence, increasing exploration and production activities in the oil & gas industry increases the demand for energy and hydrogen recovery, which in turn accelerates the demand for the reservoir analysis.

MARKET RESTRAINTS

Higher Investment Cost and Complicated Process Hampers Market Growth

Rapid technological advancements has led to higher spending by the end-user. The integration of advanced technology, such as sensor technologies, monitoring, data acquisition, and automated measurements, makes the reservoir analysis process more expensive. Hence, the availability of raw materials, complicated processes, and fabrication of various technologies make the reservoir analysis costlier, hampering the reservoir analysis market growth.

MARKET OPPORTUNITIES

Increasing Oil & Gas Exploration Activities is expected to Create Lucrative Opportunities

Countries in the Middle East & Africa, North America, and Asia Pacific are continuously expanding their oil and gas exploration activities, boosting demand for reservoir analysis services across the globe. For instance, in February 2025, the Energy Ministry of Oman announced the opening of the bidding process for investors to explore oil and gas in three onshore areas: Block 36, Block 43A, and Block 66. Such government-supported initiatives are expected to boost opportunities for market players in the near future.

Moreover, governments in China, Brazil, India, and Mexico are inclined toward investment in shale gas and tight oil exploration, which will further augment the demand for reservoir analysis services over the forecast period.

MARKET CHALLENGES

Complex Data Management and Integration Create Challenges for Market Players

Data management and integration are the key components of reservoir analysis. However, they pose major challenges for the services or technology providers, which hamper the accuracy and timelines of decision-making. Reservoir analysis includes handling enormous volumes of data generated from different sources, such as logs, 3D seismic surveys, and real-time sensor data. Hence, managing and storing large volumes of data requires robust data processing systems, which makes users and technology providers integrate the data through decision-making, related to oil & gas exploration.

RESERVOIR ANALYSIS MARKET TRENDS

Increasing Adoption of Advanced Drilling Technology has Emerged as a Trend in the Market

Significant progress in technology related to drilling and exploration has enabled producers to adopt advanced tools for reservoir fluids and formation to optimize production and recovery techniques. Precision pumps, formation response testers, mechanical integrity testing, and dynalink telemetry systems are some of the advanced tools and equipment used in production operations. It allows field performance, volumetric calculation, and probabilistic models to achieve higher reliability, accuracy, and ease of information accessibility. Appropriate characterization of the reservoir is obtained by the acquiring, processing, and integrating several basic data such as well logging, core analysis, and fluid properties, which aim to deliver geophysical, geological, and engineering data for higher accuracy. Hence, advancements in technology for production and exploration activities plays an essential role in the reservoir analysis.

Download Free sample to learn more about this report.

IMPACT OF COVID-19

The reservoir analysis market witnessed significant challenges primarily due to reduced oil demand, supply chain disruptions, and budget cuts in exploration and production activities during pandemic. Many oil and gas companies scaled back investments in new projects, delaying reservoir analysis studies and technological upgrades for the oil & gas fields. For instance, the U.S. annual crude oil production decreased by 8% in 2020, which was the major decrease in U.S. oil production to date. Hence, the production decline resulted in a decrease in drilling activity with low oil prices in 2020. Travel restrictions also hindered field operations, leading to increased reliance on remote monitoring and digital reservoir analysis solutions.

However, the COVID-19 crisis accelerated the adoption of cloud-based automation in reservoir management, pushing the industry toward cost-effective and data-driven decision-making. As the market recovered, the focus of end-users and technology providers shifted toward digital transformation, sustainability, and optimization of existing assets rather than robust oil & gas exploration.

SEGMENTATION ANALYSIS

By Reservoir Type

Increasing Oil & Gas Exploration Augmented Conventional Reservoir Analysis

Based on reservoir type, the market is segmented into conventional and unconventional.

Conventional reservoir analysis accounted for the largest reservoir analysis market share owing to the presence in major oil & gas producing regions such as North America, Middle East & Africa, and Asia Pacific. Conventional reservoir analysis is the process of evaluating a subsurface pool of hydrocarbons that are trapped in porous or fractured rock formations. The analysis helps determine the fluid properties, pressure, and flow rates of the hydrocarbons. The demand for conventional reservoir analysis is primarily driven by the need to extract resources from mature fields to ensure maximum recovery of resources from the wells. The segment is likely to gain 62.78% of the market share in 2026.

Unconventional reservoir analysis is a method used to study the production of oil and gas from low-permeability formations including shale and tight sands. It helps predict production and understand the flow of fluids in these reservoirs. Moreover, as the capacities of conventional reservoirs decline, the demand for unconventional reservoir analysis is expected to increase fueled by robust demand for energy across the globe in the coming years. The segment is expected to grow with a considerable CAGR of 7.42% during the forecast period (2025-2032).

By Service

Data Acquisition & Monitoring Segment is Growing due to Extensive Application of Advanced Technology

Based on service, the market is segmented into geomodeling & reservoir simulation, data acquisition & monitoring, and reservoir sampling.

The data acquisition & monitoring segment accounts for the maximum share owing to the extensive application of advanced technology, which enables the producer to predict appropriate real-time data, automated measurements, and communications capabilities. This segment is set to hold 44.70% of the market share in 2026.

Reservoir simulation is also growing due to wide application in completion degradation and pressure depletion within the oil & gas industry using detailed computerized models, which improves reservoir drainage and reserves recovery at lower drilling costs.

Reservoir sampling is used to complete and make production decisions for reservoir rock and fluid analysis in conventional and unconventional reservoirs. Hence, increasing energy demand and significant advancement in technology leverage the demand for the data acquisition & monitoring segment, among other segments.

Geomodeling & reservoir simulation is predicted to register a substantial CAGR of 5.61% during the forecast period (2025-2032).

To know how our report can help streamline your business, Speak to Analyst

By Application

Growing Onshore Oil & Gas Exploration Activities to Boost Market Growth

By application, the market is sub-segmented into onshore and offshore.

The onshore segment is holding the largest market share globally, owing to increasing onshore exploration and production activities. The segment held 63.74% of the market share in 2026.

Offshore applications are deployed in low, medium, and high depths of the ocean, which requires significant investment. Hence, an increasing onshore project fuels the demand for the reservoir analysis market during the projected period.

RESERVOIR ANALYSIS MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Reservoir Analysis Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

Presence of Major Oil & Gas Reserves in North America Drives Market Growth

North America held the largest share of the global market valued at USD 3.74 billion in 2025 and USD 4.03 billion in 2026. The U.S. and Canada are strategically focused on exploring more onshore reservoirs to cater to the emerging demand for hydrocarbon recovery.

According to the U.S. Energy Information Administration (EIA), U.S. Oil production witnessed a significant increase in 2024, surpassing 2023’s production record of 12.9 million barrels per day driven by technological advancements and investments for infrastructural developments in the oil & gas industry.

U.S.

Presence of Prominent Market Players Drives the Market in the Country

The reservoir analysis market in the U.S. is mainly driven by increasing oil and gas exploration, particularly in unconventional reserves such as shale and tight oil formations. Advancements in seismic imaging, 3D and 4D modeling, and AI-driven predictive analytics are contributing to the enhancement of oil & gas production processes. Furthermore, the presence of market players such as Halliburton, Schlumberger, and Baker Hughes also contributes to the dominance of the U.S. as the most prominent technology solutions provider across the globe. Moreover, rising investments in enhanced oil recovery and digital oil field technologies are expected to ensure maximum hydrocarbon recovery while adhering to regulatory compliance, which is expected to fuel the market demand over the forecast period. The U.S. market is expected to be worth USD 3.02 billion in 2026.

Europe

Increasing Offshore Oil and Gas Exploration Drives Market Growth in Europe

Europe is the fourth largest market estimated to reach a market value of USD 1.18 billion in 2026. Europe’s market is driven by increasing offshore oil and gas exploration in the North Sea and the transition to low-carbon energy sources. The U.K. market continues to grow, predicted to be valued at USD 0.11 billion in 2025. Moreover, advancements in digital technologies, stricter environmental regulations, carbon capture initiatives, and the European Union’s push towards sustainable energy are influencing the investment in Enhanced Oil Recovery (EOR) and geothermal reservoir analysis. Additionally, increased decommissioning of aging oil fields is driving demand for advanced monitoring and management solutions over the forecast period. Norway is likely to stand at USD 0.14 billion in 2025, while Russia is estimated to reach USD 0.50 billion in the same year.

Asia Pacific

Increasing Investments in Offshore Exploration to Boost Market Growth in the Region

Asia Pacific is the second largest market set to reach USD 2.78 billion in 2026, exhibiting a CAGR of 5.52% during the forecast period (2025-2032). The region is expected to witness healthy growth in the reservoir analysis market. China is expected to acquire USD 0.95 billion in 2026. China, India, and Indonesia, are majorly contributing to global oil & gas production, which led to growth in production and exploration activities. Additionally, the increasing demand for hydrocarbon recovery and growing advancement in technology drive the market growth. Indonesia is set to hold USD 0.44 billion in 2025, while Australia is expected to gain USD 0.41 billion in the same year.

China

China is the Largest Market in the region for Reservoir Analysis Due to Presence of Major Oil & Gas Reserves

China possesses a lucrative opportunity for reservoir analysis market owing to the presence of substantial unconventional hydrocarbon resources, including shale gas and coal bed methane. The development of these resources necessitates specialized reservoir analysis to understand the complex geological formations and to design effective extraction strategies.

Moreover, the Chinese government has been actively investing in the upstream oil and gas sector to enhance domestic production. Policies supporting exploration and production activities are expected to create a favorable environment for the reservoir analysis market in the coming years.

Latin America

Expansion of Oil & Gas Exploration is driving Reservoir Analysis Market Growth in Latin America

The expansion of oil & gas exploration is directly fueling the growth of reservoir analysis in the region, particularly in areas such as Brazil’s pre-salt fields, Guyana’s offshore reserves, and Argentinas’s Vaca Muerta shale. As exploration activities increase in Latin America, the need for detailed reservoir evaluations also increases to ensure the full potential of these oil and gas resources.

In November 2024, the Government of Brazil announced opportunities for oil exploration with 91 blocks aiming for significant investment and energy security. Such initiative is expected to propel market growth over the forecast period.

Middle East & Africa

High Volume of Oil Production in the Region is Expected to Offer Considerable Opportunities

The Middle East & Africa is the third largest market anticipated to hit USD 1.82 billion in 2026. The countries in the Middle East & Africa are continuously focusing on incorporating advanced technology for drilling and exploration projects. Significant developments in technology for the drilling & production of oil wells have increased the demand for reservoir analysis tools in the market. Hence, increasing oil production and growing exploratory projects will fuel the market during the forecast period. The GCC market is likely to be worth USD 1.47 billion in 2025.

COMPETITIVE LANDSCAPE

KEY INDUSTRY PLAYERS

Technological Advancements by Key players to augment Market Growth

The landscape of the reservoir analysis market depicts intense competition among the leading players. Achieving more contracts and constant innovations by leading companies are the prominent factors. In December 2024, Halliburton launched Intelli Suite to diagnose enhancement of well intervention and wireline logging services. The suite is developed to enhance well insights to foster efficient production and increased asset life.

Furthermore, key players are primarily focused on developing technology, such as deriving facies models from the outcome of seismic inversions and suitable communication capabilities, which leverage the operational efficiency and real time data of the exploration activities. These are some technological advancements that key players in the global market majorly provide.

List of Key Reservoir Analysis Companies Profiled:

- Halliburton (U.S.)

- Schlumberger (U.S.)

- Core Laboratories (U.S.)

- SGS (Switzerland)

- Baker Hughes (U.S.)

- Weatherford (U.S.)

- Emerson (U.S.)

- ALS (Australia)

- Intertek (U.K.)

- CGG (France)

- NUTECH (U.S.)

- Tracerco Ltd (U.S.)

- Trican Well Service Ltd. (Canada)

- Expro (England)

KEY INDUSTRY DEVELOPMENTS:

- In February 2025, Baker Hughes announced plans to deploy Leucipa automated field production service at offshore sites located in Nigeria. Leucipa utilizes data-driven operations to enhance the efficiency of the reservoir operations.

- In November 2024, TAQA launched the next generation M4 Inflow Control System to enhance reservoir performance and enable operators to manage fluid production efficiently. The M4 Inflow Control System consists of an advanced pilot control system that is suitable for various reservoir types and oil types, such as light, ultra-light, medium, and heavy oils.

- In November 2024, Computer Modelling Group Ltd. (CMG) announced collaboration with NVIDIA to CMG’s subsurface simulation services to enhance energy efficiency, performance, and speed.

- In October 2023, AIQ, ADNOC, and SLB introduced the Advanced Reservoir (AR) 360 solution for field development and reservoir analysis to accelerate the digital transformation of the energy industry. The Advanced Reservoir (AR) 360 solution drives operations and upstream exploration, which enhances efficiency by reducing operational energy and emissions.

- In June 2022, GeoSoftware launched solutions such as HampsonRussell 12.0, Jason Workbench 11.1, and PowerLog 11.1 to enhance the integration of digital technology in reservoir analysis.

Investment Analysis and Opportunities

The reservoir analysis market offers strong investment opportunities in AI, real-time monitoring, and enhanced oil recovery technologies. Growing demand for efficient exploration and digital solutions makes it a promising area for energy focused investors.

- In August 2024, ONGC announced the discovery of five onshore and offshore new oil & gas reservoirs in wells such as PURN-1, West Matar-2, and Chandramani (B-56-B) located in Gujrat, India. Such development is expected to create many opportunities for the market player in near future.

- In June 2024, Aker BP discovered a 12 m gas column in the Barents Sea exploration, well known as Ferdinand Nord, located in Norway. Moreover, another gas column with moderate reservoir quality was discovered in the Snadd Formation in the same well. Discovery gas wells pose as a lucrative opportunities for market players to expand their share.

REPORT COVERAGE

The global reservoir analysis market research report delivers a detailed insight into the market and focuses on key aspects such as leading companies. Besides, it offers insights into the global market trends & technology and highlights key industry developments. In addition to the factors above, the report encompasses several factors and challenges that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 3.45% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Reservoir Type, Service, Application, and Region |

|

Segmentation |

By Reservoir Type

|

|

By Service

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was USD 10.47 billion in 2026.

The market is likely to grow at a CAGR of 3.45% over the forecast period (2026-2034).

The onshore application segment is expected to lead the market in the forecast period.

The market size of North America stood at USD 3.74 billion in 2025.

Growing demand for energy and hydrogen recovery is the key factor driving market growth.

Some of the top players in the market are Halliburton, Schlumberger, and Core Laboratories among others.

The global market size is expected to reach USD 15.36 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us