Sterile Medical Packaging Market Size, Share & Industry Analysis, By Material (Plastics, Glass, Metal, Paper & Paperboard, Others), By Type (Thermoform, Trays, Sterile Bottles & Containers, Sterile Closures, Pre-Fillable Inhalers, Pre-Fillable Syringes and Others), By Sterilization Method (Chemical Sterilization, Radiation Sterilization), By Application (Pharmaceutical & Biological, In-vitro Diagnostic Products, Medical Implants, Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

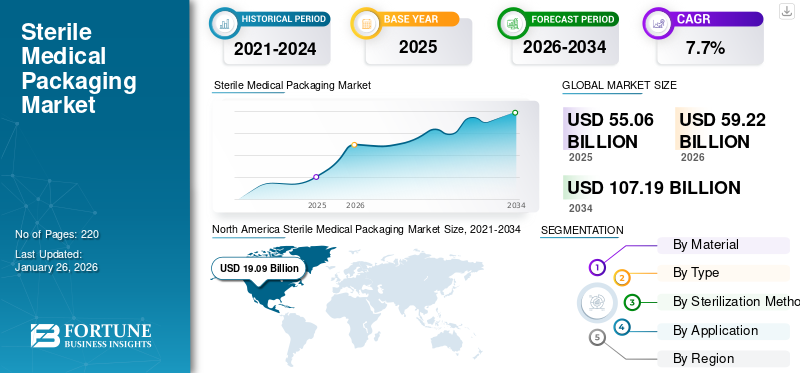

The global sterile medical packaging market size was valued at USD 55.06 billion in 2025 and is projected to be worth USD 59.22 billion in 2026 and reach USD 107.19 billion by 2034, exhibiting a CAGR of 7.7% during the forecast period. North America dominated the sterile medical packaging market with a market share of 34.67% in 2025.

Sterile medical packaging is a barrier that protects medical devices and pharmaceuticals from contamination by microorganisms. Such packaging is essential in the healthcare industry, ensuring that medical devices, pharmaceuticals, and other healthcare products remain free from contamination until their intended use, thus contributing to the market growth.

Amcor Plc and DuPont are the leading manufacturers, accounting for the largest global sterile medical packaging market share.

Global Sterile Medical Packaging Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 55.06 billion

- 2026 Market Size: USD 59.22 billion

- 2034 Forecast Market Size: USD 107.19 billion

- CAGR: 7.7% from 2026–2034

Market Share:

- North America dominated the sterile medical packaging market with a 34.67% share in 2025, driven by advanced healthcare infrastructure, high healthcare expenditure, and a well-established pharmaceutical industry. The FDA’s regulatory efforts and increased approvals of innovative therapies further propel regional growth.

- Amcor Plc and DuPont accounted for the largest global sterile medical packaging market share, strengthening industry leadership through product innovation and scale.

Key Country Highlights:

- United States: Growth driven by rising pharmaceutical output and stringent FDA regulations supporting the use of high-integrity packaging solutions for new drug approvals.

- Japan: Aging population and high demand for in-vitro diagnostics and implants contribute to strong market growth in sterile packaging.

- China: Increasing healthcare awareness and population growth drive demand for sterile packaging across pharmaceuticals and diagnostics.

- Europe: Growth supported by MDR implementation emphasizing traceability, clinical evaluation, and safety in medical device packaging.

- Brazil: Healthcare infrastructure expansion and availability of medical professionals drive steady regional market growth.

- United Arab Emirates: Rapid adoption of advanced medical technologies, including implants, supported by increasing healthcare expenditure and modernizing infrastructure.

STERILE MEDICAL PACKAGING MARKET DYNAMICS

MARKET DRIVERS

Increasing Demand for Sterile Packaging Systems in Healthcare Industry to Drive Market Growth

The rising population, coupled with an increase in the prevalence of diseases and the adoption of new regulations by governments to control the spread of infectious diseases, are some of the major factors driving the growth of the healthcare industry. Increased spending on healthcare services has propelled the demand for sterile medical packaging. The growth of sterile medical packaging in the healthcare industry is attributed to its superior microbial barrier and durable properties. The increasing demand for injectable pharmaceuticals and the need for oncology and other high-potency drugs are driving the growth of the market. Furthermore, using suitable sterile packaging products is very important as it allows the withdrawal of packaged contents without infection and damage. Hence, the rising demand for sterile medical packaging solutions in the healthcare industry will drive market growth.

Stringent Regulatory Standards and Customization of Products Enhances Market Growth

Regulatory bodies worldwide impose strict guidelines for medical packaging to ensure product safety and efficacy. Regulatory bodies, such as the FDA (U.S. Food and Drug Administration), the European Medicines Agency (EMA), and other national health authorities set stringent requirements for sterile medical packaging. Compliance with standards such as ISO 11607 (for packaging of terminally sterilized medical devices) is critical to ensuring patient safety. The strict regulations and guidelines are thus encouraging the demand for sterilized packaging solutions for medical products, thus enhancing the market growth. In addition, medical devices and pharmaceuticals vary widely in size, shape, and fragility, necessitating customized packaging designs. Customized packaging may involve specific features, such as cushioning, tamper-evident seals, and peelable pouches that ensure product integrity, which, in turn, fosters market growth.

MARKET RESTRAINTS

Growing Regulations for Sterile Packaging to Restrict Market Growth

Sterile packaging solutions must be designed to ensure sterility of packed contents until their point of use. Hence, stringent regulatory standards are made and implemented over their manufacturing. These standards ensure that the packed devices or instruments do not face any adverse reaction or damage from packaging products or external factors. EN ISO 11607 (part 1 and part 2) is the global standard that specifies the validation requirements of medical packaging systems used for sterilized medical devices or instruments. These validation requirements are used in various steps of packaging products, such as material selection, design qualification, design testing & control, and process validation. The standards are complex and act as a restraining factor for the market.

MARKET OPPORTUNITIES

Advancements in Sterilization Technologies Will Generate Growth Opportunities

The packaging must be compatible with various sterilization methods, such as autoclaving (steam sterilization), gamma radiation, ethylene oxide (EO) gas, and others. Innovations in materials such as advanced polymers (e.g., medical-grade polyethylene or polypropylene), as well as films and laminates, have improved sterilization efficiency and the shelf life of products. Integration of technologies such as RFID (Radio Frequency Identification), QR codes, and sensors in packaging to monitor and track the product’s sterility, temperature, and environmental conditions during transportation and storage. Advances in nanomaterials are being explored for medical packaging to improve antimicrobial properties and extend the shelf life of medical products. Such factors are analyzed to offer potential growth opportunities.

MARKET CHALLENGES

Risk of Counterfeit and Tampering Challenges Market Growth

Sterilized medical packaging plays a crucial role in ensuring the safety and effectiveness of medical devices, pharmaceuticals, and other healthcare products. However, several challenges must be overcome to maintain product integrity and meet regulatory requirements. Medical packaging must incorporate tamper-evident features to prevent unauthorized access or tampering. These features add another layer of complexity and cost to the packaging design. The rise of counterfeit medical devices and drugs is a significant concern. Packaging must incorporate features that make it easy to verify the authenticity of the product, such as holograms, security labels, or QR codes, which adds to the complexity of packaging design, thus challenging the market growth. Dependence on specific regions for raw materials can lead to vulnerabilities, thus challenging sterile medical packaging market growth. North America witnessed a growth from USD 15.34 billion in 2023 to USD 16.41 billion in 2024.

Download Free sample to learn more about this report.

MARKET TRENDS

Rising Adoption of Single-use Medical Equipment is Prominent Trend

The rising cases of contagious diseases such as coronavirus, cold, flu, tuberculosis, and SARS have led to a surge in demand for single-use medical equipment or devices. The adoption of single-use packaging is becoming more popular in healthcare settings as it can reduce the risk of infection and contamination. As these devices are used only once, they prevent the spreading of bacteria or infection from one patient to another. The packaging used for such devices needs to be very efficient in maintaining their sterility. These products are considered to be effective packaging solutions for such devices. They keep single-use medical equipment away from moisture and chemicals. These packaging solutions are available in different sizes and shapes according to the requirements of the application area. Hence, the rising demand for single-use medical equipment will fuel the market.

IMPACT OF COVID-19

The COVID-19 pandemic positively impacted the supply chain, thus propelling the market growrg. Hospital systems became overwhelmed with the rapidly increasing number of patients, which weighed heavily on the healthcare industry. It thus led to an increase in the demand for these packaging materials as they can prevent contamination and mitigate the spread of the virus.

STERILE MEDICAL PACKAGING SEGMENTATION ANALYSIS

By Material

Cost-effective Properties Offered by Plastic Material Boosts Segmental Growth

Based on material, the market is segmented into plastics, glass, metal, paper & paperboard, and others.

Plastic is the dominating material segment used in the production of sterilized medical packaging. The material dominates the market due to its lightweight and cost-effectiveness. They protect the packed drugs, devices, and medical instruments from damage and contamination. The plastic segment finds its application in thermoformed blister trays and packs, bottles, closures, pouches, vials, overwraps, and bags, thus driving the segment’s growth.

- The plastics segment is expected to hold a 46.09% share in 2026.

Glass is the second-largest material as it is used for its impermeability and inert nature. It is a preferred material in the manufacturing of various types of medical packaging, such as vials & ampoules, bottles, test tubes, and syringes.

To know how our report can help streamline your business, Speak to Analyst

By Type

Ability of Thermoform Trays to Hold Medical Equipment Intact Propels Segmental Growth

Based on type, the market is categorized into thermoform trays, sterile bottles & containers, vials & ampoules, pre-fillable inhalers, sterile closures, pre-fillable syringes, and blister & clamshells, bags & pouches, wraps, and others.

Thermoform trays segment are the dominant type segment with a market share of 19.23% in 2026 and are mainly used as sterile packaging systems. These are mainly produced using rigid material and have a multi-compartment to support the medical equipment. These trays are used to pack sutures, implants, testing kits, and sensitive surgical items.

The pre-fillable syringes segment held the second-largest share of the market. These ready-to-fill syringes are lightweight, transparent, and break-resistant. The rising use of multiple-dose injection therapies will surge the demand for pre-fillable syringes during the forecast period.

By Sterilization Method

Significant Benefits of Chemical Sterilization Method Drives Segmental Growth

Based on the sterilization method, the market is classified into chemical sterilization, radiation sterilization, and high temperature/pressure sterilization.

The chemical sterilization segment leads the market with a share of 53.72% in 2026 and is the fastest growing method adopted in the market, in which ethylene oxide is the most powerful chemical used for sterilization. It is an alkylating agent that disrupts the reproductive processes and cellular metabolism of microorganisms. Furthermore, it is well-suited for many materials, including plastics and glass, that degrade by radiation or heat sterilization, thus driving the segment’s growth.

Radiation sterilization is the second-largest method in which gamma radiation is the largest sub-segment. This method uses cobalt-60 as a radiation source that undergoes decomposition to release high-energy gamma rays for sterilization and decontamination.

By Application

Surged Medication and Blood Tests Demand Boosts Segmental Growth

Based on application, the market is classified into pharmaceutical & biological, surgical & medical instruments, in-vitro diagnostic products, medical implants, and others.

The pharmaceutical & biological segment held the largest market share of 52.08% in 2026. The rapidly rising contagious and non-contagious diseases have led to an increase in the number of patients. This has resulted in the increasing demand for medication and blood tests. These positive factors are expected to surge the demand for such packaging in pharmaceutical & biological applications and thereby drive the segment’s market growth.

The surgical & medical instruments segment is a rapidly growing application in the market. The rising need for surgeries and operations will increase the demand for surgical & medical instruments and will thereby lead to market expansion.

STERILE MEDICAL PACKAGING MARKET REGIONAL OUTLOOK

The market has been studied geographically across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America Sterile Medical Packaging Market Size, 2021-2034 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

Well-established Pharmaceutical Industry Drives North America Market Growth

North America is the dominating region in the sterile medical packaging market share due to advanced healthcare infrastructure and high healthcare expenditure. North America dominated the market with a valuation of USD 19.09 billion in 2025 and USD 20.4 billion in 2026. The U.S. is the most significant contributor to this region. The growth in this region is attributed to the rising pharmaceutical industry and increasing consumer healthcare spending. The FDA is responsible for regulating and approving pharmaceutical products in the U.S. It plays a critical role in ensuring that drugs are safe, effective, and manufactured to high standards. The U.S. market is valued at USD 17.73 billion by 2026.

- The FDA approved over 50 New Molecular Entities (NMEs) in 2023, with an increasing focus on gene therapies, oncology drugs, and rare disease treatments. Such initiatives also drive the market growth.

Europe

Growing Demand from Medical Equipment Sector Enhances Europe’s Market Growth

Europe is the second-largest contributor to the market. The growth is due to the rising use of medical equipment, such as thermoform trays, sterile bottles & containers, vials ampoules, and pre-fillable syringes, in various medical applications. The UK market is valued at USD 2.18 billion by 2026, while the Germany market is valued at USD 4.71 billion by 2026.

- The EU introduced new regulations for medical devices in 2017 (MDR), which came into full effect in 2021. This regulation is stricter than the previous directives and focuses on safety, traceability, and clinical evaluation.

Asia Pacific

Increasing Healthcare Awareness from Ageing Population Boosts Market Growth in Asia Pacific

In Asia Pacific, China, Japan, and India are the leading contributors to the market growth. The increasing population and awareness of consumers toward healthcare requirements have boosted the healthcare industry in this region. Further, the high demand for in-vitro diagnostics and medical implants will drive the demand for sterile medical packaging. The Japan market is valued at USD 2.55 billion by 2026, the China market is valued at USD 9.05 billion by 2026, and the India market is valued at USD 1.77 billion by 2026.

- According to the Population Reference Bureau, the aging population is a major concern in many Asia Pacific countries. For instance, Japan has one of the oldest populations in the world, with over 28% of its population aged 65 and older in 2020.

Latin America

Rising Infrastructure Development will Encourage Steady Growth in Projected Years

The Latin America region will experience steady growth in the projected period. The rising infrastructure development, availability of medical professionals, and increasing product innovation will surge product adoption in the region.

- According to the Pan American Health Organization (PAHO), Brazil has around 21.5 doctors per 10,000 people, Peru has fewer, at about eight doctors per 10,000 people, and Cuba has one of the highest doctor-to-patient ratios globally, with approximately 67 physicians per 10,000 people.

Middle East & Africa

Increasing Medical Implants in Middle East & Africa Region Aids Market Growth

Middle East region will experience significant growth in the projected period. The increasing product need for medical implants & in-vitro diagnostic applications will boost the market growth in the Middle East & Africa.

- According to the World Economic Forum, countries in the region, such as the United Arab Emirates (UAE), Saudi Arabia, Qatar, and Kuwait, are rapidly adopting advanced medical technologies, including medical implants, due to the growing aging population, increasing healthcare expenditures, and expanding healthcare infrastructure.

KEY INDUSTRY PLAYERS

Key Market Participants to Witness Significant Growth Opportunities with New Product Launches

The global sterile medical packaging market is highly fragmented and competitive. A few significant players are dominating the market by offering innovative packaging solutions in the packaging industry. These major market players constantly focus on expanding their customer base across regions by innovating their existing wide range of products. The market report also highlights the key developments by the manufacturers.

Major players in the industry include Amcor Plc, Placon Corporation, Dupont, Steripack Ltd., Wipack Group, Nelipak Corporation., and others. Numerous other companies operating in the market are focused on market scenarios and delivering advanced packaging solutions.

Some of the Key Companies Profiled in the Report:

- Amcor Plc (Switzerland)

- Placon (U.S.)

- DuPont (U.S.)

- SteriPack Group (Ireland)

- Wipak Group (Finland)

- Nelipak Healthcare (U.S.)

- Tekni-Plex (U.S.)

- Sonoco (U.S.)

- BillerudKorsnäs AB (Sweden)

- ProAmpac (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Riverside Medical Packaging Company Ltd (U.K.)

- Oliver Healthcare Packaging (U.S.)

- GS Medical Packaging (Canada)

- Orchid (U.S.)

- Technipaq Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- January 2023: Nelipak added Eastman Renew’s materials for sterile medical device packaging. The company used Eastman’s Easter Renew 6763 to produce rigid thermoformed sterile barrier packaging. Nelipak is the first healthcare packaging manufacturer to use Easter Renew 6763 to produce sterile barrier packaging for Class 2 and Class 3 medical packaging applications.

- September 2022: Kyocera Eastman collaborated with Ethicon, a Johnson & Johnson MedTech business, to source Eastman Renew materials for its medical device sterile barrier packaging. It was an essential step to help decrease waste in the healthcare system and contribute to a more circular future.

- August 2021: Amcor declared plans to build two new state-of-the-art innovation centers. The new facilities in Ghent, Belgium, and Jiangyin, China, were expected to be operational by mid-2022, with full build-out over the next two years. The total investment is expected to be approximately USD 35 million.

- June 2021: Amcor launched ACT2100, a heat seal coating medical packaging solution. This product will enhance performance in healthcare applications and serve customers’ device packaging needs.

- May 2020: Packaging Compliance Labs LLC announced an investment of USD 2.57 million with the intent of the expansion of its headquarters in the greater Grand Rapids area. The sterile packaging for engineering, medical devices, and testing firms was awarded a USD 135,000 jobs-ready Michigan grant from the Michigan Strategic Fund for the project.

INVESTMENT ANALYSIS AND OPPORTUNITIES

In August 2024, pharmaceutical companies, including Unilever, Abbott, Merck, and more, announced significant investment plans for the Mexican market, signaling a potential rise in packaging machinery demand ahead.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

The market research report provides a detailed market analysis. The sterile medical packaging market overview also focuses on key aspects, such as top key players, competitive landscape, product/service types, market segments, Porter’s five forces analysis, and leading segments of the product. Besides, it offers insights into the sterile packaging market trends and highlights key industry developments. In addition to the abovementioned factors, it encompasses several factors that have contributed to the market intelligence & growth in recent years.

Report Scope and Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2034 |

|

Growth Rate |

CAGR of 7.7% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Type

|

|

|

By Sterilization Method

|

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market size was valued at USD 55.06 billion in 2025 and is projected to reach USD 107.19 billion by 2034.

Registering a CAGR of 7.7%, the market will exhibit significant growth during the forecast period of 2026-2034.

The plastic segment is expected to lead this market during the forecast period.

The rising adoption of single-use medical equipment is the key factor driving the market.

North America held the highest market share in 2025.

The increasing demand for sterile packaging systems in the expanding healthcare industry, rising spread of contagious diseases, and increasing healthcare awareness among consumers are a few factors supporting the adoption.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us