Medical Tubing Market Size, Share & Industry Analysis, By Material (Polyvinyl Chloride (PVC), Silicone, Polyolefin, Thermoplastic Elastomers (TPE), and Others), By Application (Bulk Disposable Tubing, Catheterization, Drug Delivery Systems, and Others), By Indication (Cardiovascular, Respiratory, Urological, and Others), By End-user (Hospitals & ASCs, Aged Care Centers/Nursing Homes, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

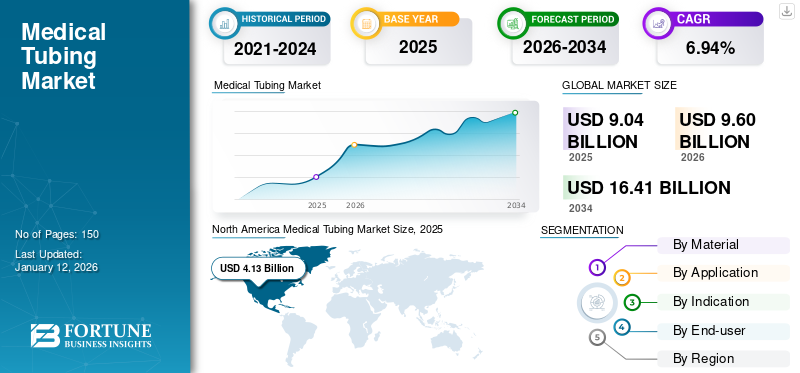

The global medical tubing market size was valued at USD 9.04 billion in 2025. The market is projected to grow from USD 9.6 billion in 2026 to USD 16.41 billion by 2034, exhibiting a CAGR of 6.94% during the forecast period. North America dominated the medical tubing market with a market share of 45.69% in 2025.

In the healthcare industry, medical tubing is a crucial component that meets industry requirements and standards for various pharmaceutical or medical-related applications. Medical tubes are more frequently utilized with surgical tubes, urological and drainage catheters, and with respiratory and anesthesiology equipment, peristaltic pumps, IVs, and biopharmaceutical laboratory equipment.

The global market’s growth can be credited to the increasing demand for medical devices that are equipped with effective tubing. This demand is primarily fueled by ongoing innovations in drug delivery systems by several medical device companies, resulting in the requirement for customizable medical tubes. Moreover, the rising burden of major diseases, such as ischemic heart disease, congenital heart defects, and fallopian tube cancer that necessitate minimally invasive procedures are also propelling the demand for tubing.

For instance, in September 2023, the Europa Group reported that nearly 620 million individuals are currently suffering from heart and circulatory diseases globally. Minimally invasive procedures to address such diseases are boosting the adoption of medical tubes globally, which is expected to augment the market growth in the coming years.

The global market witnessed slow growth during the COVID-19 pandemic. This growth was attributed to the increased demand for bulk disposable tubes and catheterization during the period. This high demand significantly contributed to the market growth in 2020.

Medical Tubing Market Overview & Key Metrics

Market Size & Forecast:

- 2025 Market Size: USD 9.04 billion

- 2026 Market Size: USD 9.6 billion

- 2034 Forecast Market Size: USD 16.41 billion

- CAGR: 6.94% from 2026–2034

Market Share:

- North America dominated the medical tubing market with a 45.69% share in 2025, driven by the high incidence of cancer and chronic diseases, leading to increased demand for tubing in therapies such as intravenous delivery, tube feeding, and biomedical applications.

- By material, silicone held the largest share in 2025 due to its excellent biocompatibility, thermal stability, and chemical resistance, making it ideal for critical medical applications.

Key Country Highlights:

- Japan: Demand driven by the growing focus on minimally invasive procedures and advanced healthcare infrastructure requiring high-performance, biocompatible tubing materials.

- United States: Growth supported by a surge in cancer and chronic diseases, prompting increased adoption of tubing in drug delivery and catheterization. Regulatory compliance with FDA standards also shapes product innovation and market dynamics.

- China: Rapid healthcare infrastructure expansion, increasing disease burden, and initiatives like Belt and Road fueling demand for advanced medical tubing, especially in catheterization and drug delivery systems.

- Europe: Adoption is driven by rising cardiovascular disease prevalence, with medical tubing utilized in ventilators, intravenous fluid delivery, and surgical applications. The presence of stringent regulatory frameworks and sustainability trends also impact market growth.

Medical Tubing Market Trends

Increasing Focus on Advancements in Material Science

Advancements in material science are driving significant innovations in the market. The development of cutting-edge materials such as Thermoplastic Elastomers (TPE) and Thermoplastic Polyurethane (TPU) is enabling the production of high-performance, biocompatible tubing for medical devices and equipment.

These material science breakthroughs are enabling the creation of tubing with enhanced properties such as flexibility, durability, and kink resistance while prioritizing biocompatibility and patient safety.

Furthermore, material science solution companies are increasingly participating in events to fuel the trend of material advancements in various applications.

- For instance, in September 2023, TekniPlex, a material science solutions company, presented new tubing advancements to drive dramatic improvements for critical fluid transfer applications at the AMI Medical Tubing & Catheters Event.

Download Free sample to learn more about this report.

- North America witnessed a growth from USD 3.67 Billion in 2023 to USD 3.89 Billion in 2024.

Medical Tubing Market Growth Factors

Rising Incidence of Chronic Diseases to Fuel the Adoption of Medical Tubes

In recent years, there has been a significant rise in the incidence of several chronic diseases, such as cardiovascular diseases, urological disorders, and cancer.

- For instance, according to data published by the World Health Organization (WHO) in February 2024, the estimated number of new cancer cases worldwide stood at 20 million in 2022. The global burden is projected to rise to 35 million by 2050, an increase of 77.0% compared to 2022.

This rising incidence can be attributed to risk factors such as the growing geriatric population and various conditions. These conditions include obesity due to a sedentary lifestyle, smoking, and alcohol consumption. For instance, as per data published by the National Center for Biotechnology Information (NCBI) in May 2023, chronic diseases such as hypertension, obesity, and diabetes were on the rise among aged individuals across the globe.

Similarly, the world has registered an increase in the total alcohol consuming population over the past few years. For instance, as per a survey by the National Institute on Alcohol Abuse and Alcoholism (NIAAA) in 2022, around 221 million people (adults aged 12 years and above) in the U.S. consumed alcohol at some point in their lifetime. These factors contributing to the rising incidence of chronic diseases are expected to boost the adoption of tubing in several diagnosis and treatment procedures.

The use of medical tubing in the treatment and diagnosis of chronic diseases offers several benefits, such as improved biocompatibility and flexibility in various medical applications and enhanced safety and efficacy during the delivery of fluid, medications, and other substances. In addition, it offers increased customization and supports minimally invasive procedures such as endoscopy.

Such efficiency of medical tubes in post-treatment procedures is anticipated to spur the global market growth during the forecast period.

Increasing Minimally Invasive Surgeries to Boost Market Growth

Over the last decade, there has been a preferential shift of patients toward minimally invasive procedures due to its expanding number of applications across the globe.

- For instance, in September 2023, according to the Journal of Hepatology, the number of endoscopic procedures related to individuals suffering from liver disease significantly increased over the last decade. Furthermore, it also altered and expanded in terms of applications and indications.

Moreover, the increasing demand for minimally invasive medical procedures is mainly due to the high prevalence of chronic diseases, including cancer and gastrointestinal diseases. Several minimally invasive procedures, such as colonoscopy and endoscopy, involve the use of tubes that offer a number of benefits reducing the procedural risks and patient discomfort. Some of these benefits include facilitating precise instrument manipulation, tissue accessibility, and therapeutic interventions, among others.

Moreover, the popularity of minimally invasive surgeries is rising in cardiology for Coronary Artery Bypass Surgery (CABG) and valvular surgery and in orthopedics for hip and knee replacements. This growing popularity is expected to encourage key medical tubing players to focus on advancements in Minimally Invasive Surgery (MIS) procedures and devices that involve the use of tubes. This is anticipated to propel the market growth during the forecast timeframe.

RESTRAINING FACTORS

Stringent Regulations and Product Recalls to Restrict Market Growth

Medical tubes have been a crucial component in a broad range of medical devices, including catheters, IVs, and respiratory tubes. They have been highly used in the diagnosis and treatment procedures of numerous conditions over the last decade. As a result, to maintain their standards ensuring patient safety and efficacy, they are regulated by various regulatory bodies such as the Food & Drug Administration (FDA) with strict regulations.

For instance, before commercializing the product, manufacturers must ensure that their products comply with strict quality and safety standards set by the FDA. This can create challenges for manufacturers in terms of meeting these requirements, as well as the significant time and resources needed for testing and certification processes. Navigating these regulatory demands can present obstacles for companies, thereby delaying product entry into the market.

Similarly, product recalls can significantly constrain market growth, leading to negative impacts such as loss of trust by customers, financial burden for manufacturers, and effects on patient care. These product recalls can be triggered by various reasons, including life-threatening malfunctions, labeling and packaging issues, or other safety concerns.

- For instance, in April 2024, Vyaire Medical, Inc. recalled its Vyaire Twin Tube, a medical tubing device, due to the potential risk of the nozzle separating during patient use, which could lead to a choking hazard. This recall was classified as a Class I recall by the FDA, indicating a serious risk of injury or death associated with the device.

- Similarly, in July 2023, Edwards Lifesciences recalled their Swan-Ganz Double Lumen Monitoring Catheter due to labeling and packaging issues.

Medical Tubing Market Segmentation Analysis

By Material Analysis

Excellent Biocompatibility and Thermal Stability of Silicone to Drive Segment Growth

Based on material, the market is segmented into Polyvinyl Chloride (PVC), silicone, polyolefin, Thermoplastic Elastomers (TPE), and others.

The silicone segment accounted for the maximum share of the global market 37.36% in 2026. This growth can be attributed to the unique property of silicone that makes it an ideal material for tubing used in fluid transfer, peristaltic pumping, infusion systems, catheters, and other life-sustaining devices. In addition, the material is well-known for its excellent biocompatibility, chemical resistance, and thermal stability, which is increasing its utilization in several medical applications, such as pharmaceutical processing and is expected to fuel the segment growth.

- For instance, as per an article published by the IQS directory in May 2024, silicone can withstand temperatures from -130°F to 600°F and is resistant to UV radiation and ozone.

The Thermoplastic Elastomers (TPE) segment is projected to expand at the fastest CAGR during the forecast period. The elastomers are formulated to withstand various fluids without degrading, making them suitable for medical applications where exposure to chemicals or biological fluids is a concern. Moreover, they can be molded into various shapes and forms, allowing for the creation of complex tubing components that require flexibility and precision. In addition, they can be reused and recycled, reducing waste and making them a more eco-friendly option compared to thermoset materials such as silicone. All these significant factors are fueling the adoption of Thermoplastic Elastomers (TPE) in medical tubes, which is expected to propel the segment growth during the projection period.

- The Silicone segment is expected to hold a 37.36% share in 2026.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Burden of Urological Disorders to Fuel the Demand for Catheterization

By application, the market is segmented into bulk disposable tubing, catheterization, drug delivery systems, and others.

In 2025, the catheterization segment accounted for the largest global medical tubing market share 53.02%. This growth can be attributed to the high burden of urological, cardiology, and neurovascular disorders. Catheters with specialized tubing are used to treat these diseases or to perform surgeries. In addition, catheters with tubing prevent urine from accumulating in the bladder, reducing complications such as Urinary Tract Infections (UTIs) and bladder damage. This is expected to increase the demand for catheterization tubes to overcome the rising burden of such diseases, thereby boosting the segment growth.

- For instance, as per an article published by the National Center for Biotechnology Information (NCBI) in July 2022, Urinary Tract Infections (UTIs) at the global level increased by 60.40% from 252.25 million to 404.61 million between 1990 and 2019 respectively.

The drug delivery systems segment is expected to grow at the fastest CAGR during the forecast period. The medical tubes in modern drug delivery systems offer several key benefits, such as precise and targeted drug delivery, improved patient comfort and compliance, enhanced drug efficacy and reduced side effects, and compatibility with the other components. As a result, the adoption of tubing is significantly rising in drug delivery systems, which is expected to boost the segment growth in coming years.

By Indication Analysis

Rising Incidence of Cardiovascular Diseases to Fuel Segment Growth

By application, the market is categorized into cardiovascular, respiratory, urological, and others.

In 2026, the cardiovascular segment accounted for a dominant share 47.34% of the market fueled by the rising incidence of cardiovascular diseases globally. To mitigate the growing prevalence, cardiac catheterization involving the use of medical tubes is being increasingly used for diagnostic and interventional purposes.

- For instance, in August 2021, according to the Journal of the American College of Cardiology, the projected rates of cardiovascular risk factors and disease are anticipated to increase significantly in the U.S.

The others segment is expected to expand at the fastest CAGR during the forecast period. The segment’s growth is mainly attributed to the rising prevalence of chronic diseases such as cancer, urological, gastrointestinal, and respiratory diseases worldwide. This is expected to fuel the utilization of tubing products, driving segment growth in the coming years.

By End-user Analysis

Hospitals & ASCs to Hold a Major Share Due to Preferred Destination for Several Medical Procedures

By end-user, the market is segmented into hospitals & ASCs, aged care centers/nursing homes, and others.

In 2026, the hospitals & ASCs segment held the largest market share 55.86% favored by the large number of diagnostic and treatment procedures being carried out in hospitals. Moreover, several emergency procedures carried out in ASCs are also anticipated to fuel the utilization of tubing products, driving the segment growth.

The aged care centers/nursing homes segment is projected to grow at a substantial CAGR during the forecast period. The segmental growth is attributed to the rising application of bulk disposable tubing in aged care centers/nursing homes.

REGIONAL INSIGHTS

Based on geography, the market has been studied across North America, Asia Pacific, Europe, Latin America, and the Middle East & Africa.

North America Medical Tubing Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 4.13 billion in 2025. The surge in the number of cancer cases in the region is expected to boost the demand for medical tubing. In cancer, tubing is being employed in various ways, including tube feeding, intravenous therapy, and biomedical applications in the region. This is expected to surge the regional market growth in the upcoming years.The U.S. market is projected to reach USD 4.06 billion by 2026.

- For instance, as of 2024, according to the American Cancer Society, there were an estimated 1.9 million new cancer cases diagnosed in the U.S.

The medical tubing market in Europe held the second-highest share in 2024 driven by the soaring prevalence of heart failure in the U.K., France, and Germany. The tubing is used in ventilators to administer oxygen and air to patients with heart failure, helping to maintain adequate oxygenation and respiratory function. In addition, it is used for Intravenous (IV) fluid administration, which is essential for managing fluid levels and electrolyte balance in patients with heart failure. Such utilization of this medical product in heart failure is driving its adoption in the region.The UK market is projected to reach USD 0.38 billion by 2026, while the Germany market is projected to reach USD 0.56 billion by 2026.

Asia Pacific is anticipated to rise at the highest CAGR over the projection period with the increasing healthcare infrastructure development, expenditure, and rise in awareness about advanced medical procedures. This results in a higher demand for specialized tubing that meets the requirements of modern medical practices and supports the growing healthcare facilities and services. These factors collectively are expected to boost the Asia Pacific medical tubing market growth during the forecast period.The Japan market is projected to reach USD 0.54 billion by 2026, the China market is projected to reach USD 0.61 billion by 2026, and the India market is projected to reach USD 0.33 billion by 2026.

Latin America and the Middle East & Africa are expected to witness comparatively lower growth in revenue during the analysis period. In the Middle East & Africa region Dubai and Abu Dhabi, are attracting medical tourists. This is leading to an increased demand for healthcare products, including tubing.

KEY INDUSTRY PLAYERS

Saint-Gobain and Nordson Corporation Held Significant Market Share in 2024 Owing to Diversified Portfolios

Saint-Gobain, Freudenberg Medical, and Nordson Corporation accounted for significant market share in 2024 propelled by their diversified product portfolio, large customer base, and strong geographical presence. In addition, the focus of these players on introducing novel products to enhance fluid transfer technology is expected to maintain and strengthen their positions in the global market for medical tubing.

- For instance, in December 2023, Nordson Corporation launched Pharma+ Tubing Retainers, representing a significant leap forward in fluid transfer technology. These advanced tubing retainers were precisely engineered to address the critical challenges faced by experts in the biopharmaceutical and high-pressure medical sectors.

Other players, such as TE Connectivity, Elkem ASA, and W. L. Gore & Associates, Inc., are actively involved in numerous strategic activities such as geographic expansions and partnerships to gain significant market share of medical tubing during the forecast period.

LIST OF KEY COMPANIES PROFILED:

- Nordson Corporation (U.S.)

- Saint-Gobain (France)

- Freudenberg Medical (U.S.)

- The Lubrizol Corporation (U.S.)

- TE Connectivity (Switzerland)

- Elkem ASA (Norway)

- RAUMEDIC AG (U.S.)

- Teknor Apex (U.S.)

- Spectrum Plastics Group (Georgia)

KEY INDUSTRY DEVELOPMENTS:

- April 2024: Cobalt Polymers, a manufacturer of heat shrink tubing for the medical device industry, partnered with HnG Medical to distribute its tubing products in Asia.

- June 2023: TekniPlex announced a significant investment in novel medical tubing extrusion lines along with downstream equipment as part of an expansion to its manufacturing facility in Costa Rica.

- April 2023: Qosina collaborated with DuPont and added five new Liveo biopharmaceutical-grade tubing products to its tubing portfolio.

- October 2023: RAUMEDIC AG expanded its portfolio of biopharmaceutical fluid-processing products and launched a new biocompatible tubing brand.

- November 2022: Freudenberg Medical launched HelixFlex, a high-purity thermoplastic elastomer TPE tubing, for the Indian pharma market.

REPORT COVERAGE

The research report provides a detailed competitive landscape and focuses on crucial aspects such as new product launches and market dynamics. Additionally, it includes insights on the prevalence of chronic diseases and key industry developments, such as mergers, partnerships, and acquisitions. Moreover, it provides an analysis of different segments in various regions, profiles of key companies, offerings, and the impact of COVID-19 on the market. The report also encompasses qualitative and quantitative insights that contribute to the market growth.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.7% from 2025-2032 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Material

|

|

By Application

|

|

|

By Indication

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 9.04 billion in 2025.

The market is expected to exhibit a CAGR of 6.94% during the forecast period.

In 2025, North America’s market value stood at USD 4.13 billion.

By application, the catheterization segment is the leading segment as it captured a dominant market share in 2025.

The rising incidence of chronic diseases, increasing minimally invasive procedures, and advancements in material science are the key factors driving the market growth.

Saint-Gobain, Freudenberg Medical, and Nordson Corporation are the top players in the market.

North America dominated the market in 2025 and held the largest market share.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us