Micro Injection Molding Machine Market Size, Share & Industry Analysis, By Type (Hydraulic, Electric, and Hybrid), By Capacity (Up to 30 Tons, 30-50 Tons, and Above 50 Tons), By End-Use Industry (Automotive & Transportation, Medical & Healthcare, Electronics & Electrical, Packaging, Telecommunication & Optics, and Others), and Regional Forecast, 2026-2034

MICRO INJECTION MOLDING MACHINE MARKET SIZE AND FUTURE OUTLOOK

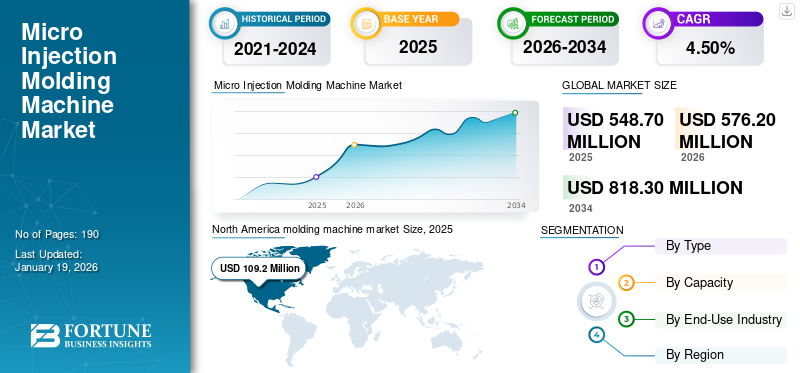

The global micro injection molding machine market size was valued at USD 548.7 million in 2025. The market is projected to grow from USD 576.2 million in 2026 to USD 818.3 million by 2034, exhibiting a CAGR of 4.50% during the forecast period. North America dominated the micro injection molding machine market with a market share of 19.90% in 2025.

Micro injection molding machines are used in creating plastic parts with tolerances between 10 and 100 microns and shot weights between 1 and 0.1 grams. This molding process ensures extremely accurate and precise creation of very small geometries. The obvious determining element for micro molding is part size. A component produced through this method features micro-scale dimensions, characteristics, and tolerances.

The growing demand for micro injection molding machines is attributed to market pull mainly in the areas of medical, electronics, and automotive sectors. Opportunities are connected with the rising use of microfluidics, lab-on-chip systems and micro-optical components, where precise molding is required. Recent developments include process technology that incorporates automatic process control with enhanced efficiency.

The main participants working in the market are Sumitomo (SHI) Demag, Engel Austria GmbH, Arburg GmbH + Co. KG, Nissei Plastic Industrial Co., Ltd., Sodick Co., Ltd., Milacron Holdings Corp., Husky Injection Molding Systems Ltd.

MARKET DYNAMICS

Market Drivers

Booming Demand in Medical Devices & Microelectronics Driving Market Growth

The micro injection molding machine market is experiencing high demand, driven by the growing need for ultra-precise plastic components in the medical device, microelectronics, and automotive sectors. The proliferation of minimally invasive surgical tools, microfluidics, wearables, and electronic connectors/sensors is also adding to the market growth. Medical applications such as microneedles combined with microfluidic systems for drug delivery and testing demonstrate the precise and clever technology, driving micro injection molding machine market growth.

According to the U.S. Census Bureau, the aging population and increase in chronic diseases are significantly boosting demand for sophisticated medical devices requiring high-precision micro molding technology. This driver is complemented by the electronics industry’s adoption of microinjection for compact wearable devices and microelectronics, making medical and electronics sectors the most significant contributors to market growth. The market is expected to grow substantially due to these technological advancements and demographic trends.

Market Restraints

High Precision Manufacturing Costs & Skilled Workforce Shortage Hinder Growth and Limit Market Scalability

The market is challenged in the growth aspects primarily due to the exceedingly tight tolerances that are required to manufacture components as small as a few microns. The need to achieve such precision is driving the demand for specialized molds, advanced cleanroom infrastructure, and higher-capital equipment, all contributing to the initial capital investment associated with micro molding. Furthermore, the industry lacks a large enough supply of highly skilled operators, mold designers, and toolmakers capable of executing complex micro molding processes. The nature of this limited skill set makes it challenging to scale operations and slow to make inroads into new markets. Without targeted training programs for the workforce and cost-cutting innovations, the large-scale commercialization of micro IMMs is limited.

Market Opportunities

Expansion in Microfluidics & Biotechnology Applications Drive Growth, Creating Opportunities for Innovation

The rapid growth of microfluidics and biotech applications is creating big opportunities for micro IMM manufacturers. Rising demand for point-of-care test kits, lab-on-chip devices, and personalized medicine is increasing the need for accurate, micro-molded parts. These higher valued applications allow machine suppliers to benefit from good margins, especially when working directly with biotech companies to create custom molding systems. In addition to the healthcare sector, additional opportunities are emerging in renewable energy integration, water conservation plumbing systems and high-efficiency HVAC systems, which require specialized Micro molded parts, allowing manufacturers a competitive advantage. Diversifying applications creates a more resilient revenue stream while serving as an opportunity to support advanced technology across the applications.

MICRO INJECTION MOLDING MACHINE MARKET TRENDS

Shift Toward Electric & Hybrid Micro IMM with Digital Integration as a Major Market Trend

One major trend in the global micro IMM market is the increase in all-electric and hybrid machines, with the rise of digital technology. Manufacturers are incorporating IoT-enabled sensors, artificial intelligence quality checks, and Industry 4.0 networks into their machines. These have enabled manufacturers to have real-time access to injection pressure, shot size, and mold cavity conditions to provide increased performance and minimized waste. Electric and hybrid machines also cost less to run, use less energy and produce less environmental impact than traditional hydraulic machines. This new technology is changing the competitive situation and giving early adopters an advantage in productivity and market leadership.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

High Preference for High Precision and Energy Efficiency Boosts Electric Segment Growth

Based on the type, the market is segmented into hydraulic, electric, and hybrid.

The electric segment held the largest share of 47.62% in the overall global market in the year 2026. The increase in revenue is driven by superior precision, consistent repeatability, and enhanced energy efficiency, making them the preferred choice for high-accuracy applications in the medical device and electronics industries. The electric segment also holds the highest CAGR of 5.8% in the global market. The growth of B2C spending is mainly due to the industry’s ongoing transition from hydraulic to electric systems. This shift is primarily fueled by increasing sustainability regulations, greater demand for cleanroom production environments, and the adoption of advanced Industry 4.0 automation technologies.

To know how our report can help streamline your business, Speak to Analyst

By Capacity

Bank Transfer Segment Dominates Market Owing to Its Widespread Adoption

Based on capacity, the market is divided into up to 30 tons, 30-50 tons, and above 50 tons.

The up to 30 tons segment dominated with a market share of 53.85% in 2026. The segment continues to generate the major revenue due to extensive utilization in microelectronics, medical consumables, and precision automotive sensors, where the demand for ultra-small, complex, and highly accurate components drives consistent and large-scale production requirements.

Above 50 tons holds the highest CAGR of 6.3% in the global market. The segment’s growth is mainly owing its growing adoption in packaging, automotive safety components, and specialized industrial applications. The rising need for larger shot sizes, higher clamping forces, and efficient production of complex multi-cavity molds is also fueling the segment’s expansion.

By End-Use Industry

Higher Volume of Global Cross-Border Payments Augments the Large Enterprises Segment Growth

Based on the end-use industry, the market is divided into automotive & transportation, medical & healthcare, electronics & electrical, packaging, telecommunication & optics, and others.

The medical & healthcare industry accounted for the largest micro injection molding machine market share of 29.92% in 2026. This growth is attributed to the essential role of micro injection molding in producing catheters, implants, surgical instruments, and diagnostic components, supported by stringent medical regulations and increasing global healthcare spending.

Electronics & electrical industry represents the largest CAGR at 5.4% in the global market. The industry is growing faster primarily due to the miniaturization of connectors, sensors, and semiconductor components. This trend is boosting adoption in consumer electronics and advanced communication devices, as precision molding supports complex designs, high performance, and reduced device size efficiently.

MICRO INJECTION MOLDING MACHINE MARKET REGIONAL OUTLOOK

Geographically the market is segmented into North America, Europe, Asia Pacific, South America and Middle East & Africa.

North America

North America continues to be a key region in the market, valued at USD 109.2 million in 2025 and reached USD 113.1 million in 2026. The region is driven by technological advancements and rising demand for precision components across manufacturing industries in the U.S. and Canada. Growth is further fueled by precision manufacturing needs in medical devices, semiconductor components, and electric vehicle parts. The U.S. is at the forefront of the North American market, with expected revenue of USD 79 million in 2026, driven by high demand from healthcare, electronics, and automotive industries.

North America molding machine market Size, 2025 (USD Million)

To get more information on the regional analysis of this market, Download Free sample

Europe

The European market is substantially growing and is likely to contribute to a revenue share of USD 85.2 million in 2026. This growth is due to increasing demand for high-precision, small-scale components across industries. Growth is fueled by advancements in medical technology, automotive manufacturing, and electronics, with manufacturers adopting innovative machinery to meet strict quality standards and support expanding production requirements across the region. The U.K., and Germany are some of the leading contributors to the growth in the market, with the required revenue stake of USD 14.4 million, and USD 18.4 million respectively by 2026.

Asia Pacific

The Asia Pacific market was valued at USD 322.5 million in 2026. The region accounts for the largest share driven by its dominant electronics and automotive manufacturing base, extensive medical device production, and availability of cost-competitive machinery and labor.

Moreover, the region is projected to record the highest CAGR of 5.6% globally. The region is set to grow the fastest as rapid industrialization, rising healthcare investments, and expanding semiconductor and microelectronics sectors continue to boost adoption of micro injection molding machines.

India, China and Japan are major contributors to the market growth with an expected revenue share of USD 61 million and USD 122.1 million and USD 44.8 million respectively by 2026.

South America and Middle East & Africa

The markets of South America and Middle East & Africa are growing with an expected share of USD 12.8 million and USD 30.7 million respectively in 2025 due expanding medical and automotive sectors and increasing demand for precision manufacturing solutions. GCC countries are predicted to have a market share of USD 17.9 million by 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Key Players Focus On Partnerships and Acquisitions to Lead the Industry

The key players in the micro injection molding machine market consist of specialized manufacturers and industrial technology providers with strong global presence and diversified product portfolios. These companies include Wittmann Battenfeld GmbH, Dr. Boy GmbH & Co. KG, Fanuc Corporation, Hillenbrand Inc., Chen Hsong Holdings Limited, KraussMaffei Technologies GmbH, Haitian International Holdings Limited, Makuta Micro Molding, and others. These market leaders leverage advanced engineering capabilities, continuous innovation in precision molding technologies, and strategic partnerships or acquisitions to enhance their competitiveness. Their focus on expanding production capacities, penetrating new regional markets, and meeting stringent quality standards positions them at the forefront of the industry.

LIST OF KEY MICRO INJECTION MOLDING MACHINE COMPANIES PROFILED:

- Sumitomo (SHI) Demag (Japan)

- Engel Austria GmbH (Austria)

- Arburg GmbH + Co. KG (Germany)

- Nissei Plastic Industrial Co., Ltd. (Japan)

- Sodick Co., Ltd. (Japan)

- Milacron Holdings Corp. (U.S.)

- Husky Injection Molding Systems Ltd. (Canada)

- Wittmann Battenfeld GmbH (Austria)

- Boy GmbH & Co. KG (Germany)

- Fanuc Corporation (Japan)

- Hillenbrand Inc. (U.S.)

- Chen Hsong Holdings Limited (Hong Kong, China)

- KraussMaffei Technologies GmbH (Germany)

- Haitian International Holdings Limited (China)

- Makuta Micro Molding (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- July 2025- Japan Steel Works (JSW) has unveiled “the industry’s first ultra-large electronic injection moulding machine”, the J400F-22000H. With a clamping force of 4,000 metric tons, the system is ideal for use with exterior parts like bumpers and tailgates as well as the conversion of electric vehicle battery cases in plastic.

- April 2025- Ansbach University of Applied Sciences is strengthening its technical center in the field of plastics technology with a Micropower injection moulding machine from Wittmann. The high-precision machine will be used in both teaching and applied research and will also serve to expand cooperation with industrial partners.

- October 2024- Milacron is ready to introduce its new all-electric injection moulding machine using monosandwich technology at Fakuma 2024. The eQ180 enables the production of multi-layer parts, using post-consumer recyclable (PCR) materials.

- September 2024- ENGEL AUSTRIA GmbH has expanded its technical center in St. Valentin, Austria, with one of the largest injection molding machines from its standard portfolio: the duo 5500 combi M. With a clamping force of 55,000 kN, this machine is the largest of its kind in any technical center worldwide, with impressive dimensions of 32 meters in length, 13 meters in width, 6.8 meters in height, and a weight of 545 tons.

- February 2024- Haitian UK announces the launch of its 5th Generation of Injection Moulding Machinery. Using AI algorithms and the latest sensor technology, the company is achieving intelligent optimisation of production processes and giving its machines the ability to self-recognise, self-adapt, self-decide, and self-reconstruct. The Generation 5 range is equipped with a wide range of flexible integration functions as standard.

REPORT COVERAGE

The global report provides a detailed analysis of the market and focuses on key aspects such as prominent companies, deployment modes, types, and end users of the product. Besides this, it offers insights into the micro injection molding machine market trends and highlights key industry developments and market share analysis for key companies. In addition to the above mentioned factors, the report encompasses several factors that have contributed to the growth of the market over recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

| Global Micro Injection Molding Machine Market Scope | |

| Study Period | 2021-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Growth Rate | CAGR of 4.50% from 2026-2034 |

| Historical Period | 2021-2024 |

| Unit | Value (USD Million) |

| Segmentation | By Type, Capacity, End-Use Industry, and Region |

| By Type |

|

| By Capacity |

|

| By End-Use Industry |

|

| By Region |

|

Frequently Asked Questions

The market is projected to grow from USD 576.2 million in 2026 to USD 818.3 million by 2034.

The market is expected to exhibit a CAGR of 4.50% during the forecast period.

Sumitomo (SHI) Demag (Japan), Engel Austria GmbH (Austria), Arburg GmbH + Co. KG (Germany) are the top players in the market.

The electric segment leads the market by type.

North America dominated the micro injection molding machine market with a market share of 19.90% in 2025.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us