Mineral Supplements Market Size, Share & Industry Analysis, By Product (Calcium, Magnesium, Iron, Potassium, Zinc, and Others), By Type (Individual Minerals and Multiminerals), By Formulation (Capsule, Tablet, Powder, Liquid/Gel, and Others), By Age Group (Pediatrics and Adults), By Application (General Health, Bone & Joint Health, Gastrointestinal Health, Women's Health, and Others), By Distribution Channel (Retail Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Online Channels, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

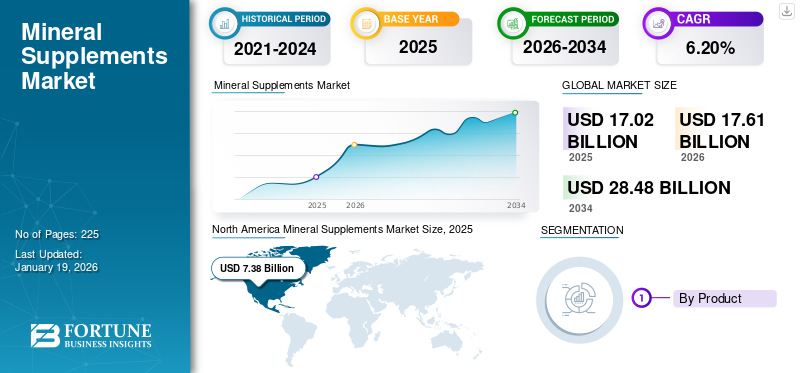

The global mineral supplements market size was valued at USD 17.02 billion in 2025 and is projected to grow from USD 17.61 billion in 2026 to USD 28.48 billion by 2034, exhibiting a CAGR of 6.20% during the forecast period. North America dominated the mineral supplements market with a market share of 43.35% in 2025.

Mineral supplements are dietary products containing one or more essential minerals, intended to increase an individual's total mineral intake when food alone is insufficient. These nutrients play an important role in filling nutrient gaps for certain groups, such as pregnant women, older adults, infants, and individuals with restrictive diets or certain health conditions. Prominent factors such as increasing health awareness, rising nutritional deficiencies, and changing lifestyle patterns are supporting the upward trajectory of the market.

The market encompasses several major players such as Abbott, Amway Corp, Bayer AG, and others. A wide range of product portfolios, coupled with strong geographic expansion, has supported the dominance of these companies in the global market.

MARKET DYNAMICS

MARKET DRIVERS

Rising Health & Wellness Awareness Amongst General Population to Drive Market Growth

One of the prominent growth drivers in the mineral supplements market is the increasing global emphasis on health, wellness, and preventive care. Preventive healthcare focuses on avoiding deficiencies and maintaining long-term health. In recent years, individuals have been focusing on managing their diet by proactively supplementing with calcium, magnesium, zinc, and multi-mineral blends. This approach aims to reduce the risk of chronic conditions such as osteoporosis, cardiovascular disease, and immune dysfunction. Additionally, the COVID-19 pandemic accelerated this trend as people sought to boost their immunity and overall resilience. Furthermore, increasing social media influence and the adoption of telehealth platforms have also increased awareness, thereby driving the overall mineral supplements market growth.

- For instance, according to the data published by the Council for Responsible Nutrition (CRN) survey in October 2022, more than 75% of U.S. adults use dietary supplements, with minerals among the most common.

MARKET RESTRAINTS

Adverse Effects & Overconsumption Risks to Restrict Market Expansion

Excessive intake or improper usage of mineral supplements can cause adverse health effects, thereby limiting their long-term growth potential. This factor is especially significant as many consumers self-prescribe supplements without professional guidance, leading to negative health outcomes. Overconsumption of mineral supplements can cause gastrointestinal issues such as nausea, vomiting, and diarrhea, and more serious problems such as organ damage, impaired immune function, and interactions with other medications. In addition, specific risks include iron overload causing organ damage, excess calcium leading to kidney stones and hypercalcemia, and excess zinc intake impairing copper absorption and immune function. The confluence of all these factors is anticipated to limit market growth.

- For example, the U.S. FDA had already issued warnings about iron toxicity in children, as accidental overdoses from flavored chewables have led to hospitalizations in the U.S.

MARKET OPPORTUNITIES

Innovation in Formulations to Create Lucrative Growth Opportunities

Traditionally, tablets, and capsules have dominated this market. However, in recent years, consumer behavior has shifted toward more convenient, palatable, and novel delivery formats. This trend is driven by factors such as swallowing difficulties, lifestyle preferences, and demand for better absorption. Innovative formulations such as Gummies, powders, and effervescent tablets offer several advantages, including improved convenience & compliance, enhanced taste & experience, and faster and more efficient absorption. Owing to these benefits, the demand for such innovative formulations is expected to increase significantly in the near future, thereby creating lucrative growth opportunities.

- For instance, in July 2025, Bayer AG introduced One A Day Kids Multi with Iron for kids.

MINERAL SUPPLEMENTS MARKET TRENDS

Shift from Single Minerals to Multi-mineral Products is One of the Significant Mineral Supplements Market Trends

In recent years, the market has witnessed the shift from single-mineral products to multi-mineral products. This shift can be attributed to increasing consumer preference for convenience and cost-effectiveness through comprehensive products. Consumers are increasingly looking for inclusive solutions that address multiple health concerns within a single formulation, rather than taking separate pills for each mineral. Multi-mineral products provide a balanced nutrient profile that supports bone, immune, and metabolic health simultaneously, resulting in stronger market growth.

- For instance, Pharmavite’s Nature Made Multi Mineral combines calcium, magnesium, and zinc to promote both bone and immune function.

MARKET CHALLENGES

Counterfeit & Low-Quality Products to Hamper Market Growth

The global market faces a significant challenge from the proliferation of fake, adulterated, or low-quality products, especially in emerging markets, where regulatory oversight is comparatively weaker. These products erode consumer trust, pose health risks, and damage the credibility of legitimate brands. Many consumers in developing economies choose low-cost alternatives, unknowingly purchasing counterfeit or diluted mineral supplements. Additionally, online platforms, third-party marketplaces, and social media sellers have made it easier for counterfeiters to reach consumers globally. Owing to this, the growth of the mineral supplements market faces slower adoption of legitimate products.

- For instance, in April 2023, supplement company NOW reported fake products imitating its brand being sold on Amazon.

Download Free sample to learn more about this report.

Segmentation Analysis

By Product

Rising Geriatric Population Boosted Calcium Segment Growth

On the basis of product, the market is classified into calcium, magnesium, iron, potassium, zinc, and others.

To know how our report can help streamline your business, Speak to Analyst

The calcium segment accounted for the largest mineral supplements market share in 2026 with 32.25%. The rising geriatric population and rising incidence of calcium deficiency have primarily driven the segment’s growth. Calcium is the most widely consumed mineral supplement as it helps prevent osteoporosis, fractures, and bone density loss, conditions that are especially prevalent in the aging population. Additionally, high usage of calcium supplements in women’s health also supplements the segment’s growth.

- For instance, according to an article published in the International Journal of Basic & Clinical Pharmacology in July 2025, more than 200 million individuals were affected by osteoporosis across the world.

By Type

Presence of Well-Established Companies Contributed to Individual Minerals Segment Growth

On the basis of type, the market is segmented into individual minerals and multiminerals.

The individual minerals segment dominated the market with a 64.99% share in 2026. The strong consumer demand for single-nutrient deficiency management, coupled with the increasing number of prescriptions to address specific health conditions, has majorly driven the segment’s growth. Moreover, the presence of well-established companies in offering these products also supplements the segment’s growth.

- For instance, Caltrate (Abbott) and Magnesium Citrate (NOW Foods) are some of the leading brands in this segment.

The multiminerals segment is expected to grow at a CAGR of 6.68% over the study period.

By Formulation

Capsules Segment Dominated due to its Advantages

In terms of formulation, the market is divided into capsule, tablet, powder, liquid/gel, and others.

The capsules segment held the leading share of the market in 2026 with 39.14% of the market share. This can be attributed to convenience, bioavailability, and consumer preference compared to tablets, powders, or liquids. Capsules are easier to swallow than large tablets, making them more appealing to both adults and elderly consumers. They also allow for better absorption and faster disintegration in the digestive tract, which enhances the bioavailability of minerals such as magnesium and zinc.

- For instance, Nature’s Bounty and NOW Foods are some of the leading companies that extensively offer capsule-based magnesium, calcium, and multimineral supplements.

The powder segment is expected to grow at a CAGR of 6.92% over the forecast years.

By Age Group

Rising Awareness Among Parents Encouraged Pediatrics Segment Growth

On the basis of age group, the market is segmented into pediatrics and adults.

The pediatrics segment is projected to witness the fastest growth in the mineral supplements market. Key factors supporting this growth include rising awareness among parents and healthcare providers about the importance of early-life nutrition in preventing deficiencies and supporting long-term health. Moreover, the increasing prevalence of iron-deficiency, anemia, and calcium deficiency among children, especially in developing regions such as Asia Pacific and Africa, also increases the demand from this age group. Additionally, government initiatives to promote supplementation programs also support the segment’s growth.

- For instance, the Government of India had introduced India’s Anemia Mukt Bharat initiative in December 2018 to combat anemia through a 6X6X6 approach, targeting six beneficiary age groups with six key interventions and six institutional mechanisms.

The adults segment represented the largest sub-segment holding an 80.03% market share.

By Application

Women’s Health Segment to Dominate due to Increasing Focus on Prenatal and Postnatal Nutrition

In terms of application, the market is categorized into general health, bone & joint health, gastrointestinal health, women's health, and others.

The women’s health segment is likely to witness the fastest growth over the forecast period. Rising awareness about issues such as iron-deficiency anemia, which affects nearly one-third of women globally, is driving increased adoption of iron and multimineral supplements. Additionally, the growing focus on prenatal and postnatal nutrition is fueling demand for mineral supplements tailored to maternal health.

- For instance, Abbott’s Similac Mom and Bayer’s One A Day Women’s formulations specifically address women’s mineral requirements for bone, reproductive, and immune health.

The bone & joint health segment is expected to witness 5.23% growth over the forecast period.

By Distribution Channel

Retail Pharmacies & Drug Stores Segment Led the Market due to their Strong Credibility

Based on distribution channel, the market is segmented into retail pharmacies & drug stores, supermarkets & hypermarkets, online channels, and others.

In 2024, retail pharmacies & drug stores held the dominating share of the global market. This is owing to their strong credibility, established distribution networks, and role in bridging supplements with professional healthcare advice. Furthermore, the segment is set to hold a 43.0% share by 2025.

- For instance, brands such as Centrum (Pfizer) and Caltrate (Abbott) are widely distributed through major pharmacy chains such as CVS, Walgreens (U.S.), Boots (U.K.), and Apollo Pharmacy (India).

The online channels segment is projected to grow at a CAGR of 10.03% during the forecast period.

Mineral Supplements Market Regional Outlook

By geography, the market is divided into Europe, North America, Asia Pacific, Latin America, and Middle East & Africa.

North America Mineral Supplements Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America

The North America region captured the dominating share of the global market in 2025, valued at USD 7.38 billion. The dominance of the region can be attributed to the factors such as high consumer awareness, strong purchasing power, and advanced healthcare infrastructure. In 2025, the U.S. market is estimated to reach USD 6.71 billion. The country has one of the highest supplement usage rates worldwide, which supports the country’s market growth.

- For instance, according to the data published by Canadian Science Publishing in June 2021, 38% Canadian men and 53% Canadian women use vitamin/mineral supplements.

Europe

On the other hand, markets in the Europe and Asia Pacific regions are projected to grow at a notable rate in the near future. During the forecast period, the European region is anticipated to grow at a CAGR of 4.97%, which is the second largest region amongst all the regions and touch the valuation of USD 3.91 billion in 2025. Key factors responsible for this include increasing awareness among the general population, advanced healthcare infrastructures, along with the rising number of government initiatives in the region. The UK market is valued at USD 0.85 billion by 2026, while the Germany market is valued at USD 0.97 billion by 2026. After Europe, the market in Asia Pacific is expected to reach USD 3.84 billion in 2025 and secure the position of the third-largest region in the market. In the region, India and China are both estimated to reach USD 0.56 billion and USD 1.06 billion, respectively, in 2025.

Latin America and Middle East & Africa

Latin America and Middle East & Africa regions are likely to witness a slower growth over the study period. Latin America market in 2025 is set to record USD 1.00 billion as its valuation. Improvements in healthcare infrastructure is anticipated to drive the adoption of these products in these regions in the coming years. In Middle East & Africa, GCC is set to attain the value of USD 0.37 billion in 2025.

COMPETITIVE LANDSCAPE

Key Industry Players

Strong Geographical Presence of Leading Companies Supported their Dominating Position

The global mineral supplements market is highly fragmented, with a few large multinational companies holding significant shares, alongside numerous regional players and emerging startups. Leading companies such as Abbott, Bayer AG, Pfizer Inc., Amway Corp., Nestlé Health Science, and Herbalife Nutrition dominate the market. This can be attributed to their broad product portfolios, established global distribution networks, and strong brand recognition. Their strong penetration through retail pharmacies, supermarkets, and online platforms further reinforces their leading position.

The other prominent players include Pharmavite, Glanbia plc, NOW Foods, Nature’s Bounty (The Bountiful Company), and Nu Skin Enterprises. These companies are focusing on innovative formulations, improved offerings, and plant-based mineral sources to gain a competitive edge.

- For instance, in May 2023, Bayer AG expanded its One A Day Gummies portfolio in North America with the introduction of new multimineral products targeting immunity and women’s health.

LIST OF KEY MINERAL SUPPLEMENTS COMPANIES PROFILED

- Amway Corp (U.S.)

- Abbott (U.S.)

- Herbalife International of America, Inc. (U.S.)

- Bayer AG (Germany)

- Bio Botanica, Inc. (U.S.)

- Glanbia plc (Ireland)

- Sanofi (France)

- Pfizer Inc. (U.S.)

- Pharmavite (U.S.)

- Catalent, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

- September 2025: Dialed Moods introduced new range of plant-based wellness gummies packed with herbs, superfoods, and minerals.

- July 2025: Menerals, a new men’s health supplement brand introduced more than 100 trace minerals to combat testosterone decline, nutrient deficiency, and performance burnout.

- April 2025: Centrum launched Centrum Recharge to enable consumers to regain essential vitamins and minerals lost during daily activities.

- May 2022: Thai Group Ingredients, one of the global dietary supplements manufacturers, opened its R&D facility for dietary products in Samut Sakhon, Thailand.

- May 2025: Pharmavite, a subsidiary of Otsuka Pharmaceutical Co., Ltd. opened a new facility in New Albany, Ohio, dedicated to gummy‐type supplements.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.20% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Product · Calcium · Magnesium · Iron · Potassium · Zinc · Others |

|

By Type · Individual Minerals · Multiminerals |

|

|

By Formulation · Capsule · Tablet · Powder · Liquid/Gel · Others |

|

|

By Age Group · Pediatrics · Adults |

|

|

By Application · General Health · Bone & Joint Health · Gastrointestinal Health · Women's Health · Others |

|

|

By Distribution Channel · Retail Pharmacies & Drug Stores · Supermarkets & Hypermarkets · Online Channels · Others |

|

|

By Geography · North America (By Product, Type, Formulation, Age Group, Application, Distribution Channel, and Country) o U.S. o Canada · Europe (By Product, Type, Formulation, Age Group, Application, Distribution Channel, and Country/Sub-region) o Germany o U.K. o France o Spain o Italy o Scandinavia o Rest of Europe · Asia Pacific (By Product, Type, Formulation, Age Group, Application, Distribution Channel, and Country/Sub-region) o China o Japan o India o Australia o Southeast Asia o Rest of Asia Pacific · Latin America (By Product, Type, Formulation, Age Group, Application, Distribution Channel, and Country/Sub-region) o Brazil o Mexico o Rest of Latin America · Middle East & Africa (By Product, Type, Formulation, Age Group, Application, Distribution Channel, and Country/Sub-region) o GCC o South Africa · Rest of the Middle East & Africa |

Frequently Asked Questions

The global mineral supplements market size was valued at USD 17.61 billion in 2026 and is projected to reach USD 28.48 billion by 2034, exhibiting a CAGR of 6.20% during the forecast period.

In 2025, the market value stood at USD 7.38 billion.

The market is expected to exhibit a CAGR of 6.20% during the forecast period (2026-2034).

The calcium segment led the market by product.

The key factors driving the market are rising health & wellness awareness and increasing nutritional deficiencies.

Abbott, Bayer AG, Pfizer Inc., and Amway Corp. are some of the prominent players in the market.

North America dominated the market in 2025.

Shift toward preventive healthcare and innovation in products are some of the factors that are expected to favor the product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us