Modular Gas Processing Plant Market Size, Share & Industry Analysis, By Type (LNG, LPG, CNG, Heavy Hydrocarbon Removal Unit, and Others), By Application (Onshore and Offshore), and Regional Forecast, 2026-2034

Modular Gas Processing Plant Market Size

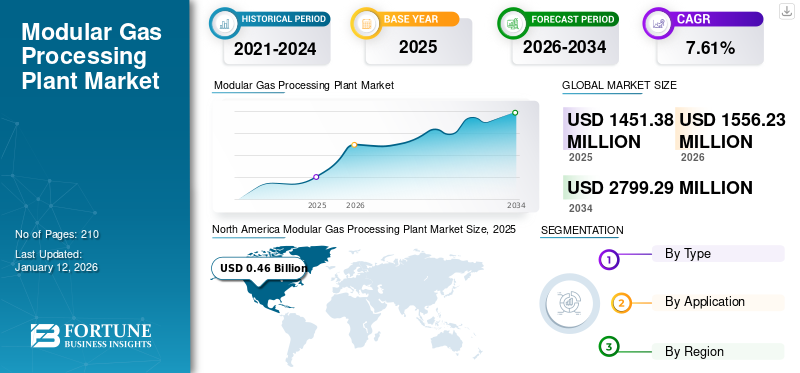

The global modular gas processing plant market size was valued at USD 1.45 billion in 2025. The market is projected to be worth USD 1.56 billion in 2026 and reach USD 2.79 billion by 2034, exhibiting a CAGR of 7.61% during the forecast period. North America dominated the global market with a share of 31.81% in 2025.

A modular gas processing plant is a facility that processes natural gas using prefabricated modules that can be manufactured off-site and assembled on location. This method allows for greater flexibility, scalability, and cost-effectiveness compared to traditional construction methods. The market is growing due to the increasing demand for natural gas as a cleaner energy source and advancements in technology that make modular plants more efficient and reliable. Modular plants offer quick deployment and portability, making them ideal for remote or stimulating locations where traditional construction may be difficult. As the world transitions toward cleaner energy sources, natural gas plays a vital role, and modular plants provide an efficient and scalable solution for processing it.

Modular Gas Processing Plant Market Overview

Market Size:

- 2025 Value: USD 1.45 billion

- 2026 Projected Value: USD 1.56 billion

- 2034 Forecast Value: USD 2.79 billion with a CAGR of approximately 7.61% from 2026 to 2034

Market Share:

- Regional Leader: North America held approximately 31.81% of the global market in 2025

- End‑User Leader: The LNG (Liquefied Natural Gas) segment leads by gas type globally

Industry Trends:

- Rapid rise in technological innovation—modular plants are increasingly compact, transportable, and efficient

- Strong government support and policy incentives, particularly in clean energy and natural gas infrastructure sectors

- Growing adoption of prefabricated modular solutions, enabling faster deployment in remote or challenging locations

Driving Factors:

- Increasing demand for natural gas, seen as a cleaner energy alternative compared to coal or oil

- Government initiatives and favorable fiscal regimes supporting natural gas infrastructure development

- Need for flexible, scalable plant solutions that can be quickly deployed in remote production zones

- Advancements in modular plant design and processing technologies, enhancing reliability and operational efficiency

- Focus on sustainability and cleaner energy transitions, with modular gas plants offering lower emissions and faster implementation

The global impact of COVID-19 pandemic on the market was moderate, as it hampered consumption in many end-use industries' growth due to disruptions in the supply chain of services and technology and hindered activities due to social distancing norms. Furthermore, China, the U.S., and India are among the significant countries manufacturing and deploying modular gas processing technology. These countries experienced various regional and national-level shutdowns of industrial operations to contain the spread of this viral infection, which led to a fall in demand for plant installation.

Modular Gas Processing Plant Market Trends

Technological Advancements and Government Support and Policies

Technological advancements and innovations are significantly growing in the modular gas processing plant industry. These plants are designed to be compact, portable, and easily transportable to remote locations where natural gas is produced. These plants incorporate a wide range of advanced processing equipment, such as compressors, separators, and dehydrators, which are used to remove impurities from natural gas and prepare it for distribution. The increasing demand for cleaner energy fuels, such as natural gas, which produces lower emissions than fossil fuels such as coal or oil, is a key factor propelling market expansion. Governments around the world have recognized the potential of modular gas processing to reduce greenhouse gas emissions and dependence on fossil fuels, leading to the implementation of policies and programs to support their development.

Download Free sample to learn more about this report.

Modular Gas Processing Plant Market Growth Factors

Government Initiatives and Fiscal Regime in Natural Gas to Create Market Opportunities

Government initiatives and regimes create industrial opportunities by providing a supportive environment for the development and operation of plants. These initiatives may involve promoting the use of cleaner energy sources, such as natural gas, and supporting infrastructure development for the extraction, processing, and distribution of natural gas. For instance, the Indian government's "Vision 2030" for natural gas infrastructure aims to develop a nationwide natural gas pipeline grid and create a free market for gas trading. This vision includes initiatives such as developing trading hubs and trading platforms and creating sufficient depth in the Indian natural gas industry. Such initiatives create industrial opportunities by encouraging investments in the upstream and midstream gas sectors, which in turn drive the demand for the market.

A well-planned fiscal regime can incentivize companies to invest in the extraction and processing of natural gas, leading to increased demand for modular gas processing plants growth. The U.K. oil and gas focus on investment and supports development of the oil and gas industry by reviewing tax structures to ensure competitiveness and attractiveness to investors.

Increasing Demand for Clean Energy Fuel to Drive Market Growth

Implementation of policies and programs to support the development of modular gas processing technology is crucial due to initiatives toward reducing greenhouse gas emissions and decreasing dependence on fossil fuels. Natural gas is considered a cleaner alternative to traditional petroleum fuels such as gasoline and diesel. As the world shifts toward cleaner energy sources to combat climate change and reduce emissions, the demand for natural gas, and consequently MGP plants, is on the rise. Modular gas processing plants play a vital role in meeting the growing demand for natural gas. These plants can be swiftly deployed, especially in remote locations where natural gas resources are abundant but infrastructure is limited. By efficiently processing natural gas for various uses, such as heating, electricity generation, and transportation, these plants contribute to meeting the increasing demand for clean energy fuels.

According to the IEA, in 2023, the global demand for gas experienced a modest increase of 0.5%. This growth was driven by expansions in China, North America, and gas-rich nations in Africa and the Middle East, although decreases in other regions partially counterbalanced it. With the easing of pandemic restrictions and the resumption of economic activities, China reclaimed its position as the leading importer of LNG globally. However, China's LNG imports in 2023 remained below the levels observed in 2021. There was a 7% rise in natural gas demand. Conversely, Europe witnessed a 7% decline in natural gas consumption, marking its lowest level since 1995. This reduction was exacerbated by the rapid proliferation of renewable energy sources and the increased availability of nuclear power, which exerted downward pressure on natural gas demand in Europe and established markets in Asia, consequently leading to a drop in prices.

RESTRAINING FACTORS

High Cost and Investment May Hamper Market Growth

The industry is capital-intensive due to the advanced technology and equipment required for processing natural gas efficiently. High initial investments in infrastructure, equipment, and skilled labor can prevent new entrants and smaller companies from entering the market, limiting competition and innovation. Beyond initial investments, operational costs such as maintenance, energy consumption, and compliance with environmental regulations can be substantial. These ongoing expenses can stress profit margins, especially for smaller players, impacting their ability to scale up operations and invest in research and development for technological advancement.

Regulatory environments, especially concerning carbon pricing, emissions regulations, or changes in government policies, can increase investment risks. Companies may hesitate to commit to long-term projects or expansions if regulatory changes could affect their profitability or operational viability.

Modular Gas Processing Plant Market Segmentation Analysis

By Type Analysis

LNG is Dominating the Market Due to its Rising Demand in Residential and Industrial Applications

Based on type, the market is segmented into LNG, LPG, CNG, heavy hydrocarbon removal unit, and others.

LNG holds a dominant modular gas processing plant market share due to its increasing demand in residential and industrial applications. The rising demand for LNG, increasing by its cleaner burning properties and versatility in various sectors, has stood it as a primary fuel source in the market. On the other hand, LPG follows LNG as the second dominating fuel source in this market, offering flexibility and efficiency in applications where natural gas accessibility or feasibility is limited. The LNG segment is projected to dominate the market with a share of 33.35% in 2026.

LPG holds the second major share of the global market due to rising demand in sectors, such as petrochemicals, automotive, metal, and ceramic industries. The LPG industry is adapting to changing economic, environmental, and technological landscapes.

To know how our report can help streamline your business, Speak to Analyst

By Application Analysis

Increasing Investment in Onshore Location is Set to Dominate the Market

Based on application, the market is segmented into onshore and offshore. The rise in onshore exploration and production projects, the prevalence of natural gas pipelines, and the availability of abundant natural gas reserves are factors contributing to the increasing investment and market dominance in onshore locations. The onshore segment is expected to lead the market, contributing 88.55% globally in 2026.

The offshore application is increasing due to limited space and weight capacity on offshore platforms and floating production units. Modular gas processing plants are designed to be compact and lightweight, making them ideal for offshore applications.

REGIONAL INSIGHTS

Geographically, the market has been studied across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Modular Gas Processing Plant Market Size, 2025

To get more information on the regional analysis of this market, Download Free sample

Globally, North America dominates the market and accounts for the majority of installed modular gas processing plants market share. North America has vast natural gas reserves, particularly in the U.S. This abundance of natural gas creates a strong demand for modular gas processing plants to extract and process the gas for various applications efficiently. The development of LNG export facilities, such as Venture Global LNG's Calcasieu Pass and Dominion Energy's Cove Point, enables the U.S. to capitalize on its resource of natural gas and meet the increasing global demand for cleaner energy sources. The U.S. market is estimated to reach USD 0.44 billion by 2026.

Asia Pacific

Asia Pacific is the second leading region with significant modular gas processing plant market growth. The region is experiencing rapid industrialization and urbanization, leading to a substantial increase in energy demand. China, India, Japan, and South Korea have made significant investments in natural gas infrastructure, including LPG and LNG projects. As a result, there is a growing focus on increasing gas plant reliability, stability, and resilience, driving the adoption of such products to support the integration of clean fuel sources and improve natural gas demand. The Japan market is forecast to reach USD 0.56 billion by 2026, the China market is set to reach USD 0.17 billion by 2026, and the India market is likely to reach USD 0.89 billion by 2026.

Europe

Europe has witnessed a substantial increasing demand for cleaner energy sources, focused on environmental concerns and sustainability goals, which has led to a growing need for modular gas processing plants. These plants play a crucial role in processing natural gas efficiently and reducing emissions, aligning with Europe's focus on clean energy solutions. Collaboration between industry players, research institutions, and government bodies in Europe has raised innovation and investment. The UK market is expected to reach USD 0.46 billion by 2026, while the Germany market is anticipated to reach USD 0.57 billion by 2026.

In Latin America and the Middle East & Africa the market’s growth is credited to constant investment in natural gas plant development and technology.

List of Key Companies in Modular Gas Processing Plant Market

Key and Regional Players Meet Local and National Demands Across the Value Chain

The global modular gas processing plant market is highly fragmented, with key players and some medium-scale regional players delivering a wide range of products at local as well as country levels across the value chain. Numerous companies are actively operating across different countries to cater to the specific demands of the customers.

Honeywell is expected to account for a significant market share owing to its extensive product portfolio, strong brand value, and continuous new project and technology development. Furthermore, the company is also focused on enhancing its sales, distribution, and marketing channels through partnerships with different local associates to fortify its product reach across the globe.

LIST OF TOP MODULAR GAS PROCESSING PLANT COMPANIES:

- Honeywell International Inc (U.S.)

- Peiyang Chemical Equipment (China)

- Linde plc (Ireland)

- EN-FAB, Inc (U.S.)

- GazSurf, LLC (Russia)

- Pioneer Energy (Canada)

- Expro (U.S.)

- Chiyoda Corporation (Japan)

- JFE Engineering (Japan)

- Black and Veatch (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- April 2024 – Archaea Energy recently brought its largest original Archaea Modular Design (AMD) Renewable Natural Gas (RNG) facility to date in Shawnee, Kansas. The facility, located next to a large landfill, can process 9,600 standard cubic meters of landfill per minute into RNG, enough to heat around 38,000 homes a year.

- January 2023 – GazSurf developed a standard line of modular block units for gas processing. These blocks allow for the implementation of a technological chain for gas processing plants, ranging from basic field gas processing setups to advanced facilities that achieve over 90% recovery of liquid hydrocarbons and produce a variety of end products.

- April 2023 – Strike Energy completed initial engineering work with Technip Energies for an affordable, modular, and scalable gas plant. This facility would be located at the company's Mid-West Low Carbon Manufacturing Precinct, coinciding with the commissioning of the South Erregulla gas field.

- April 2022 – Modular Plant Solutions (MPS), focusing on process modularization and project execution, announced its contract to help Arbor Renewable Gas in building the first-ever modularized green gasoline plant. The Spindletop Plant, located in Beaumont, Texas, would transform woody biomass, including pre-commercial thinning and forest residue, into ready-to-use, carbon-negative green gasoline, contributing to the rising demand for low-carbon intensity fuels.

- October 2020 – West Virginia Methanol Inc. constructed a plant in Pleasants County to produce ultrapure methanol from natural gas. The plant represented a USD 350 million investment and would provide 30 full-time jobs, excluding the construction work required to build the plant.

REPORT COVERAGE

The report provides a detailed analysis of the market and focuses on key aspects such as leading companies, product/service types, and leading applications of the product. Besides, it offers insights into the market trends and highlights key industry developments. In addition to the factors above, the report encompasses several factors that contributed to the growth of the market in recent years.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 7.61% from 2026 to 2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By Region

|

Frequently Asked Questions

As per the Fortune Business Insights study, the market size was at USD 1.45 billion in 2025.

The market is likely to grow at a CAGR of 7.61% over the forecast period (2026-2034).

The LNG segment leads the market due to the development of modular gas processing plants globally.

The market size of North America stood at USD 0.46 billion in 2025.

Government initiatives and fiscal regime in natural gas and increasing demand for clean energy fuel are the key factors driving market growth.

Some of the top players in the market are Honeywell International Inc, Peiyang Chemical Equipment, and Linde plc.

The global market size is expected to reach USD 2.79 billion by 2034.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us