Molecular Imaging Market Size, Share & Industry Analysis, By Type (Positron Emission Tomography (PET), Single-Photon Emission Computed Tomography (SPECT), and Others), By Application (Cardiology, Oncology, Orthopedics, Gynecology, Neurology, and Others), By End-user (Hospitals, Specialty Clinics, Diagnostic Imaging Centers, and Others), and Regional Forecast, 2026-2034

KEY MARKET INSIGHTS

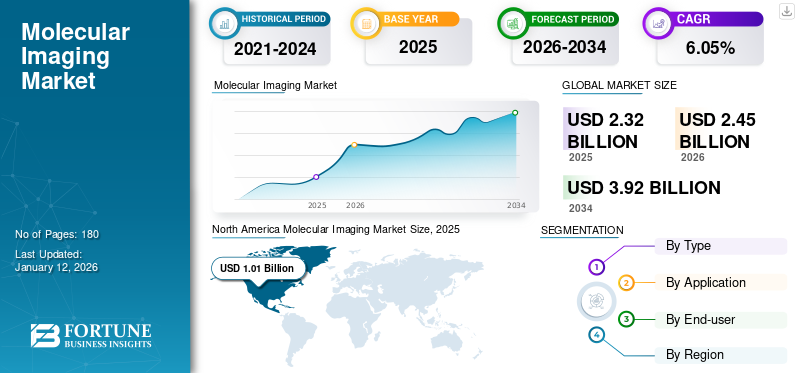

The global molecular imaging market size was valued at USD 2.32 billion in 2025. The market is projected to grow from USD 2.45 billion in 2026 to USD 3.92 billion by 2034, exhibiting a CAGR of 6.05% during the forecast period. North America dominated the molecular imaging market with a market share of 43.69% in 2025.

Molecular imaging uses advanced imaging technologies to visualize, characterize, and measure biological processes at the cellular and molecular levels within the patients. The market is driven by the growing prevalence of acute and chronic conditions resulting in an increasing diagnosis rate among the patients. This, along with the growing number of key players such as GE Healthcare, Siemens Healthineers AG, and others focusing on R&D activities to develop and introduce innovative products such as positron emission tomography scanners, is expected to support their increasing global market share.

- According to 2024 statistics published by the National Cancer Institute (NCI), it was estimated that about 2.0 million new cancer cases will be diagnosed in the U.S.

Global Molecular Imaging Market Key Takeaways

Market Size & Forecast:

- 2025 Market Size: USD 2.32 billion

- 2026 Market Size: USD 2.45 billion

- 2034 Forecast Market Size: USD 3.92 billion

- CAGR: 6.05% from 2026–2034

Market Share:

- North America dominated the molecular imaging market with a 43.69% share in 2025, driven by rising healthcare expenditure, high adoption of advanced diagnostic tools, and a strong presence of leading market players such as GE Healthcare and Siemens Healthineers.

- By Type, Positron Emission Tomography (PET) is expected to retain the largest market share in 2025, supported by increasing cases of neurological disorders, favorable per capita imaging scanner installations, and greater clinical accuracy in detecting chronic diseases.

Key Country Highlights:

- Japan: Market growth is driven by the aging population and high incidence of neurological and cardiovascular diseases, encouraging the use of hybrid imaging technologies such as PET/CT and SPECT/CT. Companies like Shimadzu and Canon Medical are also enhancing R&D to expand their diagnostic imaging portfolios.

- United States: Rising cancer and cardiovascular disease prevalence, increased healthcare spending, and favorable reimbursement policies support growing adoption of PET and SPECT systems. The country also leads in technological innovations and early regulatory approvals for advanced imaging equipment.

- China: Rapidly growing geriatric population (297 million people aged 60+ in 2023), expanding healthcare infrastructure, and strategic acquisitions by local and global players are accelerating demand for advanced imaging systems, especially in oncology and neurology applications.

- Europe: Growth supported by increasing installed base of PET/CT and SPECT scanners, government support for research in diagnostic imaging, and manufacturing expansion by players like Siemens and Philips. The Netherlands leads in PET scanner availability with 2.33 units per million population.

MARKET DYNAMICS

MARKET DRIVERS

Increasing Prevalence of Chronic Disorders to Augment Product Demand in the Market

The growing prevalence of chronic disorders, including Alzheimer’s disease, cancer, and others, is expected to increase the number of patients requiring proper diagnosis and treatment globally. The increasing geriatric population is another crucial factor resulting in the growing patient population suffering from these conditions. Thus, the rising geriatric population, coupled with an expanding inclination toward a sedentary lifestyle, is prominently expected to spike the prevalence of chronic ailments.

- According to the 2024 data published by the Pew Research Center, there are currently 62 million adults aged 65 and above living in the U.S. Additionally, the geriatric population is expected to reach 84 million adults by 2054.

Rapidly rising incidence of neurological conditions, combined with cardiac as well as musculoskeletal conditions, is dominantly responsible for increasing global molecular imaging market growth. According to a 2023 report published by the Alzheimer's Association, more than 6 million Americans are living with Alzheimer’s Disease.

The growing diagnosis rate of various neurological conditions, such as Parkinson’s disease and multiple sclerosis, in countries such as the U.S. and the U.K. is expected to boost the demand for these scanners, such as PET scanners, in healthcare settings.

Therefore, the growing prevalence of chronic conditions, including musculoskeletal and neurological conditions, coupled with increasing awareness among the general population, is expected to boost the demand for products for the diagnosis of these conditions.

MARKET RESTRAINTS

High Cost Associated with Molecular Imaging Equipment to Limit Market Expansion

There is an increasing demand for imaging equipment, such as PET scanners and SPECT scanners, in healthcare settings. However, one of the key factors that limit the adoption of these devices is the high cost associated with the products. The direct cost involved in the purchase and implementation of imaging equipment is very high due to the inclusion of manufacturing costs, distributors’ margins, and service costs. With the increasing technological advancements in this equipment by the key players operating in the market, the prices for these products are increasing owing to the initial manufacturing cost of the advanced products with novel technologies, which is expected to hamper the market growth significantly, especially in the lower income countries.

- For instance, according to the data published by PatientImage, the price of a new PET/CT scanner ranges from USD 0.5 million to over USD 5.0 million.

The high prices associated with these imaging devices are anticipated to hinder the adoption rate among the population globally.

MARKET OPPORTUNITIES

Growing Number of Medical Applications Pertaining to Molecular Imaging Equipment Offers High Growth Opportunity

The molecular imaging technique has gained widespread acceptance in several field of medicine. An increasing number of medical professionals are ordering these devices owing to the diverse range of medical applications associated with the system. For instance, molecular imaging provides the ability to accurately assess the biological response to disease treatment in individual patients over time. This is majorly attributable to the fact that molecular imaging offers enhanced image quality of the diagnosis, thereby enabling medical professionals to make an efficient and accurate analysis of any ailment.

The use of this diagnostic imaging technique continues to grow, allowing the study of more and more body parts.

Additionally, imaging examinations have also become much faster owing to the use of advanced technology with these systems. Molecular point-of-care (POC) enabled more accurate and faster assessments by allowing quick detection and infection control among patients. POC has moved into the subspecialties, most notably in critical care, internal medicine, emergency medicine, and anesthesia. Thus, increasing benefits have shifted the preference toward point-of-care molecular imaging testing, which is likely to boost the adoption rate globally.

- According to a 2021 survey published by the National Center for Biotechnology Information (NCBI), about 93% of respondents believed that POCT could improve their care in the U.S.

MARKET CHALLENGES

Emergence of Regulated Market for Refurbished Medical Devices to Limit Market Growth

Major market players are increasingly focusing on R&D, leading to the introduction of advanced imaging systems such as PET/CT scanners at a comparatively lower cost. However, the demand for these systems is limited, especially from emerging countries including Poland, China, India, and others. The primary reason for the reduced demand is the development and emergence of an established and regulated market for refurbished devices in these countries. Various key market players and domestic players have emerged and are firmly establishing themselves in the growing industry of refurbished medical devices.

The market for refurbished devices is highly concentrated on capital equipment, which is usually costly, such as medical imaging equipment such as PET scanners and SPECT scanners. These systems have a typical life cycle of 10-20 years and are later decommissioned, which leads to a replacement of the existing systems.

This price difference, coupled with inorganic growth strategies implied by the key players offering post-sales services, has been instrumental in the rapid emergence of the refurbished medical devices market globally.

- For instance, according to the 2025 data published by Block Imaging, the average cost of a refurbished PET/CT scanner ranges from USD 0.25 million to USD 0.45 million.

Other Prominent Challenges:

Limited Accessibility: Inadequate healthcare infrastructure in certain regions restricts the widespread adoption of molecular imaging modalities.

MOLECULAR IMAGING MARKET TRENDS

Preferential Shift Toward Technological Advanced Devices is a Market Trend

There has been a shifting preference toward technologically advanced machines of higher strengths, such as hybrid imaging equipment, including PET/CT, SPECT/CT, and others. Conventional scanning has been using PET and SPECT machines, but with the advent of technology in the recent era, hybrid models are being utilized.

- For instance, in November 2023, Siemens Healthineers AG received FDA approval for the Biograph Vision.X, a positron emission tomography/computed tomography scanner (PET/CT).

The combination of these molecular imaging technologies is vital in the diagnosis of chronic conditions such as neurological disorders, cardiovascular disorders, and others. Further technological advancements in these devices offer resolution and accuracy, reduce the scanning time, and improve patient outcomes by producing high-quality images among patients.

Moreover, there is an increasing preference toward advanced machines owing to their distinct advantages, such as superior image quality, streamlined storage/retrieval, telemedicine capability, advanced post-processing options, faster results, and others.

The aforementioned benefits associated with advanced equipment have caused the shift from conventional to modern or hybrid machines.

Also, a larger number of advanced systems are manufactured in developed economies such as the U.S., and the first regulatory approval processes are undertaken in these markets, thereby offering better market opportunities for developed economies.

Other Prominent Trends:

- Shift Toward Personalized Medicine: Molecular imaging facilitates tailored treatment strategies by providing detailed insights into individual disease characteristics, aligning with the growing trend of personalized healthcare.

Download Free sample to learn more about this report.

Trade Protectionism

Trade protectionism can influence the market by affecting the supply chain, pricing, and availability of imaging equipment and related technologies. Tariffs, import restrictions, and regulatory barriers may impact the cost structure and accessibility of molecular imaging solutions, particularly in regions with protectionist policies. Companies may need to adapt by localizing production or navigating complex trade regulations to maintain market presence.

Segmentation Analysis

By Type

Growing Adoption of PET Scanners Drive Segment Growth

Based on type, the market is classified into Positron Emission Tomography (PET), Single Photon Emission Computed Tomography (SPECT), and others.

The Positron Emission Tomography (PET) dominated the global molecular imaging market size in 2024. The increasing prevalence of neurological disorders, including Alzheimer’s disease, growth in per capita expenditure, developing emphasis on early detection of diseases, and rapidly growing installed base per million populations for these PET imaging scanners, especially in emerging countries, are some of the major factors likely to support the segmental growth in the market.

- For instance, according to 2021 statistics published by the World Health Organization (WHO), there are about 1.48 PET scanners per million populations in Canada.

The Single Photon Emission Computed Tomography (SPECT) segment is expected to grow with a considerable CAGR during the forecast period. The growth is due to increasing demand, further leading the focus of key players toward R&D activities to launch novel products in the market.

By Application

Increasing Prevalence of Orthopedic Injuries to Boost the Segment Growth

Based on application, the market is divided into cardiology, oncology, orthopedics, gynecology, neurology, and others.

The oncology segment dominated the market in 2024. The growth is due to the increasing prevalence of various types of cancer, such as breast cancer and lung cancer, growing diagnosis rate among patients, further leading the focus of prominent players on R&D activities to introduce technologically advanced devices.

The orthopedics segment is expected to grow with a considerable CAGR during the forecast period. The growing prevalence of orthopedic injuries, along with the ability of new and advanced equipment to provide in-detail imaging, is expected to support the increasing adoption of these machines in the market.

- For instance, according to 2022 data published by Science Direct, an estimated 3.6 million patients suffering from orthopedic injuries visit hospitals each year in the U.S.

The neurology segment is expected to grow with a considerable CAGR during the forecast period. The growth is owing to increasing technological advancements, coupled with R&D activities for neurological applications, resulting in the growing adoption of this equipment in the market.

By End-user

Increasing Number of Diagnostic Imaging Centers to Drive Segment Growth

Based on end-user, the market is segmented into hospitals, specialty clinics, diagnostic imaging centers, and others.

The diagnostic imaging centers segment is expected to grow with a considerable CAGR during the forecast period. The growth is due to certain factors, including the gradual shift of patients preference toward diagnostic centers due to patient convenience, easy accessibility, and reduced waiting time. This, along with the rising number of diagnostic imaging centers offering imaging procedures with novel technology, is likely to contribute to the growth of the segment in the market.

- For instance, according to the 2023 statistics published by Definitive Healthcare, there are about 19,000 imaging centers in the U.S.

The hospitals segment is also expected to grow during the forecast period. The growth is due to favorable reimbursement policies pertaining to cancer care that facilitate patients with better access to highly efficient radiation therapy systems in hospitals, resulting in the rising adoption rate of imaging techniques in these healthcare settings.

Molecular Imaging Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

North America Molecular Imaging Market Size, 2025 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominates the molecular imaging market share and generated revenue of USD 1.01 billion in 2025. The growing per capita healthcare expenditure, improved healthcare infrastructure, adequate reimbursement policies, and the increasing number of key players introducing advanced devices are some of the factors supporting the growth of the market.

- According to 2023 data published by the Centers for Medicare & Medicaid Services (CMS), the per capita healthcare expenditure is USD 14,750 in the U.S.

U.S.

The increasing prevalence of chronic conditions, including cardiology disorders, cancer, and gynecological disorders and awareness about the availability of advanced diagnostic procedures are some of the major factors responsible for the increasing demand for this equipment. Besides, with a significant increase in national expenditures for cancer care in the U.S., which is driven by the rise in cancer prevalence, the country is likely to remain the growing market in 2024.

Europe

Europe is expected to grow with a considerable rate during the forecast period. The growth is due to the increasing number of installed bases for imaging equipment such as PET/CT scanners and SPECT scanners, in both public and private settings, coupled with a rising focus on the establishment of new production sites among the key players in these countries. Increasing prevalence of various acute and chronic conditions and growing initiatives among governmental organizations to support R&D activities, is further expected to increase the adoption of these products in the market.

- For instance, according to 2021 statistics published by the World Health Organization (WHO), there are about 2.33 installed bases per million population of PET scanners in the Netherlands.

Asia Pacific

Asia Pacific is projected to be the fastest-growing region, with a significant CAGR in the forecast period. The increasing geriatric population, large patient pool, and developing healthcare infrastructure are some of the major factors anticipated to drive the comparatively higher growth of the market. Additionally, a growing number of key players focusing on acquisitions and mergers among the other players with an aim to strengthen their presence, is likely to contribute to the growth of the market in the country.

- For instance, according to 2023 China’s government statistics, about 297 million people in China are aged 60 and above. Thus, the increasing geriatric population, which results in a growing diagnosis rate, further supports the rising medical imaging scans in the country.

Latin America

Increasing focus on the development of healthcare infrastructure, rising healthcare spending, and growing awareness about the benefits of early detection of chronic disorders, increasing investments in research activities, and government focus on enhancing healthcare access are some of the major factors supporting the growth of the market in the region. This, along with the increasing number of institutions in the region focusing on the development and commercialization of “Mobile Imaging Equipment”, to meet the region’s structural and logistical challenges, is also likely to aid the market growth in the region.

- For instance, according to a 2023 article published by the National Center for Biotechnology Information (NCBI), it was reported that healthcare spending in Brazil increased from 8.3% of GDP in 2010 to 9.2% of GDP in 2018.

Middle East & Africa

The growth is owing to the increasing number of healthcare facilities, along with growing research and development activities to launch innovative devices in the market. Furthermore, a growing number of acquisitions and collaborations among the other players to expand their presence in Middle East countries is likely to support the growth of the market.

- For instance, according to 2025 data published by International Citizen Insurance, there are about 600 hospitals in South Africa.

COMPETITIVE LANDSCAPE

Key Industry Players

Introduction of New Products by Key Players Resulted in their Dominating Position in the Market

The global market is consolidated with companies such as GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V., accounting for a significant market share.

GE Healthcare is one of the dominant companies operating in the industry. The growth is attributable to several factors, such as a robust distribution network across the globe, a strong focus on new product launches, and mergers and partnerships among the other players in the market.

- In October 2024, GE Healthcare launched a new SPECT/CT Aurora, with artificial intelligence-powered capabilities with an aim to expand its presence in Europe.

Siemens Healthcare GmbH is also considered to be the prominent player in the industry in 2024. This is due to the company’s increased focus on business expansion in emerging nations, such as India, China, and others. The rising focus on the R&D activities of other prominent players, such as Koninklijke Philips N.V., to develop and introduce novel products is supporting their growing global market share.

LIST OF KEY MOLECULAR IMAGING COMPANIES PROFILED:

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Shimadzu Corporation (Japan)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Bruker (U.S.)

- Lantheus Holdings, Inc. (U.S.)

- Segami Corporation (U.S.)

KEY INDUSTRY DEVELOPMENTS

- October 2024: Siemens Healthineers AG collaborated with University Hospital Nantes (CHU de Nantes) with an aim to make innovations in diagnostic and interventional imaging in France. This helped the company to increase its brand presence.

- September 2024: Shimadzu Corporation expanded its subsidiary for analytical and measuring instruments and medical systems in Mexico. This helped the company to increase its brand presence in the LATAM region.

- August 2024: Koninklijke Philips N.V., collaborated with Carilion Clinic with an aim to expand quality cardiac care with the latest cardiology innovations in the U.S. This helped the company to increase its brand presence.

- June 2024: CANON MEDICAL SYSTEMS CORPORATION collaborated with Hermes Medical Solutions with an aim to focus on precision medicine with their PET/CT medical imaging products.

- January 2023: CANON MEDICAL SYSTEMS CORPORATION partnered with Sclmage, Inc., a provider of Cloud-native enterprise image management, PACS, and image exchange solutions for the healthcare industry with an aim to make innovations in diagnostic imaging.

REPORT COVERAGE

The global molecular imaging market report provides market size & forecast by all the segments included in the report. It includes details on the market dynamics and market trends expected to drive the market in the forecast period. It offers information on the prevalence of chronic disorders in key regions, key industry developments, new product launches, and details on partnerships, mergers & acquisitions. The report covers a detailed competitive landscape with information on the market share and profiles of key players.

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2021-2034 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2034 |

|

Historical Period |

2021-2024 |

|

Growth Rate |

CAGR of 6.05% from 2026-2034 |

|

Unit |

Value (USD Billion) |

|

Segmentation |

By Type

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.45 billion in 2026 and is projected to record a valuation of USD 3.92 billion by 2034.

In 2025, the market value stood at USD 1.01 billion.

The market is expected to exhibit a CAGR of 6.05% during the forecast period.

The Positron Emission Tomography (PET) segment led the market by type.

The key factors driving the market are the increasing prevalence of chronic disorders, growing development in healthcare infrastructure, and increasing number of product launches.

GE Healthcare, Siemens Healthineers AG, and Koninklijke Philips N.V., are the top players in the market.

North America dominated the market in 2025.

Increased awareness of imaging equipment, the launch of technologically superior products, and a surge in the demand for these products in emerging nations are some of the factors that are expected to favor product adoption.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us