Monofacial Heterojunction Solar Cell Market Size, Share & Industry Analysis, By Application (Residential, Commercial, and PV Power Station), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

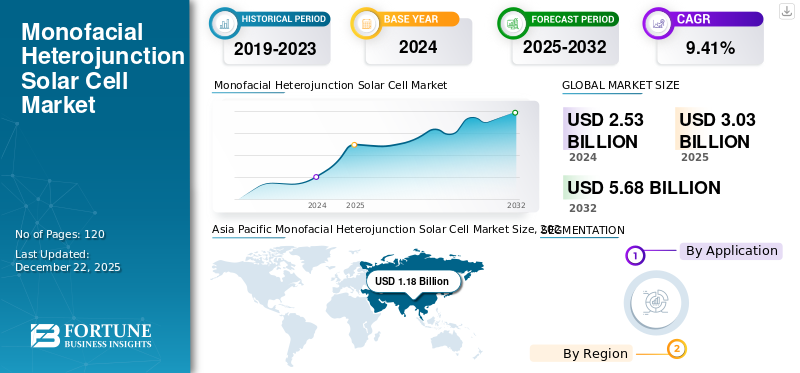

The global monofacial heterojunction solar cell market size was valued at USD 2.53 billion in 2024. The market is projected to grow from USD 3.03 billion in 2025 to USD 5.68 billion by 2032, exhibiting a CAGR of 9.41% during the forecast period. Asia Pacific dominated the global market with a share of 46.64% in 2024. Asia Pacific is expected to account for the largest market revenue share owing to the prominent market players in the region.

Monofacial heterojunction solar cells, referred to as silicon heterojunction (SHJ) solar cells or heterojunction with intrinsic thin layer (HIT) solar cells, are solar cells that capture sunlight from just one side (the front) and are recognized for their high efficiency and favorable temperature coefficient, making them ideal for a wide range of applications such as residential rooftops, and commercial buildings.

Anhui Huasun Energy Co., Ltd. is a market player engaged in R&D and large-scale manufacturing of ultra-high-efficiency N-type silicon heterojunction (HJT) solar cells and modules, including monofacial solar cells. The company’s G12R-96 module includes a refined, full-black monofacial design that ensures stable power output and meets the aesthetic choices of European customers for home integration. It is in high demand among residential PV owners & developers.

Download Free sample to learn more about this report.

MARKET DYNAMICS

MARKET DRIVERS

Technology’s Efficiency and Performance to Support Market Growth

The energy conversion efficiency and overall performance of monofacial heterojunction solar cells are anticipated to drive their adoption compared to conventional technologies. These cells generally offer efficiencies of upto 26%, which is more than conventional solar cells. The high efficiency is attributed to the unique structure of monofacial heterojunction solar cells, which combine crystalline silicon wafers with ultra-thin amorphous silicon layers on both sides, forming a heterojunction. For monofacial applications, where only the front side of the panel is exposed to sunlight, this enhanced efficiency results in greater yield per unit area.

MARKET RESTRAINTS

High Manufacturing Costs to Limit Market Expansion

High manufacturing costs associated with heterojunction technology will likely hinder its market growth. The initial capital investment, material requirements, and processing complexity are significantly higher than conventional PV technologies such as PERC and polycrystalline cells. Currently, most global solar manufacturing infrastructure is optimized for PERC technology, allowing higher economies of scale and significantly lower costs.

MARKET OPPORTUNITIES

Strong Government Policies and Support to Favor Market Growth

Government policies, incentives, and climate-related regulations aimed at facilitating the clean energy transition are anticipated to support the adoption of monofacial heterojunction solar cells. Globally, governments are setting carbon reduction targets and implementing renewable energy support programs that create favorable conditions for market growth. Government support, such as incentives, tax credits, and reduced tariffs on renewable energy, is anticipated to encourage market growth further. Regions such as North America and Asia Pacific, where solar energy is expanding at a large scale, are expected to offer immense market potential.

MONOFACIAL HETEROJUNCTION SOLAR CELL MARKET TRENDS

Development of Thinner Wafers with Reduced Silver Usage to Fuel Market Growth

The key market trend in the monofacial heterojunction solar cell market growth is a push towards thinner wafers with reduced usage to cut costs without compromising efficiency. Innovations in passivation techniques and transparent conductive oxides are enhancing performance and longevity. Manufacturers are integrating smart manufacturing with AI and IoT for better quality control and yield optimization. Moreover, the shift towards hybrid HJT-perovskite tandem structures aims to surpass conventional efficiency limits. Laser patterning and low-temperature processing methods are also being refined to support flexible and lightweight panel designs, aligning with demand for high-efficiency solar space constraints applications.

Segmentation Analysis

By Application

PV Power Stations to Dominate Owing to Demand for Utility-Scale Solar Installations

Based on application, the market is classified into residential, commercial, and PV power stations.

PV power station is expected to dominate the monofacial heterojunction solar cell market share owing to the increasing demand for utility-scale solar installations aligns well with the advantages of HJT solar cells, making them a suitable choice for PV power stations. Moreover, homeowners are adopting solar energy to lower electricity costs and lessen reliance on the grid.

Heterojunction modules are becoming preferred for residential applications due to their high efficiency and superior performance in shaded conditions, making them ideal where maximum energy output is desired, and space is limited.

As companies look to save operating expenses and improve their sustainability profiles, the commercial industry is also expanding significantly. Solar panels are installed on commercial buildings, including shopping malls, office buildings, and educational institutions, to harness renewable energy. Furthermore, corporate sustainability objectives and green building certifications propel the adoption of cutting-edge solar technologies within the commercial market.

Monofacial Heterojunction Solar Cell Market Regional Outlook

By geography, the market is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America

Asia Pacific Monofacial Heterojunction Solar Cell Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

The market growth in North America can be attributed to the region’s strong focus on energy efficiency and supportive clean energy policies. For instance, the U.S. Inflation Reduction Act (IRA) and various state-level incentives support adopting high-performing solar technologies. Furthermore, robust demand from the residential and commercial sectors is also anticipated to support the market's growth.

U.S.

In the U.S., the demand for monofacial heterojunction solar cells is increasing as part of the broader shift towards renewable energy and the need for higher-efficiency solar panels. While specific demand figures aren't provided, the market for these cells is projected to grow significantly, driven by technological advancements and decreasing production costs.

Europe

Europe is one of the prominent regions in the renewable energy transition, aiming to achieve net-zero emissions. Demand in countries such as the U.K., Germany, and France is driven by stringent carbon emission targets, rising energy prices, and an increasing focus on self-sufficient energy systems. Thus, the monofacial heterojunction market in Europe is anticipated to benefit from strong government policies, environmental concerns, and investments in renewable energy.

Asia Pacific

The Asia Pacific region is the fastest-growing market for monofacial heterojunction solar cells, with countries such as China and India leading to charge. For instance, in 2024, China added a record 277 GW of new solar capacity, bringing its total installed capacity to 887 GW, a 45% year-on-year increase. This rapid expansion highlights the immense opportunity for widescale adoption of monofacial heterojunction solar cell, owing to the growing prevalence of solar energy in the region.

Latin America

The market in Latin America is anticipated to grow gradually alongside the region’s increasing adoption of solar energy, particularly in countries such as Brazil and Mexico. While cost remains as barrier to rapid market expansion, targeted government support and foreign investments are anticipated to drive growth and help overcome these challenges.

Middle East & Africa

The Middle East & Africa region presents significant growth potential owing to growing energy demand and the need for sustainable technologies. Countries such as Saudi Arabia, UAE, South Africa, and others are actively promoting the deployment of renewable energy, including solar power. Government support, financial incentives, and foreign investments to expand renewable energy integration are anticipated to support market expansion in this region.

COMPETITIVE LANDSCAPE

Key Industry Players

Major Companies Focus on Focusing Innovative Products to Support Market Growth

Leading firms are concentrating on creating innovative products to better meet customer demands. For example, Norwegian Module Maker, REC Solar introduced lead-free 430W HJT panels tailored for the growing U.S. market. its Alpha Pure 2 series of monofacial modules delivers peak power output of up to 440 W and achieves an impressive efficiency of up to 22.2%.

LIST OF KEY MONOFACIAL HETEROJUNCTION SOLAR CELL COMPANIES PROFILED

- Anhui Huasun Energy Co., Ltd. (China)

- Vikram Solar (India)

- Waaree Energies Ltd. (India)

- Shinson Technology Co.,Ltd. (China)

- REC Solar (Norway)

- Canadian Solar (Canada)

- HEVEL Solar (Russia)

- LONGi (China)

- Sunpro Power (China)

- 3Sun (Italy)

KEY INDUSTRY DEVELOPMENTS

- August 2024: Vikram Solar, an India-based module manufacturer, introduced the Suryava module based on heterojunction cell technology. These bifacial modules feature 20 busbars and deliver a peak power conversion efficiency of 23.34%, with a maximum power output of 725W.

- May 2024: Huasun Energy introduced Everest G12R, a heterojunction (HJT) module series based on rectangular solar cells. The HJT 3.0 is a high-efficiency solar cell technology and features 182mm*105mm rectangular cells, which helps to achieve an efficiency of more than 23%.

- May 2024: REC, a Singapore-based PV module manufacturer, introduced residential solar modules built on its Alpha heterojunction cell technology. Solar panels can achieve up to 22.5% efficiencies with power ratings ranging from 610 W to 640 W.

- June 2023: Italy’s 3Sun, part of Enel Green Power, has created new monofacial photovoltaic modules that utilize n-type heterojunction (HJT) G12 solar cells. The M40 series, designed for rooftop use, has power outputs between 440 W and 480 W, featuring an efficiency of up to 25%.

- June 2023: Huasan Energy introduced N-type silicon-based monofacial heterojunction solar cells and modules. The new offering includes the Himalaya V-ocean series, the G10 series, and the M6 series, which are particularly designed for residential, commercial, and large-scale utility applications.

REPORT COVERAGE

Request for Customization to gain extensive market insights.

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Growth Rate |

CAGR of 9.41% from 2025-2032 |

|

Unit |

Value (USD Billion) and Volume (MW) |

|

Segmentation |

By Application

|

|

By Region

|

Frequently Asked Questions

Fortune Business Insights says that the global market value stood at USD 2.53 billion in 2024 and is projected to reach USD 5.68 billion by 2032.

In 2024, the market value stood at USD 1.18 billion.

The market is expected to exhibit a CAGR of 9.41% during the forecast period.

By application, PV power station segment led the market.

Technologys efficiency and performance is a key factor driving market growth.

Anhui Huasun Energy Co., Ltd., REC Solar, and Waaree Energies are the top players in the market.

Asia Pacific dominated the market in 2024.

strong government policies and support is expected to favor market growth.

Related Reports

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us