Nanomedicine Market Size, Share & Industry Analysis, By Type (Therapeutics {Biologics and Small Molecules}, Diagnostics {IVD, Imaging, and Others}, and Medical Devices {Regenerative Medicine, and Implants}), By Molecule Type (Nanoparticles {Lipid Based, Polymers & Polymer Drug Conjugates, Inorganic Nanoparticles}, Nanoshells, Nanotubes, and Nanodevices) By Application (Oncology, Neurodegenerative Diseases, Cardiovascular Diseases, Immunology, Infectious Diseases), By End-user (Hospitals and Clinics, Diagnostics Laboratories, Research and Academic Institutes), and Regional Forecast, 2025-2032

KEY MARKET INSIGHTS

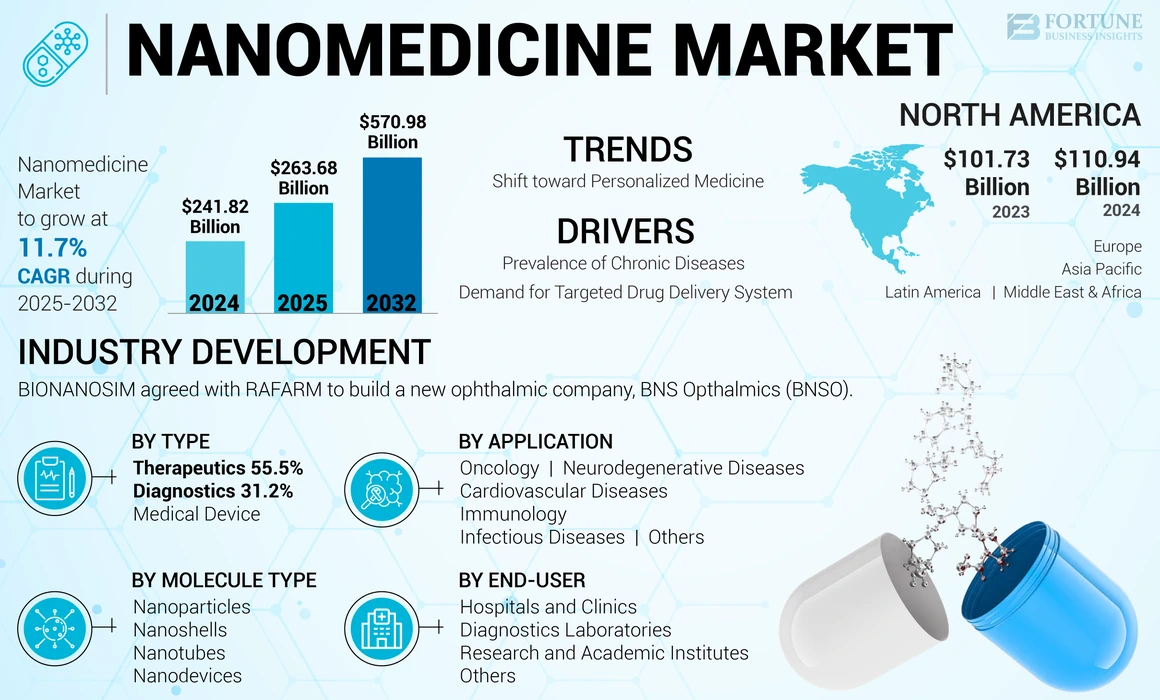

The global nanomedicine market size was valued at USD 241.82 billion in 2024. The market is projected to grow from USD 263.68 billion in 2025 to USD 570.98 billion by 2032, exhibiting a CAGR of 11.7% during the forecast period. North America dominated the nanomedicine market with a market share of 45.88% in 2024.

Nanomedicine involves the application of nanotechnology for medical purposes, utilizing materials and devices at the nanoscale (typically 1 to 100 nanometers). It aims to revolutionize diagnostics, drug delivery, and treatment by offering precise and targeted approaches at the molecular level for enhanced effectiveness and reduced side effects. The global market is growing due to the extensive application of these products in the medical sector, including the use of nanoparticles in targeted medicinal products, biomedical implants, pharmaceutical products, novel diagnostic instruments, and tissue engineering. Moreover, the growing potential for development in the field of nano-based products significantly contributes to the global market growth. The market is anticipated to witness favorable growth prospects due to the rising prevalence of several chronic diseases, such as cancer.

- For instance, according to the American Lung Association, in 2019, 221,097 people were diagnosed with lung cancer in the U.S., which increased to 238,000 in 2023. This rising incidence requires nanomedicine for targeted drug delivery and diagnosis, which, in turn, supports the growth of the market.

Moreover, the leading companies in the market, such as Pfizer Inc., Jazz Pharmaceuticals plc, Nanospectra Biosciences, Inc., Janssen Pharmaceuticals, Inc., Merck & Co., Inc., and others are focusing on strategic initiatives, including partnerships, product launches, and research and development efforts to enhance their positions in the sector.

Global Nanomedicine Market Snapshot & Highlights

Market Size & Forecast:

- 2024 Market Size: USD 241.82 billion

- 2025 Market Size: USD 263.68 billion

- 2032 Market Size: USD 570.98 billion

- CAGR: 11.7% from 2025–2032

Market Share:

- Region: North America dominated the market with a 45.88% share in 2024. This is due to the increase in the incidence of chronic diseases, a high number of IND and NDA submissions, and a strong focus on research and development in the region.

- By Application: The Oncology segment held the dominant market share in 2024. The segment's growth is driven by a strong caseload of cancers in several key countries and the increasing focus of pharmaceutical companies on developing nano-based products for targeted cancer drug delivery.

Key Country Highlights:

- Japan: As a key country in the fastest-growing Asia Pacific region, Japan is seeing market growth due to a rising prevalence of chronic diseases and increasing investments in nanotechnology for medical applications.

- United States: The market is fueled by a high prevalence of chronic diseases, with six in ten people having at least one. The country also has a robust regulatory environment, with more than 50 nanomedicines approved for use by the U.S. FDA, and a strong focus on R&D for advanced therapies.

- China: Growth is supported by a large patient population, increasing investments in nanotechnology, and a growing number of clinical trials for nano-based products. The country is also a major hub for the production and export of raw materials used in nanomedicine.

- Europe: The market is advanced by a strong focus on research and development, particularly in the areas of targeted drug delivery and personalized medicine. Strategic collaborations between key players and research institutions are also driving innovation and market growth.

IMPACT OF COVID-19:

The COVID-19 pandemic had a slight positive impact on the market, mainly attributed to the ongoing research & development initiatives. Additionally, the increased demand for vaccines shifted the focus of various pharmaceutical and biotech companies toward developing new nano-based vaccines for COVID-19. This contributed to the growth of the market during the pandemic. In 2021, there was an increase in the revenue of the key players with the sales of new products and devices. Additionally, the approvals and launches of the rising clinical studies are expected to propel market growth during the forecast period.

MARKET DYNAMICS:

Market Drivers

Rising Prevalence of Chronic Diseases to Boost the Growth of Nanomedicine Market

The rising prevalence of chronic diseases worldwide, such as cancer, diabetes, immunological, cardiovascular, neurodegenerative, and genetic disorders, is significantly driving the market growth.

It offers transformative solutions through its ability to deliver drugs in a targeted and controlled manner, addressing the limitation of traditional therapeutics management, which tends to be hindered by poor efficacy, adverse drug effects, and non-target-specific delivery. The growing incidence of chronic disease, coupled with heightened patient awareness of adverse drug reactions associated with market-available medications, is driving the increasing adoption of nanomedicine for more tailored and effective treatment approaches.

- For instance, in May 2023, the National Center for Chronic Disease Prevention and Health Promotion reported that in America, at least six in ten people have chronic diseases such as heart disease, stroke, cancer, or diabetes. The rising prevalence of chronic disease and increasing demand for advanced therapy options for specific treatment are expected to propel the growth of the market.

Additionally, the presence of key players in the market, with increasing strategic initiatives for research and development, is driving innovations in drug delivery methods, further contributing to the growth of the market.

Increasing Demand for Targeted Drug Delivery System to Drive Market Growth

In recent years, the rising prevalence of chronic diseases and rising adverse drug effects associated with traditional drug delivery methods is elevating the demand for targeted drug delivery systems. Traditional drug delivery systems affect both healthy and diseased cells, thereby reducing the overall efficacy of treatment. However, the targeted drug delivery system using nanotechnology by using nanocarriers, such as liposomes and nanoparticles, is being developed to improve the targeted delivery of therapeutics, thus enhancing drug efficacy and minimizing side effects. Such targeted delivery of drugs allows for precise delivery of therapeutic agents directly to the diseases or affected areas.

Additionally, increasing research and development initiatives by key players to launch advanced nano-based targeted drug delivery systems are expected to drive the growth of the market.

- For instance, in May 2023, Gencor and Pharmako Biotechnologies unveiled the latest liposome technology featuring the scientifically validated PlexoZome. This advanced targeted delivery system for liquid formulations is uniquely developed and manufactured in their licensed facility, allowing for fully customizable and stable liposomal ingredients.

Market Restraints

High Cost and Regulatory Challenges of Nanomedicine to Hinder Market Growth

Nanotechnology-based products incur significantly higher costs owing to the requirement for significant investments, specialized equipment, expertise, and medical infrastructure. As a result, limited funding capabilities for smaller companies and institutions can hinder their ability to innovate and conduct research activities for the development of these products. These challenges are anticipated to limit the growth of the market.

- For instance, according to the Centers for Disease Control and Prevention, in 2023, six in ten individuals in the U.S. were living with at least one chronic disease, such as cancer, diabetes, heart disease, and stroke.

Furthermore, stringent regulatory requirements to gain U.S. FDA approval and the need for comprehensive safety assessments pose hurdles in the approval process. These challenges can cause delays and impact the accessibility of these products. Such high costs and regulatory obstacles are expected to limit the adoption of these products, hampering market growth during the forecast period.

Market Opportunities

Integration Of Nanorobots For Drug Delivery And Diagnostics

In recent years, targeted drug delivery with the help of nanoparticles has been increasing, and the development of new particles offers groundbreaking solutions for precision medicine.

The integration of nanorobots for drug delivery and diagnostics is creating lucrative opportunities for the key players to advance their product offerings in the market.

Additionally, rising fundraising activities for incorporating nanorobotics in healthcare are bolstering the market's growth.

- For instance, in November 2024, Theranautilus, India, a company developing nanorobotic solutions for healthcare, secured USD 1.2 million in seed funding. The funding aimed to develop and commercialize nanorobotics-based medical devices, initially targeting dental care applications. Such advancements offer lucrative growth opportunities to the market during the forecast period.

Market Challenges

Lack Of Standardized Regulatory Frameworks Creates Challenges For The Market Growth

One of the prominent challenges in the market is the lack of standardized regulatory frameworks, which complicates the approval process and often leads to delays in bringing these advanced therapies to market. These uncertainties complicate manufacturing and impose hurdles for scaling up production and maintaining the quality of this medicine.

Furthermore, the high costs associated with research and development can be a significant barrier, particularly for smaller companies that may lack the financial resources to invest in extensive studies and trials. Additionally, the complex landscape for the advancement of nanomedicines necessitates collaborative efforts among regulatory bodies, industry stakeholders, and researchers to develop solutions that can streamline the process and foster innovation while ensuring patient safety. Such factors impose challenges on the nanomedicine market growth.

LATEST TRENDS

Rising Shift toward Personalized Medicine is a Prominent Trend in the Market

In recent years, rising awareness about personalized medicine has shifted the focus of healthcare professionals and individuals toward incorporating it into the treatment of chronic diseases. This is considered a prominent global nanomedicine market trend.

Precision medicine is a healthcare approach focused on tailoring specific treatments to individual patients or groups based on a variety of factors such as genetic makeup, phenotypic characteristics, and others. The emergence of these medicines has significantly advanced the field of precision medicine by offering innovative strategies to customize treatments based on a patient's unique genomic profiles.

Personalized nanomedicine encompasses nanotechnology to design treatments and prevent diseases for specific patients or groups. This approach specifically aligns with a patient's unique biological and genetic information but also leverages advancements in nanotechnology to enhance drug delivery systems, improve therapeutic agents' outcomes, and minimizes side effects.

Furthermore, the increasing focus of key biopharmaceutical and pharmaceutical companies on incorporating nanomedicine for personalized approaches is expected to propel the growth of the market during the forecast period.

- For instance, in September 2024, AbbVie participated at the European Society for Medical Oncology (ESMO) Congress 2024 to showcase its new innovative antibody-drug conjugate (ADC) nanoparticle platform. This platform targets protein biomarkers such as folate receptor-alpha (FRα) and c-Met (MET protein), which are overexpressed in various tumor types and linked to poor prognoses. Such advancements are expected to expand the market's growth during the forecast period.

Download Free sample to learn more about this report.

SEGMENTATION ANALYSIS

By Type

An increase in Demand for Targeted Drug Delivery Led to the Dominance of Therapeutics Segment

Based on type, the global market is categorized into therapeutics, diagnostics, and medical devices.

In the global market, the therapeutics segment held a dominant market share in 2024. The therapeutics segment is further bifurcated into small molecules and biologics. The growth of the segment is driven by the increasing demand for targeted drug delivery and personalized medicine to improve therapeutic efficacy and minimize the side effects of conventional drugs. Additionally, there is an increasing adoption of these medicines in the development of drug delivery systems that can target specific cells or tissues to enhance the therapeutic efficiency of drugs.

Furthermore, the increasing focus of pharmaceutical and biotechnological companies to develop and launch advanced therapeutic options for various chronic and genetic disorders is expected to propel the growth of the segment in the market.

- For instance, in January 2022, Pfizer Inc. and Acuitas Therapeutics, a company dedicated to advancing lipid nanoparticle (LNP) delivery systems for messenger RNA (mRNA)-based therapies, announced a Development and Option agreement. Under this agreement, Pfizer will have the opportunity to license Acuitas' LNP technology on a non-exclusive basis for up to 10 targets related to vaccine or therapeutic development.

The diagnostics segment held the second-largest share of the market. The diagnostics segment is further classified into IVD, imaging, and others. The growth of the segment is driven by increasing demand for early and accurate diagnosis of diseases, as accurate diagnosis enables healthcare providers to tailor treatment based on characteristics. Additionally, the rise in strategic activities by key players to launch advanced technologies to develop diagnostics instruments that can visualize disease processes in the body is contributing to the segment's growth.

- For instance, in April 2023, CD BioSciences launched nanoparticle imaging technology to help researchers visualize cell functions and biological processes of living organisms in a non-invasive manner, enabling accurate early diagnosis of diseases. The advancements are expected to drive the growth of the segment in the market.

The medical devices segment is expected to grow substantially during the forecast period. The medical devices segment comprises regenerative medicine and implants. Regenerative medicine focuses on restoring or replacing damaged tissues and organs by stimulating the body's repair mechanism. Nanotechnology enhances the precise delivery of drugs, growth factors, and stem cells to targeted areas. In addition to this, implants with nanoparticles are used to create scaffolds that mimic the structure of bone, which can be used for bone regeneration and help improve biocompatibility and functionality. The increasing research and development activities by companies to receive regulatory approvals for advanced implantable devices are expected to propel the growth of the segment in the market.

- For instance, in April 2024, Onkos Surgical announced the U.S. Food & Drug Administration (FDA) granted De Novo approval for the company's novel antibacterial-coated implants. These implants are used in orthopedic oncology and revision arthroplasty, where the patient population is highly vulnerable. Such approvals and product launches are expected to drive the segment's growth during 2025-2032.

To know how our report can help streamline your business, Speak to Analyst

By Molecule Type Analysis

Rising Adoption of Nanoparticles for Drug Delivery Led to the Dominance of Nanoparticles Segment

Based on molecule type, the market is segmented into nanoparticles, nanoshells, nanotubes, and nanodevices.

The nanoparticles segment held a dominant global nanomedicine market share in 2024. The nanoparticle segment is further divided into lipid-based, polymers & polymer-drug conjugates, inorganic nanoparticles, and others. The dominant share of the segment is driven by rising demand for nanoparticles in drug delivery and disease diagnosis, enabling precise and accurate delivery and imaging. Additionally, the presence of key players in the market offering advanced nanoparticle-based products and rising initiatives from key and emerging players to launch new products with nanoparticles for better patient outcomes is expected to propel the segment's growth.

- For instance, in July 2023, Cytiva introduced the NanoAssemblr commercial formulation system, designed to streamline the formulation of lipid nanoparticle medicines as they transition from clinical development to large-scale commercial production. This system also supports multi-process workflows, expediting time to market. Such launches promote the adoption of nanoparticles in the manufacturing of medicines, propelling the growth of the segment.

The nanoshells exhibit a prominent CAGR of the segment in the market. The growth of the segment is driven by rising demand for targeted drug delivery and advancement in nanotechnological research.

- For instance, in January 2018, a study published in the Proceedings of the National Academy of Sciences (PNAS) demonstrated that researchers at Rice University developed a platform utilizing gold-based nanoshells. These nanoshells are designed to deliver high concentrations of two chemotherapy drugs directly to tumor cells. The approach involves gold nanoparticles that can be activated remotely, allowing for the targeted release of chemotherapy drugs to cancerous cells while minimizing adverse side effects. Such studies promote the adoption of nanoshells during the forecast period.

Nanotubes and nanodevices are expected to grow during the forecast period. The increasing prevalence of chronic diseases, along with the rising demand for accurate, efficient drug delivery and minimally invasive diagnostics methods are expected to drive the growth of the segment during the forecast period.

By Application

Increase in Research and Development Activities Coupled with Product Launches in Oncology Led to Segment's Dominance

Based on application, the global precision market is categorized into oncology, neurodegenerative diseases, cardiovascular diseases, immunology, infectious diseases, and others.

The oncology segment dominated the market in terms of share in 2024, which is attributed to the strong caseload of cancers across several key countries. The rising number of cases and the shift of focus of pharmaceutical and biotechnology companies to develop nano-based products for targeted drug delivery for cancer treatment are prominent factors in the segment's growth.

Additionally, new product launches for oncology treatment by the major players is expected to maintain the segment's dominance.

- For instance, in March 2022, Accord BioPharma launched CAMCEVI (leuprolide) 42mg injection emulsion in the U.S. It is used for the treatment of advanced prostate cancer in adults.

The neurodegenerative diseases segment holds a substantial share of the market and is expected to grow at a significant CAGR during the forecast period. The increasing burden of neurodegenerative diseases such as Alzheimer's disease (AD), Parkinson's disease (PD), and amyotrophic lateral sclerosis (ALS) has led to the development of this medicine. Traditional therapeutic drugs and biomolecules are unable to traverse the Brain Barrier (BBB) effectively. This medicine, through therapeutic nano-delivery systems, uses nanoscale-sized particles to safely and efficiently transport pharmacologically active agents to diseased sites in the body, including the brain. Furthermore, increasing strategic activities amongst key players to develop a novel therapy for neurodegenerative diseases is expected to propel the growth of the segment.

- For instance, in May 2023, HanAll Biopharma Co., Ltd. and Daewoong Pharmaceutical Co., Ltd. entered into a co-development agreement with NurrOn Pharmaceuticals Inc., with an aim to discover and develop novel therapies for neurodegenerative diseases, including Parkinson's disease (PD). This development targets Nurr1, a regulator for dopaminergic neuron development and maintenance. The development of targeted drug delivery for neurodegenerative disease is expected to boost the segment's growth in the market.

The infectious diseases segment held a considerable share of the market. This is driven by increasing research and development initiatives by companies to advance diagnosis and treatment options for infectious diseases.

- For instance, in December 2020, IMMUNOPRECISE ANTIBODIES LTD. announced its participation in the COVABELP consortium to launch the Eureka Program. This program aimed to create a SARS-CoV-2-specific therapeutic nanomedicine, which will be delivered via nasal inhalation and can also be utilized for in-vitro diagnostics. Such participation by key players in launching novel treatment options for infectious diseases is expected to boost segment growth.

Cardiovascular diseases possessed a significant portion of the market. An increase in the number of cardiovascular disease cases is contributing to the growth of the segment.

The other segment is expected to grow during the forecast period owing to increased research and development and rising demand for personalized treatment options for rare diseases. This growth is expected to bolster the growth of the segment.

By End-user

Hospitals and Clinics Segment Dominated due to Increasing Awareness for Targeted Drug Delivery

Based on end-user, the global market is segmented into hospitals and clinics, diagnostics laboratories, research and academic institutes, and others.

The hospital and clinics segment held a dominant share of the market in 2024. The growth of the segment is attributed to the increasing prevalence of chronic diseases and rising demand for effective and accurate treatment options for better patient outcomes. Moreover, an increase in awareness and demand for targeted drug delivery by patients to decrease the dosage errors and adverse effects of the drug is expected to propel the demand for these drugs in the settings.

Diagnostics laboratories held the second-largest share of the market. This growth is owing to the increase in the adoption of nanotechnology in diagnostics tools. Nanomedicine enhances diagnostics by utilizing nanoscale materials and technologies to improve imaging, detection, and monitoring of diseases. Thus, there is an increased demand for targeted diagnostics that minimize damage and provide highly sensitive, accurate early detection of diseases, enabling treatment plans based on patient's genetic and molecular profiles.

The research and academic institutes segment in the market is expected to grow the highest CAGR during the forecast period. The rising demand for nanomedicine-based personalized medicine has led these institutes to focus on the research and development of new drugs and treatments for patient care. Additionally, advancements in nano-based technologies for launching novel nanodevices for accurate and effective treatment and diagnosis of chronic and rare diseases are propelling the growth of the segment.

- For instance, in August 2024, a researcher at the University of Chicago Medicine Comprehensive Cancer Center developed a nanomedicine that enhances the delivery and concentration of chemotherapy drugs within tumor tissues. This approach effectively targets and destroys cancer cells by activating the stimulator of the interferon genes (STING) pathway. Such developments are expected to propel the growth of the segment from 2025-2032.

NANOMEDICINE MARKET REGIONAL OUTLOOK

North America Nanomedicine Market Size, 2024 (USD Billion)

To get more information on the regional analysis of this market, Download Free sample

North America dominated the market with a revenue of USD 110.94 billion in 2024 and is anticipated to grow at a moderate CAGR during the forecast period. The growth in the region is due to the increase in the incidence of chronic diseases, including cancer, seeking treatment options in the region. Moreover, the number of Investigational New Drug (IND) and New Drug Application (NDA) submissions has increased over the past years in North America, which significantly contributed to the market growth.

- For instance, according to the American Journal of Pharmaceutical Education, in 2021, more than 50 nanomedicines were approved for use by the U.S. FDA.

The Asia Pacific market is expected to grow with the highest CAGR during the forecast period (2025-2032). The growth is due to the growing investments in nanotechnology and a higher number of ongoing clinical trials. Additionally, the approval of products in China, along with increased funding from the government for the research and development of these products, boost the growth of the market in the Asia Pacific.

Europe accounted for a substantial market share in 2024. The region's growth is due to the rising number of chronic diseases, the availability of advanced healthcare facilities with skilled medical professionals, the increase in demand for nanomedicines, and a rise in government investments in the healthcare system. These factors are responsible for the growth of the market in the region.

The markets in Latin America and the Middle East & Africa regions are anticipated to grow at comparatively lower CAGR during the forecast period. Growth in these regions is due to the development of networks aimed at supporting research in the nanotechnology field and government investment to improve infrastructure.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Activities and Enhanced Focus on Research and Development by Key Companies to Hold Key Market Share

Pfizer Inc., Janssen Pharmaceuticals Inc., and Teva Pharmaceutical Industries Ltd are the prominent players in the industry. In 2024, these companies will constitute a significant part of the global market. The large share of these companies in the market is due to factors such as strong geographical position and strong and diverse products. Additionally, strategic initiatives such as the acquisition of other companies and approval of products will help the elite manage and strengthen their position in the industry.

Other leading companies include Ipsen Pharma, Amgen Inc., Nanospectra Biosciences, Inc., and other small and medium-sized businesses. These companies engage in various activities such as new product introduction, joint ventures and partnerships, and geographical expansion to boost their market share.

LIST OF KEY MARKET PLAYERS PROFILED:

- Gilead Sciences, Inc. (U.S)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Pfizer Inc. (U.S.)

- Jazz Pharmaceuticals plc (Ireland)

- Nanospectra Biosciences, Inc. (U.S.)

- Janssen Pharmaceuticals, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Amgen Inc. (U.S.)

- Arrowhead Pharmaceuticals, Inc. (U.S.)

- Ipsen Pharma (U.S.)

KEY INDUSTRY DEVELOPMENTS:

- September 2023 - Evonik incorporated three new standard PLA-PEG di-block copolymers and a novel nanoparticle formulation service utilizing sonication technology to enhance its portfolio of nanoparticle technologies and services for parenteral drug delivery.

- June 2023 - BIONANOSIM, an Israeli nanotechnology drug discovery company, agreed with RAFARM to build a new ophthalmic company, BNS Opthalmics (BNSO).

- March 2023 - Moderna announced a strategic collaboration with Generation Bio to develop non-viral genetic medicines using Generation Bio's proprietary stealth cell-targeted lipid nanoparticle (ctLNP) delivery system.

- January 2022 - NaNotics, a nanomedical company developing and commercializing NaNots, collaborated with Mayo Clinic to develop a nanomedicine for cancer treatment.

- January 2022 - Pfizer Inc. entered into a development and option agreement with Acuitas Therapeutics for the lipid nanoparticle delivery system to be utilized in mRNA vaccines and therapeutics.

REPORT COVERAGE

The market report centers on providing an industry overview and examining the market dynamics of the nanomedicine sector. This includes the global nanomedicine market analysis, analyzing the drivers, restraints, opportunities, and trends influencing the market. Moreover, the report also presents data on the prevalence of prominent chronic diseases in different countries/regions within the market. Additionally, it highlights key developments within the industry, conducts pipeline analysis, and discusses the launch of new products by major players. Furthermore, the report delves into the impact of the COVID-19 pandemic on the industry and provides an overview of the market situation during this period.

To gain extensive insights into the market, Download for Customization

Report Scope & Segmentation

|

ATTRIBUTE |

DETAILS |

|

Study Period |

2019-2032 |

|

Base Year |

2024 |

|

Estimated Year |

2025 |

|

Forecast Period |

2025-2032 |

|

Historical Period |

2019-2023 |

|

Unit |

Value (USD billion) |

|

Growth Rate |

CAGR of 11.7% from 2025-2032 |

|

Segmentation |

By Type

|

|

By Molecule Type

|

|

|

By Application

|

|

|

By End-user

|

|

|

By Geography

|

Frequently Asked Questions

Fortune Business Insights says that the global market stood at USD 241.82 billion in 2024 and is projected to reach USD 570.98 billion by 2032.

In 2024, the North America market stood at USD 110.94 billion.

The market is expected to exhibit a CAGR of 11.7% during the forecast period.

By type, the therapeutics segment led the market in 2024.

North America region dominated the market in 2024.

The rising number of chronic diseases, the number of surgeries, growing initiatives for research activities, and increasing regulatory approvals are key factors driving market growth.

The key trend in this market is the rising shift of focus toward personalized medicine.

Pfizer Inc., Janssen Pharmaceuticals Inc., and Teva Pharmaceutical Industries Ltd are the top players in the market.

-

US +1 833 909 2966 ( Toll Free )

-

Get In Touch With Us